From "GTA6" to the Expected Speculation of Game Stocks

![]() 07/03 2025

07/03 2025

![]() 768

768

Recently, the buzz around the game industry's turnaround has been incessant. Not only have policies supporting game companies increased, but excess returns in the game sector have also grown.

Looking back, the entire industry wouldn't act unless they saw tangible results. Sales revenue wasn't enough; profits were necessary. Profits alone weren't sufficient; dividends were required because game stocks lacked sustainability. Small companies were valued at around 10 times PE, and only high dividends could prove profits were real, earning them some valuation premium. Now, it's enough to rely on product expectations for share prices to rise.

The reason lies in the industry's prolonged slump and its rich imagination. A single product can revive a company. In the current market pursuing topic-driven and event-driven outbursts, this turnaround model from troubles boasts a high win rate.

This trend has been vividly demonstrated in the U.S. stock market. Take2's "GTA6" has been delayed again to 2026, coupled with a data theft scandal, but it hasn't hindered the stock price from reaching new highs.

More such paradigmatic rises are increasingly likely to occur in A-shares and Hong Kong stocks.

I. Expectation Outweighs Reality

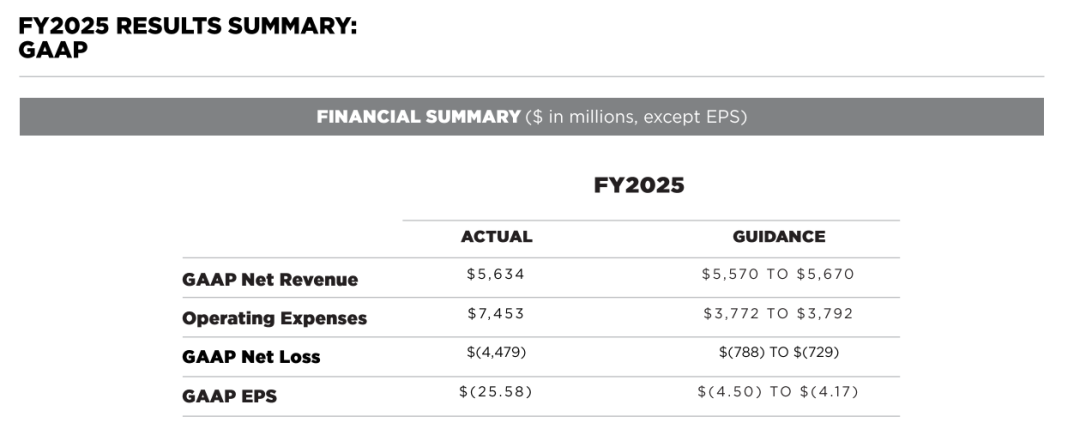

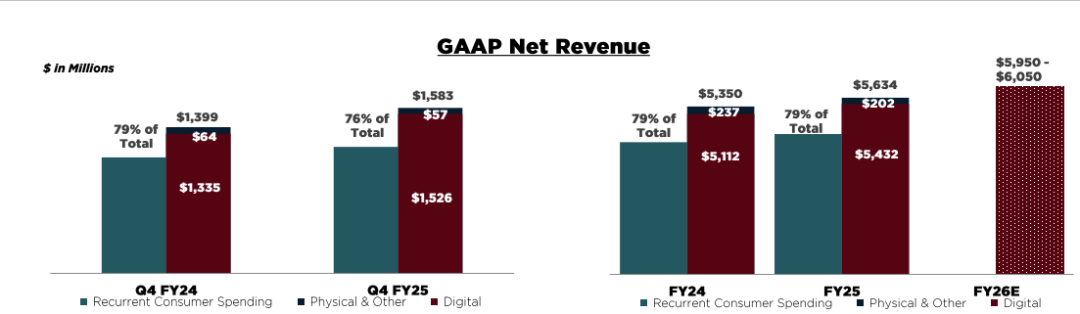

Currently, we first observe the fundamental changes in T2, a leading game stock. After the company announced last year's results, its share price soared. From the end of 2024 to the present, the share price has doubled, performing robustly even in the U.S. stock market. The main driving factor is "GTA6".

Year-on-year revenue growth is absent, but as a buy-to-play game company, product updates are urgently needed. Referring to the stage performance of many similar companies, it's inevitable for revenue to temporarily hit bottom. Not declining is already exceeding expectations.

Revenue stabilized at $5.5 billion, and without new "GTA" products, the company can still support a certain level of intrinsic value. Older products like "GTA5" and "Red Dead Redemption 2" still experienced a sales resurgence last year, and several 2K games still have a large following.

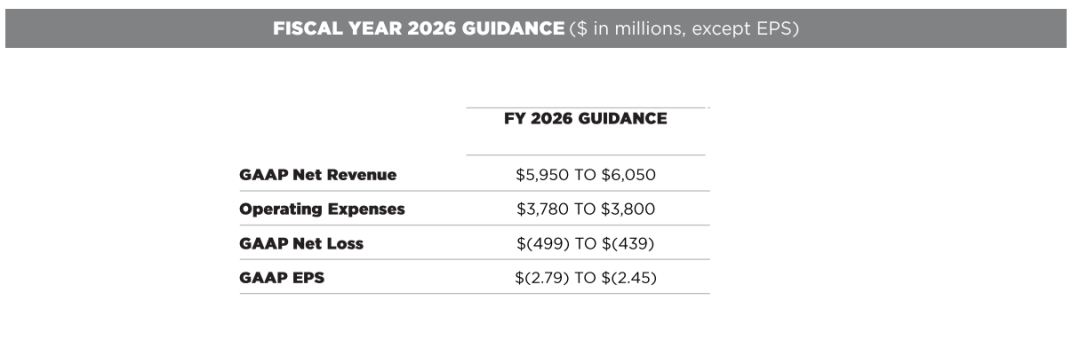

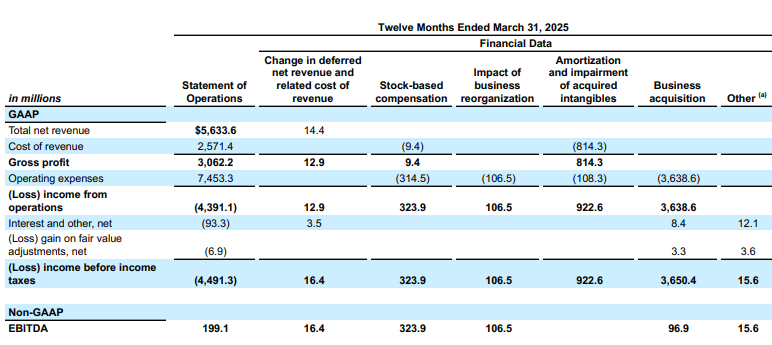

Unfortunately, profits haven't returned to positive. Even after deducting goodwill impairment, non-GAAP is still in the red, and expected profits for 2026 are also negative.

Investing in "GTA6" research and development does require substantial funds, but the game industry has always been asset-light with high net profit margins. Especially for T2, with $5 billion in revenue, "GTA6" research and development wouldn't consume billions in a single year. The company's cost control ability is still inadequate, with a gross profit margin of less than 60%. The financial report can only be described as mixed.

The company's real problem remains prominent: poor cash utilization ability, which is a long-standing issue. T2 is strong in product development, but in the long run, the company's profits aren't very high.

Spending $12.7 billion to acquire Zynga is more than the entire lifecycle profits of "GTA5".

This acquisition demonstrates the company's determination to enter the mobile game market, but the company hasn't made any breakthroughs yet. Moreover, this merger occurred at the peak of the bull market in 2021, with an exceptionally high valuation of 7 times PS. At that time, Zynga was still losing money, purely due to the scarcity premium of mobile game companies listed in the U.S. Now, with "GTA5",

This acquisition has saddled the company with considerable debt and has also led to significant goodwill impairment. Besides increasing revenue and causing huge losses, the acquisition hasn't provided any business assistance.

This acquisition even seems somewhat clumsy, like company management laundering money through acquisitions.

In the long run, even if "GTA6" is successful, given the quality of management, there's a possibility that accumulated wealth will be squandered through the purchase of junk assets.

The company does deserve a valuation discount. Its share price has previously seesawed between "GTA6" expectations and the deduction for company management, unable to break out, oscillating within a range for many years.

However, since the company announced the delay of "GTA6" on May 2, the share price has been somewhat unusual. Firstly, it recovered from the decline in a single day, and no one seemed to mind that the delivery date had been pushed to next year.

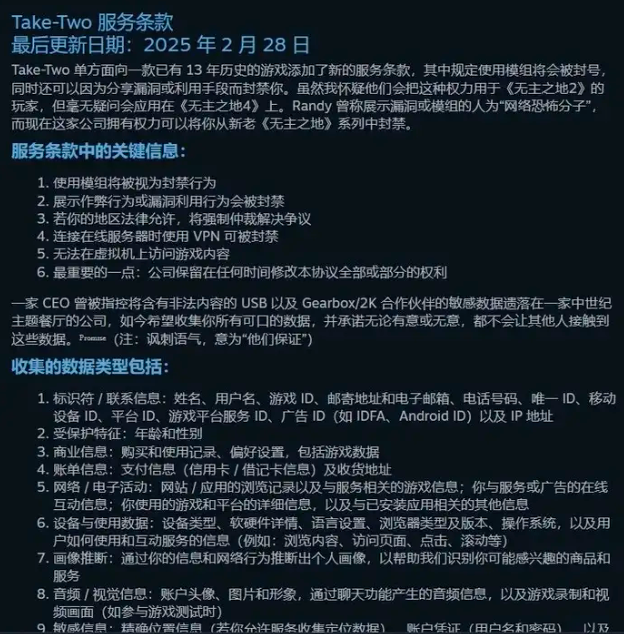

During this period, a data theft scandal also occurred. At the end of May, the company's 2K studio was exposed for recording various types of computer data during runtime and obtaining information after obtaining user consent, including users' web browsing history and collectable software chat records.

Although this is a prevalent chaos in the industry, stealing chat records is a bit excessive.

After this incident fermented, the consequence was that the company's multiple games received Intensive negative reviews on Steam. Financial report expectations were stable but occurred before this incident.

We know T2 wants to excel in mobile games and internetization, but this method of stealing data is obviously problematic.

Most game companies can't withstand such negative news, but the company's share price continued to reach new highs.

This reflects that the factors expected to reverse game stocks are being infinitely amplified and strengthened, while poor real financial conditions or even bad news in operations are completely ignored. This is related to the current market fervor and the scarcity of "GTA6", but it gives more game stocks confidence in speculation. As long as expectations haven't materialized, any rise is justifiable, and negative news isn't an issue.

Game stock profits can explode in a leapfrog manner, not step by step. Meanwhile, their model has the potential for high net profit margins. In other words, performance sustainability is poor. After a product cycle, the industry position may fall from the top to obscurity. But conversely, this also holds true. Based on such characteristics, games are inherently suitable for speculation on turnarounds from troubles.

This is quite similar to pharmaceutical stocks. However, the game industry has disadvantages: it's concentrated with oligopolies, making it harder for underdogs to turn the table . Game quality is linked to development investment, and there are few examples of new products disrupting giants. In contrast, pharmaceutical stock giants' market shares aren't concentrated. Large pharmaceutical companies specialize in commercialization, and both can cooperate. Small companies compete with other small companies.

The advantage lies in: game stocks don't require Crazy loss investments in the early stages. As long as the time budget is controlled, failures won't result in significant losses, and the development cycle isn't long. In contrast, the delivery time for pharmaceutical stocks is very long. When it comes to the clinical stage, expenses inevitably increase, requiring multiple financing methods.

In Hong Kong stocks, even the smallest game stocks rarely need share placements or additional issuances to survive. They can survive by themselves, scaling down, and starting from scratch, demonstrating strong self-sufficiency. Pharmaceutical stocks are different. It's common for them to reach out to the market for funds when prices rise.

II. Game Stocks Ready to Soar

Based on these advantages, there's some rationality behind the gradual strengthening of the game sector. Many game companies that are about to significantly improve their performance through new games have also embarked on a bull market journey.

There aren't many game companies left in U.S. stocks, and they aren't representative.

The game sector in A-shares has surged 11% this year, ranking among the top sectors in A-shares. Notably, most of the gains have been realized since April.

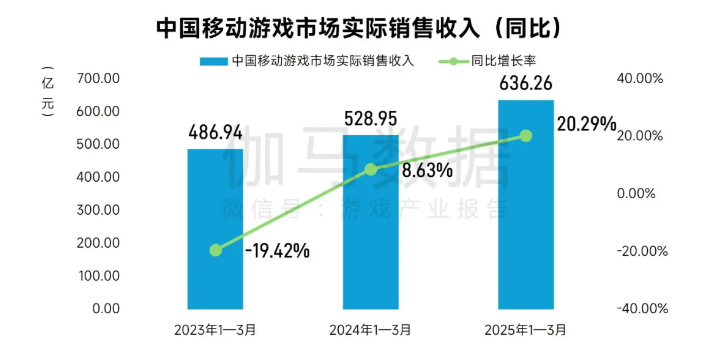

From a macro industry perspective, it can be confirmed that the domestic market has basically entered a recovery track, driven by post-pandemic factors. After all, the industry's growth rate has been low for two years, and self-indulgent cultural and entertainment consumption has been hot this year.

Since the beginning of this year, the issuance of game licenses has also reached a new high. In 2025, a cumulative total of 800 game licenses have been issued, approaching the peak in 2019. The initial intention of license restrictions was to achieve industry refinement, reduce shell-swapping imitation, and invalidate imitation and plagiarism of ideas.

However, the industry points out that the increase in license issuance isn't due to relaxed approval requirements but because more games have met quality standards.

After "Black Myth: Wukong" won the champion in 3A game sales last year, almost every game company was greatly inspired, significantly improving their product production quality.

In a state where license issuance is slow, the logic of gambling on new product outbreaks and achieving turnarounds from troubles is weakened because even a license is uncertain, and it's difficult to bet on uncertain timelines.

The release of licenses basically won't be held up anymore, making it normal for most game companies to smoothly launch their newly disclosed products. But this is a double-edged sword. The market remains the same. As the license approval rate increases, the probability of licensed products becoming blockbusters decreases because the denominator increases. This is actually a pre-screening mechanism.

Returning to the gains of relevant companies, they haven't increased much in the past few years. The outbreak of new products and the stable valuation of old businesses have driven much of the recovery. Purely from paper data, many game stocks can indeed be considered undervalued, with PE ratios of only around 10 times.

For example, Shiji Huatong, once a leading game company in A-shares, was given an ST designation after being caught in financial fraud. Its performance from 2018 to 2022 contained water. Of course, the credibility of its current profits is questionable, but the revenue from a single game, "Endless Winter", is indeed high, allowing the company to successfully return to the industry's frontline with significant performance growth. Its PE is rapidly improving, and the ST title is also a symbol of turnaround from troubles. Even with a relatively large market capitalization, it still ranks first in gains.

This shows that the return of game stocks isn't purely driven by small-cap liquidity shocks but has a certain logic, with large stocks performing smoothly. If a loss-making ST game company says it has no major product plans for the next year, no amount of talking will help.

Referring to T2, the existing business has a certain valuation basis, and new businesses bringing higher expectations are more resilient. Whether it's Shiji Huatong, Giant Network, or Perfect World, they are similar in this regard, with new businesses being more important than old ones.

Therefore, the logic of Shiji Huatong and Perfect World is stronger, while Giant Network's new games are not yet capable of surpassing its original profits.

Looking at Hong Kong stocks, there are more stocks with high gains, and giants like NetEase have also risen by nearly 50%.

Most Hong Kong stocks are bottom-tier companies within the industry, and there aren't many companies whose old businesses can provide a valuation.

New businesses can seemingly significantly repair battered share prices by simply telling stories. Looking at the small-cap stocks on the gains list, such as BioArt, Youyi Time, and Zhongxu Future, BioArt doesn't even have new games, and Zhongxu Future's recovery is only due to its holding of Shiji Huatong shares.

However, there isn't much certainty in the logic behind such rises, and many small stocks in Hong Kong have experienced massive annual losses. This is still a game where there are more losers than winners. Small-cap stocks driven by poor liquidity can give back gains in a single day.

Youyi Time's share price briefly surged due to the performance of its new product, "Bao Chao Meng Chu," at the top of the free chart. But currently, the new product has been launched, facing the problem of new products losing momentum once they hit the market. Just like "GTA6," unfulfilled expectations are good expectations, even if they are delayed.

The rise of XD is similar to that of leading companies in A-shares. They are all companies with a high industry status, a certain base business valuation, many new products, and reliable valuations. The problem is also that new products are rarely larger than old businesses. However, this is a special company with a narrative of an internet platform.

Overall, it's difficult for game stocks in Hong Kong to reverse, but one should realize that among the many stocks that are still deeply down this year, as long as this speculative style can prevail in the market for some time, grasping the time window can lead to some blockbusters. Combined with many new consumer industries where shareholders brush orders for company products and buy rankings for speculation, this is also a good idea.

Of course, the industry trend that can be observed is that it's not easy for small companies to turn the table . More medium-sized companies are challenging the top, and it's difficult for bottom-tier companies to rise. "Black Myth" has inspired industry enthusiasm but has also raised the quality and production requirements of the entire industry. In other words, the production cost of a qualified game that can enter the market has increased significantly. Stories of turn the table with tens of millions are becoming rarer. Now, the threshold has reached hundreds of millions. For game companies with a market capitalization of over a billion, an investment of hundreds of millions means all-in on a single game. This is indeed a difficult choice.

Conclusion

The current recovery of gaming stocks is only structural, which is also in line with the survival of the fittest rule in the industry. Compared to small-cap stocks, medium-sized companies are the main force behind this turnaround from adversity.

Due to the market's preference for thematic speculation and event-driven trading, the industry is inevitably overly optimistic in the short term. After this speculative window passes, it is common for stocks to retract or even return to their original state.

However, setting aside the impact of market sentiment on valuation, some stocks can still maintain the possibility of upward movement by realizing expected profits even when market sentiment is poor.

These companies basically meet the criteria of having a benchmark business, a bottom-line valuation, and having experienced adversity. Their growth is entirely dependent on how much their new products exceed expectations, such as the continuous validation of Century Huatong's "Endless Winter" and "Kingshot", whether Perfect World's "Yi Huan" can truly become an enhanced version of "Genshin Impact", and whether XD.com's products can continue their stable record of success with each release.

They basically meet several characteristics. First, there is the potential for cross-level growth. Second, there is a discernible bottom. Importantly, expectations are sustainable, including anticipations such as upcoming product launches and stable product growth. However, all of these represent potential leaps in industry status.

It is undeniable that the entire gaming industry is still consolidating. Especially after the rise of AI, some studios have achieved rapid success, but the efficiency of large companies has also been epically enhanced. Tencent and NetEase can now simultaneously develop over a dozen 3A-level games. The industry only has two paths for growth: creativity and scale.

Observing the U.S. stock market, we can see that there are hardly any gaming stocks left. The big ones are getting bigger, and the small ones are getting smaller. Nowadays, there are only two overseas listed companies. It is undeniable that as time goes on, the scarcity of top gaming stocks will only increase. However, for medium-sized gaming stocks and old gaming stocks that have been listed for many years, they are caught in a dilemma, with the potential to either rise or fall. This may be their last window to become giants or return to their starting point and rise again from the studio level.

Therefore, for the performance of gaming stocks, an important point is not to look too far ahead. Sustainable expectations are more important than qualitative analysis of products.