The Sino-Japanese Automobile Battle: “Normandy” in Thailand

![]() 08/06 2024

08/06 2024

![]() 548

548

Introduction

Introduction

There is no promised land for Chinese automakers seeking overseas markets. Only by winning in Southeast Asia and achieving “Thai peace” can Chinese automakers hope to defeat Japanese automakers and achieve global success.

“Guess how many Japanese cars and how many Chinese cars there are?”

In the parking lot near the Great Wall Motor plant in Baling District, Rayong Province, Thailand, the Automotive News Thailand research team braved the scorching sun to manually count cars and use real data to determine which would prevail: the Japanese giants or the rising Chinese stars.

“The Toyota Hilux is amazing, turning every corner to reveal another one. It has few rivals except for the Isuzu D-MAX!”

“Here’s a Haval H6, and it’s even a plug-in hybrid.”

“An MG5 is parked near the Great Wall plant. Clearly, it’s not just their own brand’s cars here.”

...

Tired of the extreme opinions on the internet, whether it’s “Chinese cars are sweeping Southeast Asia, conquering the Japanese automakers’ backyard” or “with a century of experience, Japanese cars will inevitably defeat Chinese cars, which prioritize price over quality, within a few years,” we decided to follow the route of Chinese automakers going overseas to see, listen, and ask for ourselves. Now, we’ll even count the cars.

From the dawn at Don Mueang International Airport to the sunset in Pattaya, Automotive News reporters captured and counted countless street cars amidst the bustling traffic. However, static vehicles in parking lots provided more reliable statistics.

“After counting several rounds, Japanese cars accounted for 71% of the vehicles each time, with American and Chinese cars both at 13%, and German cars at just 3%.” I shared the results with Mr. He, who was thousands of miles away.

“Chinese automakers are on the rise, while Japanese automakers have a volume advantage,” he explained. “In the Thai market, Japanese automakers are descending from the fifth floor to the fourth, while Chinese automakers are climbing from the first floor to the second. So, the progress of Chinese automakers and the dominance of Japanese automakers are not contradictory. The former represents the direction of change, while the latter represents absolute volume.”

As China becomes the world’s leading automobile exporter, SAIC Motor, BYD, Great Wall Motor, Aion, Changan Auto, and Nezha have already made inroads in Thailand and the Philippines, while Geely has also entered Malaysia.

Manufacturing sustains a country’s fate, and the automotive industry is the crown jewel. A world-class automotive industry must have a global market reach, making going overseas imperative.

In terms of markets, Southeast Asia is the most suitable starting point, with Thailand serving as a dual hub for manufacturing and sales.

In terms of competitors, Japanese and Chinese automakers have the closest pricing and positioning, and they are also the top-selling automakers globally, making them the primary overseas competitors.

“Therefore, the significance of your inspection trip goes far beyond simply exploring an export market for Chinese automakers,” Mr. He reminded me. “The rise of Chinese automakers in the Thai market can be likened to the ‘Normandy Landing’ in their overseas expansion, challenging Japanese automakers.”

Undoubtedly, the transition to new energy vehicles in the ASEAN market has brought both market opportunities and systemic pressures to Chinese automakers. The price war and quality challenges mean that opportunities are accompanied by challenges, and sweet successes are followed by troubles.

As the balance of power shifts back to the Eastern Hemisphere, the Eastern automotive camp will compete for the role of true leader. The answer to the Sino-Japanese automotive battle lies in Thailand. Only after achieving “Thai peace” can Chinese automakers truly usher in their golden age.

As we left Don Mueang International Airport, the weather alternated between rain and sunshine, yet the setting sun remained resplendent. The changing weather seemed to metaphorically represent the ups and downs of Chinese automakers in Thailand, Southeast Asia, and the global market.

Japanese Automakers: Declining or Just a Shrunken Camel?

In fact, our visit to Thailand in late June also coincided with a metaphorical shift: the retreat of Japanese automakers and the advance of Chinese automakers.

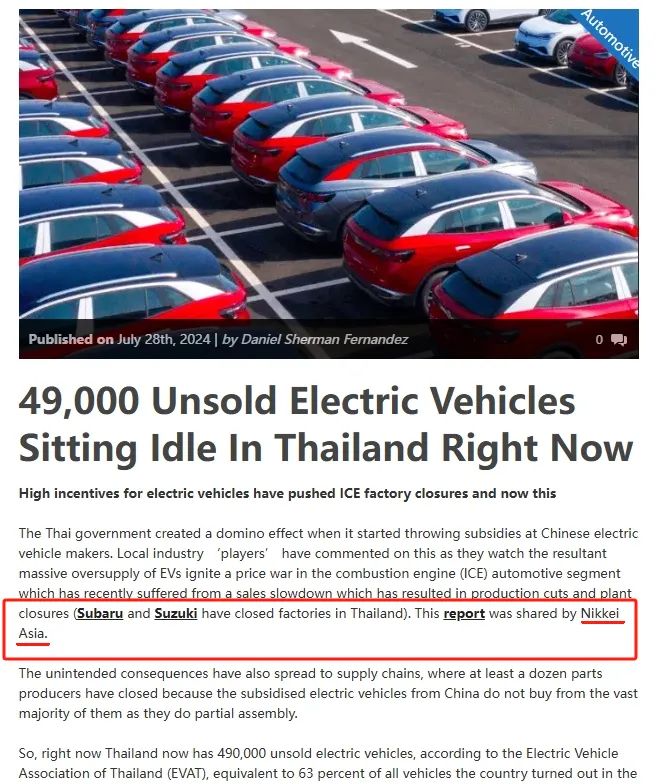

At the end of May, Subaru announced that its Bangkok plant would shut down by the end of 2024.

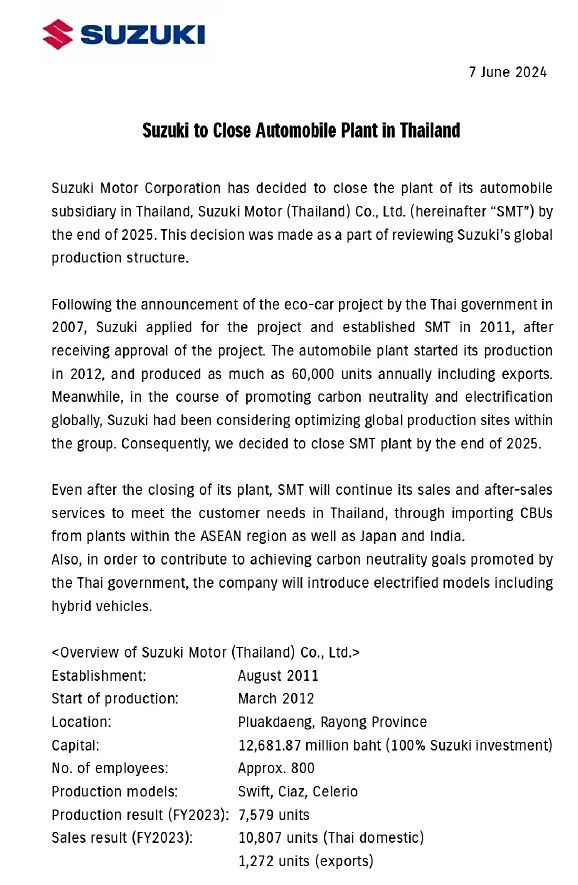

On June 7, Suzuki officially announced the closure of its plant in Rayong Province, Thailand, with operations ceasing by the end of 2025.

Image | Suzuki Announces Closure of Thai Plant

Using our inspection trip as a symmetrical axis, the influx of Chinese automakers into Thailand can be described as a “swarm.”

On July 4, BYD’s Rayong plant opened, with an annual production capacity of 150,000 vehicles.

On July 9, Geely Radar announced the official establishment of its first overseas subsidiary in Thailand, making the Thai market its first independently operated overseas market.

On July 17, GAC Aion’s smart factory in Thailand was officially completed, with a total investment of 2.3 billion Thai baht and an initial annual production capacity of 50,000 vehicles, with plans to expand to 100,000 in the future.

Soon, Changan Auto’s plant will be completed by the end of 2024 and put into operation in the first quarter of 2025, while Chery Automobile’s plant will also begin operations around 2025. “In the next two years, seven to eight Chinese electric vehicle brands will go into production, with a total investment of up to 200 billion Thai baht,” according to data from the Electric Vehicle Association of Thailand and other organizations.

Image | Top 10 Automakers in Thailand by Sales in H1 2024, with BYD Ranking Fourth

With the aggressive push by Chinese automakers, can we say that Japanese automakers are declining in Thailand? Our initial reaction was a resounding no.

“No matter how you count or photograph, Japanese cars are still the majority!” The video editor of Automotive News, Liu Yi, and reporter Zha Youyin have become accustomed to Japanese cars, but they still get excited when they spot a Euler Lightning Cat or a Nezha V and shout out to their colleagues. Meanwhile, Li Sijia, the SAIC reporter, is always on the lookout for more MG badges among the passing cars on the street.

From the bustling areas of Bangkok like Sathon Square, MBK Center, and Rama I Road, to the remote outskirts of Rayong and Chonburi, Japanese cars dominate the scene. Toyota Camrys and Honda CR-Vs play the role of primary family cars in the former, while battered old Hiluxes and D-MAXes are the most common modes of transportation in the countryside.

What evidence supports the claim that Chinese automakers are rising in the Thai market while Japanese automakers are declining?

Our initial reaction of a resounding no gradually softened. As Mr. He pointed out, in terms of development trends, Chinese automakers are indeed rising, while Japanese automakers are declining.

Compared to BYD, which is currently the top-selling Chinese automaker in Thailand, SAIC Motor’s MG brand is perhaps better qualified to evaluate the history of competition between Chinese and Japanese automakers in this land. After all, with a 12-year operating history since the joint venture with Charoen Pokphand Group, SAIC Motor has become the most established Chinese automaker locally. From a cooperation assembly plant in Rayong in 2012 to its own plant in Chonburi in 2019, SAIC Motor has invested over 10 billion Thai baht and plans an annual production capacity of 100,000 vehicles.

Great Wall Motor, which rolled out its first Haval H6 HEV on June 9, 2021, acquired General Motors’ Thai plant for 22 billion Thai baht to establish a 100,000-unit production base, can also be considered “experienced.” Even Nezha Automobile, which began production at its Thai plant in November 2023, partnered with PNA Group to invest 3.5 billion Thai baht in a 20,000-unit electric vehicle capacity and can now share various local success stories.

“Back then, the Thai automotive market was dominated by seven Japanese automakers and only one Chinese automaker, SAIC Motor.” Suroj Sangsnit, EVP of SAIC-CP and Vice President of the Electric Vehicle Association of Thailand, recalled the humble beginnings with a squint during an interview with Automotive News at the local flagship store.

Image | Suroj Sangsnit, EVP of SAIC-CP and Vice President of the Electric Vehicle Association of Thailand

However, his recollections merely served as a segue: “Now, multiple Chinese brands are entering the market, reducing the number of Japanese brands from seven to five. Meanwhile, Chinese brands have grown from one to nine, transforming the confrontation from 1:7 to 9:5. When you asked about the state of Japanese automakers, he could summarize it in one sentence: they are on the decline.”

Mr. Suroj was referring only to passenger car brands. If commercial vehicle brands are included, the number of brands on both sides would be even greater, leading to even fiercer competition.

Japanese automakers include Toyota (including Lexus), Isuzu, Honda, Mitsubishi, Mazda, Nissan, Suzuki, Subaru, and Hino, totaling nine brands.

Chinese automakers, on the other hand, include MG (all domestic SAIC brands are sold under the MG name in Thailand), Great Wall Motor, Nezha, BYD, Aion, and Changan, six passenger car companies with sales figures to report. Additionally, Chery, Wuling, which has announced plant construction plans, Geely Radar, which has just established a Thai subsidiary, NIO, Xpeng, and Zeekr, which have begun advertising in Thailand, as well as Foton, Dongfeng, and JAC, which focus on commercial vehicles, bring the total number of Chinese automaker brands to 14.

However, this does not mean that Chinese automakers have an overwhelming advantage of 14 to 9.

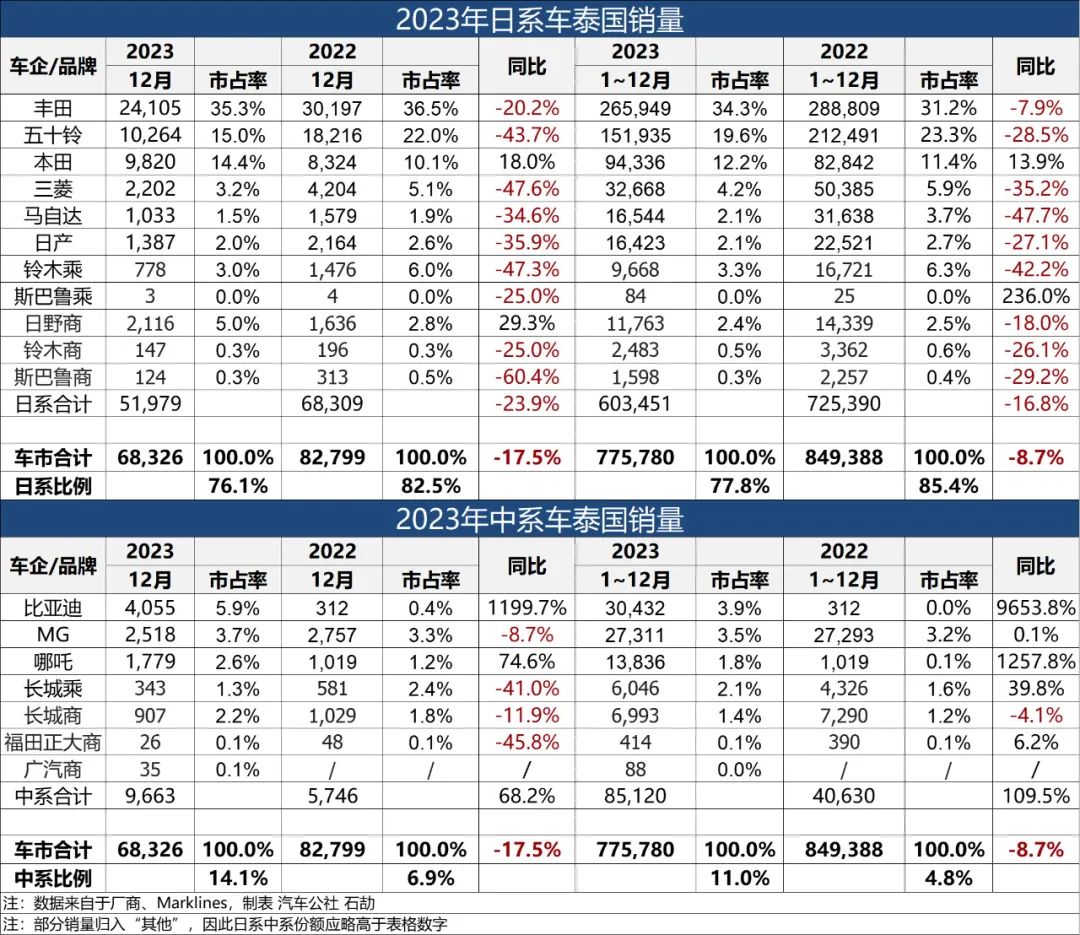

Image | Sino-Japanese Automobile Sales in Thailand in 2023

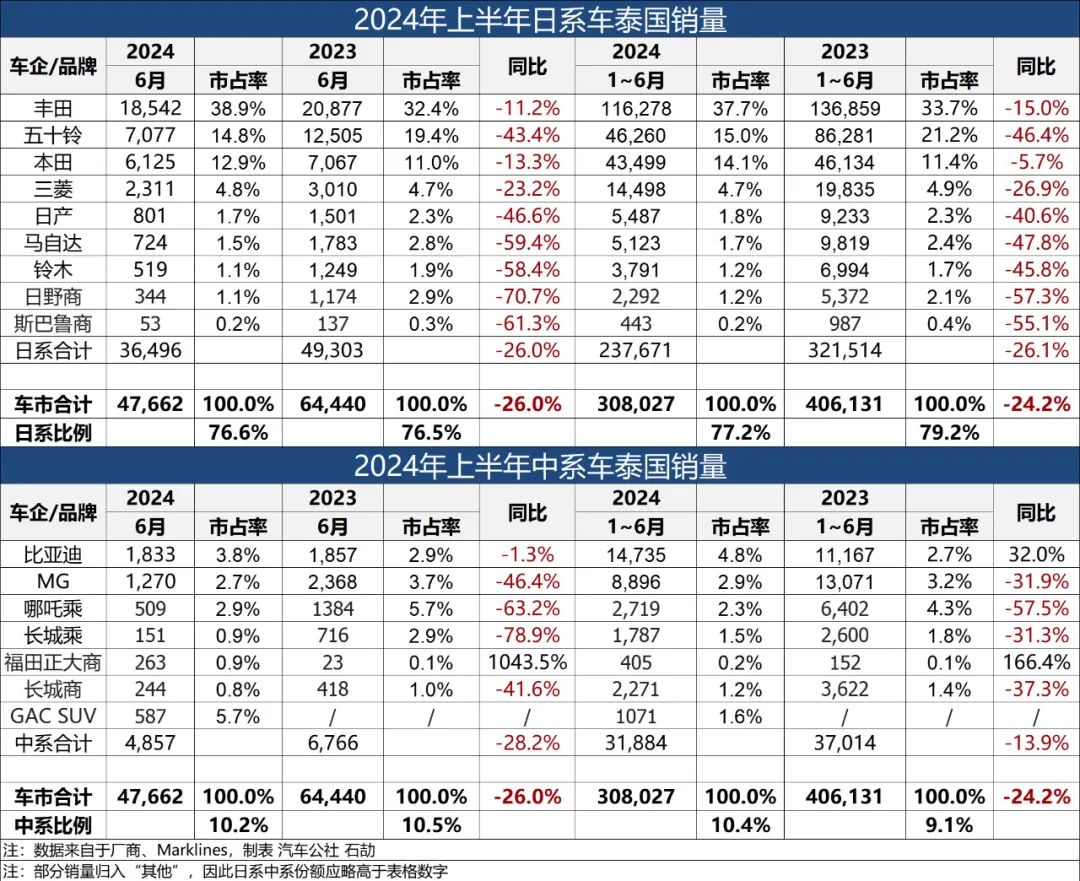

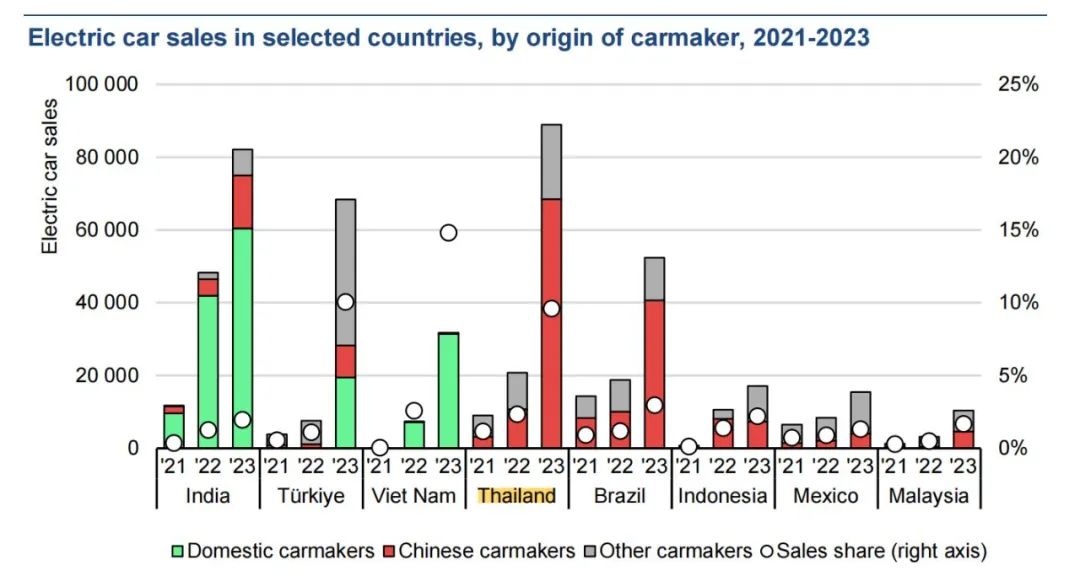

Consistent with field inspections and observations, sales data from 2023 and the first half of 2024 show that the Thai automotive market is still dominated by Japanese automakers in terms of sales, but Chinese automakers are rising at a significantly faster pace, especially when comparing the five-year change curve.

Toyota, the all-around champion, Isuzu, the pickup truck giant, and Honda, with new models boosting sales, firmly hold the top three positions in Thai automotive sales. It’s no wonder we see Hiluxes, Yaris, D-MAXes, and Citys everywhere on the streets. As a result, Japanese automakers still accounted for 77.2% of the Thai automotive market share in the first half of this year.

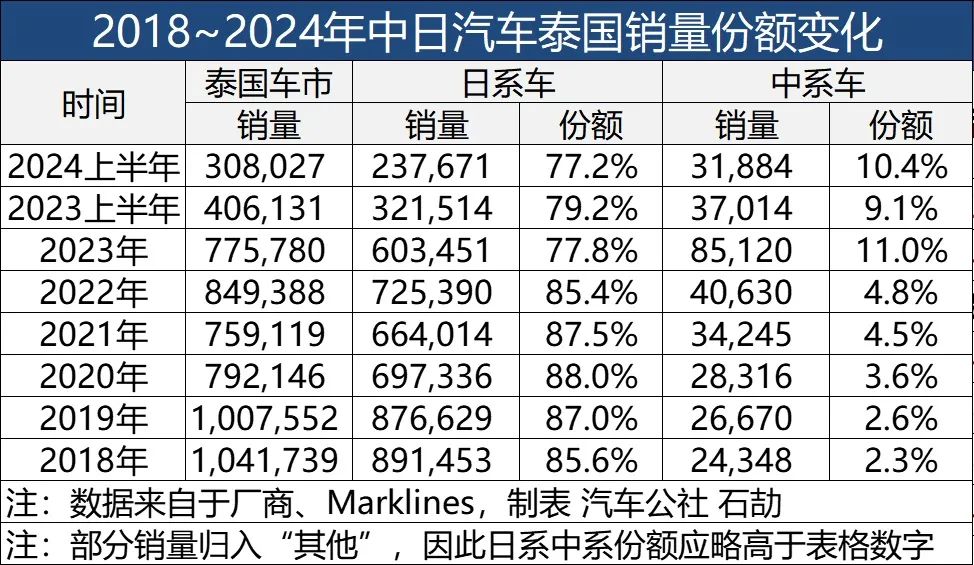

Image | Change in Market Share of Sino-Japanese Automobiles in Thailand from 2018 to 2024

However, from 2018 to 2023, the Thai market share of Japanese automakers hovered between 85% and 88%, but it suddenly dropped to 78% in 2023. In contrast, Chinese automakers’ share jumped from 2-3% for most years to 4.8% in 2022 and surged to 11.0% in 2023.

In the first half of this year, the overall Thai automotive market declined by 24.2% year-on-year, and Chinese automakers were not immune, with a 13.9% year-on-year decline. However, Japanese automakers’ 26.1% decline was almost double that.

Image | Sino-Japanese Automobile Sales in Thailand in H1 2024

As Chinese automakers continue to ramp up production and investment in Thailand, countercyclical growth is almost expected. Meanwhile, the decline of Japanese automakers seems irreversible. In this context, describing Japanese automakers as “declining” or “past their prime” is not an exaggeration, although they are far from their nadir, and Chinese automakers are just at the dawn of their rise.

“A shrunken camel is still a giant,” Mr. He sent me a few lines. “But it is indeed in the process of shrinking. However, not all competitors can seize this shrinking opportunity to deliver a fatal blow.”

‘Electrification’ and ‘Trying New Things’

The rapid changes in the Thai market cannot be separated from a major trend: the emergence of new energy vehicles (NEVs).

As the Thai automotive market declines due to factors such as the overall economy and rising US dollar interest rates, NEVs have become the brightest spot in the darkness.

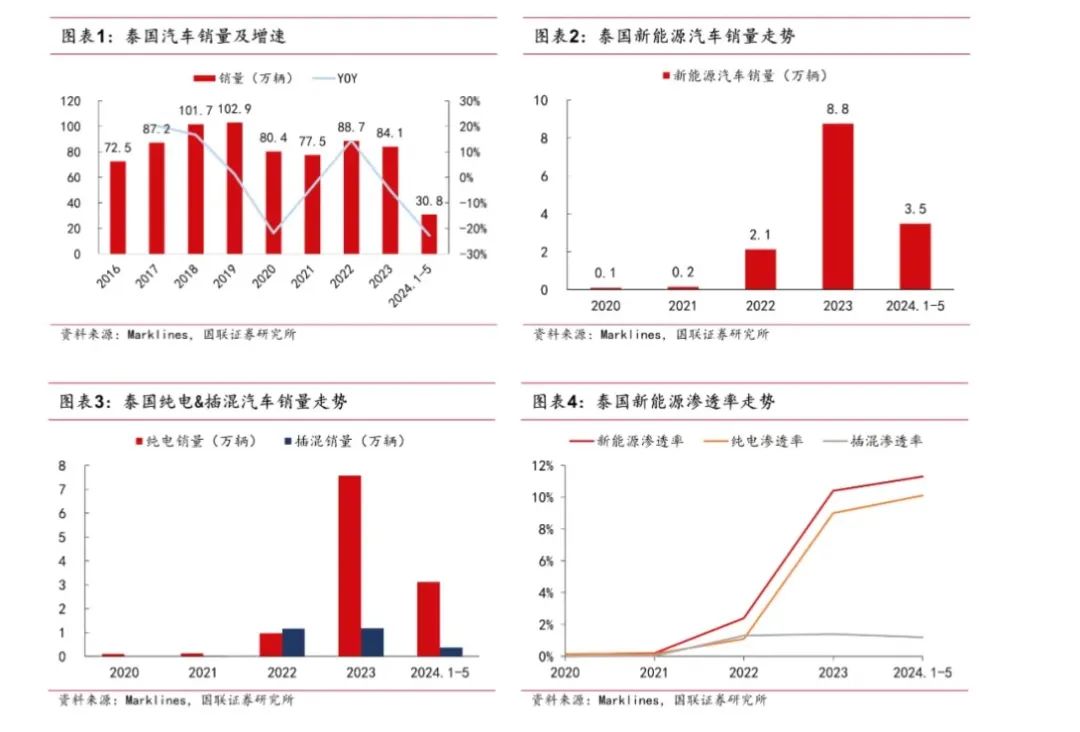

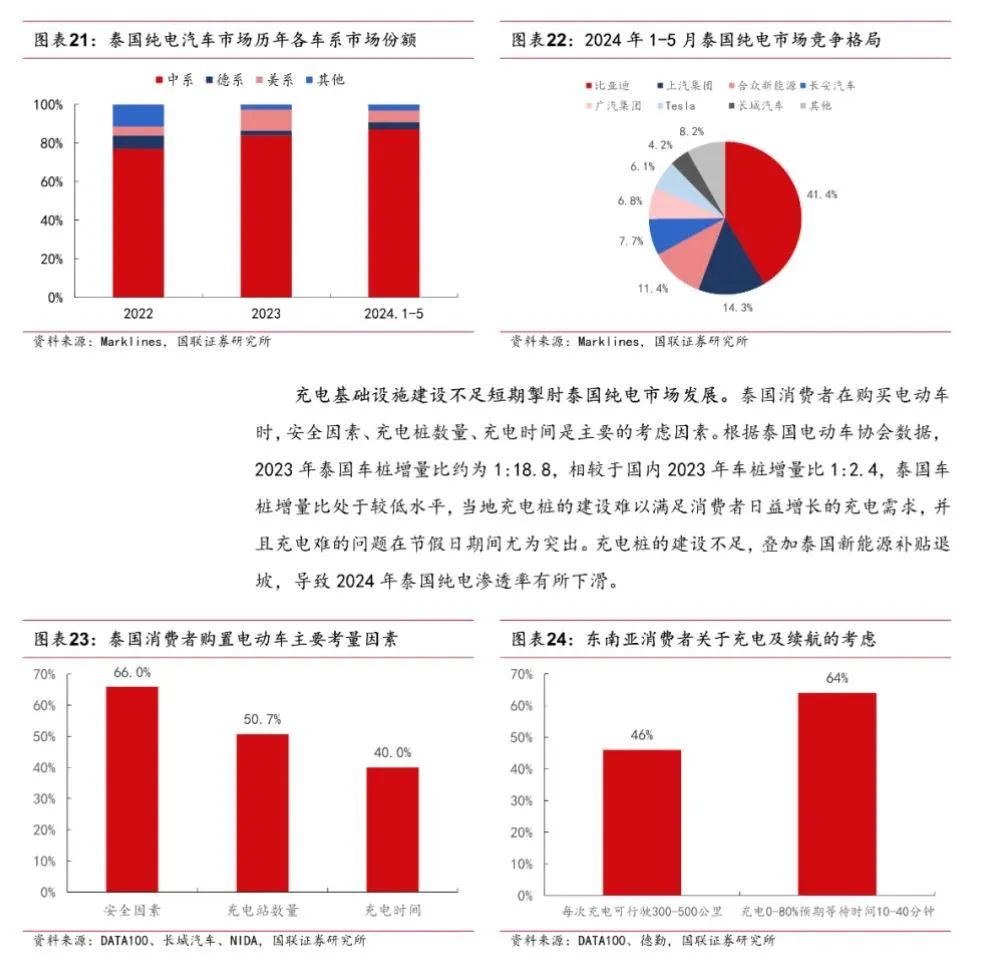

In 2023, while new car sales in Thailand decreased by 46,000 units from the previous year, NEV sales increased by 67,000 units, resulting in a net decrease of 113,000 units for purely gasoline-powered vehicles. In 2022, NEV sales were 21,000 units, with a penetration rate of 2.4%. By 2023, sales reached 88,000 units, with a penetration rate of 10.5%.

From January to May this year, BYD, SAIC Motor, Nezha, Changan Auto, and Aion were the top five players in Thailand’s pure electric vehicle market, accounting for 81.6% of the market share, while Tesla ranked sixth with a 6.1% share. No wonder Chinese automakers’ market share is still on the rise.

Can we truly experience the application scenarios of electric vehicles in Thailand?

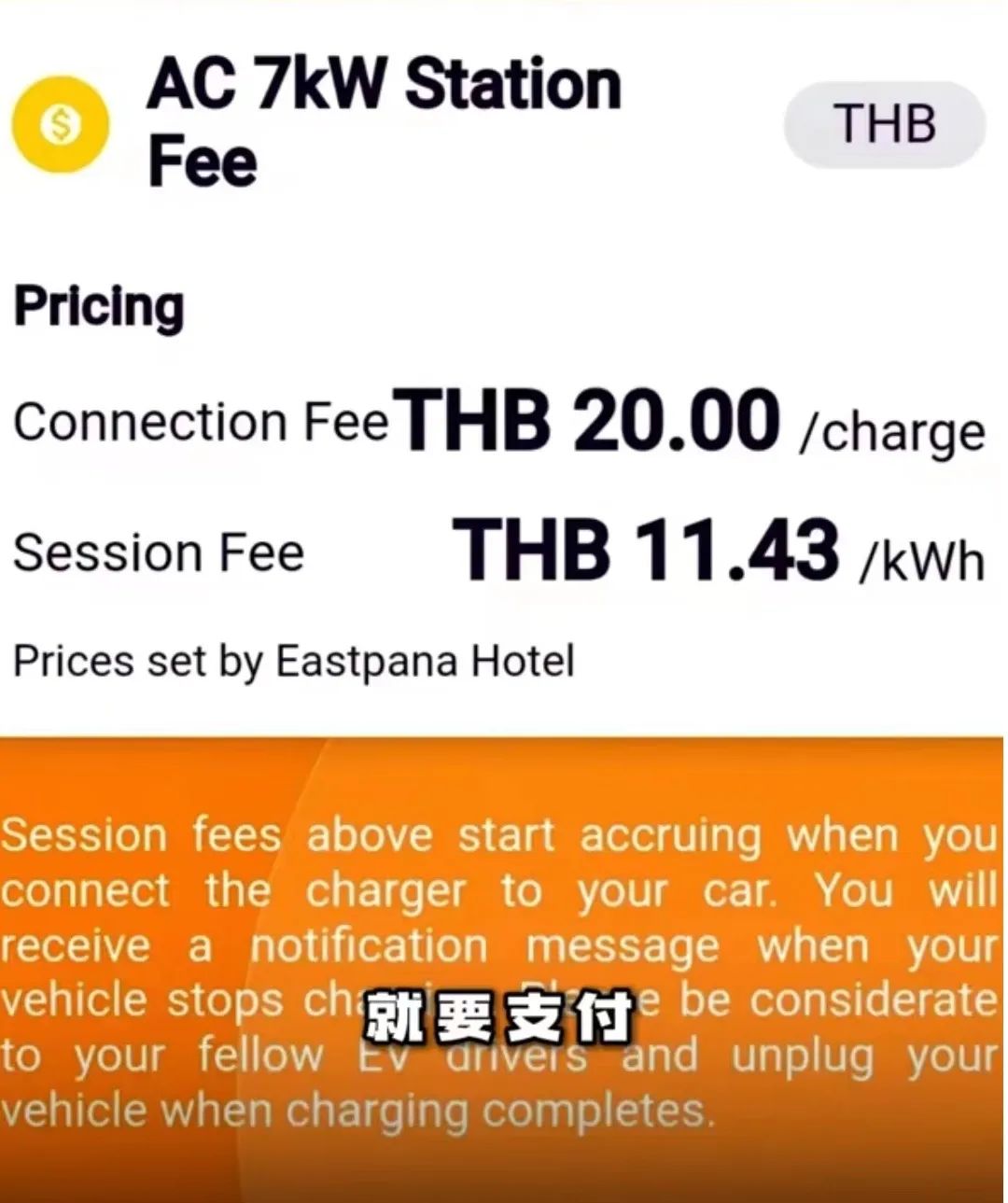

“This is a low-power 7KW AC charging pile. The process of scanning, swiping, and paying is very simple,” we spent more than ten minutes researching at the Eastpana Hotel in Chonburi before starting to film a video explaining the use of local charging piles in Thailand.

The starting fee for connecting to the charging pile is 20 Thai baht, and the price per kWh is 11.43 Thai baht. With the current exchange rate of roughly 5 Thai baht to 1 Chinese yuan, the charging price is roughly double that in China. Compared to the “private piles” at hotels, PTT Petroleum's charging piles are more common in Thailand.

After seeing various energy replenishment facilities with brand prestige and supercharging technology labels in China, we certainly marveled at the fact that “even such inferior technology in China attracts Thai consumers like moths to a flame.”

Among the major Southeast Asian countries, Thailand is one of the most friendly markets for new energy vehicles and also one of the most friendly countries towards China.

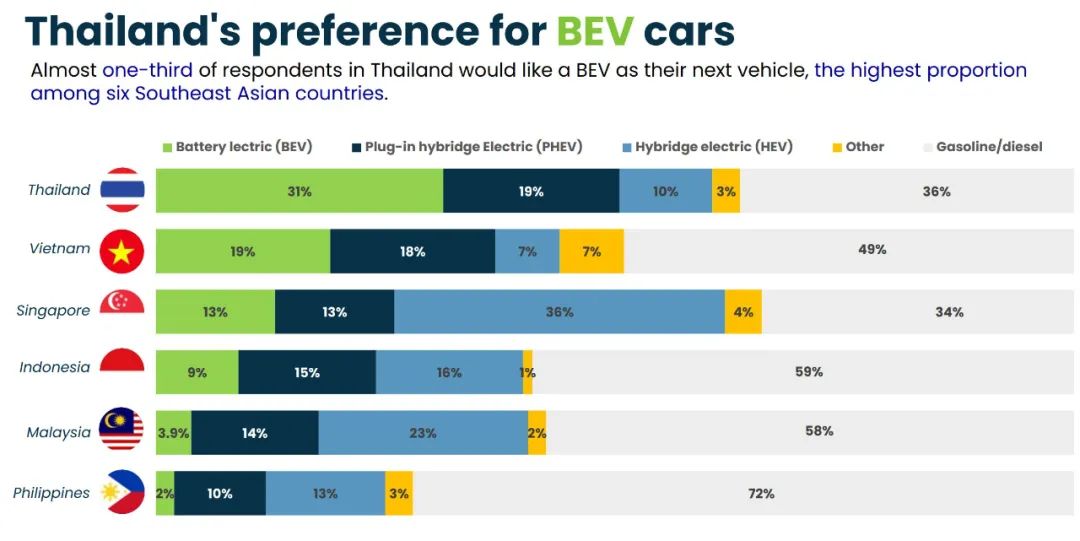

According to the results of a survey conducted last year by institutions and Deloitte, among the six major ASEAN countries, the preference ratio of Thai consumers for new energy vehicles (pure electric BEV + plug-in hybrid PHEV + mild hybrid HEV) reached 64%, second only to Singapore's 66%. Vietnam also reached over half at 51%, while Indonesia and Malaysia were both below 50%, and the Philippines was only 28%.

If we only consider pure electric or pure electric + plug-in hybrid, Thailand leads with an absolute advantage of 50%, with pure electric accounting for 31%; Singapore has a higher proportion of mild hybrids at 36%, so pure electric + plug-in hybrid only accounts for 26%.

Image | Proportion of new energy vehicles and Chinese vehicle sales in major Southeast Asian countries

Our local guide, Mr. Lin Bingkun, helped us drive the right-hand-drive Aion Y. From his skilled and efficient driving style, we could immediately see that he had extensive experience driving electric cars.

“I like cars with good handling, I used to drive a BMW 320,” Mr. Lin opened up the conversation. He is a Thai immigrant of Fujian descent with a natural talent for business. In addition to local trade and business translation services in Thailand, he also owns a fruit ice cream business in Guangzhou and comes from a relatively wealthy family. However, his new ride surprised everyone – a BYD Dolphin pure electric car.

On the one hand, he still appreciates the Dolphin's handling and praises the superior acceleration of pure electric vehicles. On the other hand, due to the sluggish trade business, he is also considering increasing revenue and reducing costs – increasing revenue by doing business translations and reducing costs by switching from the thousands of Thai baht in monthly fuel costs for his BMW to just 3,000 Thai baht in charging expenses for the Dolphin, while also saving on maintenance costs.

“This is the character of the Thai people, daring to try new things, which is very good for us (Chinese new energy vehicles),” Ma Haiyang, General Manager of GAC Aion Southeast Asia and GAC Aion Motor Manufacturing (Thailand) Co., Ltd., accepted our interview in the office building at Sathon Plaza. “Thai consumers, especially young people, tend to have more positive feedback towards bright colors.”

Senior executives from automakers such as SAIC MG, Great Wall, and Changan also unanimously mentioned this point.

Therefore, new energy vehicles with fast acceleration, good intelligence, strong technological sense, personalized exterior colors, and low ownership costs, like brightly colored clothing with a tropical style, are quickly accepted by Thai people who love life and boldly consume.

The desire to try new things and personality traits are internal factors for consumers, while the economic environment and policy incentives are explicit external factors.

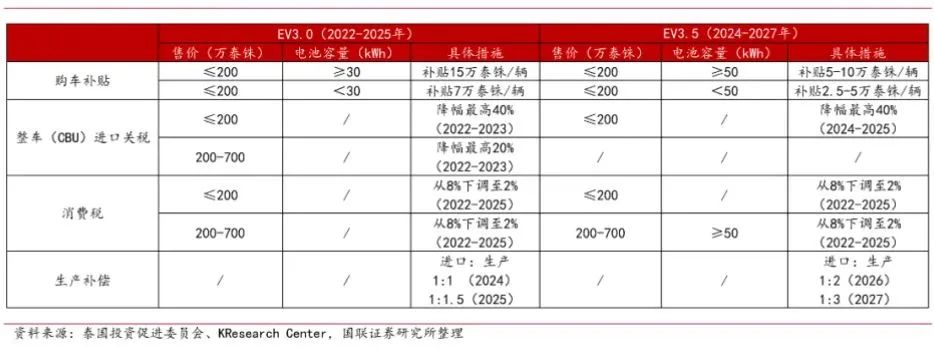

Image | Thailand's new energy policy

Starting from 2022, Thailand has continuously introduced incentives for new energy vehicles. The years 2022-2025 are designated as the EV 3.0 phase, and 2024-2027 as the EV 3.5 phase. Models that meet the criteria for selling price and battery capacity can receive a subsidy of up to 150,000 Thai baht (RMB 30,000), with the consumption tax reduced from 8% to 2%. In addition, there are import subsidies and production compensation.

“Therefore, Japanese cars have mainly lost ground in the new energy sector, which is almost another microcosm of the Chinese market,” Mr. He sent me a report from Dataxet, a Southeast Asian consulting firm headquartered in Malaysia.

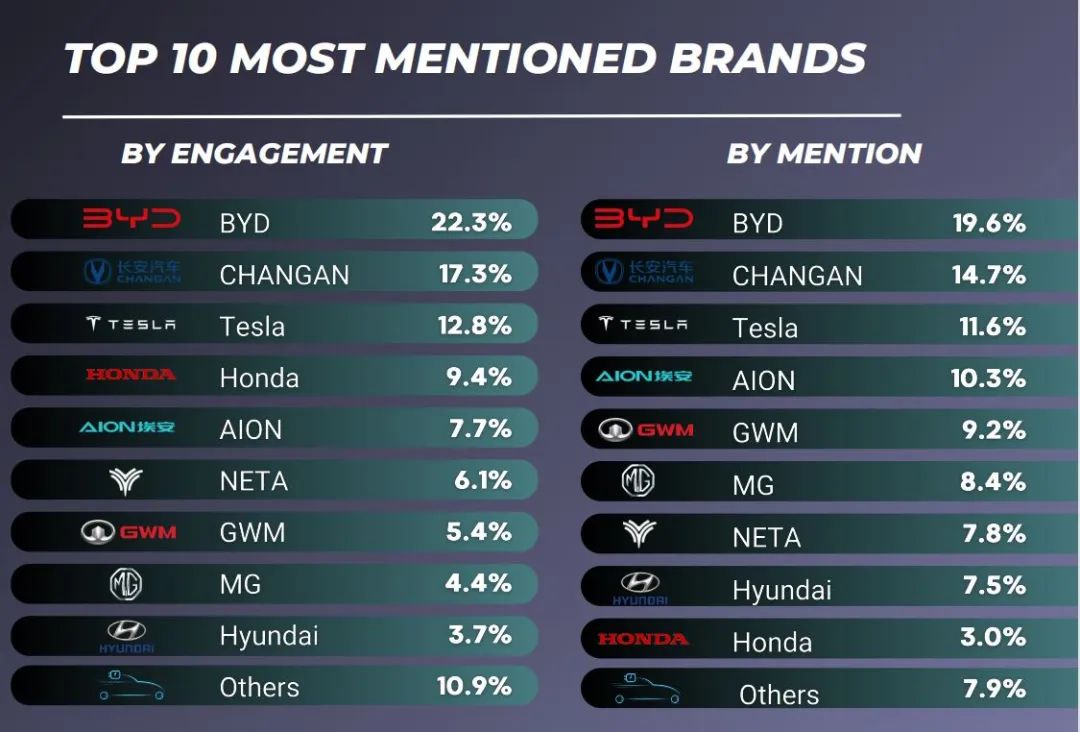

Chinese new energy brands are very popular in Thailand. Whether in offline encounters or online mentions, BYD and Changan both occupy the top two spots among the top 10 new energy brands, with Tesla only ranking third. Following closely behind are Aion, Great Wall, MG, and Nezha. Six out of the top ten spots are occupied by Chinese automakers.

To my surprise, Huawei HarmonyOS-powered AITO and Xiaomi cars have also gradually gained attention in the Southeast Asian regional market.

In a street interview, the interviewed Bangkok young man Kunle even proactively mentioned the informal term “Huawei Auto” and held up his P60 Pro, describing how he queued up to buy it when it was launched in Thailand. “So if Huawei Auto comes to Thailand, of course, I want to buy it, as long as the price is not too expensive,” he said.

However, the “electrification” trend has not only brought market opportunities to Chinese automakers but also challenges and tests.

According to data from the Thailand Electric Vehicle Association, the ratio of new vehicle sales to new charging piles in Thailand in 2023 was 1:18.8, far lower than the domestic ratio of 1:2.4. The shortcoming of supporting facilities, coupled with the policy rollback, has led to a decline in the penetration rate of pure electric vehicles in 2024.

Shen Xinghua, General Manager of Changan Automobile's Southeast Asia Business Department, told Autohome that in the short term, most new energy vehicle consumers in Thailand are concentrated in large cities, where private charging piles are easily arranged. “We provide charging piles and installation services to our customers for free, and from the daily usage scenarios of most customers, it's actually not a big problem,” he said.

However, in the long run, supporting facilities are still an indispensable link. “Drawing on China's development experience, we have invested heavily in infrastructure,” explained Tao Xunsheng, Director of Nezha BGAC Bangchang Factory. Although Nezha has chosen a “light model” for production and manufacturing, it is not vague about infrastructure investment. “Charging piles will be installed at gas stations and shopping malls.”

By 2030, Thailand aims for an electric vehicle penetration rate of 30%, and infrastructure still needs to be improved rapidly. Correspondingly, the new energy safety system, supply chain, and financial system still have a long way to go.

Are Japanese cars afraid? “We are more reliable”

In the face of the influx of Chinese cars into Thailand, are Japanese cars afraid?

This was a hotly debated topic both around me and in cyberspace before we set out.

“I'm used to driving Japanese cars,” said Chaichai, a dark-skinned Thai who spoke English with a strong accent, but this was already the best way for us to communicate. He gestured with his hands, afraid we wouldn't understand. “My family needs to carry cargo, so a pickup truck is suitable. I've been using a D-MAX for 7 years.”

Obviously, Chaichai, whom we encountered by chance in a small restaurant in Rayong Province, and the white-collar workers warmly embracing Chinese electric vehicles in Bangkok's CBD are almost entirely different groups of car users.

During the street interviews, we found that older users in remote areas tend to prefer gasoline cars, and among gasoline cars, Japanese brands are naturally the first choice.

Combining Chaichai's story with existing data, we can see that Japanese cars have been dominant in Southeast Asia for many years. The first successful factor is that they started early and worked hard. As early as the 1960s, Thailand announced a 50% tariff reduction for CKD auto components, and Japanese automakers began entering the Southeast Asian market, with Toyota, Honda, and others setting up factories.

In the 1970s and 1980s, the industrialization process in Southeast Asia drove economic growth and consumer demand for cars. Japanese cars capitalized on this opportunity. European and American automakers, who started two decades later, naturally lost the initiative.

In addition to the historical and cultural ties between Japan and Southeast Asian countries, other success factors include the fuel efficiency, excellent service, and personalization and customization strategies of Japanese cars. Whether it's the ubiquitous repair facilities, excellent resale value, or models like the Honda BR-V, which accommodates seven seats in a 4.4-meter-long body, adapting to the small parking spaces and large families in Southeast Asia, these factors have made the Southeast Asian market a “backyard” and “fortress” for Japanese cars.

Image | Honda BR-V

How do Japanese automakers view Chinese cars in the Thai market? We sought answers from several dimensions, including automakers, dealers, and suppliers.

“Chinese cars driven by electricity do have advantages in power and acceleration, and they are also more intelligent,” admitted an employee of a local Japanese automaker. “Japanese cars will do better in terms of vehicle maintenance and battery warranty. And a car should first and foremost be a car. No matter how intelligent it is, if it breaks down on the road, it's very dangerous. Reliability is still our strength.”

Obviously, reliability/failure rate, service network distribution, and historical accumulation have become the “reassurance” for Japanese cars facing the onslaught of Chinese cars in Thailand.

The NakornRayong Toyota store in Ban Chang District, Rayong Province, is a relatively flagship Toyota 4S store in the area. The showroom is filled with a variety of models, from the Camry and Hilux REVO pickup truck to various SUVs. We posed as employees of a Chinese company's Thai subsidiary to visit the store.

“Our boss likes the BYD Dolphin, and the boss's wife likes the Camry. What do you think are the strengths of Chinese cars and Toyota cars?” I found an excuse to try to get the salesperson's opinion on Chinese cars.

“Toyota has the highest market share in Thailand and has over 70 service centers in the country. This service and system advantage is something that Chinese brands cannot match,” the salesperson said, as expected. Among Japanese 4S store employees, Toyota salespeople exhibit the best professionalism and work efficiency closest to Chinese brand stores, and the display cars are also in the best condition. However, when comparing Chinese and Japanese cars, the salesperson still avoided the core dimension of product capability and repeatedly mentioned advantages such as the number of stores and reliability.

The neighboring Mitsubishi store is much smaller than Toyota's, and the salespeople's work enthusiasm is also noticeably lower. When we first walked in, it almost felt like they were about to close. It seemed that they only regained some vitality when they saw us arrive.

There were only three cars in the Mitsubishi showroom. Two were XPANDER CROSS models in different colors, an MPV that resembles an SUV, and a pickup truck. However, except for the high-end models, the interiors of other models used a lot of plastic, and the smell inside the cars was unbearable.

“Compared to Chinese cars, these models feel more like they're from over a decade ago,” our colleagues and a Chinese customer in the store reached similar conclusions.

Faced with the same question of comparing Chinese cars, the Mitsubishi salesperson was obviously not as eloquent as the Toyota employee and could only repeatedly calculate fuel efficiency. “19 kilometers per liter, which comes out to a little over 5 liters per 100 kilometers…”

Among all the stores, Honda was the most popular, and at least two groups of customers came in while we were there. It's no wonder that Honda, which has seen the lowest year-on-year decline among Japanese brands in recent years, has new Accords that are so popular that there are no cars in stock. Only the CR-V and a bunch of small Fit-like cars remained in the showroom.

It was precisely Honda, the most popular Japanese brand, that leaked the secret that it was shaken by the onslaught of Chinese cars.

Generally speaking, Japanese cars in the Thai market, especially Honda, rarely offer significant discounts except during the November auto show (Thailand has four major auto shows a year, with April and November being the most important).

As Chinese automakers kick off a price war in the Thai market, Japanese automakers, initially arrogant and detached, are gradually being forced to join in.

Honda sales representatives told us that Japanese automakers are now engaged in a price war as well: “This year, Honda made a decision to potentially advance price cuts due to the significant price reductions by Chinese automakers led by BYD.” Such a move is unprecedented for Honda.

Chinese auto brands that have undergone the “hellish crucible” of the Chinese market possess not only strong product capabilities but also a marketing prowess that provides a dimensional advantage.

At Nezha's Srinakarin flagship store in Samut Prakarn, Thailand, we witnessed a lively Nezha X launch and fan meetup. From pre-event performances to enthusiastic fan participation, efficient lead generation, and ripple effects, “These tactics are routine in China but are truly novel weapons in Thailand!”

While the focus on fan economy for users has already led to concerns about excessive fandom in China, it is still in its infancy abroad, with early dividends being reaped.

Shu Gangzhi, Vice President of Nezha's Overseas Business Unit and General Manager of Nezha Thailand, recalled the Bangkok Auto Show on March 25, where Nezha V II was launched with a user event titled “letter HOMECOMING.” Despite being a weekend, 200 invited fans, including those from other provinces, actively participated and voluntarily contributed 298 potential customer leads without being asked.

“Stemming from recognition of our products and love for our brand, these activities were spontaneous, making us feel the friendliness of our customers,” remarked Shu with emotion.

“For China at this stage, it's about brand globalization,” commented Chong Baoyu, General Manager of Great Wall Motor Thailand. Clearly, to pose a genuine threat to Japanese automakers, Chinese automakers must do more than just deliver vehicles.

Price War and the Pitfalls of Motorcycles

At a highway rest stop in Thailand's Prachuap Khiri Khan Province, a BYD dealership prominently displayed an advertisement for the “ATTO 3” (domestic Yuan Plus).

Photo | A transport truck filled with Dolphin electric vehicles, with a BYD ATTO 3 billboard in the distance

As we stopped for lunch at a nearby McDonald's, a transport truck slowly drove by. However, it was not carrying ATTO 3s but rather BYD Dolphins, which have gained popularity in Europe.

“The Dolphin platform is actually very good, but it hasn't received as much attention in China as it deserves. Its characteristics are more appealing to Europeans,” we discussed the Dolphin's situation in Thailand with representatives from BYD, SAIC, Great Wall Motor, Aion, and other automakers. Clearly, BYD preferred to focus on product capabilities, while competitors inevitably mentioned pricing.

In June, the price of the Dolphin in Thailand was significantly reduced, with the 44.9 kWh standard range version dropping from 699,900 to 559,900 Thai baht (a reduction of approximately RMB 27,700), and the 60.5 kWh long-range version decreasing from 859,900 to 699,900 Thai baht (a reduction of approximately RMB 32,000).

While some competitors believe the Dolphin price reduction was aimed at clearing inventory, it is clear that locally produced Dolphins in Thailand will also be priced similarly. On July 4, BYD held a ceremony in Rayong, Thailand, to mark the completion of its Thai factory and the rollout of its 8 millionth NEV, which honor was bestowed upon the Dolphin.

The motivations for NEV price reductions can be broadly classified into positive and negative factors. Positive factors primarily stem from the maturity of the NEV supply chain, technological and process advancements, and the amortization of initial costs through economies of scale, potentially leading to cost reductions. Negative factors involve vicious competition, with players resorting to loss-making strategies akin to the early days of e-commerce, where competitors burned cash to drive out rivals and establish dominance through low-price dumping.

With a starting price in Thailand of over RMB 110,000, close to its domestic price, the Dolphin has dealt a severe blow to a range of compact and small cars, including Chinese brands like Nezha V II and Japanese models like the Honda Fit, City, and Yaris, all of which have seen recent sales plummet.

“How do we spill over Chinese brands overseas? NEVs can serve as a viable vehicle,” affirmed Chong Baoyu, emphasizing the importance of NEVs for Chinese automakers going global while also highlighting the necessity of price stability. “If you want to build a brand, price stability is essential.”

Photo | Japan criticizes high inventory of electric vehicles in Thailand

Indeed, SAIC, Aion, and Great Wall Motor have all stated they will not engage in price cuts, which may result in short-term market share erosion.

Industry insiders can easily recall the “unity” and “division of labor” among Japanese automakers during their globalization efforts and lament the infighting among Chinese automakers.

“The so-called unity and division of labor among Japanese companies are not inherently moral advantages or efficiency strengths but are determined by the conglomerates behind them. The six major monopoly conglomerates of Mitsubishi, Mitsui, Sumitomo, Fuji (Fuji Heavy Industries), Sanwa, and Dai-Ichi Kangyo Bank control Japan's economic lifeblood,” noted Mr. He, revealing the complex truth behind the facade. “Chinese automakers are often supported by local governments, making them appear more decentralized.”

Each model has its pros and cons. Japanese automakers can coexist peacefully through unity and division of labor, while Chinese automakers' aggressive competitiveness and penetration power are unmatched but can lead to excessive internal consumption that requires stronger top-down regulation to curb. “During the transition period, Chinese automakers' ‘demonic disintegration technique’ can achieve rapid results, but long-termism requires a shift to Robust path and strategy ,” Mr. He did not completely negate aggressive competition but did not consider it a sustainable strategy.

Then, can Chinese automakers avoid a price war in the Thai market and prevent a repeat of the downfall of Chinese motorcycles in Southeast Asia, where they initially flourished but eventually retreated due to low prices and quality?

Drawing on the experience of SAIC MG, a “veteran elder brother,” holding two aces can help avoid the fate of Chinese motorcycles.

The first is “technology labels and product capabilities.”

“Chinese automakers have achieved great success in the ASEAN region, and our victory is not just about quantity but about winning the market with technology,” said Sudirawa, exuding confidence. “In the EV industry, they all mention that European and Japanese automakers cannot match our Chinese technology; we are very advanced.”

“SAIC in Thailand is not just selling EVs but also ICE fuel vehicles, hybrids, and EVs across various segments and models. Many people may think Japanese automakers still dominate the Thai market, but their decline is inevitable.”

The second is “localization of the supply chain system.”

Sudirawa told Auto Society that the first stage is for the Thai market to accept the entry of Chinese automakers, and the second stage is to localize EV production in Thailand, including supply chain matching.

To this end, SAIC-CP becomes the first Chinese automaker to deeply localize battery production in Thailand. Yang Ming, Director of the Manufacturing Department at SAIC-CP, led the Auto Society research team on a tour of the entire factory, including the battery workshop.

“We produce SAIC's Magic Cube batteries, which rolled off the line at the end of November 2023. Vehicle mass production began in March, followed by the launch. We produce 49 kWh LFP batteries and 64 kWh NCM batteries, corresponding to standard and long-range models with driving ranges of 425 km and 520 km, respectively,” Yang Ming recounted the entire process intimately.

According to Yang Ming, the depth of processing is impressive, encompassing cell assembly into modules, module assembly into battery packs, and completion of testing before supplying to the final assembly line.

Aion emphasized attention to detail. According to Ma Haiyang and other Aion employees, when entering the Thai market, NEVs must undergo steering wheel changes and adjustments to accommodate local conditions, such as increased air conditioning power and modified wiper designs for the hot, humid, and rainy climate.

“Even the differences in road camber curvature cannot be ignored as ADAS calculations may deviate,” hearing Aion's meticulous analysis of user needs and local characteristics strengthened our confidence in Chinese automakers' footing in Thailand.

Chinese automakers are indeed adept at finding joy amidst adversity and positivity amidst negativity. Even the price war itself is seen positively by some like Shu Gangzhi.

Nezha acknowledged that its V II model is being squeezed by the Dolphin but also noted that Toyota Yaris, Honda City, and Fit are similarly price-matched. “Thai consumers have different segments, with budget being the primary consideration in purchase decisions, followed by product and then service benefits,” said Shu Gangzhi, adding that competition spans multiple dimensions. “We've made adjustments, including minor price tweaks and enhanced benefits.”

From competing against the Mazda 2 to now rivaling the Dolphin and Yaris, “we've passively shifted from second-tier to first-tier competition.”

Beyond market and industrial factors, new energy policies like EV 3.0 and EV 3.5 are formulated in consultation with electric vehicle association officials like Sudirawa. “There is a dedicated association in the Thai automotive industry, and everyone supports them as leaders. An essential task is to educate the government on the industry, enabling them to accept and formulate more favorable policies for us.”

Thus, while Chinese automakers in Thailand cannot yet claim victory, their path is certainly not the same as that of motorcycles in the past.

Promised Land X, “Thai Peace and Prosperity” √

As we drove on the Chalerm Mahanakorn Expressway, familiar names suddenly appeared on towering billboards on both sides of the road—BYD ATTO 3 and Great Wall Tank 300. Remarkably, both popular models flaunted a “triple billboard” display, creating a unique landscape.

The Chinese armada has arrived! However, Chinese automakers venturing overseas will differ from Western companies, imbued with an Eastern flair and Chinese style.

Yes, we recognize the importance of going global, especially for manufacturing and, in particular, the automotive industry.

While many disagree with Milton Friedman's “laissez-faire capitalism,” his observation merits contemplation: “The greatest danger facing consumers is monopoly—whether private or state-owned. Their most effective protection lies in domestic free competition and global free trade.”

Amid a global backlash against globalization, our country remains committed to promoting a dual-circulation economy and prioritizing exports. The automotive industry plays a pioneering role in going global.

For China to rise, its manufacturing sector must thrive. For China to achieve global influence, its manufacturing must reach global markets. The automotive industry, the crown jewel of manufacturing, must lead this charge. Therefore, Chinese automakers are intensifying their efforts to go global to achieve global market coverage.

In choosing overseas markets for Chinese automakers, Southeast Asia tops the list, followed by North America (where entry can be indirect through Mexico), Europe (which was once a honeymoon period but now poses challenges), Africa (with relatively weaker consumer power), and Eastern Europe and the Middle East (which already contribute significantly).

Comprehensively considering market potential, political relations, and manufacturing capabilities, Southeast Asia is crucial, not just as a regional market but also as a manufacturing hub radiating to right-hand drive Commonwealth countries.

Thailand and Southeast Asia, while seemingly a “promised land flowing with milk and honey” in biblical terms, are not China's “promised land” in the sense of colonial conquest or dumping. China faces numerous challenges and must earn its market share through hard work and innovation.

The background of Confucian culture determines that when Chinese automakers set sail for overseas markets represented by Thailand, they are not there to dump low-quality, low-priced products, but to bring high-quality products, technology, an ecosystem that integrates brand and service systems, supply chains, and even entire industries, achieving true collaborative development.

As the world's balance tilts back towards the eastern hemisphere, the eastern automotive camp will compete to emerge as the true leader. The West, from inventing the automobile to leading the first industrial revolution, has long held an absolute voice in the industry. While Japanese cars can leverage lean production to capture the beginnings of the second industrial revolution, they are gradually falling behind in the new round of electrification and intelligentization revolution. Chinese automakers have turned around quickly but lack sufficient brand recognition and global experience.

Who will break the Western world's dominance in the automotive industry? It is a consensus in the industry that there will inevitably be a battle between Chinese and Japanese automakers in Southeast Asia. However, this battle will determine the landscape of both camps and even the global industry.

Going overseas is the only way forward, and while the journey may be thorny, the destination holds gold. Only by conquering Southeast Asia and achieving "peace and prosperity" can Chinese automakers hope to defeat Japanese automakers and usher in a global "golden age".