"NIO, Xpeng, and Li Auto's fate lies in the sales data of new energy vehicles in 2024 H1

![]() 08/08 2024

08/08 2024

![]() 529

529

In the next two years, China's new energy vehicle market will usher in its final window of development. If new automakers represented by NIO, Xpeng, and Li Auto want to become oligopolies, they need to find their exclusive business moat.

Content/Lan Yu

Editor/TV

Proofreader/Mangfu

After BMW, Audi, and Mercedes-Benz successively announced their withdrawal from the price war, Volkswagen, Toyota, and other joint venture brands also decided to adjust their terminal policies from July, reducing terminal discounts or stopping price reductions altogether. This has led to changes in the situation of China's automotive market, which was already locked in intense competition.

BBA and joint ventures' choice to "lie flat" is partly due to their insufficient competitiveness in new energy vehicles and partly due to the intensifying competition from China's domestic traditional automakers.

In the first half of the year, automakers like BYD and Geely leveraged their supply chains, price wars, and marketing advantages to introduce new energy vehicles that were either directly discounted or offered increased configurations at reduced prices, significantly capturing market dividends.

Under this background, not only are joint venture automakers feeling pressure, but new automakers represented by NIO, Xpeng, and Li Auto are also struggling to grow aggressively. Considering that the dividends of China's new energy vehicle market are gradually narrowing, and the "elimination round" is about to begin, if new energy vehicle brands fail to quickly build their core competitiveness and attract as many consumers as possible, some new automakers may become "castaways" in the consumer market.

Part.1

Leveraging economies of scale

Traditional automakers strike down NIO, Xpeng, and Li Auto

Having shed the shackles of traditional automobiles, the outside world once held high hopes for new automakers, believing that they would disrupt traditional automakers as Apple did Nokia.

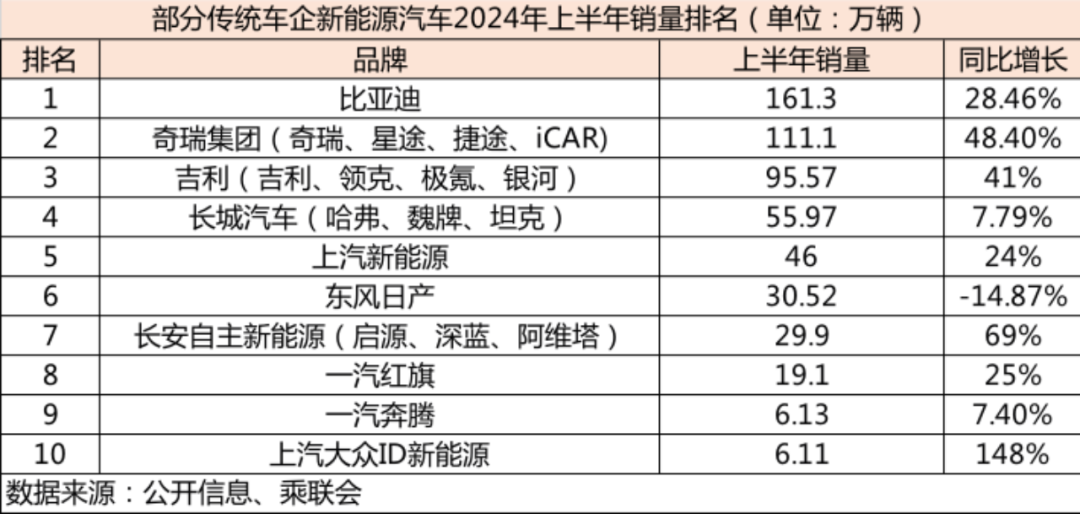

However, the automotive industry is typically asset-heavy, and traditional automakers have accumulated substantial manufacturing resources and strong brand effects, making them difficult to defeat easily. Currently, leading traditional automakers outperform new automakers in both sales and target achievement rates.

Taking BYD as an example, in the first half of 2024, its passenger vehicle sales reached 1.613 million units, a year-on-year increase of 28.46%. Among them, sales of pure electric vehicles were 726,200 units, up 17.73%, and sales of plug-in hybrid vehicles were 881,000 units, up 39.54% year-on-year.

At the beginning of 2024, BYD revealed that its sales target for the year was to increase by more than 20% over the 3.02 million units sold in 2023, reaching 3.624 million units. A simple calculation shows that BYD has achieved 44.51% of its annual sales target in the first half of this year.

BYD's impressive performance is primarily due to its vertical integration and economies of scale, allowing it to offer highly cost-effective new energy vehicles through aggressive pricing strategies.

For instance, in February 2024, BYD launched the Qin PLUS Honor Edition, with a price reduction of 20,000 yuan and a starting price of just 79,800 yuan, shouting the slogan "electricity is cheaper than gasoline." Since then, BYD has successively lowered the starting prices of the Han and Tang models to 169,800 yuan.

Considering that BYD will introduce numerous products equipped with its fifth-generation DM technology in the second half of the year, its new energy vehicle sales are expected to continue to climb.

In fact, it's not just BYD that performed well in the first half of 2024; traditional automakers like Chery and Geely also recorded impressive sales of new energy vehicles.

For example, Geely sold a cumulative total of 955,700 vehicles, a year-on-year increase of 41%. Among them, sales of new energy vehicles reached 320,200 units, a year-on-year increase of 117%. Due to its impressive sales growth, Geely increased its annual sales target by about 5%, from 1.9 million to 2 million units. Based on this calculation, Geely has also achieved 47.79% of its annual sales target in the first half of the year.

The surge in Geely's new energy vehicle sales is directly related to the "internal competition" launched by its sub-brands Zeekr, Lynk & Co, and Galaxy, offering price reductions in exchange for volume.

Taking Zeekr as an example, its product sales had not shown significant improvement in the past few years. In February 2024, Zeekr launched the new Zeekr 001, not only reducing the price by 31,000 yuan but also standardizing flagship features such as lidar, 8295 chip, 800V high voltage, and silicon carbide motor.

Image Source: Zeekr

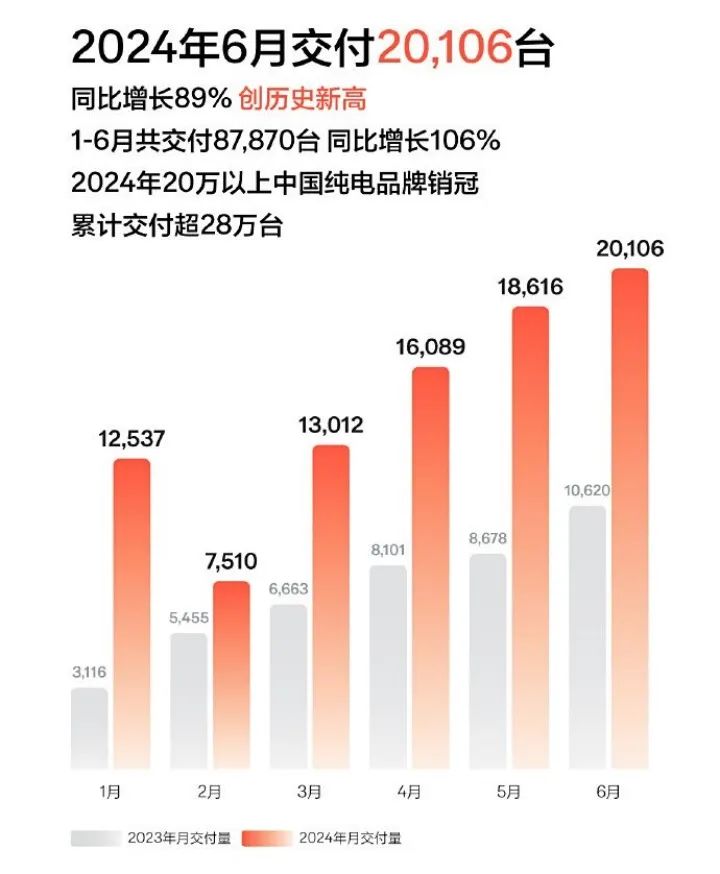

Thanks to its cost-effectiveness, the new Zeekr 001 has consistently sold over 10,000 units per month since its launch, pushing Zeekr's first-half sales up 106% year-on-year to 87,800 units.

Compared to traditional automakers, while sales of new automakers are also steadily rising, their absolute sales figures and target achievement rates are significantly lower.

Taking NIO, Xpeng, and Li Auto as examples, their sales in the first half of 2024 were 87,400, 52,000, and 189,000 units, respectively, representing year-on-year increases of 60.2%, 26%, and 35.87%, and achieving 38%, 18.6%, and 33.75% of their annual sales targets, respectively.

Overall, due to traditional automakers' easier achievement of economies of scale and their ability to offer price concessions due to cost advantages, capturing price-sensitive consumers, leading traditional automakers generally outperformed new automakers in sales figures in the first half of 2024. This means that new automakers are unlikely to easily defeat traditional automakers through intelligence, similar to how Apple surpassed traditional phone makers.

Part.2

The rise of AITO and Xiaomi

NIO, Xpeng, and Li Auto are under attack from all sides

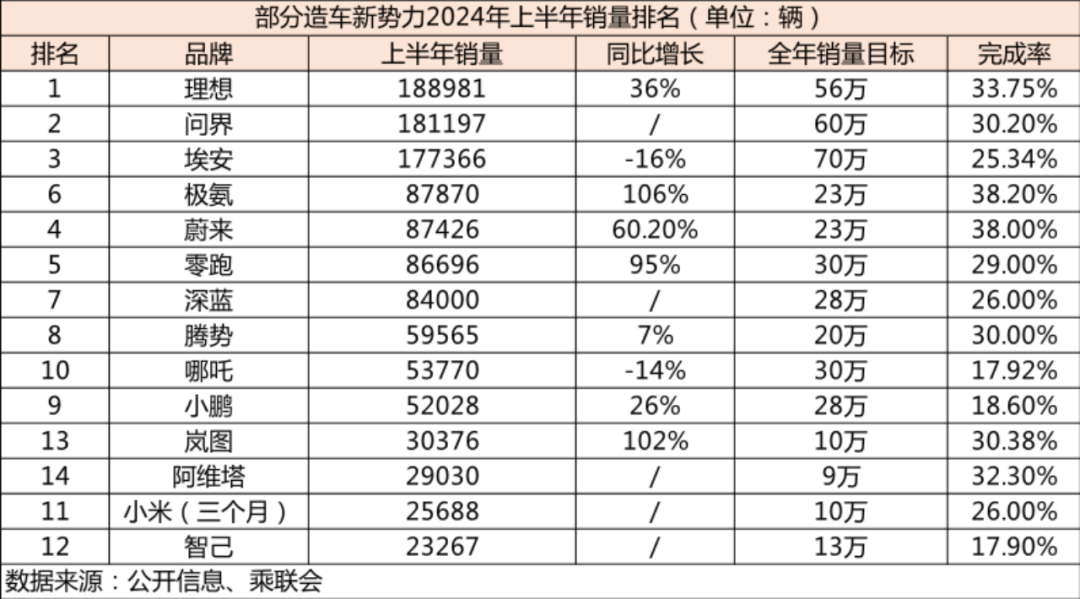

In recent years, not only have traditional automakers significantly outpaced new automakers in new energy vehicle sales, but the internal ranks of new automakers have also begun to shuffle, with NIO, Xpeng, and Li Auto no longer the undisputed top three.

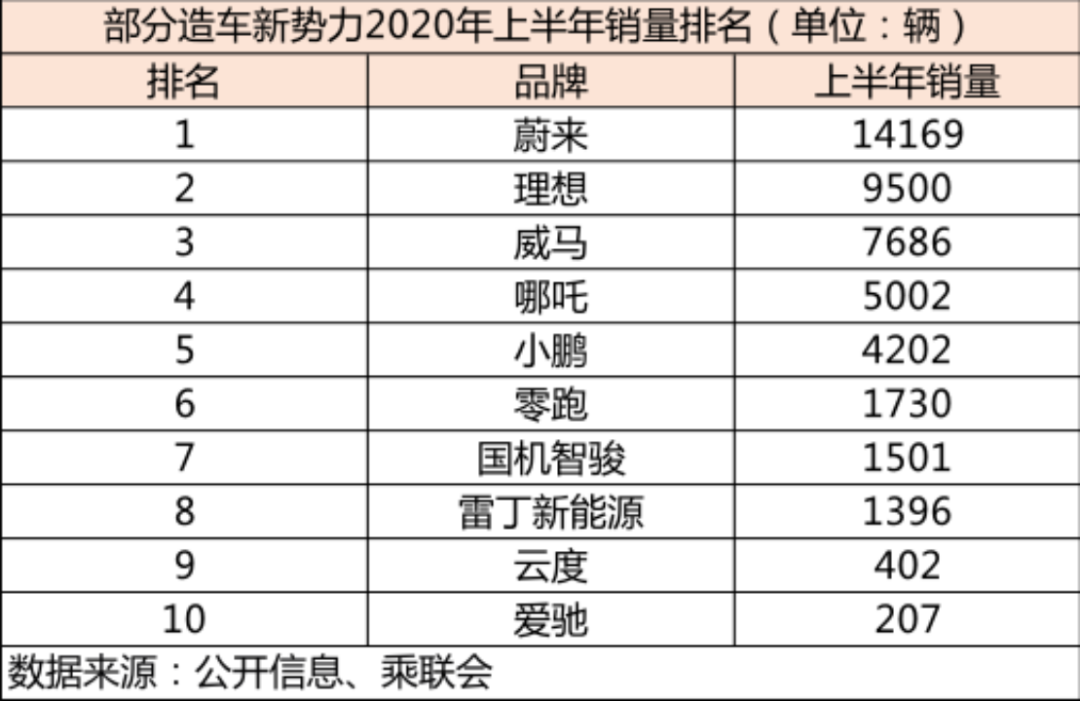

In the first half of 2020, the top five Chinese new automakers in terms of deliveries were NIO, Li Auto, WM Motor, NIOZ, and Xpeng, with sales of 14,169, 9,500, 7,686, 5,002, and 4,202 units, respectively, with NIO, Xpeng, and Li Auto ranking high.

Fast forward to the first half of 2024, and the top five Chinese new automaker brands in terms of deliveries have become Li Auto, AITO, Aion, NIO, and Leapmotor. Among them, Li Auto surpassed NIO to top the list, while NIO placed fourth. Additionally, brands with traditional automaker roots, such as AITO, Aion, and Zeekr, also made it to the top of the list.

Unlike Li Auto and NIO, which still rank high, Xpeng has fallen significantly, ranking ninth with deliveries of only 52,028 units, even being surpassed by NIOZ.

Apart from the reshuffling of NIO, Xpeng, and Li Auto, the first half of 2024 also saw the emergence of younger brands on the list of Chinese new automaker brand deliveries. For example, on March 28, 2024, Xiaomi launched its first new energy vehicle product, the Xiaomi SU7, which was highly sought after upon its launch, with 88,898 pre-orders in the first 24 hours and deliveries exceeding 10,000 units in June and July.

The rapid rise of relatively younger automakers like AITO, Xiaomi, and NIOZ over just a few years largely indicates that the first-mover advantage of new automakers like NIO, Xpeng, and Li Auto is not particularly pronounced. Once later entrants build their business moats in areas such as intelligent driving, promotion, and pricing, they can easily tap into the market.

Taking AITO as an example, it was born at the end of 2021, and its product sales were not impressive initially. It was not until September 2023 that the new AITO M7 was launched, with significant price reductions and equipped with Huawei's ADS 2.0 advanced intelligent driving system. The NCA intelligent driving pilot can cover 90% of urban scenarios, driving with or without maps, and the AEB maximum braking speed has been increased to 90km/h, thereby opening up the market.

Official data shows that within two and a half months of its launch, cumulative pre-orders for the new AITO M7 exceeded 100,000 units, with the intelligent driving version accounting for 60% and the urban NCA option selected by 75% of buyers.

Unlike AITO, which won the market with industry-leading intelligent driving technology, Xiaomi Motors primarily relies on its outstanding marketing capabilities. With over a decade of experience in the consumer electronics field, Xiaomi has planned numerous "out-of-the-box" marketing events, accumulating unique marketing experience.

In the early stages of Xiaomi Motors' launch, Xiaomi replicated its previous marketing strategies, with frequent sharing of related content on Xiaomi Motors' official Weibo account and Lei Jun's personal Weibo, and inviting tech bloggers to experience Xiaomi Motors. After the product launch, the previously accumulated momentum was quickly released, driving up Xiaomi Motors' sales.

From this perspective, NIO, Xpeng, and Li Auto are currently in a predicament, surrounded by enemies on all sides. On the one hand, traditional automakers are leveraging economies of scale to grab market share through price reductions. On the other hand, younger automakers are finding alternative paths in intelligent driving and marketing, diverting market influence away from NIO, Xpeng, and Li Auto.

To escape downward pressure, NIO, Xpeng, and Li Auto need to find new solutions.

Part.3

Elimination round begins

NIO, Xpeng, and Li Auto head in different directions

Although new energy vehicles are an important sales driver for the automotive industry in the future, as most consumers complete their vehicle upgrades, the dividends of the new energy vehicle market have narrowed.

Data from the China Passenger Car Association shows that from the first half of 2022 to the first half of 2024, China's new energy vehicle sales were 2.6 million, 3.747 million, and 4.111 million units, respectively, representing year-on-year increases of 120%, 44.1%, and 33.1%, with the growth rate gradually declining.

Against this background, traditional automakers and younger automakers are aggressively grabbing market share, which will naturally eliminate some lagging new automakers. Comparing the new automaker delivery rankings in the first half of 2020 and 2024, we can see that brands that once ranked in the top ten, such as WM Motor, State Power Smart Mobility, Yundu, and Aichi, have disappeared.

Addressing this trend, in March 2024, He Xiaopeng, Chairman of Xpeng Motors, said in an interview that "China's new energy market has begun to enter an elimination round." Zhu Huarong, Secretary of the Party Committee and Chairman of Changan Automobile, went even further, stating confidently that in 2024, the top 10 automakers in terms of sales will account for nearly 85% of the market share, and 80% of brands will cease operations in the coming years.

To avoid elimination, new automakers have been seeking change since 2024, either by incubating new products or investing in intelligent driving technology.

For example, in May 2024, NIO launched its second, lower-priced brand, "Ledao," with its first product, the Ledao L60, positioned as a smart electric family SUV. Adopting a 900V high-voltage architecture, the entry-level model uses a single motor and omits features like lidar and Orin X chips, with a pre-sale price of 219,900 yuan.

Similarly, Xpeng also announced its new brand, MONA, aimed at popularizing AI intelligent driving. MONA's first product is positioned as a compact electric sedan, scheduled for launch in the third quarter of 2024, with a price of approximately 150,000 yuan.

Considering that NIO and Xpeng are still operating at a loss, their decision to launch lower-priced brands is clearly an attempt to emulate traditional automakers by allowing higher-selling sub-brands to spread the high costs of upstream technologies such as battery swapping and intelligent driving, thereby expanding market influence and opening up profit margins.

Unlike NIO and Xpeng, which are incubating new products, Li Auto is focused on strengthening its intelligent driving technology. Due to a "late start" of half a year, Li Auto only began promoting its urban intelligent driving solution without high-precision maps in the second half of 2023.

On July 3, 2024, 36Kr Automotive reported that Lang Xianpeng, head of intelligent driving at Li Auto, is leading a team of over 300 people to develop an end-to-end large model solution. "Development has been underway for more than two months, and results are expected within the year," he said. On July 5, Li Auto publicly unveiled its end-to-end autonomous driving technology architecture and launched an early bird testing program for the new architecture solution. Clearly, Li Auto's intelligent driving technology is accelerating its rollout.

Li Auto's decision to invest in intelligent driving technology at this time is no coincidence. After the setback of MEGA, its pure electric products have been delayed until next year. Li Auto will have a long product gap in the second half of 2024.

On the other hand, by relying on extended-range products, Li Auto has already turned its cash flow positive, eliminating the need to introduce lower-priced products that would erode the company's profit margins. In this context, Li Auto has apparently decided to emulate Huawei by building differentiated intelligent driving technology to enhance the competitiveness and appeal of its existing products.

Overall, while the new energy vehicle market has continued to grow since 2024, the growth rate has fallen sharply, and competition has intensified. New automakers represented by NIO, Xpeng, and Li Auto have not been able to grab market share as aggressively as expected. On the contrary, under the siege of traditional automakers and new-generation automakers, NIO, Xpeng, and Li Auto are even feeling more pressure.

Considering that China's new energy vehicle market will usher in its final development window in the next two years, new automakers represented by NIO, Xpeng, and Li Auto need to find their exclusive business moats if they want to become oligopolies.

This also determines that the second half of 2024 will be a critical period for the differentiation of new automakers.