On the Eve of the Agent Boom, What Are the Big Players Competing For?

![]() 07/19 2024

07/19 2024

![]() 458

458

Halfway through 2024, the competition among domestic large models has intensified.

If the first half of the large model race was about basic capabilities, then in the mid-stage, the competition for AI Agents has become a top priority.

Agents are the most important product form for application implementation.

However, currently, domestic and foreign players have taken different development paths. Microsoft and OpenAI's GPTs have encountered obstacles, while an increasing number of players and agent development platforms have emerged in China.

These include ByteDance's Kouzi, Tencent Cloud's Tencent Yuanqi, Baidu Intelligent Cloud's Qianfan AgentBuilder, Alibaba Cloud's Bailian platform, and iFLYTEK's Spark Agent platform.

Apart from these giants, AI startups like Zhipu AI and Mianbi AI, SaaS companies like Ronglian Cloud and Smartbi, and collaborative office tools like DingTalk and Feishu are also intensifying their efforts in agent development and application.

Undoubtedly, the second half of the domestic large model competition has shifted to the development and application of agents, gradually forming a diversified and fiercely competitive ecosystem.

Why are domestic companies so optimistic about agents, when Microsoft and OpenAI, industry bellwethers, have not done well in this area? In the battle for agent applications, faced with increasingly homogenized products and services, how can companies compete effectively?

In the AI era, agent platforms will become the mainstream application development frontline, but C-end distribution still relies on current traffic hubs like Douyin, WeChat, and Taobao, while B-end distribution goes through ISVs (Independent Software Vendors).

What the big players are competing for is still the AI ecosystem, while other companies focus on implementing agents in vertical scenarios.

However, the real challenge lies in how to make agents practical and achieve commercialization.

On the one hand, for C-end applications, agents can become personal smart assistants, solving daily problems. On the other hand, for B-end enterprise scenarios, by integrating large language models, knowledge graphs, retrieval-augmented generation (RAG), agents, and management platforms, agents can build "enterprise brains" for various government agencies and enterprises.

However, from the current industry development perspective, with Microsoft abandoning the C-end consumer market and OpenAI's GPTs failing to achieve true commercial benefit sharing, the hope for agents to achieve commercialization in the C-end market is not high in the short term. But in the B-end enterprise services with numerous demands, suitable application scenarios can be found, such as office AI assistants, sales assistants, and R&D assistants.

01 Big Players Aim for Ecosystems, Small Players Focus on Scenarios

Currently, the agent race has attracted numerous players.

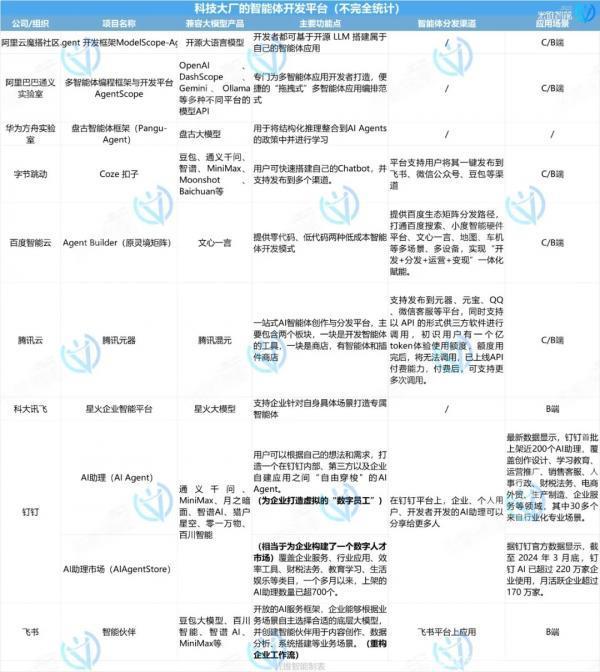

According to incomplete statistics from Guangzhui Intelligence, internet giants like Baidu, Alibaba, Tencent, and ByteDance have all laid out the agent track and launched one-stop agent development platforms. Huawei's Ark Lab has also released a Pangu Agent framework, but there isn't much information on related applications.

Among AI startups, Zhipu AI and Mianbi AI have launched agent development platforms, while companies like Dark Side of the Moon, ZeroOne, and Baichuan Intelligence focus on AI application assistants and have not yet launched agent development platforms.

Internet giants target a wider range of users and scenarios, focusing on enabling more users to use their platforms, expanding their AI developer ecosystems, and leveraging their content ecosystem advantages to provide channels for agent development and monetization, such as Tencent's WeChat ecosystem, ByteDance's Douyin, Toutiao, etc.

AI startups like Zhipu AI, while comprehensively benchmarking OpenAI in large model capabilities, tend to commercialize through the B-end market. Their agent platforms support individual developers but are more focused on obtaining data feedback from users to facilitate the implementation of agent + industry solutions. Mianbi AI is firmly committed to edge AI, and its agents will likely serve more edge-side scenarios.

It's worth mentioning that agents have invigorated the original enterprise service track.

In collaborative office scenarios, both Feishu and DingTalk have made layouts in the agent track.

DingTalk previously launched an AI assistant service, allowing users to create an AI agent that can "freely shuttle" within DingTalk, third-party apps, and self-built enterprise applications.

In addition to the AI assistant, DingTalk also launched the AI AgentStore, essentially building a digital talent market for enterprises, covering categories like enterprise services, industry applications, efficiency tools, finance and tax, education, and entertainment. In just over a month, over 700 AI assistants have been listed.

Feishu, through its open AI service framework, enables enterprises to choose suitable underlying large models based on business scenarios and create smart partners for content creation, data analysis, system construction, R&D assistants, and other business scenarios.

The difference lies in Feishu's belief that agents need to be deeply integrated with original workflows, while DingTalk believes agents are relatively independent, with mobility and transaction value like employees.

SaaS companies like Ronglian Cloud and Smartbi have also showcased their layouts and products in the agent track.

Unlike the agent development paths of the aforementioned companies, SaaS companies focus more on agent applications in vertical scenarios. For example, Ronglian Cloud's Rongxi Insight Agent and Rongxi Virtual Agent specialize in marketing, sales, and service scenarios.

There are also startups dedicated to agent development.

Dify.AI, founded in May 2023, is an LLM application development platform supporting the construction of over 100,000 applications, integrating Backend as Service and LLMOps concepts, suitable for building generative AI native applications, and creating AI agents based on any LLM.

There are also companies like Shenqing Technology, which specializes in building agent development platforms for the financial industry, and Zhenshi Intelligence, which focuses on developing virtual "digital employees" for enterprises, offering both C-end agent development services and B-end AI digital employee solutions and cloud services.

It's clear that in the battle for agent applications, different companies focus on different scenarios and ultimately aim for different goals. Big players want ecosystems, while small players want to focus on specific scenarios.

For internet giants, the focus is on building AI ecosystems and selling the ability to invoke underlying large models and cloud computing power. Feishu and DingTalk, on the other hand, are competing in the enterprise office scene, targeting the intellectualization of enterprise internal knowledge bases and promoting enterprise digital transformation.

SaaS companies like Ronglian Cloud and Smartbi are vying for further intellectualization of local scenarios, such as smart customer service and smart investment advisors. Similarly, AI startups focused on agents, while launching agent development platforms, are still focused on key application scenarios, offering related agent development services, and seeking to find commercialization paths for agents in these scenarios. However, finding scenarios and demands from scratch is challenging for startups compared to established internet giants and enterprise service companies.

Currently, many players have formed a diversified competitive landscape in the agent track, with different companies focusing on agent development and applications in various scenarios based on their respective advantages.

In this process, the company that can take the lead in commercializing agents and realizing monetization will ultimately succeed. Big players with strong resource advantages may exert overwhelming competitive pressure on startups.

02 Limited Breakthroughs in C-end, Focus on Scenarios in B-end

Currently, the agent track is on the eve of an explosion, and the industry urgently needs to find viable business models.

From an application perspective, C-end agents are positioned as personal assistants, with natural interaction as a basic requirement and personalization as the key to enhancing the experience. B-end agents, on the other hand, need to provide richer plugin options and more flexible workflow design functions, often integrating data annotation, model fine-tuning, and other functions to better meet enterprises' needs for vertical model capabilities.

In simpler terms, C-end agents require innovative experiences, while B-end agents need solid professional capabilities.

There are two main ways to develop C-end agent applications:

One is for individual developers to create their own agents using agent development platforms. For example, a fifth-grade student in Beijing developed an English tutor agent using the Kouzi platform for daily use.

The other is for enterprises to develop their own AI assistant agents for C-end users, such as software-based kimi from Dark Side of the Moon and hardware-based AI learning machines from iFLYTEK.

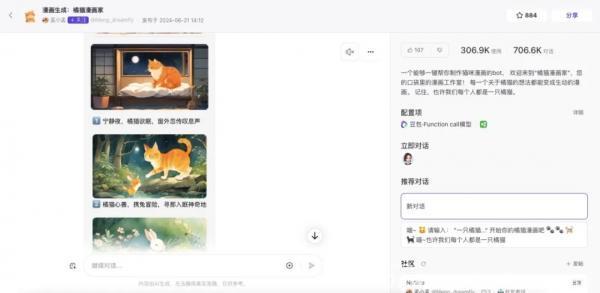

Popular Bot applications on ByteDance's Kouzi platform

Based on large language model capabilities, C-end agents currently appear mostly in the form of conversational AI chatbots, whether developed by individual users or enterprise-launched applications, generally adopting a question-and-answer format.

These include AI teachers and learning assistants in educational scenarios, AI travel planners in travel scenarios, and AI role-playing in gaming scenarios.

"If everyone can have an intelligent and user-friendly assistant, the equalization brought about by this technology will spur significant industrial changes. This could be an important direction for C-end applications and an exciting prospect," said Wang Zhongyuan, Dean of the BAAI.

However, to date, no truly popular C-end agent application has emerged.

In fact, from a C-end user perspective, agents are more often integrated into apps, but current large model capabilities fail to provide a disruptive AI experience.

From an individual developer's perspective, while agent development platforms can create agents with a single command, developing a truly useful agent requires strong programming skills, involving inputting specific prompt words, mobilizing appropriate knowledge bases, and utilizing various plugin capabilities.

Zhao Xudong, head of market operations at ByteDance's MarsCode, said that individual developers' pursuit should dictate their approach to developing agent applications. If the goal is quick profit, they can use the Kouzi platform to build a frontend product tailored to specific demand scenarios. "But if you want to create an extremely elegant interface, it's difficult for individual developers to achieve," he added.

Enterprise-developed C-end agent applications, while offering better overall experiences, cannot fully break free from scenario constraints, and in specific scenarios, there are already corresponding popular applications.

DingTalk President Ye Jun has also pointed out that GPTs with millions or tens of millions of parameters are relatively monolithic and lack the robust business understanding of traditional software, making it difficult for applications in GPT Stores to become high-value products. "Although GPTs have strong creation capabilities, even generating dozens per day, they cannot replace the traditional software market yet," he said.

Different forms of Agent capabilities introduced by ChatGPT

In the search field, besides Baidu Search, apps like Douyin, Xiaohongshu, and Toutiao have also provided information search capabilities, and these products are reshaping their business systems based on AI, offering agent services to users.

Therefore, AI assistant applications like kimi from Dark Side of the Moon and Kunlun AI from Kunlun Wanwei can answer various user questions, read documents quickly, organize materials, etc., with total active user numbers exceeding millions. While they are in the first tier among AI assistants, they are still far from becoming ten-million-level popular applications.

From these perspectives, agents based on large model capabilities are unlikely to produce popular C-end applications in the short term. Conversely, in B-end enterprise service scenarios, due to high professional requirements, suitable implementation scenarios can be found.

According to incomplete statistics from Guangzhui Intelligence, apart from the agent development platforms of internet giants like Baidu, ByteDance, and Tencent, which support all developers in agent development, most others are geared towards B-end enterprises, providing enterprise agent development and services.

"We are completely different from GPTs," Ye Jun previously said.

DingTalk and Feishu, as platforms focusing on enterprise office scenarios, have natural B-end scene advantages.

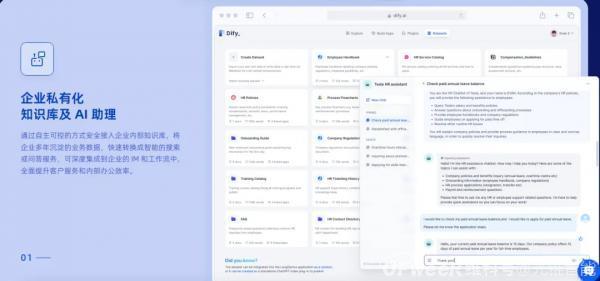

For enterprises, the core purpose of applying generative AI is to improve business R&D efficiency, and the key to generative AI's application in enterprises lies in feeding enterprise knowledge base data. By combining enterprise knowledge bases, enterprise-level agents can provide efficient operational processes and product service experiences for internal development.

For example, in HR scenarios, the main functions of human resources departments include human resource planning, recruitment, training, performance management, compensation management, and employee relationship management, and each enterprise has its own personnel-related processes.

By accumulating internal personnel data, enterprises can form corresponding knowledge base data and "feed" it to agents to develop AI assistants that best understand the enterprise's personnel process management content.

Taking Feishu as an example, in November last year, it launched a series of AI products called "Feishu Smart Partner," allowing Feishu users to create an "AI colleague" to extract meeting points, generate documents, spreadsheets, mind maps, perform data analysis, and more.

Enterprise users of Feishu can build an agent that better understands the enterprise's operational processes based on their own knowledge bases, such as an HR agent that provides answers to operational process-related questions for internal employees, including how to claim expenses and navigate business trips.

In B-end enterprise scenarios, different businesses and departments have demands for generative AI and can build agents through enterprise knowledge bases to improve operational efficiency.

Therefore, the application of agents in B-end scenarios focuses more on specific application scenarios and the construction of enterprise knowledge base capabilities.

However, B-end enterprise users pay more attention to data privacy and security. Industry insiders have previously expressed concerns about data leakage when building agents that require external knowledge bases, "accidentally uploading data."

"Dify.AI enables local deployment for enterprises, making it suitable for building enterprise knowledge bases," said a developer.

Moreover, many companies focus on the B-end track because they can truly realize the monetization of agent applications.

The primary monetization method is through enterprises invoking large model API interfaces. Dify.AI, a startup, charges on an app subscription basis, offering different service contents based on enterprises' specific needs, with annual and monthly payment options.

Comprehensively considering the current competitive landscape in the agent track, internet giants undoubtedly occupy a dominant position in the agent market due to their comprehensive technical ecosystems and strong resource integration capabilities.

However, with numerous B-end demands and small scenarios, other SMEs can also occupy a place in the agent market by continuously delving into their technical and product advantages.

While there are many B-end demands and practical scenarios that enable rapid agent implementation, whether small and specialized scenarios can truly cultivate a super app and achieve profitability remains uncertain.

03 The Battle for Agent Stores

In the AI era, the software application ecosystem is being restructured, with App Stores gradually transforming into Agent Stores.

IDC's "Top Ten Trends in AIGC Application Layer in 2024" mentioned that the new round of AIGC competition will also be a battle for traffic entry points.

Whether C-end or B-end, what Chinese companies are competing for in the agent track is essentially the traffic distribution entry points in the AI era, especially for internet giants.

Statistics show that Alibaba has built an AI Agent Store through DingTalk, while platforms like ByteDance's Kouzi, Tencent Cloud's Yuanqi, and Baidu Intelligent Cloud's Qianfan AgentBuilder all have agent store functions and support one-click distribution across multiple channels.

Among them, DingTalk primarily supports sharing the platform's AI assistant with users within the platform. ByteDance's Koushi platform allows users to publish content with one click to channels such as Feishu, WeChat Public Accounts, and Doubao.

Baidu provides a distribution path through its Baidu ecosystem matrix, integrating multiple scenarios and devices such as Baidu Search, Xiaodu smart hardware platform, Wenxin Yiyan, Maps, and in-car systems. This achieves an integrated enablement of "development + distribution + operations + monetization."

Tencent Cloud Yuanqi supports publishing to platforms such as Yuanqi, Yuanbao, QQ, and WeChat Customer Service. It also supports API access for third-party software, offering an initial user experience quota of one billion tokens. Once this quota is exhausted, API calls can no longer be made unless the user opts for the paid API service, which facilitates additional calls.

In fact, compared to small and medium-sized enterprises focusing on developing and applying intelligent systems in specific key scenarios, for major internet companies, the decisive factor lies in their ecosystem operations capability and whether the front end has enough scenario-driven traction.

After all, in the era of the internet and mobile internet, major companies have already established their respective traffic distribution gateways. Therefore, in the AI era, these companies also experience FOMO (Fear of Missing Out).

China's intelligent systems market is in a rapid development phase. The participation of various types of enterprises injects boundless vitality into the market. A golden age, even more prosperous than the internet and mobile internet eras, is gradually unfolding.