Micron: "The East Wind" is not far, but waiting for it carries risks

![]() 03/24 2025

03/24 2025

![]() 696

696

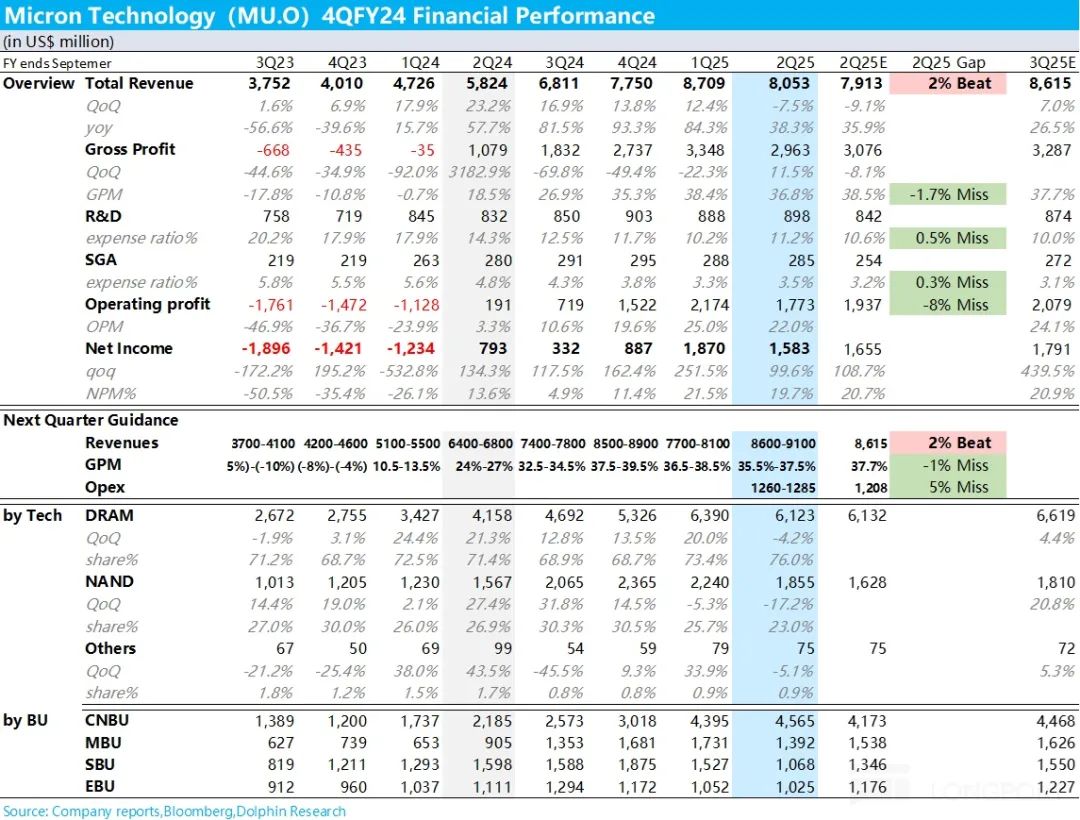

Micron Technology released its fiscal second-quarter 2025 earnings report (ended February 2025) after the U.S. market close on March 21, 2025, Beijing time. The key points are as follows:

1. Key Point: The revenue rebound was decent. As the top priority, guidance for the next quarter (March-May 2025) is revenue of $8.8 billion, with a fluctuation of $0.2 billion; this equates to a sequential growth of around 9%, exceeding the market consensus average recovery rate of 7%. However, Dolphin notes that some leading outsiders have raised their sequential rebound estimates to over 10% in their latest reports.

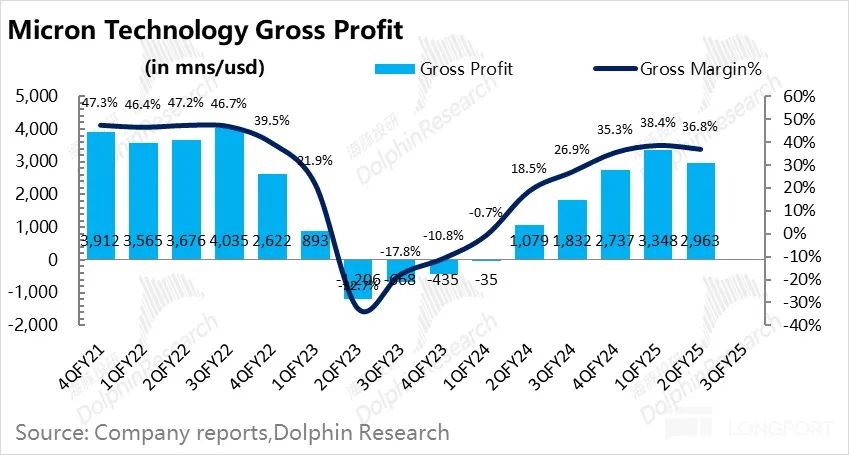

2. Key Point: Gross margin guidance is a bit weak. Although HBM is in a shipping lull, prices of DDR4 and DDR5 memory have rebounded since February, and the market originally expected this to offset some of the gross margin decline. However, the company's guidance of 36.5%, with a fluctuation of one percentage point, has a median value slightly lower than expectations.

In fact, the company mentioned in a small-scale communication meeting in February that gross margin would decline by a few hundred basis points (bps) sequentially in the third quarter. This is mainly due to the increase in the proportion of to-C products, which are still at relatively low prices, coupled with poor NAND market conditions. However, after the third quarter, the industry will recover, and gross margin will continue to improve.

3. Overall performance: After suppressing market expectations, actual revenue was $8.1 billion, slightly exceeding the expected $7.9 billion; however, gross margin was still weak due to low HBM shipments in the first quarter and DDR and NAND prices remaining at lows in December and January.

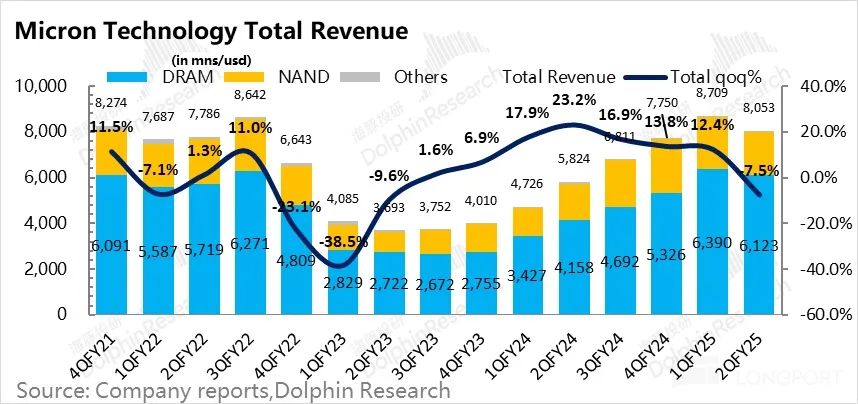

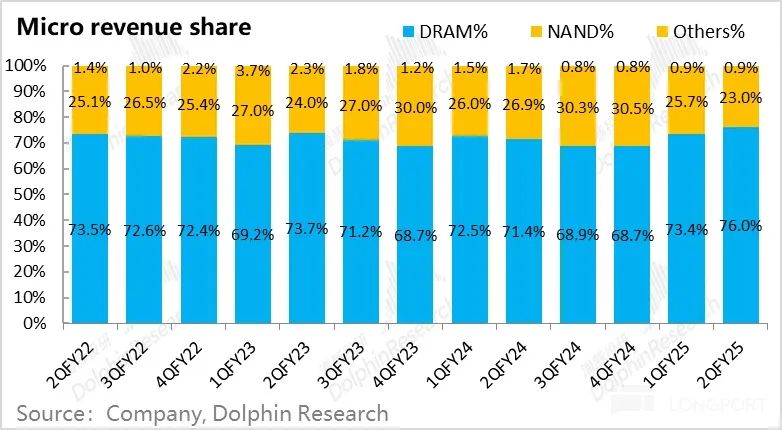

4. DRAM, where HBM is located, also experienced negative sequential growth: As the main revenue driver accounting for over 75%, DRAM business revenue declined by 4% to $6.1 billion, almost exactly in line with market expectations. Within DRAM, HBM used in AI servers contributed over $1 billion in revenue for the quarter, with sequential growth of over 50%, and HBM shipment rhythm exceeded our own expectations.

In addition to HBM used in GPUs, high-performance D5 and low-power DRAM in traditional servers will generate billions of dollars in revenue in fiscal 2025.

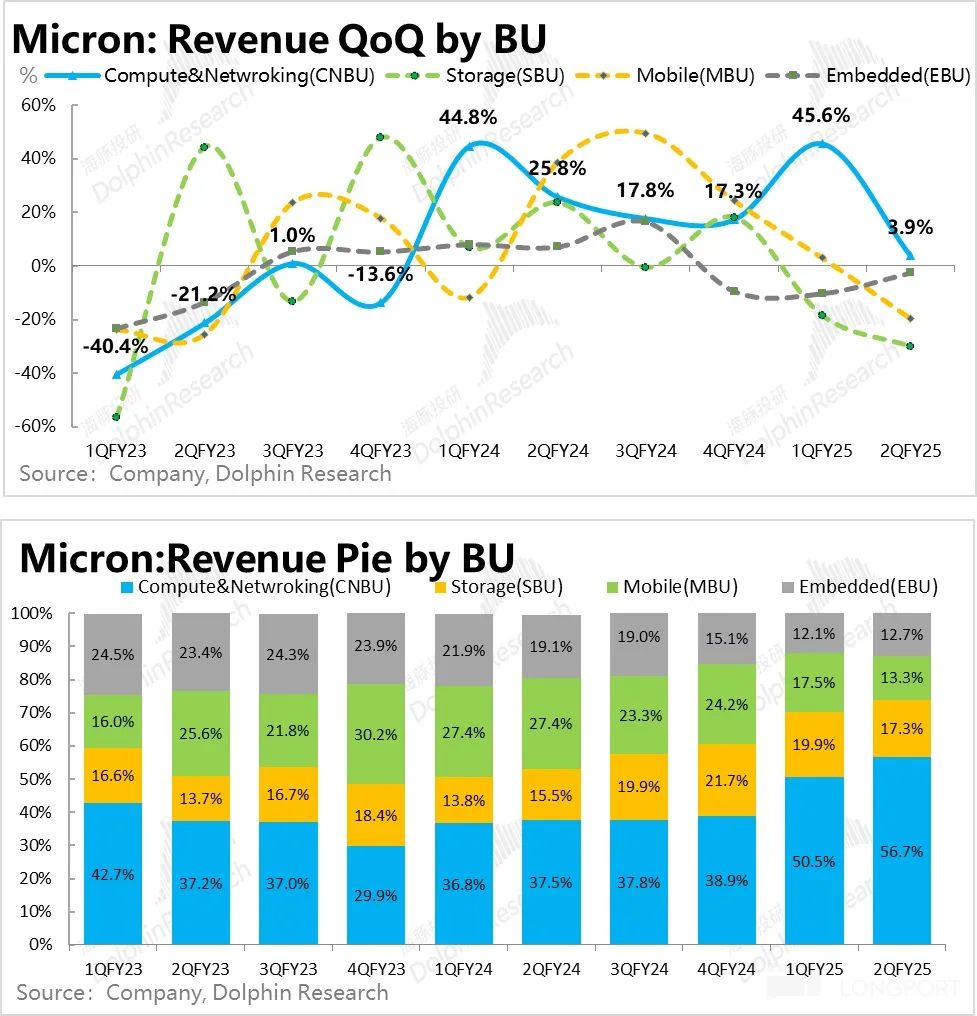

5. By breaking down revenue by business unit, it becomes clear why gross margin weakened: The Computing and Networking business, which accounts for 60% of revenue, increased by only 4% sequentially this quarter after a 46% sequential surge in the first fiscal quarter.

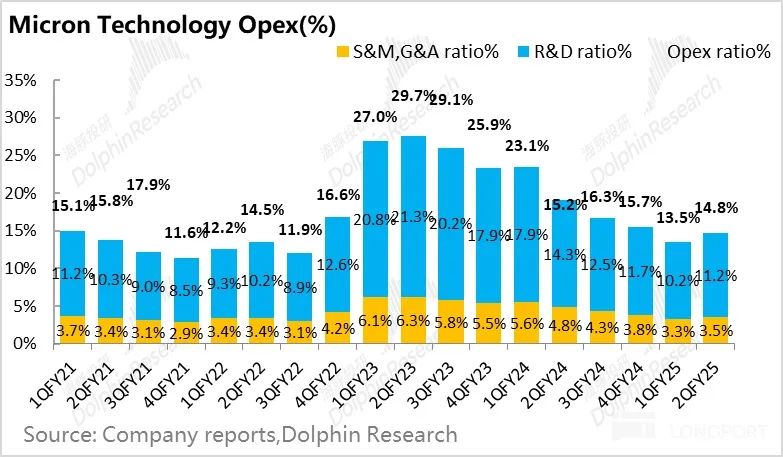

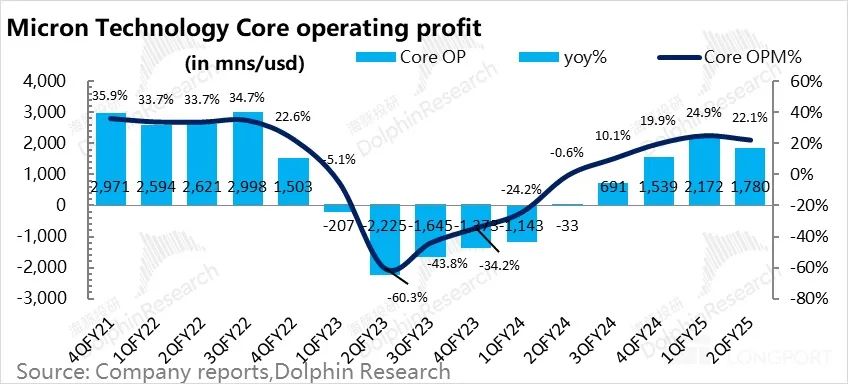

6. Operating profit declined significantly: Due to high R&D expenses for new product development, there was no sequential decline as expected by the market. Meanwhile, marketing and administrative expenses were also basically stable, both exceeding market expectations. As a result, operating profit was significantly lower than market expectations.

However, it should be noted that under the current expectations of an AI cloud-side and end-side hardware explosion, the demand for HBM and DDR is relatively certain. While advancing HBM product iterations, there are no excessive requirements on the expenditure side.

Dolphin Investment Research Viewpoint:

At this stage, the most important indicators for Micron are still revenue and gross margin trends. Among them, revenue growth, especially the ramp-up speed of HBM, is even more crucial.

However, the issue here is that Micron's HBM capacity has already been fully booked. For the rest of 2025, it will be a matter of capacity ramp-up and release.

Currently, the overall pace is smooth and even exceeds the company's expectations, which is good news. But given the current supply-side logic, there is essentially no elasticity from the perspective of HBM revenue.

Therefore, the two major factors that are likely to drive its share price are:

a. What are the HBM supply and demand expectations after 2026? Can the supply-side-driven logic continue? For example, will Samsung be able to supply Nvidia by then? At the same time, the emergence of technologies like Deep Seek will increase the hardware configuration requirements for AI use in low-end products, potentially causing significant disturbances to the certainty of HBM.

It should be noted that in the AI memory investment landscape: unlike the monopoly logic of Nvidia and TSMC, HBM is more driven by supply-demand mismatches, with much weaker monopoly logic. In this scenario, Micron is essentially still a "cyclical stock" logic, with a business quality far inferior to that of Nvidia and TSMC.

b. Can end-side AI hardware penetrate rapidly? Can it drive an increase in DDR demand and push up DDR unit prices? The company's current shipment expectations for the PC and mobile phone markets are still in the mid-single-digit growth range, suggesting that expectations are not overly optimistic.

As a cyclical stock, the good news is that during the current upward cycle, Micron has the incremental market of HBM and the opportunity for increased memory/storage value per device brought about by AI end-side applications.

However, in the very short term, from a timing perspective, for the quarter ending in May, although the company's guidance exceeded expectations, the magnitude of sequential growth suggests that it should still be a relatively "slow" season for Micron.

It will not be until the second half of calendar year 2025, when the AI replacement story gains momentum and HBM follows large-scale shipments of GB systems, that Micron's high-profile moment will truly arrive.

Overall, Dolphin believes that in the current high-growth cycle, if Micron experiences a significant pullback, it may present a good entry opportunity.

Currently, in terms of valuation, with a PE of 20X for fiscal 2025, it should be said that Micron is at a slightly mid-range valuation position in the upward cycle. While there is certainty in the second half of the year, investors can look for more comfortable prices to enter.

Below is a detailed analysis

I. The following is the core information provided by the company's management regarding HBM and related markets:

1. HBM Core Information: Emphasizing the TAM story once again.

a. Raised HBM market size expectations again: The market size expectation for HBM in 2025 has been increased to $35 billion, and by the fourth quarter of calendar year 2025, Micron's market share will rise along with its capacity share. All HBM capacity for 2025 has been sold out. Discussions on 2026 orders have now begun.

b. In terms of HBM capacity classification, HBM3E 12H has a higher capacity share and has already started mass production. In the second half of calendar year 2025, HBM3E 12H (primarily equipped in GB 300) will be the main shipping product, with HBM3E 8H (installed in GB 200) playing a supporting role.

c. HBM revenue expectations: Mass shipments to a third customer have already begun in the February quarter, with new customers expected to follow. HBM will generate "multi-billion" dollars in revenue in fiscal 2025.

d. Product progress: HBM4 will be released in calendar year 2026, with a 60% increase in bandwidth compared to HBM3.

2. NAND: Some data center customers are still clearing inventory in the short term, and shipments may increase in the following months.

3. PC Market: Estimated mid-single-digit growth in calendar year 2025, with growth accelerating in the second half of the year. This is mainly due to the retirement of Windows 10 in October, which may stimulate interest in AI PC replacements. The minimum memory for AI PCs is at least 16GB, while the current average is around 12GB.

4. Mobile Phone Market: The main hope lies in AI, as AI phones require at least 12GB of internal memory, while last year's phones generally had 8GB of memory.

5. DRAM shipments in 2025 will be in the mid-to-high double-digit range, while NAND shipments will be in the low single-digit range. In the long term, both should be around 15%.

6. Micron's DRAM and NAND production growth in calendar year 2025 will be lower than industry demand growth, and inventory days will decline; however, market share in terms of sales will remain stable;

II. Key Charts for Reference:

- END -

// Reprint Authorization

This article is an original by Dolphin Investment Research. For reprints, please obtain authorization.

// Disclaimer and General Disclosure Notice

This report is for general information and data reference purposes only, intended for users of Dolphin Investment Research and its affiliates for general browsing. It does not consider the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person who makes investment decisions using or referencing the content or information in this report does so at their own risk. Dolphin Investment Research shall not be liable for any direct or indirect responsibility or loss that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available information and are provided for reference purposes only. Dolphin Investment Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or opinions expressed in this report shall not be construed as or deemed to be an offer to sell securities or an invitation to buy or sell securities in any jurisdiction, nor do they constitute advice, inquiries, or recommendations regarding relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for or to be distributed to citizens or residents of any jurisdiction where the distribution, publication, provision, or use of such information, tools, and data would violate applicable laws or regulations or result in Dolphin Investment Research and/or its subsidiaries or affiliated companies being required to comply with any registration or licensing requirements in such jurisdiction.

This report reflects only the personal views, opinions, and analysis methods of the relevant authors and does not represent the position of Dolphin Investment Research and/or its affiliates.

This report is produced by Dolphin Investment Research and its copyright is solely owned by Dolphin Investment Research. Without the prior written consent of Dolphin Investment Research, no institution or individual may (i) produce, copy, reproduce, duplicate, forward, or make any form of copy or reproduction in any way, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Investment Research reserves all related rights.