Did Xiaomi, which is booming in both mobile phones and cars, win big?

![]() 08/23 2024

08/23 2024

![]() 593

593

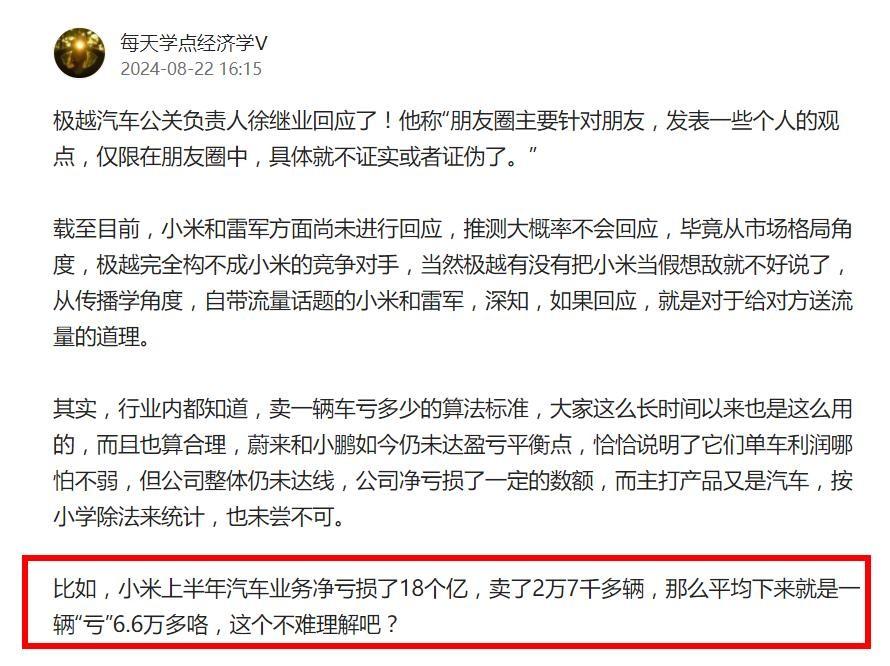

Recently, Xiaomi's disclosure of its second-quarter results sparked widespread discussion. As related topics frequently trended on social media, executives from a new energy vehicle manufacturer criticized Lei Jun and Xiaomi, stating that "selling one car leads to a loss of over 60,000 yuan," leaving netizens confused and wondering why the atmosphere was so tense.

Let's take a factual and objective look to determine if the claim of "losing over 60,000 yuan per car sold" holds water and assess the actual value of Xiaomi's "most outstanding quarterly report in history."

01. Does Lei Jun's statement that "selling one car leads to a loss of over 60,000 yuan" hold true?

On August 22, BiaNews reported that Xu Jiye, the PR head of Jiyue Automobile, was internally reprimanded by CEO Xia Yiping for his remarks. According to the reprimand, Xia stated that Xu's comments did not represent the company's views and were not in line with its values. Relevant departments have been severely criticized, and employees have been reminded to strictly adhere to communication discipline.

Xu Jiye's belief that "selling one car leads to a loss of over 60,000 yuan" constitutes dumping is clearly factually incorrect. Even ordinary netizens outside the industry find it illogical to sell cars at a loss, with some even suggesting that if selling one car leads to such a significant loss, then no one should buy, thereby saving Xiaomi money...

In reality, the phrase "losing XX yuan per car sold" is quite common and well-established in the new energy vehicle industry. If you've followed related media reports or trending topics, you'll notice similar claims made by companies like Xpeng and NIO, some of which have even trended on social media.

An illustrative example might help clarify. Suppose I'm a street vendor selling egg cakes. After making a profit, don't I need to calculate my costs? These include expenses like the cart, pan, spatula, oil, eggs, ham, and other raw materials. Only after deducting these fixed costs can I determine my net profit.

Similarly, the logic applies to car manufacturing. Xiaomi, for instance, has built its own factory, purchased equipment, and developed or co-developed most hardware and software systems. Expenses like R&D personnel costs and marketing expenses are all included in the financial statements. Xiaomi's net loss in the automotive business segment for the second quarter was 1.8 billion yuan, which is the result of consolidated calculations.

Given a net loss of 1.8 billion yuan and the delivery of over 27,000 vehicles, the average loss per vehicle comes to 66,000 yuan, which is logically sound. While the second quarter saw a loss, what about the third and fourth quarters? Next year? Based on Xiaomi's current momentum, it's highly likely that it will achieve profitability faster than its competitors.

It's not that manufacturers are reluctantly selling cars at a loss; rather, it's an inevitable outcome of the accounting methodology. Therefore, selling cars at a loss doesn't save money; it actually incurs greater losses. Understanding this negates the misguided criticisms like "crocodile tears" and "feeling sorry for Lei Jun."

The second and most crucial indicator is the gross margin of the entire vehicle. According to Xiaomi's financial report, the gross margin of the Xiaomi SU7 has reached 15.4%, second only to NIO and BYD and higher than other new energy vehicle manufacturers. This demonstrates Xiaomi's prowess in supply chain management and cost control, even as a first-time carmaker.

Assuming an ASP of 220,000 yuan, selling one Xiaomi SU7 generates a gross profit of 33,880 yuan. Can this be considered dumping? Netizens are not fools; they have their own fair judgments.

02. How far is Lei Jun from being able to rest easy?

Driven by positive financial results, Xiaomi's share price surged, bringing joy to Lei Jun. Let's look at the specific market data:

On the evening of August 21, Beijing time, Tiger Brokers data showed that Xiaomi Group ADRs opened higher on the U.S. stock market, with a peak gain of 4.25%. By the close, the gain was 3.45%. On August 22, Beijing time, Xiaomi Group's H shares rose by over 9% intraday. Due to Xiaomi's second-quarter results exceeding expectations, multiple international investment banks have raised their price targets for Xiaomi, with Nomura upgrading its rating.

What are the highlights behind Xiaomi's impressive financial performance?

Clearly, the smartphone business remains Xiaomi's core segment and the largest contributor to its "three cash cows." Xiaomi's outstanding financial report is largely attributed to its smartphone business:

In the second quarter, Xiaomi generated revenue of 88.9 billion yuan, an increase of 32% year-on-year, with an adjusted net profit of 6.2 billion yuan, up 20.1% year-on-year. Xiaomi's smartphone and AIoT businesses combined contributed 82.5 billion yuan in revenue.

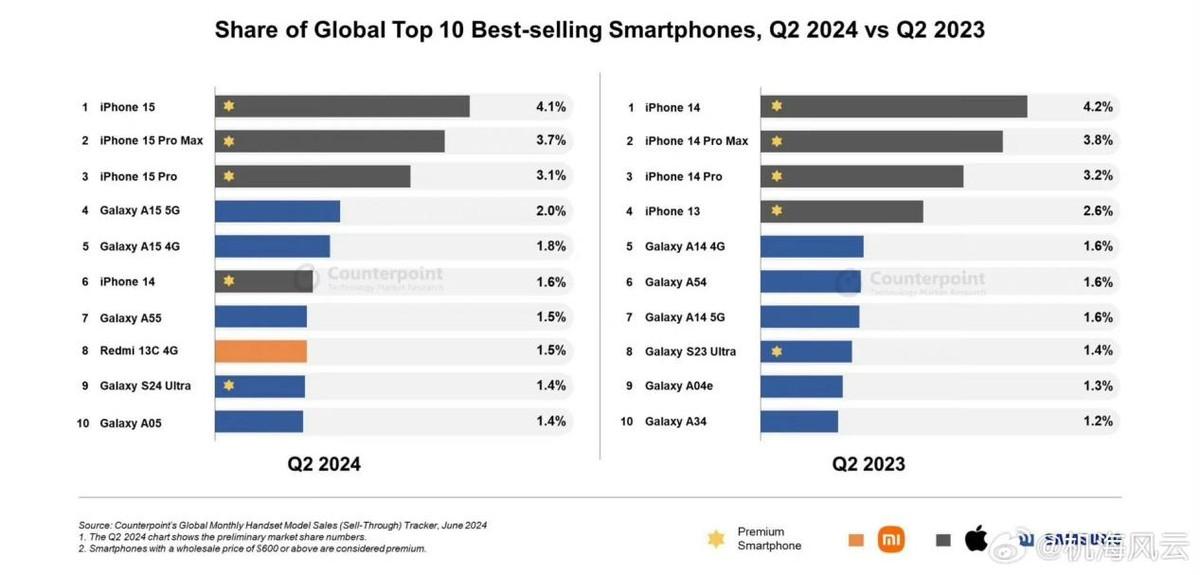

In the second quarter, Xiaomi shipped 42.3 million smartphones globally, ranking third after Apple with a market share of 15%, significantly outpacing OPPO in fourth place. In India, Xiaomi has staged a strong comeback, regaining the top spot in market share after six quarters.

How did Xiaomi's flagship smartphones perform? In China, Xiaomi's market share in the 3,000-4,000 yuan price range increased by 5.4 percentage points year-on-year, and similarly in the 4,000-5,000 and 5,000-6,000 yuan ranges, indicating successful progress in its push for higher-end devices.

Globally, due to the dominance of low-to-mid-range devices, ASP declined to around 1,100 yuan, and gross margin fell to 12%. However, Xiaomi's substantial overseas shipments remain the cornerstone of its third-place ranking, and Lei Jun remains vigilant.

In the second quarter, Counterpoint's list of the world's best-selling smartphones featured only Xiaomi's Redmi 13C 4G, priced at 600 yuan domestically and 130-150 euros internationally, confirming Xiaomi's strength in low-to-mid-range devices. While Xiaomi's progress in high-end overseas markets has been slower, it remains insignificant given its overall performance.

It's worth noting two factors contributing to Xiaomi's smartphone and brand ascendancy:

In July 2024, Xiaomi officially announced the Xiaomi Changping Smart Factory, a new-generation facility with an annual capacity of 10 million flagship smartphones and 100% automation in key processes. The factory independently develops core manufacturing equipment and software systems, handling the innovation verification and production of flagship devices like the Xiaomi 14 Pro, Xiaomi 14 Ultra, Xiaomi MIX Fold 4, and Xiaomi MIX Flip.

This means Xiaomi no longer relies on ODM giants like Huaqin, Longcheer, and Wingtech for its flagship and high-end devices, enabling tighter control over design, production, and quality.

The second factor is Xiaomi's in-house chip development, eagerly anticipated by fans. Xiaomi's IC design subsidiary, Xuanjie, has iteratively developed peripheral chips for fast charging, power management, image enhancement, and RF enhancement (e.g., Xiaomi C1, P1, G1, T1). However, since the launch of the Surge S1, Xiaomi's second-generation in-house AP has been delayed. If successfully integrated into products next year, Xiaomi would become the second company after Huawei with in-house high-end chip design capabilities, positively impacting brand premium and recognition.

In the second quarter, Xiaomi's R&D expenditure reached 5.5 billion yuan, up 20.7% year-on-year. Sales and marketing expenses were 5.9 billion yuan (with sales costs for innovative businesses like smart cars reaching 5.4 billion yuan), up 31.8% year-on-year, including 1.7 billion yuan for advertising and promotion, up 14.8% year-on-year, and 1.2 billion yuan for administrative expenses, up 3.4% year-on-year.

Xiaomi's innovative businesses, including smart cars, generated revenue of 6.4 billion yuan, with smart car revenue accounting for 6.2 billion yuan and a gross margin of 15.4%. The company delivered 27,307 vehicles in the second quarter, incurring a loss of 1.8 billion yuan due to high investments. The loss per vehicle calculation has been explained earlier.

According to Lu Weibing, Xiaomi aims to have 220 automotive dealerships covering 59 cities by the end of the year, though specific plans for 4S dealerships have not been disclosed, with a focus on 2S dealerships.

As of June 30, Xiaomi had 18,290 R&D personnel, accounting for 48.7% of its total workforce. Globally, Xiaomi holds over 40,000 patents. Considering the nearly 21% year-on-year increase in R&D expenditure in the second quarter, it's evident that Xiaomi is committed to R&D investment, which is crucial for a tech company to thrive in the highly competitive smartphone and automotive industries.

As of June 30, 2024, Xiaomi had cash reserves of 141 billion yuan, an increase of 38 billion yuan year-on-year. This figure surpasses that of NIO, Xpeng, and LI Auto and is close to Huawei's cash reserves at the end of 2023 (trailing by only 51.9 billion yuan). Despite having fewer employees and a smaller business footprint, Xiaomi's substantial cash reserves provide a strong foundation for its future growth.

Of course, Lei Jun and Xiaomi fans wouldn't agree to rest on their laurels. In the smartphone and automotive industries, few founders work as hard as Lei Jun. Working tirelessly all year round, he inspires executives like Lu Weibing and Zeng Xuezhong to follow suit. Perhaps this is why shareholders unanimously demanded at an annual general meeting three years ago that Lei Jun personally lead Xiaomi's foray into the automotive industry—they believed only his dedication could make it a success.

Initially, investors trusted Xiaomi because of Lei Jun. Now, they trust Xiaomi's systematic operational capabilities, including product quality, R&D, and marketing. This is the path for a young Fortune Global 500 company to become even stronger.

Lei Jun can rest easy when Xiaomi's various businesses continue to thrive without his direct involvement, but that day is still far off.

Keep up the good work!

Reference materials: Lei Jun, Lu Weibing, and other Xiaomi executives' Weibo updates, BiaNews , Daily Economics Lessons, and other media reports, Xiaomi's financial reports, and images sourced from the internet.