Lazada achieves profitability, changing the logic of e-commerce competition in Southeast Asia?

![]() 08/15 2024

08/15 2024

![]() 605

605

Author | Liu Yu

The news of Lazada's profitability has been widely circulated in the industry.

On August 13, the Wall Street Journal reported that the Southeast Asian e-commerce platform Lazada recorded positive EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) in July this year, achieving profitability.

This information leaked from Lazada CEO Dong Zheng's internal speech. Dong Zheng said that this profitability proves the effectiveness of Lazada's business strategy, and Lazada will continue to increase investment in the Southeast Asian market under a sustainable operating model.

Currently, among the mainstream e-commerce platforms in Southeast Asia, only Shopee and Lazada have achieved profitability first.

Shopee's parent company, Sea, announced in its financial report released in the first half of this year that it achieved its first profitability since its IPO in 2023, reaching $163 million, but its e-commerce business is still struggling to shake off losses; Tokopedia, acquired by TikTok last year, has not yet shaken off losses either.

Behind the pursuit of profitability by Southeast Asian e-commerce and internet giants lies a profound change and adjustment in their venture capital environment, which forces these giants to abandon their past burn-and-grow strategies and move towards healthy operations. Whoever reaches the "shore" first will have a better chance of navigating through economic cycles.

Lazada Thailand achieved profitability as early as 2022, making it the first country where the platform became profitable. That year, Lazada Thailand generated total revenue of approximately 38 billion Thai baht, with a profit of 3.2 billion Thai baht.

As an important market in Southeast Asia, Thailand has immense development potential. Thanida Suiwatana, head of Lazada Thailand, has stated that the number of sellers on Lazada Thailand increased by 30% in 2022, while the number of e-commerce users in Thailand is projected to reach 43.5 million by 2025, presenting a significant opportunity for Lazada.

To seize this development opportunity, Thanida Suiwatana revealed that Lazada Thailand will achieve sustainable growth from three aspects: creating differentiated services for users, ensuring a smooth shopping experience and enhancing security, and leveraging innovation to promote platform development.

These strategies are undoubtedly effective and align with the headquarters' approach. According to Alibaba's financial reports, since 2023, Lazada has continuously narrowed its order losses for several consecutive quarters through measures such as increasing monetization rates, reducing logistics costs, and providing more value-added services, ultimately achieving profitability in July this year.

In fact, the pressure to achieve profitability has been hanging over almost every e-commerce platform and internet company in Southeast Asia. A Singapore-based e-commerce practitioner believes that "the Southeast Asian market has moved beyond the stage of large-scale subsidy burning, and now the challenge for players is to improve efficiency."

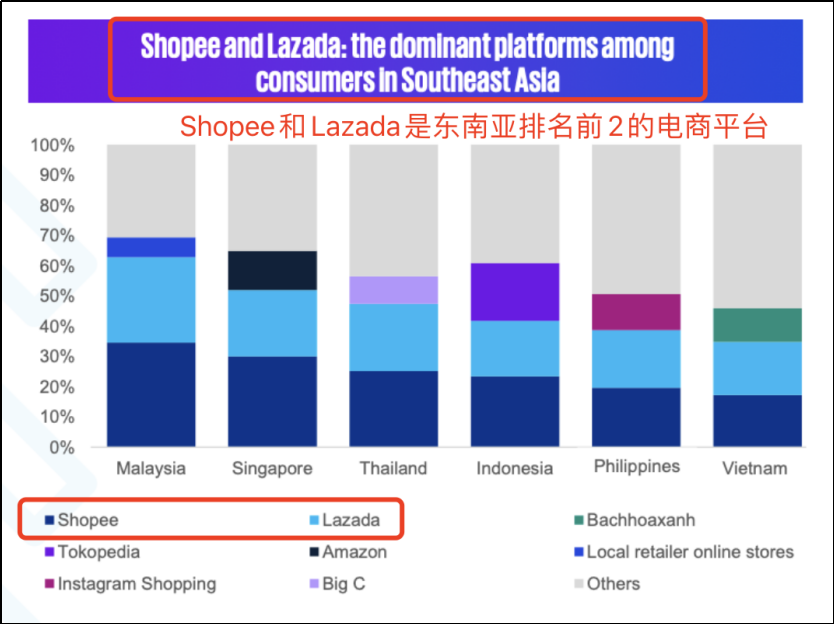

In this context, whoever achieves profitability first gains the initiative. According to KPMG's latest report in 2024, Shopee and Lazada currently occupy the top two positions in terms of market share in Southeast Asia.

The latest KPMG report indicates that Shopee and Lazada occupy the top two spots in terms of market share in Southeast Asian e-commerce. Shopee is also actively striving to shed losses. In 2022, its parent company, Sea, experienced a significant drop in market value. Amid this dramatic change in the environment, the Southeast Asian internet giant began prioritizing profitability. After more than a year of adjustment, Sea announced in its financial report on March 4, 2024, that it achieved its first profitability since its IPO in 2023, reaching $163 million.

However, just this Tuesday, Sea reported a net profit of $79.91 million for the second quarter, a year-on-year decrease of 75.9%. The decline was attributed to increased investment in its primary online retail division, as Shopee faces fierce competition from companies such as Lazada and TikTok Shop.

Another significant e-commerce platform in Southeast Asia is TikTok Shop, which has merged with Tokopedia (the merger has been completed). TikTok Shop has emerged as a formidable force in Southeast Asia, and following its merger with Tokopedia at the end of 2023, it continues to invest in the region, while Tokopedia remains unprofitable. Nevertheless, it appears that mainstream e-commerce platforms in Southeast Asia are all moving towards profitability.

For e-commerce and internet companies in Southeast Asia, profitability is becoming the best news.

Firstly, e-commerce and the internet economy in Southeast Asia have been developing for over a decade, but in the past, most e-commerce platforms have been continuously unprofitable.

This is related to the inherent characteristics of the e-commerce industry. Compared to traditional businesses, e-commerce platforms require significant upfront investments in technology research and development, including platform construction, data management, algorithm updates, and extensive marketing campaigns to enhance platform visibility. These ongoing investments often result in e-commerce enterprises operating at a loss or barely breaking even during their initial years.

However, if profitability remains elusive for over a decade, it casts doubt on the viability of this business model in the market.

Therefore, Lazada's profitability serves as validation of its business model's efficacy. As CEO Dong Zheng noted, it demonstrates the effectiveness of Lazada's business strategy and the Southeast Asian e-commerce model as a whole.

Secondly, the venture capital environment in Southeast Asia is undergoing significant adjustments.

As previously mentioned in the article "Ups and Downs: Southeast Asian VC Bids Farewell to the Golden Decade" published by Xiaguangshe, macroeconomic factors have cooled the global investment climate and increased market uncertainty, with Southeast Asia being particularly affected. The pessimism surrounding internet venture capital in the region is palpable, with sentiments like "The Southeast Asian gold rush dream is shattered," "A $3 billion fund lost money in India and Southeast Asia," and "The first batch of VC funds investing in Southeast Asia are trapped" echoing loudly. The head of a European endowment fund bluntly stated, "The DPI (Distributed to Paid-In Capital) of Southeast Asian funds is very unimpressive... Looking back at eight years of investment performance, the best-performing fund in Southeast Asia had a DPI of only 0.7. In contrast, even our worst-performing fund in China had a DPI exceeding 1."

This has put enormous pressure on many Southeast Asian tech companies, leading to a lack of confidence in their operations.

As a result, from e-commerce platforms and internet giants to offline consumer economies, there is a pursuit of profitability, with "profitability" being the primary criterion for investors when selecting projects.

Lazada's profitability not only boosts its confidence in long-term operations in the Southeast Asian market but also brings hope to other e-commerce platforms in the region.

Thirdly, there is a growing emphasis on health and sustainability, both at the corporate and industry levels, leading to a new stable state in the e-commerce landscape.

In the past, Southeast Asia was arguably one of the most fiercely competitive e-commerce markets globally.

With a population of 600 million, an average age of just 29, and a low e-commerce penetration rate, the Southeast Asian e-commerce market has been a hotly contested battleground for local platforms and Chinese enterprises looking to expand overseas. In addition to the established players Shopee and Lazada, TikTok Shop and Temu entered the market in 2022, with TikTok Shop merging with the Indonesian platform Tokopedia later that year to become a major player.

According to reports from LatePost, Southeast Asia has been mired in low-price subsidy competitions for years, and even aggressive players like Temu approach Southeast Asia with caution.

Moreover, since 2022, Shopee's parent company, Sea, has virtually ceased investing in subsidies in the Southeast Asian e-commerce market, shifting all business objectives from "growth" to "profitability." This suggests that the stage of competing for market share through massive spending is largely over, and the focus should now be on enhancing user and merchant experiences and improving fulfillment efficiency.

As companies shift their goals towards profitability, the e-commerce landscape in Southeast Asia is moving towards a new balance.

For e-commerce platforms, achieving profitability does not signify the end of the "battle." In fact, the e-commerce ecosystem in Southeast Asia remains volatile.

On the one hand, TikTok Shop's rapid development through acquisitions of local businesses compels established e-commerce enterprises to continuously innovate and adapt to changes in young consumers' spending habits and shopping behaviors. On the other hand, Southeast Asia, often referred to as the "Land of a Thousand Islands" and a "melting pot of ethnicities," still grapples with inadequate e-commerce infrastructure such as logistics and payment systems. The payment experience and fulfillment capabilities continue to hinder e-commerce development in many Southeast Asian countries and cities.

In his internal speech, Lazada CEO Dong Zheng stated that the profitability demonstrates the effectiveness of Lazada's business strategy, and Lazada will continue to increase investment in the Southeast Asian market under a sustainable operating model. These investments will primarily focus on technology, user experience, and logistics.

In terms of infrastructure, Lazada's advantage lies in its decision to build its own logistics network from the start, encompassing inventory management, first-mile pick-up, warehousing, transportation, and last-mile delivery. This approach enables Lazada to manage logistics processes, ensuring timely delivery and enhancing consumer experience, thereby driving order growth. At the same time, it allows Lazada to control the cost of each package and continuously improve efficiency across various logistics links.

Lazada also puts considerable thought into enhancing user experience and stickiness. For instance, it prioritizes localized operations in different countries. In the Malaysian market, brand support and upgraded user experience have driven double-digit growth in sales for LazMall's key brands. The "Gold Coin Deduction" interactive feature in Malaysia has spurred rapid order growth and has been replicated in other markets. In the Philippines, gaming and entertainment are key business focuses, contributing to double-digit growth. Lazada also designs interactive features tailored to local consumer preferences, such as LazLand, a game where users earn points for shopping that can be redeemed for real rice and other daily necessities, significantly boosting user stickiness and activity.

In the technology realm, the global surge in "large models" over the past two years has ushered AI technology into a new development cycle. Lazada has taken the lead among Southeast Asian companies in leveraging AI to enhance efficiency. Since May last year, it has successively launched AI chatbots like LazzieChat for consumers and AI marketing assistants and advertising ROI prediction tools for operational staff.

The application of AI has significantly improved Lazada's conversion and payment rates. A notable example is the over 30% increase in conversion rates among consumers assisted by LazzieChat and merchant smart customer service.

These endeavors require continuous investment and strong financial support. Indeed, not only has Lazada CEO Dong Zheng recognized this issue, but it is also why Lazada has been strengthening its self-sustaining capabilities in recent years.

Lazada is not alone in maintaining a clear focus on self-sustaining capabilities. Grab, which aims for profitability this year, has also expressed a similar sentiment. Its Chief Operating Officer, Alex Hungate, noted that while Southeast Asia offers immense growth potential, the significant income disparity between wealthy Singapore and relatively impoverished Cambodia necessitates enhancing payment experiences for users across different regions while deepening data management and analysis.

Perhaps Southeast Asia is indeed entering a new era, bidding farewell to reckless spending and vicious competition.