Perspective on China's Top 100 Supermarkets in 2023: 'Tactics' Save the Day, but Not the Long Run

![]() 08/06 2024

08/06 2024

![]() 520

520

Chain supermarkets adopt a more flexible strategy to navigate business, founder, and industry cycles.

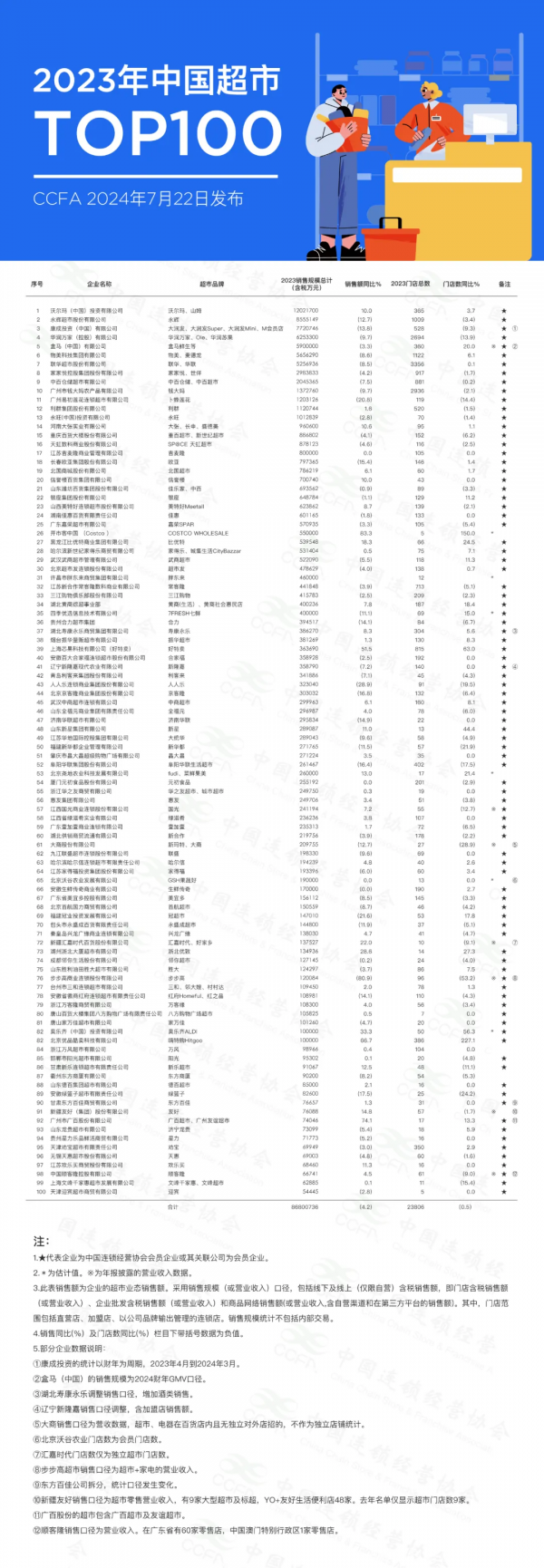

According to the latest "Top 100 Chinese Supermarkets in 2023" report released by the China Chain Store & Franchise Association (CCFA) (list attached), the top 100 supermarkets in 2023 generated sales of RMB 868 billion with a total of 23,800 stores, representing a decrease of 7.3% and 16.2%, respectively, from the previous year's top 100.

Despite the overall decline in sales and store count for the top 100 enterprises, nearly half of them have demonstrated robust growth, while 33 enterprises have increased their store count, sending a positive signal to the industry.

If we use a tree as a metaphor, we can still see the whole picture of the 'tree' through specific 'numbers'.

Especially in the past two years, 'seeking change' has become the main theme of the industry. Chain supermarkets have adopted a more flexible strategy to adapt to market changes, including exploring new formats such as membership stores and discount stores, as well as introducing and learning from the 'Pang Donglai Model' to improve product and service quality.

In the long run, the supermarket industry is striving to draw a 'smiling curve'. While facing short-term pressures, the long-term outlook remains positive. Next, those who can stabilize and deepen their foundations and be the first to navigate through the painful transition period will establish enduring businesses and stand at the forefront.

01 Highlights Amidst Overall Decline

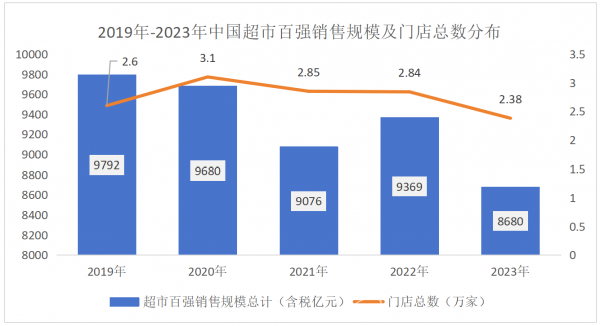

Over the past five years, the top 100 supermarkets have experienced continuous declines in overall sales. In 2023, sales amounted to RMB 868 billion, a 7.4% drop from RMB 936.9 billion in 2022. Meanwhile, the number of stores peaked at 31,000 in 2020 before declining to 23,800 in 2023, a reduction of nearly a quarter.

Figure 1: Sales and Store Count of Top 100 Supermarkets Over the Past Five Years | Chart by Qianxing

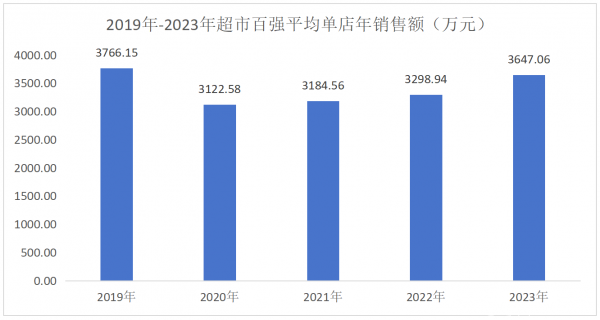

However, on the 'bright side,' the average annual sales per store for the top 100 supermarkets have increased, rising from RMB 31.2258 million in 2020 to RMB 36.4706 million in 2023. Although this has not yet recovered to the RMB 37.6615 million of 2019, it reflects to some extent that supermarkets have made initial progress in improving business performance through store closures and optimization.

Figure 2: Distribution of Average Annual Sales per Store for Top 100 Supermarkets from 2019 to 2023 | Chart by Qianxing

Further analysis shows that national chain enterprises remain the backbone of the top 100 supermarket chains in terms of operational scope.

In 2023, the top 100 national chain supermarkets generated total sales of RMB 665.6 billion, accounting for nearly 80% of total revenue with only 7,105 stores (less than 30% of the total). Meanwhile, the top 100 regional chain supermarkets (operating within a single province or municipality) generated total sales of RMB 203.4 billion with 16,701 stores, roughly conforming to the 80/20 rule.

Additionally, the average annual sales per store for national chain supermarkets are nearly 1.4 times that of regional supermarkets, reaching nearly RMB 40 million annually.

Table 1: Overview of Regional and National Supermarkets | Chart by Qianxing

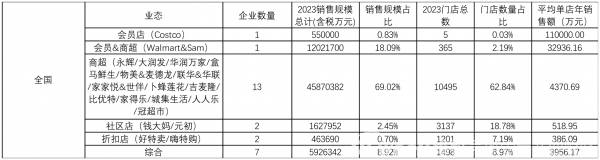

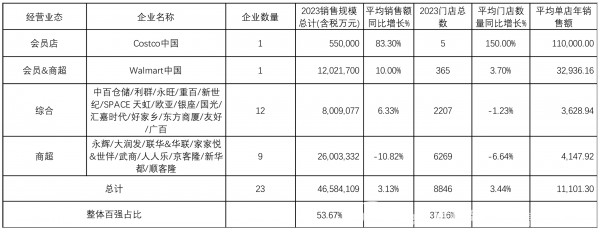

Among the retail formats explored by the top 100 national chain supermarkets, membership stores significantly outperform other formats. Costco and Walmart achieved RMB 125.7 billion in sales, accounting for nearly 20% of total sales, with only 370 stores (2.2% of total stores in China).

The average annual sales per membership store stand out, with Costco China, which opened its first store in Shanghai in 2019, achieving an average annual sales of RMB 1.1 billion per store, far exceeding integrated formats (supermarkets, department stores, department store complexes) and standard supermarkets.

Furthermore, Walmart China's Sam's Club, after two decades of preparation since its first store opening in 1996, has rapidly expanded since 2016, with an average annual sales of over RMB 1.5 billion per store. Nearly 50 stores contribute to nearly two-thirds of Walmart's overall sales in China.

Table 2: Business Performance and Format Distribution of Top 100 Supermarkets | Chart by Qianxing

The discount store format is also noteworthy, despite accounting for less than 1% of overall sales. Discount retailers like Haotemai and Hitegou have experienced significant year-on-year growth in both sales and store count, with average annual sales per store reaching RMB 4.46 million and RMB 2.59 million, respectively.

Table 3: Business Performance of Discount Stores | Chart by Qianxing

It is foreseeable that current sales represent only the 'appetizer' for the discount store format.

Traditional retailers are increasingly experimenting with discount stores. Yonghui Superstores plans to complete the transformation of 600 'Authentic Discount Stores' this year, introducing a 'store-within-a-store' model with dedicated 100-square-meter areas offering discounted products with nearly 100 SKUs in each store. Jiajiayue Supermarkets is also experimenting with the new format 'Haohuixing,' offering low-cost products through its own brands and 'unpackaged' display methods.

Image Source: Internet

While the trend is positive, the discount store model is still in its exploratory phase and requires considerable time to develop an effective path.

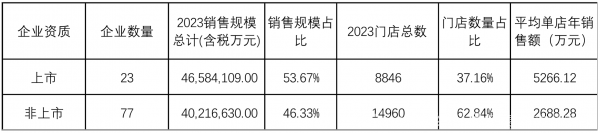

Finally, comparing the performance of listed and unlisted companies, listed companies demonstrate superior operational capabilities.

Specifically, 23 of the top 100 supermarkets are listed (including foreign enterprises such as Costco and Walmart). Listed top 100 supermarkets generated total sales of RMB 465.8 billion in 2023, accounting for 53.67% of the total. They operate a total of 8,846 stores, representing 37.16% of the total, with an average annual sales per store of RMB 52.6612 million, double that of unlisted companies.

Table 4: Comparison of Business Performance Between Listed and Unlisted Companies | Chart by Qianxing

Among listed companies, membership store operators Costco and Walmart achieved double-digit sales growth in 2023. Costco opened three new stores in 2023 and plans to open its sixth store in Longhua, Shenzhen, in January 2024. Integrated formats (supermarkets, department stores, department store complexes) also experienced a 6.33% year-on-year increase in sales, while standard supermarkets saw a 10.82% year-on-year decline, posing greater operational challenges.

Table 5: Business Performance of Listed Companies Among Top 100 Supermarkets | Chart by Qianxing

In summary, despite the overall poor sales performance of the top 100 supermarkets in 2023, national chain enterprises still achieved nearly 80% of total sales with their superior operational capabilities. Membership stores accounted for 20% of this, and listed companies significantly outperformed unlisted ones. Future opportunities will belong to companies with higher levels of chain development, stronger professionalism, and more advanced business philosophies.

02 Changes in Business Models

The list data actually reveals two contrasting trends: some companies are 'surging ahead,' while others are 'struggling.' The extremes in sales reflect ongoing shifts in supermarket business models.

First, companies targeting the mid-to-high-end market, such as Sam's Club, Costco, and Aldi, have experienced notable growth. Costco achieved 83% sales growth, while Aldi grew by 33%. Some regional retail supermarkets, including Zhebei Youzhi, Huijia Times, Xinxing, and Dazhang, also achieved double-digit sales growth in 2023.

Second, despite no overall sales growth, only 12 retail enterprises with annual revenue exceeding RMB 1 billion achieved double-digit growth. National chain supermarkets continue to decline, including Yonghui, RT-Mart (Darunfa), and China Resources.

Table 6: Growth in Sales Scale of Top 100 Supermarkets in 2023 | Chart by Qianxing

From a macro perspective, the growth of social retail demand is slowing, with consumers shifting from discretionary purchases to either postponing purchases or making more selective decisions. This indicates that the overall retail market has moved beyond incremental growth and into a period of intense competition for existing market share. For the top 100 retail chains, business has become more challenging, and the traditional model of simply opening stores in good locations is no longer effective.

From a micro perspective, traditional retail supermarkets face numerous challenges at both the 'people, products, and places' level and in terms of corporate operations.

First, 'places' are becoming more specialized and segmented. The original advantage of 'one-stop shopping' for retailers is gradually disappearing, as consumers have more options.

Online, there are comprehensive e-commerce platforms like JD.com and Tmall, as well as fresh food e-commerce platforms like Xiaoxiang Supermarket, Duoduo Maicai, Dingdong Maicai, and Pupu Supermarket. These platforms offer convenient 'online ordering and offline delivery' experiences, reducing the need for offline store visits and causing a continuous loss of offline customer traffic.

Offline, new physical store formats like snack specialty stores and fresh food membership stores have emerged, further diverting already declining in-store customer traffic with their portable and unique shopping experiences.

Second, at the 'products' level, the traditional offline supermarket shelf leasing business model focuses on 'square meter efficiency' rather than 'product efficiency.' Retailers prioritize shelf rental fees, material fees, and promotion expenses over whether products sell well.

This leads to severe homogenization of similar products in supermarkets, making it difficult to guide consumer choices. Retailers signal to brand owners that they prioritize price wars, focusing on promotions and low prices to attract customers. However, price wars essentially benefit brand owners who engage in a vicious cycle of low prices leading to low quality, low traffic, and even lower prices, resulting in a lose-lose situation for both retailers and brand owners.

Products should be the key driver for retailers, assisting brand owners in defining product differentiation and strengthening competitive advantages offline, thereby enhancing their own product capabilities and providing consumers with a reason to visit stores.

Third, current retail enterprises lack insight into changes in consumer demand, losing their appeal to 'people.'

Physical retail enterprises could leverage their unique offline 'private domain' to proactively test and uncover potential consumer needs and respond accordingly. Based on the layout of 'places,' they could differentiate themselves from online e-commerce's 'price wars' and achieve an advantage in 'people.' Today's consumers seek unique and novel shopping experiences, and retailers unable to cater to these expectations will struggle to regain customer traffic.

In reality, there is still a strong market demand for physical retail, but traditional supermarkets are not currently meeting this demand. This explains why adjusted stores (after Pang Donglai-style renovations or self-renovations) have seen significant sales rebounds, indicating that traditional supermarkets have not sufficiently impressed consumers with their product quality, service details, or other aspects.

Finally, at the corporate level, many leading enterprises face transitions between founding leaders and successors.

Most of the current management teams at leading retail chains have extensive experience in the retail industry, including Zhang Wenzhong of Wumart and Zhang Xuansong and Zhang Xuanning of Yonghui. However, companies like RT-Mart and Hema also face changes such as key personnel transfers and retirements. Navigating the founder cycle, organizational adjustments, and operational decisions to quickly adapt to changing consumer preferences remains a significant challenge.

On the other hand, companies are experiencing increasing labor costs. Due to the labor-intensive nature of the industry, it is difficult to replace human labor with standardized processes and automation, though process improvements and equipment upgrades can enhance operational efficiency to some extent.

This corroborates the three core challenges facing traditional supermarket enterprises highlighted in the CCFA report: continuous loss of in-store customer traffic, gradual loss of product differentiation competitiveness, and rising store operating costs.

03 False Breakthroughs vs. Genuine Breakthroughs

Many enterprises embarked on a 'self-rescue' mode in 2024, adopting two main strategies.

First, they have embraced the business model of the regional retail supermarket Pang Donglai, with traditional supermarket brands like BBK and Yonghui initiating 'Pang Donglai-style' renovations. Second, they have vigorously developed their own brands, with hard discount models gaining popularity.

The former strategy, based on adjusted store performance data, has shown remarkable results in both in-store traffic and sales transactions. Taking BBK's Meixihu store in Changsha as an example, the store achieved total sales of RMB 41.2866 million in May with 361,000 visitors, averaging RMB 1.3318 million in daily sales and 11,600 daily visitors. On May 1st, the store recorded its highest daily sales of over RMB 2.4 million, attracting 17,700 visitors. In contrast, before the renovation, the store averaged only RMB 150,000 in daily sales with around 2,000 daily visitors.

Similarly, Yonghui Supermarket's Xinwan Plaza store in Zhengzhou experienced a significant boost on its first day of operation after renovation, with sales reaching RMB 1.88 million, 13.9 times the average daily sales before the renovation. Daily traffic surged to 12,926 visitors, 5.3 times the pre-renovation average, demonstrating the effectiveness of the renovation.

But the author believes that the Donglai Model is more like an "Internet celebrity model". Apart from the attraction of revamped stores to consumers, coupled with the "Internet celebrity" persona of "Donglai Ge" and the natural traffic brought by Donglai's popular products, it remains to be seen whether future sales data will continue to improve.

In other words, the "borrowed doctrine" can only bring short-term traffic, and it is difficult to draw conclusions about its true long-term suitability. The Donglai Model can only be a "clever" solution, not a long-term business approach.

The latter increases investment in private label products, and its overall development is too utilitarian and radical, failing to meet retailers' expectations, and is more about "PB for PB's sake."

Sam's Club, which currently operates the best private label business, has less than 40% of its products under its own brand, while other retailers generally have private label products accounting for 10%-30%. However, there is one outlier - Aldi, which, according to its external data, currently has over 90% of its products under its own brand. The increase in private label strength does not seem to have won over consumers, as evidenced by numerous online doubts about the quality of its products such as 52-degree, 500ml baijiu for 9.9 yuan, 950ml milk for 9.9 yuan, and facial cleanser for 9.9 yuan.

This also illustrates that "affordable price" is just one of the characteristics of private brand (PB) products. Low prices do not necessarily mean low quality; high quality at low prices is the core focus of PB products. However, many PB products in the market still rely on price as a gimmick.

The core reason why the above two approaches are ineffective is that they focus more on the "technique" level, i.e., helping retail businesses adjust through specific execution actions. This approach often prioritizes form over substance, resulting in unsustainable effects.

To truly change the status quo, retail businesses need to unify their business mindset at the "philosophy" level and explore a more suitable path to navigate through economic cycles, from top to bottom and from the surface to the core.

Specifically, the author believes there are two main points.

First, retail requires long-term commitment and continuous improvement.

Retail is also a service industry, emphasizing "repeat purchases," meaning it is not a one-time transaction but rather providing long-term services to different consumers. By constantly iterating and revitalizing its own format, the supermarket provides a good shopping experience for consumers, leading to their continued repeat purchases and recommendations.

At the same time, there is no upper limit to the standard of service; there is no best, only better. Retail businesses need to continuously observe and reflect on how to provide consumers with more "fast, convenient, high-quality, and affordable" services, as well as "unique, innovative, and special" experiences. They must not only provide the essential material value of goods but also emotional value.

Second, truly achieve "customer first, employee second."

The premise of excellent service experience is understanding "who your customers are" and "who will deliver these services." Only by putting "customers first, employees second" can businesses discover and maximize the satisfaction of customer needs.

Donglai is an excellent example. In terms of customer service, it offers seven-day no-reason returns, seven different types of shopping carts, readily available cookbooks, and thoughtful service throughout the shopping experience. For employees, it provides generous benefits, including salary increases, paid annual leave, overtime pay, short-term incentives, and employee grievance awards.

Supermarket businesses need to consider their own development and start from the details to create their own "Donglai" effect.

Furthermore, the continuous decline in sales volume over the past four years has prompted many businesses to rethink what retail truly is. The success of the Donglai Model is attributed to its focus on retail essentials from the outset, emphasizing product strength, valuing customer experience, and continuously refining internal capabilities to reduce costs and increase efficiency. This is even more evident in foreign companies like Costco and Sam's Club.

Therefore, the author believes that with supermarket businesses finding their own suitable operational methodologies, the future of the domestic supermarket industry is promising under their leadership in the current retail environment.

Attachment: China Chain Store & Franchise Association's "Top 100 Supermarkets in China 2023"