Broadcom (AVGO.O): A Unique Winner in the Era of AI Computing Power with Both Software and Hardware Capabilities

![]() 12/05 2024

12/05 2024

![]() 538

538

*Note: The following text contains hidden valuation information that is not fully displayed in this public post. Interested users can access the full content by searching for "Dolphin Investment Research" in the Longbridge App.

Due to Broadcom's distinct "extensive development" characteristics, Dolphin has already focused on detailing the company's history of external mergers and acquisitions in the previous article. Broadcom has grown from a "semiconductor division" to one of the top five semiconductor companies globally, following the growth path of "external acquisition - internal integration - external acquisition".

As seen in the previous article ("Broadcom: Paving the Way to 'Trillion' with 'Buy, Buy, Buy'? Tencent and Alibaba, Take Note!"), when the company reduces the ratio of "total liabilities / LTM adjusted EBITDA" to around 2 or below, it begins a new round of acquisitions. Currently, after acquiring VMware, the relevant ratio is still as high as 3.5, indicating that Broadcom is in the internal integration phase. Its main focus will be on streamlining personnel and reducing related expense ratios, thereby improving the profit margin of the merged company. During this period of endogenous development, the company will mainly focus on the performance of its own business and the integration of personnel costs.

From the perspective of Broadcom's business development and integration, the company's current main concerns are AI revenue and the VMware business, which are also its primary sources of growth at present.

1) AI Business: Leveraging its well-established capabilities, Broadcom has taken the lead in entering the ASIC domain. Currently, its collaborative products with Google and Meta are already in mass production. With the growth of the computing power market and the increasing demand for self-developed chips, Broadcom's AI business is expected to continue to grow rapidly;

2) VMware Business: Acquired recently by Broadcom, this business is valued for the cloud services market and VMware's leading position in the virtual machine market. After divesting non-core businesses, Broadcom is adjusting the acquisition model of perpetual licenses to a subscription-based SaaS model, effectively "raising prices" and further enhancing the monetization capabilities of its software business. After the adjustment of the pricing model, the growth rate of VMware will return to the overall growth level of the virtual machine industry.

After dissecting the company's core and traditional businesses, Dolphin expects Broadcom's core operating profit for fiscal year 2025 to reach $33.6 billion, a year-on-year increase of 38%. Considering factors such as business integration in fiscal year 2025, Dolphin further projects a core operating profit of $40.1 billion for fiscal year 2026, representing a year-on-year increase of 19%.

The previous surge in Broadcom's share price was mainly driven by the incremental growth of its AI business and VMware. Combining PE and DCF methods, the company's operating performance generally aligns with its current share price.

As Broadcom plays the role of a "water seller" behind major cloud companies (providing ASIC chips for hardware and virtual machine services for software), it enjoys relative certainty in the current industry trends. If there are signs of a systemic downturn in the US technology sector, it could present a better buying opportunity for the company.

For Dolphin's detailed analysis of Broadcom (AVGO.O), please refer to the following:

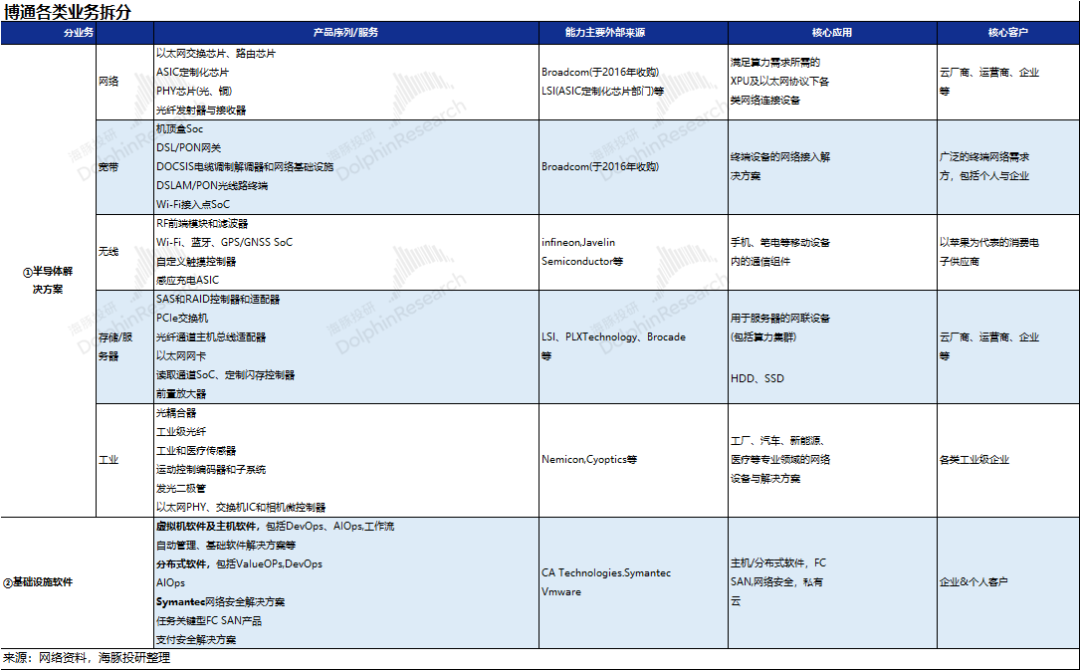

In its financial reports, Broadcom primarily classifies its business into two main categories: semiconductor solutions and software services. However, the growth drivers within these two segments remain relatively unclear.

Specifically, the semiconductor business primarily encompasses networking, storage connectivity, broadband, wireless communications, and industrial and other applications;

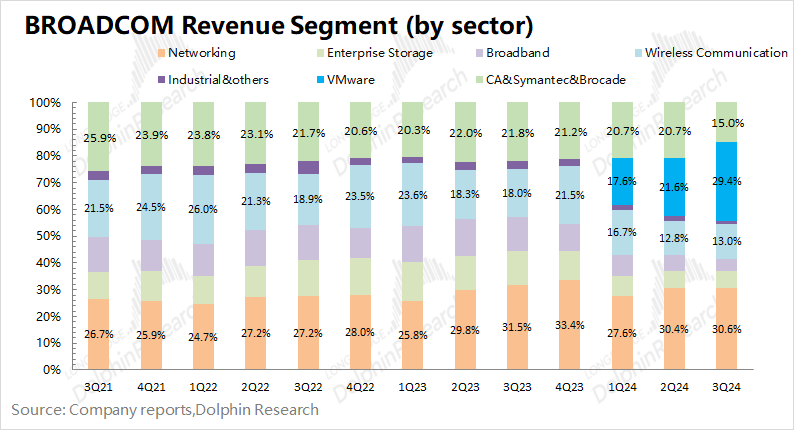

The software services business mainly includes the newly acquired VMware and the existing CA&Symantec&Brocade. After acquiring and consolidating VMware, the company's primary revenue sources are currently from its networking business and VMware business, which together account for 60% of total revenue.

For Broadcom, the current market focus is on the AI business within its networking segment and the integration of VMware. These two areas represent the company's most significant incremental growth. Before conducting a performance forecast, Dolphin will first provide an overview of these two business segments.

Here is a detailed analysis:

I. AI Business

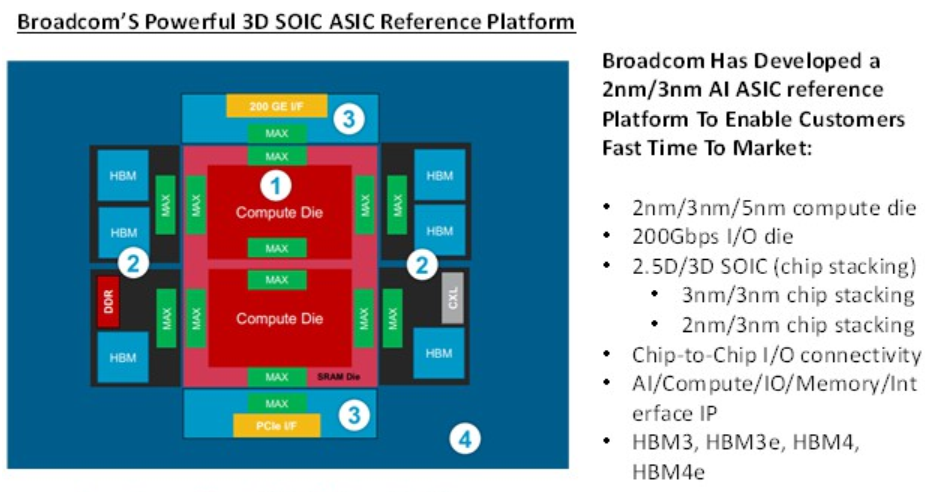

The AI business is a key highlight within Broadcom's semiconductor operations, categorized under its networking business. With a comprehensive product portfolio, Broadcom can provide services for various components in cloud computing clusters beyond CPUs, including custom ASIC chips (XPU), switching chips, PHY chips, etc.

Specifically: 1) Computing: Processing unit architecture (provided by customers), design process, and performance optimization (by Broadcom); 2) Memory: HBM PHY chip integration (by Broadcom); 3) Network I/O: Network IO architecture and related components (by Broadcom); 4) Packaging: 2.5D, 3D, and silicon photonics architectures (by Broadcom).

1.1 ASIC Chips in the Computing Power Market

Due to the physical scaling law, manufacturing processes are approaching their physical limits, slowing down chip performance improvements. Since the computational performance per unit area (TFLOPS/mm^2) of GPUs has improved slowly, performance enhancements primarily rely on increasing the chip's size (e.g., NVIDIA's B200). Therefore, abandoning some general-purpose functions of GPUs and focusing on ASIC chips tailored for specific computing scenarios is a way to boost performance and reduce power consumption.

Currently, cloud service providers still primarily procure GPUs from NVIDIA and AMD. However, Google, Meta, Microsoft, and Amazon are also developing their ASIC chips. Dolphin believes that the primary motivations for these companies to develop ASIC chips are: 1) Possessing proprietary technology to reduce dependence on other vendors; 2) Achieving better cost-efficiency and power consumption under equivalent computing power. However, self-developed ASICs also face challenges such as IP and supply chain integration, often necessitating collaboration with companies like Broadcom and Marvell for chip design.

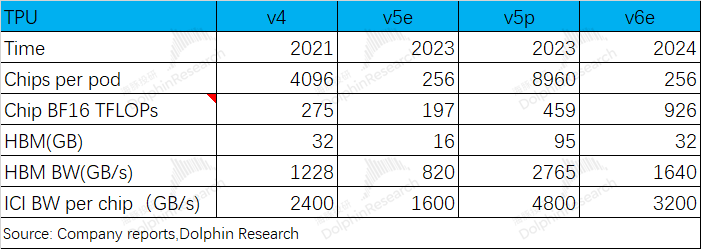

According to the company's disclosures, Broadcom's current AI revenue primarily comes from Google and Meta, with both companies' ASICs already in mass production. The largest portion comes from Google's TPUs.

Google's TPUs have evolved from the first generation to the latest TPU v6e released in 2024. In terms of FP16/BF16 precision, Google's TPU v6e can achieve 926 TFLOPS, approximately 93% and 53% of NVIDIA's H100 and B100, respectively (non-sparse computing power). NVIDIA's H100 was released in 2022, making Google's TPUs roughly two years behind in computing power.

Based on current announcements, Google's latest TPU v6e is primarily intended for both training and inference, and the company is expected to introduce the TPU v6p specifically for larger-scale foundational model training tasks. Currently, the v4 and v5p versions are still primarily used for large-scale training, with Google's deployed TPUs supporting internal projects like Gemini, Gemma, and Search, as well as workloads for external clients like Apple. Apple has previously disclosed that its cloud-side AI foundational model was trained on 8,192 TPU v4 chips, while its edge-side AI model was trained on 2,048 TPU v5p chips.

1.2 Broadcom's AI and Networking Business

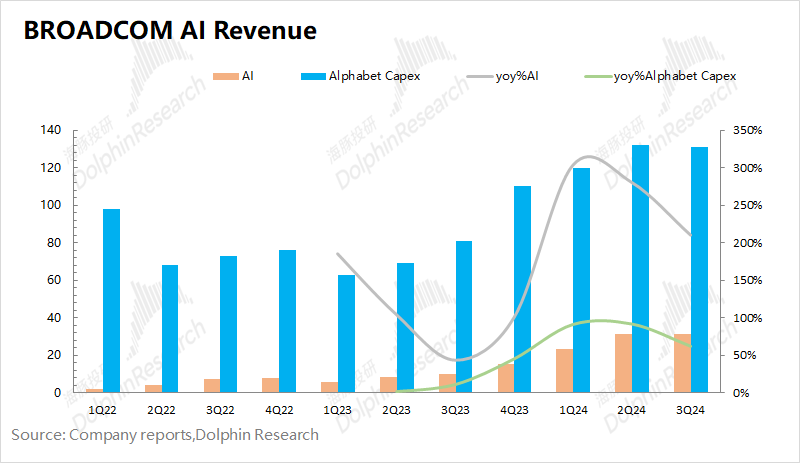

Since Google is Broadcom's significant AI business client, comparing Google's capital expenditures with Broadcom's AI business revenue reveals that from late 2023, Google's capital expenditures increased significantly, accompanied by a doubling of Broadcom's AI business revenue. Overall, Broadcom's AI revenue growth trend closely mirrors changes in Google's capital expenditures.

Additionally, the graph below shows that Broadcom's AI business growth rate exceeds that of Google's capital expenditures. Dolphin believes this is due to: 1) Google increasing the proportion of self-developed TPUs in its cloud infrastructure; 2) Meta's ASIC chips entering mass production in 2024.

As both of Broadcom's major AI clients are already in mass production, Google's and Meta's capital expenditures will directly impact Broadcom's AI revenue. Based on calculations, the current ratio of Broadcom's AI revenue to the combined capital expenditures of these two companies is approximately 15%.

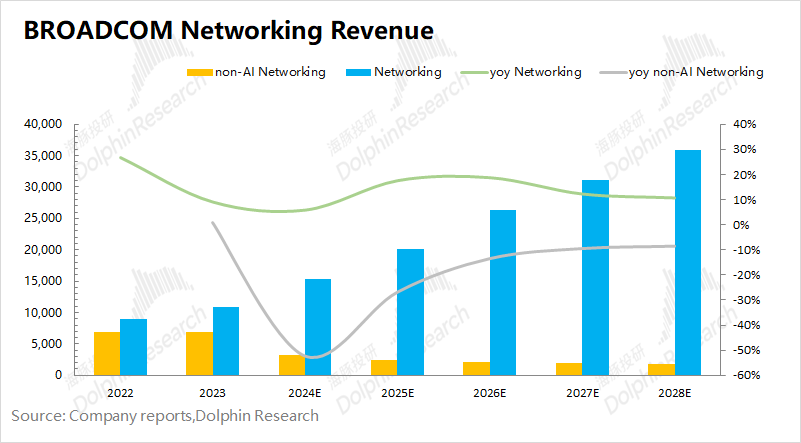

If Broadcom's networking business is divided into AI revenue and non-AI revenue, it can be observed that AI revenue is growing rapidly, while non-AI revenue has declined slightly. Considering the company's and industry's conditions, Dolphin anticipates that the capital expenditures of these two major companies will continue to grow by over 30% next year, further increasing the share of self-developed chips in cloud infrastructure. Broadcom's AI revenue for fiscal year 2025 is expected to exceed $17 billion, with a year-on-year growth rate exceeding 40%. Although non-AI revenue remains subdued, driven by the AI business, the company's overall networking revenue is expected to grow to over $20 billion, with a year-on-year growth rate of over 30%.

II. VMware Business

Broadcom's software business primarily includes virtualization software, mainframe software, distributed software, network security solutions, storage network management software, etc. However, almost all of its software businesses originate from acquisitions. Virtualization software comes from VMware, mainframe software from CA, network security from Symantec, and storage network management from Brocade.

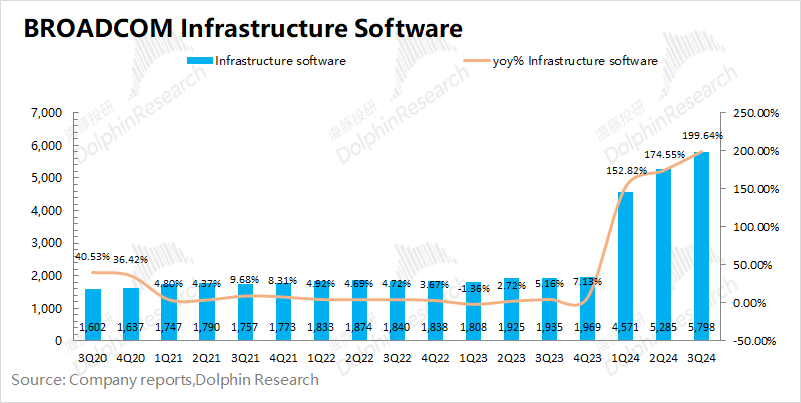

From the perspective of the total revenue changes in Broadcom's software services, although most businesses come from external acquisitions, the company has achieved stable growth through integrated management. The sharp increase in revenue in 2024 is primarily due to the consolidation of VMware.

Currently, the market is particularly concerned about the consolidation of VMware, which Broadcom recently acquired. In November 2023, Broadcom completed the acquisition of VMware at a 40%+ premium, valuing it at $69 billion. This included a $61 billion acquisition price (cash + shares) and the assumption of VMware's $8 billion in net debt.

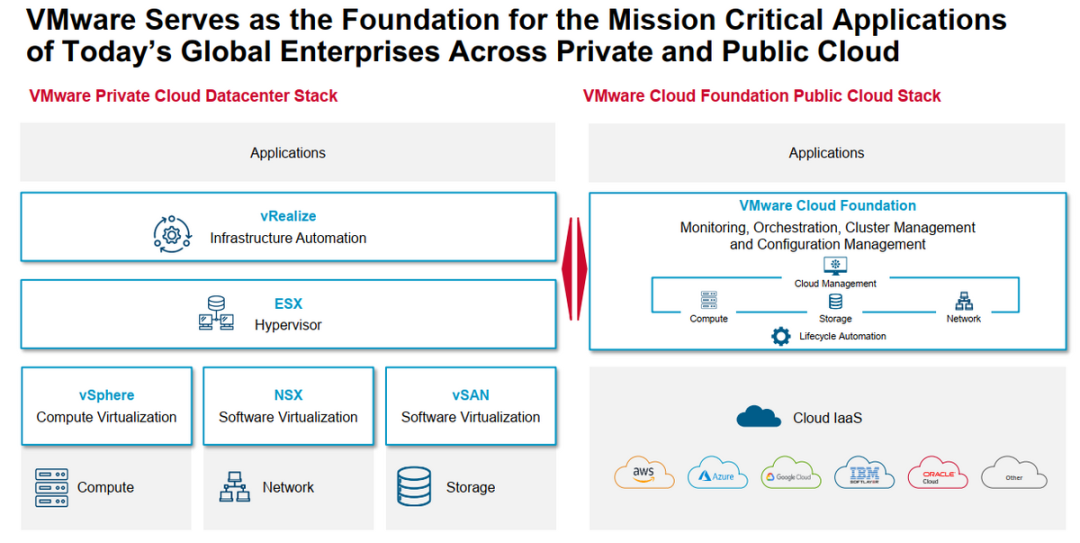

After the acquisition, Broadcom restructured VMware: 1) Transitioning from a software sales model to a SaaS and subscription model; 2) Reducing the size of the reseller network to deal more directly with customers; 3) Divesting non-core businesses such as EUC (End-User Computing) and endpoint protection. Broadcom's acquisition of VMware was primarily motivated by VMware's industry position in virtual machine software and opportunities for business integration.

2.1 Virtual Machine Market

Server virtualization allows multiple virtual machines to run concurrently on a single physical server, maximizing hardware resource utilization, reducing the number of physical servers, and facilitating management and maintenance. Currently, cloud service providers (Amazon, Microsoft, Google, etc.) widely use virtualization technology and are major clients of VMware. The company initially gained prominence with server virtualization products before expanding into storage virtualization, network virtualization, and compute virtualization.

Part of Broadcom's motivation for acquiring VMware was to capitalize on the prospects of the virtual machine business in the server market. VMware is a leading player in the virtual machine market. According to the State Administration for Market Regulation of China, in 2021, VMware's market share in the global and Chinese non-public cloud virtualization software markets was 92-97% and 22-27%, respectively.

In addition to cloud service providers being major VMware clients, VMware acquires customers through partnerships with major cloud vendors to enter their IaaS cloud service markets (e.g., the 2016 collaboration with AWS to launch VMware Cloud on AWS).

According to VMware's official website, it has over 300,000 global users. Over 58% of the world's top 50 wealthiest companies utilize VMware's services.

2.2 VMware's Virtual Machine Business

VMware's virtualization software enables multiple operating systems to run simultaneously on a single physical computer, suitable for both personal and commercial use (e.g., servers). The company offers VMware Workstation Pro and VMware Workstation player to cater to different needs.

The company's flagship product, "VMware Workstation," is a mature virtualization solution that allows multiple operating systems to run concurrently on a single computer. It supports 64-bit Windows and Linux host operating systems and traditional x86 architecture hardware with 64-bit Intel and AMD CPUs. As a virtual machine solution developed over 20 years, its stability and reliability have been widely validated, making it suitable for various scenarios such as personal use, enterprise desktop virtualization, development, and testing.

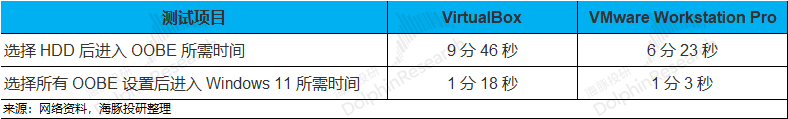

Compared with Oracle's VirtualBox, both can handle lightweight tasks. However, under higher workload demands, VMware's performance is significantly better than its competitors. In a Windows 11 environment, each test allocated 8 vCPUs and 24GB of RAM to Ryzen5 5600X, and VMware responded significantly faster than VirtualBox.

With its leading product capabilities and market position, VMware possesses significant bargaining power. Therefore, Broadcom's decision to transition VMware from a perpetual licensing model to a subscription-based SaaS model after acquiring it can be seen as a disguised price increase. This is similar to Microsoft's Office 365, which shifted from a one-time CD key purchase to a yearly/monthly subscription SaaS model. VMware has also made a similar transition from a one-time purchase to an annual/monthly fee structure.

After divesting non-core businesses like EUC, VMware's revenue primarily comes from subscription SaaS fees and licenses. VMware was delisted in Q3 2023, and for consistency in estimation, Dolphin Research only included "licenses + subscription services" revenue prior to delisting in its calculations.

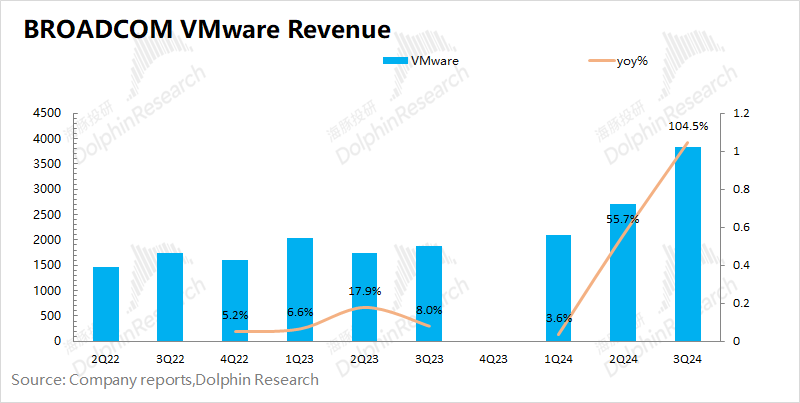

As seen in the chart below, business growth was steady from 2023 and earlier. However, starting in 2024, VMware's subscription + license revenue surged, mainly due to the company's pricing policy adjustments. Although customers were unhappy with the 200-400% price increase post-acquisition, even AT&T sued the company, the case eventually ended in a settlement, reflecting VMware's strong bargaining power in the industry.

Broadcom's current software business primarily consists of VMware and the legacy businesses of CA, Symantec, and Brocade. Dolphin Research expects the legacy software business to remain stable, while VMware is expected to continue benefiting from the "price increase" policy. As perpetual licenses gradually transition to subscription-based SaaS services, VMware's medium to long-term growth rate will converge with the growth rate of the virtual machine industry (around 10%). Driven by the shift to subscription-based SaaS services, Broadcom's VMware revenue is expected to reach over $17 billion in FY2025, representing a 40% year-over-year increase.

III. Broadcom's Performance Forecast and Valuation

Broadcom's business structure comprises semiconductor solutions and software services. In the above article, Dolphin Research focused on the AI and VMware businesses, which are of great interest to the market, but the company also has other business segments.

3.1 Revenue Side

1) Semiconductor Solutions: Besides the networking business, which accounts for the largest share, Broadcom also has storage connectivity, broadband, wireless communications, and industrial and other businesses. ① Storage connectivity is expected to recover slightly in FY2025 due to the storage cycle. ② Broadband is expected to remain relatively subdued in FY2025 due to investment trends in telecommunications and broadband operators. ③ Wireless communications, which primarily provides RF front-end and WiFi chips to major customers like Apple, is expected to recover slightly in FY2025 due to Apple and electronics cycles. ④ Industrial and other businesses, which account for a relatively small portion of overall revenue, are expected to improve in FY2025. Overall, Broadcom's semiconductor solutions revenue is expected to reach $35 billion in FY2025, representing a 17% year-over-year increase.

2) Software Business: ① The legacy business (CA, Symantec, and Brocade) is expected to remain stable with slight growth in FY2025. ② VMware's revenue is expected to continue growing rapidly in FY2025 due to pricing adjustments. Overall, Broadcom's software revenue is expected to reach $27 billion in FY2025, representing a 25% year-over-year increase.

3.2 Gross Margin and Operating Performance

1) Gross Margin: Broadcom includes some acquisition-related expenses in its cost base, directly impacting its gross margin figures. Dolphin Research believes that excluding these expenses provides a clearer picture of the company's operating performance. Therefore, when forecasting gross margins, Dolphin Research primarily uses figures that exclude these expenses.

After adjusting its pricing policy, the software business's gross margin (operating side) is expected to continue recovering. Although the semiconductor business's gross margin (operating side) remains relatively low, the overall operating gross margin is expected to improve in FY2025 due to the increasing share of software revenue.

2) Operating Expense Ratio: Based on Broadcom's past acquisition and integration experience, the company will continue to control expenses and reduce expense ratios. Management has also stated its commitment to streamlining personnel costs. It is expected that R&D and selling, general, and administrative expenses will continue to decline in FY2025.

3.3 Operating Profit

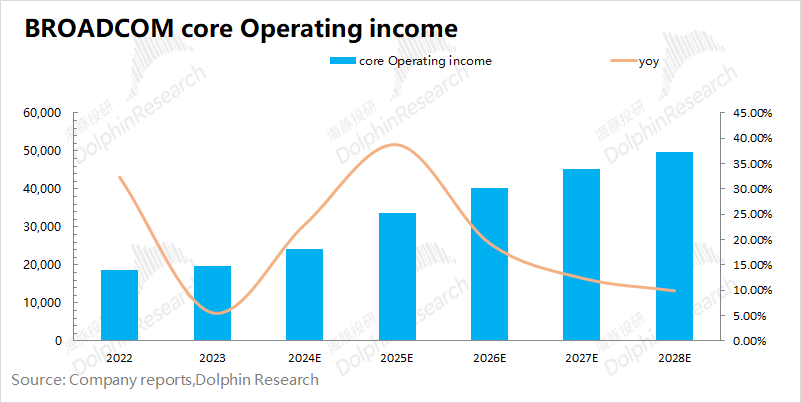

With revenue growth, improving operating gross margin, and declining operating expense ratios, Broadcom's core operating net profit is expected to reach $33.6 billion in FY2025, representing a 38% year-over-year increase.

For FY2025 and beyond, capital expenditure growth is expected to decline for companies like Google and Meta but will still maintain a compound annual growth rate of around 20%. With the continued increase in the use of self-developed ASIC chips, Broadcom's AI revenue is still expected to achieve a compound annual growth rate of over 20%. VMware's growth rate is expected to converge with the industry average, with a compound annual growth rate of 12.6%. The company's traditional businesses and gross margins are expected to remain relatively stable, and both expense ratios are expected to fall below 20%.

Under these expectations, Broadcom will largely complete pricing adjustments and business integration by FY2025. In the subsequent fiscal years 2026-2028, the company's core operating net profit is expected to reach $40.1 billion, $45.1 billion, and $49.5 billion, respectively, with a compound annual growth rate of 13.9% during this period.

3.4 Valuation Levels 1) PE Perspective

Due to Broadcom's acquisition and consolidation of VMware in late 2023, the company's recent financial statements have been impacted by amortization and other factors, making it difficult to directly observe the company's operating performance. Dolphin Research analyzes the company's core operating profit: Core Operating Profit = Revenue * Operating Gross Margin - R&D Expenses - Selling, General, and Administrative Expenses. For the complete valuation content, please visit the Longbridge App and navigate to "Dynamics - Investment Research" to read the full article.

2) DCF Perspective: The current acquisition of VMware by Broadcom will result in significant amortization, impacting the company's profits. However, this impact is expected to diminish after FY2028, and the company's profit margins will gradually improve. Using the DCF valuation method, ****. (For the complete valuation content, please visit the Longbridge App and navigate to "Dynamics - Investment Research" to read the full article.)

3) Comprehensive View: **** (For the complete valuation content, please visit the Longbridge App and navigate to "Dynamics - Investment Research" to read the full article.)

Dolphin Research's Related Articles on Broadcom: In-depth Analysis: September 13, 2024 - "Broadcom: A 'Buy, Buy, Buy' Strategy Paving the Way to a 'Trillion-Dollar' Future? Lessons for Tencent and Alibaba!" Financial Report Review: September 6, 2024 - "Broadcom's 'Wild Ride': Can AI Support the Collapsing Traditional Semiconductor Industry?"