Tencent grows by 8%, which brands are "furiously launching rockets"?

![]() 08/22 2024

08/22 2024

![]() 444

444

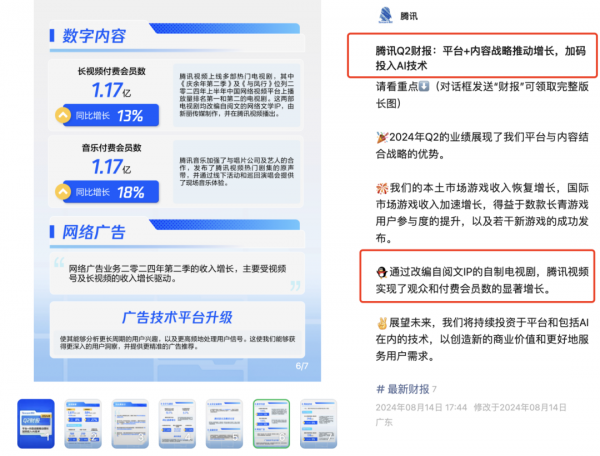

In August, internet giants released their Q2 and first-half performance reports. Among them, Tencent's total revenue for the second quarter was 161.1 billion yuan, an increase of 8% year-on-year; gross profit was 85.9 billion yuan, up 21% year-on-year; net profit for the period was 48.4 billion yuan, up 79% year-on-year; and net profit for the period under Non-IFRS was 58.4 billion yuan, up 51% year-on-year.

(Source: Tencent's official WeChat account)

Both revenue and profit indicate that Tencent is still growing steadily. Achieving 8% growth for such a large company in such an environment is no easy feat.

Who is carrying Tencent forward?

Tencent's revenue structure remains the "three-pronged approach": value-added services, advertising, and financial technology & to B. In the second quarter, these contributed 78.8 billion, 29.9 billion, and 50.4 billion yuan in revenue, respectively. Among them, the online advertising segment led the growth with a year-on-year increase of 19%.

(Source: Tencent's official WeChat account)

From a business perspective, Tencent has multiple business segments moving forward in parallel. The domestic gaming business resumed growth, with both domestic and international gaming revenue growing by 9%, outperforming the broader market. The enterprise services business achieved double-digit growth, mainly "benefiting from the growth in cloud services revenue (including the commercialization of WeChat Work) and the increase in technical service fees for merchants on WeChat Video.

However, what deserves attention this time is the video business. The overview of Tencent's financial report released on its official account was titled "Tencent Q2 Financial Report: Platform + Content Strategy Drives Growth, with Increased Investment in AI Technology." Undoubtedly, "content" became a major highlight of the Q2 financial report. Tencent's long-form video and music paid subscribers both reached 117 million, with increases of 13% and 18%, respectively. Pony Ma directly stated, "The Q2 2024 results demonstrate the strengths of our platform and content integration strategy. Through self-produced dramas adapted from Ireader IPs, Tencent Video has achieved significant growth in audience size and paid subscribers."

(Source: Tencent's official WeChat account)

Specifically, in terms of revenue contribution, online advertising led the pack with a 19% increase, primarily driven by revenue growth from WeChat Video and long-form video. This means that Tencent is the only giant with both strong long-form and short-form video businesses, and unlike some platforms that only focus on content creation, Tencent has successfully established a closed loop from IP to content to subscribers to commercialization.

Tencent's Chief Strategy Officer James Mitchell subsequently revealed during the earnings call that video number advertising revenue increased by more than 80% year-on-year. Tencent Video did not disclose separate figures, but given that it was mentioned alongside video number advertising, which increased by 80%, its growth should be considerable. The commercial actions of some brands on Tencent Video also indirectly confirm the commercial potential of long-form video.

These brands have contributed significantly

How to commercialize long-form video? It's a complex question.

As a premium long-form video content platform, Tencent Video continuously produces high-quality dramas based on IPs under its PGC-focused content production model. Commercialization is more diversified. In addition to encouraging users to become paid subscribers to access content, Tencent Video has been exploring new forms of content marketing, making brands willing to "launch rockets."

For example, the high-profile appearance of OPPO Reno 12 in "Celebration of Remainder Year 2" left a deep impression on me. In fact, we reviewed this phone when it was first released. In 2024, mid-range phones focused on thinness and AI were Intensive release , and OPPO Reno 12 had plenty of competition. At this point, it was crucial to see the intensity and effectiveness of marketing efforts.

How did OPPO communicate the key selling points of Reno 12's "thinness" and "AI" to young people? It inserted creative custom advertisements into the drama, such as a tailored plot advertisement featuring the character Second Prince, naturally promoting the killer feature of AI photo removal. Although many phones come with this feature as standard, OPPO, which strategically bets on AI, reinforces the AI phone label. Additionally, while users are watching the drama, OPPO uses "accompanying stickers," "customized danmu expressions," and other advertising resources to surround and accompany users without disturbing them, continuously increasing the intensity of product selling points such as AI, thinness, and beauty.

(Source: OPPO Reno 12 x "Celebration of Remainder Year 2")

On Tencent Video, the marketing approach of OPPO Reno 12 x "Celebration of Remainder Year 2" has become a replicable or even programmed marketing model. After studying the "rocket launching" strategies of multiple brands on Tencent Video, I found that Tencent Video has truly platformized its ability to market major dramas.

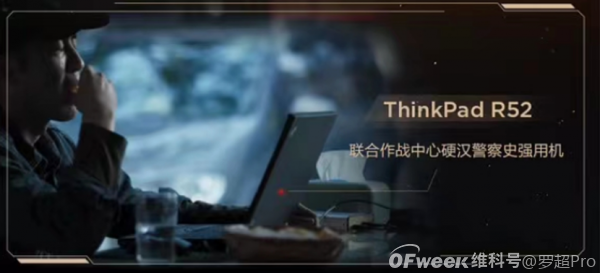

In 2023, "The Three-Body Problem" became an instant hit on Tencent Video. Before its release, ThinkPad, with discerning eyes, secured the exclusive PC partnership for "The Three-Body Problem." In the drama, ThinkPad became a "resident guest" without being out of place with the plot. For example, hard-boiled police officer Shi Qiang and key members of the ETO organization used ThinkPads with red dots at crucial moments in the plot. Through the hardcore sci-fi plot, ThinkPad's "stable and reliable" brand power was conveyed to the audience, laying a solid brand foundation for Lenovo's AI PC strategy in 2024. Beyond plot integration, Lenovo also launched "The Three-Body Problem" co-branded products, further capturing the hearts of science fiction fans.

(Source: ThinkPad x "The Three-Body Problem")

TCL was also a big winner in the marketing of "The Three-Body Problem." By utilizing customized in-drama mini-plays and other marketing resources, TCL consistently conveyed the advantages of MiniLED image quality, especially the concept of "large screens with details," to the audience, creating a phenomenal case of IP marketing in the home appliance industry. In 2024, TCL continued its efforts, once again betting on "Celebration of Remainder Year 2," combining the "master-level image quality" of its flagship model X11H with the character Wang Qinian's "martial arts master" identity to create a custom mini-play advertisement. It further leveraged prime-time resources such as pre-roll countdowns to deeply communicate the brand image of "master-level image quality."

(Source: TCL x "Celebration of Remainder Year 2")

Brands that have reaped substantial benefits from major drama marketing on Tencent Video are not limited to hard-core technology brands such as digital devices and home appliances. For example, the rejuvenated old Chinese brand Pechoin has become a frequent participant in major drama marketing in recent years.

At the end of 2023, "Flowers of War," directed by Wong Kar-wai and featuring stories set in Shanghai, became a hit, scoring 8.7 on Douban and ranking first in video views across all Chinese online platforms to date. Founded in Shanghai in 1931, Pechoin is one of the few time-honored Chinese beauty brands. It was once the exclusive cosmetics of celebrities and socialites during the Republic of China era, with customers including celebrities like Ruan Lingyu, Hu Die, and Zhou Xuan, as well as prominent figures like the Song Sisters.

With significant brand origins overlapping with "Flowers of War," Pechoin strategically bet on the drama, leveraging the shared identity symbol of "Shanghai" and inserting various in-drama advertisements to promote its "rapid wrinkle reduction" products. Upon realizing the potential of "Flowers of War," Pechoin decisively increased its investment, even customizing advertisements in both Shanghainese and Mandarin to deeply integrate with different versions of the content. Concurrently, Pechoin officially announced its brand ambassador partnership with Xin Zhilei, a stroke of genius.

(Pechoin x "Flowers of War")

Having tasted the sweetness of major drama marketing with "Flowers of War," Pechoin decisively deployed its strategy for "Celebration of Remainder Year 2," using resources such as opening title cards, accompanying stickers, creative in-drama insertions, and end credits teasers to continuously, repeatedly, and comprehensively influence users. In the finale, Pechoin recalled all advertising messages in a "summary speech" format, recalling users' attention and reinforcing core perceptions.

Brands such as Dong'e Ejiao, Mead Johnson Nutritionals, and Yili Jin Dian, spanning daily consumer goods, food and beverages, and healthcare, have also "furiously launched rockets" in major dramas on Tencent Video. Beyond established top brands with significant recognition, even emerging brands like Guozi Shule and Lee Kum Kee have found their footing in major drama marketing, becoming increasingly prominent.

The certainty of major drama marketing

In today's fragmented media landscape, brands have a plethora of marketing platforms and methods to choose from. While it seems that there are more paths for brands to communicate with users, and even AI can be leveraged to "buy traffic," brands are struggling more than ever in marketing. Common pain points include "traffic without engagement," "attention without conversion," "high awareness but vague branding," "difficulty entering new product categories," "hidden new features," and "unsold new products."

The root cause of the difficulties in brand marketing in the post-mobile internet era lies in the excessive fragmentation of media, leading to highly fragmented user attention. Truly attention-grabbing platforms like the "central station" and marketing tactics that resonate deeply like a "nail" are rare. Brands from various industries are increasing their investments in Tencent Video's major dramas, recognizing their high-certainty traffic base, deep influence capabilities, and the full lifecycle marketing value of IPs.

On the one hand, Tencent Video offers a high level of certainty in traffic, with the ability to consistently produce hits. By June 2024, five dramas had surpassed 30,000 in popularity, including "The Story of Rose," "Celebration of Remainder Year 2," "Flowers of War," "With Feng Xing," and "Cheng Huan Ji." Basically, there was a hit every month in the first half of the year. This consistent output of hits is not due to luck or methodology but rather a thriving content ecosystem, from IP sourcing to content production to promotion and operation. This is also the essence of what Pony Ma referred to as the "platform and content integration strategy" during the earnings release.

Certainty implies broad coverage across different age groups, professions, and social circles, allowing brands from various industries to reach their target audiences effectively. This certainty has increasingly driven brands to invest in major dramas.

On the other hand, there is certainty in traffic distribution. In today's era of personalized content, long-form video is one of the few content forms that remains "one size fits all," with major dramas truly capturing the attention of everyone. Based on this, the widest range of attention can be consolidated.

Taking Tencent Video as an example, it has 117 million paid subscribers, with pre-release reservations for "Celebration of Remainder Year 2" exceeding 18.19 million. After its release, it set a new record for the highest popularity on Tencent Video. Brands that bet on "Celebration of Remainder Year 2" gained the certainty of communicating deeply with all viewers. Such certainty is harder to achieve on algorithmic platforms, which either require massive content output or the luxury of full-screen opening advertisements, neither of which offers the same cost-effectiveness as long-form video platforms.

Today, Tencent Video continuously strengthens its commercial infrastructure, productizing and platformizing content marketing capabilities, enabling brands to easily customize opening title cards, accompanying stickers, creative in-drama insertions, end credits teasers, and more strongly content-related advertisements. Simultaneously, Tencent Video integrates resources inside and outside the platform, online and offline, and related to IPs, actively exploring a closed loop from brand building to product seeding to lead generation to order conversion, allowing brands to complete integrated IP major drama marketing in one stop.

Today, on Tencent Video, brands can even automate, program, and standardize major drama marketing like search engine advertising, with solutions tailored to brands of different industries, sizes, and growth stages.

New possibilities for long-form video

Does the long-form video platform have a better business model? Tencent Video's explorations may offer some new insights for the industry:

First, to make hits a certainty, a rich upstream IP reserve is essential. Tencent Video is the exclusive broadcast platform, with Ireader as the source of original IPs and New Classics Media and China Literature as content producers. Literary originals are the IPs of IPs, the soil from which high-quality video content grows. Tencent Video's exclusive access to this "living water source" is the fundamental guarantee for its hit-making machine, as evidenced by the success of the "Celebration of Remainder Year" series.

Second, high-quality content with certainty attracts a large-scale audience, including paid subscribers. In the first half of this year, among the top 10 major dramas across the entire network, Tencent Video had five, iQIYI had three, Youku had two, and Mango TV had one. Supported by major dramas, Tencent Video's daily active users on mobile were also at the top among long-form video platforms. This large user base not only attracts "paying users" (Tencent Video has 117 million paid subscribers), but the underlying "user engagement time" or "immersive attention" also creates unlimited possibilities for commercialization.

Finally, an innovative content marketing ecosystem can significantly enrich revenue sources and support content production. The deep, immersive, concentrated, and influential nature of long-form video is irreplaceable. Furthermore, the influence of Tencent Video's major dramas has spread across the entire network, continuously igniting social media topics. For example, "The Story of Rose" alone generated 479 trending topics as of June 24. With its strong marketing potential and increasingly rich and mature combined resources, Tencent Video solves brands' marketing challenges in the fragmented era. Precisely because of this, Tencent Video has become a necessary or even preferred marketing choice for an increasing number of brands, contributing to Tencent Video's strong growth in the second quarter.

Remarkably, Tencent Video has Cleverly combined commercial marketing with content experience, with both paid subscribers and commercial revenue rising simultaneously, proving this point. Balancing such contradictions is neither simple nor overly difficult: Tencent Video's marketing explorations have a bottom line—never compromising user viewing experience. In fact, many marketing explorations have even enhanced user experience, such as IP co-branding, online and offline interactions, and brand fan benefits. In the long run, a positive commercial cycle can support content production, enabling the platform to continuously output more and better content.

Giving virtual gifts to 'Xiaoqian' by users through 'Kejin' is equivalent to sending flowers. Brand sponsorships for marketing are equivalent to 'launching rockets'. Users, brands, platforms, and the IP industry behind them work together to create better content. Everyone benefits from this long video game. From this perspective, I think Tencent Video may have truly found a broad path for long video platforms and even the streaming media industry.