New energy vehicle enterprises: compete on price in the first half, and compete for small-town youth in the second half

![]() 08/08 2024

08/08 2024

![]() 611

611

Original by New Energy View (ID: xinnengyuanqianzhan)

In recent years, the term "small-town youth" has frequently appeared in the public eye.

This term carries some positive connotations, after all, who doesn't want to be "rich" and "leisurely"?

Some industry insiders believe that "small-town youth" will become the main force in the future consumer market, and it is estimated that by 2030, consumer spending in third- and fourth-tier cities will reach 45 trillion yuan.

Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, once said, "At present, the penetration rate of new energy vehicles in cities above the third tier has reached about 40%, and the increase in penetration rate has slowed down significantly compared to the past, while the penetration rate of new energy vehicles in cities below the third tier is currently only around 20%, with more room for improvement compared to first- and second-tier cities."

Faced with such a lucrative market, various automakers in the automotive industry naturally want to compete for it.

New energy brands such as NIO, Li Auto, and Xpeng have turned their attention to the lower-tier markets, successively launching new models such as Ledo L60, Li Auto L6, and Xpeng MONA M03.

What kind of new energy vehicles will win the favor of "small-town youth"?

1. Small-town youth who prefer new energy SUVs

In 2018, seeing his hometown developing better and better, Li Song quit his job at a gas station and returned to Huanggang City, Hubei Province, from Beijing. Today, he is not only the owner of two hotels but also the father of two children.

"We have two cars in our family. The business car is mainly used to pick up and drop off customers, but for daily family trips, I still prefer my Leapmotor C10. It has strong cargo capacity and good road adaptability. Some roads here are in poor condition, and SUVs offer a smoother ride with less jolting, and there's enough space in the back seat."

After graduating from university, Xpeng G6 owner Chi Yuan returned to her hometown of Handan, Hebei, and became an airport ground staff. In her words, neither a "golden nest" nor a "silver nest" is as beautiful as her hometown. When asked about the reason for buying an SUV, her answer was quite different from Li Song's. "Some roads on the way home are bumpy due to heavy traffic, and the chassis of sedans is generally too low, making them prone to scratching. SUVs don't have such concerns."

Photo/Xpeng G6

Source/Screenshot from New Energy View on the Internet

Certainly, with the development of urban-rural integration and government policy support, there are not a few young people like Li Song and Chi Yuan who have returned to the countryside from cities.

And it is an indisputable fact that in the eyes of today's youth in low-tier cities, SUVs are popular, and new energy SUVs are even more so.

More than 80% of the hundred "small-town youth" surveyed by New Energy View expressed their desire to purchase a new energy SUV.

Guo Yong, who works at a township government, said, "In addition to commuting to and from work, I also need to visit the masses frequently, going up and down mountains and into the countryside. Therefore, I value two things most when buying a car: fuel efficiency and off-road capability. If I were to buy another car, I would consider a new energy SUV for its lower travel costs."

According to Li Song, he installed a charging pile at home, and with commuting and weekend road trips, his monthly vehicle costs are about 90% less than when he used to drive a gasoline car.

Photo/Leapmotor C10

Source/Screenshot from New Energy View on the Internet

Indeed, from the perspective of vehicle usage scenarios, car owners in third-tier and lower cities, as well as small towns, tend to travel shorter distances daily compared to those in first- and second-tier cities, which means that starting and stopping the car will be more frequent. In such cases, new energy vehicles offer significantly better economy than gasoline cars.

Meanwhile, with the rapid economic development of urban and rural areas today, automobiles have gradually become ubiquitous in low-tier cities and counties, and the situation of "minor traffic jams during minor holidays, major traffic jams during major holidays, and peak hours are always busy" is no longer limited to first- and second-tier cities.

According to several small-town youth, traffic jams occasionally occur in county towns as well.

Thus, the combination of "new energy + SUV" has become the "Dream Car" of small-town youth.

2. What limits small-town youth from keeping up with the trends

It's worth noting that although most small-town youth want to buy a new energy SUV, very few actually do.

So, what prevents youth in low-tier cities from owning their own "Dream Car"?

Data shows that there were 33,779 4S sales and service outlets nationwide in 2023, and currently, less than 20% of these outlets are located in county-level economies.

Photo/Number of 4S stores nationwide as of the end of 2023

Source/Screenshot from China Automobile Dealers Association and New Energy View

And based on the currently disclosed information, most 4S sales and service outlets in third- and fourth-tier cities that have sink to the county level and below are for gasoline cars.

Through contact with youth from different third- and fourth-tier cities and county-level areas, New Energy View learned that there are few stores of emerging brands such as Xpeng and NIO in most county-level areas of third-tier and lower cities. Consumers who wish to purchase these vehicles must travel to urban areas, which can be a long and time-consuming journey.

"I've always wanted to buy a new energy SUV because electricity is cheaper than gasoline, but there are no stores of emerging brands like Xpeng and Li Auto in our county. I have to go to Binzhou City to buy and pick up the car, which is over 100 kilometers round trip. It would be great if these emerging brands could open stores right at my doorstep someday. I would definitely make a purchase as soon as possible," complained Wang Xin.

Cai Hong, a post-2000s born who lives in Wulian County, Rizhao City, Shandong Province, recently obtained his driver's license and is considering buying a new car. "I initially researched electric cars online, mainly considering the lower future costs of ownership, and the fact that electric cars now offer excellent intelligent driving capabilities. I went to the city to see the Xpeng G6 and NIO ES6, and I was quite tempted, but thinking about the distance to the stores from my home, I ultimately gave up."

Since the beginning of this year, new energy brands such as "NIO, Xpeng, and Li Auto," ZEEKR, and BYD have expanded their sales channels into third- and fourth-tier cities, which is the best illustration of this trend.

Previously, brands like Xpeng and AVITAR shifted from direct sales to embracing the dealer model, which was also a means of expanding sales channels in lower-tier markets.

In fact, the limited availability of new energy brand sales outlets in low-tier cities and their subordinate county-level areas is just one of the reasons hindering "small-town youth" from buying new energy vehicles.

It is understood that as various new energy brands are still struggling to turn a profit, building a public charging pile is bound to be time-consuming and costly, so there are still relatively few public charging piles in low-tier cities at present.

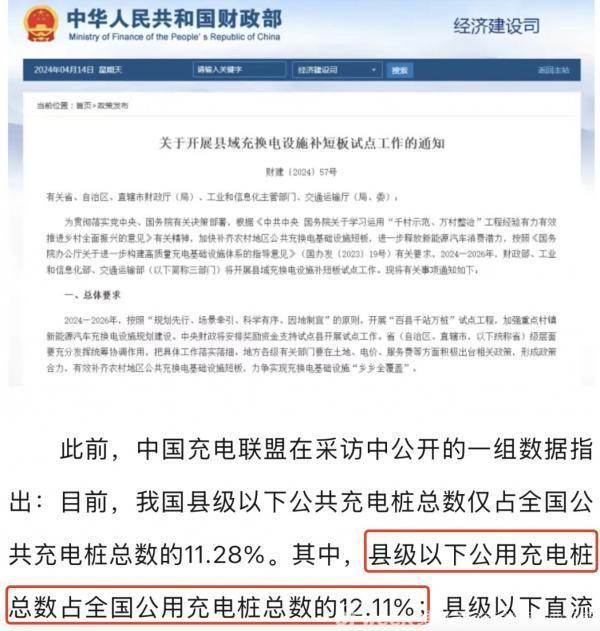

Data from the China Electric Vehicle Charging Infrastructure Promotion Alliance shows that currently, the total number of public charging piles below the county level accounts for only 11.28% of the total number of public charging piles nationwide.

Photo/Proportion of public charging piles below the county level

Source/Screenshot from Zhigu Supercharger and New Energy View

Meanwhile, due to the varying age of power systems in different county-level areas, although most new energy manufacturers support installing charging piles at home, very few new energy car owners can actually achieve home charging in the end.

Thus, in the future, if major emerging brands want more small-town youth to join the "trendy" ranks of new energy vehicles, in addition to expanding sales channels in third-tier and lower cities as soon as possible and improving the convenience of "small-town youth" in selecting and purchasing vehicles, they should also expedite the construction of charging infrastructure.

3. Small-town youth: Achieving our annual goals depends on us

As Lang Xuehong said, compared to first- and second-tier cities, there is more room for improvement in the penetration rate of new energy vehicles in lower-tier markets.

In recent years, many new energy brands have begun to plan and layout the lower-tier market on a large scale. Obviously, by winning over small-town youth, they gain significant support for their sales targets.

Statistics show that last year, most new energy brands, such as Xpeng, NIO, and Nezha, failed to achieve their annual sales targets.

Photo/Annual target achievement of major emerging brands in China in 2023

Source/Chart made by New Energy View

Looking at the "report cards" already delivered by various new energy brands this year, if sales performance in the second half remains at its current level with no significant improvement, several new energy brands may once again face the situation of failing to achieve their annual targets.

Specifically, from January to July, Xpeng sold a total of 63,173 vehicles, achieving 22.56% of its annual target; NIO sold a total of 107,924 vehicles, achieving 46.92% of its annual target; and ZEEKR sold a total of 103,525 vehicles, achieving 45.01% of its annual target.

Ren Wanfu, an automotive industry analyst, said that automakers' move to expand into lower-tier markets is inevitable, but in the process, it is hoped that new energy brands will not be overly optimistic. After all, while expanding into lower-tier markets can drive sales to a certain extent for emerging brands, the extent of this drive, whether it is short-term or long-term, remains to be seen.

Lang Xuehong believes that "consumers in low-tier cities have a more pronounced herd mentality, so whoever can penetrate such markets first will be more likely to drive consumption in the region and seize the initiative, which is very important for new energy brands."

In the seemingly lucrative lower-tier market, not all players can successfully grab a share of the pie, as there is still much for new energy manufacturers to do if they want to achieve rapid growth in this market.

First, in terms of price, influenced by the overall level of urban and rural development, most small-town youth will prefer products with high cost-effectiveness, which is why brands like Xpeng and NIO have continued to explore the market this year, creating low-cost products such as MONA M03 and Ledo L60.

Photo/MONA M03 and Ledo L60

Source/Screenshot from the Internet and New Energy View

Second, in terms of service, unlike the novelty-seeking in first- and second-tier cities, youth in low-tier cities tend to avoid uncertainty and prefer to choose products that can be conveniently experienced before purchase through friends, family, or local dealers. Therefore, if new energy brands want to win over small-town youth, they should strengthen and improve their service systems and expand their sales channels.

Third, in terms of configuration, owners of pure electric vehicles in low-tier cities are significantly less satisfied with the refueling experience than those in first- and second-tier cities, with a satisfaction rate that is ten percentage points lower. Thus, the construction and improvement of charging facilities is urgent. However, in areas where it is not feasible to quickly install large-scale public charging stations in the short term, new energy brands should rely on user operation systems to help car owners install home charging piles as much as possible.

Photo/Charging piles in townships

Source/Screenshot from the Internet and New Energy View

Industry insiders believe that focusing on the lower-tier market is not a "one-day job" compared to first- and second-tier cities and cannot rely solely on experience. Whether traditional automakers or new carmakers, their top priority at present is to address existing issues such as a lack of sales and service networks and inadequate charging infrastructure.

The "pie" of the lower-tier market may seem tempting, but it is also full of variables, as the decision-making power ultimately rests with consumers.

In the future, New Energy View will continue to keep a close eye on who will be the first to win over "small-town youth."

(Note: Li Song, Chi Yuan, Guo Yong, Wang Xin, and Cai Hong are pseudonyms used in this article.)