Luobo Kuaipao Sparks a War: Autonomous Ride-hailing Takes to the Table

![]() 07/15 2024

07/15 2024

![]() 573

573

By Leon

Edited by cc

Grab your phone, open the WeChat mini program, and "tap" on a Luobo Kuaipao. Not only can you enjoy the novelty of autonomous driving, but you also don't have to worry about drivers not turning on the AC or taking detours, perfectly avoiding awkward conversations throughout the ride. This might just be the coolest way to get around in Wuhan and even all of China right now.

Starting in July, "Luobo Kuaipao," the autonomous ride-hailing service platform under Baidu, quickly gained popularity and became a nationwide focus.

In the public's stereotypical impression, autonomous ride-hailing is still a novelty. In reality, Baidu has been honing its skills in this field for a decade. In 2015, Baidu initiated research and development. Since 2022, Luobo Kuaipao has been tested and operated in 11 cities across the country.

Although the initial L4 autonomous driving performance out of the testing ground was not as expected, and netizens' evaluations of Luobo Kuaipao's autonomous driving were polarized, this did not affect Luobo Kuaipao's popularity or the positive feedback from the capital market. Even netizens joked that Baidu finally made a good investment. Baidu, which once failed in the ride-hailing market, is poised to make a comeback with this opportunity. (Details: Exclusive: Baidu Spins Off Mini Program Business, Duoli Bear Team Laid Off)

The ride-hailing market has never lacked covetous players like Baidu, and all parties are unwilling to give up completely. The smart ride-hailing camp hopes to re-enter the battle with a leap in productivity.

A new round of ride-hailing wars is about to unfold. In the short term, the pie that autonomous driving can carve out is limited. However, in the future, with the support of new technologies, the industry will undergo a shakeup. It is certain that while new modes of transportation save human resources, the market space has not expanded accordingly, and the ride-hailing market will become more competitive.

Autonomous Ride-hailing Difficult to Produce Short-term Substitution Effects

Wuhan is one of the first cities to open "fully autonomous driving" services.

The reason Baidu chose Wuhan is that as the "Automobile City of China," Wuhan became an international intelligent and connected vehicle testing demonstration zone in 2019. Additionally, its complex traffic scenarios created by crisscrossing rivers and lakes are more suitable for testing autonomous driving technology. (Details: My Father and I in the Same Major: He Struggles to Find a Job, I Joined ByteDance)

According to public data, Luobo Kuaipao has currently deployed approximately 400 autonomous vehicles in Wuhan, covering 12 districts with an area exceeding 3,000 square kilometers, and providing 7*24-hour services. It is reported that Luobo Kuaipao's daily order volume per vehicle has approached 20 orders, reaching the level of taxis, but its overall market share is not significant. Wang Yunpeng, Vice President of Baidu Group and President of Intelligent Driving Business Group, said, "Luobo Kuaipao's daily order volume in Wuhan is approximately 1% of the city's entire ride-hailing market."

Baidu's next plan is to increase the number of autonomous vehicles deployed, aiming to introduce 1,000 new-generation autonomous vehicles in Wuhan within 2024. Under this premise, Baidu is optimistic about Luobo Kuaipao's future revenue. Chen Zhuo, General Manager of Baidu's Autonomous Driving Business Unit, has stated that Luobo Kuaipao in Wuhan is expected to achieve break-even by the end of 2024 and begin profiting in 2025.

In fact, Baidu's financial report data also supports this point: Baidu's Q1 2024 financial report shows that as of April 19, Luobo Kuaipao had accumulated over 6 million orders, providing approximately 826,000 rides in the first quarter, a year-on-year increase of 25%. Baidu's share price also rose more than 12% intraday on July 10, hitting a new high in nearly one and a half months. (Details: Li Yanhong: Developing Large Models, Baidu Encountered Countless Pitfalls and Paid High Tuition Fees)

Luobo Kuaipao's ability to capture nationwide attention is not only due to its novel "autonomous driving" experience but also because it is affordable. According to Wuhan netizens, the current fare for a 10-kilometer trip on Luobo Kuaipao is 4 to 16 yuan, far more affordable than the 18 to 30 yuan charged by ordinary ride-hailing services.

Regarding Luobo Kuaipao's pricing, which is significantly below the market average, media outlets interviewed the market regulatory department in Wuhan's Economic Development Zone and learned that the current prices of autonomous ride-hailing are market-regulated and have not yet been included in government pricing, so they have no authority to interfere.

Currently, Luobo Kuaipao has begun providing fully autonomous driving services and tests in Beijing, Wuhan, Chongqing, Shenzhen, and Shanghai. Since ride-hailing and taxi markets are already red oceans, Luobo Kuaipao's forceful entry has undoubtedly intensified industry competition and internal pressure, causing some practitioners to feel anxious in advance.

Data shows that as of April 30, 2024, there were 349 ride-hailing platforms in China, with a total of 6.964 million ride-hailing driver licenses issued; in 2023, there were approximately 1.39 million taxis nationwide. Calculating based on the convention that one taxi is operated by two drivers, there are approximately 2.78 million taxi drivers. In other words, there are nearly 10 million ride-hailing and taxi drivers nationwide.

Will autonomous vehicles completely replace drivers? Not for now. Globally, cases of machines fully replacing humans are extremely limited.

Baidu's founder Li Yanhong once said at the World Artificial Intelligence Conference, "AI only assists humans in their work, not replaces them." This statement is in line with the current competitive landscape of autonomous taxis and ride-hailing services like Luobo Kuaipao. Considering that Luobo Kuaipao currently only accounts for 1% of Wuhan's ride-hailing market orders, it is clear that it has not yet reached the critical point of substitution.

Even if optimistically assuming that L4 autonomous taxis will achieve full coverage in China's first- and second-tier cities within the next few years, they will still be travel products with a different positioning from ride-hailing and taxi services. Autonomous vehicles are slower, may be cheaper, and are more suitable for users who are not in a hurry; while most people commuting will still choose faster ride-hailing and taxi services.

"Luobo Kuaipao" Cannot Run Fast, L4 Level Still Needs to Be Exploited

So, what is the user experience of Luobo Kuaipao like? Based on feedback from Wuhan netizens, opinions are polarized. Positive evaluations include affordable prices, novel experiences, no need for social interaction, and no worries about detours, among others; negative evaluations mainly focus on slow speeds, inability to change lanes or overtake, and even stopping in the same spot for half an hour.

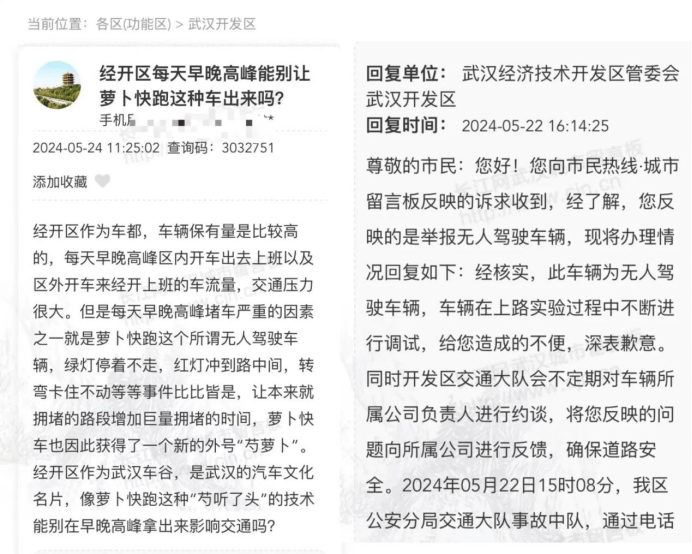

As Luobo Kuaipao's operating range expands in Wuhan, problems have gradually emerged. Some Wuhan netizens have complained to relevant departments that during morning and evening rush hours, Luobo Kuaipao vehicles "stop at green lights and rush into the middle of intersections during red lights," causing traffic congestion and affecting other vehicles' normal commutes. However, even with its slow speed, it has not prevented accidents from occurring.

On the afternoon of July 7, a Wuhan netizen posted a short video claiming that a Luobo Kuaipao vehicle collided with a pedestrian at an intersection in Wuhan. The next day, a responsible person from Baidu responded: "The accident occurred when the vehicle started with the green light and had a minor collision with a pedestrian who ran a red light. After the accident, our company immediately cooperated with the police and accompanied (the injured person) to the hospital for examination. They are currently under further observation and rest in the hospital."

Why is Luobo Kuaipao slow and unresponsive? First, let's clarify a concept: autonomous driving levels. Currently, the global market typically divides autonomous driving technology into five levels, L1-L5. Based on its own situation, China has issued the national recommended standard "Classification of Automobile Driving Automation" (GB/T 40429-2021), dividing driving automation into levels 0-5, with specific standards shown in the figure below:

Many autonomous vehicles in the market, including Luobo Kuaipao, are at level 4, which means highly automated driving. The system is responsible for vehicle control, target detection, and response, but there are limitations to the designed operating range. Only by reaching level 5 can true "fully autonomous driving" be achieved, and no relevant domestic enterprises have achieved this yet.

Let's not even mention the additional sensor fusion, stronger multi-modal perception capabilities, and more advanced algorithms needed to progress from level 4 to level 5. Even at the current level 4, the full potential has not been realized. Considering safety, road conditions, and emergencies, automakers prioritize safety when operating autonomous vehicles. As a result, the algorithms need more processing time, which explains why Luobo Kuaipao cannot run fast.

Furthermore, when autonomous vehicles encounter unsolvable problems and there is no safety driver on board, automakers can intervene remotely. This part has rigid requirements. According to the "Guidelines for Safe Autonomous Vehicle Transport Services (Trial)" issued by the General Office of the Ministry of Transport, the ratio of remote safety operators to vehicles must not be lower than 1:3.

Figure: Baidu's remote intervention system for autonomous vehicles

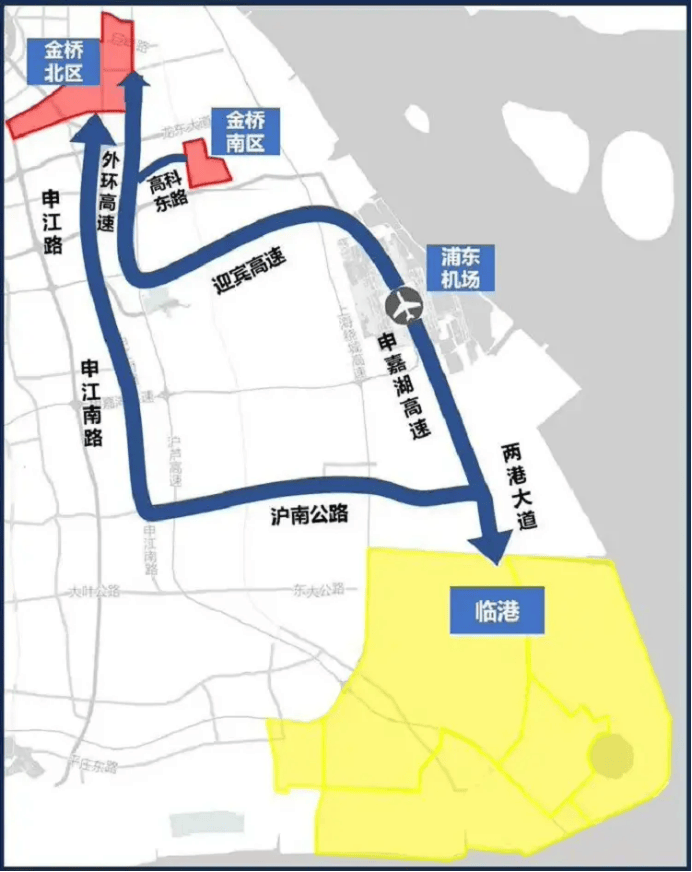

"Integrated vehicle-road-cloud" is actually a very complex concept that includes "road automation levels," "infrastructure impact on autonomous driving deployment," and even considerations for weather and many other factors. Currently, only 20 cities in China have been selected as pilot sites for the "integrated vehicle-road-cloud" application of intelligent and connected vehicles. In addition to the four major first-tier cities, this includes new first-tier and some second-tier cities such as Wuhan, Chengdu, Shenyang, Nanjing, Suzhou, and Changsha. Autonomous vehicle pilots are strictly limited to certain areas, such as limited sections near Pudong Airport in Shanghai.

The process from pilot application to official operation is also very lengthy. It is reported that after completing at least 5,000 kilometers of demonstration applications for a single vehicle, the vehicle's operating system, passenger safety, and reliability must undergo rigorous verification before relevant departments will conduct a final assessment of automakers and vehicles.

In fact, it is not only Luobo Kuaipao that has not fully realized the L4 level of autonomous driving. Google's Waymo, which began testing autonomous vehicles in 2012, is also in the same situation. Recently, The Verge reported that police intercepted a Waymo autonomous taxi for driving the wrong way in Phoenix because it was indeed driving the wrong way. Waymo responded that the vehicle turned around and drove the wrong way after encountering "inconsistent" construction signs. It seems that autonomous vehicles are not yet "smart" enough.

Even professionals approach the commercialization of autonomous driving with extreme caution. Huang Hantao, Director of Government Affairs at Pony.ai, said in an interview that obtaining a demonstration application license for autonomous taxis is only the beginning, and there is still a long way to go before final commercial operation. Companies still have many dimensions to continuously improve. This process is complex and lengthy, requiring companies to face challenges in laws and regulations, technology maturity, and safety.

Autonomous Driving Enters the Travel Market

Although it is still too early to consider the commercialization of autonomous driving, this does not affect its appeal to capital.

As early as 2012, Google began testing autonomous vehicles and later established the "Waymo" brand, raising over $2.5 billion in funding. Currently, Waymo operates in Los Angeles and the San Francisco Peninsula in the United States, covering an area of over 1,200 square kilometers. In addition to Google, Tesla also plans to launch its Robotaxi service in the United States, claiming to achieve L5 autonomous driving, with an expected official release in October this year.

Domestically, Baidu is one of the pioneers in autonomous driving technology. In 2015, Baidu established its L4 Business Unit to develop autonomous driving technology, and in early 2017, it launched the "Apollo" platform, which is an essential part of Baidu's AI strategy. Over the following years, Baidu invested over RMB 10 billion in Apollo, which has now been iterated to the sixth generation. As of April this year, Apollo has accumulated over 100 million kilometers of driving and has not experienced any significant casualties.

In addition to Baidu, there are many competitors in the domestic autonomous driving travel sector (non-vehicle manufacturing enterprises). For example, three companies recently obtained Shanghai's first batch of pilot application licenses for driverless intelligent and connected vehicles: SaiKe Intelligence, AutoX (Antu), and Pony.ai.

SaiKe Intelligence Technology is a subsidiary of SAIC Motor, leveraging SAIC's rich resources. Its 3D object detection algorithm ranked first globally on the international nuScenes leaderboard last year, achieving the top spots in key indicators mAP and NDS. Currently, SaiKe Intelligence's autonomous taxis have driven over 2 million kilometers, including over 70,000 kilometers of highway testing, with zero traffic accidents.

AutoX (Antu) is a startup founded in 2016, which has completed two rounds of financing, including US$100 million in Series A and tens of millions of dollars in Pre-B, with investors including Dongfeng Motor, Alibaba Entrepreneurs Fund, and Shenzhen Qianhai Hongzhao Fund. AutoX's fifth-generation autonomous vehicles are said to number over 1,000 and have been approved for fully autonomous driving tests in Beijing, Shanghai, Guangzhou, Shenzhen, and Silicon Valley, USA.

Another startup, Pony.ai, is even more favored by capital, having received a total of 10 rounds of financing, including from Sequoia Capital, IDG Capital, and China Merchants Capital, with a disclosed total funding amount exceeding US$1 billion. Pony.ai's business covers Robotaxi, Robotruck, and L2+ solutions, making it one of the few intelligent driving companies focusing on the autonomous truck market. Currently, Pony.ai has obtained fully autonomous passenger-carrying licenses in China's four major first-tier cities and has driven over 10 million kilometers in autonomous driving tests globally.

Additionally, there are startups such as WeRide and DeepRoute.ai dedicated to autonomous driving technology, backed by major players like Yutong Group, Alibaba, and Dongfeng Motor.

For both investors and companies, the key factors are the growing trend of autonomous driving and the desire to reshuffle the ride-hailing market in new ways. For instance, the previously unsuccessful Baidu Ride-Hailing aims to re-enter the mobility market using autonomous vehicles.

However, one must not overlook the traditional ride-hailing forces. As the largest ride-hailing platform in China, with a market share of 75% (including Didi and Huaxiaozhu), Didi is well-prepared.

In 2023, Didi unveiled its first futuristic service concept car, DiDi Neuron, and announced plans to mass-produce autonomous vehicles by 2025 and integrate them into Didi's ride-hailing network. It is reported that Didi's autonomous driving team now exceeds 1,000 members, focusing on full-stack core technologies for L4-level autonomous driving.

Similarly, other ride-hailing companies like T3, CaoCao Mobility, and Ruqi Mobility (09680.HK) are also advancing in the autonomous ride-hailing space. T3 has partnered with QCraft to begin testing in Suzhou, with plans to operate 1,000 L4-level vehicles by 2026.

CaoCao Mobility has entered a strategic cooperation agreement with Geely Auto, aiming to establish a nationwide platform for the commercial operation of L4-level autonomous ride-hailing services.

Ruqi Mobility, which went public on the Hong Kong Stock Exchange on July 10, has become China's first listed "Autonomous Driving Operation Technology" company. Backed by GAC Group and Tencent, Ruqi Mobility entered the market in 2019 to offer ride-hailing services. Currently, it holds a market share of about 1.1% nationwide and 6.9% in the Greater Bay Area. It is reported that 40% of the funds raised from Ruqi Mobility's IPO will be allocated for autonomous driving research and development.

From a market perspective, the advent of driverless taxis does not add incremental value to the entire market but merely supplements the range of available product types. According to data from the ride-hailing regulatory information exchange system, the nationwide ride-hailing order volume in May 2024 was 944 million, compared to 897 million in April, showing a month-on-month growth of only 5.24%. This data range has actually stabilized since 2018, without significant increases.

The market is already crowded, with numerous players including internet giants, automotive companies, and startups all eager to get a piece of the pie.

Reflecting on several industry battles in China's ride-hailing, food delivery, and bike-sharing sectors, it seems that autonomous driving might follow the same pattern: "massive entry - burning money to acquire users - elimination rounds - return to stability," leaving only a few players standing in the end.

Will services like "Apollo Go" always remain so affordable?

Based on past experience, during the fervent period of capital influx, consumers can enjoy the benefits of new offerings. The "ride-hailing wars" of the past were initially driven by various forms of price wars to capture market share; however, once the market stabilized, prices returned to rational levels. Following this pattern, it is unlikely that driverless taxis will continue to operate at a loss indefinitely.

Moreover, despite the absence of drivers, vehicle costs cannot be ignored. According to Baidu, some of the operational vehicles in Apollo Go are the latest sixth-generation Apollo autonomous vehicles, which have seen a cost reduction compared to earlier models, with a per-unit procurement cost of approximately 204,600 yuan. Thanks to the reduction in automotive hardware costs, the service cost of Apollo Go is expected to decrease by 80%, and operational costs by 30%. Even so, the cost of autonomous vehicles remains relatively high.

According to data from the "2023 National Taxi and Ride-Hailing New Car Market Analysis" released by the China Automobile Dealers Association, new energy vehicles (NEVs) accounted for 87% of the taxi and ride-hailing market in 2023, while fuel vehicles accounted for only 13%. Among these, entry-level NEV models from GAC AION and BYD were the most popular, with prices generally under 100,000 yuan. For instance, the BYD Qin PLUS DM-i is currently priced starting at 79,800 yuan.

Moreover, shifts in technology direction could also increase the potential costs of autonomous ride-hailing. Currently, most autonomous vehicles rely on expensive sensors such as LiDAR and millimeter-wave radar to achieve self-driving capabilities. However, Tesla's latest FSD V12 system offers a different solution: pure vision. This technology, based on the HydraNet technology built on neural networks, uses cameras to capture image information, enabling precise judgments of 3D position and speed.

Due to the excellent test results of Tesla’s FSD V12, some domestic car manufacturers and intelligent driving companies have decided to switch to developing pure vision solutions, including Huawei and Xpeng. Huawei has already launched its visual intelligent driving solution, HUAWEI ADS, which will compete directly with Tesla's FSD in the future. Referring back to Baidu, all six generations of Apollo autonomous vehicles have adopted radar solutions. Switching technological directions would inevitably incur additional costs.

In summary, for major players keen to boost profitability through ride-hailing services, the current level of subsidies is clearly unsustainable for formal operations. Additionally, once autonomous taxis are officially commercialized, market regulatory authorities will likely impose pricing requirements to prevent unfair competition. The 4 yuan for 10 kilometers ride offered by Apollo Go is something to cherish while it lasts.