Alibaba Cloud's Ambition, Passed on to AI

![]() 11/18 2024

11/18 2024

![]() 514

514

Written by Hao Xin

Edited by Wu Xianzhi

"Recharge to Become a Member" is Tony's trump card. The original price and member discount price of the barber shop project always make consumers generous. Moreover, the higher the recharge amount, the more attractive the free credit and discount.

If this business model is applied to cutting-edge and geeky cloud and AI, Tony becomes a cloud vendor, and those Schrödinger's cat AI companies become wealthy consumers.

AI startups such as Wisdom Matrix, Dark Side of the Moon, Minimax, Baichuan Intelligence, and Zero-One have undergone multiple rounds of financing. Their valuations, reaching tens of billions of RMB, are reminiscent of the Prefabricated vegetable market .

These AI startups can only receive a portion of the cash from cloud vendors, with the remainder being consumed in the form of cloud credits, akin to saving dozens of small goals after getting a trendy haircut.

For cloud vendors, participating in investments through a combination of "cash + cloud credits" is a win-win situation. On the one hand, it pushes up the value of the target and adds a major cloud customer, increasing revenue. On the other hand, regardless of the success or failure of the AI company, cloud vendors can recover a portion of the funds from the cloud credits.

For the target companies, the stored cloud credits not only reduce the cost of model training and inference but also enhance their chances at the negotiating table by increasing their valuation.

"The cloud I use is Alibaba Cloud"

After the wave of large models arrived, Alibaba Cloud had two main interests: promoting recharge cards and finding endorsers.

As a professional Tony, promoting requires strategy and can't just be empty-handed. Therefore, Alibaba Cloud began implementing a strategy of baiting first and then collecting.

From last year to now, there have been six investments and financings in the name of Alibaba, with a disclosed amount of 13.54 billion RMB. In the short term, this is a "long-term solution to an immediate thirst." Alibaba is afraid of missing future opportunities and chooses to bet on investments now, while AI companies obtain initial startup funds and quickly occupy the market, becoming unicorns.

(Photon Planet Chart)

The amounts invested and post-investment valuations after Alibaba's moves are astonishingly high, essentially a shell game. Its promise to acquire AI companies at high prices is actually a sales pitch for recharge cards. The cards contain two parts: pre-paid credits, one of which is the disposable credit for cloud computing. As long as the above companies and their customers consume on Alibaba Cloud, the cloud credits in the account are immediately deducted and transferred to Alibaba's account, becoming new revenue. The remaining part is the actual cash paid by Alibaba, which the AI company can use for daily operations.

It is rumored that nearly half of Alibaba's 800 million USD investment in Dark Side of the Moon is in the form of cloud credits. If half of the investment is in cash and half in cloud credits, Alibaba has actually only invested less than 7 billion USD. Typically, settlement and payment are carried out in cycles, and it is possible for an AI company to have to pay Alibaba Cloud before receiving the cash in its account.

After a series of operations, the momentum of the so-called "Five Little Tigers" and "Six Little Dragons" of AI seems strong, but so far, AI-related revenue is mainly limited to the cloud domain, where enterprises train and run large models on the cloud. Beyond the cloud business, investment returns are more qualitative than quantitative and difficult to measure with specific numbers.

To date, the only company that Alibaba has proactively disclosed as having completed an investment holding is Dark Side of the Moon. Its 2024 fiscal year report clearly states that it invested approximately 800 million USD in Dark Side of the Moon, acquiring approximately 36% equity, emphasizing that "this is a preferred stock investment in Dark Side of the Moon." Additionally, according to an announcement from Visual China, Alibaba currently holds 2.18% of Wisdom Matrix's shares.

Perhaps based on the 36% figure, Yang Zhilin, the founder of Dark Side of the Moon, has become Alibaba Cloud's hottest endorser.

Yang Zhilin's employees are full of confusion. Their usually reclusive boss suddenly appeared on the airport screen with prominent words: "The cloud I use is Alibaba Cloud."

The heads of star AI companies have become Alibaba Cloud's "best BD," and Alibaba Cloud has officially named Dark Side of the Moon twice. Once was after releasing the Q1 results for fiscal year 2025, with a large personal poster of Yang Zhilin stating: "Alibaba Cloud's computing power and large model service platform help Dark Side of the Moon improve model inference efficiency and accelerate technological breakthroughs for the Kimi intelligent assistant."

The other time was in the fresh 2025 fiscal year semi-annual report, stating that "Dark Side of the Moon uses Alibaba Cloud's database to help the intelligent assistant Kimi accurately understand users' search intentions, integrate and summarize data from multiple information sources, and achieve accurate and comprehensive information recall."

The same thing happened to Wang Xiaochuan. For them, this is a "political task" that they have to endorse. As long as Yang Zhilin's name appears simultaneously with Alibaba Cloud, it's like a living sign that says, "Everyone is already on board; you're the only one left."

According to Alibaba Cloud, 80% of technology enterprises and half of all large model enterprises in China are running on Alibaba Cloud.

Alibaba Cloud has not yet met expectations

Whether the "card swiping" of the Dark Side is powerful depends on Alibaba Cloud's financial statements.

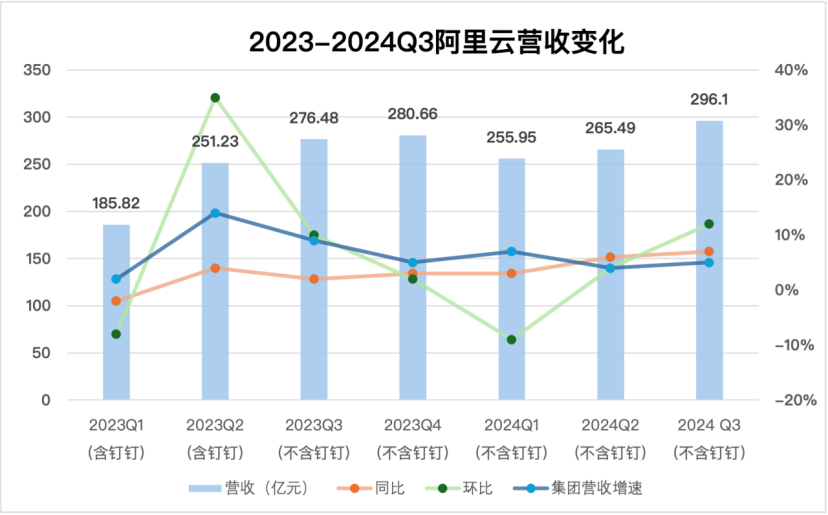

Alibaba's 2025 fiscal year semi-annual report shows that for the quarter ending September 30, 2024, Alibaba Group's revenue was 236.503 billion RMB, a year-on-year increase of 5%. Among them, the revenue of the Cloud Intelligence Group was 29.61 billion RMB, a year-on-year increase of 7%.

Extending the timeline to last year, as Alibaba's second pillar business, Alibaba Cloud's own revenue growth rate has consistently been lower than the Group's revenue growth rate until this year's Q2 and Q3. This is largely due to orders from leading AI companies during the peak training period in the second half of last year being settled this year, as well as companies like Dark Side of the Moon switching from Volcano Engine to Alibaba Cloud this year due to investment reasons.

(Photon Planet Chart)

A more crucial turning point was Q1 2024. Although there was a significant quarter-on-quarter decline, it was from this quarter that Alibaba's strategy of "focusing on public cloud services and increasing investment in AI infrastructure" began to bear fruit. Previously, the main reason for Alibaba Cloud's profit growth was cost reduction and efficiency enhancement, officially attributed to "improvements in product mix and operational efficiency."

From Q1 this year, the main driver of profit growth has shifted to AI and public cloud. This is reflected in Alibaba Cloud's emphasis on "double-digit growth in public cloud and triple-digit growth in AI-related product revenue for five consecutive quarters." This is reflected in the financial report as double-digit growth in both revenue and profit. From Q1 to Q3 2024, Alibaba Cloud's revenue increased from 25.595 billion RMB to 29.61 billion RMB, and its adjusted profit increased from 1.432 billion RMB to 2.661 billion RMB, a year-on-year increase of 89%.

However, this still does not break Alibaba Cloud's long-standing status of single-digit revenue growth. Alibaba has high hopes for the cloud revenue generated by AI, and its management previously stated: "In the second half of 2024, cloud business growth will return to double digits."

The energy brought by AI has not been fully released yet. In the next quarter, Alibaba Cloud's revenue will likely continue to rise, but whether it can break through the double-digit mark remains uncertain. There is still room for imagination regarding potential. Similarly, in the third-quarter report, Google Cloud's business grew by 35%, refreshing the second-quarter record of over 10 billion USD in revenue, with profits increasing more than six-fold year-on-year.

Alibaba Cloud awaits recovery

Internationally, Alibaba is also a special presence. It focuses on both open-source and closed-source large models, investing and developing simultaneously, and vigorously pursuing AI and cloud infrastructure.

Alibaba Cloud's expansionary and aggressive strategy gives it a strong voice but also buries hidden dangers.

The financial report directly shows a cliff-like decline in free cash flow. In Q1 2024, Alibaba Cloud's free cash flow was 15.361 billion RMB, a year-on-year decrease of 52%. In Q2, free cash flow was 17.372 billion RMB, down 56% year-on-year. In the latest Q3 financial report, its free cash flow was 13.735 billion RMB, a year-on-year decrease of 70%.

Roughly calculated, as of now, Alibaba has invested over 70 billion RMB this year, focusing on cloud-related infrastructure construction. This is just the foundation and does not include upgrades to large models and AI products, as well as AI transformations of other businesses such as e-commerce and logistics.

For Alibaba Cloud, normal capital investments are divided into two categories: investment in technology infrastructure and investment in facilities and other areas. According to its strategic deployment and general trends, capital investment will continue to expand, and the resulting funding gap must be filled by larger cloud usage and revenue.

It is ultimately unavoidable to involve major model companies in the market. It is understood that leading AI companies consume a significant portion of Alibaba Cloud's resources for large model training and inference. At this stage, to some extent, changes in Alibaba Cloud's revenue reflect the current development of AI in China. From quarter to quarter, the large fluctuations in quarter-on-quarter growth indicate the instability of cloud inventory consumption. The entry ticket for converting to the new O1 inference paradigm has become unattainable. As more and more AI companies abandon model pre-training and focus on applications, the demand for the cloud will also decrease.

It is also difficult to recover funds from investments, and investors' patience is dwindling. OpenAI has already embarked on the path of seeking commercialization, compromising on technology and products. Sundar Pichai, CEO of Google, believes that "the risk of underinvesting in AI is far greater than overinvesting." Alibaba, which has placed its money in others' pockets, shares the same concerns for the future. A new round of price hikes may be imminent.

AI companies are born with a "golden spoon" and grow under the cover of capital, but their ability to generate revenue independently remains to be seen. Prosperity does not necessarily lead to shared prosperity, and signs of mutual loss have already emerged. Microsoft's latest financial report revealed that OpenAI's losses are beginning to have a material impact on its profits, with expected losses of approximately 1.5 billion USD in the next quarter.

Alibaba Cloud, which has just undergone business divestitures and strategic repositioning, is gradually showing signs of recovery. To achieve double-digit growth, it cannot afford any setbacks in the short term.