Which AI marketing company is the most profitable?

![]() 12/09 2024

12/09 2024

![]() 650

650

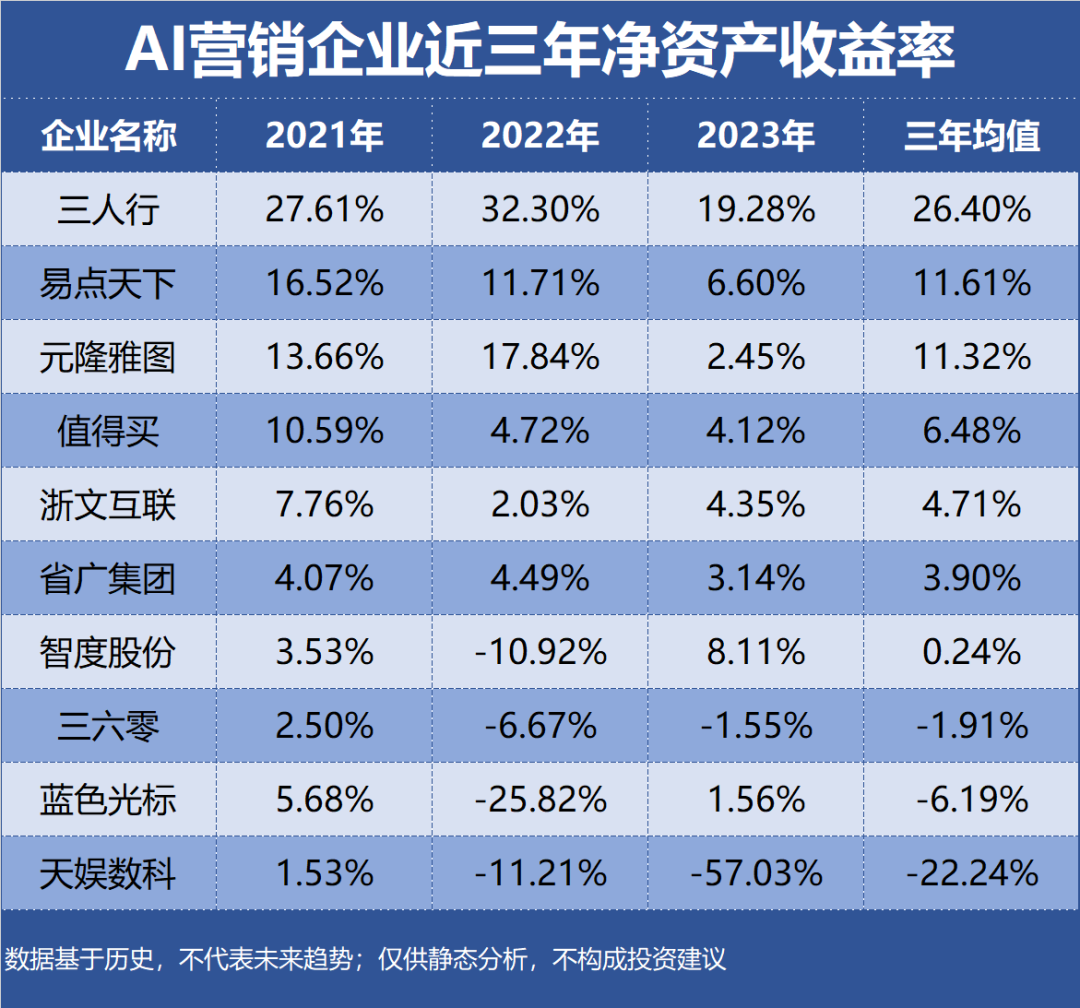

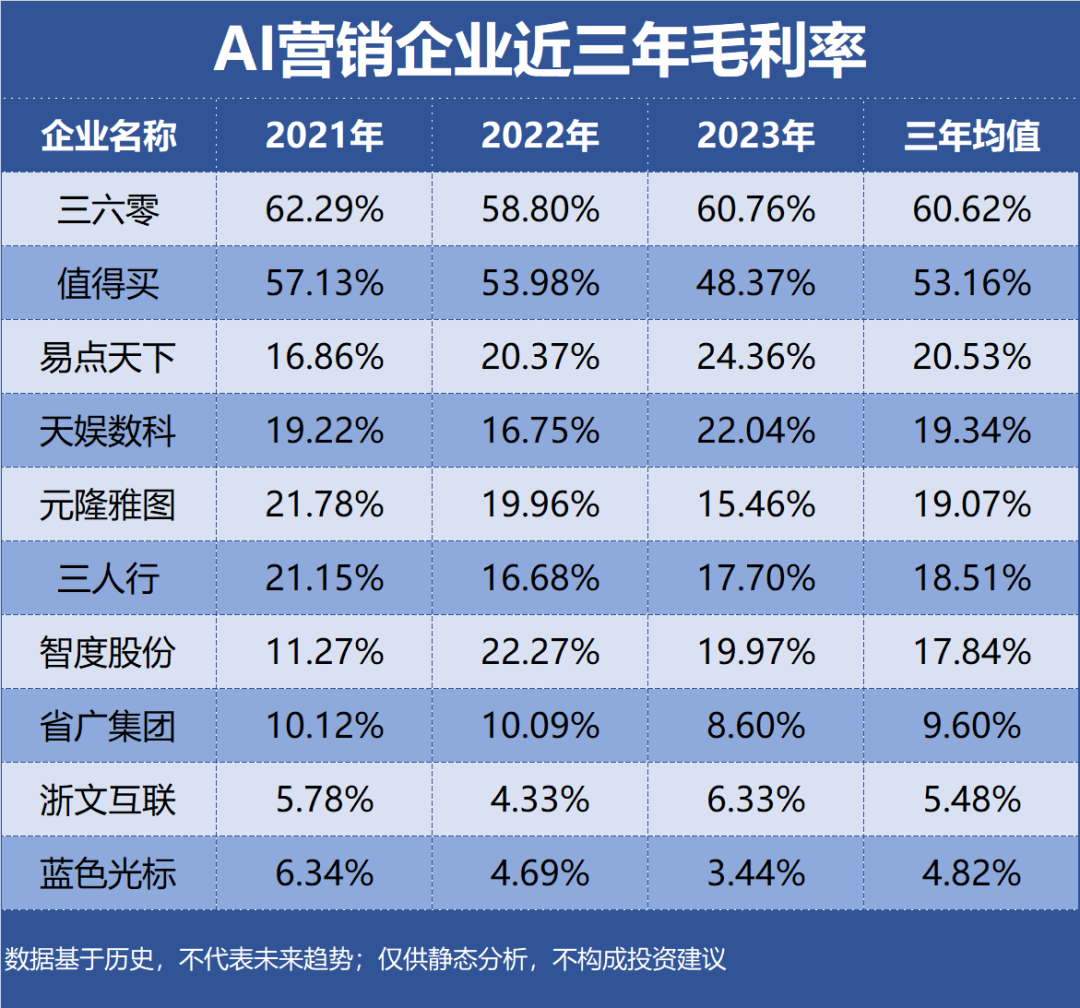

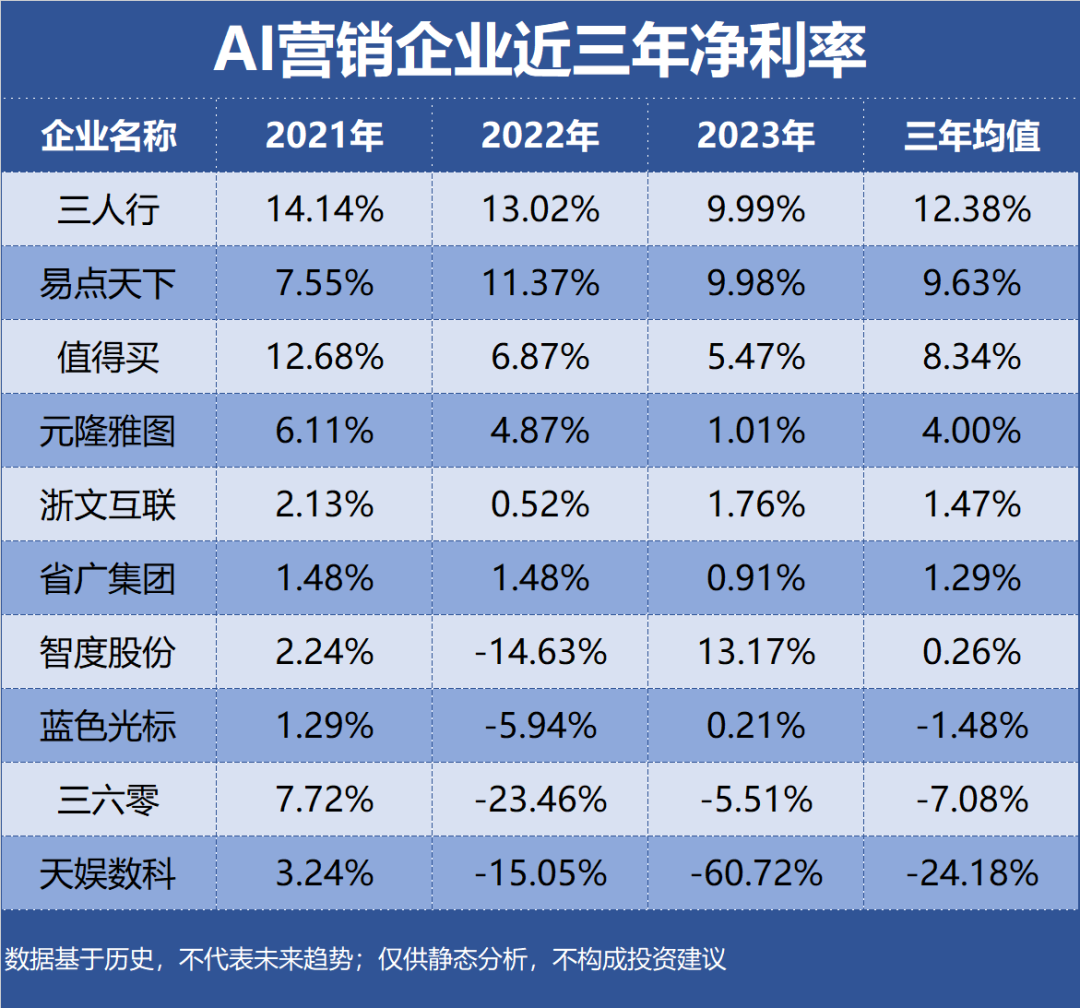

AI marketing can be defined as a model that utilizes artificial intelligence technology to analyze massive amounts of data, mine potential needs, and provide personalized recommendations, thereby assisting companies in making marketing decisions. Profitability is typically reflected in the amount and level of a company's earnings over a certain period. The analysis of profitability involves an in-depth examination of a company's profit margins. This article is part of the Enterprise Value series, focusing on [Profitability]. A total of 14 AI marketing companies were selected as research samples, with evaluation indicators including return on equity, gross profit margin, and net profit margin. The data is based on historical performance and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 AI marketing companies by profitability:

10th. Shenguang Group Industry Segment: Marketing Agency Profitability: ROE 3.90%, Gross Margin 9.60%, Net Margin 1.29% Performance Forecast: No agency forecasts available for this year Main Products: Digital marketing as the primary revenue source, accounting for 85.37% of revenue, with a gross margin of 6.84% Company Highlights: Shenguang Group's Lingxi AI marketing platform was successfully selected as an "AI+" excellent solution, setting an excellent example for the digitization and intelligent transformation of the advertising industry.

9th. Zhewen Interactive Industry Segment: Marketing Agency Profitability: ROE 4.71%, Gross Margin 5.48%, Net Margin 1.47% Performance Forecast: No agency forecasts available for this year Main Products: Internet business as the primary revenue source, accounting for 100.00% of revenue, with a gross margin of 6.33% Company Highlights: Zhewen Interactive's programmatic advertising application tool, "Paizhi", can assist advertisers in producing multimodal creative content, enabling large-scale advertising content production at low cost.

8th. 360 Industry Segment: Horizontal General Software Profitability: ROE -1.91%, Gross Margin 60.62%, Net Margin -7.08% Performance Forecast: The highest ROE in the last three years was 2.50%, with the latest forecast average at 0.10% Main Products: Internet advertising and services as the primary revenue source, accounting for 55.16% of revenue, with a gross margin of 65.48% Company Highlights: 360 Smart Business has integrated large model technology and brand direct display forms on top of traditional search advertising, creating a new AIGC-driven search brand advertising model.

7th. Tianyu Digital Industry Segment: Marketing Agency Profitability: ROE -22.24%, Gross Margin 19.34%, Net Margin -24.18% Performance Forecast: The highest ROE in the last three years was 1.53%, with the latest forecast average at 0.15% Main Products: Data traffic business as the primary revenue source, accounting for 97.99% of revenue, with a gross margin of 22.73% Company Highlights: Tianyu Digital's AIGC short video intelligent marketing assistant, "Mobox Mix", supports short video marketing needs from advertisers, content providers, and MCN agencies.

6th. Yuanlong Yatu Industry Segment: Marketing Agency Profitability: ROE 11.32%, Gross Margin 19.07%, Net Margin 4.00% Performance Forecast: ROE has fluctuated between 2% and 18% in the last three years, with the latest forecast average at 4.35% Main Products: Marketing business income as the primary revenue source, accounting for 98.58% of revenue, with a gross margin of 17.73% Company Highlights: Yuanlong Yatu's AIGC text-to-video technology has numerous applications in the company's advertising and marketing business.

5th. BlueFocus Industry Segment: Marketing Agency Profitability: ROE -6.19%, Gross Margin 4.82%, Net Margin -1.48% Performance Forecast: The highest ROE in the last three years was 5.68%, with the latest forecast average at 3.99% Main Products: Overseas advertising as the primary revenue source, accounting for 71.01% of revenue, with a gross margin of 1.66% Company Highlights: BlueFocus's BlueAl will focus on video intelligent understanding and creation, intelligent workflow, and other directions, empowering AI marketing.

4th. Zhidemai Industry Segment: Portal Profitability: ROE 6.48%, Gross Margin 53.16%, Net Margin 8.34% Performance Forecast: ROE has continuously declined to 4.12% over the last three years, with the latest forecast average at 4.64% Main Products: Information promotion income as the primary revenue source, accounting for 43.43% of revenue, with a gross margin of 55.90% Company Highlights: Zhidemai's main businesses include consumer content, marketing services, and consumer data, with information promotion and internet performance marketing platforms as its primary products.

3rd. Zhidu Stock Industry Segment: Marketing Agency Profitability: ROE 0.24%, Gross Margin 17.84%, Net Margin 0.26% Performance Forecast: The highest ROE in the last three years was 8.11%, with the latest forecast average at 7.20% Main Products: Digital marketing business as the primary revenue source, accounting for 58.91% of revenue, with a gross margin of 4.47% Company Highlights: Zhidu Stock has applied ChatGPT to some of its overseas internet media business, offering paid subscription features such as AI assistants and ad-blocking for users.

2nd. Madhouse Industry Segment: Marketing Agency Profitability: ROE 11.61%, Gross Margin 20.53%, Net Margin 9.63% Performance Forecast: ROE has continuously declined to 6.60% over the last three years, with the latest forecast average at 7.73% Main Products: Performance advertising and marketing services as the primary revenue source, accounting for 96.46% of revenue, with a gross margin of 18.82% Company Highlights: Madhouse's "Digital Human Video Creation Platform" project aims to generate AI advertising copy.

1st. Sannrenxing Industry Segment: Marketing Agency Profitability: ROE 26.40%, Gross Margin 18.51%, Net Margin 12.38% Performance Forecast: ROE has fluctuated between 19% and 33% in the last three years, with the latest forecast average at 11.67% Main Products: Digital marketing services as the primary revenue source, accounting for 89.60% of revenue, with a gross margin of 15.84% Company Highlights: Sannrenxing has pioneered the launch of a multimodal AI product in the marketing field: "One" AI. Top 10 AI marketing companies by profitability, with ROE, gross margin, and net margin over the past three years: