AI phones lack exclusive large model suppliers

![]() 07/24 2024

07/24 2024

![]() 468

468

Caught up in the race for large model smartphones, Baidu, Alibaba, and ByteDance have become suppliers to mobile phone manufacturers, while AI phones do not favor any one company, choosing to integrate multiple large models as the mainstream option.

@TechInsights Original

Just as the flames of the Hundred Model War have subsided, the wave of AI hardware has swept in.

Smartphones, as universal terminal products, have become the forefront of the hardware landing trend for large models. Among domestic mobile phone manufacturers, OPPO has announced that 2024 is the first year of AI phones, while Meizu has stated that it will officially stop new projects for traditional smartphones, both All in AI. Overseas, Apple, which had been heavily focused on car manufacturing for a decade, has turned to generative AI projects, fully betting on its next-generation iPhone 16 series.

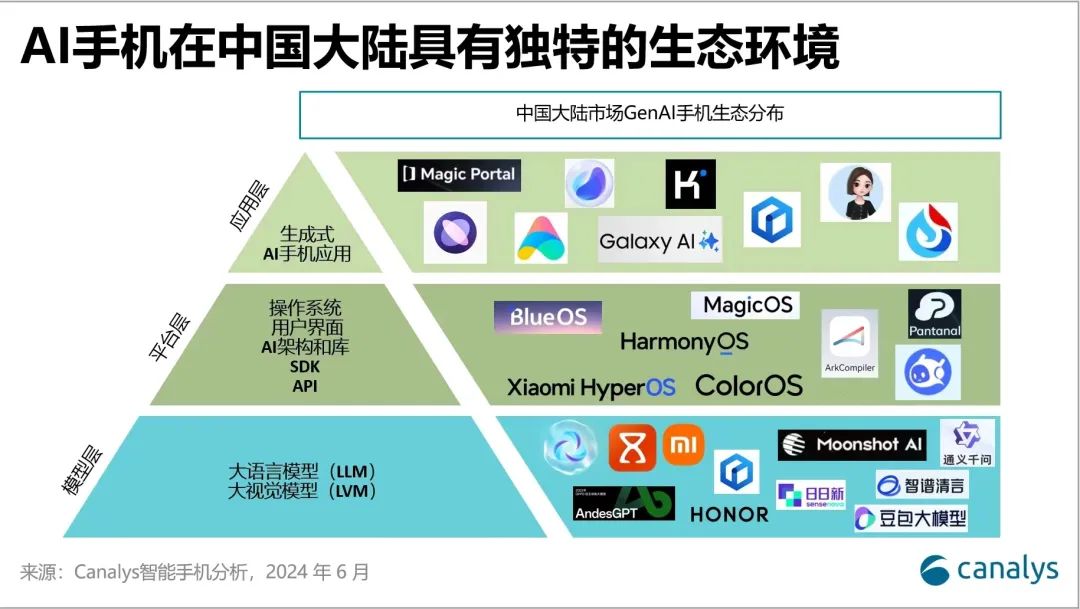

Prior to this, starting last year, mainstream mobile phone manufacturers such as Samsung, Xiaomi, Honor, and vivo have all, sooner or later, announced their AI technology layouts and product launches. A recent report titled "The Appeal of AI Phones to Chinese Consumers" by Canalys revealed that in the first quarter of 2024, the Chinese mainland market, relying on the early mover advantage and high-end market structure of local manufacturers, shipped 11.9 million AI phones, accounting for 25% of global AI phone shipments.

Source: Canalys

The trend of AI phone terminals has also attracted leading large model service providers to join in succession.

In May last year, Baidu's Xiaodu Technology announced its intention to enter the smartphone market and planned to release its first smartphone integrating Xiaodu AI technology capabilities in late May. However, instead of a major return to the smartphone market after eight years, the public was greeted with the launch of an "Xiaodu Qinghe" AI learning machine.

ByteDance, on the other hand, was rumored to have secretly initiated an AI phone research and development project in April this year, with the core team mainly composed of the Smartisan phone R&D team acquired by ByteDance in 2019 and the PICO VR R&D team acquired in 2021. However, ByteDance later clarified that the information was inaccurate and that it was actually exploring large model software solutions based on mobile phones to provide reference for mobile phone manufacturers.

Alibaba, meanwhile, is all-in on selling shovels in the large model market. In March this year, mobile phone chip supplier MediaTek announced that it had successfully deployed the Tongyi Qianwen large model on flagship chips such as the Dimensity 9300, achieving deep adaptation of the large model on mobile phone chips for the first time. Tongyi Qianwen can still run multiple rounds of AI dialogues smoothly offline.

After multiple rumors of personally entering the AI phone market, for top large model suppliers like Baidu, ByteDance, and Alibaba, compared to competing in the mobile phone hardware market, being a more comfortable shovel seller is becoming a consensus.

However, what Baidu, ByteDance, and Alibaba did not anticipate was that when there are too many shovel sellers in the market, it becomes a buyer's market. First, rumors emerged that Apple, the largest buyer of AI phones, might join Baidu's large model, subsequently boosting Baidu's share price. However, it was quickly followed by rumors that Apple was also in contact with other large model suppliers.

In July, the release of Samsung's sixth-generation foldable phones, the Galaxy Z Fold6 and Galaxy Z Flip6 series, further illustrated the buyer's market. In addition to previous collaborations with Baidu Intelligent Cloud, Meitu, and Kingsoft Office, Volcano Engine was added to provide the latest foldable phones with intelligent assistants and AI vision access to the Doubao large model.

Clearly, when large models aim to enter smartphones, they come to the Achilles heel of hardware on the side of major manufacturers. After weighing costs and performance from various mobile phone manufacturers, an AI phone integrating large model technologies from Baidu, Alibaba, and ByteDance was born. As the behind-the-scenes technology providers, Baidu, ByteDance, and Alibaba, who previously fought over the large model market as shovel sellers, even briefly presented a scene of shaking hands and making peace.

Part.1

Baidu is not Apple's sole favorite for AI phones

About a year after domestic mobile phone brands "warmly embraced" AI phones, Apple's "AI phone" arrived later, in partnership with OpenAI. However, the 161 countries and regions currently supported by OpenAI do not include mainland China and Hong Kong. Therefore, Apple's AI partner in China has not been publicly announced.

Early information mainly pointed to Baidu's Wenxin Yiyan, while recent media reports claimed that Apple has also held talks with other Chinese large model companies such as Alibaba and Baichuan. It is evident that Apple is talking to multiple large model companies, and no single large model vendor can become the sole supplier for Apple's AI. This is not only true domestically but also in terms of Apple's AI partnerships overseas. While partnering with OpenAI is a landmark event for its entry into AI phones, OpenAI is far from being Apple's only AI partner.

After the WWDC conference ended in June, Apple's Senior Vice President of Software Engineering, Craig Fedrighi, stated in an interview that he looks forward to future integrations with other AI models, such as Google's Gemini. Additionally, American AI startup Anthropic is also expected to become an Apple service provider.

For collaborations and adoptions with large model vendors, Apple is attempting to replicate the tactics it uses to manage its mobile hardware supply chain: habitually configuring two suppliers with similar levels for each type of component. This not only balances suppliers against each other but also facilitates control over confidentiality and ease of management. Always prepared with a Plan B that is not inferior in quality, Apple will ruthlessly drop suppliers if their products or management levels decline.

However, some industry insiders believe that compared to the Plan B strategy in the hardware supply chain, which mainly involves replicating manufacturing processes, the replicability of AI suppliers is not significant. Even if the code is identical, different training data can lead to variations in the final AI performance. The reason for seeking multiple AI suppliers may be that Apple is not satisfied with the AI capabilities of any existing single supplier.

Ultimately, Apple's path to realizing AI phones may be similar to Samsung's: identifying advantaged large model suppliers in specific vertical functional areas and then integrating AI services into the mobile phone system layer.

For example, this was the case when Samsung selected large model suppliers for the previous generation of its AI phone, the Galaxy S24 series in China. Multiple functions on Galaxy AI were based on AI applications from Baidu Intelligent Cloud's Qianfan platform. At the image processing level, Samsung chose to further collaborate with Meitu, leveraging Meitu's self-developed AI vision large model, MiracleVision, to bring AI image editing, AI image expansion, and AI image generation capabilities to the photo album app.

By collaborating with more AI large model companies, Apple may also adopt this logic of selecting the best AI capability suppliers, which means that Apple's market, with over 1 billion active users globally, will become the most intense AI performance arena for large model vendors.

Part.2

AI phones that eat from a hundred sources

Mobile phone brands collaborating with large model companies is not a first for Apple.

In January, Honor and Samsung partnered with Baidu, with Samsung integrating Wenxin Yiyan into Galaxy AI and Honor accessing Wenxin Yiyan through YOYO, both using AI assistants to invoke large model capabilities. In May, at ByteDance's 2024 Spring Volcano Engine Force conference, Volcano Engine joined forces with OPPO, vivo, Honor, Xiaomi, Samsung, and ASUS to announce the formation of the Smart Terminal Large Model Alliance.

On June 12, ByteDance's "Volcano Engine" official account announced that Xiaomi's AI assistant "Xiaoai Classmate" had partnered with Volcano Engine to access the Doubao large model. In the future, Xiaoai Classmate will leverage the capabilities of the Doubao large model to provide users with internet search capabilities, especially real-time search results sourced from Toutiao content, presenting users with comprehensive and timely responses.

Samsung is particularly renowned for reaping the benefits of collaborating with numerous AI suppliers. Taking the latest sixth-generation foldable phones, the Galaxy Z Fold6 and Galaxy Z Flip6, released on July 17 as examples, Samsung further expanded its AI supplier base. In addition to previous collaborations with Baidu Intelligent Cloud, Meitu, and Kingsoft Office, Volcano Engine was added to provide the latest foldable phones with intelligent assistants and AI vision access to the Doubao large model.

Among domestic mobile phone manufacturers, according to public market data, Xiaomi, OPPO, vivo, and Honor have all integrated large model products from Alibaba's Tongyi, Baidu's Wenxin, and ByteDance's Doubao to varying degrees. However, prior to this, 2023 was a year of comprehensive in-house large model development for mainstream mobile phone manufacturers.

First, Huawei integrated its Pangu large model into mobile phones, enabling them to perform complex tasks such as text generation, knowledge retrieval, data summarization, intelligent arrangement, fuzzy and complex intent understanding. Later, in his annual speech on August 14, Lei Jun revealed that Xiaomi had established a large model team in April, and the in-house large model on mobile phones had been preliminarily tested.

Almost simultaneously, OPPO announced the upcoming launch of a large-scale experience event for its new Xiaobu assistant, based on AndesGPT, a generative large language model built by OPPO's Andes Intelligent Cloud team on a hybrid cloud architecture. Following this, vivo launched the Lanxin large model, which is also lightweight and conducive to localized data processing on mobile phones; Honor introduced its self-developed 7 billion parameter platform-level AI large model for the end side.

Mobile phone manufacturers that had just announced comprehensive in-house large model development in 2023 became collaborators with Alibaba, ByteDance, and Baidu's large model phones in 2024. The shift from in-house development to open third-party collaboration is essentially a consideration of balancing costs and performance in bringing large models to mobile phones.

On the one hand, in terms of hardware performance, Zhuang Shirong, Senior Manager of AI Technology at MediaTek's Wireless Communications Business Unit, previously revealed that a 13 billion parameter AI large model requires approximately 13GB of memory to run, while a smartphone running the Android operating system typically uses 4GB of memory. To run other regular apps smoothly and keep them alive, an additional 6GB of memory is needed, bringing the total memory requirement for the phone to 23GB.

Although directly increasing memory is the simplest approach to some extent, it involves various technical and market factors. Currently, the majority of mainstream smartphones have 8GB/12GB of memory, while most flagship smartphones have up to 16GB, with only a handful reaching 24GB. How to bring this down to the sub-2000 yuan price range to drive greater market demand for phone upgrades and further break through hardware limitations, cloud-based large models have become the choice.

On the other hand, deploying large models is a long-term and costly trend that cannot be halted for the time being, requiring continuous investments in server power consumption, related research and development, and more. Deep Trading, an algorithm trading company, has pointed out that with a user base of 180 million and 100K tokens per user per day, ChatGPT4's daily cost is as high as $882,000.

Previously, Vivo's Vice President Zhou Wei also revealed that the cost of a single cloud-based dialog with Vivo's large model is approximately 0.012-0.015 yuan. Based on 250 million daily active users and 10 dialogs per user per day, the daily cost could reach tens of millions of yuan. Undoubtedly, such cost expenditures will also become a pressure point for mobile phone manufacturers on the path to popularizing large models.

Balancing costs and performance, the current mainstream approach to achieving AI performance in mobile phones typically adopts an integrated "combined punch" model of end-side and cloud collaboration.

The so-called in-house AI large models of mobile phone manufacturers mainly focus on end-side large models, characterized by deploying AI training models based on local hardware terminals for faster performance response and better data privacy protection. In terms of cloud-side large model performance, it is mainly implemented through partnerships with external large model vendors.

From the perspective of mobile phone manufacturers' choice of third-party AI partners, accessing multiple models is the mainstream trend. This includes not only diverse models from the same large model company but also models from different large model companies. For example, OPPO uses Volcano Engine's Doubao General Model Pro, Doubao General Model Lite, and Doubao Role-playing Model, while Samsung incorporates both Wenxin Yiyan and Doubao.

This also aligns with the current concept of large model selection. Facing diverse business types and user needs, a single large model is difficult to cover all aspects. Mixing models, with different models excelling in different application scenarios, is more practical.

Part.3

AI phone entrants who take what they need

As mainstream mobile phone manufacturers optimize their choices based on cost and performance considerations and integrate as many large model technology providers as possible, this means that Baidu, ByteDance, and Alibaba cannot become exclusive large model suppliers for any one brand. Long-standing internet thinking such as the take-it-or-leave-it approach and economies of scale under the platform economy will also face new challenges.

On the one hand, unlike partnerships with hardware chip vendors, where mobile phone processors like Qualcomm and PC processors like Intel can provide technical endorsements for hardware products, in terms of AI technology capabilities, for mobile phone manufacturers, as brands targeting the C-end market, the battle for user mindshare is more critical than technology deployment.

Therefore, in terms of collaboration, although AI phones strive to integrate as many third-party large models as possible, there is a consensus to fuse the underlying technologies of hundreds of third-party large models and develop in-house multimodal AI agents. Ultimately, for consumers, only smart assistants like Xiaobu and Xiaoai Classmate have AI mindshare.

On the other hand, under the vast user base of leading mobile phone brands, the pressure on large model companies will naturally increase, and the computational costs they bear may rise exponentially. Whether these costs can be passed on to mobile phone manufacturers is uncertain. There are indications that Apple does not pay fees to large model vendors. According to media reports, at least in its partnership with OpenAI, Apple did not pay fees.

Even though other smartphone manufacturers collaborating with large model service providers don't have as much leverage as Apple, AI features are currently being offered for free by all parties involved. Therefore, the cost of AI for these free users is likely not borne solely by the smartphone manufacturers. According to some tech experts, a more feasible solution might be for both smartphone manufacturers and large model service providers to share the costs.

Smartphone manufacturers are not earning revenue from AI services; instead, they are capturing user mindshare. The key is to be the first to secure user mindshare in this round of the large model competition, laying the foundation for converting free users into paying customers for AI-enabled smartphones.

For large model service providers like Baidu, ByteDance, and Alibaba, being a "shovel seller" might not necessarily bring in more money. In fact, as they integrate with more smartphone brands, the pressure and computational costs they need to bear will greatly increase. However, by connecting with more smartphone terminals and reaching more users, they will gain new opportunities for product refinement. This serves as valuable practical application for the products of large model companies like Baidu, Alibaba, and ByteDance.

Throughout this collaboration, the "hardware land grab" by large model companies will result in them obtaining what they desire most: more data that can be used for model training.

Under the witness of countless smartphone users, this will be a real head-to-head showdown in the field of large models. The true capabilities of each large model will be further "exposed to the sunlight," accelerating the reshuffling of the market and the reshaping of the landscape. Whether for smartphone manufacturers or large model service providers, this represents an AI journey where each party gets what it needs.