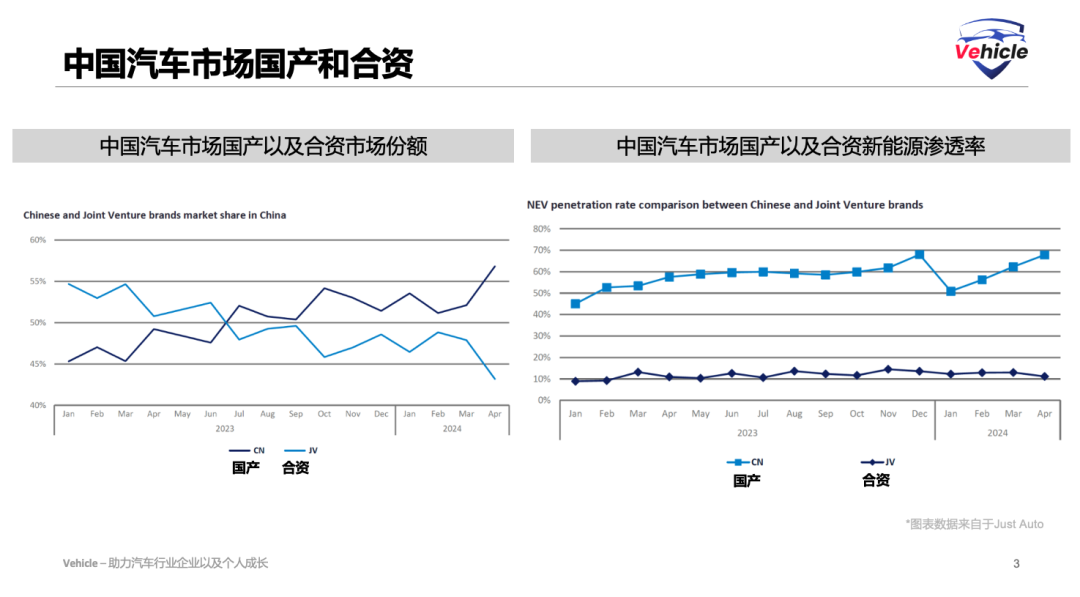

What are domestic and joint venture automakers doing?

![]() 08/06 2024

08/06 2024

![]() 721

721

What are domestic and joint venture automakers in China's auto industry doing?

Price cuts. From last year's price war of discounted sales to the current trend of a 10% decline in new car prices every six months, price cuts have been the main theme in the auto industry.

Earning profits through hybrid vehicles. The development of pure electric vehicles has shown signs of fatigue, but new energy vehicles continue to surge ahead, with plug-in hybrids rapidly gaining market share from traditional gasoline-powered vehicles.

Going global has become the main theme for all Chinese automakers. The domestic market is too competitive, and staying within China means either failing to secure orders or making little profit even if orders are obtained. The only way out is to expand internationally.

Joint venture brands

Downsizing, production cuts, and layoffs are undoubtedly the current theme for joint venture brands in China. Many photos and videos of joint venture employees showing off their work badges have gone viral on the internet, attracting significant traffic and giving many people the illusion that they could join the ranks of self-media bloggers. However, this is merely a fleeting buzz in the internet era that will soon dissipate without further developments.

Regarding the failures of foreign brands, they can be summarized as follows: European and American brands have struggled with three-cylinder engines, Japanese brands have suffered from low specifications, French brands have struggled with strange designs, and Korean brands have been accused of cost-cutting measures.

In short, each has its own unique set of problems, and these problems are so severe that they have led to the current situation.

The foreign auto brands are currently at a turning point: should they continue to compete in this fiercely competitive market or withdraw? It is highly likely that most will choose the latter option, as history has shown that few can compete with China's manufacturing prowess.

Chinese brands

Overtime work and increased productivity - Chinese automakers are engaged in a cutthroat competition, striving to reduce costs and introduce new products to capture market share amidst this intense competition.

The traditional automotive product cycle of a minor facelift every three years, a major facelift every five years, and a full model change every seven years has been completely disrupted.

When some products find that their costs and competitiveness are mismatched due to the intense competition, they may introduce a facelift every year and a full model change every three years.

The atmosphere of cost reduction and efficiency enhancement has pushed practitioners and supply chains to the limit in terms of time and profit.

What impact does this have on the automotive industry?

As the automotive industry continues to iterate with new products and prices continue to drop, particularly for pure electric vehicles, this has led to rapid depreciation of used cars. As a result, we are seeing growing concerns among consumers about the asset costs of electric vehicles.

Moreover, in China's fiercely competitive automotive market, where prices are constantly being driven down, consumers are responding based on their needs and budgets. They have become numb to various stimuli.

Practitioners are also consumers. If practitioners are solely focused on work, their products will inevitably lack a sense of life and practicality. Such products, more often than not, will be mere tools or pseudo-demand products, ultimately leading the industry towards mediocrity and replacement by alternative products.

From a long-term and sustainable perspective, I believe this is damaging the industry.

Looking back at China's history, it is difficult to find examples of products or industries that have stood the test of time. This is because we tend to destroy and exalt in the midst of rapid change. Our beginnings are always grandiose, and so are our endings, with an endless cycle of booms and busts.

But when we look back, what do we have to show for it? Grandiose stories? Or perhaps scars and wounds that are both tragic and inspiring?

Are we relying on demographic dividends (which imply the exploitation of labor and time) to fuel our perceived manufacturing prowess? Are we merely repeating the same old stories of steel and shirt manufacturing?

Back in the day, we traded 800 million shirts for a single airplane. Perhaps now and in the future, we will trade 800 million cars for something entirely different?

Others

Domestic supply chains are desperately seeking orders to fill the capacity left by joint ventures, even if it means accepting lower prices or longer payment terms. Foreign supply chains, facing the intense competition from Chinese supply chains, are following suit with joint ventures by implementing layoffs and production cuts.

The traditional 4S dealership system, once dominated by joint venture automakers, is rapidly collapsing and undergoing significant transformations.

Both domestic and joint venture automakers are embracing cost reduction and efficiency enhancement measures, working overtime to prepare for either a new beginning or the end of an era.