Studied 44 AI products and discovered the secrets of AI application pricing

![]() 08/14 2024

08/14 2024

![]() 693

693

AI applications have begun to explode this year.

A notable change is that AI investment is shifting from base models to applications. Starting from the second quarter, investment in AI applications doubled compared to the same period last year, with AI application stars like Perplexity and Suno securing substantial funding rounds.

As more money flows into AI applications, people are increasingly concerned about a practical issue:

How do these AI applications actually make money?

To better understand this, Palle Broe analyzed the pricing strategies of 44 native AI application products, examining pricing models, value metrics, public promotion, free versions, and pricing transparency.

Palle Broe, the author of this article, has led pricing strategies at Uber (B2C) and Templafy (B2B SaaS) and provided monetization strategies for over 20 tech startups from Seed to Series D rounds.

Through this report, Palle Broe aims to answer two questions: How do tech companies monetize AI features today, and what can entrepreneurs learn from this information?

/ 01 / Direct vs. Indirect Monetization: Which is Better?

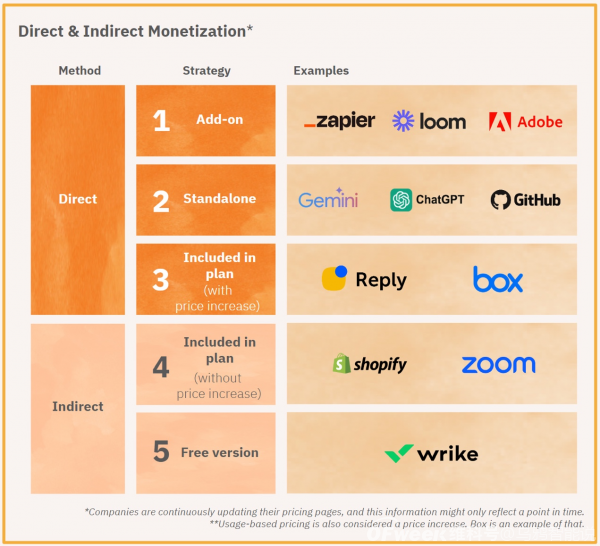

In general, there are two ways to monetize AI features: directly and indirectly.

Direct monetization involves charging for AI features directly or increasing product prices after adding new AI capabilities. Indirect monetization, on the other hand, integrates AI features into existing bundles without price changes or offers them as standalone services without additional costs.

Overview of Five Advanced Monetization Strategies for AI Features and Products Launched by Tech Companies

According to statistics, the most common monetization strategy is bundling AI features into existing software packages (adopted by 59% of companies). This approach benefits current subscribers from AI features, sometimes leading to price increases.

In other cases, AI features are added without changing the existing pricing structure, allowing companies to quickly launch and gather data on AI feature usage.

The second most common strategy is direct monetization, offering AI features as add-ons with specific prices (adopted by 23% of companies). This direct profit-making approach provides data on AI feature usage and end-user willingness to pay, informing product roadmaps and development.

Additionally, 18% of surveyed companies, particularly those with large language models (LLMs), have developed standalone AI products purchasable without affecting existing subscriptions.

Most companies adopt direct monetization, either offering new AI features/products as add-ons or bundling them into existing plans with price increases (or usage-based components). This strategy clarifies user willingness to pay and potential cost structures for AI features, unlike indirect monetization, which struggles to track and accurately attribute increased retention and upselling value.

So, what kind of AI companies are more suited to direct monetization?

High variable costs: New-generation AI's high variable costs (e.g., computation, bandwidth, storage, security, and maintenance) cannot be absorbed through indirect revenues. Companies leveraging large models require users to pay per AI feature use due to the high computational costs.

Clear customer value: Customers recognize the added value of new-generation AI features and are willing to pay for them, such as GitHub's Coding Copilot or Intercom's AI bot Fin.

Indirect monetization strategies (e.g., including AI features without price increases or offering them for free) succeed when AI features significantly enhance product usage, conversion rates, or retention rates. For example, AI features that significantly boost overall customer conversion or retention rates in usage-based pricing models can generate more revenue than their costs, as seen in Zoom and Shopify's strategies. Another reason for indirect monetization is to gather more feedback on AI features, especially in products with large customer bases where price increases require caution and consideration of competition, such as price wars.

/ 02 / How to Choose a Direct Monetization Strategy?

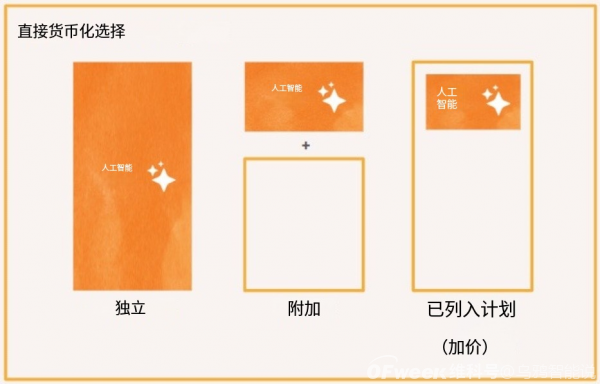

Next, we delve into three direct monetization strategies: add-on services, standalone products, and bundled price increases.

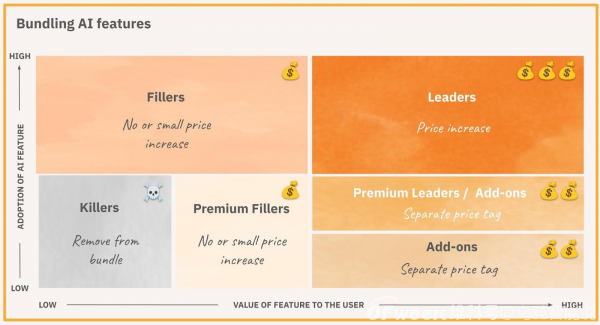

Selecting a monetization strategy involves considering the value AI features bring to users and your business, optimal bundling methods, and AI feature distribution across different plan tiers.

Step 1: Define AI's Role in Your Product Portfolio

Consider the following questions:

1. Will this feature be widely used by users or only by specific segments? If over 70% of users are likely to use the feature, include it in the standard package; otherwise, consider its commercial viability as an add-on.

2. Are enough people willing to pay for this feature? Determine if the AI feature is a luxury or necessity. Use product testing or customer surveys to gather data on willingness to pay.

Once you have answers, plot the feature on the map below to determine the best bundling path.

For example, if an AI feature is widely used (over 70%) and provides significant value, it becomes a "priority" feature in your bundle, potentially justifying a price increase. If used by a minority (e.g., 20%), it should be an "add-on."

Step 2: Evaluate Three Direct Monetization Strategies

AI product maturity and capabilities significantly impact monetization strategies. Some companies, like OpenAI with ChatGPT, can monetize their AI products independently due to their strong capabilities. These rare products target specific use cases and attract buyers willing to pay for solutions.

Standalone Product Strategy

Standalone AI products offer flexibility in designing pricing models, unconstrained by traditional pricing or bundling structures. Major standalone AI products, like ChatGPT and Gemini, are based on proprietary LLMs. GitHub Copilot, an exception in non-LLM fields, demonstrates another monetization possibility for AI features.

Standalone products are best suited when they solve problems distinct from existing products with minimal overlap.

Add-On Strategy

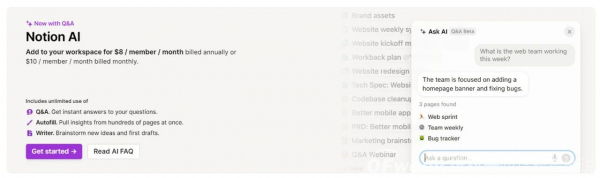

Similar to standalone products, add-ons require significant standalone value. However, they are bundled with existing products, potentially targeting the same buyers. AI add-ons should align with existing portfolios, solving related problems for seamless integration. Companies like Notion, Microsoft, and Airtable adopt this approach, e.g., Notion charges $10 for its AI feature.

Add-on strategies are best suited when:

- AI features benefit some customers but not all are willing to pay for them.

- AI features enhance existing portfolios, helping customers solve problems better.

Included in Plans with Price Increases

59% of companies integrate new AI features into existing plans (though it's unclear how many raise prices). Price increases depend on the value AI features bring to customers. If they significantly improve the user experience, increasing plan prices or adding usage-based pricing components may be justified. However, raising prices for large customer bases requires caution and communication to understand willingness to pay.

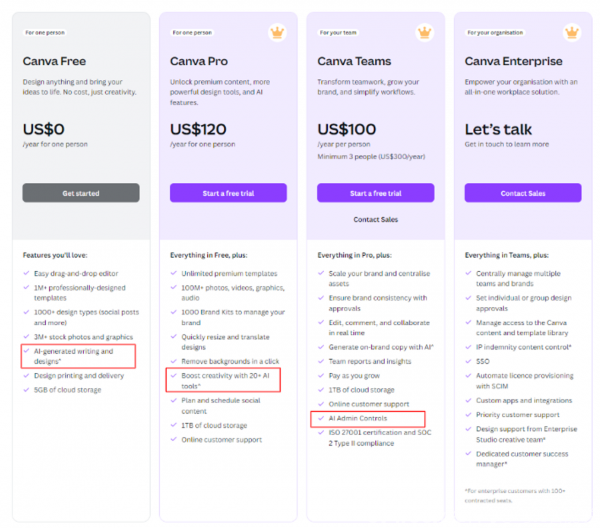

Companies like Canva, Box, and Grammarly integrate AI features into existing plans and raise prices based on usage.

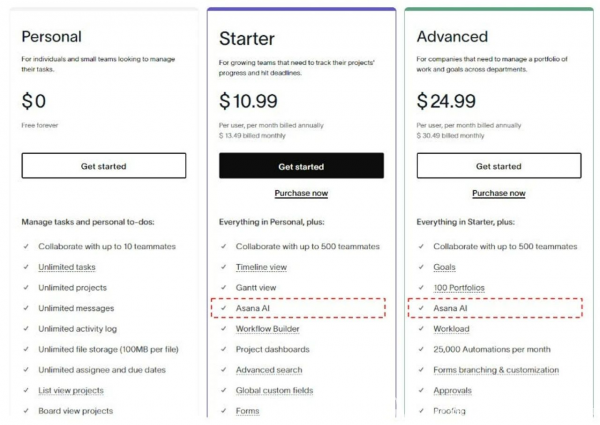

Asana's pricing scheme adds AI features to existing plans, suitable when:

- The feature aligns with the plan's core value proposition and is considered critical by around 70% of customers.

- Customers are unlikely to purchase the feature standalone.

- Offering it separately may seem too transactional or petty to customers.

When integrating AI features, strategically distribute them across plans based on customer willingness to pay and various use cases. This approach ensures features align with customer needs and maximizes revenue potential while creating upgrade paths and saving costs for entry-level subscriptions, as demonstrated by Canva.

/ 03 / How to Price AI Products?

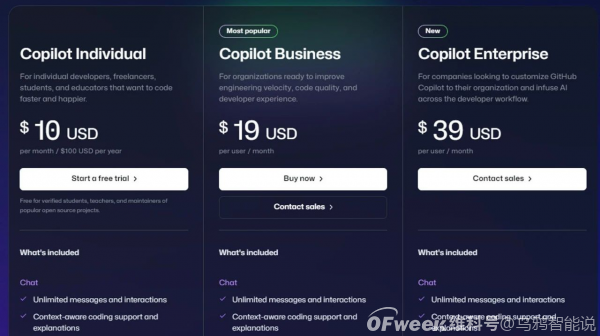

By studying companies offering AI products as add-ons or standalone products, we can understand their pricing strategies and compare them to standard SaaS products (excluding those integrating AI features into existing plans due to pricing allocation difficulties).

This provides insights for other AI companies pricing their products. Currently, AI add-on pricing varies widely, from 25% of base plan prices (Adobe) to 4.75 times the cost of standard SaaS products (GitHub). In absolute terms, AI products range from $4 to $30 per user per month, typically priced lower than non-AI add-ons.

AI feature pricing should match their value. For example, Microsoft charges $30 per user for Microsoft 365 Copilot, exceeding its subscription fee, while GitHub Copilot costs $19 per user, over 4.75 times its standard SaaS subscription cost.

Expensive pricing is justified by significant product value. Microsoft Copilot boosts productivity by 70%, while GitHub Copilot accelerates task completion by 55%, according to reports.