Masayoshi Son Reclaims Japan's Richest Man Title, Then Offloads NVIDIA Shares—Is This a Sign of an Impending AI Bubble Burst?

![]() 11/21 2025

11/21 2025

![]() 541

541

The market seems to be bracing itself for a potential bubble burst.

Masayoshi Son 'Misses the Boat' on NVIDIA—Yet Again

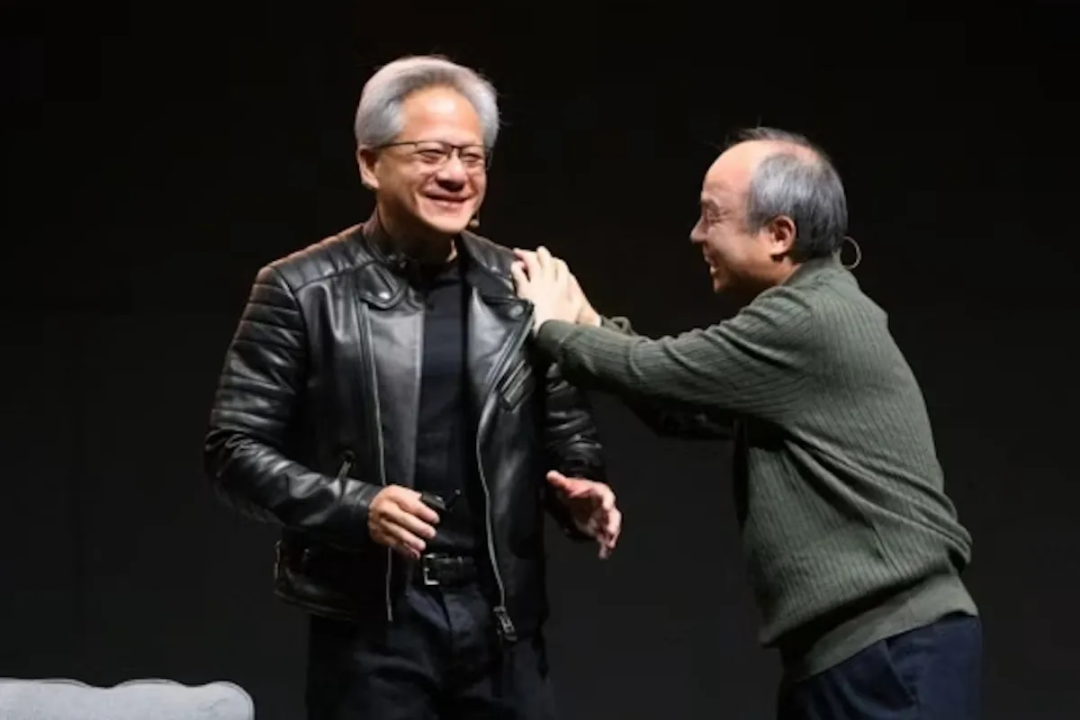

A year ago, SoftBank's Masayoshi Son and NVIDIA's Jensen Huang shared a heartfelt embrace, tears streaming down their faces as they lamented the 'early sale' of NVIDIA shares. At the time, most believed NVIDIA's value was unparalleled, and if given another chance, Son would likely rue not buying more or holding onto the shares longer.

However, Son has a knack for surprising with unconventional moves. He has once again liquidated his NVIDIA holdings, with SoftBank announcing the sale of its entire stake in NVIDIA, cashing out approximately $5.8 billion (around 41.5 billion yuan). NVIDIA's stock price took a hit that evening, with a staggering $100 billion in market value wiped out overnight. What kind of strategic masterstroke is this? Is there a more promising investment than NVIDIA?

Image Source: Xueqiu

Indeed, there is—OpenAI, the driving force behind this AI revolution. Without OpenAI, NVIDIA's remarkable story would not have unfolded. But is it premature to bet on OpenAI's breakthroughs in the application sphere? We'll delve into this later.

Masayoshi Son's two liquidations of NVIDIA shares share a common thread: his approach lacks diversified hedging and relies solely on heavy bets on market leaders—a 'go big or go home' mentality.

Previously, there was the WeWork debacle—valued at $70 billion in 2020, its IPO collapsed, leading to annual losses exceeding $100 billion. Later, heavy investments in unlisted tech companies saw valuations plummet in 2022, with annual losses hitting a staggering $32 billion—a record. Additionally, investments in the South Korean e-commerce platform Coupang and the 'Amazon of food' Zume also resulted in significant losses.

However, since the first half of this year, Son—once the subject of online ridicule—has reclaimed the title of Japan's richest man by betting on NVIDIA, acquiring Arm and ABB's robotics business, and constructing a comprehensive AI supply chain. He has once again become the internet's most inspirational and influential investor.

Image Source: Internet

But Son has a history of proving his critics wrong. Recently, SoftBank sold NVIDIA shares, cashing out approximately $5.83 billion, sold T-Mobile shares, cashing out around $9.2 billion, and pledged Arm shares, using the chip designer as collateral to expand guaranteed loan facilities to $20 billion.

Notably, SoftBank liquidated all NVIDIA holdings for $3.6 billion in 2019, only to repurchase them in 2020 before this latest sale. The prior sale became a cautionary tale in investing: if SoftBank had retained those original shares, they would now be worth over $150 billion.

While many focus on Son's failure to hold onto NVIDIA, the deeper reason lies in SoftBank's focus on autonomous driving and AI investments. In 2019, Son clearly did not view NVIDIA as the core AI stock, often sacrificing mature layouts for more promising opportunities—a recurring pattern.

Though he later attempted to merge ARM with NVIDIA in 2020 at a $40 billion valuation, regulatory rejection left Son missing out on NVIDIA once again.

Image Source: Internet

Clearly, Son's investments are driven by financial perspectives, prioritizing market potential over value investing. This approach led him to underestimate NVIDIA before and now to see OpenAI—valued at $500 billion—as undervalued, prompting a shift. However, this style often results in missteps—buying the wrong companies or investing too early or too late. So, where does OpenAI fit into this picture?

Masayoshi Son Goes All-In on OpenAI's IPO

Overall, OpenAI appears to be in its early stages rather than a phase of explosive application revenue growth.

'Some say I have DeepSeek anxiety and overspend on AI,' Son has publicly stated more than once, projecting that AI will impact at least 5–10% of global GDP over the next decade. 'If returns reach $9–18 trillion annually, why hold back? Competition is fierce—we must lead, be bold, and go all-in.'

When asked about the timing of selling NVIDIA shares during an earnings call, SoftBank CFO Yoshimitsu Goto said the company needed liquidity to fulfill its investment commitment to OpenAI. 'This year, our OpenAI investment is substantial—over $30 billion. To fund this, we must liquidate some assets.'

Image Source: Internet

But is this merely a portfolio shift? Or does it reflect bearish views on NVIDIA's future valuation and concerns about an AI bubble concentrating at the top? Currently, it seems like a 'pre-emptive exit' signal.

Coincidentally, Bridgewater Associates, Wall Street's largest hedge fund, released its Q3 holdings report on Friday. It showed a near-two-thirds reduction in NVIDIA holdings and cuts of over half in Alphabet, ~9.6% in Amazon, and ~35% in Microsoft. In a note to investors, Bridgewater's CIO Karen Karniol-Tambour warned of rising risks to market stability.

When asked if selling NVIDIA reflected valuation judgments, Goto declined to comment, stating only that asset reallocation is an investment firm's inherent strategy.

Son would never openly voice bearish NVIDIA views, but observers detect warning signs.

Last week, SoftBank announced a 4-for-1 stock split effective January 1, 2026. Historically, SoftBank's splits have coincided with global market turmoil:

June 2000 split (1:3): Dot-com bubble burst.

January 2006 split (1:3): U.S. housing bubble burst.

June 2019 split (1:2): 2020 pandemic-triggered global sell-off.

What waves will this split create? This is not alarmist—the bond market seems to sense danger, with SoftBank's recent bond yields exceeding 8%, indicating higher risk premiums demanded by investors. David Gibson noted, 'The stock market appears to ignore this latent, underfunded risk.'

SoftBank's trust in OpenAI may surpass any prior company: of the $8 billion in gains from OpenAI investments, SoftBank has not yet contributed real cash—merely counting a promise as profit.

Wall Street analysts point out a potential $54.5 billion gap between SoftBank's committed investments and actual available funds, risking overcommitment.

In its latest earnings report, OpenAI was mentioned 100 times, while NVIDIA was cited only 14.

Image Source: Internet

Can SoftBank escape risks by backing OpenAI? Probably not.

An OpenAI executive publicly mentioned that 'computing investments may require government guarantees,' sparking a sell-off in U.S. tech stocks and erasing over $400 billion from six giants overnight.

'The U.S. stock market faces severe downside risks, with a sharp correction possible in 6–24 months,' Jamie Dimon, JPMorgan's CEO, warned. He called AI-driven asset inflation 'concerning,' noting many assets appear bubbly.

In October, OpenAI CEO Sam Altman admitted bubbles exist in parts of AI, with 'foolish' startups easily raising funds.

Estimates suggest OpenAI could lose over $5 billion in 2025, with total cash burn exceeding $100 billion in coming years under its $1.4 trillion infrastructure commitment. Despite Microsoft's support, sustained cash drain pressures the company. Market fears mount that hardware bottlenecks like chip scarcity will drive AI training costs higher. If investor confidence wavers, a 'tech bubble burst' chain reaction could ensue.

Currently, OpenAI cannot resolve funding issues alone and relies on 'circular transactions' to sustain markets. For example, Microsoft's ~$13 billion investment in OpenAI designates Azure as its exclusive cloud provider.

Image Source: Internet

Another example: NVIDIA agreed this year to invest up to $100 billion in OpenAI for joint data centers, with OpenAI committing to buy millions of NVIDIA GPUs. Oracle, an early OpenAI investor, signed a $300 billion, five-year cloud services deal with OpenAI this year.

Nobel laureate Paul Krugman likens this to a 'self-devouring ouroboros': 'Revenue appears as sales, but it's just the same money circulating among companies.'

Sequoia's David Cahn puts it bluntly: 'If a company can only survive through infinite financing, it's fundamentally flawed.' He cautions against hype over '10-day ARR growth' or 'triple valuation rounds'—excessive capital may trick founders into believing they've won, but the real challenge is surviving after momentum fades.

Can OpenAI succeed in its IPO? Probably, but its biggest issue isn't capital—it's a lack of massive power support.

By 2028, U.S. data centers will need 57 GW of electricity, but utilities can supply only 21 GW, leaving a 36 GW gap. Beyond power, land, water, fiber networks, and even transformer production pose bottlenecks.

These physical constraints cannot be resolved through financial engineering alone. Circular transactions create an illusion of 'infinite demand' but may collide with 'finite supply' realities.

Epilogue

Historically, tech bubbles have varied, and their bursts don't equate to failed revolutions—the 2000 dot-com crash didn't stop the internet's rise after a brief lull.

Thus, AI insiders often repeat: 'The risk of not investing far outweighs the risk of investing.' Nobody wants to be left behind in an exponential revolution.

The ultimate winners likely won't be 'oil-to-chip' firms—those creating products with computing power may endure the bubble.

References:

The $10 Trillion AI Bubble—Source: LatePost

SoftBank Liquidates NVIDIA, Cashing Out $5.8 Billion—Source: FORTUNE

Masayoshi Son Cashes Out to Bet on OpenAI—Source: National Business Daily