Delay in Flagship Car Chip: Who Is More Anxious About NVIDIA's 'Trump Card'?

![]() 04/14 2025

04/14 2025

![]() 571

571

Introduction

Automakers that have pinned their hopes on Thor are the most affected by the delays.

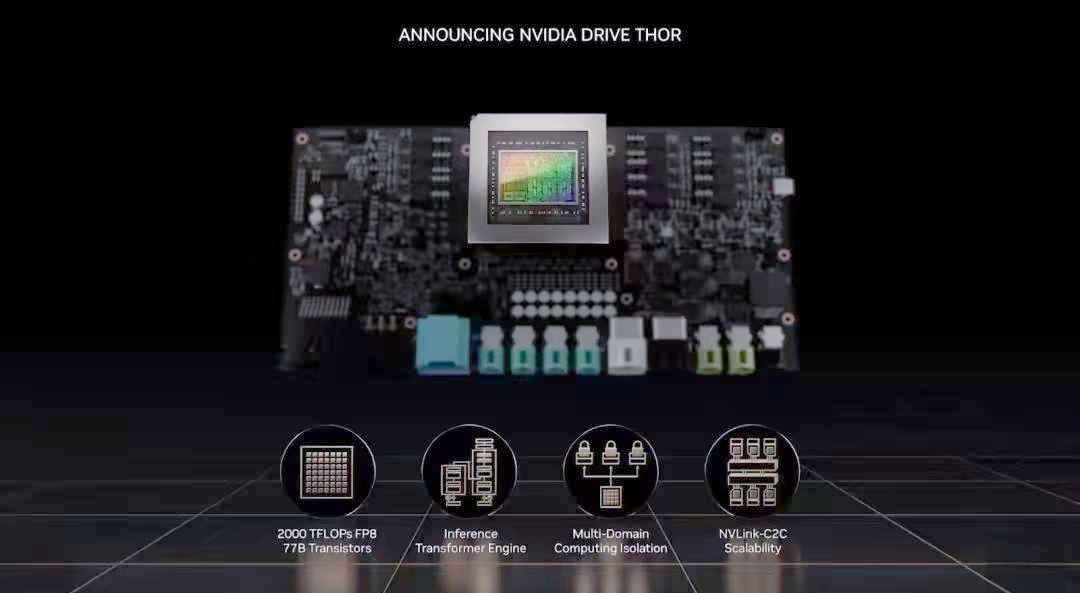

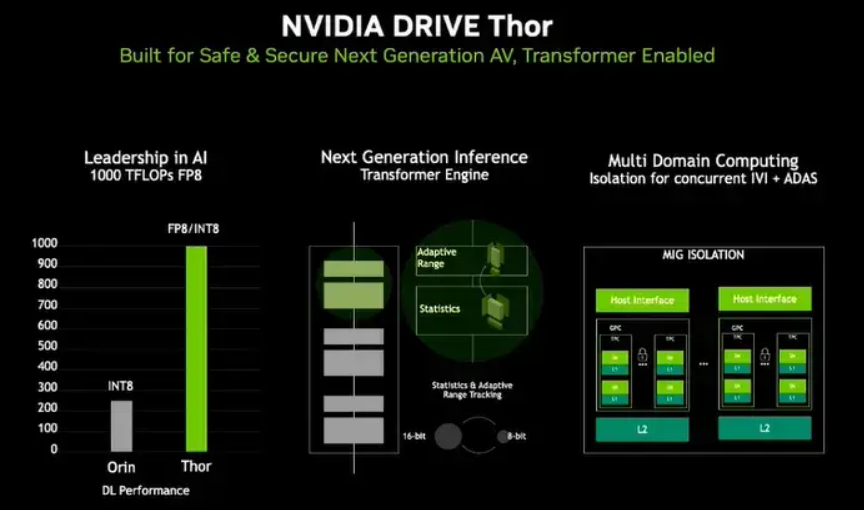

In 2022, NVIDIA unveiled its cutting-edge Thor autonomous driving chip, boasting a peak computing power of 2000 TFLOPS—twice that of Altan and eight times that of Orin. This flagship automotive chip garnered immense attention even before its market debut, positioning it as the industry leader.

Its impressive data and unprecedented performance ignited excitement among fans, leading many to exclaim, "The only one that can defeat NVIDIA is NVIDIA itself!"

Three years later, this star chip, originally scheduled for mass production in 2024, has faced repeated delays. Based on these production delays, it seems that NVIDIA may not have defeated itself, but it has certainly dug itself into a hole with its flagship product, Thor.

The delays not only hamper automakers' new car plans but also affect NVIDIA's market strategy. With a pattern of iterating automotive chips every 1-2 years, NVIDIA has no new autonomous driving chip products planned after Thor.

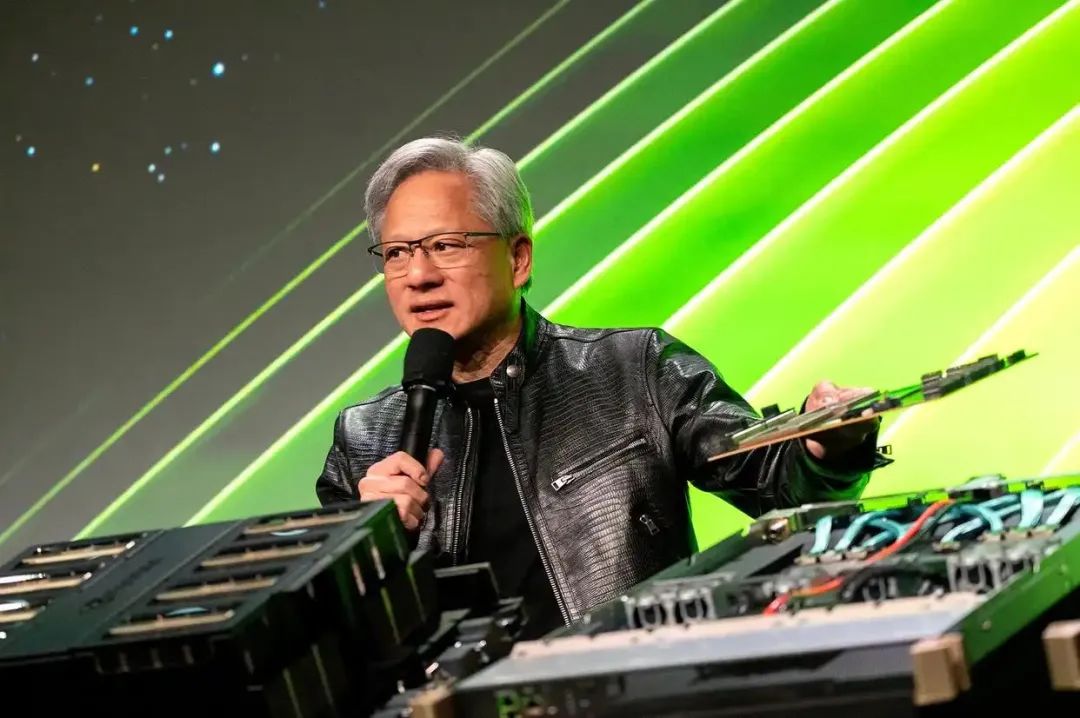

Jen-Hsun Huang, a manager with a keen sense of crisis, has been under immense pressure over the past year, facing scrutiny from both the industry and investors. Despite his attempts to hide this pressure under his black leather jacket, the repeated difficulties in delivering the flagship product have repeatedly exposed it.

When the product was first announced, NVIDIA gave Thor a commanding Chinese name: Leishen (Thor). This chip not only boasts explosive performance but also arrived at the perfect time, with mass production originally planned for 2024, coinciding with the growth and outbreak of high-level intelligent driving in China's new energy vehicles. Once successfully integrated into vehicles, it could quickly reap market dividends.

However, things did not go as planned.

01 Why Is the 'Trump Card' Difficult to Deliver?

NVIDIA has incredibly high expectations for Thor.

The top model offers 2000 TOPS of computing power, nearly eight times that of the previous generation Orin. It supports end-to-end autonomous driving, real-time multi-sensor fusion, and the visual language action large model VLA, leveraging the Blackwell+4nm process. It leads the industry in AI training, inference efficiency, and energy efficiency ratio.

In NVIDIA's plan, Thor was to become the "king that rules all," solving all problems with one high-powered chip and fueling the growth of the company's automotive business. According to the original plan, NVIDIA was to mass-produce Thor in mid-2024, but this was later postponed to April-June 2025. The latest news suggests that mass production of the chip is highly likely to be delayed until 2026, and it is probable that only the 750 TOPS low-power version will be available.

NVIDIA has not provided many explanations for the delay, but it is an unspoken fact in the industry. The product leader of Xpeng Motors' P and G series once stated on social media: "NVIDIA Thor is still delayed, and there is no definite SOP (standard operating procedure) time. It would be good if it can be mass-produced in 2026."

Regarding the reasons for the delay, there are design challenges faced by the Blackwell GPU architecture. Specifically designed by NVIDIA for large language models and generative AI, the Blackwell architecture encountered issues during mass production, including design flaws, insufficient yield, and heat dissipation challenges.

Another explanation is that TSMC discovered issues with the bare die design during production, affecting the yield rate and impacting Thor's mass production schedule. Additionally, the complexity of the chip architecture can encounter various difficulties during the production debugging phase, and production may also be challenged by the supply chain, such as capacity allocation and process optimization.

There are also policy obstacles to consider.

In recent years, the United States has gradually tightened its export control measures for semiconductors to China, further restricting semiconductor manufacturing equipment and memory chips. This indirectly affects the stability of NVIDIA's supply chain, even though NVIDIA's Thor itself is not a restricted product.

Automakers that have pinned their hopes on Thor are the most affected.

Xpeng Motors had planned to release a new car equipped with Thor this year, but due to repeated delays, Xpeng accelerated the self-development of the autonomous driving chip "Turing," with computing power equivalent to three Orin-X. It is reported that the Xpeng P7+ considered using NVIDIA's Thor during development but ultimately adopted a dual Orin-X configuration due to the chip's continuous delays.

The Lynk & Co 900 will be the world's first model equipped with Thor. Whether the supply of this chip goes smoothly will soon be seen. During the group interview at the ZEEKR Intelligent Driving Press Conference, ZEEKR Vice President Lin Jie denied the issue of NVIDIA Thor being "difficult to deliver." He said that the Lynk & Co 900 will be launched in April and delivered in the second quarter. "At my level, I haven't heard of any issues with Thor supply yet."

Li Auto is also one of the first automakers to support Thor, but the company is also accelerating the self-development of the 5nm intelligent driving chip "Schumacher" to reduce dependence on NVIDIA. BYD has also announced the adoption of NVIDIA Thor and has not yet officially announced an alternative solution, but the company also has layouts in self-developed chips, enhancing the autonomy and controllability of the supply chain.

02 Jen-Hsun Huang's Triple Anxiety

After the automotive chip has been taped out, it still requires rigorous automotive validation and functional validation. Any uncertainty in subsequent testing can only result in design adjustments. First, time is becoming increasingly urgent; second, automakers' scrutiny of chip stability will only become more stringent, leading to more cautious purchases and investments. The longer it takes, the more passive NVIDIA will become.

Industry rumors suggest that the reason for Thor's silence is because Jen-Hsun Huang saw competitors such as Qualcomm and Mobileye successively launching integrated automotive computing solutions, with more players sharing the pie. NVIDIA must ensure that Thor has obvious advantages in computing power and functionality before confidently proceeding with mass production. The company's internal continuous optimization of the design has delayed the process significantly.

Wolves in front, tigers behind.

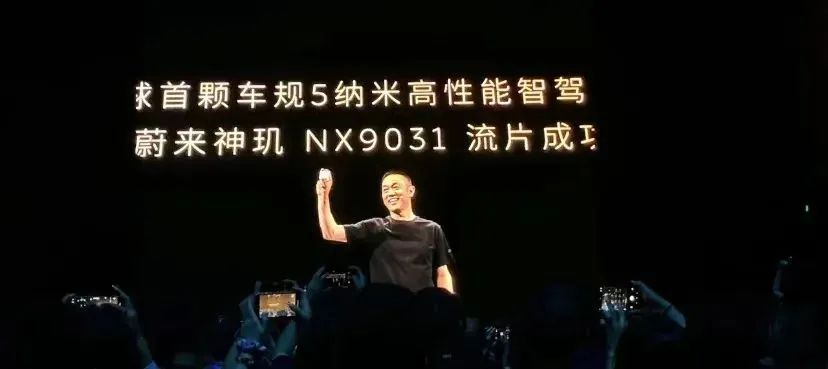

The "wolves" that are eyeing them hungrily are automakers developing their own chips. By doing so, they reduce dependence on external suppliers and lower external procurement needs, putting pressure on NVIDIA's revenue at the market level. Li Bin, CEO of NIO, once said in an interview with the media that the international impact on chip supply, due to US restrictions, has had a real impact on China's automotive industry.

Self-developed chips are more compatible with one's own algorithms, involving the coupling degree between algorithms and chip platforms. One of the main reasons Tesla's 144 TOPS computing power outperforms chips with 400-500 TOPS on the market and has high computing efficiency is that it is designed for Tesla's own algorithms. Tesla released its 144 TOPS computing power chip (Autopilot HW3.0) in 2019, and it can still support the end-to-end implementation of intelligent driving today.

It is worth mentioning that NVIDIA's ecological moat lies in the versatility of CUDA and GPU architecture. When more automakers choose ASIC dedicated chips, such as several main products of Black Sesame Technology, NVIDIA's ecological advantages will gradually weaken.

Even if automakers choose to continue cooperating with NVIDIA and purchase intelligent driving chips from it, they are essentially shifting to a hybrid model of "self-developed + third-party procurement" or "multiple procurement channels," eroding NVIDIA's absolute dominance.

The "tigers" lurking behind are intelligent driving chip suppliers. In addition to competitors like Qualcomm, Mobileye, Black Sesame, and Horizon Robotics, there is another force that cannot be underestimated: the Huawei group.

Taking the Chinese market as an example, it is a huge group empowered by Huawei, including brands such as Wenjie, Zhijie, and Zunjie under Hongmeng Zhixing, as well as cooperation partners like AVIATA and Blueprint. The intelligent driving systems of their models mostly use Huawei's MDC810/MDC610 computing platforms.

With the efforts of intelligent driving chip suppliers and the accelerated landing of self-developed chips by companies like NIO, in the coming years, from automaker camps to supplier camps, the desire for domestic intelligent driving chips to be "not constrained by NVIDIA" will gradually be partially realized.

The third layer of anxiety brought by Thor is NVIDIA's automotive business.

Over the past few years, although the automotive business has been a strong engine for NVIDIA, its share of the company's internal business is still relatively small. Wu Xinzhou, who moved from Xpeng to NVIDIA, comes with a mission under the spotlight, but this also depends on how much say Jen-Hsun Huang is willing to give him. Moreover, Wu Xinzhou himself is also aware of the limited window period NVIDIA has for the landing of autonomous driving.

After all, NVIDIA has encountered projects being handed over to others due to delays in recent years. Mercedes-Benz has shown NVIDIA its utmost sincerity, but the latter has been slow to deliver the expected product.

Editor-in-Charge: Li Sijia Editor: He Zengrong