Estun Stalls Domestically, Following "CATL" to Go Abroad for Gold Mining

![]() 07/25 2024

07/25 2024

![]() 550

550

Author/Xie Chunsheng

Editor-in-Chief/Su Huai

The enthusiasm for robots continues.

On July 22, Musk posted on X (Twitter) that Tesla will produce a small batch of humanoid robots for internal use next year, with mass production expected in 2026, potentially supplying them to other companies. Tesla's (NASDAQ:TSLA) stock surged over 5% that day.

A week earlier, the humanoid robot company "Zhuge Robotics," which was Alibaba's (NYSE:BABA 09988.HK) first bet, completed its Series A strategic financing round, led by Alibaba, China Merchants Venture Capital, and Shangqi Capital, a subsidiary of SAIC Motor (600104.SH).

The "heat" surrounding humanoid robots goes far beyond this. In the first half of 2024, capital frequently entered the humanoid robot race. According to incomplete statistics, there were 13 humanoid robot investment and financing events in China in the first half of the year, with a total financing amount exceeding 2.5 billion yuan. Among them, there were big-name investors such as Sequoia China, Matrix Partners China, Source Code Capital, Alibaba, Meituan (PINK:MPNGY 03690.HK), Jinshi Investment, and Lenovo Capital.

In order to catch the humanoid robot wave, many companies that had previously bet on industrial robots began quietly entering the humanoid robot race.

Estun (002747.SZ), the "leader" of domestic industrial robots, recently stated on the investor platform that "the company has made some initial layouts in the field of humanoid and other intelligent robots." In terms of market operations, Estun is also accelerating its international expansion.

However, such positive news did not completely resolve the troubles brought by the harsh market environment in the first half of this year to Estun.

Affected by the downturn in the photovoltaic industry, performance forecast turns from profit to loss

On July 11, Estun's performance forecast showed that its net profit attributable to shareholders in the first half of 2024 is expected to be a loss of 65 million to 85 million yuan, compared to a profit of 97 million yuan in the same period last year, a year-on-year decrease of 166.73% to 187.27%.

The forecast disclosed that the "culprit" behind Estun's expected loss is significant fluctuations in downstream application markets, especially a severe year-on-year decline in sales revenue in the photovoltaic sector.

Over the past two years, the rapid growth of the photovoltaic industry and the gradual penetration of robots into the entire photovoltaic industry chain have provided a significant boost to robot sales.

Image from Estun's official website

Data shows that 26,100 robots were sold in the photovoltaic sector in 2023, an increase of 90% year-on-year, accounting for 9.2% of total robot shipments that year. Among them, 11,000 robots were sold in the photovoltaic sector in the first half of 2023, an increase of 94% year-on-year.

This growth trend also allowed domestic industrial robot companies such as Estun, Inovance (300124.SZ), and Effort (688165.SH) to reap the benefits of high growth in downstream sectors in the past year.

However, just as the photovoltaic industry boosted them, it also caused their downfall. After entering 2024, the positive trend in the photovoltaic industry failed to continue. Companies were busy clearing out excess capacity while rushing to expand production, even attempting to avoid domestic price competition by going abroad. However, the results did not meet their expectations.

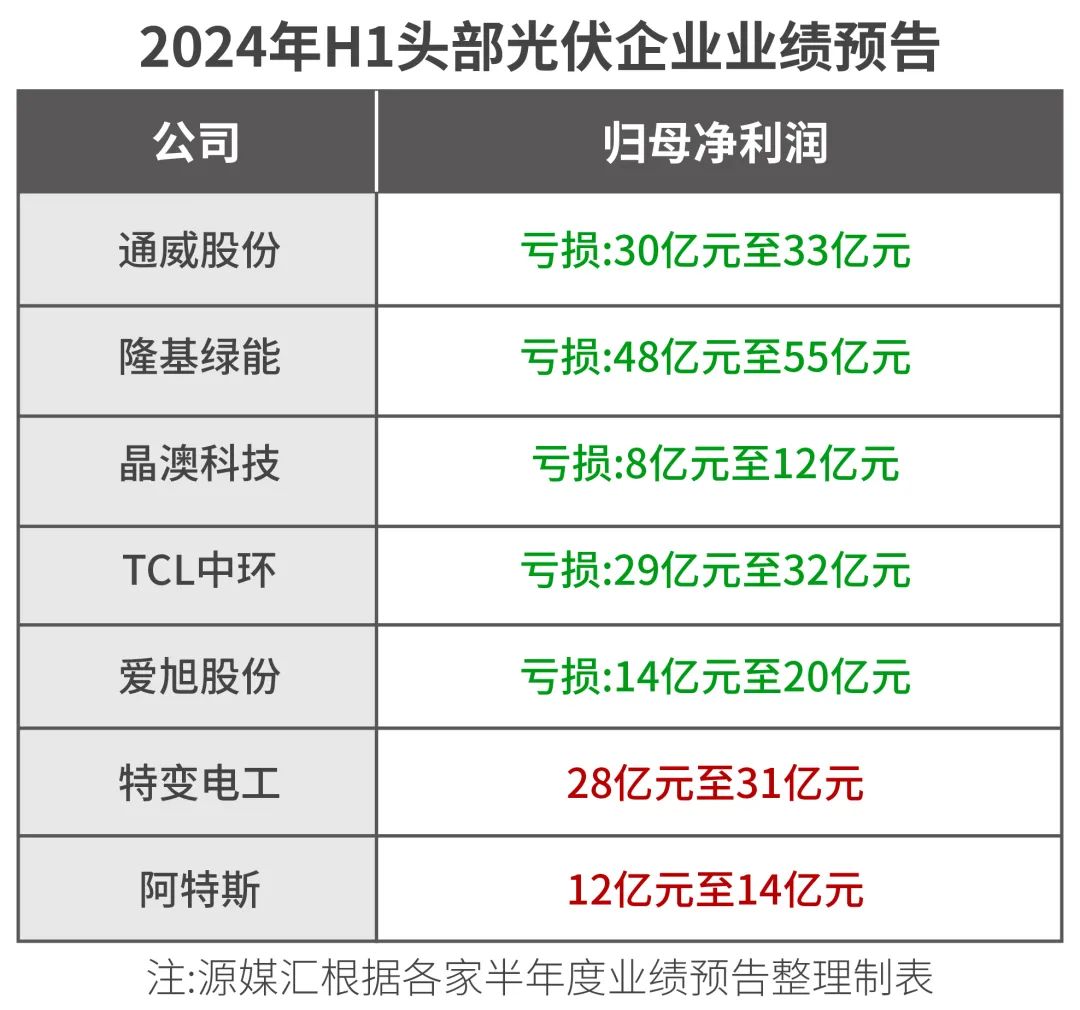

Yuan Media Hub's statistics based on published semi-annual performance forecasts show that many leading photovoltaic companies faced heavy pressure on profitability in the first half of 2024. Of the seven photovoltaic companies surveyed, five incurred significant losses, with only TBEA (600089.SH) and Canadian Solar (688472.SH) remaining profitable. Tongwei (600438.SH), LONGi Green Energy (601012.SH), JA Solar (002459.SZ), TCL Zhonghuan (002129.SZ), and Aikosolar (600732.SH) are expected to lose a combined total of over 12 billion yuan in the first half of 2024. Among them, LONGi Green Energy's expected loss is the largest, at 4.8 billion to 5.5 billion yuan.

The significant expected losses of leading photovoltaic companies directly reflect the grim situation in the industry. As one of the critical downstream application areas highly dependent on the robot industry, the decline in demand in the photovoltaic industry has also directly affected robot companies. Estun is one of the "victims" in this regard.

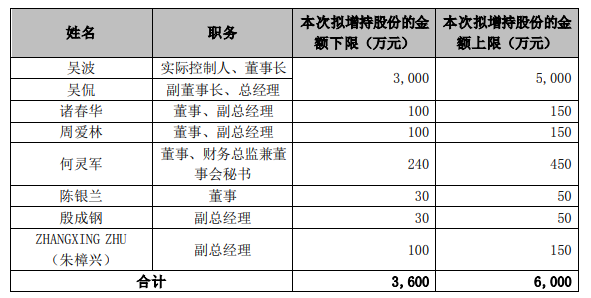

Perhaps to restore investor confidence, on the same day as the performance forecast was released, Estun also announced that the company's actual controllers and some directors and senior executives would increase their shareholdings, with a total increase of no less than 36 million yuan and no more than 60 million yuan.

Image source: Estun announcement

From then until July 19, Estun's actual controllers Wu Bo and directors and senior executives He Jiongjun, Zhou Ailin, Chen Yinlan, and Yin Chenggang successively increased their shareholdings through competitive bidding transactions to varying degrees.

However, in terms of share price performance, such operations did not yield significant results. Taking the day of the performance forecast announcement, July 11, as an example, the closing price was 13.1 yuan per share; as of July 25, the closing price was 12.04 yuan per share, a decline of 8% in two weeks.

Regarding issues such as expected performance losses and shareholding increases by directors and senior executives, Yuan Media Hub sent a letter of inquiry to Estun but did not receive a response as of press time.

Regarding the current situation, in the record of investor relations activities on July 11, Estun stated directly that although the company is currently facing challenges in its operations, short-term adverse factors will not change the company's medium- and long-term development prospects. It also stated that improving profitability indicators through stable operations is the company's business focus in the second half of the year.

In fact, Estun's answers to investors' questions provide some insight into its own growth.

Regarding the growth drivers for the industrial robot industry in the future, Estun believes they mainly stem from three points:

First, the improvement of automation in downstream industries, including capacity expansion and upgrading; second, domestic substitution is the current development trend, and as domestic brands significantly improve in performance and quality, the market will enter a stage of stable growth; third, the acceleration of overseas market layout.

Among these three points, overseas layout is considered the "top priority" by Estun. In this year's strategic positioning, the "dual-wheel drive" of domestic and foreign markets has been repeatedly mentioned by Estun.

Heavy investment in going abroad to seek a way out of the "convoluted market"

If you don't go abroad, you'll be left behind.

Image: Estun exhibition hall at a Turkish industrial exhibition | Source: Estun's official website

In recent years, laying out overseas markets has become a top priority for Estun in betting on future growth.

Apart from trend factors, Estun may have two considerations behind this move:

First, the overseas market is relatively undeveloped, making it easier to find new growth opportunities; second, the domestic market is highly competitive, especially in terms of pricing, where many companies claim to be "technologically catching up" while simultaneously engaging in "price wars," leading to a continuous decline in gross margins. At present, this competition is not only difficult to improve in the short term but may persist and even intensify for a long time to come.

In contrast, overseas customers place more emphasis on value creation and are willing to pay for it, which is conducive to the steady growth of gross margins.

From the perspective of overseas layout, Estun initially followed downstream application companies to go abroad. Previously, Estun has repeatedly emphasized that it will follow domestic industry leaders such as CATL (300750.SZ) to go abroad.

Estun is a qualified supplier of motion control systems and robots to CATL. Specifically, Estun mainly provides motion control products and SCARA robots to CATL's equipment suppliers, and these products have been used in multiple CATL factories. Previously, there were rumors in the market that Estun's cooperation orders with CATL had reached the ten-million level, and some investors even directly asked whether such orders were sustainable. Although Estun did not directly answer, it did not deny it either.

Earlier this year, Estun was also asked whether it would cooperate with CATL to develop overseas business, and it reiterated its cooperation with CATL and stated that it would continue to follow CATL to go abroad, expanding the company's global market layout.

As one of Estun's important customers, CATL is quite active in going abroad. According to media reports, CATL has disclosed plans for six overseas factories so far, located in Germany's Thuringia, Hungary, the United States (Michigan and Nevada), Indonesia, and Thailand.

Furthermore, there are recent rumors that CATL is currently in talks with overseas sovereign wealth funds and private offices of super-rich individuals to raise a $1.5 billion fund to build its global supply chain. This is undoubtedly a significant positive development for Estun.

While following leading enterprises can bring overseas order increments in the short term, it also poses risks in the long term. Once the overseas orders of the followed enterprises decline or encounter blockades, it will directly affect Estun. Additionally, even if the followed enterprises have sufficient orders, there is always the concern of being excluded from the cooperation.

Perhaps realizing this, in addition to the early "follow-to-go-abroad" strategy, Estun has also expanded its overseas market through acquisitions and the establishment of overseas subsidiaries. Furthermore, it has initiated the construction of overseas manufacturing bases and formed an international team.

So, how has Estun's overseas market performance been in the past few years?

Yuan Media Hub's statistics show that after Estun's overseas revenue surged from 285 million yuan in the previous year to 1.127 billion yuan in 2020, it has continued to show a steady upward trend in subsequent years, albeit with relatively slow growth.

The surge in overseas revenue in 2020 is directly related to an overseas acquisition by Estun at that time. On August 25, 2019, Estun announced its plan to acquire German welding giant CLOOS by jointly increasing the capital of its subsidiary Dingpai Electromechanical with its controlling shareholder, Paileisi.

According to information, CLOOS, founded in 1919, is a pioneer in welding technology integration and moved to Heiliger in 1924. At the time of the acquisition, CLOOS had 11 subsidiaries and 50 sales and service locations worldwide, with audited sales of 144 million euros in 2018.

This overseas acquisition was not the first for Estun. Between 2016 and 2017, Estun acquired Italian company Euclid, British company TRIO, American company BARRETT TECHNOLOGY, and German company M.A.I. through shareholding and acquisition.

These moves laid the foundation for Estun's comprehensive entry into overseas markets.

On July 23, according to Xinhua Finance, Estun has initiated an ambitious overseas market expansion plan. An insider stated that in the future, the overseas market share of Estun's industrial robot products should reach 20% or even higher. And achieving this goal does not require five years, it may be achieved within three years.

Regarding Chinese companies going abroad, Zeng Li, Chairman of Yilin International and former HR General Manager of ZTE (000063.SZ, 00763.HK), who has many years of overseas work experience, told Yuan Media Hub: "Domestic companies will undoubtedly face various problems in the short term when going abroad, such as local policies, talent, and political situations. However, we cannot be intimidated by these. The global market is a huge incremental market, and for domestic companies to expand their scale, going abroad is an inevitable move sooner or later. But how to do it? Companies need to judge based on their own situation."

As for what truly constitutes going abroad, Zeng Li believes: "Domestic companies need to build factories or set up service agencies in overseas regions, localize their teams, services, and after-sales support to be considered as truly going abroad. If they merely sell products overseas, I don't consider that going abroad, at most, it's just foreign trade."

Another industry insider told Yuan Media Hub: "For Chinese robot companies to gain a foothold in overseas markets after entering, in-depth localization is the key to building brand power."

From this perspective, Estun's journey abroad has just begun.

Some images are quoted from the internet. Please inform us for deletion if there is any infringement.