Ma Huateng, earning 500 million yuan a day, is still looking for new money!

![]() 08/19 2024

08/19 2024

![]() 446

446

Author/Leon

Editor/cc Sun Congying

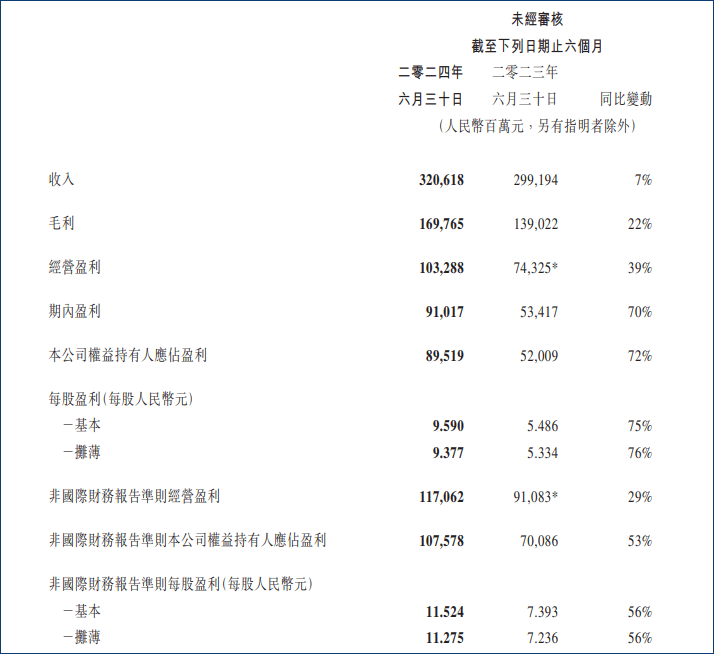

On August 14, Tencent Holdings (00700.HK) released its second-quarter and half-year financial reports for 2024. In the second quarter, Tencent achieved revenue of 161.12 billion yuan, a year-on-year increase of 8%; net profit attributable to shareholders was 47.63 billion yuan, a year-on-year increase of 82%.

For the six months ended June 30, Tencent's revenue was 320.618 billion yuan, a year-on-year increase of 7%; net profit attributable to shareholders was 89.519 billion yuan, a year-on-year increase of 72%.

For a giant like Tencent, such revenue growth is within the normal range, but such a significant increase in net profit is remarkable. In contrast, Alibaba, which just released its second-quarter financial results, saw a 27% drop in net profit during the same period.

Figure: Key Financial Data of Tencent Holdings' Half-Year Financial Report 2024

As of the close on August 16, Tencent Holdings was quoted at HK$372.6 per share, up 1.14%, with a total market value of HK$3.48 trillion (approximately RMB 3.19 trillion). This exceeds the combined market value of Pinduoduo (approximately RMB 1.44 trillion) and Alibaba (approximately RMB 1.35 trillion), firmly establishing Tencent as the leader among Chinese internet companies.

Figure: Tencent Holdings' Performance Trends in the First Half of the Past Five Years

Based on the same period reports of the past five years, Tencent's profitability has gradually rebounded after experiencing a trough in 2022, and the net profit attributable to shareholders in the first half of this year returned to the peak level of 2021. The return of profitability indicates that Tencent is about to enter a strong growth cycle.

Can Tencent continue to make stable profits without worry in the future? Not necessarily. There has been little improvement in the pressure on its revenue structure, and Tencent can be seen to be anxious to explore new growth curves. (For details, see: Is it convincing to emphasize that Tencent's "Non-IFRS profit is not bad"?)

Game Business Recovery, Video Account Drives Advertising Revenue Growth

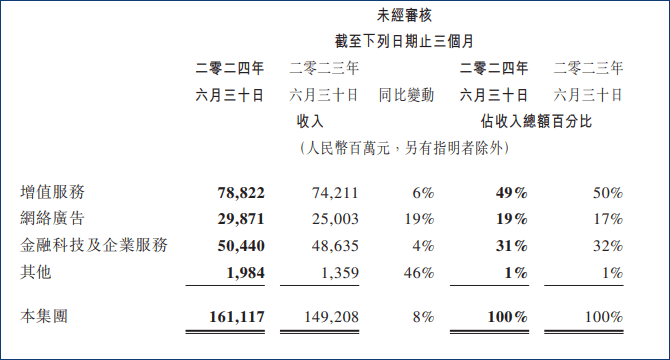

Let's first look at Tencent's three main revenue segments.

In the second quarter of this year, value-added services led the way with revenue of 78.822 billion yuan, accounting for 49% of total revenue. Games remain Tencent's most profitable business, bar none. However, the growth rate of 6% is slightly low, which is understandable considering the ongoing recovery phase.

Compared to the sluggishness in the first quarter, Tencent quickly adjusted its domestic market game strategy in the second quarter, restoring growth (9%) with revenue of approximately 34.6 billion yuan. Specifically, in addition to the two old IPs "King of Glory" and "Game for Peace" continuing to generate revenue, "Naruto" mobile game achieved over 10 million daily active users on average, and "Dungeon & Fighter: Origin" attracted millions of IP fans, potentially becoming Tencent's next evergreen popular game.

Tencent's financial report also noted accelerated growth in international game revenue in the second quarter. Among them, "PUBG MOBILE" performed strongly, and games produced by Supercell studios such as "Brawl Stars" and "Brawlhalla" saw a surge in popularity, driving international game revenue to 13.9 billion yuan, a year-on-year increase of 9%.

In addition, 30.3 billion yuan came from social network and mini-game platform service fees and virtual item sales for mobile games, representing a 2% increase, partially offset by declines in music and game live streaming revenue.

Online advertising was Tencent's fastest-growing business in the second quarter, with a growth rate of 19% and revenue of 29.871 billion yuan. This growth was mainly driven by the video account and long-form video content. Tencent specifically mentioned that the exclusive dramas "Celebration Years 2" and "With Feng Xing" on Tencent Video drove membership revenue.

Financial technology and enterprise services revenue was 50.44 billion yuan, a slight year-on-year increase of 4%, accounting for 31% of total revenue. The slowdown in growth was mainly due to further slowdowns in commercial payment revenue growth and declines in consumer lending service revenue, but wealth management service revenue achieved double-digit growth, reflecting the broader economic environment to some extent. Enterprise services achieved growth of over ten percentage points, benefiting from cloud services and technical service fees for video account merchants.

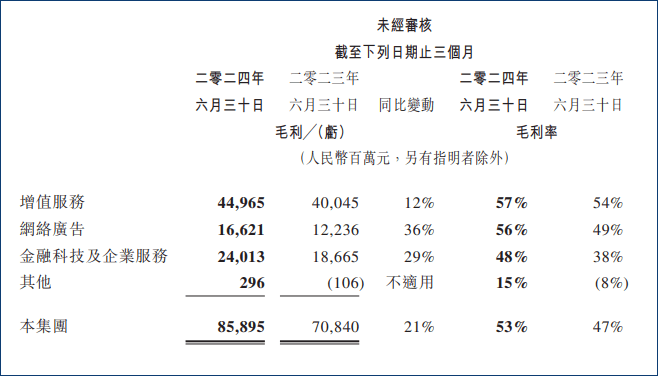

Next, let's look at the gross profit margins of the three main businesses. Although value-added services had the lowest growth rate (12%), a gross profit margin of 57% indicates that Tencent's games are highly profitable. Additionally, online advertising had a gross profit margin of 56%, while financial technology and enterprise services had a gross profit margin of 48%. The exceptional profitability of these "three pillars" is envied by outsiders.

While Tencent is often ridiculed as an "investment company," it is undeniable that its investments have been shrewd. The acquisition of Supercell for $8.6 billion brought multiple blockbusters to Tencent, giving it a taste of success and prompting it to increase its bets in various niche segments. For example, Tencent invested in the single-player AAA game "Black Myth: Wukong" and holds a 5% stake in its developer, Game Science Studios. Tencent also fully acquired developer Grinding Gear Games, and its highly anticipated game "Path of Exile 2" is expected to compete with Blizzard's "Diablo" series.

However, the failure of "Dream Star" left Tencent wary, and the game was not even mentioned in this financial report. As Nobel laureate in economics James Tobin said, "Don't put all your eggs in one basket." Games are Tencent's core business, but they cannot be its only core business. (Tencent's Internationalization Story Finally Has Substance!)

As a result, high hopes are placed on the video account. During the reporting period, the video account has directly empowered other businesses, such as advertising and enterprise services. More importantly, the video account has given WeChat the ability to convert traffic into e-commerce consumption, completing a closed-loop ecosystem. (For details, see: Relying on the Power of WeChat, Video Accounts Begin Supporting Ma Huateng's Family)

Rapid Growth of Video Accounts Still Falls Short of Douyin

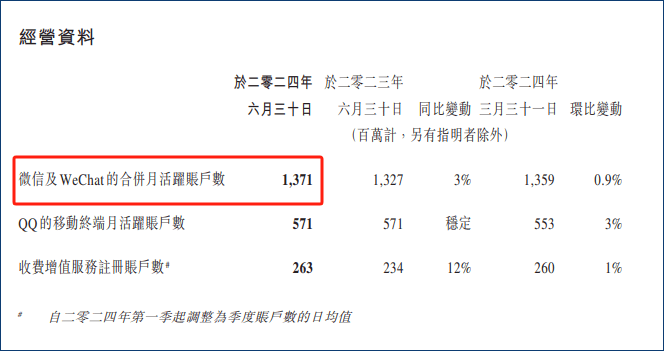

During the reporting period, the combined monthly active user accounts of WeChat and WeChat Work reached 1.37 billion, an increase of approximately 0.9% from the previous quarter, approaching its limit. In contrast, QQ Mobile has become exclusive to young people, with its 571 million users remaining stable.

WeChat, which integrates chat, payments, short videos, and live streaming, has become Tencent's "super platform" and carries the company's hopes for re-entering the e-commerce space. While WeChat provides users, the video account is the executor. The financial report noted that due to enhanced recommendation algorithms and more localized content, video account user engagement time has "significantly increased."

However, Tencent has not explicitly disclosed active user and GMV data for the video account, so we can only roughly estimate it based on third-party data.

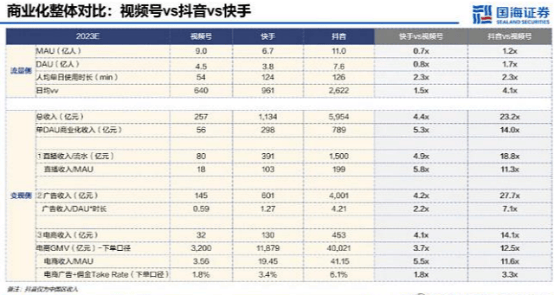

According to a report by Guohai Securities, the daily active user count of the video account reached 450 million in 2023, surpassing Kuaishou's 380 million but still lagging behind Douyin's 760 million.

In terms of average daily engagement time per user, the video account only had 54 minutes, less than half of Kuaishou and Douyin. Daily active users (DAU) and engagement time are the foundations of commercialization, which explains why Tencent emphasized the growth in video account user engagement time in its report.

In terms of GMV, the video account is projected to generate revenue of 320 billion yuan in 2023, compared to 1.18 trillion yuan for Kuaishou and 4 trillion yuan for Douyin, indicating a significant scale gap. The lack of top streamers may be a bottleneck for the video account's GMV growth.

However, Tencent does not seem in a rush to support its top streamers. Tencent mentioned in its report that it will systematically strengthen transaction capabilities, promote merchant sales, and enhance user shopping experiences. At the same time, it will continue to strengthen machine recommendations and algorithms to drive more WeChat users to the video account.

Additionally, Wall Street Technology Eye previously reported that the video account had recruited and expanded its local lifestyle services team. However, based on my personal experience, the video account does not currently push a significant amount of group buying content based on user location, suggesting it is still in its early development stage. (For details, see: Ma Huateng's Ambitions Resurface: The Struggles and Compromises of Video Account E-commerce)

It is certain that for the video account to grow significantly, it cannot rely solely on live streaming e-commerce and short video showcases; local lifestyle categories are inevitable. In fact, Douyin has successfully captured a share of Meituan's market through local lifestyle group buying.

Is Video Account E-commerce Just an Empowering Tool?

Relying on WeChat's vast user base, the video account is poised to become Tencent's new profit growth point, leading the entire group in transformation and reducing the risks associated with over-reliance on the gaming business.

Of course, the e-commerce market is not friendly, with Pinduoduo, Alibaba, and JD.com fiercely competing as shelf e-commerce platforms, while Douyin and Kuaishou are also vying for a piece of the pie, making the market nearly saturated. (For details, see: Smallest in Scale, Highest Growth Rate: Kuaishou E-commerce GMV Exceeds Trillion Yuan)

The advantage of the video account lies in not requiring additional app downloads, and short videos and live streaming content can be seamlessly shared with WeChat users or groups, resulting in highly efficient dissemination. Additionally, Tencent actively introduces private domain traffic from mini-programs and official accounts to the video account, rapidly increasing the number of merchants.

However, Tencent has not chosen to follow in the footsteps of predecessors in developing live streaming e-commerce.

According to service providers in the video account industry belt, the operating logic of the video account differs significantly from that of Douyin and Kuaishou. Taking the commodity supply side as an example, platforms like Douyin initially open up comprehensively before implementing centralized governance, but the video account's e-commerce approach is the opposite, with a strict access mechanism. For instance, certain categories require merchants to have achieved sales of millions in platforms like JD.com over the past three months before being allowed to sell on the video account.

Similarly, the video account is not proactive in supporting top streamers. Unlike Douyin, the video account does not have a dedicated team for streamer operations and incubation. Its traffic recommendation mechanism focuses more on algorithms and social connections, creating a decentralized traffic field. While this benefits small and medium-sized merchants, it also means that the video account cannot leverage super streamers to generate significant GMV increments during specific periods, such as 6.18 sales events.

The reason for this lies in the video account's integration with WeChat, which is based on acquaintance social networking and is not suitable for the extreme commercial conversion model of Douyin, as this could potentially harm the reputation of the entire WeChat ecosystem. Therefore, Tencent has chosen another path to bridge traffic.

It is reported that the upgrade of the video account store to the WeChat store has been in beta testing for some time. After the upgrade, product circulation on the WeChat store will not be limited to video account short videos and live streams but will also be integrated into advertising scenarios such as official accounts, mini-programs, and Moments, and may eventually be integrated into "Search."

This strategic direction aligns with what Tencent Vice President Martin Lau mentioned, stating that after repositioning live streaming e-commerce, it is more akin to the WeChat e-commerce system.

It is certain that Tencent places great importance on video account e-commerce internally. Earlier this year, Ma Huateng expressed his determination to fully develop video account e-commerce in 2024, making the video account a genuine "hope for the entire Tencent organization."

Perhaps Ma Huateng's intention is not to turn the video account into a second Douyin but rather to make it a tool that ignites the potential of the WeChat ecosystem.