"Chinese cars are meant to carve out a niche in the Japanese market"

![]() 08/07 2024

08/07 2024

![]() 653

653

Introduction

Introduction

This time, it's the Japanese automakers' turn to be nervous.

At 6 am on June 24th, local time, the Automotive Society's Thai auto market research team successfully landed at Bangkok's Don Mueang International Airport.

The announcements on the plane, casual conversations among passengers, and phone notifications filled the air. Amidst the hustle and bustle, I opened my phone and sifted through the pile of messages, finally finding the push notification from our local guide: "I'm waiting at the airport exit."

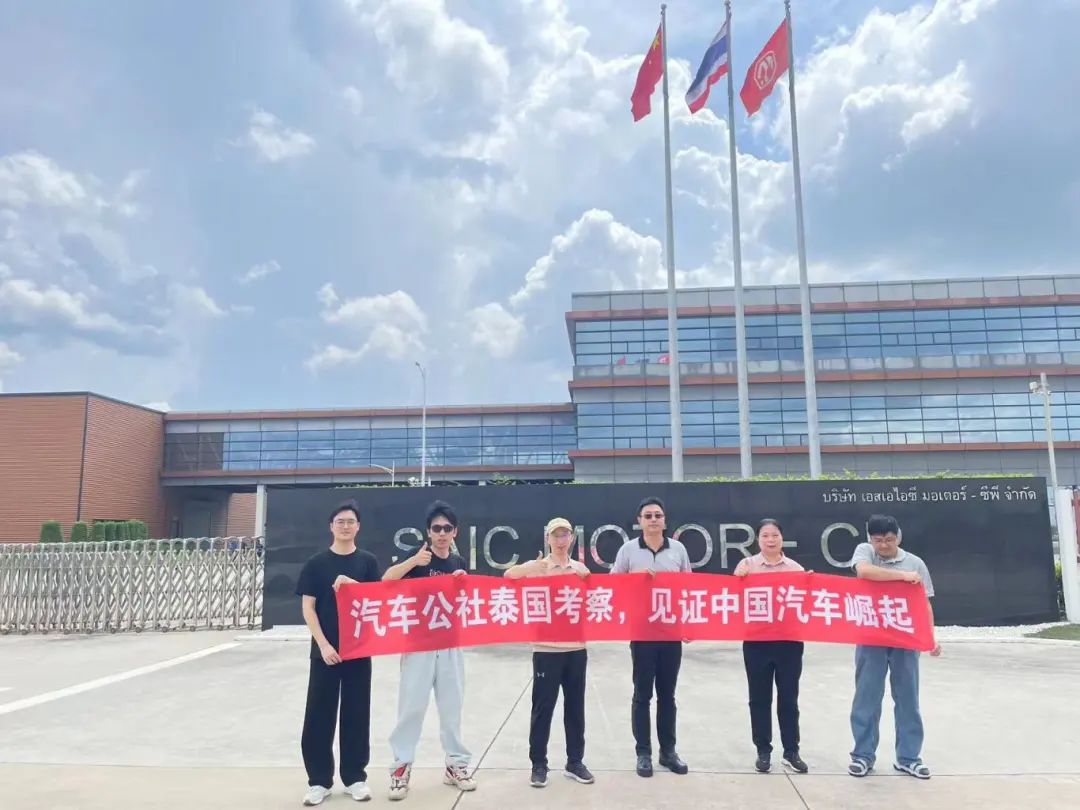

Our local guide was a Chinese employee hired by SAIC-CP in Bangkok. Originally from Shanghai, she had lived in Thailand for years, witnessing firsthand SAIC's and indeed all Chinese automakers' progress in the Thai market. Despite her busy schedule, she made time to welcome us, a group of Chinese automotive journalists and fellow Shanghainese.

As soon as I stepped off the plane, I fully experienced the unreserved enthusiasm of this Southeast Asian land. Looking around, the tropical charm of Thailand unfolded like a delicate painting. The scorching heat wafted freely under the morning sun, accompanied by the greetings of "Sa Wasdee Kha" and other unintelligible Thai phrases, inadvertently revealing the exuberance of the Thai people.

"Welcome! Come see the development of Chinese cars in Thailand."

After meeting our local guide, our group embarked on this journey. During casual conversations, huge billboards for MG (SAIC-CP), BYD, Great Wall, AION, NIOZ, and even multiple consecutive billboards for one Chinese brand, lined both sides of the highway leading from Don Mueang Airport. In contrast, few other automakers had billboards, and even Japanese brands, which dominate the Southeast Asian market, were scarce, making me marvel at the progress of Chinese automakers in Thailand.

This feeling is difficult to describe without witnessing it firsthand. It encompasses pride in the current state of Chinese automakers going global, nostalgia for the past development of China's automotive and industrial sectors, and anticipation for the future global expansion of Chinese cars.

Unlike China, where building advertisements are ubiquitous, Thailand still favors large billboards, reminiscent of China 10 to 15 years ago. Chinese automakers entering Thailand thus chose a more mainstream and localized form of advertising, an essential first step in brand recognition.

As our journey progressed, I witnessed the tire tracks left by Chinese cars in Thailand over the years. Vehicles with Chinese branding roared past us on both sides of the road, their engines humming with history or electric motors playing a hopeful future.

After observing for a long time, I couldn't help but feel deeply moved.

As a recorder, even I, who is witnessing these scenes for the first time, feel deeply moved. Imagine those who have been actively involved in China's automotive expansion into the Thai market. Faced with this genuine and precious sight, I must delve into the efforts made by Chinese automakers to go global, focus on the stories behind their international expansion, and pay attention to their past, present, and future endeavors.

Backpackers in budget hotels

"Expanding Chinese cars into the Thai market is not as simple as it sounds," said our local guide when discussing the remarkable changes in China's automotive market entry into Thailand. "When SAIC first arrived, there were only a handful of people in the management team, carrying backpacks. Including subsequent short-term technical support staff, there were only 20-30 people in total."

These backpackers from Shanghai, 2,900 kilometers away, efficiently adapted SAIC's overseas plans, forming teams for management, finance, technical support, and sales. Under clear and decisive leadership, these diverse forces quickly coalesced into a cohesive unit, ready to tackle the Thai market.

"Seeing the potential for new energy vehicles to go global, AION decided to take action rather than just talk about it. So nine of us flew over with our backpacks...," said Ma Haiyang, General Manager of AION Southeast Asia, as he reminisced about the early days in Thailand, leaning back in his office chair, which had accompanied him through countless late nights and early mornings.

As AION's Southeast Asia General Manager, Ma Haiyang has been involved in every step of AION's entry into Thailand, from being a backpacker to establishing an office on Silom Road 98 and finally commissioning the AION Thailand factory, bringing models like the second-generation AION V and AION Y Plus to the market.

"From our brand's internationalization last September to the delivery of our first batch of new cars, even the durian sellers here know about AION's efficiency," Ma Haiyang proudly stated when discussing AION's delivery milestones.

To this day, Ma Haiyang vividly recalls his first days in Thailand, working tirelessly at the Centara Grand at CentralWorld in Bangkok. This was AION's first foothold in Thailand and had also served as a frontier for other Chinese brands like ZTE. This hotel holds countless memories of backpackers' sweat, tears, and joys.

Shen Wei, Head of PR at SAIC-CP, also lamented, "Especially when we first arrived, it wasn't easy for anyone. We had to adapt to and learn many things." He noted that backpackers tend to only share good news and hide their hardships, whether at work or at home. Initially, they faced numerous challenges.

First, there was the adjustment to Thai cuisine, with its heavy use of spices, which was a gastronomic challenge for Chinese stomachs. Second, homesickness lingered deep within every Chinese person, a testament to their cultural identity and adherence to traditional values. Living in the south but yearning for the north, they wondered where their autumn thoughts would land.

Adapting to potential health risks like malaria and air-conditioning sickness in living environments, as well as cultural differences and etiquette taboos in social settings, were also long-term self-adjustment processes. Behind a simple "It's okay," there were untold stories.

Beyond daily living, backpackers also encountered numerous work-related difficulties.

"It was about renting a factory and importing only a few models from China," an SAIC-CP employee shared. When SAIC and other Chinese automakers arrived in Thailand, they faced challenges such as lacking brand recognition, limited product support, and not even owning their factories or offices. Everything was new and challenging.

During the brand-building phase, Chinese automakers were busy participating in the four major auto shows in Bangkok, including the Bangkok International Motor Show and the Bangkok International Motorcycle Show. However, some booths struggled to display decent models, resorting to concept cars to attract visitors. Backpackers had to endure physical and mental strain while traveling extensively and preparing for suboptimal promotional outcomes.

One particularly inspiring story was that of Great Wall Motors.

Great Wall entered the Thai market amidst the pandemic, when mobility was restricted. Operating under such difficult circumstances felt like navigating a "love story during a cholera epidemic." When asked about his feelings, Chong Baoyu, General Manager of Great Wall Thailand, said with emotion, "Fighting the pandemic while expanding our market presence made exploring the Thai market objectively more challenging than for other automakers."

From executives to employees, backpackers often spoke casually about their work and life in Thailand over meals, but beneath their casual demeanor lay untold hardships. Only those directly involved could fully comprehend the emotions and feelings—thoughts of family, reflections on entrepreneurial struggles, and satisfaction with interim achievements—that could easily bring tears to one's eyes with a toast, encouragement, or a simple "Well done."

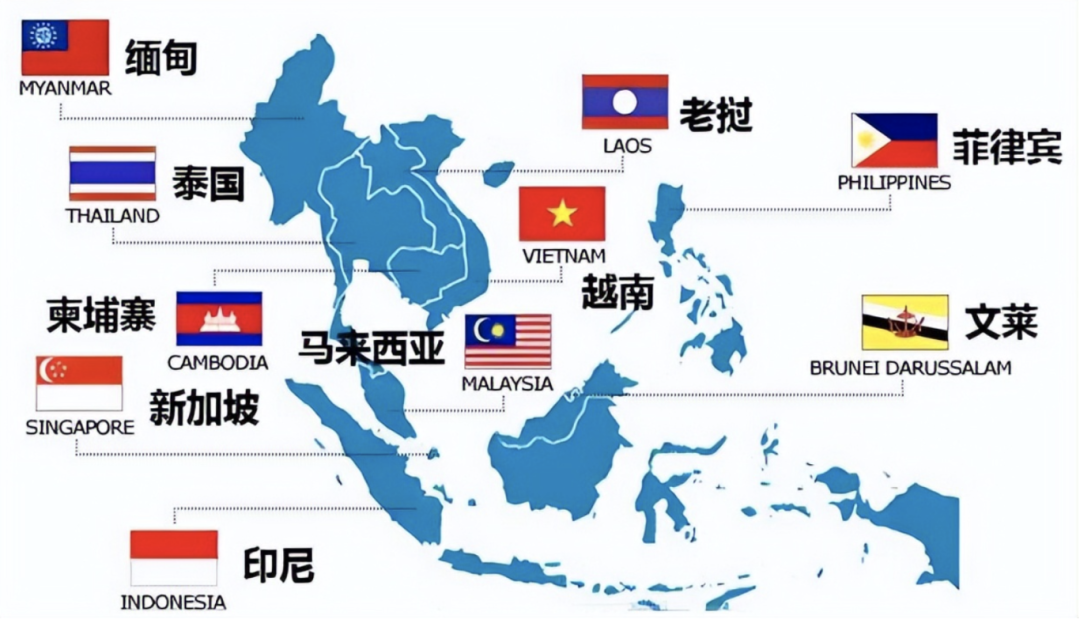

Since China has promoted the global influence of its industries, the automotive sector, as a crucial component, has actively expanded into various global markets. Currently, over ten Chinese automakers have entered Southeast Asia, with Thailand, known as Asia's own "Detroit," serving as a bridgehead for Chinese cars entering Southeast Asia and an essential springboard for their global expansion.

Drawn by the opportunities of the times and driven by brand expansion, a convergence of forces originating from various corners of China has made Thailand the main stage for this endeavor.

Behind this grand strategy lie the efforts of backpackers and budget hotels, paving the way for Chinese automakers to go global from scratch. This romantic tale is unfolding in Thailand, ASEAN, and around the world.

As backpackers write the legendary story of an industry's struggles in a foreign land, they also pen their own exciting chapters. China's automotive expansion wouldn't be possible without national strategies, continuous industrial progress, and the backpackers from all over China who have left their homes to embark on this arduous entrepreneurial journey.

The power of role models is crucial for overseas expansion

The power of role models is boundless, and the strength of spirit is immense.

For individuals, backpackers serve as role models for those who follow in their footsteps to participate in China's automotive globalization efforts. For companies, SAIC Group serves as a role model for automakers venturing overseas. In the epic tale of Chinese automakers expanding into the Thai market, SAIC wrote the first chapter.

As early as 2013, SAIC partnered with Charoen Pokphand Group to bring Chinese cars to Thailand.

As the first Chinese automaker to enter the Thai market, SAIC had no successful precedents to follow. Every step forward was a pioneering effort for Chinese automakers in Thailand; every step backward represented a significant setback; and every stride taken could be meticulously analyzed frame by frame in later PPTs...

Starting a business is never easy, and the challenges faced by SAIC were even greater.

"When MG, as a Chinese brand, first entered Thailand, market acceptance was still low," said Mr. SUROJ, Executive Vice President of SAIC-CP and Secretary-General of the Thai Electric Vehicle Association, in an interview with the Automotive Society. This issue wasn't unique to SAIC but a potential challenge faced by all Chinese automakers entering the Thai market.

On one hand, Japanese automakers had been entrenched in Thailand for over 60 years, with stronger brand recognition, a diverse product lineup, a sophisticated supply chain, deep consumer insights, and close relationships with policymakers. As a result, Japanese automakers have held nearly 90% of the Thai market since the 1990s, dominating not only Thailand but also the entire Southeast Asian market.

On the other hand, the tarnished reputation of Chinese motorcycles in Thailand due to past incidents had a lasting impact on subsequent market entry attempts.

As the domestic motorcycle market became saturated, Chinese brands turned to Southeast Asia, quickly capturing an 80% market share in Thailand with their cost-effective models. However, due to a lack of R&D investment, inconsistent product quality, and irrational price wars, the reputation of Chinese motorcycles declined sharply, eventually leading to their exit from the region.

This is why, despite Thailand's motorcycle population exceeding 30 million, it's rare to see a "Made in China" label. As I walked through the streets of Bangkok, I couldn't help but hear the tragic tale of Chinese motorcycle globalization in the roar of Japanese motorcycles whizzing past me.

Whether due to the long-standing dominance of Japanese automakers, the initial "break-in" period for Chinese cars, or the painful history of Chinese motorcycle globalization, SAIC faced numerous obstacles when entering the Thai market. This didn't even include the usual challenges of brand building, product refinement, factory construction, policy understanding, and consumer behavior research.

However, amidst the intertwining challenges and missions lay both pressure and opportunity. This pioneering phase is inevitable for startups, whether small companies or entire industries. This time, the mission of making "Saawadee Ka" (Hello in Thai) fall in love with Chinese cars fell on SAIC's shoulders.

As the vanguard of Chinese automakers entering Thailand, SAIC, as the leading domestic automaker, had to take on this role. China's automotive globalization needed role models, and SAIC, consistently ranked first in domestic sales, had always led the way, with the saying that "out of every 10 Chinese cars sold overseas, 3 are from SAIC."

However, exploring from scratch was never easy, and SAIC faced multifaceted challenges in Thailand. Amidst unfavorable beginnings, some even questioned, "How long can SAIC survive in Thailand?"

Fortunately, since SAIC Motor decided to go abroad, it has always adhered to the long-term strategy, which is also a common consensus among Chinese automakers currently expanding overseas.

As a result, we have witnessed the emergence of SAIC Motor's Chivayo plant in Chonburi, the continuous introduction of new energy technologies into Thailand, the formulation of preferential policies through numerous efforts by enterprises, the promotion of product and talent localization, and the extension of the automobile-related industrial chain to Thailand... All these reflect that SAIC Motor, as a model for Chinese automakers entering Thailand, will accumulate experience for those who follow and strive for a favorable development environment.

In September 2020, Great Wall Motor acquired General Motors' plant in Rayong; in October 2021, NIO entered the Thai market; in August 2022, BYD Thailand Co., Ltd. was established; in June 2023, Aion entered the Thai market... With the promotion of overseas expansion strategies and the support of SAIC Motor as a role model, Chinese automakers have flocked to Thailand.

Today, BYD and Aion's Thai factories have officially been completed and put into operation; NIO's plant has been bustling since the end of last year; Changan's plant is also under construction, while SAIC Motor has entered the second stage of development in Thailand, having surpassed the previous model of importing vehicles and gradually realizing localization in production and sales in Thailand.

Success is not as easy as picking dandelions on a hillside; achieving localization is a lengthy and arduous process, for which SAIC Motor has made tremendous efforts.

Take the introduction of core technologies as an example. As one of the first automakers to propose the concept of "new four modernizations," SAIC Motor began applying connected vehicle technology as early as 2016. At that time, SAIC Motor and Alibaba jointly launched the world's first internet SUV, the Roewe RX5, which became a dark horse in the auto market that year thanks to its outstanding connected technologies such as "Aliyun."

However, this "cloud" was difficult to cross the ocean. It was not easy for SAIC Motor to replicate its domestic success in connected vehicles in Thailand and had to reintegrate resources to create a localized i-Smart connected voice control system, bringing the trend of connected vehicles to Thailand.

This approach, with technology as the foundation of the brand, successfully opened up opportunities for SAIC Motor.

When everything was well prepared, SAIC Motor Chivayo began to exert its strength. Since the launch of its first model, the MG 6, in Thailand in 2014, SAIC Motor rewrote the Thai auto market landscape dominated by Japanese cars within three years, achieving a compound annual growth rate of 200%. Since the launch of the MG ZS EV, SAIC Motor has spent five years increasing the number of electric vehicles in Thailand from fewer than 200 in 2019 to 150,000 today. It has also promoted the expansion and distribution of charging stations, setting standards and becoming a benchmark.

Today, these new energy vehicles from Chinese brands and SAIC Motor are freely cruising the streets of Bangkok and other major Thai cities. The charging stations that have been installed are densely distributed in front of 7-Eleven convenience stores, which are popular in Thailand, and beside gas stations and hotels, serving as monuments to China's auto exports.

From 2013 to 2024, as the rainy and hot seasons alternated in Thailand, sea grapes grew in abundance, and child star Jirada Morlan grew into a graceful young lady... Today, SAIC Motor has progressed from tentative steps to steady progress, marking 11 years of continuous development.

Not only has it not withdrawn from the Thai market, but it has thrived amidst the opportunities of the times and its own pioneering efforts. From having nothing at the beginning to moving forward relentlessly, the market is no longer filled with questions like "How long can SAIC Motor survive in Thailand?" Instead, over 230,000 MG models are driving on Thai streets, serving as the best calling card for Chinese auto exports.

In the opinion of Mr. Sudirawa, the reason Chinese automakers have been successful in Thailand is that Japanese cars cannot match the technology of Chinese electric vehicles, leading to the recognition of Chinese brands. When asked about the increasing number of Chinese brands in Thailand, Mr. Sudirawa generously stated, "We now have partners. From a situation where only one Chinese automaker faced seven Japanese automakers, it has now become 9:5."

"Carving out a niche from the Japanese"

As Mr. Sudirawa said, from SAIC Motor's entry into Thailand in 2013 to Great Wall Motor's acquisition of the Rayong plant, only SAIC Motor was poised for development in Thailand during this period. In contrast, there were as many as seven Japanese automakers with a market share of up to 90%.

Since the 1960s, when Nissan partnered with Siam Motors to become the first Japanese automaker to establish a factory in Thailand, followed by Toyota, Honda, Isuzu, and others, Thailand has become one of the main overseas export production bases for Japanese cars. Toyota alone accounts for more than one-third of the Thai market, making it a "street car" in the country.

According to data from the Thai Ministry of Industry, Japanese cars accounted for an astonishing 86% of the market share in 2022. From the Grand Palace in Bangkok to Wat Rong Khun in Chiang Rai and Pattaya Beach... Japanese cars can be seen everywhere in Thailand, and this dominance has a long history and is deeply ingrained in people's habits.

According to locals, buying a car is a big deal. People dress up nicely and go to a 4S dealership as a family, but their choices are limited when buying a car. Japanese cars are the inevitable option for most Thai families.

However, with the advent of new energy vehicles in Thailand, this market landscape is about to be disrupted.

"In recent years, many Chinese cars have entered the market, and many people are willing to try them out," many locals have expressed similar views.

This aligns with the local people's behavioral habits. These people living in the "Eastern Hawaii" not only love seafood but also enjoy trying new things. Thai youth not only love driving Chinese cars but also enjoy watching Chinese dramas. Bai Lu is one of their favorite Chinese stars, and subscribing to iQIYI to watch dramas and participating in fan club activities fill their daily lives... This has given Chinese cars a great opportunity.

As the saying goes, "Seeing is believing," and traditional Chinese medicine emphasizes the principles of "observation, auscultation and olfaction, inquiry, and palpation." The same applies to Chinese cars. In addition to youthful designs and increasingly daring configurations, the technology hidden beneath the design shell will receive positive feedback after extensive hands-on experience, especially in areas where Japanese cars are not proficient in intelligence, giving Thai users the impression that "Chinese cars are very advanced."

From zero to one and from one to many, as more and more Thai consumers add Chinese cars to their shopping lists, the latter is also witnessing a breakthrough in the market.

According to data from Marketline, a market research agency, eight of the top ten selling brands in Thailand in 2022 were Japanese, but SAIC Motor Chivayo's MG also successfully made the list, becoming a "standout" among them. This is a manifestation of SAIC Motor's achievements after nine years of cultivation in the Thai market and a precursor to the explosive growth of Chinese cars in Thailand.

In the subsequent year of 2023, Chinese cars accelerated their entry into Thailand, with a large number of enterprises bringing competitive models to the country, such as Great Wall Motor's Ora Good Cat and Haval first love ; BYD's ATTO 3 (Yuan PLUS), Dolphin, and Seal; GAC Motor's Aion Y PLUS; and NIO's NIO X. As an "early bird," MG's product line in its Thai base even covers B/Eco, B-SUV, C-SUV, Pick-up, EV B SUV, EV MPV, and other models. These products are not only sold in Thailand but are also exported to other Southeast Asian countries such as Vietnam and Indonesia.

These familiar cars in China not only provide Thai consumers who are tired of driving Japanese cars with more options but also pave the way for Chinese cars to expand their presence in Thailand.

According to data from the Thai Ministry of Industry, at the end of 2023, the share of Chinese automakers in new car sales in Thailand exceeded 10%, an increase of 5.5% year-on-year; whereas the share of Japanese cars fell below 80%, to 78.3%, a decrease of 7.5% year-on-year. This shift also reflected the decline of Japanese cars at the sales terminals, with leading brands such as Toyota and Honda adjusting their prices early in the year.

"Toyota and Honda never used to offer discounts or compulsory third-party liability insurance, but with the arrival of Chinese cars, the discounts are significant. We have no choice but to increase our offers at times," said a salesperson at a Toyota 4S dealership located near Laem Chabang Port, Thailand's largest automotive import and export base and seaport.

The Toyota 4S dealership next door faced a similar situation. Despite occupying the largest share of the Thai auto market, Toyota had to make adjustments in the face of the rapid expansion of Chinese cars. For example, the Camry, which has seen widespread price cuts in the Chinese market, and the popular pickup truck model Hilux in the Thai market, now mostly offer zero-interest loan financing policies, with some models even offering loan terms exceeding seven years.

Previously, Japanese car prices in Thailand remained stable throughout the year, with few preferential policies introduced except for price reductions to clear inventory before model changes. This is an area where Chinese cars, upon entering the Thai market, found Japanese cars unprepared but forced to adjust. After all, the inventory cars parked around various Japanese 4S dealerships constantly remind them of sales pressure.

The situation for the aforementioned Japanese automakers is relatively better. Just before the departure of the Automotive News Thailand investigation team, Suzuki and Subaru successively announced their plans to close their production plants in Thailand this year.

Amid the rapid development of new energy, Suzuki is facing increasing pressure from overcapacity, and the decision to withdraw from the market is a prudent move in the long run. Taking Suzuki as an example, its production plant in Rayong Province employs 800 workers. Since its commissioning in 2012, it has mainly produced models such as the Swift, Ciaz, and Celerio, with an annual planned production capacity of 60,000 units. However, Suzuki's total sales in Thailand in 2023 were just over 10,000 units.

With their withdrawal, the number of Japanese competitors faced by Chinese cars in Thailand has decreased from seven to five. "I don't think this is a turning point," said Mr. Sudirawa. Although the market share of Japanese cars has declined, he believes it is too early to consider the withdrawal of Suzuki and Subaru as the beginning of the decline of Japanese cars. He added, "But there are positive signs for Chinese cars."

The positive sign is that during the same period when the aforementioned Japanese automakers withdrew from the Thai market, many Chinese automakers swarmed in, further expanding their strength, which was also reflected in the market.

Data shows that from January to May this year, Thailand's passenger car market sold 201,000 units, down 11.6% year-on-year. Among them, 57,000 new energy vehicles were sold, accounting for 28.5% of total sales and increasing by 52.2% year-on-year. Chinese new energy vehicles accounted for more than 70% of these sales, with Chinese brands led by BYD, SAIC Motor, and Great Wall Motor topping the new energy brand sales chart.

Among them, SAIC Motor sold over 5,000 new vehicles in Thailand in the first half of the year, with a market share of 16.1%. Its main models, such as the MG4 EV and MG ZS EV, are popular among Thai youth. The globally developed MG4 is not only a best-seller in China and Europe but also one of the most popular electric vehicles in Thailand.

BYD, with its strong product lineup and continuously improved sales network, has solidified its position as the sales champion of new energy vehicles in Thailand in the first half of the year, with monthly sales reaching 1,833 units in June. The Yuan PLUS, Dolphin, and Seal are BYD's main models in the Thai market, contributing sales of 819, 754, and 249 units, respectively.

These achievements not only reflect the high popularity of SAIC Motor and BYD's products but also demonstrate the competitiveness of Chinese brands' new energy vehicles in the Thai market.

Of course, if you're used to domestic sales of over 300,000 units per month, Thailand's sales figures seem paltry. However, it's important to note that unlike China's incremental market, Thailand belongs to a stock market with an annual production of only 2 million units. Apart from exports, the local annual sales in Thailand are less than 1 million units. Additionally, pickup trucks are the foundation of the Thai auto market, further discounting passenger car sales.

This means that Chinese cars must compete for a share in a market of less than 500,000 units, which has been dominated by Japanese cars in Southeast Asia for many years. Considering the short time frame and the remarkable achievements, with 70% to 80% of new energy vehicle sales in the 10% market share belonging to Chinese cars, this is undoubtedly a performance that surprises both Japanese and Chinese automakers.

Although the current share of new energy vehicles in Thailand is small, government support has already begun to materialize. Firstly, on the production side, the Thai government allocated 35 billion Thai baht from 2023 to 2025 to support electric vehicle companies in purchasing land, constructing factories, and developing electric vehicle charging facilities. Secondly, on the consumer side, in the fourth quarter of 2023, Thailand announced electric vehicle incentives, offering up to 100,000 Thai baht in subsidies for electric vehicle purchases from 2024 to 2027...

There are both subsidies for the production end and incentives for the sales end. It is foreseeable that the share of new energy in the Thai market will continue to expand in the future, which is undoubtedly good news for Chinese auto companies that focus on the new energy track.

Based on market performance and policy support, as well as the current trend of Chinese auto companies entering the Thai market, an executive of a Chinese auto company even boldly stated, "We don't just want this 10% (share), we also want the remaining 90%. What we need to do is to carve out a niche from the Japanese!" It has a certain momentum of "Why don't men carry Wu hook?"

Behind this ambition lies the fact that Chinese cars have already shown scale and standardization in Thailand.

At the end of last year, the China Automotive Technology and Research Center (CATARC) opened its Southeast Asia Representative Office in Bangkok, the capital of Thailand, which is the fourth branch of CATARC overseas. The main task of CATARC is to understand and grasp the dynamics of automobile-related standards and regulations in neighboring countries such as Indonesia, and provide support for local Chinese auto companies.

In the future, with the arrival of more Chinese auto companies, more high-quality products will be brought to Thailand, a more complete supply chain will be established in Thailand, and more comprehensive infrastructure will be built here... Chinese cars are expected to achieve further breakthroughs in the Thai market, setting an example for Chinese cars going overseas and injecting confidence into the current volatile overseas market situation.

Twelve years ago, the Thai movie "First Love" was just released in China, and it was loved and recognized by audiences for its unique perspective and emotional expression. This movie also filled the author's first impression of Thailand; Today, 12 years later, I embarked on a journey to Thailand and witnessed firsthand the major event of Chinese cars going overseas. How could I not be touched by the development of Chinese cars in Thailand, how could I not be moved by the story behind it, and how could I not be proud of its past, present, and future.

On the evening of June 29th, the Thailand auto market research team of Autotimes boarded the return flight, and I began to review every moment of this trip. The plane's announcement, passengers chatting, and mobile phone message alerts filled my ears. Amidst the hustle and bustle of the crowd, I tried to empty my mind and sift through the mountain of information accumulated over the past few days. Suddenly, the words of a Chinese auto company executive echoed in my ears...

He said, "Regarding the development of Chinese cars in Thailand, we want to avoid two things. First, don't ruin the image of the Chinese brand that we have worked so hard to build, making others laugh at us; second, the 'price war' in China has already reached Thailand, and we don't want business to become completely unprofitable. Actually, we have the opportunity to segment the market."