2024WAIC: Large Companies Compete on Implementation, Small Companies Compete on Applications

![]() 07/16 2024

07/16 2024

![]() 571

571

Preface:

The focus of the current large model competition has shifted to the application level. However, the attempts made by various model vendors in terms of applications still exhibit obvious homogeneity and early POC characteristics.

In terms of these conventional scenarios, even relatively mature vendors have not provided in-depth introductions to their commercialization and implementation, while vendors with slower progress are still in the demo stage.

Author | Fang Wensan

Image Source | Network

AI Competition Moves Towards Infrastructure and Application Layers

Based on detailed statistical data analysis, in 2023 alone, investment in artificial intelligence in the primary market reached $22.4 billion, exceeding the cumulative total investment over the past decade.

Among them, more than two-thirds of the funds were used to support enterprises engaged in infrastructure or model development.

In other words, this trend clearly shows that the vigorous development of artificial intelligence has expanded from fierce competition at the model layer to a broad layout at the infrastructure and application layers.

The so-called infrastructure layer refers to AI computing technologies that can significantly improve model training and inference efficiency, reduce costs, and enhance energy efficiency, including but not limited to chip research and development adapted to AGI.

The application layer, on the other hand, covers a diverse range of vertical fields, from tools that enhance productivity efficiency to edge AI, robotics, automobiles, and more.

At the model layer, in addition to Moon Dark Side, ZeroOne, and DeepSpeech, most of China's Tier 1 and Tier 2 large model teams actively participated in the exhibition, including Zhipu AI, Mianbi Intelligence, Baichuan Intelligence, Jieyue Xingchen, and others.

However, it is worth noting that no new Chinese large model companies emerged both inside and outside the conference.

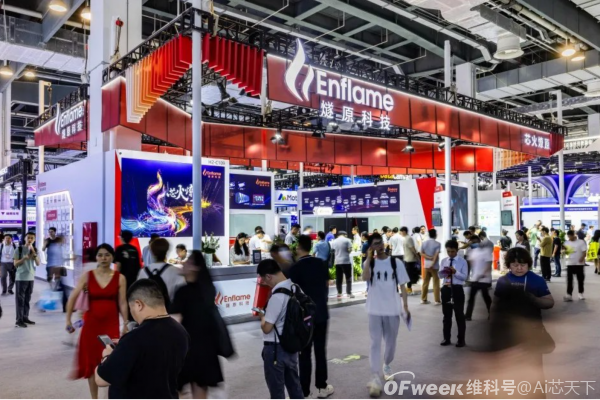

At the computing layer, Chinese enterprises such as Alibaba Cloud, Huawei Cloud, Wuwenxinqiong, Biren, Suiyuan, and others have showcased their latest achievements surrounding large model training and inference, demonstrating the vigorous development trend of AI models in various industries.

From WPS AI by Kingsoft Office to the "Eighteen Vajras," the integration of AI models with actual scenarios is becoming increasingly tight.

At the industry forums of WAIC, experts proposed that the development of AI innovative applications is gradually shifting from improving efficiency (Save Time) to obtaining pleasure (Kill Time).

Although some [Kill Time] level applications have emerged at this year's WAIC, such applications are not yet prevalent, and current innovations in AI tools that improve efficiency remain the primary development direction for AGI applications.

Large Model Vendors Apply Large-Scale Trial and Error

At this year's WAIC booths, whether it was AI chip companies at the bottom layer, middle-tier enterprises, or enterprises at the model and industrial implementation layers, all placed [practical application value] at the core of their exhibition logic.

For example, in previous years, Suiyuan Technology in the AI chip field primarily focused on showcasing its various generations of AI chips and performance characteristics.

However, this year, the company highlighted the practical application of AI chips and Zhipu's large model in code scenarios and introduced the progress of its computing center construction in collaboration with the Yichang Dianjun Smart Computing Center.

At the model layer, Alibaba launched the [Tongyi Twelve Hours] series, aiming to comprehensively demonstrate the practical applications of Tongyi's large model in various scenarios such as dialogue, efficiency, agents, vision, and more.

iFLYTEK not only showcased its latest iteration of the large model 4.0 version but also specifically introduced its iFLYTEK Xiaoyi experience in medical scenarios.

Baichuan Intelligence launched a medical Q&A product for medical scenarios, providing users with a platform for querying medical health knowledge.

Jieyue Xingchen elaborated on video understanding and search capabilities through its newly released Step-1.5V trillion-parameter multimodal large model.

SenseTime released its multimodal interactive large model Ririxin 5.5 at this year's WAIC, not only showcasing the capabilities of the model but also externally displaying it on the booth through appropriate productization methods.

At the middle layer, Wuwenxinqiong announced the world's first thousand-card-scale heterogeneous chip mixed training platform at the AI Infrastructure Forum of the 2024 World Artificial Intelligence Conference. This platform supports efficient and unified deployment of various large model algorithms on multiple chips.

At the industrial application layer, social networking companies such as Bilibili and Soul also showcased their AI explorations at WAIC, such as using AI for online werewolf games.

NetEase introduced AI copilots into its games, helping players analyze the game situation and participate in games together.

Embodied Robots Compete for [Flexible Object] Tasks

At this year's WAIC (World Artificial Intelligence Conference), a total of 45 intelligent robots were exhibited, with humanoid robots occupying a prominent position, accounting for 25 models.

Last year, Tesla showcased its Optimus robot at the WAIC booth, quickly becoming the center of attention in the robot area.

This year, although the Optimus robot was still exhibited in a boxed form, its top status and popularity remained unchanged.

Additionally, the robot exhibited by Yanshan Technology achieved real-time voice communication with humans by adding cameras and introducing large models, marking a significant improvement in robot interaction capabilities.

In terms of the implementation of robot B-end scenarios, new progress has also been made this year. In addition to traditional power inspections, Amazon has applied robots to factory product yield inspection scenarios, demonstrating the broad application prospects of robot technology.

SenseTime's controllable character video generation large model Vimi won the highest honor at the WAIC exhibition, [Treasure of the Museum], becoming one of the most innovative exhibits at the conference.

At the exhibition, China's first full-size open-source general humanoid robot public version, [Qinglong], was officially launched.

Developed by Humanoid Robot (Shanghai) Co., Ltd., this robot has 28 degrees of freedom, supporting flexible movement and precise grasping, making it an ideal platform for general AI hardware and software development.

Tesla's Optimus second-generation humanoid robot was also a focus of the exhibition.

Empowered by AI large models, the second-generation robot weighs less, has stronger body control capabilities, more natural hand joint movements, and can even complete delicate operations such as grasping eggs.

Tesla plans to start limited production of humanoid robots next year and aims to control their cost at around $10,000, with an expected selling price of $20,000.

Fourier Intelligence has taken the lead in achieving mass production and delivery in the industry, covering more than 2,000 institutions and hospitals in over 40 countries and regions worldwide.

The unveiling of the upgraded version of its humanoid robot GR-1 and the lower limb exoskeleton robot ExoMotus M4 brought new solutions to the field of rehabilitation medicine.

CloudMinds Robotics' latest humanoid bipedal robot XR4 [Seven Fairies] Xiao Zi was unveiled for the first time at the conference.

Made of carbon fiber composite materials, this robot has over 60 intelligent flexible joints and can move at a speed of 3.5 kilometers per hour, showcasing the potential of future robot technology.

The Mover Mini INS power distribution room inspection robot also made its debut at the conference.

Based on an integrated [cloud-network-terminal] architecture design, this robot provides efficient and intelligent inspection solutions for the complex indoor environment of the power system.

Lite3 and X3 robot dogs from CloudMinds demonstrated their excellent abilities in upright and handstand walking, as well as their anti-interference balance and AI visual perception of terrain to autonomously select movement postures, embodying the advancement and practicality of robot dog technology.

Large Companies Reach Out to To B, Unicorns Explore To C

Before the AIGC era, companies that already had stable cash flow businesses were actively leveraging AIGC technology to empower these businesses and achieve upgrades and optimizations in business forms.

For large model enterprises, the benefits of lower prices are significant, not only helping to attract more users, increase online user duration, and expand traffic but also enabling the exploration of more ideal business models based on these traffic values.

Traditional internet technology giants tend to focus on To B business at this stage, due to their customer resource advantages in the To B field.

Whether it's large models or previous new concepts and technologies, they often first achieve success in To B scenarios during the initial stages of commercialization.

In terms of ToC applications, a typical example is Kuaishou's integration of its Keling large model with the Kuaishou app.

In the ToB field, technology companies are promoting the application of AIGC technology through organic integration with industries such as energy, transportation, and communications.

By developing their own AIGC models and technologies, enterprises can build corresponding AIGC applications, including platforms and apps, and customize specific AIGC solutions based on customer needs.

This model is similar to AI solutions in the traditional deep learning era, primarily targeting the ToB market.

For unicorn enterprises that lag behind in customer resource accumulation, directly targeting the To C market is a more realistic choice.

They are actively expanding the C-end market, following the direction of OpenAI, and some domestic unicorn enterprises have already adopted this strategy.

Regarding the future evolution path of domestic large models, the key lies in achieving autonomous co-creation with a vast number of users in general scenarios.

Users' initiative and proactivity are crucial in this process, which is difficult to achieve in the two cooperation models of To B.

Currently, Moon Dark Side's Kimi chatbot has performed quite impressively in the C-end application.

According to SimilarWeb data, in May 2024, Kimi's traffic ranked 23rd among global AI products, becoming the highest-ranking domestic large model.

In the context of major models competing to announce platform traffic, this data is quite objective.

Looking ahead, the trend of large companies continuing to delve into the To B market while unicorn enterprises actively explore the To C market is expected to continue for some time.

Until large companies launch new C-end platforms or unicorn enterprises achieve scale advantages in the C-end market and feed back into B-end scenarios, the landscape of domestic internet enterprises may undergo profound changes.

Conclusion:

Currently, AI vendors exhibit a comprehensive and diversified approach in their application explorations, but many have yet to find a suitable and proven product roadmap.

It is expected that in the next year, the market validation of AI products will become the primary strategic direction for many vendors, and the number of AI products on the market will continue to show rapid growth.

Some reference materials: AI Alignment: "Closing Thoughts, [WAIC 2024] Details and Predictions," Understanding Business: "Robots [Surrounding] Large Models, AI Empowering All Industries," New Position Pro: "2024WAIC: Large Companies to B, Unicorns to C," Bluehole Business: "Domestic Large Models WAIC Competition: Large Companies Compete on Implementation, Medium-sized Companies Show Anxiety," Lei Feng Network: "WAIC 2024 Has Concluded: No New Players in Large Models, AGI's Second Half is Computing and Applications"