"Blacklisting" Behind It, Great Wall Motors Needs a Sales Turnaround

![]() 08/26 2024

08/26 2024

![]() 470

470

Small waves can also brew into big storms!

Editor: Chen Chen

Wind Quality: Li Li

Source: Shoucai - Shoucai Finance and Economics Research Institute

More urgent than "blacklisting" is Great Wall Motors' battle to increase sales.

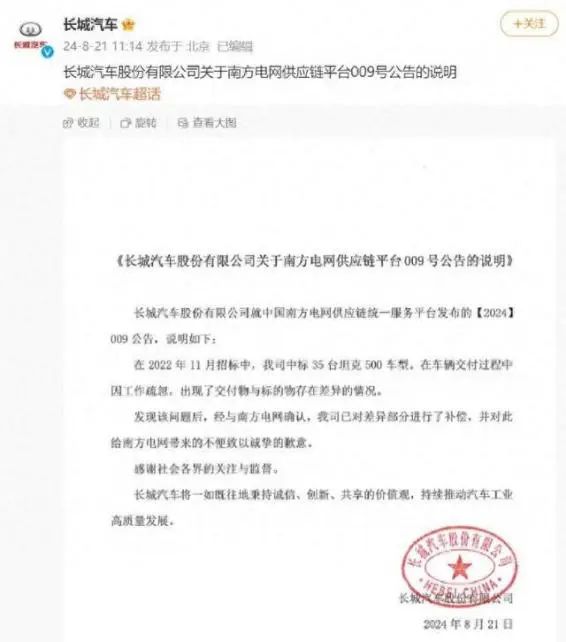

On August 20, according to an announcement from China Southern Power Grid, Great Wall Motors was listed as an "unaccepted bidder." That evening, the Shanghai Stock Exchange issued a regulatory work letter regarding public opinion related matters involving Great Wall Motors, directors, supervisors, and senior executives.

On August 21, Great Wall Motors' official Weibo account issued a statement stating that in a November 2022 tender, the company had won a bid for 35 Tank 500 models. Due to oversights in the delivery process, there were discrepancies between the delivered products and the target products. Upon discovering the issue, the company confirmed the discrepancies with China Southern Power Grid, compensated for the differences, and apologized to China Southern Power Grid.

While it may seem like a minor internal control oversight, there are still differing voices in the market: If Great Wall Motors had explained and compensated for the issue immediately after discovering it, why was it still listed on the "List of Major Dishonest Suppliers" and "blacklisted" for two years? Neither party has provided further clarification on this matter.

1

Increased Performance Cannot Hide Sales Weakness

Three Consecutive Months of Decline: Revisiting the Fear of Crisis

What is certain is that during a critical period of recovery and growth, suddenly being "blacklisted" is not good news.

On July 10, Great Wall Motors' 2024 first-half performance forecast showed a net profit attributable to shareholders of between 6.5 billion and 7.3 billion yuan, representing a year-on-year increase of 377.49% to 436.26%, and a non-recurring net profit of between 5 billion and 6 billion yuan, representing a year-on-year increase of 567.13% to 700.56%.

The company attributes its growth to two main factors: the impact of its primary business, including increased overseas sales and further optimization of domestic product mix; and non-operating income and expenses, primarily driven by increased government subsidies year-on-year.

In the first half of 2024, Great Wall Motors sold a total of 559,669 vehicles, an increase of 7.79% year-on-year. Overseas sales exceeded 200,000 units, a year-on-year increase of 62.59%.

However, this does not mean that everything is flawless. Compared to the first half of 2023, when overall sales were 518,796 units and overseas sales were 123,294 units, representing a year-on-year increase of 80.22%, domestic sales in the first half of 2024 declined, and overseas growth was also slower than in the same period last year.

Specifically, for its various brands, there were both increases and decreases, a mix of good and bad news. In the first half of the year, Haval sold a total of 299,738 vehicles, an increase of 2.42% year-on-year; WEY sold 19,867 vehicles, an increase of 9.46% year-on-year; Pickups sold 91,916 vehicles, a decrease of 10.41% year-on-year; Ora sold 31,749 vehicles, a decrease of 32.87% year-on-year; and Tank sold 116,038 vehicles, an increase of 98.94% year-on-year.

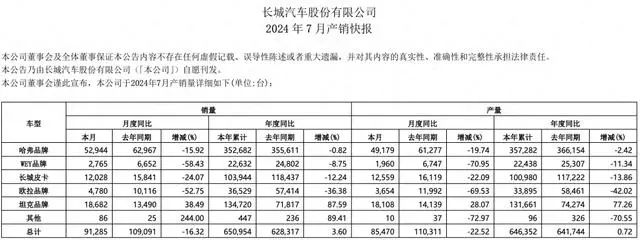

From January to July 2024, Great Wall Motors sold a total of 650,954 vehicles, an increase of 3.60% year-on-year. This represents approximately 40% of the company's annual target of 1.6 million vehicles set at the beginning of the year, making it difficult to achieve. Additionally, total sales in July were 91,300 vehicles, a year-on-year decrease of 16.32%, marking the third consecutive month of year-on-year sales declines. This raises concerns about how the company's performance will fare in the second half of the year if the downward trend continues and whether the double-digit growth momentum can be sustained.

It's not an unfair question. The company's production and sales report shows that among Great Wall Motors' various brands in July, only Tank achieved positive year-on-year growth, while sales of Haval, Ora, WEY, and Great Wall Motors all declined, with Ora and WEY experiencing declines of over 50%.

Behind the halving of sales for its two major new energy brands, Great Wall Motors sold only 156,500 new energy vehicles from January to July 2024. In the same period, BYD sold nearly 2 million vehicles, reaching 1,955,400. As a fellow front-runner in the domestic market, Great Wall Motors faces pressure to keep up.

Looking back to the 2023 Chengdu Auto Show, Great Wall Motors' President Mu Feng boldly stated that 2023 marked the beginning of the company's intelligent transformation, and 2024 would be a year of significant progress in electrification and intelligence for Great Wall Motors.

At least judging from the above performance, it seems that the year of great progress is still far off. Taking WEY as an example, as a high-end intelligent new energy brand, it has been entrusted with the mission of advancing Great Wall Motors' high-end transformation since its inception in 2016. Renaming WEY to WEYI reflects Wei Jianjun's high hopes for its development.

In June 2021, Great Wall Motors officially announced its 2025 strategy. At that time, Wei Jianjun stated that by 2025, Great Wall Motors aimed to achieve global annual sales of 4 million vehicles, with 80% of these being new energy vehicles (i.e., 3.2 million vehicles), and revenue exceeding 600 billion yuan. To achieve this vision, Wei Jianjun said that the company would invest a cumulative total of 100 billion yuan in research and development over the next five years.

Time flies, and three years have passed since then. How impressive are the first seven months' sales of 156,500 vehicles? How efficient and precise has the investment been? Will the aspirations for 2025 become mere pipe dreams?

Performance is most vulnerable to roller coaster rides, and steady growth requires a solid sales foundation. For Great Wall Motors at this point, a more practical goal may be as Wei Jianjun stated in his 30-year reflections on Great Wall Motors: only by maintaining a sense of crisis and awe can the company survive.

2

Reflections on the Decline of Haval H6: Revisiting the Importance of Quality

Ultimately, it's the product that speaks for itself.

First, let's look at the mainstay Haval brand. As the former sales leader of the Haval series, the lackluster performance of Haval H6 has exceeded market expectations. According to the China Passenger Car Association, in July 2024, Haval H6 sold 5,981 vehicles, ranking 44th among SUV sales, a steep decline from January's 22,846 vehicles and 7th place ranking.

It's worth noting that Haval H6 holds a milestone position in Great Wall Motors' development history, having been the top-selling domestic SUV for nine consecutive years and 103 consecutive months. It has been a household name and a phenomenal success.

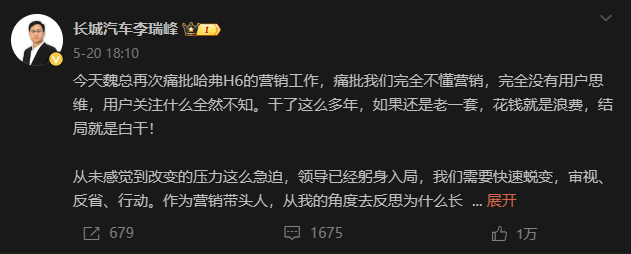

The rapid decline of this star model has also sparked strong dissatisfaction from Wei Jianjun. As early as May, Li Ruifeng, Chief Growth Officer of Great Wall Motors, posted on his personal Weibo account that "Today, Mr. Wei criticized the marketing efforts of Haval H6 again, saying that we completely lack understanding of marketing, user thinking, and what users care about. If we continue to do things the same old way, spending money will be a waste, and the result will be nothing accomplished!"

The harsh words sparked numerous comments and shares from netizens. However, looking deeper, marketing is just the surface; the core product experience is what truly matters. The core pain point for Great Wall Motors is that its transformation pace in the wave of electrification and intelligence has been slow, causing its classic brands to struggle to keep up with the changing times.

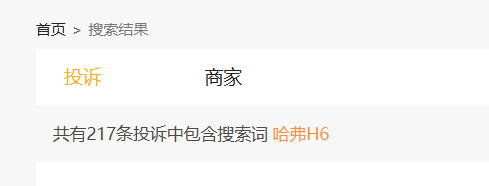

Browsing Black Cat Complaints, as of August 23, there were a total of 217 complaints related to Haval H6 on the platform.

For example, on August 22, complaint number 17375359323 on the platform showed that a consumer purchased a Haval H6 from a Great Wall Motors franchise store in June and discovered issues such as stale fabric on the car's ceiling, lack of a new car smell, lack of power when starting the engine, a misaligned passenger seat leaning towards the dashboard, and very few tire hairs.

On the same day, complaint number 17375358213 on the platform showed that a consumer purchased a new-generation Haval H6 2.0 two-wheel-drive model in August, but discovered a problem with the car the next day. After inspection at the 4S store, it was found that the compressor needed to be replaced.

As everyone knows, Great Wall Motors has always been known for its practicality and reliable quality. Building trusted products based on user needs has been an important goal of Great Wall Motors' automotive manufacturing. Judging from the above complaints alone, is the foundation of quality still as solid as before? The golden cup and silver cup are not as good as the word of mouth of consumers. Craftsmanship quality is the only way for enterprises to win in the long run and defend the glory of their legendary cars.

Another basic sales segment, pickups, is also not doing well. Sales in July fell by 24% year-on-year, a deeper decline than Haval's 15.9% drop. Fortunately, as one of its representative models, Great Wall Cannon has maintained its strength, becoming the first Chinese pickup brand to produce over 600,000 units in July.

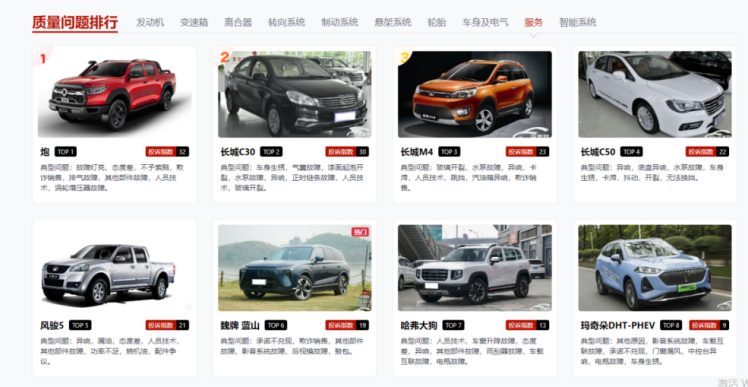

However, this does not mean there are no hidden concerns, and some flaws in complaints cannot be ignored. Browsing the Auto Complaints website, Great Wall Cannon ranks first in service complaints among Great Wall series products, and fourth in complaints about engines, steering systems, and tires. Issues mainly focus on malfunction indicator lights, poor attitude, refusal to compensate, fraudulent sales, exhaust faults, other component faults, personnel technical issues, and turbocharger faults.

For example, on August 7, complaint number TX304506 on the platform showed that a consumer negotiated the price, discounts, and production date of a new car when purchasing it, but encountered various delays when picking up the car. The next day, when registering the car, it was discovered to be an inventory car. The dealer refused to take responsibility, and contacting Great Wall's 400 customer service line did not yield satisfactory results, leading to disappointment with the Great Wall brand.

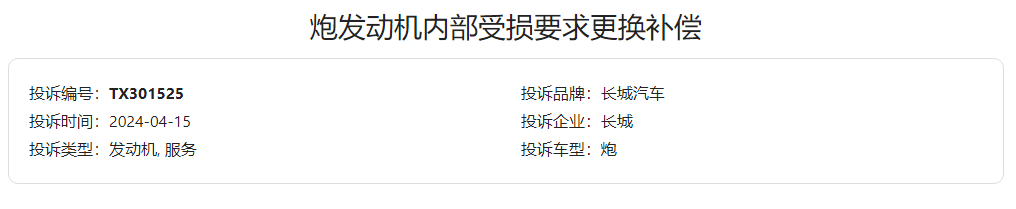

Another example is complaint number TX301525 on April 15, which showed that a consumer purchased a Great Wall Cannon in March 2023. After driving 30,190 kilometers, the spark plug broke, causing severe internal engine damage. During the warranty period, the 4S store refused to cover the repair cost due to a lack of maintenance records, claiming it was not a quality issue. After contacting the 400 customer service line, the 4S store agreed to replace the damaged parts but required the consumer to bear half the cost.

(All the above complaints have been reviewed by the platform)

Objectively speaking, in the fast-moving consumer goods sector, it is unrealistic to expect everyone to be satisfied. Some of the above complaints may be biased or one-sided. However, the driving experience and user feedback are the cornerstones of sales. Especially as market competition becomes increasingly intense and consumers have plenty of options, it is essential to strengthen product quality control and refine product services.

On August 28, 2020, according to information on the official website of the State Administration for Market Regulation, Great Wall Motors filed a recall plan with the administration. Starting from September 1, 2020, it recalled a total of 71,319 Great Wall Cannon vehicles produced between September 24, 2019, and August 9, 2020.

Industry analyst Sun Yewen said that in addition to quality issues and lagging development in new energy, brand confusion is also hindering Great Wall Motors' sales. The company currently owns numerous brand series, including Pickups, Haval, WEY, Ora, Tank, and Jiajialong. As durable goods, automotive brand positioning and recognition are crucial. When people think of Great Wall Motors, many immediately associate it with Haval, indicating that brands need time to accumulate recognition and make a lasting impression on consumers.

3

The Automotive Industry Turns into a Fan Circle; Breakthroughs Require Patience and Persistence

Looking at the current automotive industry, the new four modernizations are shaking things up, with new entrants constantly challenging the established order. To maintain its position, direction is far more important than effort.

Since 2024, the automotive market has welcomed another disruptor: Xiaomi Motors, which has added fuel to the already intense competition. For example, Lei Jun's personal involvement in promoting the brand has sparked a trend among automotive industry leaders to become internet celebrities. To address Great Wall Motors' sales crisis, Wei Jianjun, now in his sixties, has personally created a personal IP by joining multiple social media platforms and leveraging short videos and live streams to promote his personal brand and that of Great Wall Motors.

On May 10, Great Wall Motors held a shareholders' meeting attended by Chairman Wei Jianjun and several senior executives, which was also broadcast live online. During the meeting, Wei Jianjun admitted that he did not object to becoming an "internet celebrity."

In the era of internet traffic, where consumers' attention goes, business opportunities follow. It is understandable and commendable for company leaders to appear at the forefront and try to increase brand exposure through internet thinking. However, judging from the above performance, it remains to be seen how much of this buzz can be converted into actual sales after the initial excitement wears off.

Traffic is a double-edged sword. Under the microscope of public opinion, both strengths and weaknesses are magnified. There are numerous examples of companies that have suffered backlashes due to their inability to manage the flow of traffic effectively.",

At the shareholders' meeting in May 2024, Wei Jianjun also stated that the intensity of competition in the automotive industry would not diminish in the next three years, and that a long-term approach was needed to face the future.

Notably, during the Great Wall Motors press conference on August 21st, a blogger suggested inviting Zhou Hongyi to test drive one of their vehicles. Wei Jianjun waved his hand and declined, saying, "We don't need him to test drive." He also emphasized to staff, "On record, we just don't need them to test drive. Recognition from our vast user base is what matters. You can't use traffic or popularity to represent a product's value."

Indeed, regardless of how times change, car manufacturing remains a technical, patient, and cumulative endeavor that rigorously tests craftsmanship. Whether it's refining fuel-powered brands or accelerating the pace of intelligent transformation, both require staying true to the product's original intention and user needs. Only by enduring solitude, focusing intently on improving product quality and technological level, can one break through fierce competition, boost sales, and achieve invincibility in performance.

4

Envisioning a New Great Wall: Be Wary of Minor Turbulence

One loss, another gain. Amidst the domestic slowdown, Great Wall Motors' sustained overseas efforts have ushered in a harvest season. Currently, they have over 1,000 overseas channels and have launched the GWM brand in places like Qatar, Uzbekistan, Kazakhstan, Mauritius in South Africa, and Morocco.

In July 2024, Great Wall Motors sold 38,185 vehicles overseas, a year-on-year increase of 41.39%; cumulative sales from January to July reached 239,685 vehicles, a year-on-year increase of 58.80%.

In August 2024, Great Wall Motors announced its "New Four Modernizations" strategy for global development. 1) Localization of production capacity: Driven by both domestic and overseas markets, forming a "10+3+N" global production layout. 2) Localization of operations: Establishing local offices or wholly-owned subsidiaries in eight major overseas regions such as the EU and ASEAN, with local teams at the core of operations to better access local markets. 3) Cross-cultural branding: As a global company, it is essential to reconstruct culture, blending the philosophy of inclusiveness with modern industrial civilization. 4) Secure supply chain: Factories should be established where the market is, taking root and growing there.

Great Wall Motors plans to achieve overseas sales of over 1 million vehicles by 2030, with high-end models accounting for over one-third of total sales. Wei Jianjun stated that Great Wall Motors would adhere to a long-term perspective, uphold a global passion, and collaborate with partners to create a new era and build a new Great Wall Motors.

It is not difficult to see that Great Wall Motors' overseas layout is systematic and ecological, guided by a macro perspective and deep market insights, leading to the impressive sales figures mentioned above.

The bigger the aspirations, the bigger the stage. From this perspective alone, Great Wall Motors still has many aces up its sleeve, and the aforementioned three consecutive quarters of declining sales may merely be a minor interlude or turbulence.

However, even minor turbulence can brew into significant waves, and the underlying concerns revealed therein warrant deep reflection by the company. No matter how beautiful the vision of building a new Great Wall Motors in the vast sea of stars, it must be supported by data and performance. As 2025 approaches, whether and how the goals of 4 million annual global sales and revenue exceeding RMB 600 billion can be achieved remain serious questions.

To avoid broken promises and empty promises, perhaps achieving the target of 1.6 million sales in 2024 is crucial. The odds of success depend on whether a sales turnaround can be achieved in the remaining four months.