Why is GAC AION going public despite its equity being listed for transfer and declining sales?

![]() 08/08 2024

08/08 2024

![]() 531

531

Writer | Duoke

Source | Beduo Finance

On August 1, the Beijing Equity Exchange issued a business invitation announcement for the "equity transfer of GAC AION New Energy Vehicle Co., Ltd. (hereinafter referred to as 'GAC AION')."

According to the announcement, the main investor for this equity transfer is China Cinda, one of the four major AMC companies in China, but the proportion of GAC AION's equity to be transferred and the requirements for investors' identities were not mentioned.

It is worth noting that this business invitation announcement also simultaneously "advertised" GAC AION's IPO listing plans. According to the information, GAC AION is currently preparing for its IPO listing on the Hong Kong stock exchange, and all preparations are proceeding as scheduled.

In fact, as early as October 2022, GAC AION completed its Series A funding round, with 53 investors, including People's Insurance Capital and Southern Power Grid Energy Innovation, subscribing for RMB 18.294 billion. At that time, its valuation soared to RMB 103.239 billion. After completing the Series A funding round, GAC AION has been seeking opportunities to go public.

So, is now a good time for GAC AION to go public? What challenges will its IPO process encounter?

1. Sales have been declining for several consecutive months; is GAC AION 'running out of steam'?

Since its inception, GAC AION has carried the boundless aspirations of GAC Group for its new energy vehicle business.

As everyone knows, GAC Group has profited significantly from the strong sales of its 'two Toyotas' (Toyota and Lexus). However, the market is always changing rapidly. In recent years, the automotive market has undergone significant changes, with the most notable feature being the 'shift from gasoline to electric vehicles.' This is when the sales of the 'two Toyotas' began to decline.

Against this backdrop, GAC Group launched GAC AION in July 2017, with the responsibility of developing GAC Group's pure electric new energy vehicle business. Among GAC Group's various businesses, the independent pure electric brand AION is also the most valued and heavily invested brand.

It can be seen that GAC AION has a heavy burden on its shoulders. Of course, GAC AION has not disappointed GAC Group. Relying on GAC's natural advantages in capital, manufacturing, and distribution channels, AION quickly captured the market with its low-price strategy and has consistently ranked among the top ten in monthly sales charts.

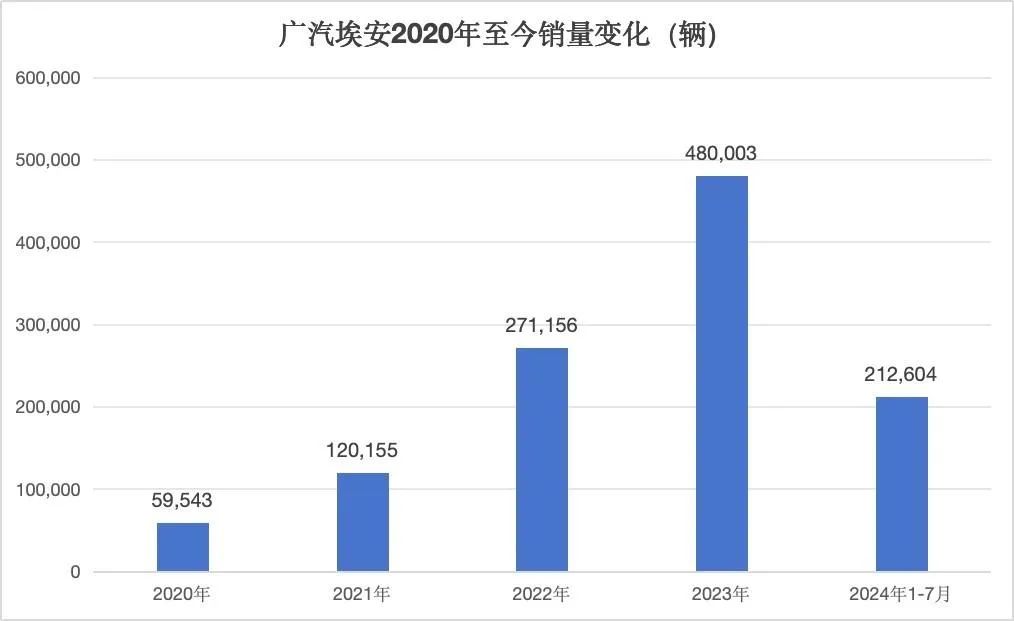

In 2019, GAC AION debuted with its iconic model, the AION S, which achieved sales of 42,000 and 59,500 units in 2019 and 2020, respectively.

Entering 2022, GAC AION witnessed an unprecedented 'leap year,' with annual sales surging to 271,200 units, achieving a staggering 125.67% year-on-year growth compared to the previous year. Among many new energy vehicle manufacturers, GAC AION stood out and successfully claimed the title of top sales among new forces in vehicle manufacturing that year.

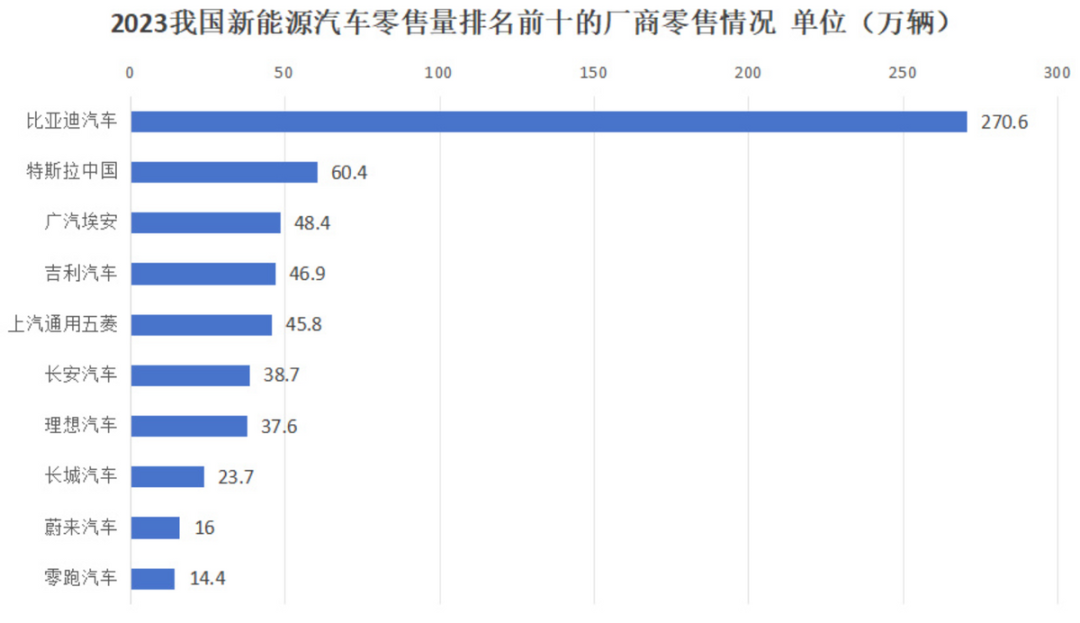

By 2023, AION's sales soared to 484,000 units, a year-on-year increase of 77.02%. Although it fell short of GAC's target of 'ensuring 500,000 and striving for 600,000,' it still catapulted GAC AION into the third-largest new energy vehicle brand in China and the second-highest-selling new energy vehicle in 2023.

However, after five years of market tests, GAC AION, which had achieved such impressive results, saw its sales plummet and gradually lost its leading edge after 2024.

Public data shows that as early as April this year, AION experienced a year-on-year sales decline of 31.45% and a month-on-month decline of 13.5%, marking four consecutive months of sluggish performance. In May, although AION's sales reached 40,073 units, up 42.5% month-on-month, they were still below the 45,003 units sold in the same period last year. In June, GAC AION's sales fell 22.2% year-on-year and 12.59% month-on-month to 35,027 units.

Fast forward to August 2, 2024, GAC AION announced its July 2024 sales figures. The data showed that GAC AION sold 35,238 units in July 2024, basically flat from the previous month (June 2024) but down 21.7% year-on-year from 45,025 units in July 2023.

Calculations reveal that GAC AION's cumulative sales from January to July 2024 totaled 212,604 units, down 16.42% from 254,361 units in the same period last year. Notably, its cumulative sales growth rate in the first seven months of last year was as high as 103%. Clearly, the sales growth rate has plummeted from its previous high to negative territory, marking a significant decline.

More importantly, based on current sales figures, GAC AION has only achieved 30.37% of its annual target of 700,000 units. With the current declining sales growth rate, AION may not only struggle to meet its set target but also find it difficult to match its 2023 sales performance.

From this trend, we can perceive that the market ceiling for some 'new force' brands may have already been reached, accelerating industry consolidation. Additionally, amidst fierce market competition, even well-established 'new forces' like GAC AION face significant growth pressure.

Amid various adverse conditions, rumors circulated in June that AION had laid off 20% of its staff and terminated contracts with recent graduates, pushing the company into the spotlight. Coupled with Chairman Zeng Qinghong's call at the 2024 China Automotive Chongqing Forum in June to 'avoid internal competition,' it is hard not to wonder why AION seems to be 'running out of steam.'

2. With a series of challenges looming, can GAC AION return to its peak?

As mentioned earlier, GAC AION's rapid market capture is closely tied to its consistent low-price strategy.

On the one hand, the positive response from the domestic market to low-price strategies is an obvious advantage. More crucially, the booming ride-hailing industry's explosive demand for low-cost, new energy vehicles has significantly driven AION's rapid development, making it almost the preferred choice in the ride-hailing market and enjoying a wave of market dividends.

Public data shows that in the ride-hailing market in 2023, the total demand reached 850,000 vehicles. Among them, GAC AION, with its strong market performance, alone captured a 220,000-vehicle market share, accounting for 46% of its annual sales and exceeding 25% market share in the ride-hailing segment.

Notably, even though BYD's sales far exceeded those of AION, its sales in the ride-hailing segment failed to surpass GAC AION, falling short by 30,000 units, further highlighting AION's leading position in the ride-hailing market.

Data released by CITIC Securities also show that from 2020 to the first half of 2021, GAC AION's flagship model, the AION S, accounted for 60% to 70% of sales in the leasing market, significantly higher than its competitors.

Clearly, a series of data indicate that GAC AION's market performance relies heavily on the B-end market rather than individual consumers.

However, as the ride-hailing market approaches saturation, this growth model has gradually exposed GAC AION's shortcomings in product diversification and market expansion, making it difficult to break through its own growth ceiling.

Meanwhile, the penetration rate of new energy vehicles in the ride-hailing industry has approached 90%, indicating widespread adoption of new energy vehicles in this sector and intensifying competition.

However, this high penetration rate, combined with the strong regional protection characteristics of the ride-hailing market, has led to further fragmentation of the market, posing significant challenges for GAC AION to seek high-speed growth in this sector.

In short, as the ride-hailing market approaches saturation, GAC AION, with the highest market share, will undoubtedly be most affected, and it is only natural that sales will decline.

Apart from the limited incremental space in the ride-hailing market, an even more critical challenge for GAC AION is facing the downward pressure from mid-to-high-end brands entering the lower-end market through 'price wars.'

Earlier this year, BYD led the way, initiating the first wave of auto price wars in 2024. For example, the BYD Qin model, considered GAC AION's biggest threat, lowered its price below RMB 100,000, directly targeting the ride-hailing market where GAC AION has been deeply entrenched.

Furthermore, brands that previously focused on the mid-to-high-end market, such as NIO and XPeng, have also started to penetrate the lower-end market with products priced between RMB 150,000 and RMB 200,000.

Just like mobile phone brands, when outstanding representatives of the high-end market like Apple and Huawei choose to lower their prices, they become highly attractive to users who previously chose other mid-to-low-end brands, leading them to switch to more premium phone brands. This forms a 'dimension-reducing strike' on other brands.

Similarly, in the low-end market, GAC AION faces immense pressure from mid-to-high-end brands entering from above. It also means that potential car owners who might have chosen GAC AION due to price considerations may now switch to mid-to-high-end new force brands with lower prices.

In fact, GAC AION is not alone in this situation; all low-end new energy brands face the same pressure. While the low-end market boasts vast numbers and significant scale advantages, unfortunately, it lacks solid barriers to effectively resist the penetration and invasion of mid-to-high-end brands.

Moreover, the ingrained image of low-end brands limits their ability to extend into more premium markets, making it difficult for them to achieve breakthroughs and growth in more competitive and higher-priced segments.

Under such a cramped market competition landscape, for GAC AION, quickly addressing issues such as brand image solidification, market share competition, and seeking breakthroughs in the mid-to-high-end market may be more troubling than mere profit pressure. These are areas where GAC AION needs to delve deeper into.