BYD's Dilemma in Autonomous Driving

![]() 08/28 2024

08/28 2024

![]() 419

419

Witnessing the Rise of China's Auto Industry: BYD's Challenges in Autonomous Driving, by Mulinsen, Creator, Driver, and Legend in the Automotive World. Mulinsen says: BYD has capitalized on the wave of electrification, but may have fallen behind in the autonomous driving revolution. This lag could stem from misguided perceptions of autonomous driving.

BYD's dilemma in autonomous driving is most evident in its in-house research and development efforts. While BYD has partnered with multiple autonomous driving solution providers, these external solutions ultimately fail to contribute to its in-house capabilities and may even crowd out in-house development.

A simple analogy: If the US continues to restrict access to high-end chips for China, it will be extremely difficult for China to develop its own high-end chips.

BYD has officially announced that its upcoming "FANGCHENGBAO Leopard 8" will adopt Huawei's autonomous driving solution equipped with LiDAR technology.

Some interpret this move by BYD as a strong partnership between two industry giants.

Reversing the logic: If BYD already possessed a competitive autonomous driving solution, would it be necessary to partner with Huawei?

BYD may have seized the wave of electrification, but it may not be as successful in grasping the opportunities presented by intelligent technology. BYD's urgency should lie in advancing its autonomous driving capabilities.

BYD's choice of Huawei may not be the optimal solution.

1. BYD Captures the Electrification Wave

BYD has captured and led the wave of automotive electrification, a fact that is undisputed. As the first automaker in China to announce the abandonment of traditional fuel vehicles, BYD has fully committed to the new energy sector. BYD's electrification efforts are evident in the following aspects:

Product Layout: BYD has established a range of product lines, including Dynasty, Ocean, Tang, FANGCHENGBAO, and DENZA, all focused on pure electric and hybrid technologies.

Technological Reserve: BYD has built a comprehensive vertical integration across the entire supply chain, with technologies centered around electrification, such as Blade Battery, CTB (Cell to Body), battery protection, Cube Energy Storage System, thermal management, YiSiFang, and YunNian technology.

Both BYD's product offerings and technological advancements are centered around electrification. In other words, had the national strategy leaned towards hydrogen-powered vehicles, BYD's position would have been precarious.

BYD's dedication to electrification technology paid off when the national strategy shifted towards electrification. BYD's success in this area is evident in its sales figures, which have soared 28.83% year-on-year to 1.955 million units as of July 2023.

However, sales volume does not necessarily equate to quality, let alone high-quality development. While BYD's sales have reached historic highs, this does not necessarily indicate high-quality development, especially when considering the importance of intelligence in the automotive industry.

2. BYD May Not Have Captured Intelligence

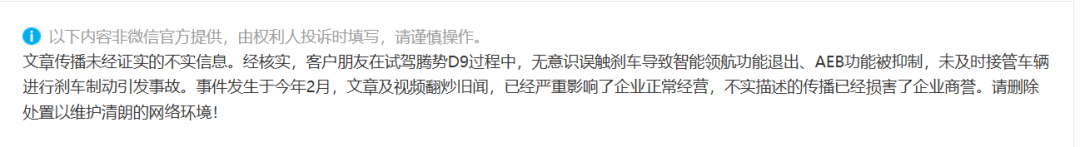

BYD's progress in intelligence remains uncertain, with no significant achievements visible compared to market leaders like Huawei ADS, Tesla FSD, Xpeng, Lixiang, and Great Wall Motors. In June, BYD showcased its autonomous driving capabilities in a Shenzhen village, but the demonstration was conducted at low speeds and was not yet commercially available. This suggests that BYD's advanced autonomous driving technology is still in the research and development stage. Additionally, BYD's explanation for a recent autonomous driving accident further raises questions about its capabilities in this area.

Video available upon request. Please note that the video is sourced from the internet and will be removed upon request if it infringes on any copyrights.

BYD's limited success in in-house autonomous driving has led it to partner with multiple solution providers, including Momenta, Horizon Robotics, Black Sesame, DJI, and Hongjing ZhiJia, for their autonomous driving technology and chips.

Overall, BYD's approach gives an impression of disorganization and urgency. With this new partnership with Huawei, one wonders if BYD's existing partners were unable to meet its needs.

3. Huawei May Not Be the Optimal Solution for BYD

BYD's partnership with Huawei for autonomous driving may not be the optimal solution. The power dynamic between the two companies, with Huawei as the stronger partner, could lead to disagreements over decision-making. Additionally, Huawei may prioritize offering generic autonomous driving solutions rather than tailored ones, which could be a point of contention between the two parties.

Some interpret BYD's partnership with Huawei as a move to diversify supply channels and reduce costs, but this rationale is flawed. In today's highly competitive new energy vehicle market, intelligent technology is a crucial selling point. Without an attractive autonomous driving solution, BYD's rapid sales growth could be threatened, especially as autonomous driving technology becomes more accessible to mid-range and low-end models. For BYD to become a world-class automaker, in-house autonomous driving research and development is crucial, but this endeavor is still in its infancy.