Black Myth breaks 10 million global sales, is Tencent's “sugar daddy” shouting for free?

![]() 08/29 2024

08/29 2024

![]() 531

531

writing /Leon

edit / Hou Xi

2024 has been widely regarded as a “lean year” for the gaming industry, until the arrival of Black Myth: Wukong (hereinafter referred to as Black Myth). On August 20, Black Myth, six years in the making, debuted and instantly topped Steam's sales charts.

In the days that followed, this monkey continued to break records: 3 million concurrent online users across all platforms, 10 million copies sold in three days, boosting game and cultural concept stocks, and causing shortages of domestic PS5 consoles…

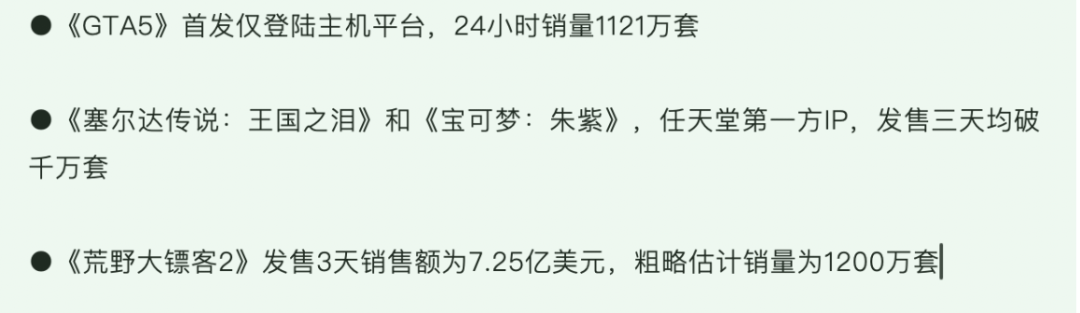

According to incomplete statistics, there have been no more than five standalone games on PC and console platforms in recent years that have surpassed 10 million copies sold within three days.

chart : List of single player games with sales exceeding 100000 sets

undoubtedly ,Black Myth has created a miracle in the history of Chinese standalone games and proven the spending power of its primary consumer group (adult males). The popularity of the collaborative event with Luckin Coffee caused Luckin's CGO (Chief Growth Officer) Yang Fei to exclaim on social media, “Merchandise sold out nationwide in seconds, almost crashing the system. Male purchasing power this morning has overturned team perceptions, more reliable than 10 Father's Days combined.”

Thanks to its outstanding artistic style, many filming locations in Black Myth have become popular destinations. Zhangjiakou Tourism Bureau and Zhangjiajie Tourism Bureau have personally posted messages praising Black Myth and inviting netizens to visit, hoping to capitalize on this wave of traffic.

Black Myth's enormous success is primarily attributed to the game development team, Game Science. As a game company that has only produced two mobile games, Game Science used a team of just over 100 people and six years to create a truly meaningful “domestic 3A standalone game,” no small feat. Therefore, even with minor flaws like excessive air walls and suboptimal PS5 optimization, domestic players have been very forgiving.

Of course, the role of Tencent, the “sugar daddy” behind the scenes, cannot be ignored. According to Game Science's founder and CEO Feng Ji, the production cost of Black Myth is as high as 15 million yuan per hour, with an overall cost of approximately 300 to 400 million yuan. With the support of a giant like Tencent, Game Science had more leeway in development and the capital to realize more ideas.

In addition, Black Myth was developed using Epic Games' Unreal Engine 5, and Tencent holds a 40% stake in Epic Games. Although Tencent does not interfere with Epic's operations, it shares technology and provides considerable assistance to Game Science at the development level.

Curiously, Black Myth's standalone, no in-app purchases attribute is vastly different from Tencent's pay-to-win mobile games on which it relies. So why did Tencent invest in Black Myth? To understand this, we must delve into Feng Ji's career background and the birth of Black Myth.

The “rebellious” Black Myth drew Tencent to its door

As is widely known, Feng Ji was a former Tencent employee, joining the company in 2008 as the lead planner for DouZhan Shen. DouZhan Shen, a large-scale multiplayer online role-playing game (MMO RPG) based on the novel Journey to the West, boasted impressive graphics and gameplay, garnering significant attention upon release.

Feng Ji's departure was closely related to DouZhan Shen's failure. Although he claimed to have left to pursue the market potential of mobile games, Tencent did not provide much support for DouZhan Shen's promotion, leading to disappointing revenue. Ultimately, the main development team was disbanded, and Tencent resorted to a heavy pay-to-win model to recoup costs, drawing criticism from players.

Because of this, Feng Ji once produced a short film where he flees from DouZhan Shen players to an abandoned factory, only to be found and scolded by them. In the video, Feng Ji appears disheveled, expressing helplessness and coercion under players' questioning.

In 2014, Feng Ji left Tencent to found Game Science, initially focusing on mobile games with a lower barrier to entry to quickly accumulate funds and reputation. However, Feng Ji and his team soon decided to do something different, realizing their aspiration to “only create games that move themselves.” Thus, the unconventional 3A standalone game Black Myth was born, not catering to the domestic market.

In the traditional gaming industry, “3A games” generally refer to those with high investments, top-tier technology, and significant market influence, akin to blockbusters in the film industry. Typically, only Japanese and Western game studios with over a decade of experience dare to tackle 3A games, such as Square Enix, Rockstar Games, Activision Blizzard, and Sony. As for China, the 3A game market remains largely undeveloped.

On August 20, 2020, Black Myth released its first in-game demo trailer, stunning viewers and offering hope for a “domestic 3A standalone game.” However, as development progressed, rumors began to spread that Black Myth had accepted investment from Tencent.

“Won't Black Myth have in-game purchases?” was the immediate reaction of many players upon hearing this news.

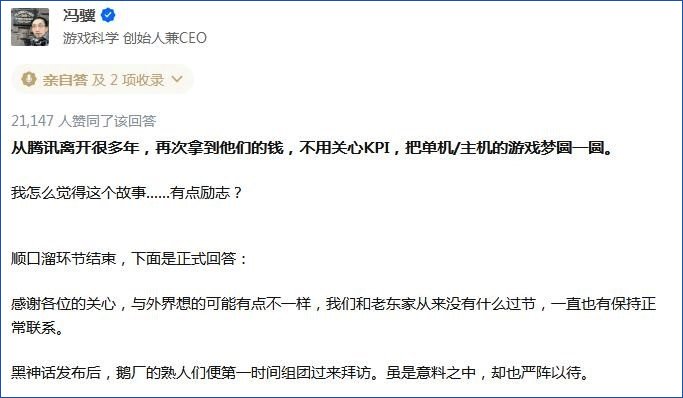

In April 2021, Feng Ji responded to questions about Tencent's investment on Zhihu, stating that Tencent had proactively sought cooperation, promising not to interfere with product decisions, daily company operations, or covet the Black Myth IP. Tencent also pledged not to seek publishing or operating rights, providing only financial and technical support.

Notably, Feng Ji even reminded Tencent's investors, “You should be well aware that even if this game is completed, it won't make much money and may even lose money.” Tencent's response was, “We value long-term potential more.”

“Passion is costly, and the journey is arduous. Finding companions on the path is essential.” Feng Ji ultimately evaluated Tencent's investment in these terms. It turns out that both Game Science and Tencent made the right “bet.”

How much money can Tencent make from Black Myth?

With sales exceeding 10 million copies and a base price of 268 yuan, Black Myth's total sales exceed 2.6 billion yuan. So, how much can Tencent, as an investor, expect to earn? Neither Game Science nor Tencent have disclosed specific figures, but clues can be found through related information.

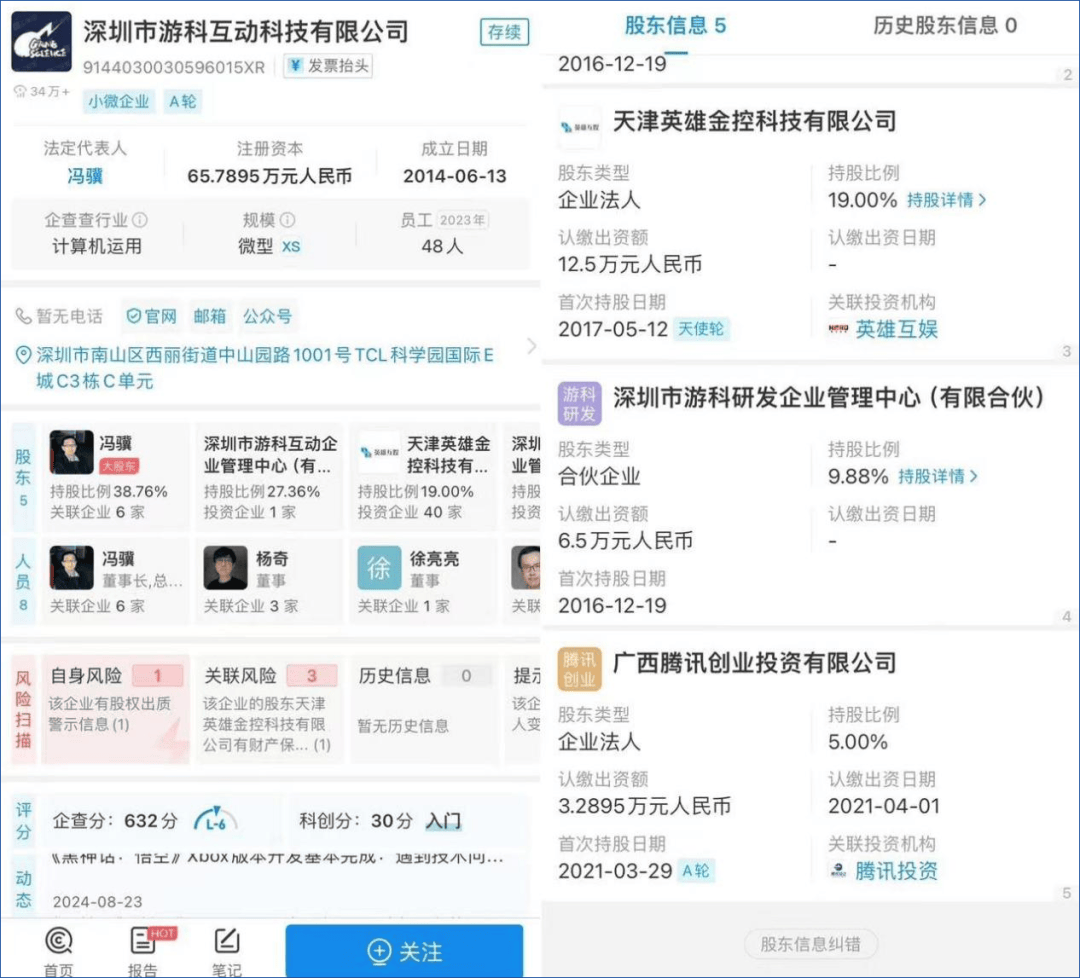

According to Qichacha data, Game Science's operating entity, Shenzhen Youke Interactive Technology Co., Ltd., is majority-owned by Feng Ji with a 38.76% stake. Public records show that in May 2017, Tianjin Yingxiong Jinkong Technology Co., Ltd. (wholly-owned by Yingxiong Technology Co., Ltd.) invested 60 million yuan in Game Science as an angel investor, acquiring a 19% stake.

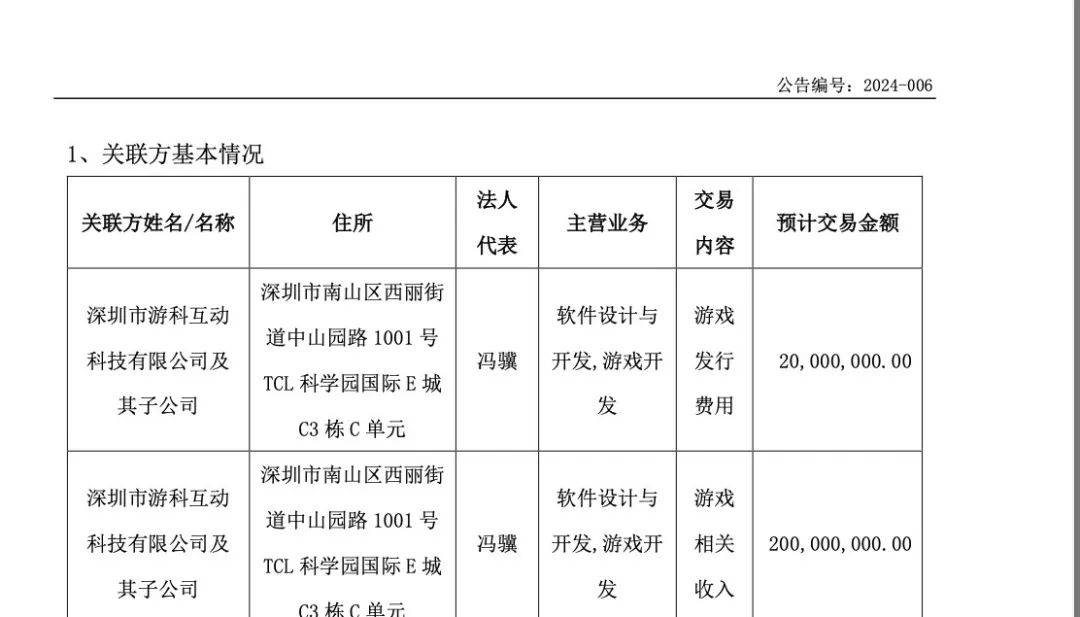

In February of this year, Yingxiong Games Technology Co., Ltd. (hereinafter referred to as “Yingxiong Youke”) announced that it had prepaid 20 million yuan to Shenzhen Youke Interactive for game publishing. Additionally, Yingxiong Youke expects to generate 200 million yuan in game-related revenue from Black Myth. This means that, excluding equity sales revenue, Yingxiong Youke roughly invested 80 million yuan and expects a return of 200 million yuan, resulting in a simple return on investment of 150% at the business level.

Image source :DC Hero Game Technology 2024 Announcement of Annual Routine Related Transactions

On Tencent's side, its subsidiary Guangxi Tencent Venture Capital Co., Ltd. invested in Game Science as an A-round investor in 2021, acquiring a 5% stake. While the equity subscription fee was only 32,895 yuan, this amount is for statistical purposes and does not represent the actual investment.

By comparing Game Science's asset changes before and after receiving Tencent's investment, some estimates have been made: its total assets and net assets increased significantly from 40.4137 million yuan and 15.6192 million yuan at the end of December 2020 to 298 million yuan and 270 million yuan at the end of June 2021, suggesting that Tencent's investment likely exceeded 200 million yuan. Combined with Yingxiong Interactive's investment, the total investment in Black Myth roughly matches this figure.

Based on Yingxiong Youke's disclosure and rough estimates based on equity distribution, Tencent could expect to receive approximately 52.63 million yuan from Black Myth's revenue.

If this amount is accurate, Tencent is effectively shouting for free. However, it's also possible that in February 2024, Yingxiong Youke underestimated the game's popularity.

Even if profitability has not yet been achieved, a 200 million yuan investment is merely a drop in the ocean for Tencent. Based on 2023 data, Tencent's Arena of Valor mobile game generated an average daily revenue of 107 million yuan, topping the mobile game revenue chart with annual revenue of 39.1 billion yuan. From this perspective, Tencent's investment in Black Myth is more about generating buzz than direct profits.

Is Tencent's investment in Black Myth truly motivated by “long-term value,” as the company claims? In what ways does this long-term perspective manifest? By examining Tencent's recent performance, game development, and investment directions, we can roughly analyze why Tencent invested in Black Myth.

Is Black Myth the beginning of Tencent Games' “revenge?”

In the first half of 2024, Tencent's gaming revenue reached 78.822 billion yuan, a 6% year-on-year increase, accounting for 49% of total revenue. The primary sources of income remain Arena of Valor and Game for Peace, with growth coming from overseas mobile games like PUBG MOBILE and Bullet Echo. It is evident that Tencent's gaming business is heavily reliant on mobile games, mostly old IPs, and that highly anticipated titles like Star of Yuanmeng and Taris World have failed to meet expectations.

At Tencent's annual meeting earlier this year, Pony Ma criticized the gaming department, stating, “Gaming is our flagship business, and we claim to be the world's largest gaming company. However, in the past year, we have faced significant challenges as new generation gaming companies have emerged, bringing changes in gameplay and content that have left us at a loss.”

The “new generation gaming companies” referred to by Pony Ma include miHoYo, known for its hit game Genshin Impact. Beyond its anime style, Genshin Impact boasts an open-world ARPG (Action Role-Playing Game) that supports PC, console, and mobile platforms with interconnected data.

According to Sensor Tower data, Genshin Impact generated a total revenue of $4 billion (approximately 28.5 billion yuan) in 2023, with the Chinese server accounting for 34.6% of total earnings, followed by Japan, the United States, and South Korea.

In recent years, cross-platform games have become highly popular, effectively “stitching together” the advantages of standalone and online/mobile games: they offer a game world design and gameplay similar to standalone games, supporting both solo and multiplayer modes, and adopt a free-to-play monetization model through in-game purchases or skins rather than upfront payments. Benefiting from the convenience of cross-platform play and the low barrier to entry of free downloads, these games have rapidly gained popularity both domestically and internationally.

However, Tencent lags behind in this area, with its dual-platform MMO title Taris World, a competitor to World of Warcraft, only set to officially launch in October. Based on previous open beta results, its performance has been less than ideal. To change its overreliance on mobile games and old IPs, Tencent has invested heavily and made diverse attempts in game development in recent years.

In 2022, Tencent increased its investment in Ubisoft, raising its stake to 9.99%, and introduced Tom Clancy's The Division 2 to the domestic market (PC version) the following year. Tencent also holds a 16.25% stake in FromSoftware, the developer of the critically acclaimed standalone 3A game Elden Ring, making it the second-largest shareholder. Additionally, Tencent has invested in companies like Riot Games, Activision Blizzard, and Larian Studios.

According to incomplete statistics, Tencent has invested in nearly 100 overseas games and over 80 companies in the past two decades. Notably, since 2020, there has been a noticeable increase in standalone, PC, and console game investments. Interested readers may refer to the attached table at the end of this article for more details.

Similar to its investments in Epic Games and Game Science, Tencent's approach to investing in foreign game developers is more strategic, avoiding involvement in company management or game production decisions while collaborating as partners to attract core global game developers, share technology, and distribute localized versions.

Besides sharing profits, Tencent can continuously absorb mature game development experience to create its own IPs. For example, Tencent is currently developing Honor of Kings: World, a multi-platform, open-world, 3A-scale game with rich gameplay, aiming to compete with Genshin Impact and somewhat redeem itself.

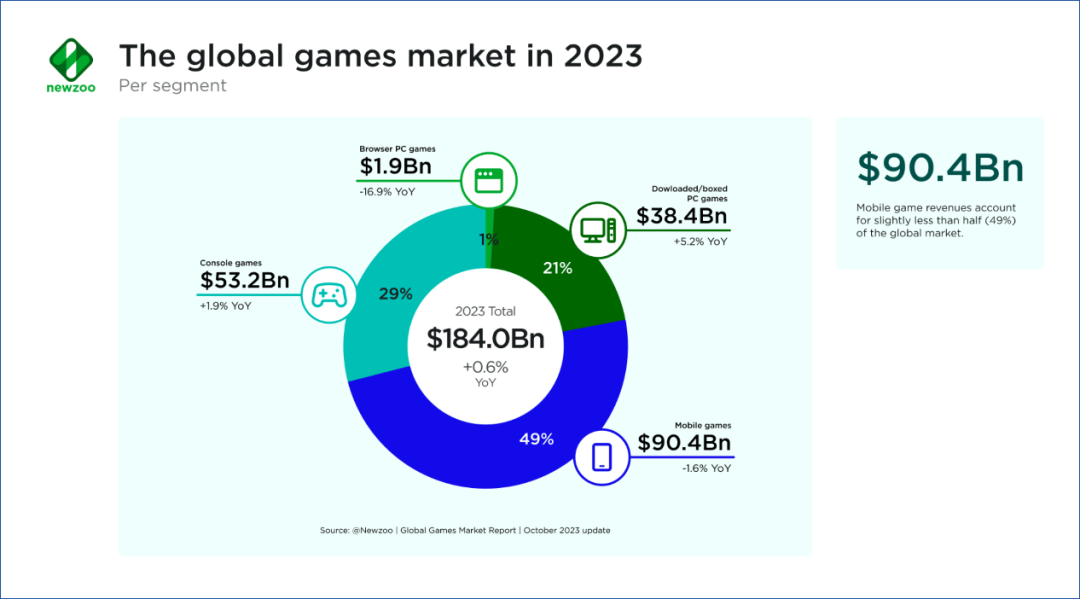

Of course, Tencent's primary revenue will continue to come from mobile games for a long time due to the enormous size of this market. According to Newzoo data, the global games market was worth $184 billion in 2023, with mobile games accounting for $90.4 billion or 49% of the total, nearly equaling the combined revenue of console and PC games. It is precisely due to its dominant position in the mobile games market that Tencent has become the world's largest gaming company.

As for the Chinese 3A games market, it will not undergo a qualitative change solely due to Black Myth. Most small and medium-sized companies still prefer to develop pay-to-win mobile games with low development costs, short development cycles, and higher profitability.

On the positive side, Black Myth has proven its market value and the spending power of Chinese standalone game consumers. Giants like Tencent and NetEase, driven by strategic development considerations, need 3A games to enrich their game portfolios, earn reputation, and enhance global influence. It is expected that they will increase investments, further enriching the overall Chinese gaming market ecosystem.