Ecovacs and Xiaomi-Affiliated Brands Challenge iRobot in Overseas Markets

![]() 01/16 2025

01/16 2025

![]() 491

491

Have you ever imagined that one day, domestic floor-cleaning robots would shed the label of "copycats" and comprehensively captivate foreign consumers?

At the recently concluded 2025 International Consumer Electronics Show (CES), known as the "Tech Spring Festival Gala," domestic floor-cleaning robot manufacturers such as Ecovacs, Roborock, Dreame, and Narwal captivated overseas users with innovative products, including the "first floor-cleaning robot equipped with a robotic arm," the "long-legged floor-cleaning robot," and models boasting "high airflow and strong suction."

For over a decade, Chinese brands have been tagged as "copycats" and "followers." Due to a prolonged lack of innovative, self-developed products, they were overshadowed by the foreign floor-cleaning robot giant iRobot.

To dispel these labels, domestic floor-cleaning robot manufacturers have embarked on a vigorous pursuit of independent product innovation. Taking Ecovacs as an example, after the "second-generation" successor Qian Cheng took the helm, he prioritized innovating self-developed products and targeted the overseas market.

After several efforts, domestic floor-cleaning robots have finally surpassed iRobot and gradually gained prominence in overseas markets. However, tempted by market share, domestic giants expanding overseas have initiated another round of competition.

01

Pain Point-Driven Innovation

Driven by the trend of "go overseas or be eliminated," domestic floor-cleaning robots have pioneered a gap in the overseas market by precisely addressing user pain points.

In its early years, Ecovacs was relatively conservative in both strategic positioning and product development. It wasn't until 2012, when Qian Cheng, the son of Ecovacs founder Qian Dongqi, returned from studying abroad and began overseeing international business, that he proposed a nine-word business strategy of "globalization, multi-category, high-tech," marking the start of Ecovacs' overseas expansion.

Looking back at the history of domestic floor-cleaning robots going overseas, Ecovacs was one of the earliest Chinese brands to actively seek overseas expansion. From solitary ventures to a collective exodus of domestic manufacturers, over the past few years, Ecovacs has experienced and witnessed the transformation of Chinese manufacturers from "internal competition" to "external competition."

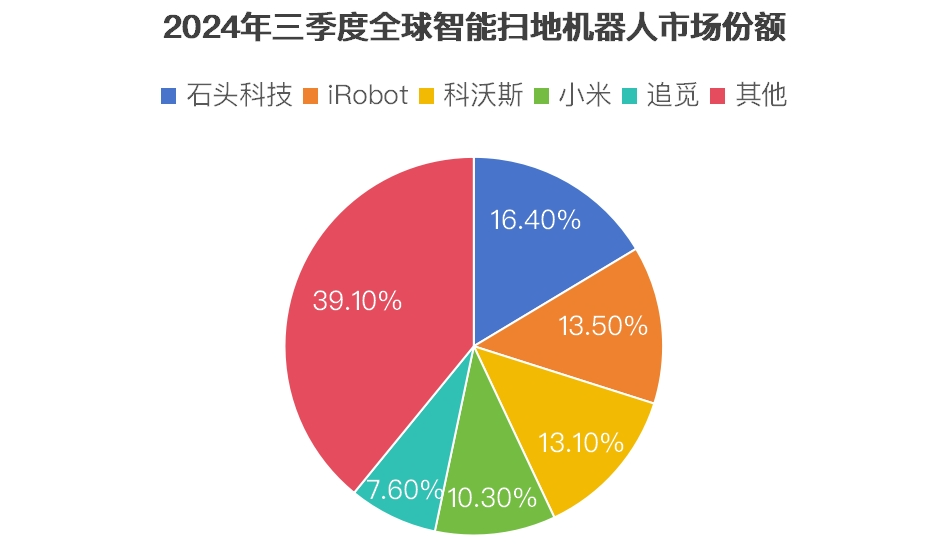

The IDC Q3 2024 tracking report reveals that in Q3 2024, global shipments of smart floor-cleaning robots reached 5.014 million units, with Chinese manufacturers accounting for nearly 50% of the global market share.

The key to Chinese manufacturers' rapid growth in a short period is their profound understanding of real user needs.

For instance, Ecovacs has introduced floor-cleaning robots with integrated sweeping and mopping functions in European and American markets, tailored to the distinct cleaning requirements of hard floors and carpets. Additionally, recognizing the pain points of European consumers in lawn mowing, Ecovacs launched the GOAT series of smart lawn mowing robots, achieving fully automated and intelligent lawn maintenance.

This approach of developing products that address user pain points is also evident in another Chinese floor-cleaning robot manufacturer, Dreame.

For example, facing the widespread use of large-area carpets in European and American households, Dreame has customized a "cloth removal" function for overseas users. Given the abundance of pet hair and carpets in European and American home environments, Dreame's vacuum cleaners are equipped with V-shaped anti-tangling carpet brushes, effectively preventing hair from wrapping around the brushes.

There are numerous similar cases. It is precisely this "pain point-driven" approach that gives domestic manufacturers the upper hand in overseas market competition.

In addition to product innovation, Ecovacs, Dreame, and others have adopted a localized approach in channels, marketing, and services.

"Pain point-driven research and development" combined with "localized strategies" have also allowed Chinese manufacturers to collectively savor the sweetness of overseas market expansion.

Unlike comparable companies in the industry, Ecovacs has also launched the brand "Tineco," with the "two carriages" jointly entering overseas markets.

Tineco's business performance in various regions such as North America, Europe, and Australia has been impressive. It not only ranks first in market share on multiple online e-commerce platforms like Amazon but has also successfully entered more than 50 important retail channels in over 20 countries, including Europe.

According to Tianyancha, Tineco is still 100% owned by Ecovacs, which has become a crucial trump card for its pursuit of overseas markets.

The intensification of domestic robot manufacturers' overseas efforts is inseparable from the continuous internal competition in the domestic market.

02

Innovation and Growth

In the past two years, industry competition has intensified, with frequent reports of Ecovacs' position as the "top dog" in floor-cleaning robots being threatened.

Financial report data shows that in 2023, Ecovacs achieved revenue of 15.502 billion yuan, a slight year-on-year increase of 1.16%; net profit attributable to shareholders was 612 million yuan, a year-on-year decrease of 63.96%.

Behind the increase in revenue without a corresponding increase in profit lies the downturn in the domestic market. Judging from the market performance at home and abroad, in 2023, Ecovacs' domestic and overseas revenues were 8.98 billion yuan and 6.522 billion yuan, with year-on-year increases of -11.4% and 25.8%, respectively.

In the first three quarters of 2024, under the market environment characterized by government subsidies, Ecovacs' overall performance still slightly declined, with revenue of 10.226 billion yuan, a year-on-year decrease of 2.9%.

This is why Ecovacs is eager to expand overseas.

However, despite the overall decline in revenue, the overseas business of Ecovacs' two major brands has not disappointed.

In the first half of 2024, the overseas revenues of the Ecovacs and Tineco brands increased by 11.3% and 31.7%, respectively, year-on-year.

Although the domestic floor-cleaning robot market is facing saturation, the overseas market is still considered a blue ocean.

According to Euromonitor International data, the global floor-cleaning robot market size was approximately $7.023 billion in 2023 and is showing a growth trend.

From a regional perspective, Europe and America offer considerable market prospects.

From 2020 to 2023, the average selling price of floor-cleaning robot products in Western Europe increased from $460 to $508, and market sales also grew.

As an important market, the household penetration rate of floor-cleaning robots in the United States is 17.1%. In 2023, the sales of the floor-cleaning robot market reached $1.77 billion, with the average selling price increasing from $319 in 2019 to $392. The increasing demand for smart home appliances has driven the sales of floor-cleaning robots.

In the Asia-Pacific region, taking South Korea as an example, the market share of Chinese brand floor-cleaning robots reached 80% in the first half of 2024.

For different overseas markets, domestic brands are also continuously conducting localized operations.

Taking Ecovacs as an example, in the European market, Ecovacs flexibly adjusts its strategies in response to the diversified market landscape. For instance, for core markets such as Germany and France, it adopts a close collaboration between online and offline channels; for emerging markets such as Switzerland, Italy, and the Benelux countries, it achieves channel coverage through channel integration and the introduction of new partners.

Moreover, overseas consumers have increasingly higher functional requirements for floor-cleaning robots. In addition to basic cleaning functions, they also pay special attention to self-cleaning functions, intelligent map drawing, the ability to clean animal hair, cleaning effects on wooden floors, etc. Floor-cleaning robots with base station functions such as automatic dust collection and automatic mop washing are more popular.

At the same time, C-end users in the European and American markets are more willing to spend more money on mid-to-high-end or high-end models with richer functions and better product experiences, paying more attention to product performance, usage feelings, and personalized services.

Under such circumstances, Ecovacs launched its first wireless window cleaning product, the W2 OMNI, driving overseas revenue and sales of Winbot to increase by 273.2% and 175.7%, respectively, year-on-year. The once highly regarded lawn mowing robot has also expanded its gears and channel coverage through new product iterations, driving overseas revenue and sales of lawn mowing robots to increase by 185.9% and 252.1%, respectively, year-on-year.

According to Stackline data, as of the first half of 2024, the Tineco brand has maintained its leading position in sales of floor washing machines for three consecutive years on Amazon sites in the United States, Canada, France, Italy, Australia, and Japan.

The continuous increase in the overseas business of domestic brands also reflects two points: first, the global floor-cleaning robot market size continues to climb; second, Chinese brands are continuously strengthening their competitiveness overseas and are rapidly shedding the stereotyped impressions of being "imitators" and "followers," reshaping a new image towards "innovation" and "leadership."

03

Overseas "Internal Competition"

As Chinese manufacturers continue to increase their global market share, they actually face another problem similar to that in China - internal competition.

As mentioned earlier, in Q3 2024, nearly half of the global market share of smart floor-cleaning robots came from China. Specifically, the market shares of Roborock, iRobot, Ecovacs, Xiaomi, and Dreame in that quarter were 16.4%, 13.5%, 13.1%, 10.3%, and 7.6%, respectively. Among them, Roborock and Dreame are both Xiaomi-affiliated brands.

In other words, the upcoming competition in the overseas market will likely be internal competition among Chinese manufacturers, with the "battlefield" extending from domestic to foreign markets.

Based on past internal competition scenarios, it mainly focuses on price and technology.

However, from the current technological perspective, domestic floor-cleaning robots have entered a stage of "micro-innovation," and it is difficult to achieve disruptive innovations, which will inevitably lead to imitation or even plagiarism as in the past.

In 2023, Qian Cheng, CEO of Ecovacs, publicly criticized the phenomenon of plagiarism within the industry.

He believes that products obtained through plagiarism can only be superficial in appearance and cannot deliver a good user experience. Plagiarism and patent infringement should be resolutely resisted.

Even so, it cannot be denied that going overseas has brought growth opportunities to domestic manufacturers in the past few years.

Wind data shows that Ecovacs, which ventured overseas earlier in the field of floor-cleaning robots, has seen its overseas revenue soar from 1.251 billion yuan in 2015 to 6.522 billion yuan in 2023, an increase of over five times in nine years. Roborock's overseas growth has also been rapid, increasing from 581 million yuan in 2019 to 4.229 billion yuan in 2024, an increase of over seven times in five years. It ranks among the top market shares in multiple countries such as the United States, Germany, Norway, and Sweden.

In addition to the above two companies, Chinese floor-cleaning robot manufacturers such as Dreame and Narwal have also shown a trend of increasing overseas market revenue year after year. For example, Dreame has performed well in market share in Germany, Italy, Singapore, and other markets.

The popularity of Chinese floor-cleaning robots overseas has also eroded the market share of the foreign giant iRobot, dethroning it.

Overall, Chinese manufacturers, with their complete supply chain resources, have more advantages in core component production, hardware assembly, and large-scale mass production, with fast product iteration speeds. All these provide strong support for domestic floor-cleaning robots to go overseas and help enterprises accelerate their overseas business layout.Some images are quoted from the internet. Please inform us for deletion if there is any infringement.