Valuing Xiaohongshu: Where's the ceiling for a 'Lifestyle E-commerce' platform?

![]() 08/08 2024

08/08 2024

![]() 622

622

This article is based on publicly available information and is intended solely for information exchange purposes and does not constitute any investment advice.

In our previous report on valuing Xiaohongshu, we summarized the valuation model for content communities combined with e-commerce and conducted corresponding calculations based on this model. The day after our first report was published, sources revealed that Xiaohongshu's latest valuation range was approximately $17 billion.

Using the same valuation model from our previous report, we can almost calculate a similar pricing range based on user value and commercialization scale.

However, just as we were about to verify the rationality of the valuation formula through a mathematical problem, another voice seemed to emerge from our pens: Are inflexible numbers that aim for fairness but lack elasticity causing us to miss out on imaginative companies, just like how Warren Buffett missed out on Walmart over a few cents?

Today, let's set aside absolute numbers and discuss the valuation ceiling of Xiaohongshu from the perspectives of consumer generations and cycles, combined with Xiaohongshu's latest strategies.

01

Tides of the Times

(1) Consumer Generational Cycle

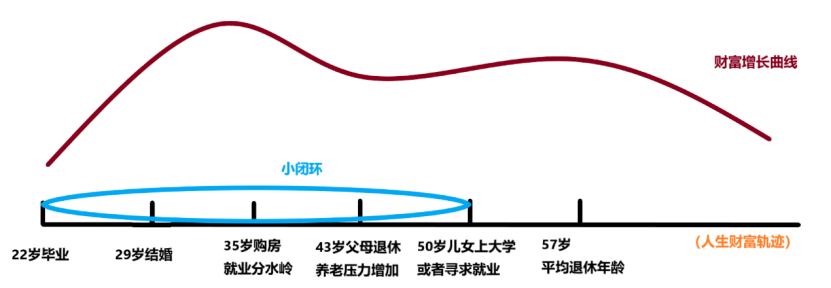

We mentioned the concept of a 7-year consumption cycle in 'The 7-Year War Between Short Videos and E-commerce': If we segment wealth stages, family wealth undergoes relatively significant iterative development every 7 years, leading to shifts in lifestyles and preferences.

Coincidentally, consensus changes in consumption history generally follow this pattern. From automobiles in the broader consumer market: historically, the median time from the launch to the volume production cycle of best-selling car models is 7 years. Down to e-commerce for the masses: since the dawn of e-commerce in 1999, the wind direction in 2006 pointed crazily towards the future giant, Alibaba, whose annual GMV surged, and its B2B business entered the capital market the following year.

Ultimately, it boils down to shifts in the dominant discourse power across consumer generations. Each generational gap, from entering the workforce to marriage, parenthood, and retirement, is roughly 7 years. New things and technologies accepted 7 years ago gradually evolve into new habits and models.

Figure: Life's Wealth Accumulation Stages over 7 Years, Source: Brocade Research Institute

Decisions made by older generations will influence younger generations. When early adopters of these new habits and models become wealth decision-makers, their decisions will be passed on to the next generation, and the cycle repeats.

This generation that directly engages with new things is the native generation, both in terms of consumption values and technology.

Two weeks ago, a Poor Review article explored why younger generations don't use computers, ultimately concluding that the broader environment of an era shapes a generation's skills. So-called "young people don't understand computers" is merely because smartphones and tablets emerged with more structured and comprehensive technical frameworks, replacing the need for young people to explore computers.

Once habits are formed, they are not easily changed. While parents may disapprove of our addiction to the digital world without a specific skill, it didn't stop the 80s and 90s generations from changing the world with code. We may not understand young people's hedonistic attitude towards life, but the post-00s generation leverages broader experiences and ideas to build the business universe they excel in, such as short videos and live streaming.

All intergenerational arrogance and prejudice will slap the faces of the conservative faction.

(2) 7 Years of Xiaohongshu, Influencing Two Generations

Returning to Xiaohongshu, when discussing its uniqueness as a content and e-commerce platform, we often mention the term 'ability to create trends': from early fitness Pilates to hiking, cycling, meditation, City Walk in recent years, and even this year's viral '20-Minute Park Effect,' all originated from the words and deeds of Xiaohongshu users.

If we focus on Xiaohongshu's commercialization capabilities, we can find attack points from various angles, such as questioning its poor conversion rates, short links, and difficulties in fully realizing profits. Another perpetual challenge is the conflict between content tone and commercialization.

However, considering this problem from another angle, as a content platform, why can Xiaohongshu always spark waves of trends? To clarify this, we must go back to 2017.

At that time, with the influx of celebrities like Lin Yun who treated Xiaohongshu as their social media platform to share daily life, Xiaohongshu experienced a surge in traffic. Over the following seven years, the Xiaohongshu community continued to broaden, with the overall user base roughly sextupling.

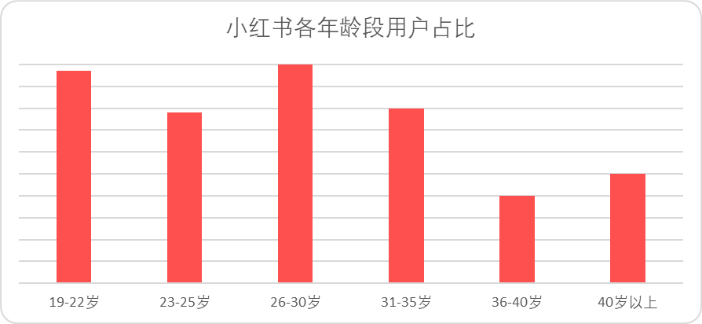

In terms of structure, 70% of Xiaohongshu's new users in 2017 were post-1995, roughly estimated to be aged 22-26. In 2024, users aged 26-30 and 31-35 rank first and third, respectively, across all age groups, corresponding to the core user demographics from seven years ago.

Figure: Age Distribution of Xiaohongshu Users, Source: Xiaohongshu CNY Merchandising 2024, Brocade Compilation

This suggests that Xiaohongshu has maintained high user stickiness over the past seven years and can form a word-of-mouth effect within the same demographic profile (a higher MAU base implies a higher base within the same age group).

The sustainability of structural growth among core user demographics lays the foundation for the platform's long-term influence. Early forums like Mao Pu and Tianya also had highly sticky mainstream user demographics, but their sustainability was weak. They were typical examples of platforms accompanying users' growth. As these users gradually deviated from the mainstream, their brilliant past could only be remembered.

Currently, Xiaohongshu's content-driven approach addresses the logic that content communities often serve only one generation. Future demographics aged 19-22 rank second across all age groups, indicating that Xiaohongshu has achieved a virtuous cycle of attracting and nurturing native generations, at least from a content perspective.

From essential study notes and certification guides during school years to practical tools for professionals' outfits and travel, to parenting tips for moms and dads, fitness references for young people, travel planning, and asset allocation and financial planning for middle-aged individuals – almost all questions can find genuine experience sharing on Xiaohongshu.

Therefore, whether Xiaohongshu can achieve a commercial leap based on two consumer generations is crucial to lifting its valuation ceiling.

02

What Does 'Lifestyle E-commerce' Mean?

E-commerce is a vital aspect of Xiaohongshu's commercialization. In the past two years, discussing Xiaohongshu's e-commerce inevitably led to two topics: imperfect links and the challenge of simultaneously achieving brand and performance goals; compared to other platforms, Xiaohongshu's e-commerce model differentiation remained unclear.

However, regarding these topics, I gained different insights from Xiaohongshu's recent public statements and ecosystem cases.

Recently, COO Conan proposed 'Lifestyle E-commerce,' emphasizing that users can purchase not just good products but also a desirable lifestyle on Xiaohongshu.

Is that a bit abstract? Let me explain: While traditional e-commerce platforms may excel in supply, expanding revenue requires personalized products and content on Xiaohongshu, as non-standard products tend to have higher take rates and can leverage smaller GMV to generate higher revenues.

The core of non-standard products is Give meaning to the product , and that meaning is lifestyle.

Some investors and observers may see this as another buzzword creation by an internet e-commerce platform, but I believe Xiaohongshu's lifestyle e-commerce has tangible value.

First, Xiaohongshu indeed has the genes for this. Numerous brands spontaneously gather on Xiaohongshu to establish their 'content bases,' ranging from domestic beauty brands like Perfect Diary, Flower Knows, and Banmu Huatian to retail brands like Pop Mart and Genki Forest, each with diverse narratives around Chinese beauty, IP aesthetics, and healthy living.

When a product is endowed with a context, users can ultimately experience its true value.

Take Pop Mart as an example: Is a product more appealing when presented with a few product images of the box and dolls on Taobao, or when described in a scenario on Xiaohongshu, where a lively doll sits in a dull study room or cubicle?

Second, while having the right genes doesn't guarantee success, Xiaohongshu has a clear vision for lifestyle e-commerce. The main logic revolves around two points:

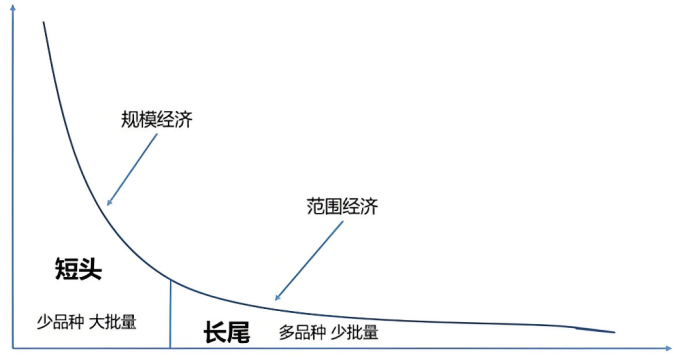

As long-tail demand, non-standard products are inherently about economies of scope, requiring a broad supply to offset the scale advantages of standard products.

Figure: Short Head and Long Tail Economic Model, Source: Online Image

Xiaohongshu doesn't lack content; the core challenge on the supply side is building a creator ecosystem. Only when more users willingly become lifestyle promoters (buyers) can a broad supply of non-standard products be achieved.

Over the past year, Xiaohongshu's buyer base has grown 6.7-fold, with buyer livestream orders surging 9.8-fold, and the number of brands collaborating with buyers increasing 5.2-fold. Currently, Xiaohongshu has initially established a broad supply of creators, an achievement not fully reflected in simple business data.

In June 2024, long-tail search terms (more than 8 characters) accounted for over 60% of all search terms on Xiaohongshu.

To highlight the meaning of non-standard products, personalization extends beyond the product itself, encompassing marketing channels and the connection between people, products, and scenarios.

As some e-commerce platforms adjust their service terms, the model of competing on low prices and supply has proven unsuitable for all platforms.

Whether by chance or design, Xiaohongshu faced skepticism from some investors for too long an emphasis on content and commercialization balance. However, as the core of livestream e-commerce competition shifted from low prices to content experience and emotional value, Xiaohongshu found itself on high ground.

Most Xiaohongshu livestreams differ from traditional sales pitches. For instance, selling antiques, short video platforms often attract attention with 'high-value' gems or treasure hunts, while Xiaohongshu focuses more on antique education, exemplified by Wenwan Chaowan brand founder Yinuo Bennuo.

Based on understanding their consumer base, Yinuo, with a decade of experience, hesitated to livestream due to concerns about selling high-priced items. After declining three invites, they eventually tried three livestreams and discovered Xiaohongshu's differentiation. Their 'edges' were embraced by users, leading to their first-month livestream sales of 180,000 yuan, surging to 1 million yuan by March 2023.

In livestreams, Yinuo doesn't merely highlight product features or rely on low prices but comprehensively explains product histories and industry knowledge, akin to an 'antique education livestream.' In note sharing, Yinuo also describes personal feelings and daily life, weaving stories with fans, enriching account content and deepening fans' understanding of the founder.

In Xiaohongshu's recent public statements and ecosystem cases, buyers and creators frequently mention, 'You can be yourself on Xiaohongshu.' Because Xiaohongshu's core is 'people.'

Lastly, while emphasizing content has been controversial, some e-commerce professionals view Xiaohongshu's lifestyle e-commerce as a gimmick to raise unit prices, believing abandoning low prices during rational consumption cycles is a dead end.

However, in our view, Xiaohongshu's lifestyle doesn't equate to expensive. Lifestyle is a collection of decentralized needs, encompassing both high-value products showcasing individuality and cost-effective products fulfilling practical life needs.

By refining product usage scenarios, such lifestyles are not only affordable but also practical. Lifestyle refers not to daily necessities but to practicality and individuality.

In my opinion, lifestyle e-commerce is a 'clever' expression, where a thousand readers can interpret a thousand Hamlets. For the general public, lifestyle encompasses clothing, food, shelter, transportation, and leisure time entertainment. Compared to the cold definition of e-commerce, lifestyle offers a more intuitive, low-cost decision-making, and easily accepted narrative.

There's no one-size-fits-all formula in the internet world. Symbolic images are just the first step. Part of Xiaohongshu's current rapid growth stems from its previous low base. For long-tail non-standard products, Xiaohongshu's test lies in its content quality, creator ecosystem sustainability over the long term, and product supply capabilities.

In summary, I hold a cautiously optimistic attitude towards Xiaohongshu's e-commerce development prospects. However, if Xiaohongshu can maintain its current advantages and growth trends, the ceiling remains highly imaginative.

03

Extended Thinking

Above, we've delved into Xiaohongshu's valuation ceiling, from generational shifts to specific business logic. Many readers may wonder, 'Not all visions come true. The tulip bubble is more alluring than the rotation of a steam engine. How do we distinguish between a steam engine and a tulip bubble?'

Or, how did Warren Buffett miss out on Walmart over a few cents but also blindly invest in Netjets? When should we choose to believe and when should we be cautious?

In my view, judging a company's long-term investment value requires a trifecta: 'Tao' (the way), 'Shu' (the techniques), and 'Shi' (the trends).

Just like Danone and General Motors in 2008, both seemingly suffered from double hits to valuation and performance under external pressure. However, Danone Keenly perceive changes , altered pricing strategies, and united the supply chain to weather the crisis, while General Motors collapsed due to its long-standing reluctance to change, monolithic model, and stagnant products, ultimately filing for bankruptcy.

Why did we single out Xiaohongshu from the content community platform valuation model to discuss its ceiling? The main reason, as mentioned earlier, is:

From a user structure perspective, Xiaohongshu has become a content platform influencing consumer generations, with users increasingly relying on Xiaohongshu for various aspects of their lifestyles. As a content platform, Xiaohongshu is gradually finding its 'Tao.'

From a business model perspective, Xiaohongshu has gradually explored a 'Shu' that matches its 'Tao' – lifestyle e-commerce. Compared to traditional shelves and livestreams, Xiaohongshu's people-centric differentiation model has achieved relatively rapid short-term growth (though the base is small and requires continuous observation).

From an economic cycle perspective, Xiaohongshu is in a rational period with significant macroeconomic fluctuations, and its valuation has already reached a lower limit. This means Xiaohongshu faces less valuation pressure than bubble-era startups, similar to today's Pinduoduo, which rose during the mandatory consumption period. The elasticity coefficient for future valuation upsides during optional consumption cycles is significant.