Airbnb: Can't Even Be Boosted by the Olympics?

![]() 08/08 2024

08/08 2024

![]() 646

646

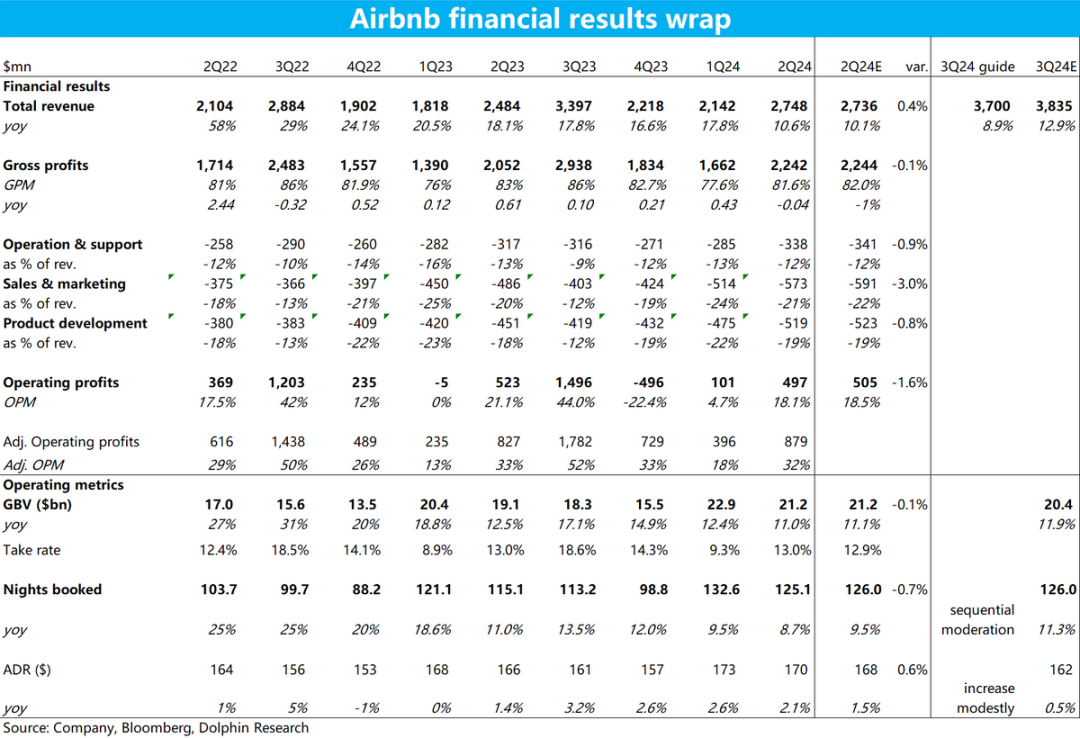

On August 7, Beijing time, after the US stock market closed, Airbnb released its fiscal Q2 2024 earnings report. While the quarter's performance was weaker than expected, it was still within forecasts. However, the guidance for the upcoming quarter, which continued to weaken, was significantly below expectations, shattering the market's 'wishful thinking' of a recovery and acceleration in business growth in the second half of the year. Key points are detailed below:

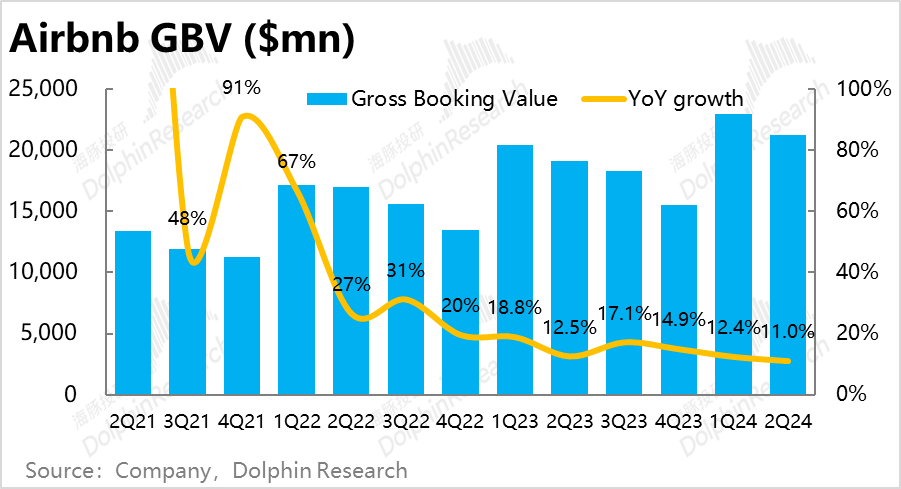

1. Key operating metrics: Airbnb's total gross booking value (GBV) for the quarter was approximately $21.2 billion, with year-over-year (YoY) growth slowing further from 12.4% in the previous quarter to 11%. However, market expectations were for an even deeper slowdown, making the actual performance slightly better than the more conservative forecasts.

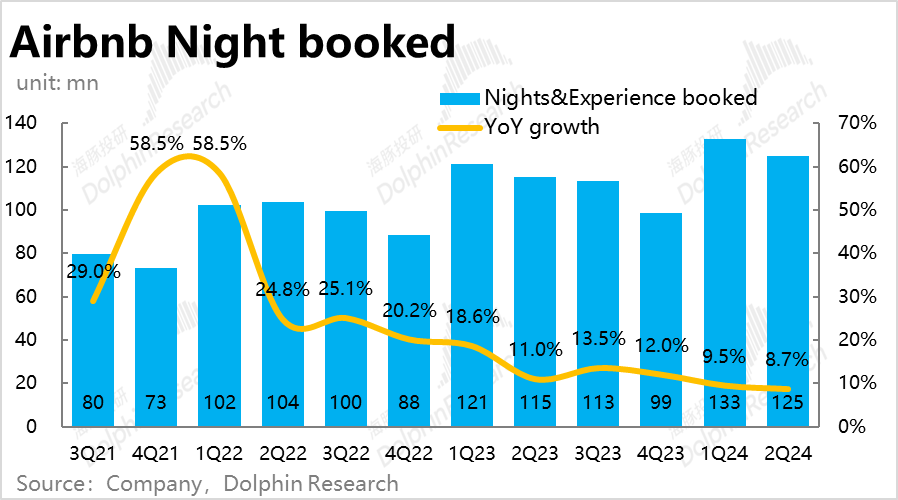

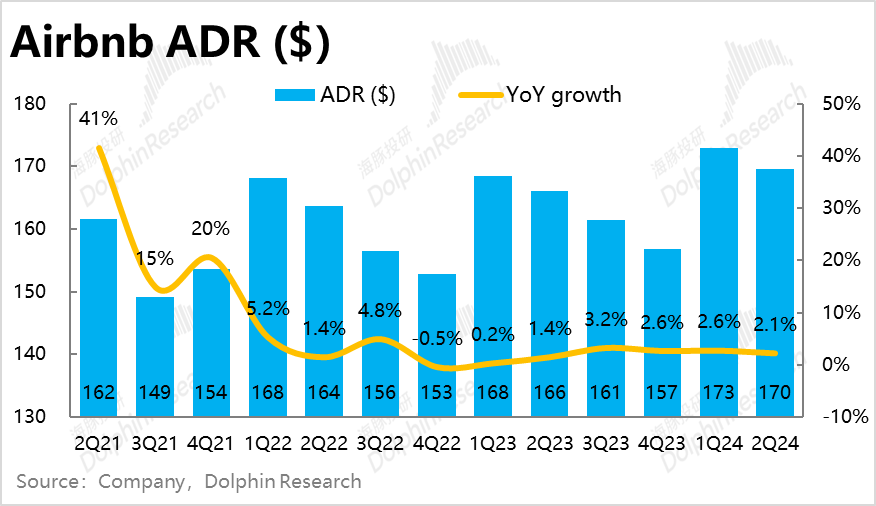

In terms of price and volume drivers, the total number of nights booked in the quarter was approximately 125 million, a slight decrease of 0.8 percentage points (pct) quarter-over-quarter (QoQ). However, market expectations were for flat growth in nights booked QoQ, resulting in an actual figure 0.7% lower than expected. On the pricing front, the average daily rate (ADR) reached $170 per night, 0.6% higher than expected. The increase in ADR partially offset the decline in nights booked, which is the main reason why GBV was slightly better than expected.

Regionally, the growth rates of nights booked in emerging South America and Asia-Pacific were 17% and 19%, respectively, significantly outperforming the company's overall growth rate of less than 9%. In other words, growth rates in North America, Europe, and Africa should have been in the low single digits.

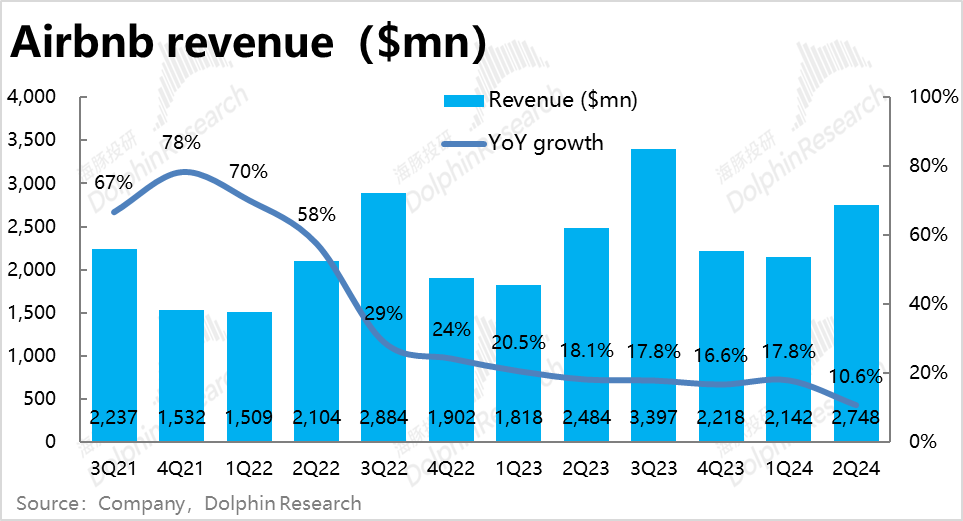

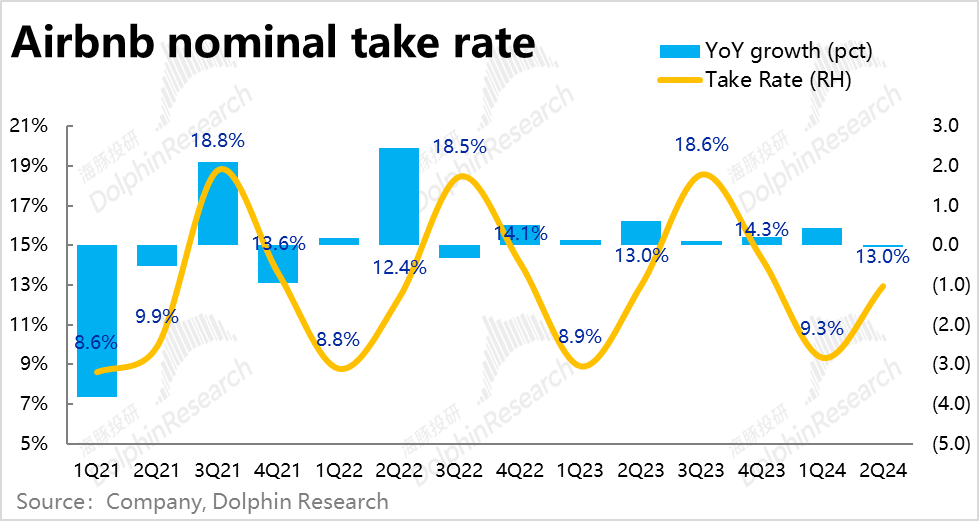

2. Revenue perspective: The take rate decreased slightly YoY, but the market had expected a steeper decline. The actual take rate was 0.1pct higher than expected, leading to revenue being slightly higher than anticipated by 0.4%. However, the combination of a slightly lower YoY take rate and slower GBV growth resulted in revenue growth decelerating significantly to 10.6%, a decrease of 7pct QoQ.

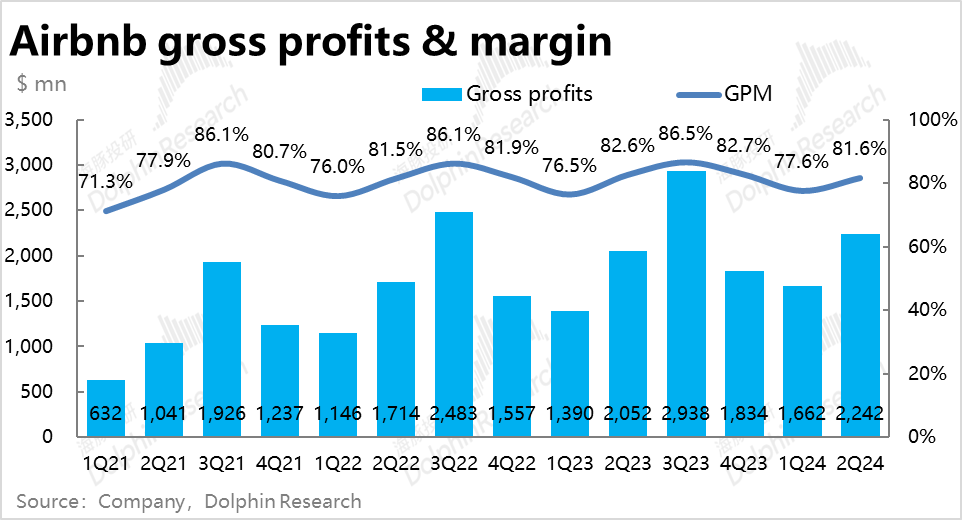

Similarly, due to the slight decrease in the take rate, gross margin also decreased by approximately 1pct YoY. Despite revenue being slightly higher than expected, gross profit was slightly below forecasts.

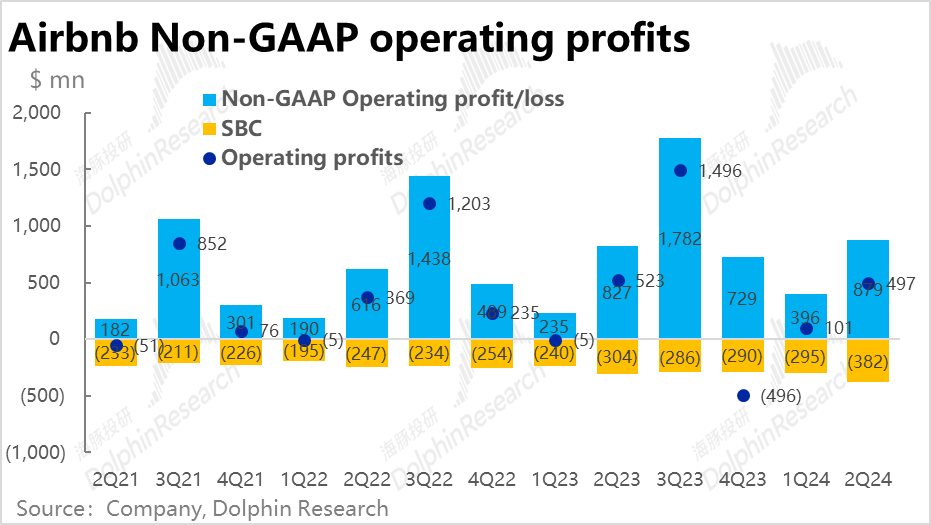

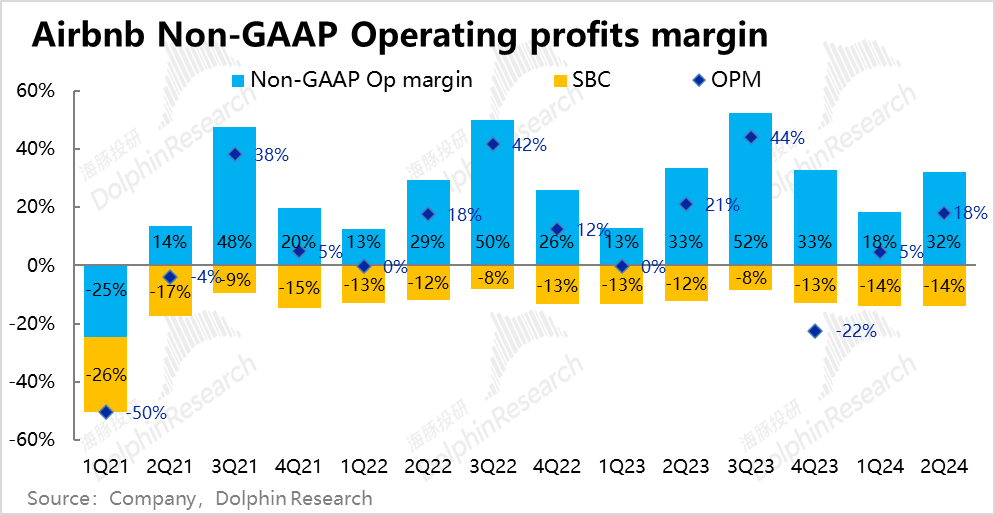

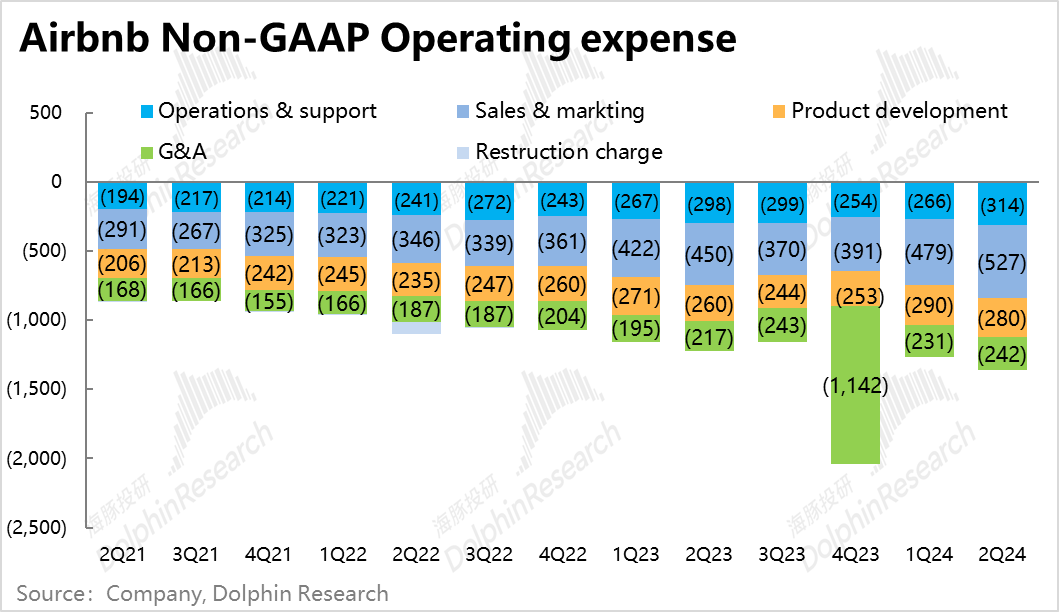

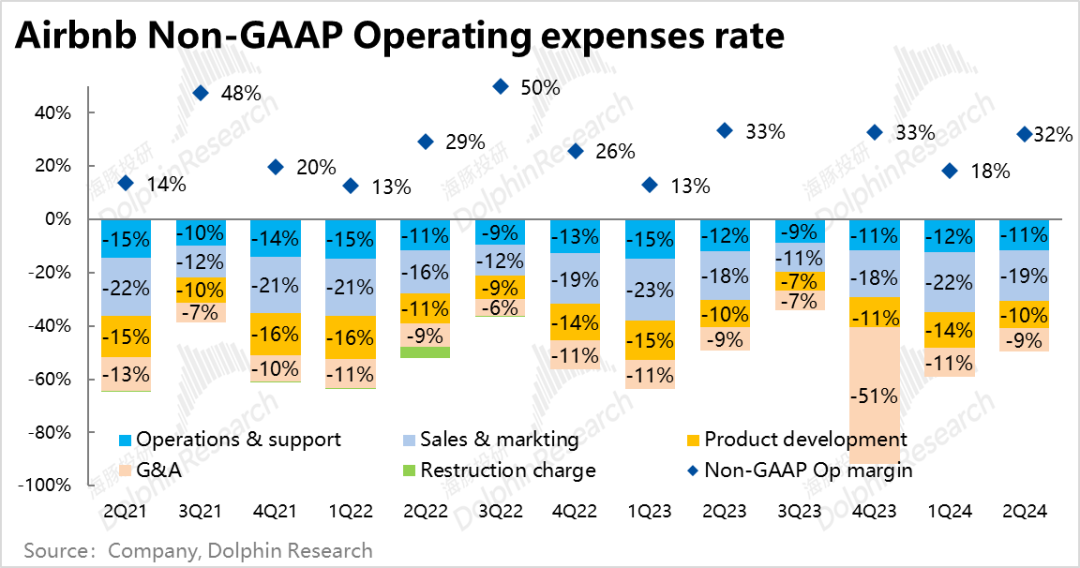

3. Expense level: Excluding stock-based compensation (SBC), all expenses increased QoQ from 1Q, except for R&D expenses, which decreased slightly. Marketing expenses increased significantly by approximately 19% QoQ from $480 million to approximately $530 million, the most notable increase. This aligns with management's guidance from the previous quarter about increasing investments, reflecting both proactive choices and growth pressures faced by the company.

GAAP operating profit was $497 million, lower than the $523 million in the same period last year, primarily due to SBC expenses reaching $382 million, a 26% YoY increase. Excluding SBC, adjusted operating profit was $880 million, still representing a 6.3% YoY increase. However, despite increasing operational pressures, management continued to significantly increase SBC, which was not well received by investors.

4. A more significant issue is the guidance for Q3 2024. Revenue guidance of $3.67 to $3.73 billion is significantly below market expectations of $3.84 billion, even at the upper end. The midpoint growth rate of 8.9% is a further deceleration from market expectations of 12.9%. In terms of price and volume drivers, the company's guidance for 3Q nights booked growth continues to slow compared to the 8.7% growth in the current quarter, rather than accelerating to 11.3% as the market expected. Only ADR is expected to increase YoY, relying solely on pricing factors to support GBV growth.

Dolphin Investment Research Perspective:

Overall, while Airbnb's performance in this quarter was not outstanding, with significant slowdowns in key metrics like GBV, nights booked, and revenue growth, the weakness was largely within expectations and not a 'shocking' issue. The bigger problem is that the market had anticipated a notable acceleration in growth in the second half of the year, benefiting from the quadrennial Paris Olympics. If this had materialized, the slightly weaker performance in Q1 and Q2 this year would have been forgivable. However, disappointingly, the guidance for Q3 not only failed to accelerate but decelerated further, shattering market expectations that the slowdown would be temporary and more likely persistent. This constitutes a serious issue that 'kills the narrative'.

Furthermore, based on management's pre-earnings communication, they explicitly stated that investments would increase this year to address growth slowdowns and expand into new businesses, guiding for an adjusted operating margin narrowing YoY in fiscal year 2024. The combination of slower growth, increased expenses, and narrower profit margins represents a 'double whammy' of bad news.

From a valuation perspective, based on the post-market decline, the company's share price has fallen below the $110 mark, finally entering the neutral range previously calculated by Dolphin Investment Research. However, this pullback is due to earnings and environmental pressures rather than a simple valuation bubble bursting, so we believe it's not a straightforward buying opportunity. Nonetheless, with the valuation no longer excessively high, if subsequent observations show that the deterioration in performance is not as severe as guided, there may be entry opportunities.

Detailed Interpretation Below

I. Decline in Volume but Increase in Price, Slight Slowdown in GBV Growth This Quarter

Airbnb's total GBV for the quarter was approximately $21.2 billion, with YoY growth slowing further from 12.4% in the previous quarter to 11%. However, market expectations were for an even deeper slowdown, making the actual performance slightly better than the more conservative forecasts.

From a price and volume perspective, Airbnb's total nights booked in the quarter were approximately 125 million, a slight decrease of 0.8pct QoQ. However, market expectations were for flat growth in nights booked QoQ, resulting in an actual figure 0.7% lower than expected. On the pricing front, the ADR reached $170 per night, 0.6% higher than expected. The increase in ADR, partially driven by changes in accommodation mix, compensated for the decline in nights booked, leading to GBV being slightly better than expected.

Regionally, the company disclosed that nights booked growth in Latin America accelerated from the previous quarter, while growth in Europe and the Middle East remained flat QoQ, albeit with a similar ADR increase of approximately 4%. In emerging markets, nights booked growth in South America and Asia-Pacific were 17% and 19%, respectively, significantly outperforming the company's overall growth rate of less than 9%. In other words, growth rates in North America, Europe, and Africa should have been in the low single digits.

II. Slight YoY Decline in Take Rate, Decreases in Revenue Growth and Gross Margin

From a revenue perspective, the take rate decreased slightly YoY but was 0.1pct higher than market expectations. As a result, while GBV was slightly below expectations, revenue was slightly higher by 0.4%. However, beyond this expectation gap, the combination of a slightly lower YoY take rate and slower GBV growth led to a significant deceleration in revenue growth to 10.6%, a decrease of 7pct QoQ.

Due to the slight YoY decline in the take rate, gross margin also decreased by approximately 1pct YoY, resulting in gross profit being slightly below expectations despite revenue being slightly higher than anticipated.

III. Increased Marketing Investments Amid Growth Pressures

From an expense perspective, excluding SBC, all expenses increased QoQ from 1Q, except for R&D expenses, which decreased slightly. Marketing expenses increased significantly by approximately 19% QoQ from $480 million to approximately $530 million, the most notable increase. This aligns with management's guidance from the previous quarter about increasing investments, reflecting both proactive choices and growth pressures faced by the company amidst sustained slowdown.

Ultimately, GAAP operating profit was $497 million, lower than the $523 million in the same period last year. However, this was primarily due to SBC expenses reaching $382 million, a 26% YoY increase. Excluding SBC, adjusted operating profit was $880 million, still representing a 6.3% YoY increase. Despite continued slowdown in the company's business growth trend and increasing operational pressures, management continued to significantly increase SBC, which was not well received by investors.