Vertical e-commerce platforms face existential crisis

![]() 08/23 2024

08/23 2024

![]() 681

681

The once-independent vertical e-commerce platforms are now facing increasingly limited survival space, as the e-commerce model focusing solely on a single niche market is no longer suitable for the current era.

Cover image source: Unsplash

Yang Haoyong, founder of Guazi.com, once held the view that there are two sayings in the entrepreneurial field that should not be taken seriously. The first is, "The market is vast, and we can all thrive within it." The second is, "Don't worry about what others are doing; just focus on doing your best."

According to Yang Haoyong, the first saying is used to deceive investors, while the second is meant to mislead the media. He personally believes that regardless of the future potential of the market, only three players will likely share the market share, and they will not divide it equally. The most likely outcome is a 7:2:1 ratio, with the strong getting stronger and the weak struggling for survival.

Looking at the current state of the e-commerce industry, the collapse of various vertical e-commerce platforms seems to confirm Yang Haoyong's assessment.

Small and beautiful vertical e-commerce platforms were once the darlings of venture capital firms. The rationale behind these investments was widely accepted: with such a large e-commerce consumer base in China, the market could not be monopolized by giants alone.

However, this belief seems to be gradually eroding. The once-independent vertical e-commerce platforms are now facing increasingly limited survival space, as the model of focusing solely on a single niche market is no longer suitable for the current era.

1

Vertical e-commerce struggles to survive

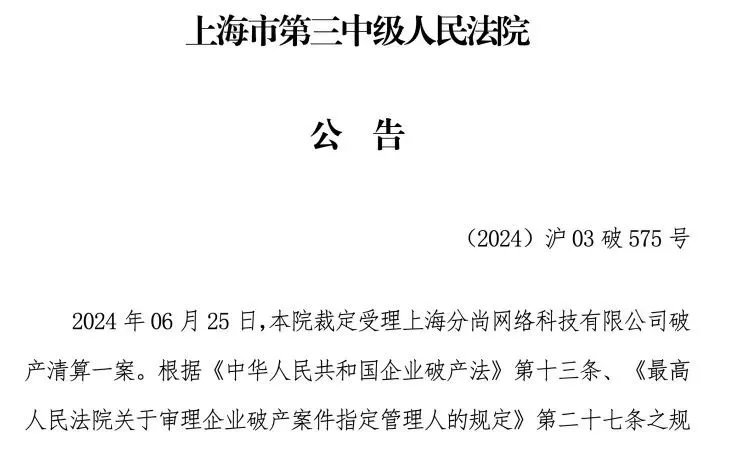

Recently, the Shanghai Third Intermediate People's Court formally accepted the bankruptcy liquidation case of Huajia's parent company, Shanghai Fenshang Network Technology Co., Ltd., marking the failure of the once-popular flower e-commerce platform's self-rescue efforts.

According to public information, Huajia began official operations in 2015, establishing itself in the industry with its innovative model of "online subscription + direct delivery from origin + value-added services." Its 99-yuan monthly flower subscription package won the favor of many consumers, attracting 15 million paying users at its peak, with monthly sales exceeding 100 million yuan and raising hundreds of millions of yuan in multiple rounds of funding.

However, as industry competition intensified, Huajia struggled to achieve profitability. After losing subsequent investments, its capital chain quickly snapped, leading to difficulties in fulfilling orders for even paying customers.

Although the founding team attempted self-rescue efforts such as live streaming, it was unable to reverse Huajia's declining fortunes. Its parent company is now embroiled in legal disputes and has been listed as a dishonest debtor.

Similar to Huajia's fate, Haidaiwang, a B2B e-commerce platform specializing in cross-border maternal and child products, also encountered operational difficulties in early August, leading to layoffs and legal disputes with suppliers.

Haidaiwang had previously raised 65 million yuan in A+ round funding, peaked at monthly sales exceeding 200 million yuan, secured authorizations from over 20 brands, and served more than 100,000 small and medium-sized sellers. Its founder, Zhu Baojin, a former Alibaba employee, was forced to sell personal assets to raise funds to address the crisis.

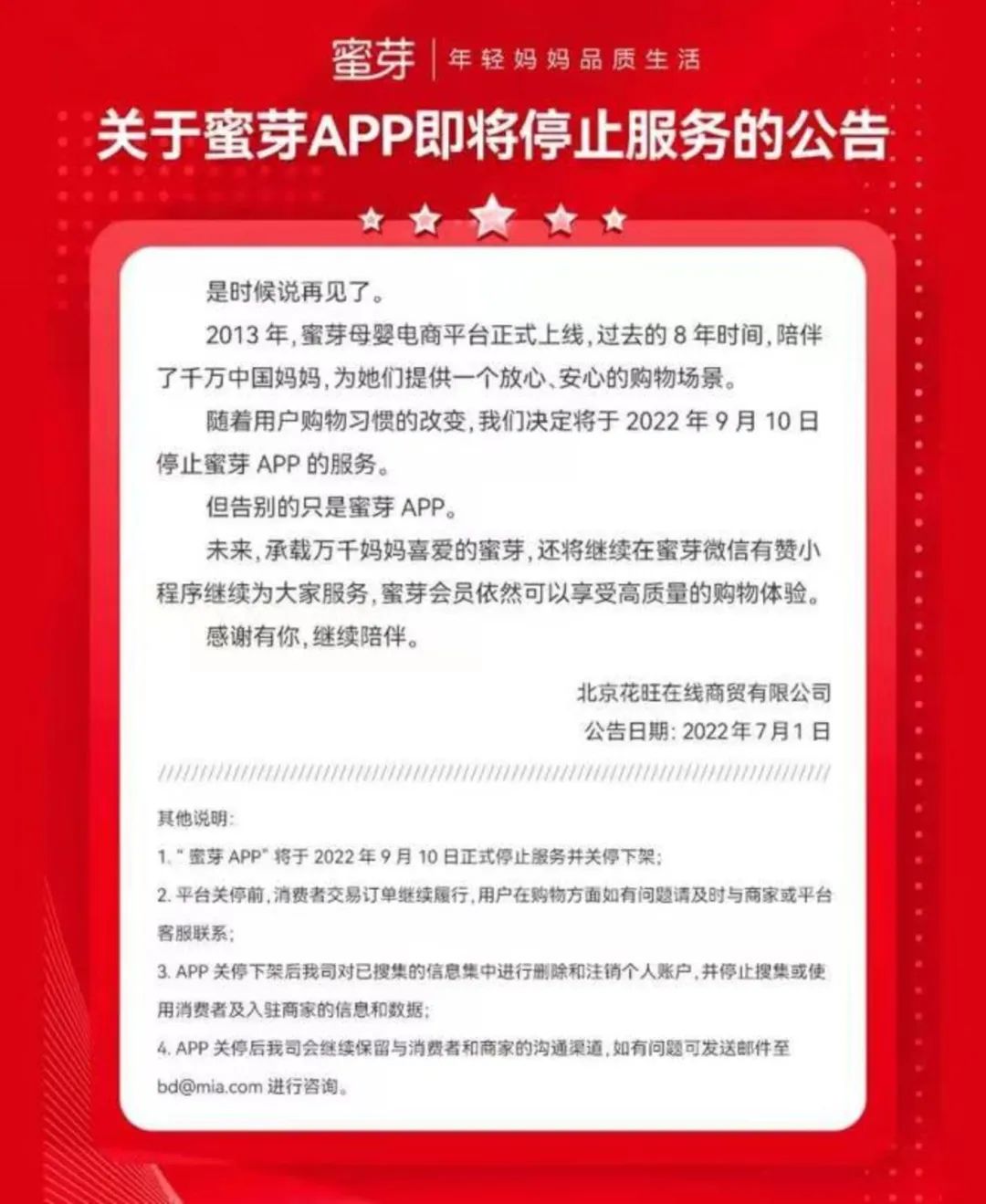

Notably, Haidaiwang was led by Miya, another vertical e-commerce platform in the maternal and child sector, which was once valued at up to US$1 billion, making it the highest-valued cross-border maternal and child e-commerce platform in China at the time. However, Miya's decline was even swifter, announcing its official shutdown and service cessation over two years ago.

In fact, the number of struggling vertical e-commerce platforms extends far beyond those mentioned above. Well-known examples include overseas shopping platform Yangmatou, luxury e-commerce platform Secoo, maternal and child e-commerce platform Redbaby, and beauty e-commerce platform Jumei.com.

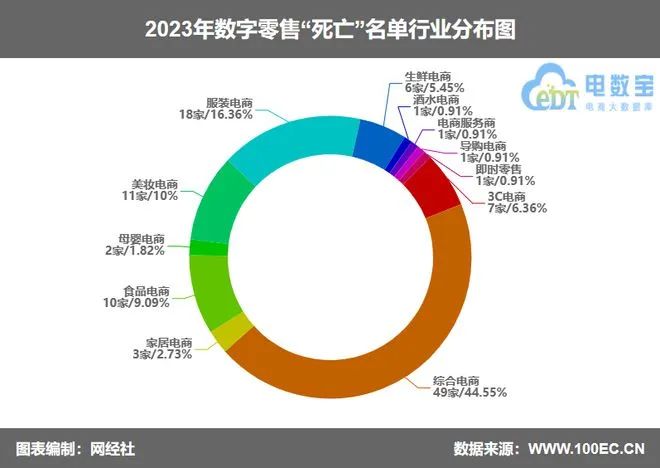

According to Dianshubao statistics, nearly half of the digital retail companies that "died" in 2023 were vertical e-commerce platforms, with apparel and beauty e-commerce being particularly hard-hit sectors.

2

Caught between giants and live streamers

It is undeniable that as competition among top e-commerce platforms intensifies, vertical e-commerce platforms, which once survived in the cracks between these giants, are finding it increasingly difficult to maintain their foothold.

Features like "billions of subsidies" for the lowest prices across the board and extreme service experiences like "seven-day no-reason returns" and "refund only" policies are unmatched by smaller platforms, leading consumers to vote with their feet.

The logistics and supply chains that once underpinned vertical e-commerce platforms have become industry infrastructure over time, with few secrets left among competitors.

Beyond the top e-commerce platforms, the rise of interest-based e-commerce represented by live streaming and short videos has undermined two crucial pillars of vertical e-commerce: targeted consumer segments and a strong community atmosphere.

Personalized algorithm recommendations have catapulted tech, beauty, and maternal and child bloggers into stardom, each commanding highly targeted followings and influencing countless purchasing decisions with their videos, which often garner tens of millions of views.

Compared to platforms, niche bloggers have a warmer and more approachable demeanor, and their traffic effects often enable them to secure more competitive pricing advantages in collaborations with brands.

While a single beauty blogger may not rival a vertical e-commerce platform, when there are hundreds or thousands of influencers active in the same niche, the share of consumer spending available to vertical e-commerce platforms dwindles.

When Miya ceased operations two years ago, its founder Liu Nan told the media, "As e-commerce becomes a more traditional industry, supply chain infrastructure has matured, marking the end of the golden age of vertical e-commerce. Comprehensive e-commerce platforms, armed with algorithmic capabilities, can now showcase vertical content to targeted audiences."

While Miya's shutdown was regrettable, Liu Nan's decision, based on his insights and the subsequent market developments, proved prescient. By announcing the shutdown proactively before Miya collapsed, Liu Nan avoided leaving debts to employees, suppliers, or users, achieving a dignified exit.

In contrast, many other vertical e-commerce platforms were unable to maintain such dignity, finding themselves mired in difficulties by the time they realized their predicament.

3

Will live streaming be the answer to transformation?

Adhering to the principle of "if you can't beat them, join them," will vertical e-commerce platforms' transition to live streaming become a new industry trend in the coming years?

Past cases suggest that successful turnarounds leveraging live streaming are possible.

As a liquor e-commerce brand with over two decades of industry experience, Jiuxian.com has experimented with various e-commerce models, including building its own platform, and once came close to an IPO. However, its decisive transition to live streaming proved pivotal in propelling the company onto a fast track of growth.

In May of this year, Jiuxian Group Chairman Hao Hongfeng revealed that the company's revenue grew by over 60% year-on-year in 2022 and the first quarter of 2023, with a target GMV of 15 billion yuan for the full year.

Today, Jiuxian.com resembles an MCN agency fostering liquor-focused live streamers. Its MCN arm boasts over ten million followers across its influencers, several of whom have become top live streamers in the liquor category.

One such influencer, "Jiuxian Lafei Ge," has long dominated the liquor category on Douyin, racking up 58.18 million yuan in a single live stream in 2021 and achieving a stunning 117 million yuan in a single live stream on Tmall this year. Over four years, he has conducted 1,500 live streams, accumulating 6,000 hours of airtime and generating 2.1 billion yuan in sales.

In contrast to Jiuxian.com's proactive transformation, the book e-commerce platform Zhongtushu's foray into live streaming was more of a last resort.

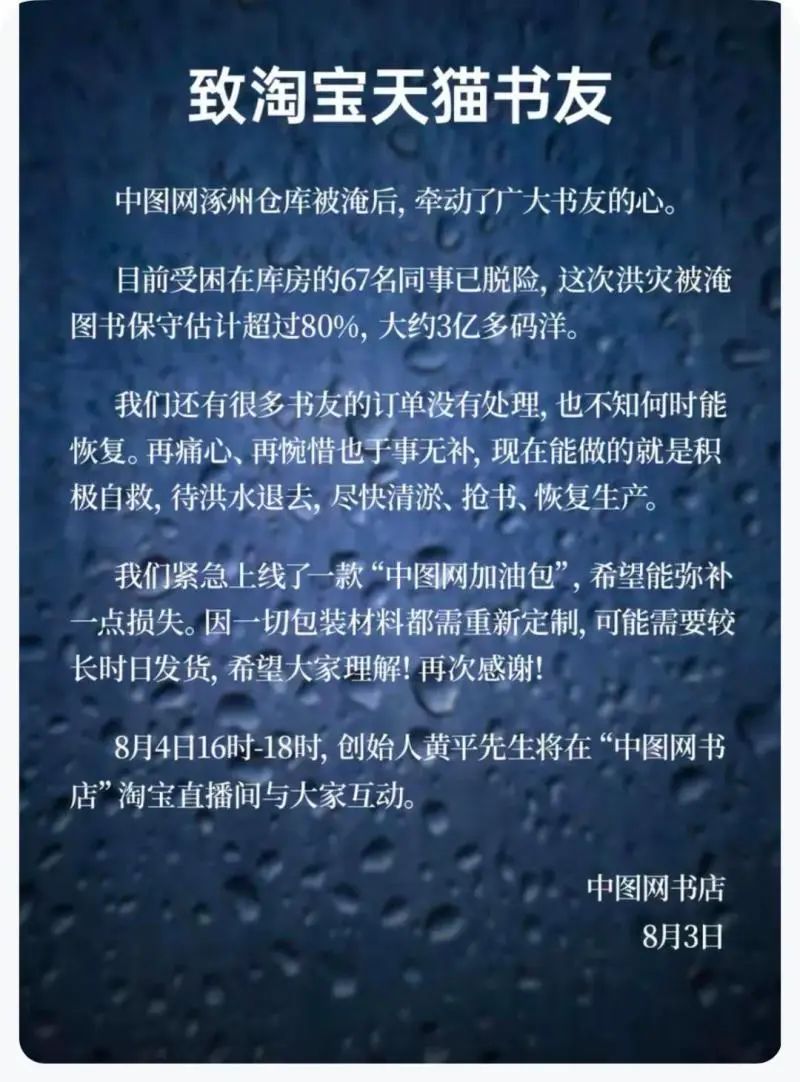

Last summer, flooding in the Beijing-Tianjin-Hebei region submerged the country's largest book logistics and warehousing base in Zhuozhou, Hebei, resulting in massive losses for nearly a hundred domestic publishing institutions, including Zhongtushu, which lost over 4 million books worth 300 million yuan.

To save the company, Zhongtushu founder Huang Ping launched his first live stream on Taobao, ultimately generating nearly 20 million yuan in sales within days, saving the 25-year-old book website from collapse.

However, not all live streaming endeavors can serve as lifelines. For instance, despite Huajia's founder Wang Ke's attempts to rescue the company through live streaming, he ultimately failed to prevent its decline.

From the current industry landscape, vertical e-commerce platforms still have an advantage in terms of professionalism when transitioning to live streaming, especially with founder IPs retaining significant traffic effects. However, they must still learn from and align with top live e-commerce agencies in terms of product selection and live stream operation.