Tencent makes money, Apple gets jealous

![]() 08/22 2024

08/22 2024

![]() 515

515

A few days ago, Apple and Tencent once again sparked a dispute over in-app purchases, with Apple claiming that Tencent's WeChat has "loopholes" that allow Tencent to process in-app purchases through external payment systems, thereby circumventing Apple's 30% commission.

Interestingly, on the 14th, Tencent released its financial report, revealing that its performance in the first half of this year was truly lucrative, and Tencent made a fortune.

On one hand, Apple is concerned about its own taxes, and on the other, Tencent is making money hand over fist. When these two things happen in the first half of this year, it becomes quite interesting.

1. Apple's Tax, Tencent's Toll

Apple believes Tencent has paid too little "tax."

This time, the dispute between Apple and Tencent also revolves around in-app purchases. Apple demands that Tencent close the payment loopholes to prevent users from bypassing Apple's payment system and thereby avoiding Tencent's obligation to pay Apple's 30% commission on app purchases.

This fee stems from a regulation requiring consumers to pay a certain percentage of their purchases of apps or in-app services to Apple on iOS devices. For domestic developers, this percentage is tiered, with standard enterprises paying 30% and small enterprises paying 15%.

Based on Apple's accusations against Tencent, the fees mainly come from Tencent's gaming revenue, especially from mini-games, where Apple believes players avoid fees by purchasing resets through other channels.

Apple and Tencent have had disputes over in-app purchases before. When WeChat introduced a tipping function, Apple argued that the tips should be subject to its commission. Tencent later explained that it did not retain any tip money, giving it all to creators, thereby resolving the dispute.

Interestingly, Tencent's financial report for the first half of this year shows a significant rebound in performance, primarily driven by its gaming business.

Tencent's first-half 2024 financial report revealed a revenue of RMB 320 billion, gross profit of RMB 169.8 billion, and an operating profit of RMB 103.3 billion, up 39% from the same period last year.

In the report, Tencent repeatedly mentioned the impact of the significant increase in gaming revenue on its performance, including the explosion of revenue in the mobile gaming and mini-game markets. Tencent also revealed that mini-game revenue grew by over 30% year-on-year during the reporting period, far outpacing the growth of mobile gaming and other businesses.

Gaming has long been Tencent's cash cow. In particular, Tencent's value-added services (including gaming, music, video, and other paid services) generated revenue of RMB 157.5 billion in the first half of this year, accounting for half of Tencent's total revenue. In the second quarter, the gross margin of value-added services increased from 54% to 57%, making it the highest among Tencent's four major businesses.

Tencent makes money, and Apple gets jealous.

In fact, Tencent is also a publisher in the domestic gaming market.

Take Tencent's mini-games, which have stood out in Tencent's performance in the first half of this year. Tencent itself takes a significant commission from these mini-games. Currently, Tencent charges a channel technology service fee of 40% of the total revenue from mini-games.

In other words, while Apple's 30% commission has caused much hardship for developers, Tencent's commission on mini-games is even higher than Apple's.

Of course, some market voices point out that the 40% commission on mini-games differs from Apple's 30% in that Tencent provides underlying development tools and game engine support for the mini-game ecosystem.

In fact, Tencent is also the largest game publisher in China's mobile gaming industry, and publishers hold the key to distribution channels, which often play a crucial role in a game's success.

2. Toll is much harsher than Apple tax

As a publisher, Tencent charges game developers fees, known as tolls within the industry.

While Apple has a tight grip on iOS gaming, Android gaming is dominated by manufacturers' own app stores and earlier products like Yingyongbao.

Several of Tencent's games are currently bestsellers, giving Tencent the confidence to challenge mobile phone manufacturers.

The high commissions charged by Android channels have caused much hardship for many game developers.

Previously, NetEase CEO Ding Lei publicly stated, "The Android revenue sharing market in China is the most expensive, reaching 50%. That doesn't make sense," and expressed hope that the Chinese Android market could "be in line with the world." In addition to Apple's 30% commission, Google Play also charges a 30% commission.

Some game developers choose not to list their products on Android channels that require a 50-50 revenue split. For example, miHoYo's open-world game "Genshin Impact" explicitly stated that it would not be listed on Huawei, Xiaomi, and other channel servers during its official beta test. However, its stance on channel servers has since softened.

Similarly, Lilith Games' SLG game "Rise of Kingdoms" was not listed on multiple app stores such as Huawei, Xiaomi, OPPO, and vivo when it officially entered beta testing in September 2020. Android users could only download the game through the APK package provided on the official website or the TapTap game page.

Over a month ago, the mobile game "Dungeon & Fighter" announced that due to the expiration of its contract, it would no longer be listed on some Android app stores starting June 20, including those of Huawei, Xiaomi, OPPO, and vivo. This is Tencent's first mobile game to be delisted from Android channels.

In fact, this is not the first time such a dispute has arisen. As early as January 1, 2021, Huawei's mobile game platform delisted all Tencent games. Tencent Games issued a statement at the time, explaining that its games were suddenly delisted due to the failure to renew the "Mobile Game Promotion Project Agreement" with Huawei's mobile game platform as scheduled. However, just one day later, the two parties reached a new cooperation agreement and ultimately compromised.

Furthermore, in 2019, Tencent negotiated with channel partners from the "Hardcore Alliance" to increase the revenue sharing ratio of some of its games from 50% to 70%. While Huawei accepted this request, OPPO and vivo insisted on maintaining the 50% revenue sharing ratio. Ultimately, the negotiation did not achieve full success, and the two sides remained divided.

There are currently two main distribution channels for Android games: one is the Hardcore Alliance, composed of eight mobile phone manufacturers, including their respective app stores. These manufacturers split revenue 50-50 with developers, taking 50% of the total revenue.

The other is represented by new channels such as Tencent and TikTok. In addition to early app distribution platforms like Yingyongbao, Tencent's various traffic platforms and TikTok's information flow have become new app distribution channels.

Currently, internet traffic is gradually concentrating on top products such as social media, news platforms, and short videos. New traffic purchasing platforms represented by Tencent Advertising and ByteDance (Juliang Engine) are rapidly rising and becoming mainstream. Meanwhile, emerging channels featuring zero revenue sharing and user growth, such as TapTap, are continuously eroding the market share of mobile app stores.

It was reported that in 2019, ByteDance surpassed Tencent to become China's largest game buyer platform.

Of course, Tencent's tolls are not limited to gaming compared to Apple's tax. Just as Apple and WeChat had their first dispute in 2017 over tipping, which involved creators, Tencent's tolls extend beyond gaming.

After the era of official accounts, we have entered the era of short videos and live streaming. In live streaming, the revenue sharing between broadcasters and platforms is substantial, typically at a 55 split. However, since live streaming tips are considered in-app purchases on Apple devices, Apple takes 30% of every RMB 100, while broadcasters and platforms each take 35%.

As content continues to evolve into the era of short dramas, the platform's commission fees become even more daunting.

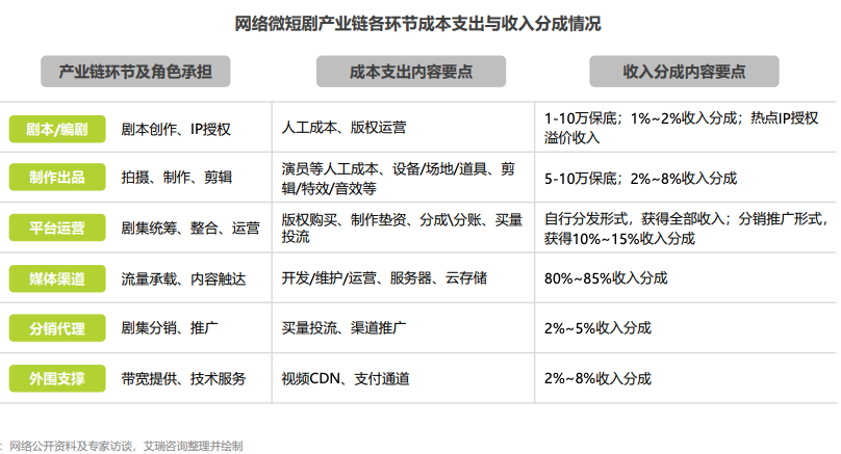

According to an iResearch report, in the production process of short dramas, the platform's commission can reach 80-85%, leaving only around 5% of revenue for producers.

So, as mentioned above, while Tencent may complain about Apple's tax and Android fees, Tencent itself makes money through "tolls."