Who is Baidu Search losing to in the face of adversity?

![]() 08/26 2024

08/26 2024

![]() 676

676

Baidu is facing a comprehensive decline in the advertising and marketing market.

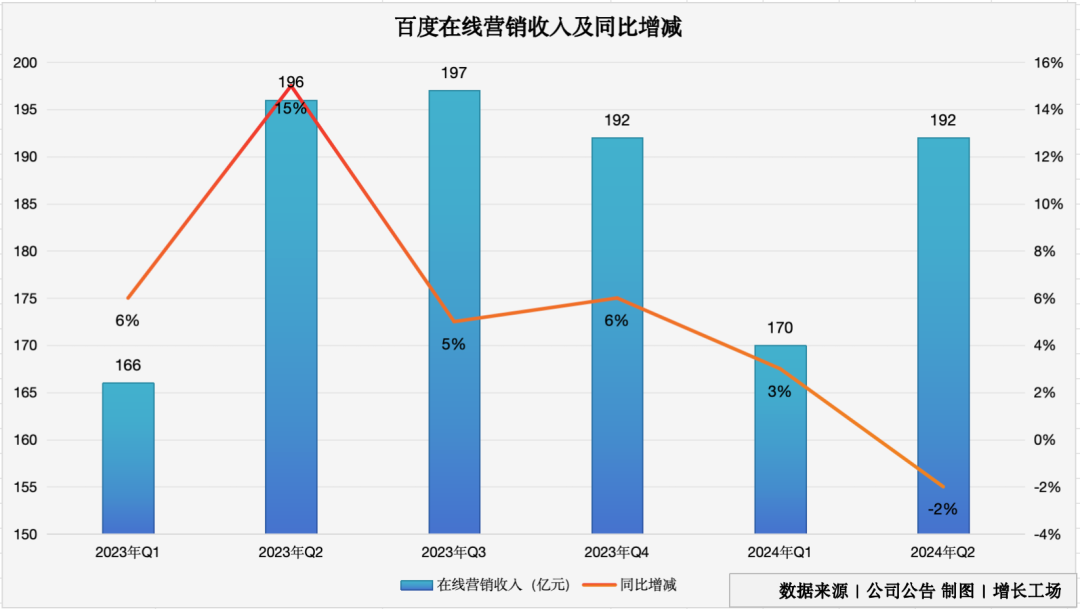

On August 22, Baidu released its Q2 2024 financial report, showing online marketing revenue of 19.2 billion yuan, a year-on-year decrease of 2%. This marks the first time in six consecutive quarters that Baidu's online marketing revenue has declined, despite the growth in the overall internet advertising market.

Baidu, which once dominated the traditional search advertising space, is now facing continuous erosion from competitors.

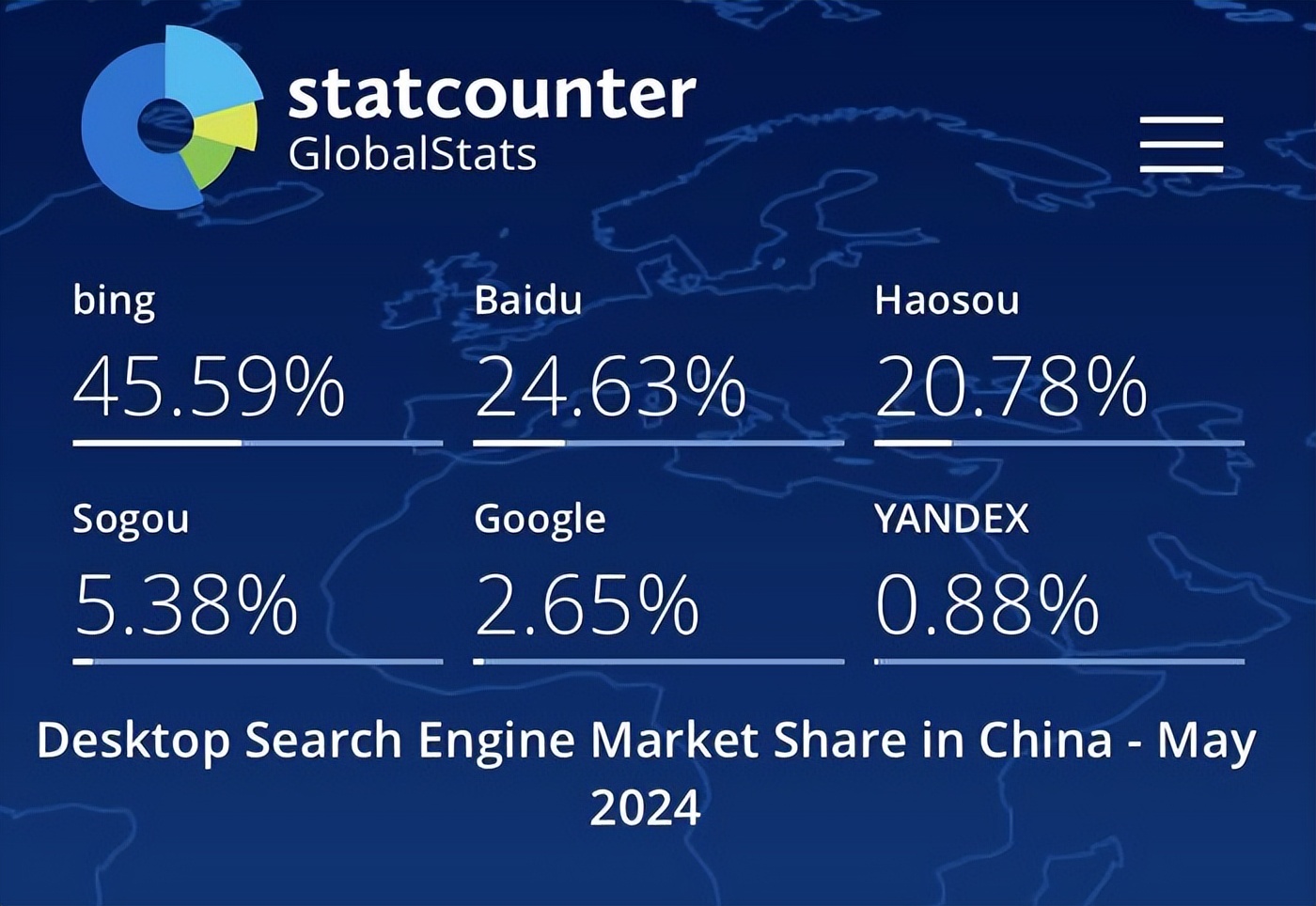

According to statcounter data, in the Chinese search engine market on PC in July 2024, Bing accounted for 53.43%, while Baidu accounted for 24.52%. In May last year, Baidu was no longer China's largest desktop search engine, a news that trended on social media.

While many have questioned these figures, it is difficult to find the latest authoritative data on the PC search engine market by searching various report websites.

Today, apps on users' phones have become isolated information islands, making it difficult for Baidu Search to break through this barrier.

The era of "asking Baidu when unsure" is long gone. Now, people follow celebrities on Weibo, watch short videos on Douyin and Kuaishou, and seek experience and tips on Xiaohongshu. Consequently, Baidu Search is gradually losing the favor of advertisers.

I. Baidu Marketing Lags Behind the Advertising Market

In the past year and a half, Baidu's online marketing revenue has only seen double-digit year-on-year growth in Q2 2023, with the rest showing single-digit increases.

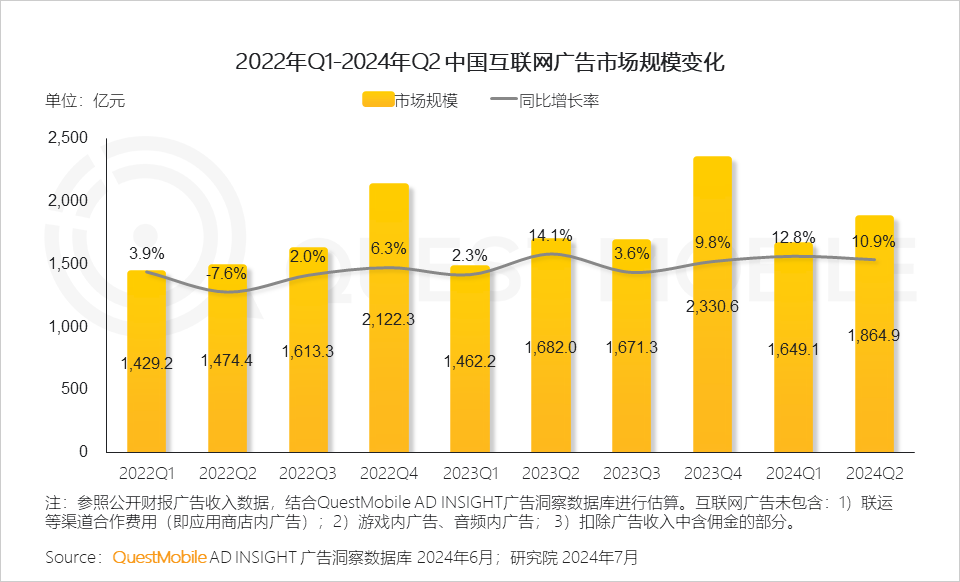

According to QuestMobile, the internet advertising market reached 186.49 billion yuan in Q2 2024, a year-on-year increase of 10.9%. However, despite the growth in the overall market, Baidu, once the top internet company in terms of advertising revenue in China, saw a decline.

Comparing the overall market and Baidu's financial reports, Baidu's online marketing revenue has consistently lagged behind the overall internet advertising market since Q4 2024.

There are three major models in internet advertising: search ads, e-commerce ads, and feed ads. Baidu has essentially retreated across the board.

In 2016, Taobao surpassed Baidu in advertising revenue; in 2019, ByteDance surpassed Baidu. This represents the victory of e-commerce and feed ads over search ads.

To reverse its decline amidst the rise of feed ads, Baidu launched a strategy in 2019 to "consolidate mobile capabilities and win in the AI era." The core strategy was to establish an information distribution model combining "search + feed," hoping to leverage search traffic to drive content-side products like Haokan Video, Baidu Library, and Baidu Post Bar, forming a closed loop from traffic to content monetization.

In 2023, with the popularity of large language models, Baidu comprehensively AI-nativized its products and services, launching AI applications like Baidu New Search, Baidu New Library, and ERNIE Bot, as well as AI marketing tools like Qingke and Brand Intelligent Agent.

However, Baidu's marketing efforts still struggle to reverse the decline.

In July this year, multiple media outlets reported that Baidu's Jiangsu Changzhou agent Qingzhifeng ceased operations on June 30. A company representative responded that only Baidu bidding-related promotion services were no longer handled, and the rest of the business remained normal, with employees responsible for this part of Baidu's business being laid off.

On August 22, "Growth Factory" called the company seeking promotion, and a staff member said, "We don't do Baidu anymore."

Qingzhifeng is a core agent of Baidu in Jiangsu. Its official website shows that it serves as a Baidu marketing service center in Changzhou, Taizhou, Lianyungang, and Yangzhou, and is also authorized by Baidu to provide marketing services in Henan Xinxiang, Jiaozuo, Anyang, Luoyang, Zhejiang Jinhua, and other regions.

Regarding the above news, Baidu responded to TechPlanet that the relationship between manufacturers and agents operating through the agency authorization model involves the normal business practice of replacing old agents with new ones, implying normal agent turnover.

However, according to TechPlanet, an employee at Qingzhifeng said that several agents voluntarily withdrew from Baidu this year. "High targets and losses for agents, how could we continue?"

The changes at Qingzhifeng are just a microcosm of Baidu's declining marketing services. In the search space, Baidu's original user base is being diverted, and it is facing erosion from platforms like Douyin and Xiaohongshu.

II. Strong Competition in Search Advertising

For users, Baidu's feed content is far less attractive than other social platforms, so Baidu essentially remains stuck in search. But even in search, Baidu faces significant challenges.

In June this year, at the Yabuli China Entrepreneurs Forum, DingTalk President Ye Jun mentioned changes in search. He said, "The search scenario has changed, and Baidu must catch up. If not, I fear you'll only use Xiaohongshu and not Baidu."

Ye Jun also compared video numbers, saying, "If I buy a device and don't know how to use it, searching on video numbers gives me plenty of results. The first ten results on Baidu probably won't be what I need. This is because after gaining intelligent capabilities, the interaction feels completely different."

Ye Jun's sentiment reflects the reality of many people's search experiences. Currently, China's search market is diverse, and Baidu is no longer users' first choice or even in their consideration set.

The reason is that Baidu's content ecosystem has not been established, making it difficult to provide "valuable content" to users. Many Xiaohongshu users feedback that "there's too little information on Baidu" or "Xiaohongshu has real feelings from people, making me feel more at ease."

"Use Xiaohongshu like Baidu" and "ask Xiaohongshu when unsure" are common sentiments among Xiaohongshu users, resonating with many and sparking interactions.

Xiaohongshu has revealed that nearly 70% of its monthly active users engage in search behavior, with one-third opening the app directly to search upon activation.

Meanwhile, Douyin has been vigorously developing its search capabilities. Recently, following Toutiao Search, Wukong Search, and Lightning Search, Douyin launched its fourth independent search app, "Douyin Search."

Douyin's "2023 ByteDance Search Value" report shows that the monthly active search user penetration rate (monthly active search users / total monthly active users on Douyin) consistently remained above 92% in 2023. Additionally, in 2023, Douyin's local services search GMV increased by 254%, and product search GMV increased by 143.8%.

Like Douyin, Kuaishou has also been exploring search services. In Q2 2024, monthly active users using Kuaishou Search reached nearly 500 million, with daily search queries increasing by over 20% year-on-year.

For Baidu, it is gradually being diverted by various apps and losing its status as a traffic entrance. With advertisers tightening their budgets, they can only spend money on more efficient platforms like traditional e-commerce platforms, Douyin, Kuaishou, and Xiaohongshu.

As we all know, the closer to the transaction, the shorter the ad conversion path, and the higher users' tolerance for ads. However, Baidu is too far removed from transactions, and users are now more accustomed to making consumption decisions on e-commerce platforms, short video platforms, and Xiaohongshu, making Baidu's ad value increasingly low.

Now, Douyin, Kuaishou, and Xiaohongshu are also vigorously developing search and accelerating its commercialization. If Baidu does not change, it will face further market share compression in the search advertising market.

III. The Remaining Story: AI?

In the past year, Baidu has continued to iterate from traditional search to generative search, attempting to empower search with AI.

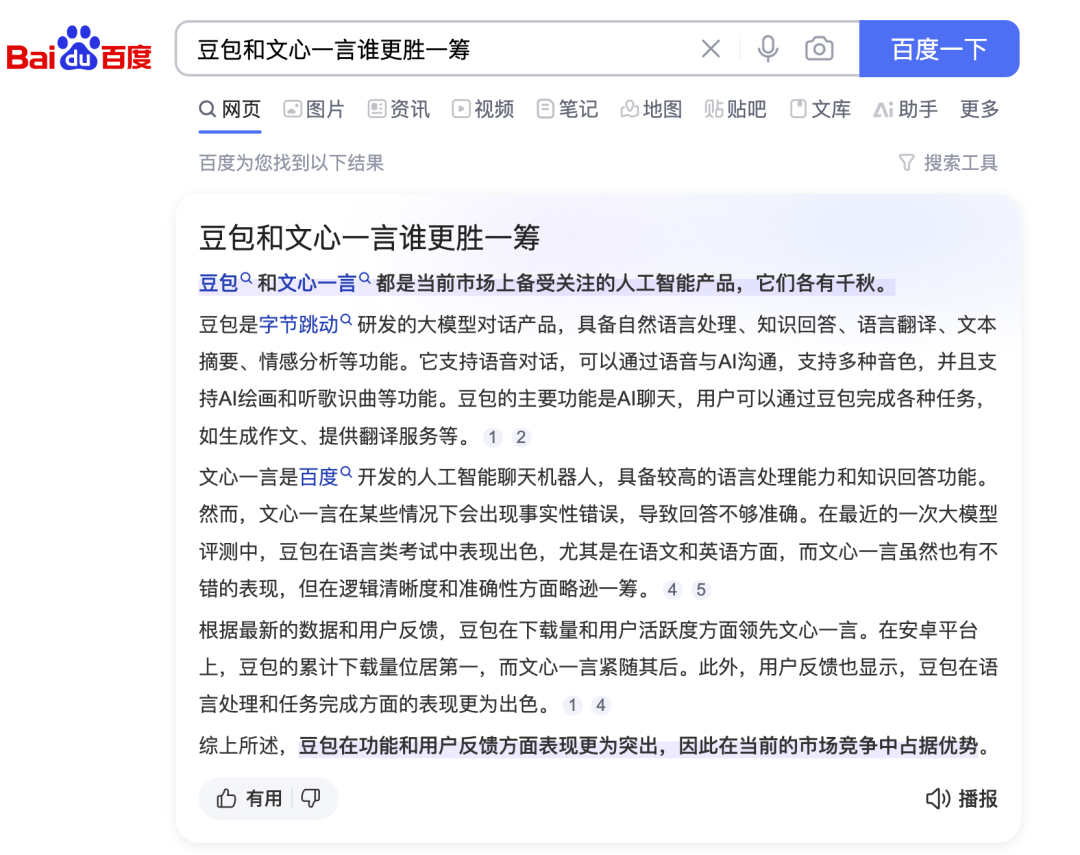

For users, the core of this iteration is that when a user asks a question in the search box, Baidu analyzes and summarizes an answer using the ERNIE Bot large language model.

For example, when we input "Which is better, Douyin's Doubao or ERNIE Bot?" Baidu Search gives the following response:

During Baidu's earnings call, Robin Li stated that 18% of search results are now generated by AI. Meanwhile, the distribution of intelligent agents in Baidu's ecosystem has increased significantly, with an average daily distribution exceeding 8 million times in July, double that of May.

However, Baidu's AI ecosystem will also face many challenges.

On the one hand, it still faces strong competition.

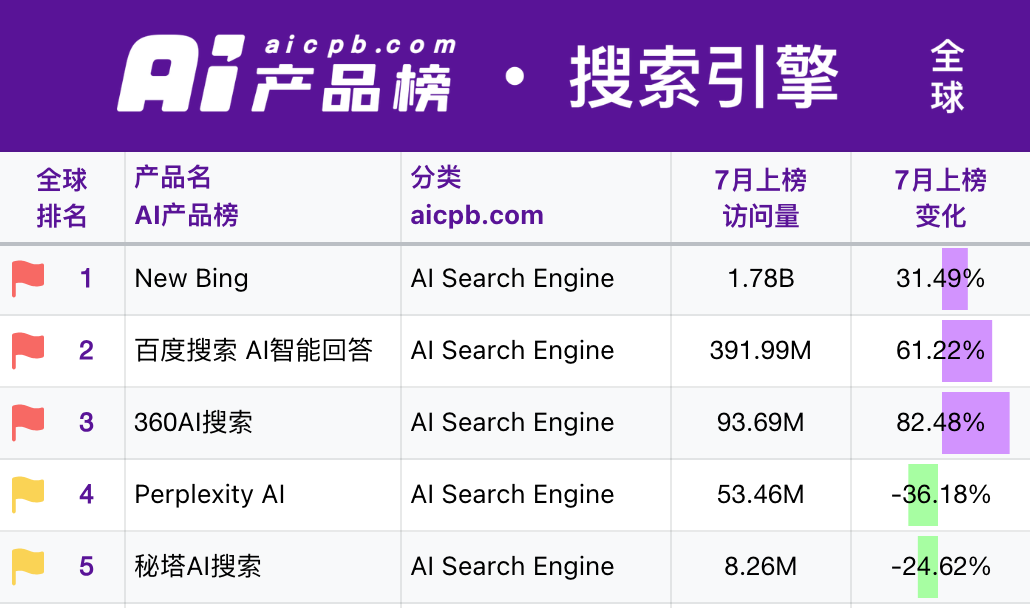

According to the July ranking by "AI Product Rankings," Baidu Search's AI-powered answers ranked second in the "AI Search Engine" category, with New Bing ranking first.

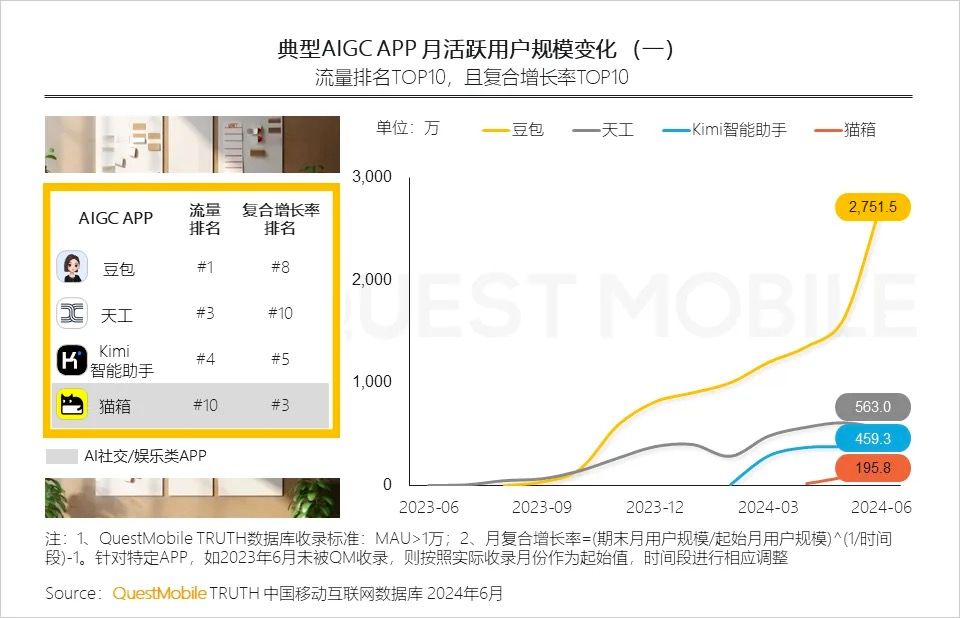

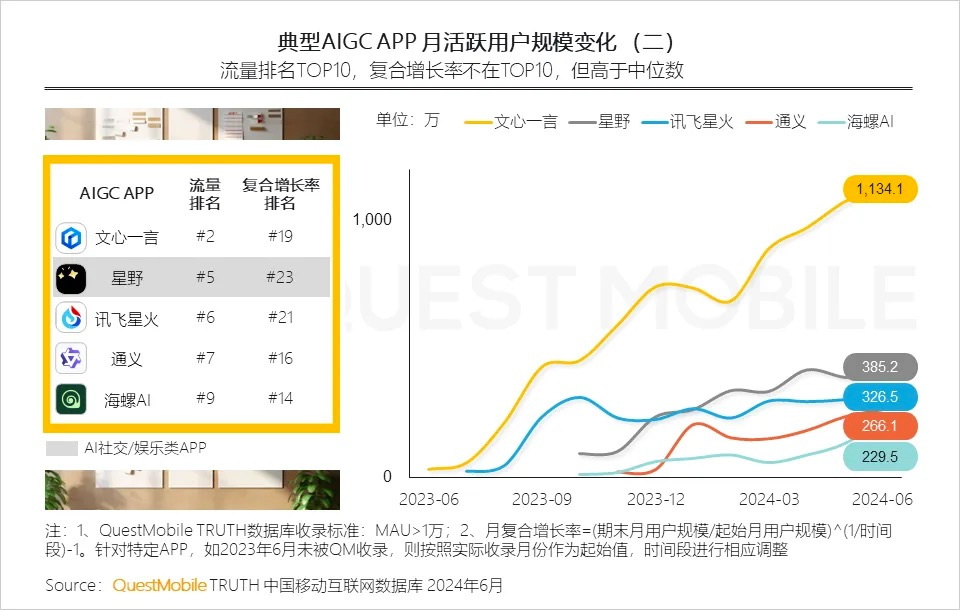

Regarding generative AI applications, while Baidu's ERNIE Bot has a first-mover advantage, its active user base has been surpassed by Douyin's Doubao.

According to QuestMobile data, Douyin's Doubao app reached a new monthly active user high of 27.52 million in June, while Baidu's ERNIE Bot also reached a record high but with only 11.34 million monthly active users in June.

On the other hand, AI-powered search may negatively impact advertising.

Robin Li acknowledged this during the earnings call, stating that AI-generated search results may reduce ad exposure, negatively impacting monetization in the short term.

He believes this provides significant value to users. "We prioritize long-term user experience over immediate revenue and profit, believing that the generative search strategy is crucial for future success."

As Baidu's core business, the monetization capabilities of Baidu Search are declining, and it continues to face strong competition in the future.