TikTok's Quest for a 'Baidu' in Search

![]() 08/29 2024

08/29 2024

![]() 524

524

TikTok's search ambitions are on full display! With four consecutive fierce assaults, is it aiming to disrupt the search market? Or is it seeking new avenues due to peaking traffic?

Too deep-rooted an obsession! TikTok still hasn't given up on search and has embarked on a prolonged battle.

According to TechPlanet, following Toutiao Search, Wukong Search, and Lightning Search, TikTok recently launched its fourth independent search app, "TikTok Search," marking its fourth challenge to the search space.

Search – this time-honored internet content product that propped up the giant Baidu. As the content landscape evolves, the new battleground for search shifts to video. TikTok has attempted several times to seize this opportunity for overtaking and grab a slice of the search pie.

But things didn't go as planned. If ByteDance's rise began with TikTok, it's not an exaggeration to say that TikTok's stumbles have stemmed from search, with repeated failures and retries. Search has become a lingering obsession for TikTok.

Media reports indicate that unlike Baidu, Quark, and other services that display content provided by website service providers, "TikTok Search" primarily showcases short videos and graphics created by bloggers.

It seems TikTok intends to recreate a "Baidu" within the realm of video and graphics. The question is, what are the odds of success?

01 Can TikTok Break the Search Mold with Its Fourth Attempt?

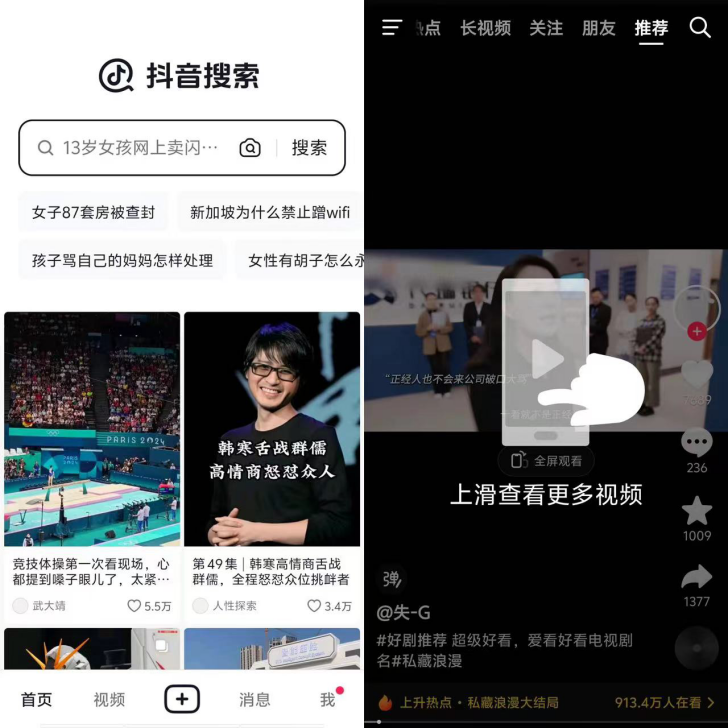

On the Android app store, "TikTok Search" quietly debuted.

From the app's interface, TikTok Search's homepage features a prominent search bar accompanied by recommended content, including graphics and videos. After trying it out, "Xinshang" found that the current TikTok Search app resembles a simplified version of TikTok's built-in search function. Users can log in with their TikTok accounts to access information like friend connections and browse short videos seamlessly, tapping into a video feed. Clicking the "+" button at the bottom allows users to post TikTok videos.

Under the same keywords, the search results presented by both platforms are largely consistent, primarily comprising short videos, graphics, accounts, and products from TikTok Mall.

However, "Xinshang" noticed that search results for local services like "group purchases" are currently unavailable on the TikTok Search app.

This marks ByteDance's fourth foray into the search domain. In August 2019, through official job postings, ByteDance officially disclosed the establishment of a dedicated search team serving multiple apps, including Toutiao, TikTok, Xigua, Huoshan, and Dongchedi.

Soon after, ByteDance launched "Toutiao Search" in 2020, initially differentiating itself from traditional search engines. It emphasized personalized recommendations, leveraging ByteDance's internal content for primary search results and interconnected with TikTok, Xigua, Fanfiction, and other in-house products to facilitate cross-platform traffic. In January 2022, ByteDance introduced Wukong Search, positioned more as a browser, enabling direct web page access while offering similar search results to Toutiao Search.

Last year, TikTok Search emerged as a prototype, joining Toutiao Search and Wukong Search as the "troika" of ByteDance's search offerings. However, the latter two had relatively short lifespans:

In 2023, Toutiao Search was renamed "Youshi," transforming into a community product akin to Xiaohongshu, focusing on food sharing and life experiences. Meanwhile, Wukong Search was renamed "Xiaowukong," repositioning itself as an AI toolset based on large language models, supporting smart conversations and recommendation assistance, eventually abandoning its search focus.

Following these, Lightning Search emerged and vanished swiftly, akin to its namesake. Its model resembled the initial Wukong Search, launching in September 2023 with its last update in December 2023.

Overall, ByteDance's strategic shifts align with evolving user demands for search.

On one hand, user search behavior has migrated to content platforms in recent years, with platforms like Zhihu, Xiaohongshu, and TikTok becoming direct competitors to traditional search engines like Baidu and Sogou. Users prefer rich, diverse content emphasizing authentic sharing. TikTok Search provides personalized recommendations based on users' interests and past behavior, aligning search results with individual profiles and enhancing the user experience through video-based answers.

On the other hand, navigating through a deluge of short video information streams makes finding relevant content more challenging, testing the accuracy and precision of search results. While recommendations aim to "guess what you like," search must "understand your needs." Especially with the support of large models, search has returned to prioritizing quality answers over sheer volume.

This time, ByteDance has entrusted the search mission to its flagship product, TikTok – will there be a new narrative?

02 Peak Traffic Drives the Search for New Avenues

Frankly, "Xinshang" was somewhat disappointed not to encounter any groundbreaking product iterations or upgrades in TikTok Search. This begs the question: why is ByteDance so obsessed with creating a search product?

According to 2023 data from the Giant Engine, TikTok users initiate an average of three search requests per day, with 57% of users performing a search within the first 30 seconds of opening the TikTok app. In TikTok, casual searching has become a natural habit and an untapped goldmine of content.

Amidst a saturated video ecosystem, TikTok's growth demands necessitate continuous expansion. Search becomes a channel to revitalize resources.

An independent search entry point also serves as a fresh traffic gateway. As short video user growth plateaus and traffic dividends wane, a bidirectional content distribution mechanism combining recommendations and search supplements more efficient content dissemination, granting long-tail content greater visibility.

Furthermore, search delves deeply into user needs, aligning with TikTok's unwavering ambition for commercialization.

According to the Giant Engine, "users' active and inspired searches on TikTok initiate the marketing journey." The impact on businesses is tangible; for example, Buick witnessed an 84% increase in daily search traffic within seven days of advertising, with search-to-store conversion and search transaction rates rising by 15% and 20%, respectively. TikTok Search App further expands these opportunities.

Despite harboring a search dream, TikTok faces unchanged challenges in realizing it.

Firstly, user habits are deeply ingrained. Third-party data from Statcounter shows that in June 2024, Baidu led China's mobile search engine market with a 69.09% share, followed by Bing with 13.88% and Sogou with 5.40%. Together, they occupy nearly 90% of the market, making it challenging for new entrants.

Secondly, a more diverse content ecosystem complicates matching queries with answers. Short videos are condensed into tags and keywords, awaiting search triggers. Users demand faster responses and more direct answers, elevating the need for search engines to deliver both broad and precise results that swiftly guide them to their interests.

Moreover, accessing information has become more complex. Even Robin Li admits, "Information and services on mobile internet are fragmented across apps, turning each into an isolated information island." Recent reports indicate that Baidu Encyclopedia has started blocking most search engines like Google and Bing.

In Chinese search, challengers persist. Quark, aspiring to be a "multi-functional search portal," is best known for its cloud storage, with membership services as its primary revenue stream, unrelated to search. Xiaohongshu, centered on "grassroots marketing," emphasizes search's direct conversion efficiency for businesses, hoping to bolster market confidence with a new narrative.

Similarly, TikTok's attempts to "de-search" its search products reflect commercialization bottlenecks. For ByteDance, search seems like an add-on to its product matrix, requiring time for debugging and validation before assuming profitability responsibilities.

03 The Uncertain Outcome of the New vs. Old Battle

The current situation leaves it unclear whether TikTok aims to recreate a "Baidu" in video or directly challenge Baidu.

Indeed, ByteDance and Baidu's rivalry extends beyond search. Despite their respective dominance, neither has relinquished its ambitions, continuously eyeing and competing in each other's territories.

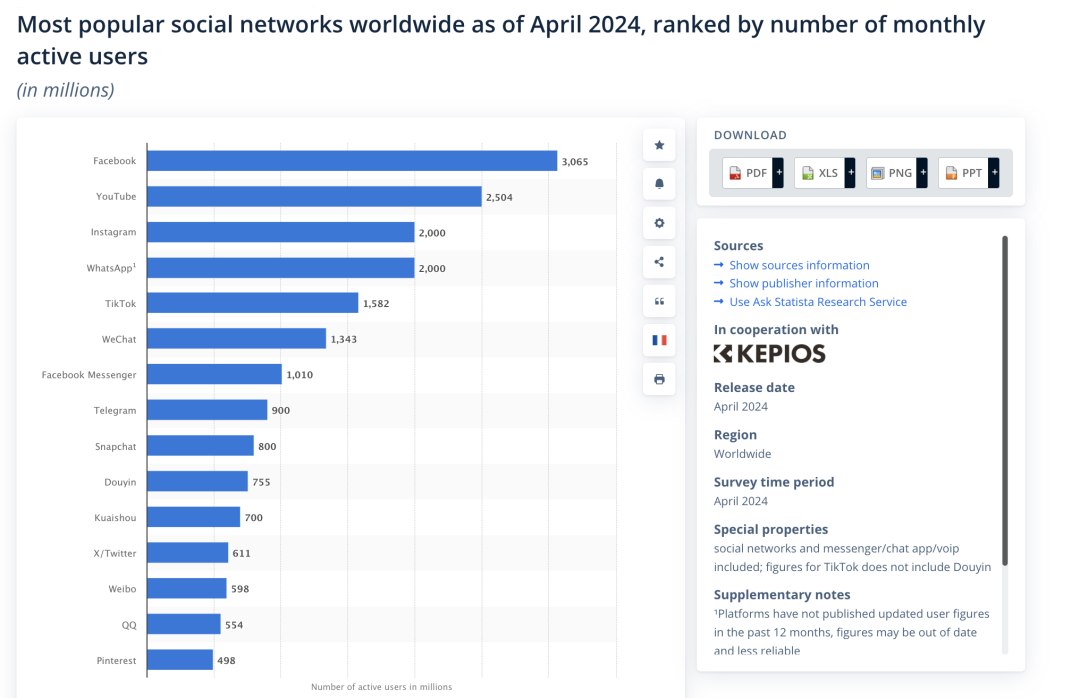

TikTok boasts advantages. According to QuestMobile, by September 2023, TikTok had 743 million monthly active users, up 5.1% year-on-year. TikTok's global counterpart, TikTok (known as Douyin outside China), surpassed 1.582 billion monthly active users by April 2024, ranking fifth among the world's most popular social apps, per Statista.

For comparison, Baidu's Q2 2024 financial report revealed 703 million monthly active users on the Baidu App, up 4% year-on-year. TikTok has surpassed Baidu in user scale.

Today, around a third of mobile internet users spend their time on short video platforms. According to the China Internet Audiovisual Development Research Report (2024), short videos account for 151 minutes of daily usage per capita, out of a total 435 minutes of mobile internet usage. This vast user base emboldens TikTok to confront Baidu.

Notably, the market reacted to this news. TikTok-related stocks surged post-announcement, with companies like Universal Printing, Tianlong Group, and Jiayun Technology soaring. Discussions heated up over whether TikTok could become the new search leader.

However, Baidu, the other protagonist, seems focused on the next level. Baidu's Q2 financial report revealed that approximately 18% of search results are now AI-generated, with plans to continue AI search transformation, positioning search as the primary gateway for intelligent content distribution.

While TikTok holds sway over video traffic, this also constrains its search ambitions. Many search-dependent users lack motivation to cultivate new habits rooted in video and graphics. Moreover, as generative AI evolves, search-targeted content formats may lose competitiveness, with AI application and monetization becoming crucial for sustainability.

Thus, TikTok Search must confront the AI+search test, unavoidably engaging in technological competitions, algorithm upgrades, and ecosystem optimizations. In this realm, TikTok lacks proven success.

TikTok and Baidu's search rivalry highlights the fragmentation of the internet content ecosystem over the years. More strikingly, as internet giants struggle with a lack of new narratives and sluggish growth, they're returning to traditional search battles, reviving a "sunset industry" with fresh strategies to reshape old markets and reclaim their seats at the table.

TikTok's relentless pursuit of search is both a chance for self-validation and a new round of the game – the outcome is eagerly anticipated.