The secret of Alibaba's reshuffle lies in merchants' service fees

![]() 08/09 2024

08/09 2024

![]() 616

616

Under the new algorithm, Alibaba's various layouts have reversed the market trend counterclockwise, but the old question of "how to achieve GMV growth without pursuing low prices" will once again be put on the table.

Cover image source: Unsplash

At 8 am, as soon as Zhang Heng sat down at his workstation, he quickly opened the Xianyu APP. His first task was always to "polish his treasures," which could increase their exposure. The next second, he clicked on the "Messages" tab, where he saw that 11 people were interested in the sneakers he had just listed yesterday, with countless buyers messaging him to negotiate prices.

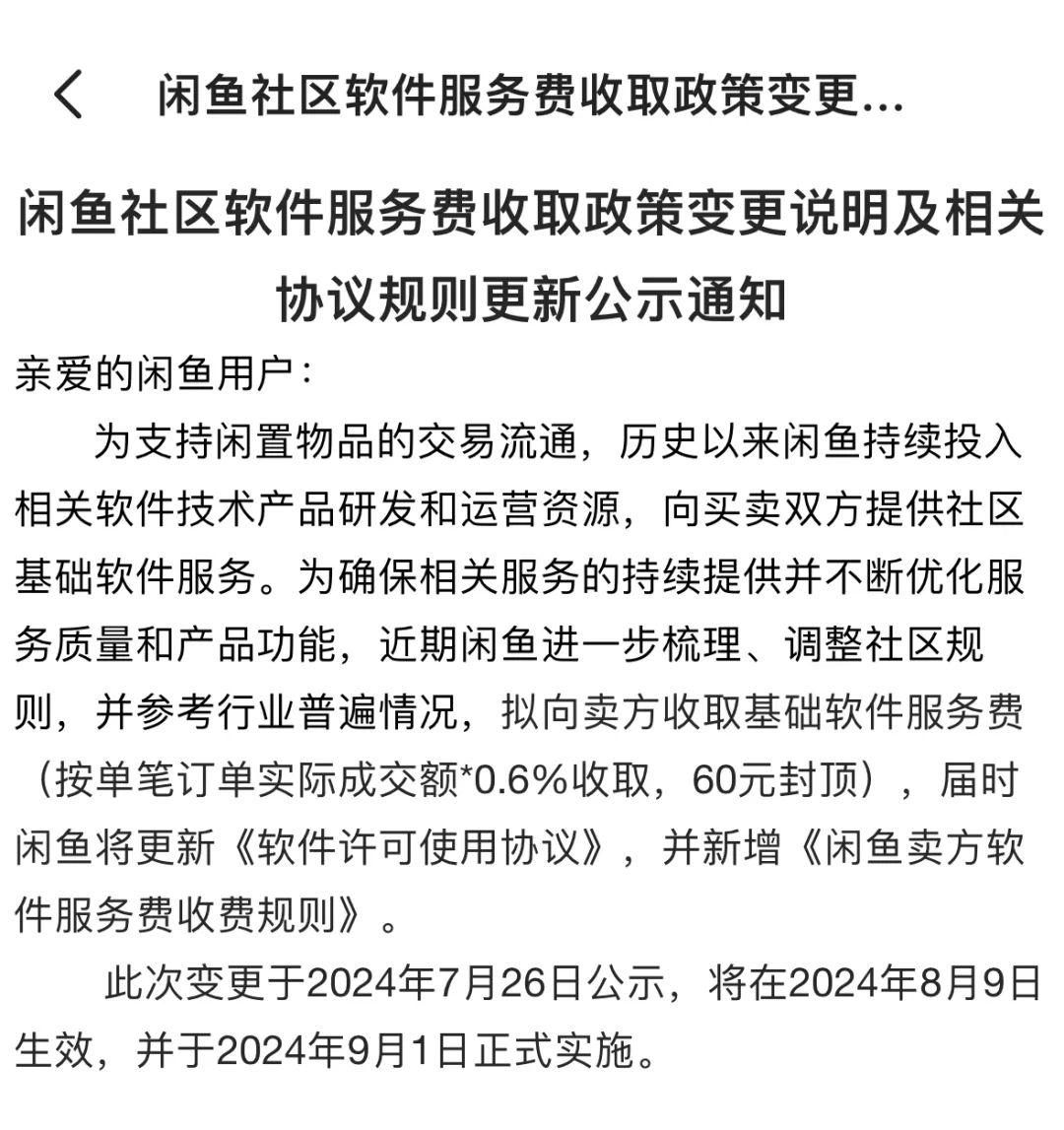

Zhang Heng copied and pasted the same message back to each of them: "Please read carefully before bidding. I'm not open to negotiation." However, as soon as he sent the messages, he saw a notification pop up at the top of his inbox, leaving him stunned—it was an official announcement from Xianyu stating clearly: "We plan to charge a basic software service fee from sellers (calculated at 0.6% of the actual transaction amount per order, with a cap of 60 yuan)."

This announcement of less than a thousand words left Zhang Heng feeling disappointed. Moreover, the announcement stated that sellers who completed more than 10 transactions within a month and had a total transaction amount exceeding 10,000 yuan would be charged an additional 1% service fee on amounts exceeding this threshold.

He quickly calculated the month's data and realized that things were not looking good. Limited-edition sneakers were expensive, and just a few pairs could easily exceed 10,000 yuan in transactions. As a part-time reseller, he completed over 10 transactions in just a week.

Fuming, Zhang Heng thought, "Is it wrong to sell a lot? We're even increasing Xianyu's activity, yet they're the first to come after us like this?" In the sneaker community he frequented, many netizens were also complaining about Xianyu's "unsightly behavior," saying things like, "How much money can you make from one transaction? Now it's 0.6%, up to 60 yuan, and who knows how much more in the future. It's like working for Xianyu for free all day!"

"Guys, if you're not happy, just uninstall Xianyu and start anew on other apps. We can't indulge them!" Upon reading this comment, Zhang Heng couldn't help but smile bitterly. He had considered uninstalling Xianyu and switching to other second-hand platforms, but Xianyu's large user base and traffic meant that he could always sell his items quickly.

In the end, he said nothing, silently liked each of these posts, and continued to respond to messages on Xianyu.

1

Alibaba's "Two Rises and One Fall"

As Alibaba Group's second-hand trading platform, Xianyu has grown into China's largest second-hand trading "traffic entrance" after nine years of iteration and transformation. In 2014, when Xianyu was first established, it promised not to charge transaction commissions from individual users, making it a "white moon" for many individual sellers.

Experienced users may know that Xianyu's sudden increase in service fees was not accidental. Last June, Xianyu had already quietly signaled its intention to start charging service fees from high-frequency and high-transaction sellers. Judging from the thresholds set, this policy mainly targeted professional sellers, commonly known as "resellers" in the industry. While it seemed like a move to improve the platform's environment, no one expected the era of "universal fees" to arrive so quickly.

According to QuestMobile data, as of April 2024, Xianyu had reached 162 million monthly active users, an increase of 19.1% compared to the same period last year. Among high-value users, those with online spending power exceeding 2,000 yuan accounted for 52.7%, significantly higher than the overall internet average.

Various indicators suggest that Xianyu, celebrating its 10th anniversary, is now capable of "earning a living" and must accelerate its commercialization.

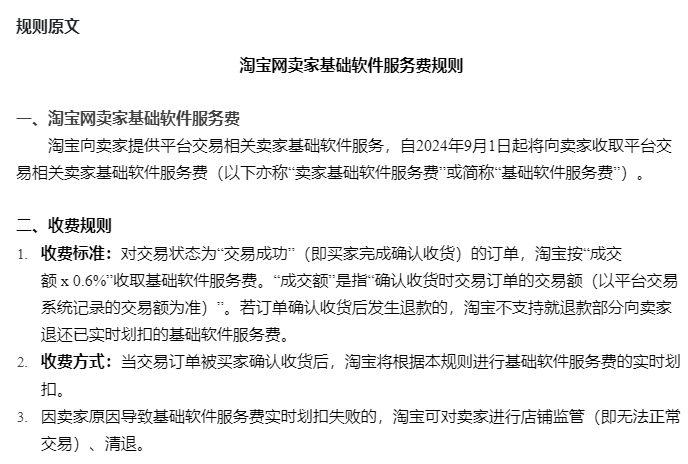

Similarly, as another "established e-commerce platform" under the Alibaba Group, Taobao also revised its merchant rules in late July, announcing that starting from September 1, it would charge a 0.6% "basic software service fee" on confirmed transactions on the platform. Previously, Taobao was the only e-commerce platform in China that was free for sellers to use. On the first trading day after the news broke, Alibaba's share price rose by 5%.

Before this adjustment, Taobao's primary business model was to charge sellers for advertising. In contrast, other mainstream e-commerce platforms adopted a "transaction commission model." Commissions typically consisted of two parts: a basic technical service fee, commonly charged at 0.6%-1% of the transaction amount, and a category-specific commission deducted from the seller's transaction amount, with a primary rate range of 5%-8%.

Taobao's decision to finally charge a 0.6% service fee based on GMV (Gross Merchandise Volume) means that the platform's take rate (conversion rate) will increase by 0.6%. In fiscal year 2020, this would have meant an additional revenue of 24.8 billion yuan for Alibaba, when the entire core commerce segment's operating profit was just 138.6 billion yuan.

However, amidst the trend, there are still contrarians showing their true colors, blazing a trail of "anti-convolution."

Also in July, Tmall released the "Opinion Solicitation on Cancellation of Tmall Annual Fees," stating that starting from September 1, Tmall would cancel the platform's annual software service fees: new merchants joining after September would not need to pay; merchants who had already paid annual fees would be refunded in batches according to settlement rules.

Previously, Tmall merchants in different categories paid annual fees ranging from 30,000 to 60,000 yuan. After the exemption, new merchants joining Tmall after September 1, 2024, would no longer need to pay this fee. Meanwhile, for merchants whose transactions from January to August 2024 met their annual targets, Tmall would fully refund their annual fees.

This measure effectively lowers the barrier to entry, helping Tmall attract more new merchants and inject new vitality into small and medium-sized businesses. With these favorable conditions, Tmall has the potential to revitalize a new round of traffic, breaking through the window period amidst competition from content-based e-commerce platforms like Douyin and Pinduoduo.

2

Same Alibaba, Different Moves

Belonging to the same Alibaba Group, why are the three "top-tier" platforms naturally divided into "Taobao + Xianyu" and Tmall camps, with different actions taken by each?

First, let's look at Taobao and Xianyu, which have started charging fees. Many people may have forgotten that Xianyu originally spun off from "Taobao Second-hand," with the initial intention of driving traffic to Taobao in the second-hand goods sector. In 2014, it spun off independently, becoming one of the first strategic innovation-level businesses planned by Alibaba's current CEO, Wu Yongming.

Today, items purchased on Xianyu are directly shared with Taobao's data, making it another "moat" for Taobao, which is already at the peak of its traffic. The two platforms can be said to be "of the same root."

In contrast, JD.com does not follow the C2C route but focuses on B2C, requiring merchants to be formal companies or brand-authorized. This ensures higher quality products and better after-sales service. With higher thresholds and a premium positioning, JD.com naturally attracts big-brand merchants, fundamentally different from the "safety net" and "startup base" provided by Xianyu and Taobao for small and medium-sized merchants.

Therefore, the service fees charged by Taobao and Xianyu are essentially targeting the GMV pie of small and medium-sized merchants.

Xianyu's daily GMV has exceeded 1 billion yuan. In its 10th year, it has finally seized an opportunity with its youthful user base, low prices for second-hand items, low barriers to entry, and ability to save and earn money.

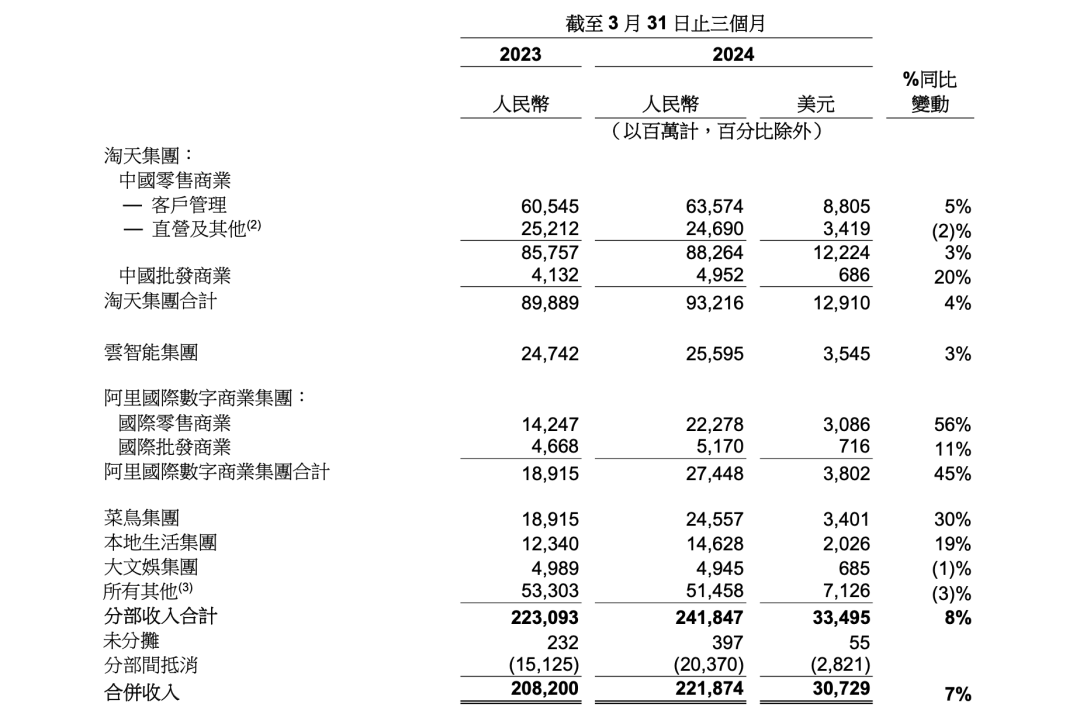

In the first quarter of this year, Alibaba reported to shareholders that the GMV of the Taobao-Tianmao Group achieved double-digit growth year-on-year, with Taobao being the primary contributor. Xu Hong stated that "Taobao's GMV growth exceeded that of Tmall."

The growth in GMV and transaction volume is largely attributed to changes in consumer habits. Currently, mainstream consumer preferences are characterized by both "sensibility and rationality." On the rational side, consumers carefully evaluate cost-effectiveness and functionality when making purchasing decisions, making them partial to practical second-hand items. On the emotional side, consumers tend to follow trends and prioritize emotional value, with many opting for "emotional spending" driven by passion.

The combination of these two "buffs" has made the transaction volume and GMV of Taobao and Xianyu unstoppable, giving them the confidence to take a slice of the GMV pie and leaving merchants and individual users with little choice but to accept the fees.

Tmall, on the other hand, faces considerable pressure in its merchant recruitment efforts. In terms of top brands, its user base is already significant, and the convertible traffic channels have been largely exhausted. For this traditional e-commerce platform to grow further, it must rely on attracting more new traffic. Eliminating annual fees and lowering thresholds are essential to compete with interest-based e-commerce platforms and gain growth momentum.

While the moves of these two platforms may seem inconsistent, they are actually market considerations based on different platform environments and tones. One focuses on "driving consumer spending," while the other focuses on "empowering merchants for better operations," ultimately converging towards Alibaba's overarching strategy.

3

Is Tmall Getting Another Chance?

Before fully eliminating annual fees, Tmall had already introduced a series of merchant-friendly initiatives: providing nearly 10 measures to all brands and merchants, including AI tools for operational efficiency, free business insights, shipping subsidies, and more, to reduce operating costs and improve efficiency.

In doing so, the relationship between Tmall and merchants has become more positive. In the past, merchants viewed Tmall primarily as a "digital advertising space" for exposure, paying annual fees regardless of actual sales. Now, fees are charged based on actual transactions, and Tmall goes the extra mile to provide "tips" for merchant operations. By sharing transaction revenue, Tmall can reduce its revenue pressure while also sharing risks and benefits with merchants, achieving a win-win situation.

Under this trend, Alibaba seems to have found the optimal path to breaking the stalemate through Tmall. After all, Alibaba's e-commerce business has been divided into two parts: Taobao and Xianyu, which focus on attracting traffic, and Tmall, which focuses on generating revenue. Whether in the past or present, Taobao's traffic allocation has heavily favored large merchants and brands, which is where Tmall's advantage lies.

Although Taobao's C-stores still contributed over 50% of Taobao Group's GMV until 2019, they received minimal traffic support. Alibaba's past strategy was to support mid-to-high-end brands, with "Taobao providing the stage and Tmall taking center stage." Moreover, in the realm of branded e-commerce, Alibaba prioritized flagship stores and exclusive stores, placing dealers and agents managing multiple brands in a disadvantaged position, let alone white-label brands with limited brand recognition.

Alibaba has always understood one truth: only big-brand merchants have the highest marketing budgets and can provide the most revenue for the platform. This is the fundamental reason behind Alibaba's "Tmallization" of its e-commerce business.

Today, while expanding its merchant base to gradually open up to small and medium-sized merchants, Tmall has not compromised on its strict control over product quality and merchant operations. Aligning with the mainstream of consumption upgrades, Tmall plans to gradually increase brand recognition, i.e., improve product quality and average order value.

4

GMV Growth Remains the Core

Whether it's the confidence behind Taobao and Xianyu's decision to charge basic software service fees from sellers or Tmall's bold move to actively reduce annual fees, both are underpinned by the rising trend of Taobao's GMV.

Before revising its seller rules in late July, Alibaba had held multiple internal meetings to adjust its platform strategy, including removing some "non-price-sensitive products" and revising the recommendation algorithm to prioritize GMV over price competitiveness.

Under the new algorithm logic, low prices no longer carry high weight, and the core of traffic allocation becomes the "experience point." Wu Yongming stated that Taobao's top priority this year remains "enhancing consumer experience and driving GMV growth through improved consumer experience."

These adjustments are essentially another round of exploration by Alibaba to monetize its core e-commerce business. Over the past year, the e-commerce industry has undergone significant changes, with platforms emphasizing low-price strategies, emulating Pinduoduo's success. Taobao succumbed to this temptation, redesigning its homepage and algorithm to prioritize low prices, prompting many netizens to comment that Taobao was "imitating Pinduoduo blindly."

However, judging by its performance, low prices have not brought Alibaba commensurate returns. With this path blocked, Alibaba must seek alternative routes. Its new strategy shifts the focus from the once-vaunted "five-star price competitiveness" to GMV driven by user experience, converting GMV growth into tangible revenue growth.

Hence, we see these two contrasting moves: charging fees and reducing fees. Alibaba is abandoning blind imitation of the "Pinduoduo model" and returning to a business rhythm that suits its characteristics, leveraging its strengths to find new growth points.

Under the new algorithm logic, Alibaba's various layouts are reversing the market's counterclockwise trend, but the old question of "how to achieve GMV growth without pursuing low prices" will once again be brought to the forefront. (All characters in this article are pseudonyms)