TCL's Li Dongsheng Returns to the Same River: Caution Required in Acquiring LGD's Guangzhou Production Line for Over Ten Billion

![]() 08/07 2024

08/07 2024

![]() 499

499

Written by Leon

Edited by cc Sun Congying

Flashback to the end of 2009, TCL Group's founder Li Dongsheng had already envisioned shedding the label of 'Color TV King.' The first Chinese-built 8.5G LCD panel production line, invested in by TCL, had just commenced operations.

Meanwhile, China's national plans to revitalize the electronic information industry and color TV industry were in full swing. Hefei, Guangzhou, Suzhou, Chengdu, and Nanjing submitted high-generation LCD panel project materials to China's National Development and Reform Commission (NDRC) and Ministry of Industry and Information Technology (MIIT). The technology and investment partners for these projects were BOE, LG Display (hereinafter referred to as 'LGD'), Samsung, Foxconn, and Sharp, respectively. It was widely anticipated in the industry that due to capacity regulation factors, only two of the five projects would ultimately be approved, colloquially known as the '5 choose 2' scenario.

According to China's national plans, the introduction of foreign capital must bring more advanced technology that empowers China's market. Competition among the five candidate lines was intense.

It wasn't until December 1, 2010, after nearly a year of screening by the NDRC, that the results of the '5 choose 2' for high-generation LCD panel production lines were made public. Samsung and LG's joint venture high-generation lines in Suzhou and Guangzhou, respectively, had officially received NDRC approval.

This approval was also significant for Li Dongsheng and his classmate Huang Hongsheng, who led Skyworth Group. Li and Huang were among the first batch of candidates after the restoration of the college entrance examination. Benefiting from this, they changed their destinies and became instinctively sensitive to policies. Under the electronics revitalization plan, TCL and Skyworth sought a piece of the pie. Consequently, TCL invested in Samsung's Suzhou project, while Skyworth became a participant in LG's Guangzhou project.

TCL Secures First Right of Refusal for LGD's Guangzhou 8.5G Line

At the time, LGD was already the world's second-largest LCD panel producer, with a market share of approximately 25% globally, second only to Samsung of Korea, according to the latest statistics available.

TCL Group, which had just begun to focus on upstream development, was still a minor player in the panel display industry, struggling to play a minor shareholder role in high-generation joint venture projects. Compared to Samsung and LGD, TCL had a long way to go. At the time, Li Dongsheng might not have anticipated that 13 years later, TCL would secure first right of refusal for a project it once admired and potentially become the leading force behind it.

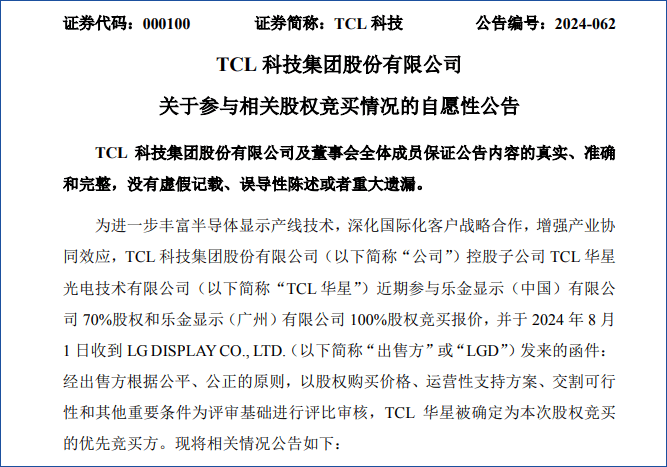

On August 2, TCL Technology (000100) announced that its subsidiary TCL Star would acquire a 70% stake in LG Display (China) Co., Ltd. (hereinafter referred to as LG China) and a 100% stake in LG Display (Guangzhou) Co., Ltd. (hereinafter referred to as LG Guangzhou). TCL Star was designated as the preferred bidder for this equity auction.

According to the announcement, LGD directly and indirectly held a total of 70% of LG China's equity, while the Guangzhou High-tech Zone Technology Holding Group Co., Ltd. held 20%, and Shenzhen Skyworth-RGB Electronics Co., Ltd. held 10%. In the case of LG Guangzhou, LGD held 100% equity.

Based on the equity acquisition ratio, the total net assets acquired by TCL Star in this transaction will exceed RMB 10 billion.

It is reported that LG China and LG Guangzhou are respectively responsible for an 8.5G LCD panel production line and a supporting module factory, with revenues of RMB 6.334 billion and RMB 11.86 billion in 2023, and net assets of RMB 11.802 billion and RMB 2.839 billion, respectively.

As of the announcement date, TCL Star had not yet reached a binding agreement with the seller regarding this transaction, and there was uncertainty as to whether the acquisition would ultimately be implemented. If a final transaction agreement is reached, TCL Star expects to fund the acquisition with its own funds or self-raised funds.

Production Line Revenue Declines by Over 40%, Yet Buyers Remain Eager

The LG Guangzhou project, as a winner in the '5 choose 2' competition, is highly renowned. As the world's second-largest panel manufacturer, LGD has multiple high-generation production lines and substantial technical expertise. At the time, the Guangzhou Development Zone not only had LGD's largest LCD module project but also a joint venture partner in Skyworth with an annual production capacity of over 3 million flat-panel TVs, providing a cost advantage from a nearby industrial chain perspective. Furthermore, the combined TV shipments of Skyworth and LG amounted to 20 million units, providing stable demand support for the project. These were key factors in the project's success.

However, the profitability of this production line fell short of expectations. In 2023, LGD's LCD panel business revenue in China declined by 41% year-on-year, contributing to a 20.4% expansion of its parent company's revenue loss, reaching approximately RMB 13.455 billion. Consequently, LGD was eager to divest its LCD business line to reduce expected losses for the year.

Senior home appliance industry analyst Liu Buchen pointed out that part of the reason for the decline in profitability was due to a reduction in internal demand within the LG Group. LG Electronics' TV business had been surpassed by Chinese companies, reducing its own demand for panels.

Meanwhile, its joint venture partner Skyworth has seen a steady decline in its core business in recent years. The direct reduction in demand from these two downstream enterprises has significantly impacted the shipment volume and profitability of the Guangzhou 8.5G line.

In fact, Korean companies' plans to divest LCD production lines had been in the works for some time, with Samsung taking earlier action than LGD. (For details, see: Exclusive: Samsung Display to End 30-Year LCD Business in June) On LGD's side, as early as 2022, there were intentions to sell its LCD panel factory in China (also its last remaining LCD production line globally) to focus on OLED technology development.

However, even though it is currently experiencing a decline, LGD is unwilling to make significant concessions on price. Despite this reluctance, Chinese buyers remain eager. (For details, see: Clinging to Apple, LGD Turns a Profit in a Single Quarter)

Previously, The Korea Economic Daily reported that LGD had received letters of intent from BOE, TCL Technology, HKC, and financial investors, with a transaction partner expected to be selected as early as the first half of this year. Currently, TCL Technology has a strong chance of acquiring the assets, and the landscape of the panel industry is poised for some changes. (For details, see: Panel Enterprises Endure Harsh Times)

Demand for Large-size LCD Panels Still Exceeds OLED

From a display technology perspective, LCD has clearly passed its peak, lagging behind OLED in terms of image quality and light leakage. OLED TVs, or organic light-emitting diode TVs, have a simpler display structure that does not require a backlight, resulting in thinner, lighter, and flexible displays. In theory, OLED displays can be attached to any transparent or irregular object surface, providing a feasible solution for a future world where displays are everywhere. So why are domestic panel companies still eager for LCD, a seemingly outdated technology?

The reasons mainly encompass two aspects: market demand and panel manufacturers' business and strategic directions.

Before 2019, there was a prevalent belief in the industry that 'not doing OLED means falling behind.' No downstream company wanted to miss out on new development opportunities. This sentiment was particularly strong among participants in LGD's Guangzhou 8.5G line, such as Skyworth, which vocally supported OLED development and invested heavily.

The outbreak of COVID-19 at the end of 2019 marked a turning point. During the three-year pandemic, civilian exchanges and cross-border trade between China and Korea were severely impacted. LGD became less visible in marketing, and the market it had spent years cultivating was gradually forgotten. OLED all but disappeared from public view, and Skyworth was often ridiculed in the media for 'betting on the wrong horse.' (For details, see: Has OLED TV Disappeared in 2022?)

The fall of 2022 was particularly dark for the OLED industry. With no end in sight to pandemic lockdowns, Chinese TV manufacturers launched Mini LED products, giving each company a sense of control over the entire supply chain. In September 2022, Ouyang Zhongcan, an academician of the Chinese Academy of Sciences, commented that 'Hisense's ULED X display technology surpasses OLED in image quality,' effectively concluding that OLED's advantages had been fully overshadowed. According to Omedia data, unit shipments of large-size OLED panels decreased by 8.4% year-on-year in 2022.

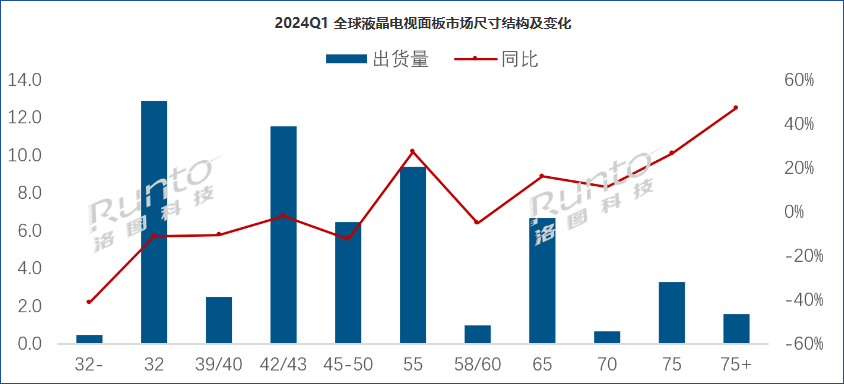

In contrast, the LCD market is experiencing a cyclical upturn this year, particularly for large-size panels. Data from RUNTO shows that global shipments of large-size LCD TV panels reached 56.5 million units, up 1.3% and 11.3% year-on-year and month-on-month, respectively. Shipment area reached 41 million square meters, up 9.6% and 5.6% year-on-year and month-on-month, respectively.

Among them, 55-inch shipments increased by 27.2% year-on-year, accounting for 16.6% of the market share, the largest growth among all sizes; 65-inch and 75-inch shipments increased by 16.1% and 26.5% year-on-year, respectively. Meanwhile, although 32-inch and 42/43-inch models held higher market shares, they both experienced year-on-year declines. This phenomenon suggests that consumers prefer to purchase large-size LCD TVs above 50 inches.

In addition, combining monitoring data, RUNTO predicts that LCD TV panel shipments will increase by 3% in the first half of 2024, with mainstream sizes such as 55 inches continuing to grow, given the stable operation of the end market without significant stimulus.

In contrast, global OLED TV shipments declined by 6% in the first quarter of 2024 (Counterpoint Research data). The global economic downturn and high prices of large-size OLED TVs have steered consumers towards more cost-effective LCD TVs (including LED backlight models). However, in mobile phones and tablets, OLED panels are still growing. Ma Cong, a long-time observer of the display industry, believes that to objectively assess the potential of OLED development, it is necessary to distinguish between the Chinese and global markets. The Chinese market has its particularities. He specifically cited figures showing that large-size OLED has a penetration rate of 10% in the global market but only 3% in China. An important manifestation of this particularity is that China's TV market is determined by the supply side, i.e., the upstream.

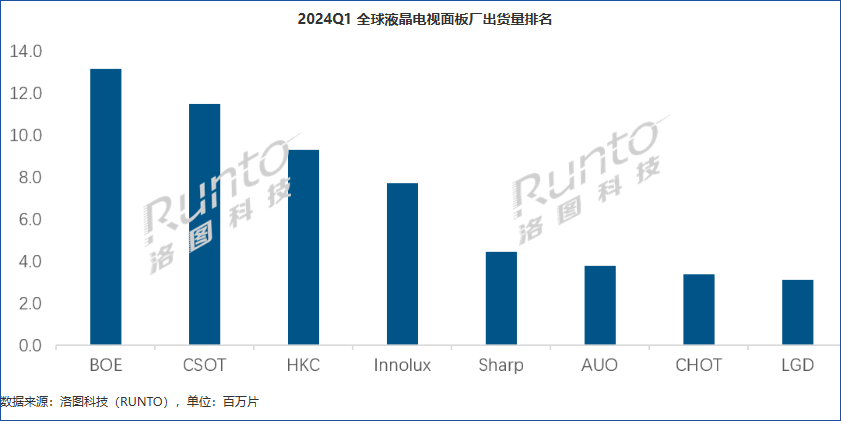

In other words, upstream panel manufacturers dictate the direction of industry trends and define downstream manufacturers' product strategies. In the LCD market, BOE, TCL Star, and HKC rank first to third in shipments, accounting for over 65% of the global market share. In the large-size OLED panel market, Samsung alone holds over 50% market share, while LGD holds approximately 33%, Hefei BOE Optoelectronics holds around 10%, and BOE holds only 3%. Overall, Chinese companies aim to extend the lifecycle of LCD and curb the growth of OLED.

Combining the above data, it is not difficult to see that BOE, TCL Star, and HKC's core strengths lie in the LCD field for large-size panels. Although all three companies have developed OLED businesses to varying degrees, they are currently focused on small-size products. Continuing to develop large-size LCD businesses can both meet market demand and constrain competitors like Samsung.

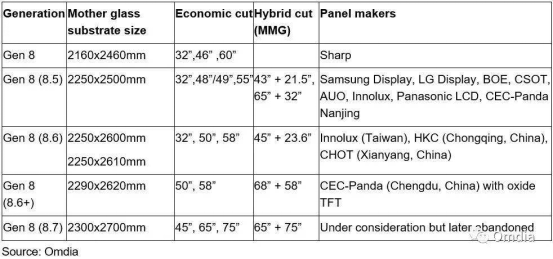

From a technical perspective, the 8.5G LCD panel production line belongs to the 8th generation, with a substrate size of 2250mm*2500mm. Through economic cutting and MMG hybrid cutting methods, it can produce panels of various sizes such as 32, 43+21.5, 48/49, 55, and 65+32 inches, offering high adaptability.

According to an AVC Revo report, LGD's Guangzhou 8.5G factory will achieve full capacity this year, with annual production increasing to 15 million units and having completed depreciation. Its customers include Samsung, KTC, LGE, Skyworth, etc., and it is expected that these customers will be taken over by the acquirer. Overall, the cost-effectiveness of LGD's Guangzhou factory is very high.

Determined to Succeed, Raising Prices to Cater to Sellers

In several exclusive interviews with the founder of Wall Street Tech Eye, Li Dongsheng expressed his obsession with learning from Samsung to build a comprehensive industrial empire, and TCL and he himself have been determined to succeed in acquisitions. Motivated by this goal, TCL has always been determined to succeed in the acquisitions it pursues. In the competition for LGD's Guangzhou factory, TCL once again demonstrated the decisiveness it showed when acquiring Homa Appliances. (For details, see: Homa Appliances and TCL: Promising to Rescue Each Other)

It is understood that at the beginning of the year, LGD quoted approximately KRW 1 trillion (approximately RMB 5.28 billion) for the two factories. However, as LCD TVs sold well in the first half of the year and panel prices continued to rise, LGD repeatedly delayed the sale. Industry insiders analyzed that LGD was pressuring potential buyers to increase the price.

Subsequently, it was reported that TCL Technology had raised its bid to KRW 2 trillion (approximately RMB 10.56 billion), which may have convinced LGD, making TCL Technology the preferred bidder.

Whether BOE has given up is unknown for now. On Skyworth's side, although it has a partnership with LGD, it has abandoned the acquisition due to price differences; HKC, which is preparing for its second IPO this year, is unlikely to divert funds and energy to compete.

If the merger and acquisition is successfully completed, TCL Star will have four 8.5G production lines, increasing its annual production capacity by at least 15 million units, potentially making it the second-largest player in the global LCD panel industry and poised to lead the sector. Liu Buchen believes that while TCL lags behind BOE in terms of capacity and output, acquiring LGD's Guangzhou project will unleash its scale advantages. Additionally, TCL places great importance on revenue scale, and acquiring this project could potentially push TCL's overall revenue scale above RMB 300 billion, which is highly anticipated by Li Dongsheng.

From an industry perspective, after LGD's exit, the concentration of the large-size LCD panel market will further increase, with the top three companies holding an unshakeable market share. This will also have an impact on mid-to-low-tier companies, such as Taiwan's Innolux and Japan's Sharp.

Zhang Hong, Deputy General Manager of the Large Size Business Department at Sigmaintell, believes that this acquisition may cause short-term turbulence in the large-size LCD panel market, leading to divergent decision-making among manufacturers. However, in the long run, further consolidation of supply is expected to stabilize the market structure, helping to mitigate industry cycle fluctuations and stabilize overall industry profitability.

Too optimistic savior?

However, the industry is also cautious about whether TCL can successfully manage production lines with significantly reduced profitability.

First, let's analyze from the perspective of industry development. As mentioned earlier, LCD is currently considered an outdated display technology. Chinese upstream manufacturers have artificially extended the life cycle of LCD, stifling the growth of OLED. However, the outbreak of new technology trends will come sooner or later. In May 2023, at the Home Expo, which had been suspended for a year, Samsung Electronics, the world's largest TV manufacturer, released the long-awaited OLED TV. At this point, the two major Korean brands have completed their technological evolution from LCD to OLED. (For details, see: Samsung Remains Samsung, Can It Revive OLED TVs?)

At this point, if TCL invests billions to acquire a heavily loss-making production line, it raises questions about whether this amounts to acquiring outdated capacity. In fact, TCL's acquisition of Thomson can serve as a cautionary tale. Twenty years ago, TCL Group announced the signing of a strategic cooperation agreement with France's Thomson Group to establish a joint venture called TCL-Thomson. Thomson was a pioneer in cathode-ray tubes. This partnership subsequently led TCL Group into losses. If TCL were to invest billions to acquire LG Display's Guangzhou factory, the situation would be similar to the Thomson acquisition, involving the acquisition of a production line with the risk of obsolescence. (For details, see: Breaking Korean Monopoly, China's First High-Generation OLED Panel Production Line to Land in Chengdu)

Whether TCL can change the situation of insufficient downstream shipments from LG Display's panel production lines through self-production and self-marketing. Zhao Jun, CEO of TCL Huaxing, proposed at the performance forecast conference that as TCL Huaxing's production lines gradually expand, the company will continue to promote the large-sizing of TV displays while vigorously developing medium-sized fields such as IT displays and small-sized products, seeking diversified and differentiated development. When LG Display's production line was first established, it was expected to have two stable demand sides in LG and Skyworth, which could maintain sufficient profitability for the production line. To turn around the loss-making situation, it is imperative to boost production and sales, but the industry environment is not ideal. According to AVC's total push data, retail sales of color TVs in China's market reached 13.51 million units in the first half of 2024, a year-on-year decrease of 7.9%. Regarding this, Liu Buchen believes: "It's too early to say whether TCL can successfully operate after the acquisition."

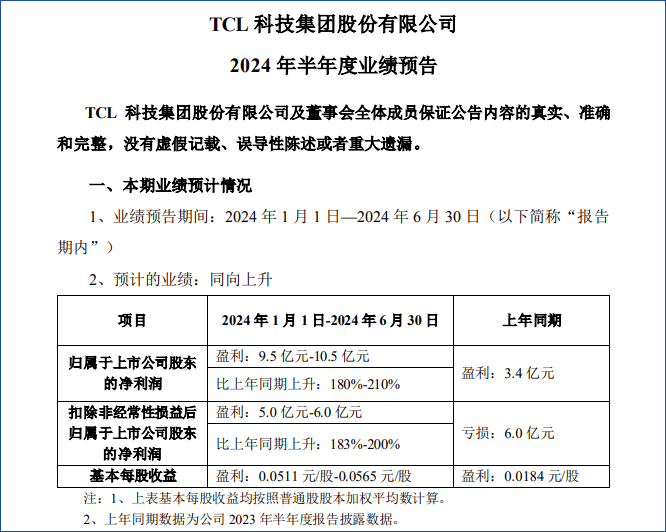

Judging from TCL's internal business planning, optimism about the acquisition's effectiveness should not be overstated. Recently, TCL Technology released its "Semi-Annual Performance Forecast for 2024," stating that thanks to the trend of larger screen sizes and continuous improvement in small-to-medium-sized businesses, operating performance has grown significantly. It is estimated that in the first half of the year, the display business is expected to achieve a net profit of 2.58 to 2.88 billion yuan, an increase of over 6 billion yuan year-on-year, with a net profit of 2.04 to 2.34 billion yuan expected in the second quarter.

Analysts at Soochow Securities believe that as the panel industry's prosperity improves, Chinese mainland manufacturers continue to increase their voice. As one of the two leaders in the panel industry, TCL Technology's profit inflection point is in sight. The company is expected to generate revenue of 192.1 billion yuan in 2024, a year-on-year increase of 10.1%, with a net profit attributable to shareholders of 4.72 billion yuan.

As TCL Technology's performance data also includes that of its subsidiary TCL Zhonghuan, the continued downturn in the new energy photovoltaic market has led to price declines, with an expected net profit of -2.9 to -3.2 billion yuan for the same period, resulting in an overall expected profit of 950 to 1050 million yuan for TCL Technology and a net profit after deducting non-recurring items of 500 to 600 million yuan.

From this perspective, semiconductor displays are the cornerstone of TCL Group, and their development prospects are currently positive. The Guangzhou Gen 8.5 line, which is expected to generate economies of scale and industrial coordination effects, is actually a double-edged sword. If the integration goes smoothly and synergy is achieved, TCL Group's semiconductor business will reach a new level. However, another possibility of the acquisition is also evident. LG Display excels over Chinese domestic enterprises in terms of technological accumulation and organizational management. Under its governance, LG Display failed to meet investment expectations. TCL has the advantage of local operations, but even so, upstream enterprises still struggle to counter the overall downward trend in the TV industry. If cash flow is tied up due to the acquisition of LG Display projects and affects performance, the group's core profitability will be severely impacted.

It has been exactly 20 years since TCL initiated the Thomson acquisition. Over the past 20 years, TCL Group has transformed from a TV king to a comprehensive technology group dominated by the semiconductor display industry. Although the industrial position has changed, the same acquisition dilemma once again confronts Li Dongsheng. To be or not to be, the management of TCL Technology must carefully consider!