Intel: The "Core" Pain of a Giant

![]() 08/07 2024

08/07 2024

![]() 525

525

From a global chip giant to the "core" pain of a giant, Intel

What has happened exactly?

Today, Securities Trader China said that Intel has never been able to enter the mainstream holdings of QDII funds over the years, and the last QDII that tentatively held Intel has already liquidated its position at the end of March this year,

This liquidation also allowed this QDII to perfectly avoid a 51% decline in four months. Good grief, so Intel is so unpopular?

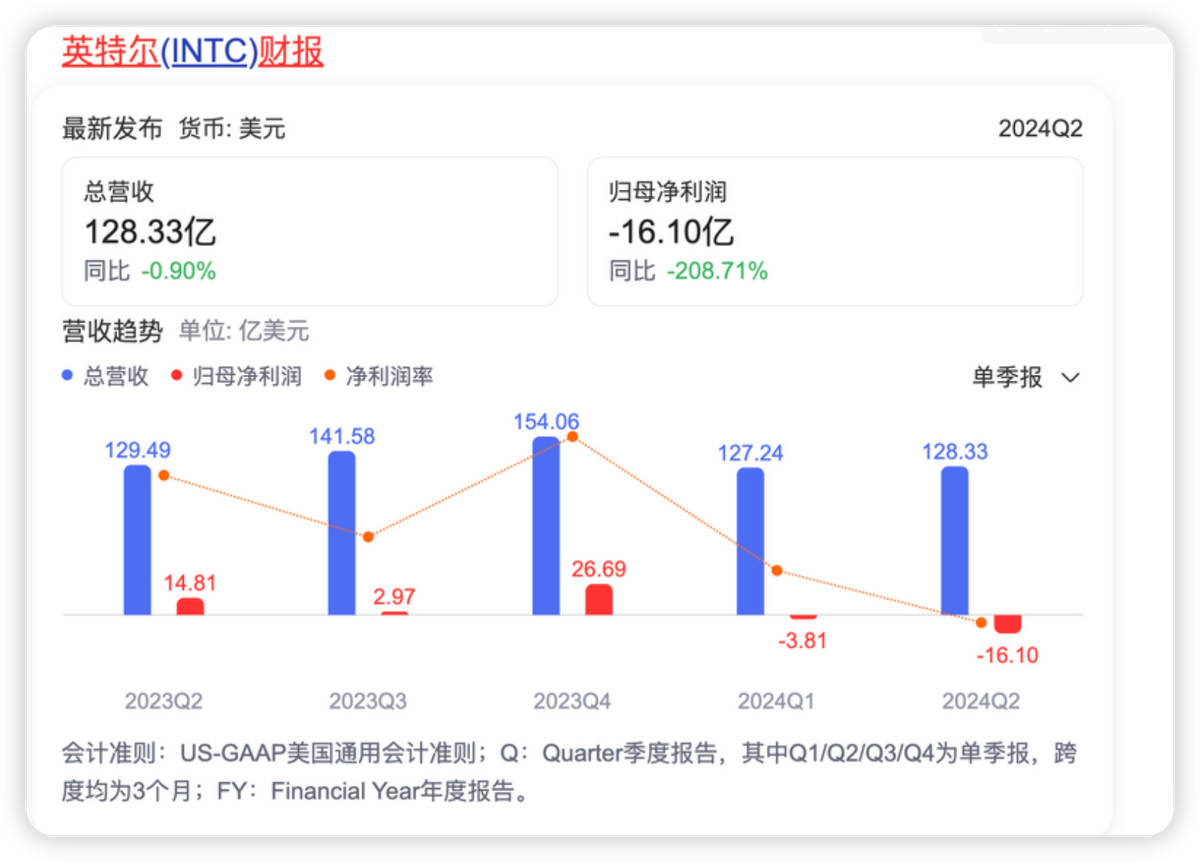

Revenue decline, turning from profit to loss, laying off 15% of employees, and a 20% drop in share price. Intel's financial report practically sentenced itself to death. Indeed, the once-glorious chip giant is now struggling with its "core".

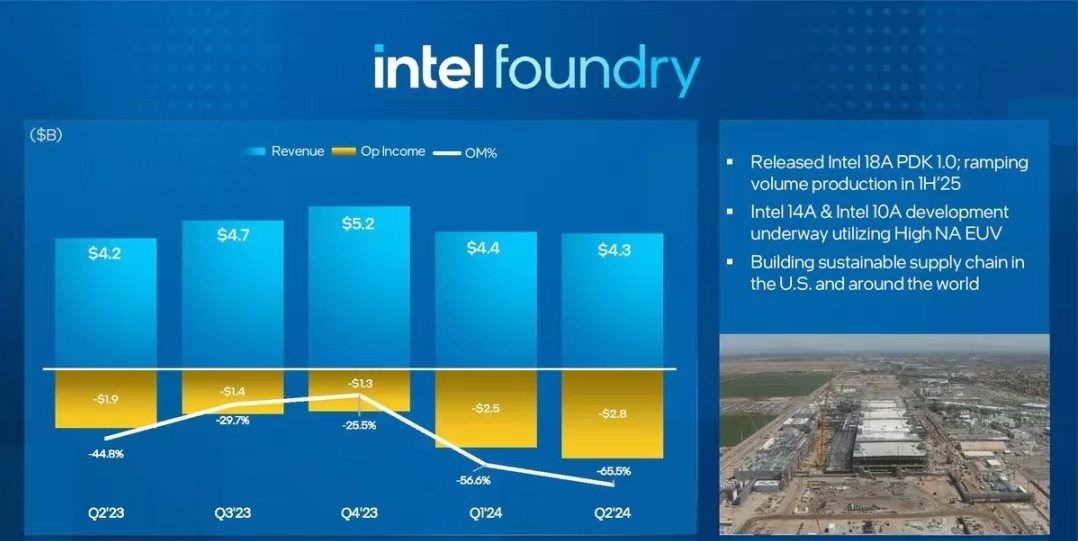

In reality, Intel's main business has not incurred a loss. The revenue of its Client Computing Group increased by 9% year-on-year to $7.4 billion. It is Intel's foundry business, which specializes in chip manufacturing, that is in an absolute state of loss. In 2023 alone, this segment incurred an operating loss of up to $7 billion, with a continued loss of $2.8 billion in the current quarter.

Unlike the prevalent "fabless" model in the semiconductor industry, where only chip design is handled and manufacturing is outsourced to foundries such as TSMC, Intel stubbornly chose the "Integrated Device Manufacturer" model, which integrates both design and manufacturing.

At the beginning of this year, Intel officially spun off its chip design and manufacturing business, establishing an independent chip manufacturing division called Intel Foundry.

However, attempting to do both has resulted in failure on both fronts. This division, which was initially intended to challenge Samsung and TSMC, has continued to incur significant losses, and the increased costs have dragged down Intel's overall performance.

In Q2 2024, Intel's revenue was $12.833 billion, a slight decrease of 1%; however, its net profit turned from a profit to a loss, incurring a significant loss of $1.654 billion.

Even though the revenue of the chip manufacturing division has maintained steady growth, Intel's swing between loss and profit over the past two years has worn out investors' patience. Under pressure, Intel has also proposed its own solutions. It is impossible for Intel to close factories, so it continues to be stubborn and chooses to cut costs and increase efficiency by turning the knife inward.

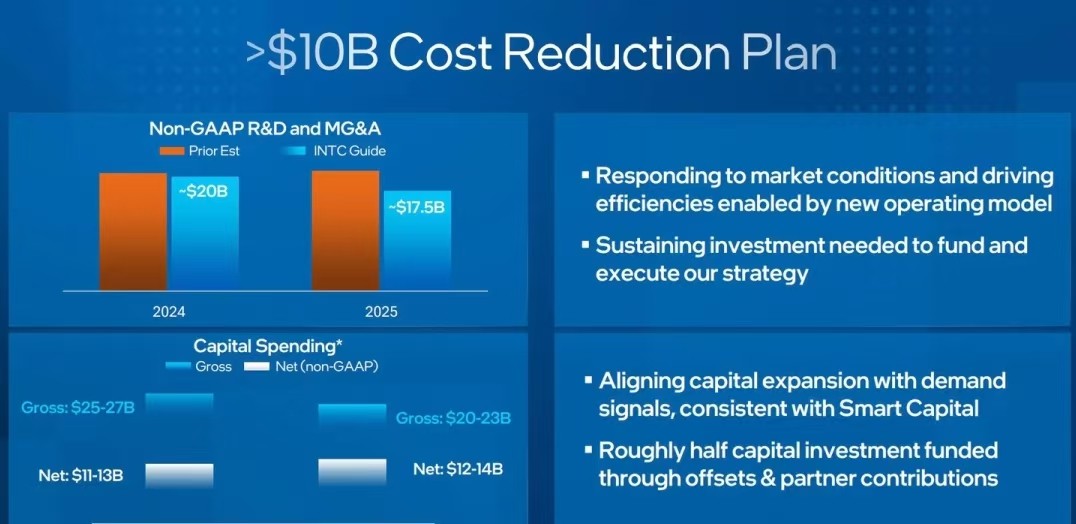

It plans to save $10 billion in costs by 2025, starting with laying off 15% of its employees, equivalent to about 15,000 people, and then targeting shareholders by suspending the fourth-quarter dividend.

Of course, cost-cutting is only a stopgap measure to reduce losses, and to truly turn around the fundamentals of performance, the pie needs to be enlarged. For Intel, the biggest problem in recent years may be that it has not gained much from AI. Its former rivals NVIDIA and AMD are thriving in the AI space, while Intel has performed mediocrely; while AI PCs are good, market share growth takes time, and competition from Qualcomm and Apple is not enough for a turnaround.

To stick to one path to the end is Intel's choice for the future, and it is also a choice forced by necessity. Due to the significant sunk costs of long-term investments, Intel must strive to achieve results in chip manufacturing to turn around its performance, even if it means tightening its belt. "Integrated Device Manufacturing 2.0" is its last lifeline. However, before that, the gradual loss of existing customers has dimmed several lights on this path, leaving a long way ahead.