July's brutal tale of new energy vehicles: 'Extended Range' becomes the top driver of EV sales

![]() 08/06 2024

08/06 2024

![]() 499

499

The heated debate among auto industry leaders such as Li Xiang, Li Bin, and He Xiaopeng about whether weekly sales rankings should exist has barely subsided when it's time for monthly sales data to be released. Every month at this time, some automakers are overjoyed, while others are dismayed, and this month is no exception, with an even more severe situation.

With the monthly penetration rate of new energy vehicles reaching around 50% today, the market is gradually becoming saturated, and competition among automakers is akin to walking a tightrope. The sales growth or decline of certain models and brands can serve as a bellwether, alerting and guiding automakers towards the right direction.

When new energy vehicles first emerged, many industry insiders and netizens believed that hybrid vehicles were merely 'transitional products' and that pure electric vehicles (BEVs) were the future. However, sales data frequently contradicted this belief. It can be said that the powertrain mode has likely become a crucial factor determining automaker sales and a core competitive advantage for high-end new energy vehicles.

Based on July's sales figures, we can conclude that choosing an extended-range powertrain is almost the only 'shortcut' to quickly ramp up sales.

Growth Slows, but the Sales Secret Remains in Extended Range Powertrains

As the penetration rate of the new energy vehicle market continues to rise, it is becoming increasingly difficult for automakers to maintain high sales growth rates. Among automakers that have disclosed specific sales data, only BYD, LIXIANG, AITO, and Leapmotor have been able to maintain growth rates of over 30%.

BYD delivered 340,799 passenger vehicles in July, representing a year-on-year increase of 30.5%. Considering BYD's massive scale, maintaining a growth rate of over 30% is no small feat. LIXIANG delivered 51,000 new vehicles, a year-on-year increase of 49.4%, setting a new record.

AITO delivered 41,535 new vehicles, with the most exaggerated year-on-year growth rate of 823% due to only delivering around 4,500 vehicles in July last year (Data source: LIXIANG sales report; official figures not disclosed). Leapmotor sold 22,093 vehicles, a year-on-year increase of 54.1%.

Upon closer inspection, it becomes evident that these brands with higher sales growth rates share a common trait: they have popular hybrid models. BYD, in particular, recently introduced its fifth-generation DM technology, reducing fuel consumption to below 3L per 100km. DM-i/p models from the Qin, Song, and Han families have consistently been popular among consumers.

The main models of LIXIANG, AITO, and Leapmotor are all extended-range vehicles. After the sales of LIXIANG's only pure electric model, MEGA, fell short of expectations, the company promptly postponed the launch of three planned pure electric SUVs. AITO offers only three models – M5, M7, and M9 – with the popular M7 not yet available in a pure electric version. Meanwhile, Leapmotor officially stated that the share of its extended-range and pure electric models is roughly 55:45.

Extended-range vehicles were once at the bottom of the new energy vehicle industry's pecking order, as they rely on an electric motor for propulsion and use an engine solely for power generation, eliminating the need for large batteries and direct engine drive, resulting in a relatively simple structure. However, sales figures reveal that consumers are more concerned with meeting their usage needs rather than the technical complexity or industry hierarchy.

The advantage of hybrid technology lies in reduced energy consumption in urban areas and the elimination of range anxiety during long-distance travel. While extended-range technology may experience increased energy consumption at high speeds, this is generally acceptable, and the ability of plug-in hybrid models to drive directly or operate in extended-range mode can effectively mitigate this issue.

More crucially, the cost advantage of pure electric vehicles for travel is diminishing, especially with BYD's fifth-generation DM technology reducing fuel consumption to below 3L per 100km. Considering 92 octane gasoline at 8 yuan/L, the average cost per kilometer is less than 0.3 yuan. Additionally, public charging stations are also increasing their prices, suggesting that the cost of travel in hybrids may soon equal that of pure electric vehicles.

The China Passenger Car Association's sales data for new energy vehicles also attests to the strong momentum of hybrids. From January to May this year, domestic sales of pure electric vehicles reached 1,931,676 units, a year-on-year increase of 17.5%, while cumulative retail sales of plug-in hybrid electric vehicles (including extended-range) totaled 1,324,095 units, a year-on-year increase of 70.1%. While the former holds a larger market share, the latter is growing at a faster pace.

It is projected that by 2025, the domestic new energy vehicle market will have an equal share of pure electric vehicles and plug-in hybrids (including extended-range). In the premium market, where vehicle prices are high and consumers are less sensitive to fuel prices, automakers like AITO and LIXIANG, which focus on extended-range vehicles, will continue to dominate.

As people's joys and sorrows are not always shared, the same is true for automakers. While BYD, AITO, LIXIANG, and Leapmotor celebrate their continued sales surges, some pure electric vehicle brands are seeking ways to break out of their predicament.

Growth Stalls: How Can NIO and XPeng Break Through?

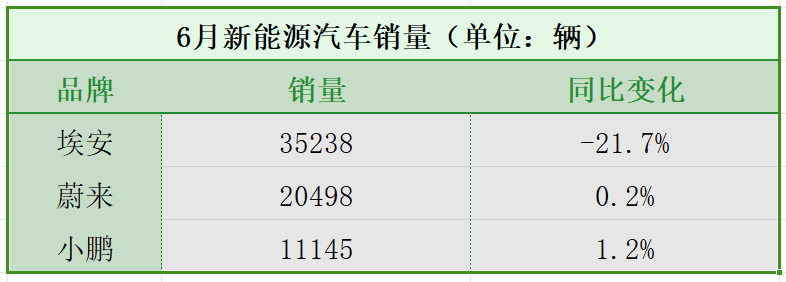

Unlike the promising growth of hybrid vehicles, pure electric vehicle companies generally experience slower growth rates. In July, NIO delivered 20,498 vehicles, a year-on-year increase of 0.2%, while XPeng delivered 11,145 vehicles, a year-on-year increase of 1.2%. While NIO and XPeng can at least maintain growth, Aion, which once outsold Tesla in the B-end market, saw its sales decline by 21.7% year-on-year to 35,238 vehicles in July.

Is it the automakers' fault when product sales stagnate or even decline? Is it because their products are inferior? Certainly not. XPeng and NIO are leaders among new-energy vehicle brands, and Aion, backed by the powerful Guangzhou Automobile Group, has years of experience in the new energy vehicle industry, with rich technical and manufacturing expertise. However, as Ma Lin, Assistant Vice President of Brand and Communication at NIO, noted, hybrids and new energy vehicles operate in different markets, and direct comparisons cannot reflect the true market situation.

It's not that the products are inadequate; rather, the difficulties faced by the pure electric vehicle route have caused its growth rate to decline at this stage. The problem that pure electric vehicles need to solve remains unchanged: how to avoid range anxiety for users while keeping costs low. Whether it's lithium-ion, lithium iron phosphate, or solid-state batteries with higher energy density, all can achieve ultra-long range, but at a prohibitively high cost. Currently, the pure electric version of the same model is typically thousands to tens of thousands of yuan more expensive than the hybrid version.

In terms of energy replenishment, pure electric vehicles generally do not experience range anxiety for daily urban travel, but long-distance travel depends on timing. Based on my driving experience, EV charging stations at highway service areas often go unused during non-holiday periods but become overcrowded during holidays due to increased travel.

Another factor is the impact of the B-end market. Ride-hailing services, which primarily operate within cities, can maximize the low operating costs of pure electric vehicles, making ride-hailing drivers the primary buyers of pure electric vehicles. However, as the domestic ride-hailing market becomes increasingly saturated, with even the Ya'an Transport Bureau advising potential entrants to conduct thorough research and choose carefully, and with income declines reported among ride-hailing drivers in Aion's home base of Guangzhou, these factors inevitably affect automakers reliant on the B-end market.

The overall pure electric vehicle market is experiencing slower growth, which explains the stagnation in sales growth for NIO, XPeng, and Aion. However, among pure electric vehicle brands, there are two outliers: Zeekr, which delivered 15,655 vehicles in July, a year-on-year increase of 30%, and Xiaomi Automobile, whose first model, the SU7, was launched at the end of March and has sold over 10,000 units for two consecutive months.

It's worth noting that neither in June nor July did Xiaomi disclose specific sales figures, only stating that monthly deliveries exceeded 10,000 units. Based on LIXIANG's weekly sales reports, Xiaomi Automobile delivered a cumulative total of 11,400 vehicles from July 1 to July 28, averaging around 40 vehicles per day. At this rate, Xiaomi Automobile likely delivered around 12,600 vehicles in July.

The reasons for these two automakers' sales growth may lie in their brand value and route choices. Although Zeekr and Xiaomi Automobile have been established for a relatively short time, they are backed by major players – Zeekr by Geely Automobile, a leading Chinese automaker, and Xiaomi Automobile by Xiaomi Group. This gives them a louder voice and significant brand influence compared to many leading new-energy vehicle startups.

In terms of route choice, Zeekr and Xiaomi Automobile are remarkably consistent. Zeekr's popular models, the 001 and 007, and Xiaomi's SU7 are sports sedans targeting the 200,000-300,000 yuan market segment, appealing to young consumers seeking power. According to big data on consumer searches released by Baidu, post-90s individuals are generally more willing to spend money and have become the largest potential consumer group for luxury goods and cars. Limited by economic capabilities, the 200,000-300,000 yuan range is the primary price point for post-90s consumers when purchasing luxury cars.

As evidenced by LIXIANG's introduction of the more affordable L6 and NIO's launch of its sub-brand Ledao, targeting the 200,000-300,000 yuan price range is crucial for luxury automakers seeking sales growth.

To break through the bottleneck in pure electric vehicle sales growth and resume rapid expansion, it is essential to choose the right market segment and continuously innovate technology.

The 'Race Against Time' in the Automotive Industry is Underway

Combining the popularity of brands like BYD, AITO, LIXIANG, and Leapmotor, it is evident that hybrid technology combined with modern amenities like refrigerators, TVs, and large seats remains the key to sales success. Incorporating advanced autonomous driving capabilities can further solidify a position in the premium market.

As for pure electric vehicles, with sales growth slowing, automakers face greater challenges in boosting sales. Both the industry and individual automakers need to break through this bottleneck. Automakers' ability to do so primarily depends on their route choices. Even if they have previously focused on pure electric vehicles, they can still transition to offering extended-range products, as evidenced by AVATR.

According to leaked information, AVATR will introduce extended-range powertrains for the first time in its upcoming new model (possibly the AVATR 07) to be launched in the second half of the year. This will enhance driving range, reduce range anxiety, and further lower overall vehicle costs.

If some automakers persist in the pure electric route, they may follow the examples of Zeekr and Xiaomi by launching pure electric sports sedans priced in the 200,000-300,000 yuan range. Additionally, XPeng's sub-brand MONA's first product, the M03, is set to launch and will target the 100,000-200,000 yuan market segment, potentially capturing a share of the market with its autonomous driving technology.

The key to breaking the industry bottleneck lies in reducing battery costs, lowering the cost of ultra-long-range driving, and addressing users' range anxiety. In terms of energy replenishment infrastructure, China's network is already relatively comprehensive, with 10.24 million charging stations by the end of June, including 7.12 million private and 3.12 million public charging stations. Public charging stations in major cities are already sufficient, as construction, operation, and maintenance require significant costs, limiting the potential for unlimited expansion. Future efforts should focus on expanding access to smaller cities and townships.

Declining prices of lithium carbonate, the commissioning of lithium-sulfur batteries, and the increasing number of automakers embracing battery swapping all offer hope for new energy vehicles in addressing range anxiety.

It is foreseeable that future growth in the new energy vehicle market will become more challenging, and competition among automakers will intensify. Securing market share and boosting sales will become the primary focus, leaving limited time for new-energy vehicle startups.

Over the next two to three years, it is expected that targeting lower-tier markets and introducing new brands will become more common. In addition to Ledao, NIO's third brand, Firefly, is also approaching its debut. Leapmotor will continue to refine its A/C/D/T product lines. As new-energy vehicle startups enter the final stages of competition, they face many tough battles ahead.

Source: Leitech