Honor IPO: A Pivotal Step Towards Reclaiming Glory

![]() 07/03 2025

07/03 2025

![]() 628

628

The IPO of Honor marks not only a milestone in its "second startup" journey but also a significant step in its transformation into an AI terminal ecosystem company. Ditching the "replacement" tag, Honor is crafting a fresh IPO narrative centered around AI.

Original New Entropy Big Company Team

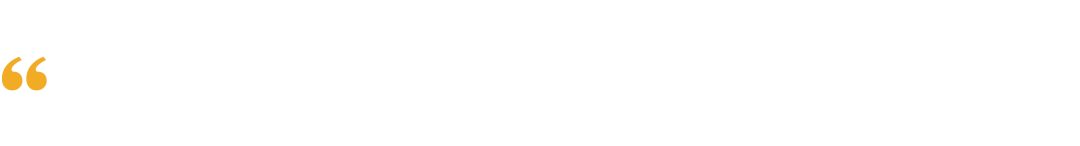

After years of speculation, Honor's IPO has finally taken its first meaningful step. According to the disclosure on the China Securities Regulatory Commission's website, Honor Device Co., Ltd. has obtained listing coaching and filing, with CITIC Securities serving as the coaching securities trader. The coaching work is scheduled to be completed from January to March 2026.

In the eyes of the outside world, this IPO is not just about whether Honor can become the third domestically listed smartphone brand after Xiaomi and Transsion; it also signifies a landmark event in its "second startup". Furthermore, Honor is progressing with its "Alpha Strategy", evolving from a hardware manufacturer to an AI terminal ecosystem company, potentially becoming the first AI terminal ecosystem enterprise on the A-share market. This strategic transformation will also create synergies with the AI sector of the capital market. This year has seen significant changes among Honor's senior management. In January, Li Jian took over as CEO, and China initiated a reform for competitive recruitment, opening up 38 key management positions for public competition, with 24% of participants being post-90s. Concurrently, the company established first-tier departments such as the AI and Software Business Department and the New Industry Incubation Department, elevating AI research and development to a strategic core position. In May, Honor officially announced its entry into the robotics industry. Fortunately, with the recent completion of internal organizational renewal and the frequent launch of new products, Honor has returned to the right track and regained its former momentum. The IPO will serve as an important footnote to its next stage of growth.

AI May Unlock a Valuation of 200 Billion Yuan

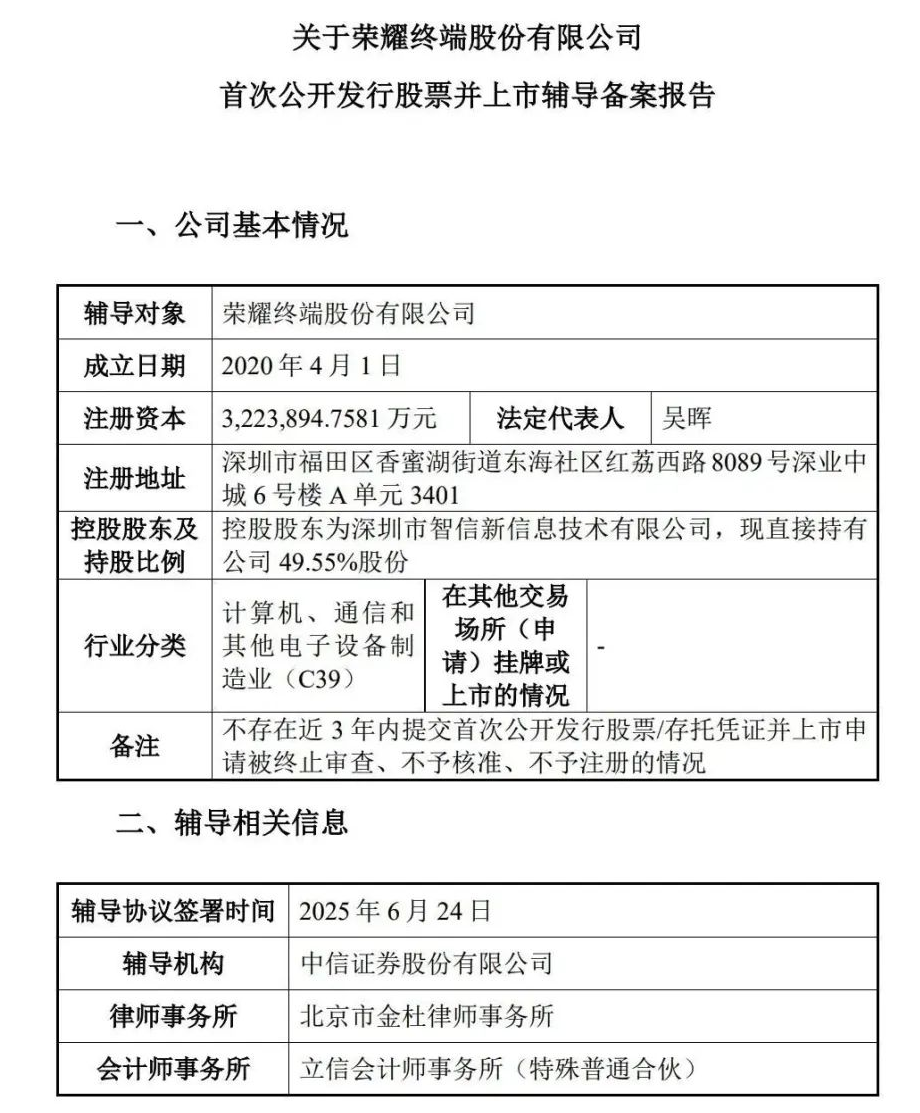

It has long been an industry consensus that Honor is seeking to go public. In 2024, it began frequently raising funds in the primary market, with participants including China Mobile, China Telecom, funds under the China International Capital Corporation, related enterprises of China Reform Holdings Corporation, and Tefa Fund. Currently, Honor boasts over 20 shareholders, including local state-owned assets, operators, distributors, suppliers, and third-party capital. A rumored Pre-IPO financing plan for Honor indicated a valuation of 200 billion yuan, though Honor has not confirmed the authenticity of this claim. Late last year, Honor announced the completion of its share reform and declared that it would initiate the IPO process in due course, a statutory preparatory step towards the capital market. In January of this year, Zhao Ming resigned as CEO of Honor due to health reasons, followed by the departure of senior executives such as Jiang Hairong, CMO of Honor China, and Zheng Shubao, head of the sales department of Honor China. Some analysts believe that this move was to distance itself from Huawei and facilitate the listing process.  ▲Image/Weibo Screenshot

▲Image/Weibo Screenshot

While Honor's core business remains smartphones, it has embarked on exploring new development paths and cannot be solely defined as a "mobile phone enterprise". For instance, Honor's strategic positioning extends beyond the smartphone field to encompass a broader AI terminal ecosystem. In March of this year, Li Jian, the new CEO of Honor, made his public debut at the Mobile World Congress in Barcelona, introducing the ambitious "Alpha Strategy" (HONOR ALPHA PLAN). The core objective is to transform Honor from a smartphone manufacturer into a globally leading AI terminal ecosystem company. To achieve this, Li Jian stated that Honor will invest tens of billions of dollars over the next five years to advance the "Alpha Strategy". This investment of nearly 15 billion yuan per year is one of the largest AI investments publicly stated by mobile phone manufacturers in recent years.

For the capital valuation of an IPO, both performance and narrative are paramount. Many research analysts have stated that "Honor has previously proven its capability to rank highly, but it also faces the pressure to challenge higher rankings. However, with the end of adjustments, from marketing promotion to channel interaction, it has become more dynamic, performing well overall and returning to the right track. It is anticipated that in the second half of the year, Honor can once again challenge the forefront of the Chinese market." In terms of imagination, with the rise of domestic large models like DeepSeek this year, the capital market has been driven to reevaluate the value of Chinese technology companies, particularly AI companies. National policy support and capital market pursuit have spurred AI enterprises to initiate listings in batches. Honor may hold the potential to become the first AI terminal ecosystem stock on the A-share market. Although there are currently enterprises in the fields of AI chips and intelligent voice on the A-share market, there is still a relative scarcity of terminal ecosystem companies representing AI applications. If Honor can successfully list on the A-share market, it will become a scarce target in this field, and a market value of 200 billion yuan is not an unrealistic aspiration. Both internally within Honor and externally, substantial investments in AI, robotics, and building an open ecosystem are seen as inevitable choices for the company. This will not only consolidate its advantages in the AI terminal field but also form an ecological alliance with upstream and downstream industries to propel the development of the AI intelligent terminal ecosystem.

The Smartphone Market Emerges with Independence

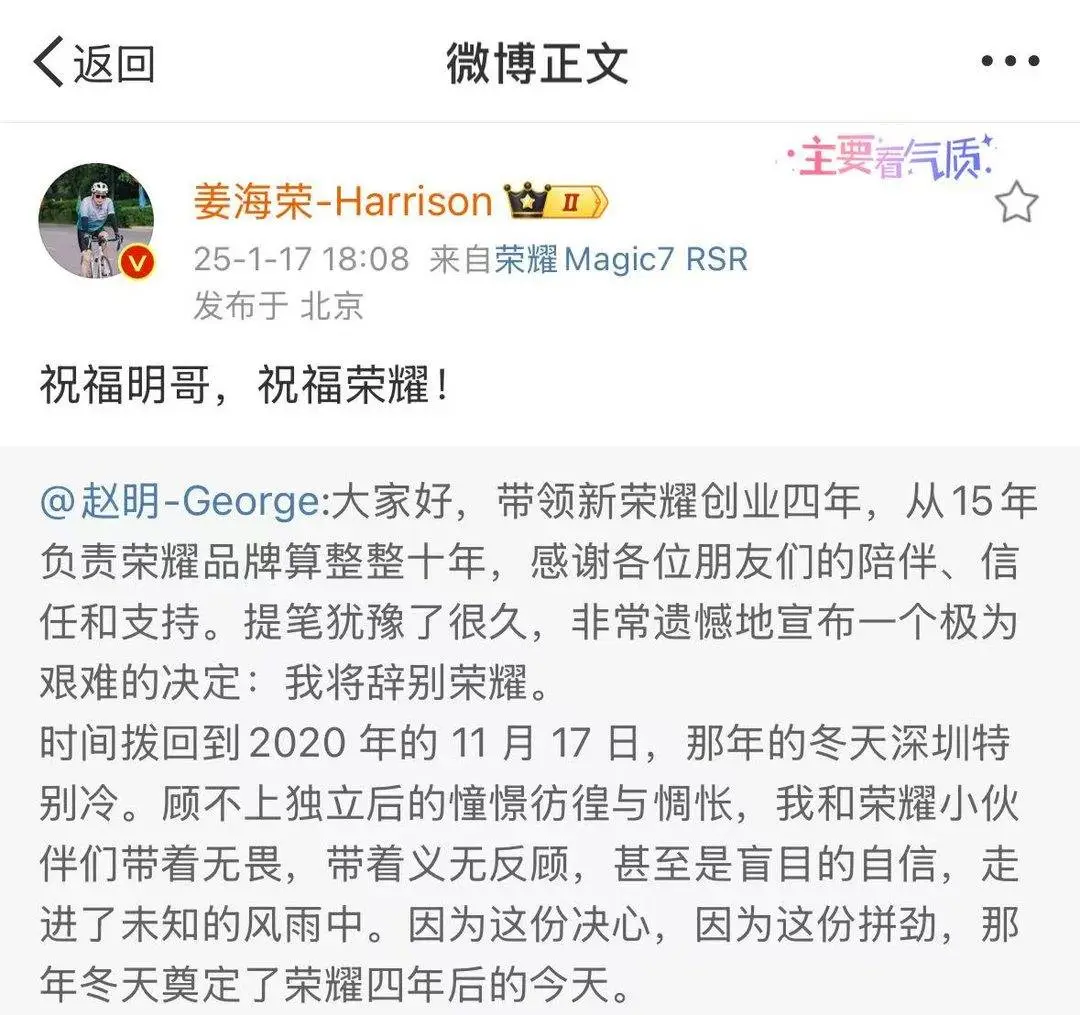

In the immediate aftermath of Honor's independence in 2020, it was labeled as a "Huawei replacement" by the market. Its ascent was meteoric, swiftly filling the market void left by Huawei's exit. Even in 2021, amidst supply constraints, Honor still ranked fifth in the Chinese market with an 11.7% market share. Over the next two years, as Huawei gradually returned, Honor's share remained among the top three. A significant turning point occurred in the second quarter of 2024, when the domestic smartphone market experienced significant growth, but Honor's sales declined against the trend, falling out of the top three in market share. In the first quarter of this year, according to the report of the renowned research institution Counterpoint, Honor ranked only sixth in the Chinese mobile phone market, with sales decreasing by 12.8% year-on-year, and was classified as "Others" in the statistical table.

▲Image/Counterpoint

Starting from the second quarter, Honor initiated strategic changes, accelerating its AI layout and establishing an AI terminal ecosystem, a key direction for the next five years. In fact, Honor can be considered one of the earliest mobile phone manufacturers to emphasize its AI capabilities. As early as 2016, Honor proposed the concept of mobile phone AI and released the Magic Live smart system; in 2024, Honor disclosed innovative achievements related to the Honor AI Agent and launched the industry's first cross-application open ecosystem agent; now Honor has achieved seamless integration from YOYO voice assistant to AI Agent, from Magic OS to cross-device agents. Nowadays, guided by the "Alpha Strategy", Honor's notebook, tablet, smart wearable, and other AI terminal ecosystem product families have successively launched their initial results. For example, leveraging deep AI software and hardware collaboration, Honor's tablet supports seamless file transfer with iOS, HarmonyOS, and Android systems, breaking down system barriers.

Furthermore, Honor has added a new AI industry department, with R&D investment accounting for more than 10% of annual revenue. It has designated AI-related research and development work as a first-tier R&D department. Currently, Honor's AI and software department boasts over 2,000 employees and has accumulated over 2,100 AI patents. While competitors such as Apple's "Apple Intelligence" and vivo's Blue Technology are also moving towards AI, the fact remains that there may still be significant differences between these peers and Honor in terms of investment and actual AI achievements. This is also the independent path that Honor has taken since separating from Huawei. However, this does not mean that Honor can rest on its laurels. The focus for future growth lies in how to make consumers experience the convenience brought by AI and be willing to pay for it. Apart from AI, Honor has also made inroads into the robotics industry. On March 31, it recruited interns for 2025 for its new industry incubation department, which includes multiple laboratories such as the Embodied Intelligence Laboratory and the Bionic Ontology Research Laboratory. Positions include robot data generation algorithm engineers, robot virtual simulation platform engineers, robot power system (joint motor) simulation engineers, and other robot-related roles. Of course, the robotics business is a clear strategic-level initiative, and topics such as "going global and high-end" are clichés but realistic avenues for restoring current performance and value.

Going Global and High-End are Compulsory Questions

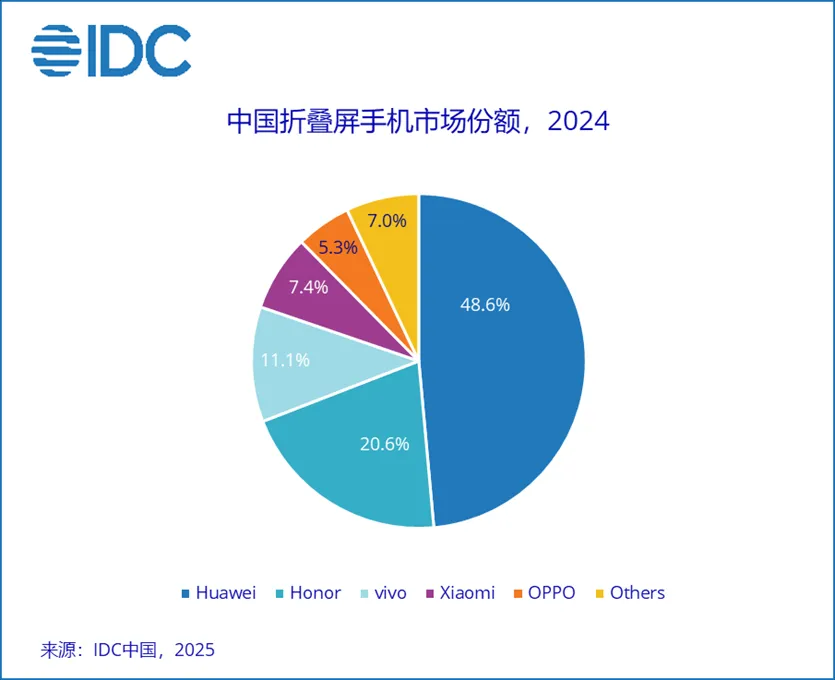

From industry practice, when a new CEO of a mobile phone manufacturer takes office, their first public appearance is often at the launch event of their high-end flagship model. For Honor, the Magic series better embodies its "prestige" and upward narrative. However, the first thing Li Jian did after taking office was to humble himself and let Honor relearn how to embrace users. Li Jian made his debut at the launch event of Honor's mid-range 400 series. This signal may suggest that Honor has abandoned its past arrogant attitude and adopted a more grounded posture, returning to the trenches of the mid-range market to survive first, which is closest to users and can best drive shipments. In the view of "New Entropy", the change in Honor and Li Jian's approach does not mean abandoning the high-end and overseas markets but is instead a strategic move to lay low and ultimately make a stunning debut. On one hand, by allowing dealers to become shareholders, Honor has deeply tied itself to the channel side, opening up a high-speed channel from the production end to the consumption end; on the other hand, with the support of self-developed technology, it can build a positive cycle of product strength and brand value, all of which are preparations for firmly establishing itself in the high-end market. Honor's actions are also continuously increasing its efforts in the high-end market, with the upcoming launch of the new generation AI foldable flagship smartphone, Honor Magic V5. IDC data shows that Honor currently ranks second in the domestic foldable screen market.

▲Image/IDC China

Meanwhile, going global is also the consensus of all domestic mobile phone manufacturers at present. Since 2022, Honor has comprehensively accelerated its overseas expansion. It first returned to the mainstream European market and then penetrated more emerging markets. At the beginning of 2025, it announced its entry into Indonesia, a strategic area for smartphones, with high profile. From a data perspective, by the end of 2024, Honor's overseas sales exceeded 50% for the first time, equaling its domestic sales. And in the past year, Honor's growth in Latin America, the Middle East and Africa, and Asia-Pacific regions all exceeded 50%, with growth in Southeast Asia even exceeding 100%. Notably, Honor's Middle East and Africa region grew fourfold over the past two years, continuing to grow by 66% in the first four months of this year. It is worth mentioning that when Li Jian first took office, his years of overseas experience were repeatedly highlighted by the outside world. For Honor, his overseas experience is a crucial asset for leading the enterprise into deeper waters, and by putting him in the spotlight, Honor seems to be aiming for greater possibilities. Therefore, going global is not just a compulsory question for Honor but also for Li Jian.

▲Image/AI Creation

In the ever-evolving global market landscape, the appetite for intelligent technology products among consumers worldwide continues to soar, with a heightened focus on the application and user experience of AI technology. Honor, recognizing this trend, must expedite the integration of its AI capabilities with product prowess. This involves making tailored launches and adjustments tailored to the unique characteristics of diverse regional markets, thereby enhancing its global market share. Earlier, Li Jian remarked, "Honor didn't perish; it was reborn." Indeed, Honor's listing signifies not just a pivotal step towards its own capitalization but also an ambitious stride into the burgeoning blue ocean of AI terminals. With years of expertise in AI algorithms and hardware R&D, Honor possesses inherent advantages. While the journey towards rebirth is undeniably fraught with challenges, the company fortunately has a clear direction.

Reference: Information sourced from the official website of the China Securities Regulatory Commission, Interface News ("Honor Obtains Listing Counseling Record, IPO Takes a Crucial Step Forward"), 21st Century Business Herald ("More Than Just Mobile Phones, Honor IPO Shows Its AI Ambition"), and JD Finance ("As Honor Launches IPO, Will the A-share Market Welcome the First 200 Billion AI Terminal Stock?").