JD.com and Taobao's strategic changes: loss of focus, imitation, and return – is there nothing new in e-commerce anymore?

![]() 08/15 2024

08/15 2024

![]() 441

441

To continue steady growth in the existing e-commerce market, it's no longer about blindly pursuing 'new stories' but returning to user needs.

Content/Lianshan

Edited by TV

Proofread by Mangfu

After a year of intensified price wars, China's e-commerce players are collectively returning to their roots.

Starting in the second quarter, Pinduoduo adjusted its business focus, shifting from commercialization and profit maximization to prioritizing GMV. This means Pinduoduo is no longer solely pursuing higher monetization rates through absolute low prices.

In fact, Pinduoduo is not alone in changing course recently, as Taobao, Douyin, and other e-commerce platforms have also weakened their strategies focused on absolute low prices.

At the end of June, Taobao Group announced at a closed-door meeting for merchants that the previous system of allocating search weight based on the 'Five-Star Price Competitiveness' would be weakened, with GMV taking precedence instead. Meanwhile, Douyin E-commerce also adjusted its business objectives, no longer prioritizing 'price competitiveness' and focusing instead on GMV growth in the second half of the year.

With the diminishing dividends of China's e-commerce industry, players initially engaged in a collective race to the bottom on prices before turning towards pursuing GMV growth. This 'collective unconsciousness' reflects a strategic void.

At one time, e-commerce companies like JD.com, Taobao, and Pinduoduo relied on business model innovation to create unique commercial success stories in different segments and build deep moats. Today, however, an increasing number of players struggle to find effective strategies to boost performance and can only blindly follow the leaders.

However, the reality that 'what grows well in the south may not thrive in the north' has finally made Chinese e-commerce companies realize that blindly following the leaders is not the solution to growth issues. To continue steady growth in the existing e-commerce market, they must stop blindly pursuing 'new stories' and instead return to user needs.

Part.1

How Long Has China's E-Commerce Been Without 'New Stories'?

In stark contrast to the current blind race to the bottom on prices, China's e-commerce industry was vibrant just a few years ago, with players capturing massive user bases through business model innovation.

Image source: Alibaba

For example, at Alibaba Group's Yunqi Conference in 2016, Jack Ma stated that 'there will be no e-commerce in 10 or 20 years, only new retail.' Following this, Alibaba established a new retail ecosystem through acquisitions, investments, and incubations, with Taobao and Tmall serving as the foundation and Hema, RT-Mart, and Intime Department Store as verticals.

In April 2017, JD.com also launched '7FRESH,' a competitor to Hema, offering high-quality fresh food products and lifestyle services.

At that time, China's mobile internet boasted abundant traffic dividends and consumption upgrades were prevalent, providing a fertile ground for 'new stories' in e-commerce platforms.

Financial reports show that in Q4 FY2017, Alibaba's revenue was RMB 38.579 billion, up 60% year-on-year, marking the highest quarterly revenue growth since its IPO. Koubei's Alipay-settled transactions amounted to RMB 75 billion, a staggering 257% year-on-year increase, highlighting Alibaba's successful 'new retail' strategy.

The turning point came in 2020, when factors such as the pandemic, the real estate downturn, and economic pressures halted China's consumption upgrade trend, with consumption downgrading becoming the norm in the consumer market.

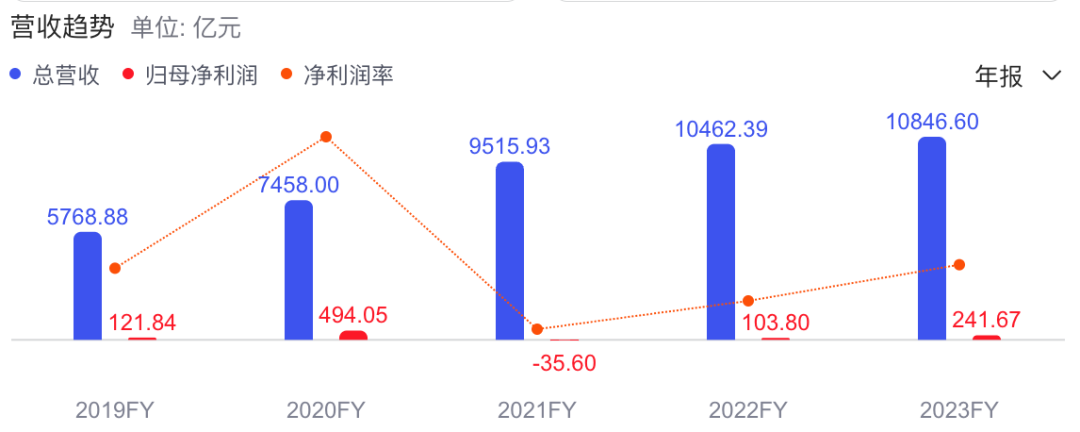

Under these circumstances, e-commerce companies like Alibaba and JD.com, which had bet on consumption upgrades, faced immense pressure. In 2021, JD.com reported a net loss attributable to ordinary shareholders of RMB 3.6 billion, swinging from profit to loss year-on-year.

In stark contrast to the struggling Alibaba and JD.com, Pinduoduo emerged as a leader in China's e-commerce sector during the post-pandemic era.

Financial reports show that in 2023, Pinduoduo's revenue reached RMB 247.6 billion, up 90% year-on-year, with adjusted net profit of RMB 25.477 billion, a staggering 110% increase year-on-year. Due to its impressive performance and growth potential, Pinduoduo's market value surpassed Alibaba's twice in 2023, becoming the most valuable Chinese company listed in the US.

While Pinduoduo's rise seems attributable to its ultra-low prices, the root cause lies in its innovative business model. On the user side, Pinduoduo leverages community fission and 'viral' sharing to capture massive traffic. On the product side, Pinduoduo aims to naturally lower prices through traffic allocation and reduced sales thresholds.

For example, when Apple launched the iPhone 11 in September 2019 with a starting price of RMB 5,499, Pinduoduo offered a subsidized price of just RMB 4,999, RMB 500 cheaper than all other e-commerce platforms and offline channels.

In essence, the combination of ultra-low prices and community fission created a virtuous cycle where the platform drives down prices, which in turn attracts users, making Pinduoduo a giant in the fiercely competitive e-commerce landscape.

In contrast to Pinduoduo, while e-commerce platforms like JD.com, Taobao, and Douyin have also explored live streaming e-commerce models in the post-pandemic era, this model is largely an upgrade of marketing tactics, enhancing interactivity and entertainment to attract consumers and improve conversion rates rather than representing true business model innovation.

Moreover, live streaming e-commerce heavily relies on incremental traffic dividends and influential super KOLs. In recent years, as mobile internet traffic dividends diminish and top KOLs encounter setbacks, the live streaming e-commerce industry has become increasingly subdued.

Part.2

Lack of Direction Leads to Blind Race to the Bottom on Prices

With strategies like new retail and premiumization, which were previously pursued to cater to the consumption upgrade trend, failing, and live streaming e-commerce models showing signs of fatigue, Pinduoduo, with its impressive financial results, became the benchmark for e-commerce platforms like JD.com, Taobao, and Douyin, which began intensifying their focus on low prices.

At JD.com's internal retail conference at the end of 2022, Liu Qiangdong stated that 'low prices were the most important weapon for JD.com's past success and will continue to be its fundamental weapon in the future.' Subsequently, JD.com made 'low prices' its most critical strategy for the next three years.

Similarly, in early 2023, Taobao Group launched its Price Competitiveness Project, introducing a Five-Star Price Competitiveness system to offer more low-priced products. During the FY2024 Q1 earnings call, Taobao Group CEO Dai Shan emphasized that the 'Price Competitiveness Battle' would be a key area of continued investment for the company.

Despite the intensified focus on low prices by e-commerce platforms like JD.com, Taobao, and Douyin, Pinduoduo's business model has not been successfully replicated, and the growth potential of these platforms has even weakened.

Financial reports show that JD.com's revenue growth rates declined from 29.28% in 2020 to 3.7% in 2023, slowing to single digits. Douyin E-commerce's monthly sales growth rates ranged between 50% and 70% in 2023, while cumulative year-on-year growth slowed to below 40% in March 2024 from 60% in January and February.

The failure of many e-commerce platforms to revive their performance despite focusing on low prices may stem from a mismatch between their business models and user characteristics.

It is well known that JD.com, Taobao, Douyin, and Pinduoduo have distinct business models. JD.com focuses on genuine and authorized products, Taobao on branded goods, Douyin on live streaming e-commerce, while Pinduoduo specializes in white-label low-cost products.

Due to these different business models, it's challenging for platforms like JD.com, Taobao, and Douyin to prioritize absolute low prices like Pinduoduo when selecting and promoting products.

For instance, in Douyin's live streaming e-commerce model, merchants rely heavily on influencers to reach consumers, incurring higher circulation costs. When allocating traffic to live streams, the platform must consider both content quality and product characteristics. As a result, merchants on Douyin's platform struggle to offer absolute low prices, even if they do, the high upstream costs may not be offset by sufficient consumer attraction due to the performance of the live streamer.

On the other hand, while consumers generally seek cost-effective products, the extreme low prices offered by some platforms may turn off certain segments due to their unique characteristics and target audiences.

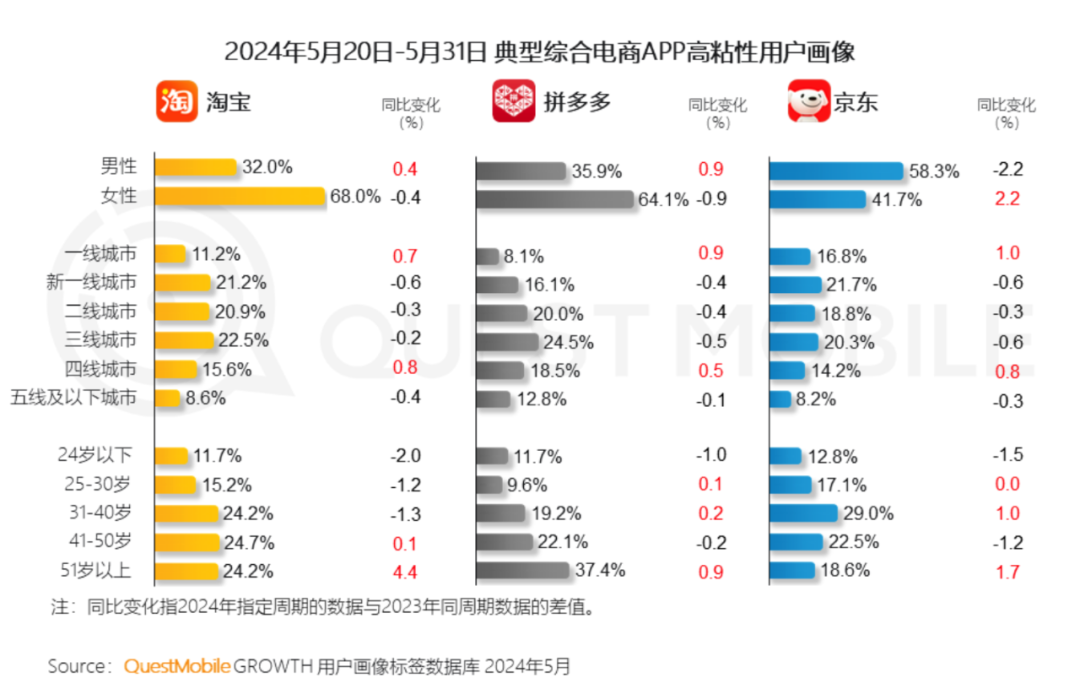

According to data from the First Financial Commercial Data Center, as of Q1 2023, JD.com's PLUS membership base exceeded 35 million, with half residing in top-tier cities and characterized by young, sophisticated couples, middle-aged parents seeking convenience, urban middle-class, and emerging white-collar professionals. These consumers, while valuing cost-effectiveness, may shy away from ultra-low-priced, potentially low-quality white-label products.

In contrast, data from QuestMobile shows that as of late May 2024, over 75.8% of Pinduoduo's users hailed from second-tier and lower-tier cities, with 59.5% aged 41 and above. These users naturally gravitate towards ultra-low prices. Pinduoduo's financial reports reveal an average order value of approximately RMB 40.

Part.3

How to Tap into the Value of Existing Users without New Innovations?

Realizing that their absolute low-price strategies were ineffective due to mismatches in business models and user characteristics, e-commerce platforms like JD.com, Taobao, and Douyin began weakening their focus on low prices in mid-2024 and returning to their previous pursuit of GMV growth.

Returning to previous strategic directions can stabilize platform performance but also underscores the lack of 'new stories' in China's e-commerce industry in the short term.

However, this is not about encouraging e-commerce companies to fall back into complacency after emerging from the 'race to the bottom.' Instead, focusing on user-centricity, optimizing shopping experiences, and tapping into the potential value of existing traffic seems more achievable than developing entirely new and imaginative business models.

Over the past few years, China's e-commerce industry has grown rapidly amidst exploding traffic, but the shopping experience has not been flawless. E-commerce companies often prioritize transaction-related data while neglecting to provide comprehensive and exceptional shopping experiences for users.

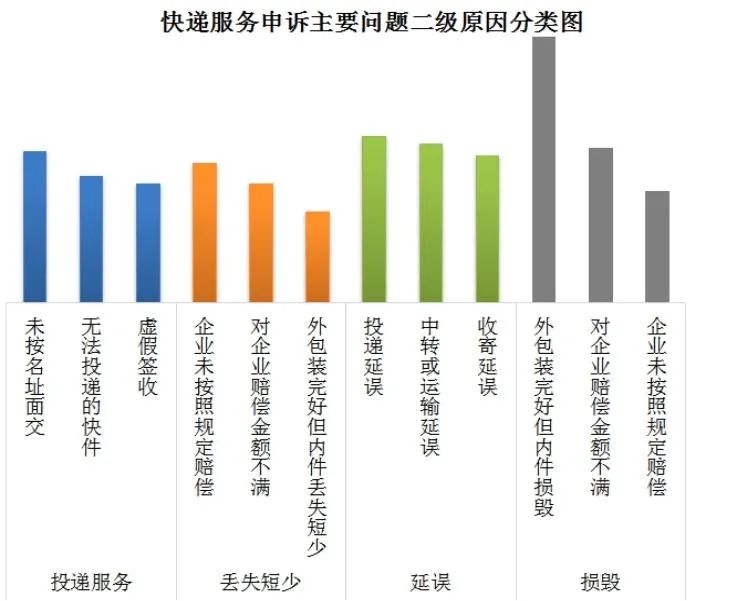

For example, the issue of couriers not delivering packages to the doorstep continues to plague consumers. According to the Beijing Municipal Postal Administration's complaint report for May 2024, complaints about delivery services accounted for 12.69% of all complaints, primarily concerning failure to deliver to the designated address and false signatures.

Considering that logistics and delivery are crucial links in the shopping chain, couriers not delivering packages to the doorstep can inhibit consumer spending to some extent.

Acknowledging these issues in the e-commerce industry, platforms like JD.com, Taobao, and Douyin are not only returning to their previous focus on GMV but also striving to optimize the shopping experience.

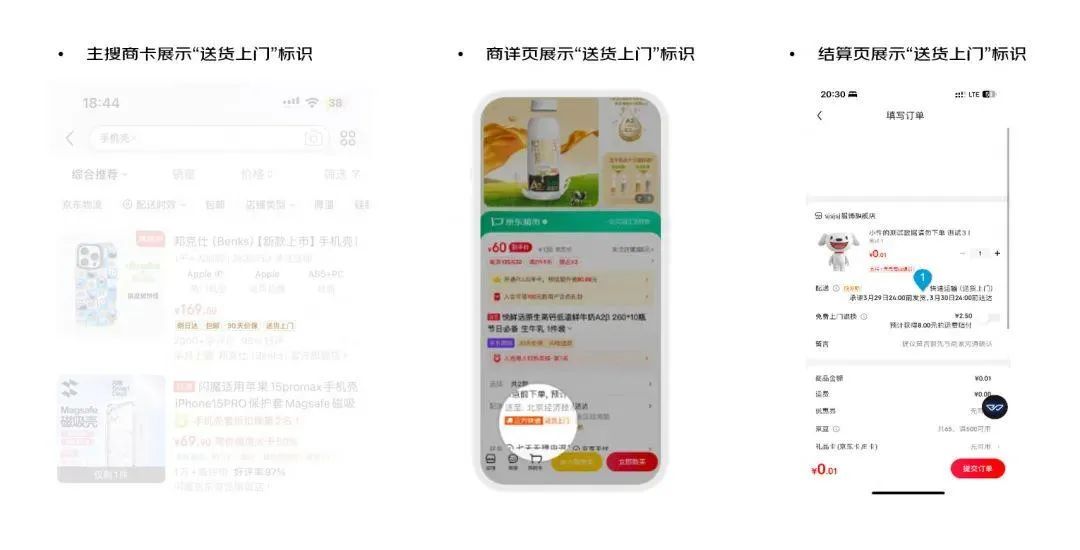

To address the issue of couriers not delivering packages to the doorstep, Douyin introduced on-demand delivery services, allowing consumers to choose between doorstep delivery, locker pickup, and front desk collection after the package is shipped. Similarly, JD.com recently announced that merchants can now fully activate doorstep delivery services, requiring carriers to provide doorstep delivery to consumers.

Apart from addressing doorstep delivery issues, many e-commerce companies are also working to optimize other aspects of the user experience.

For example, ahead of the 2024 618 shopping festival, Alibaba optimized its Taobao web version and relaunched the Taobao Forum, aiming to enhance the shopping experience for PC users. During the 618 period, both Taobao and JD.com abolished controversial pre-sales activities to reduce consumer shopping costs.

Furthermore, to address consumers' hesitance to shop due to concerns about high return shipping costs, Taobao introduced an unlimited free return shipping service for 88VIP members in April 2024, offering a maximum subsidy of RMB 25 per return shipment, with no limit on the number of returns and compatibility with shipping insurance.

Similarly, JD.com upgraded its 'Free Home Return and Exchange' service, allowing free home return and exchange for products labeled with this service, regardless of size, weight, or quantity.

Commenting on e-commerce platforms' focus on enhancing user experience, Goldman Sachs noted in a research report that 'as prices converge across Taobao, JD.com, and Pinduoduo, we believe service quality and user experience will become differentiating factors in consumers' purchasing decisions.'

In conclusion, similar to industries like ride-hailing, local services, and social networking, after years of development, e-commerce players have largely exhausted the business models with significant commercial potential. As a result, it's becoming increasingly difficult to introduce 'new stories.' Instead, a return to user-centricity, optimization of the shopping experience, and a focus on service-level details and patience will become the standard approach for e-commerce companies to navigate the fiercely competitive market and pursue steady growth.