The contradiction of new energy vehicle insurance may be resolved

![]() 08/22 2024

08/22 2024

![]() 420

420

Introduction

Introduction

Today's new energy vehicle insurance market is indeed facing a dilemma on both the supply and demand sides.

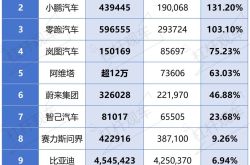

In July, with the retail penetration rate officially exceeding 50%, new energy vehicles undoubtedly witnessed another milestone moment in China's automotive market, and surpassed traditional fuel vehicles in terms of sales volume.

This begs the question, why?

The answer is actually quite simple: it is due to the overall improvement in product competitiveness. Better driving experience, higher comfort, superior intelligent cabin and driving capabilities, and lower operating costs have all contributed to consumers' willingness to pay for new energy vehicles.

However, despite these advantages, some 'flaws' still exist. For example, compared to traditional fuel vehicles, new energy vehicles of similar prices often have significantly higher insurance premiums, and these premiums tend to increase rather than decrease upon renewal, leading to numerous complaints from users.

The reasons behind this are undoubtedly multifaceted.

Factors such as high maintenance costs, short replacement cycles, and high accident rates have compelled insurance companies to raise premiums on new energy vehicles to ensure profitability. In summary, the current new energy vehicle insurance market is indeed facing a dilemma on both the supply and demand sides.

Against this backdrop, we can see that an increasing number of OEMs are choosing to enter the market personally in an attempt to fundamentally address these issues.

For instance, China's automotive giant – BYD.

Delivering the First Results

'BYD's entry into the new energy vehicle insurance industry will leverage its accumulated expertise in technology, sales, and user engagement to provide comprehensive support in areas such as cost savings and scientific claims settlement.'

This paragraph opens with a statement from Wang Chuanfu, Chairman of BYD.

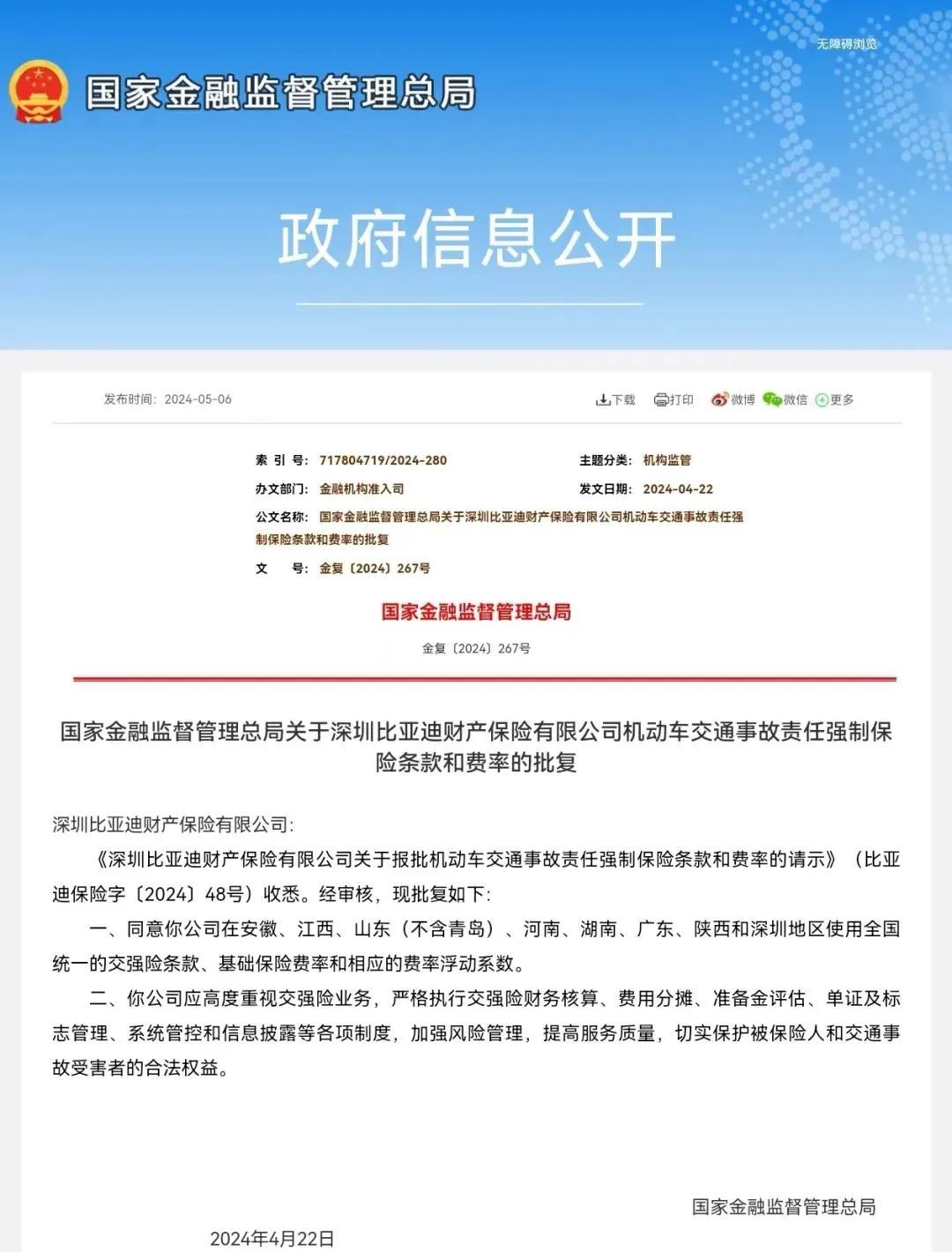

In fact, as early as April this year, the China Banking and Insurance Regulatory Commission (CBIRC) approved BYD Property & Casualty Insurance's use of nationally unified compulsory traffic insurance terms, basic premium rates, and corresponding floating premium rate coefficients in Anhui, Jiangxi, Shandong (excluding Qingdao), Henan, Hunan, Guangdong, Shaanxi, and Shenzhen.

The CBIRC emphasized that BYD Property & Casualty Insurance should prioritize compulsory traffic insurance operations, strictly enforce relevant regulations, enhance risk management, improve service quality, and effectively protect the legitimate rights and interests of insured parties and victims of traffic accidents.

This news immediately sparked heated discussions within the industry.

Some analysts believe that BYD's extensive vehicle and customer data enable precise and reasonable pricing and claims settlement, thereby reducing insurance premiums and costs for vehicle owners. The CBIRC's approval signifies a significant step forward for BYD in this field.

Little did people know that just this week, BYD Property & Casualty Insurance released its first set of performance results.

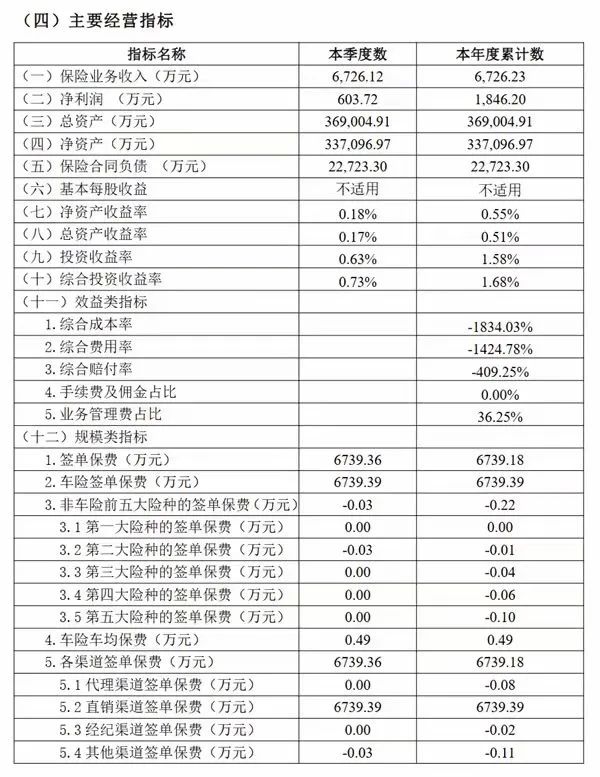

According to its second-quarter solvency report, the company achieved insurance business income of RMB 67.2623 million and net profit of RMB 18.462 million in the first half of the year, with a net profit of RMB 6.0372 million in the second quarter alone.

In terms of vehicle insurance, BYD Property & Casualty Insurance realized insurance premiums of RMB 67.3939 million in the first half of the year, all contributed by direct sales channels, with an average premium per vehicle of RMB 4,900.

Notably, BYD Property & Casualty Insurance's combined ratio for the first half of the year was -1834.03%, and its combined expense ratio was -1424.78%.

The company explained in its report that these negative ratios were due to the resumption of operations in May 2024, which led to a lack of historical business transfers, resulting in negative earned premiums for the year. As the business cycle progresses, newly signed policies will gradually mature, and these ratios will turn positive.

Furthermore, based on relevant data, within a little over a month from mid-May to the end of June, with a relatively limited insurance coverage scope, BYD's vehicle insurance policies reached approximately 13,700, with an average premium of RMB 4,900 per policy, slightly higher than the national average of approximately RMB 4,000 for new energy vehicle insurance in 2023.

However, it is important to note that the actual average premium per vehicle is influenced by various factors, including vehicle risk, actual vehicle value, and sales and management costs associated with vehicle insurance business.

As a newcomer, BYD Property & Casualty Insurance is still in its infancy, but its initial performance results demonstrate a promising trajectory.

Many industry insiders believe that OEMs have a deeper understanding of new energy vehicle technology and performance, enabling them to better customize insurance products and control costs. As such, consumers are eagerly anticipating further reductions in insurance premiums from BYD Property & Casualty Insurance.

Rest assured, as Wang Chuanfu stated, 'BYD will further reduce costs and expenses in its insurance business to ensure that new energy vehicle insurance is not only profitable but also lucrative.'

Ultimately, BYD aims to achieve a win-win situation for both the company and its customers.

Must Top-Tier Players Enter the Market?

At this point, some readers may still lack a clear understanding of the challenges facing the new energy vehicle insurance sector. Let us continue to elucidate with evidence.

According to statistics from the National Platform for Monitoring and Management of New Energy Vehicles, the average insurance premium for new energy commercial vehicles last year was RMB 4,003, approximately 1.8 times that of traditional fuel vehicles. Research institutions predict that this premium will continue to rise to RMB 5,001 this year.

With such high premiums, are insurance companies making money?

The answer is no. According to the China Banking and Insurance Information Technology Management Co., Ltd. (CBIT)'s 'New Energy Vehicle Insurance Market Analysis Report,' the average insurance premium for new energy vehicles is approximately 21% higher than that of fuel vehicles. However, with a claims ratio of nearly 85%, the new energy vehicle insurance business remains on the brink of profitability for most insurance companies, with some even incurring losses.

Therefore, change is imperative.

Recently, positive signals have emerged. A senior official from the Ministry of Commerce stated that they would study and promote the optimization of new energy vehicle insurance rates and enhance socialized maintenance services to address consumer concerns regarding vehicle purchases.

Although implementation will take time, government intervention is underway.

Meanwhile, besides BYD, many top-tier players are actively deploying in the vehicle insurance business. For instance, in March 2023, after acquiring HD Insurance Brokerage, NIO terminated its NIO Insurance Brokerage, which was established in January 2022, and renamed HD Insurance Brokerage as NIO Insurance Brokerage. In June 2022, Xpeng acquired Yinjian Insurance Brokerage to obtain an insurance broker license, enabling it to directly engage in vehicle insurance-related business.

Particularly noteworthy is Tesla, which was the first OEM to venture into the insurance market for new energy vehicles. In April 2019, the American new energy vehicle company acquired an insurance broker license in the US and launched its self-operated insurance service in California.

In August 2020, Tesla established Tesla Insurance Brokerage (China) Co., Ltd. in China with a registered capital of RMB 50 million. Its business scope includes insurance brokerage services, and it is located in the Lingang New Area of China (Shanghai) Pilot Free Trade Zone, where Tesla's Shanghai Gigafactory is situated.

However, it is intriguing that despite its establishment, Tesla Insurance Brokerage (China) Co., Ltd. failed to obtain an insurance broker license for a long time. In late March this year, it applied for simplified deregistration, and by mid-April, its business status officially changed to deregistered.

Yet, just four months later, Tesla made a comeback. Recently, Tesla Insurance Brokerage (China) Co., Ltd. was re-established with the same registered capital of RMB 50 million and the same scope of business. Zhu Xiaotong serves as its legal representative and chairman.

The underlying message behind these developments is clear. Whether acknowledged or not, as the market continues to expand, new energy vehicle insurance is gradually becoming an essential part of the 'ecosystem' for OEMs, particularly top-tier players.

Nevertheless, the path to self-operation remains long and fraught with challenges.