Can young people drive the next stage of the new force?

![]() 08/29 2024

08/29 2024

![]() 491

491

Breaking the price barrier of intelligent driving

Written by Meng Huiyuan

Edited by Li Wenjie

Typeset by Annalee

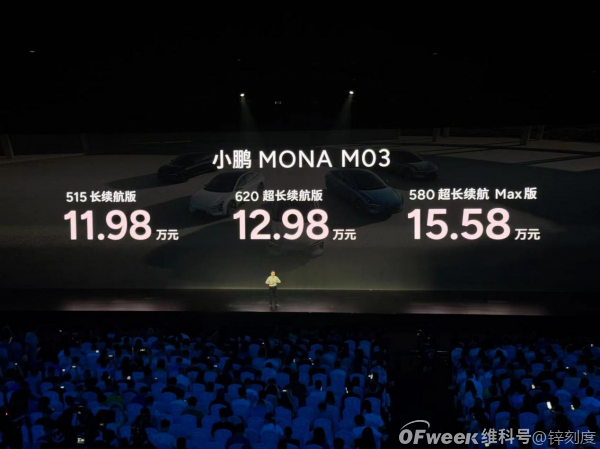

Within 52 minutes of its launch, over 10,000 pre-orders were placed for the Xpeng MONA M03, a testament to the strong purchasing power of young consumers. But looking beyond the numbers, Xpeng has truly pushed the boundaries of pricing for intelligent driving technology. With a highly competitive price range of RMB 119,800 to RMB 155,800, the M03 aims to redefine the market standard for new energy intelligent driving products.

Beforehand, high-level intelligent driving systems were virtually non-existent in vehicles priced below RMB 200,000. However, when a manufacturer pioneers the application of cutting-edge technology in entry-level models, it not only creates a compelling new selling point for new energy vehicles but also drives market share growth for the brand. This trend will also pressure more manufacturers to develop or deepen their self-research into related technologies, making intelligent driving more accessible and affordable to a wider range of consumers through healthy competition.

Catering to Young Consumers' Preferences

The overwhelming response to the Xpeng MONA M03, with over 10,000 pre-orders placed within 52 minutes of its launch, once again underscores the purchasing power of young consumers.

According to the announcement made during the evening of August 27, the Xpeng MONA M03 is positioned as "the first intelligent pure electric hatchback coupe loved by young people," priced between RMB 119,800 and RMB 155,800. It comes in three versions: the entry-level model offers a range of 515km and is priced at RMB 119,800; the mid-range model extends the range to 620km and includes comfort features like seat ventilation and heating, priced RMB 10,000 higher than the entry-level; the top-end Max version boasts a 580km range and advanced intelligent driving assistance, priced at RMB 155,800.

Priced between RMB 119,800 and RMB 155,800

According to a Weibo post by Xpeng CEO He Xiaopeng on August 29, the Xpeng MONA M03 is about to commence large-scale nationwide deliveries. Earlier announcements by Xpeng indicated that deliveries would commence in September, with the M03 Max version following after the 2025 Chinese New Year. The delivery schedule suggests a precise targeting of the intended audience.

On social media platforms, discussions around the M03 are filled with comments like "the cheapest high-end intelligent driving model ever," "at this price point, the MONA M03 is simply unbeatable," "unbeatable value for money," and "despite others' doubts, you've proven yourself." The combination of an affordable price and high-end intelligent driving experience speaks for itself.

Behind this trend lies the fact that young consumers are becoming a significant source of growth in the new energy vehicle market. According to the "2023 China Automotive Consumer Insights" report by Autohome Research Institute, young consumers under 35 years old account for over 40% of potential car buyers, with a year-on-year increase of 8.3% among those aged 26-30. The automotive buying demographic is clearly skewing younger.

In fact, young consumers have already created sales miracles in the new energy vehicle industry, exemplified by Xiaomi SU7, jokingly referred to as "the first Xiaomi for young people." According to the China Passenger Car Association, Xiaomi SU7 sold 13,100 units in July, outpacing the Tesla Model 3 to become the top-selling pure electric sedan priced above RMB 200,000. Reports suggest that Xiaomi expects to maintain this momentum in August, potentially delivering over 100,000 vehicles by November, exceeding its annual target ahead of schedule.

At the same time, the M03, which has shattered the "price barrier" for intelligent driving, targets the underserved lower-tier markets, a promising untapped resource. Lang Xuehong, Deputy Secretary-General of the China Automobile Dealers Association, has noted that while the penetration rate of new energy vehicles in cities above the third tier has reached around 40%, growth has slowed significantly. In contrast, penetration rates in cities below the third tier are still around 20%, leaving ample room for improvement compared to first- and second-tier cities.

Under the combined influence of "young consumers" and "lower-tier markets," the Xpeng MONA M03 is presenting the industry with a new possibility.

"Only Seven Will Remain in the Next Decade"

Of course, the more familiar narrative in the industry is that since Tesla's price cuts in January last year, the domestic new energy vehicle market has been locked in a price war with no end in sight. Manufacturers have resorted to "direct price cuts" or "launching new models" to maintain sales and market share. However, this has led to mixed results reflected in their financial statements.

For the domestic new energy vehicle industry as a whole, data from the National Bureau of Statistics shows that automotive industry revenue from January to June 2024 totaled RMB 4.7672 trillion, up 5% year-on-year. Meanwhile, data indicates that the industry's profit margin has been declining, from 7.8% in 2017 to 5.0% in the first half of 2024.

Cui Dongshu, Secretary-General of the China Passenger Car Association, believes that companies lacking stable cash flow will struggle to sustain growth. He notes that aside from leading players, new energy vehicle manufacturers still face pressure to turn a profit, and selling vehicles at a loss is not a sustainable strategy.

Facing an increasingly competitive market landscape, He Xiaopeng made a bold prediction during the M03 launch event: "In the next ten years, there will only be seven mainstream Chinese automotive brands left. Selling 1 million AI vehicles annually will be the ticket to the finals."

On the other hand, the penetration rate of new energy passenger vehicles continues to rise, from 25.6% in January 2023 to a historic high of 51.1% in July this year, marking the first time it surpassed 50% in a single month. This represents a significant increase of 15 percentage points compared to the same period last year. Notably, despite the traditional off-season and slower production and sales, new energy vehicle sales have continued to grow at a rapid pace.

As the world's automotive factory, China boasts a vast potential consumer base. To survive the upcoming shakeout, new energy vehicle brands must swiftly identify new opportunities.

Marking its tenth anniversary, Xpeng has set its sights on capturing young consumers and announced AI as its "trump card." As He Xiaopeng puts it, "Our goal for the last decade was to build intelligent electric vehicles. For the next decade, I want to perfect AI vehicles."

Meanwhile, NIO, which debuted alongside Xpeng, is set to launch its family-oriented pure electric mid-size SUV, the Ledao L60 (pre-sale price of RMB 219,900), in late September. Notably, during the Ledao launch event, NIO CEO William Li expressed high hopes for the L60, repeatedly comparing it to the acknowledged sales champion among pure electric vehicles, the Tesla Model Y, demonstrating his confidence in the product.

Let alone Lixiang Auto, which unveiled its family-oriented five-seater luxury SUV, the Lixiang L6, back in April. According to Li Xiang, Chairman and CEO of Lixiang Auto, "The Lixiang L6 has continued its strong performance, with monthly deliveries exceeding 20,000 units, making it a hit in the RMB 200,000 to RMB 300,000 price range."

...

Observing the moves made by these new energy vehicle brands this year, it's clear that their success or failure in the second half of the year and beyond, to some extent, hinges on the new models launched based on these new positioning strategies. Only time will tell if these efforts bear fruit.

Driving Technological Innovation: We Are All Contributors

For consumers, the intense price competition and influx of new models ultimately mean access to more intelligent driving services at lower prices.

As mentioned earlier, some consider the M03 the "cheapest high-end intelligent driving model ever." Why has it garnered such praise? One explanation lies in the democratization of technology.

Three years ago, Xpeng mentioned that "the threshold for intelligent vehicles is above RMB 150,000." Creating a RMB 150,000 intelligent driving vehicle is challenging due to balancing functionality and affordability. End-to-end technology alters the iterative and behavioral patterns of intelligence, requiring substantial investment and time.

In the traditional approach, designing an algorithm or model and making changes within a team could yield quick results. However, this often addressed symptoms rather than root causes. In contrast, today's end-to-end systems demand a more comprehensive experience, requiring nationwide coverage and continuous improvement. As He Xiaopeng explains, "End-to-end technology extends the entire chain, and we invest RMB 3.5 billion annually in AI, including computing power and, more importantly, data collection, which takes time and patience."

He Xiaopeng, CEO of Xpeng Motors

He Xiaopeng further elaborates, "In the past, Tier 1 autonomous driving suppliers wrote rules that could be adapted for use in different vehicles with minor modifications. This set a relatively high floor but a low ceiling. In contrast, the end-to-end system offers a higher ceiling but also a lower floor if not executed well. As the end-to-end system matures, it will become increasingly difficult for Tier 1 suppliers to provide rules and methodologies to partners, pushing more manufacturers to develop or deepen their in-house research in this area."

According to the National Information Center, high-end intelligent driving systems are nearly ubiquitous in new energy vehicles priced above RMB 300,000. However, in the 80,000 to 200,000 RMB price range, which accounts for 74% of the domestic passenger car market, the penetration rate of high-end intelligent driving systems is virtually zero.

With the introduction of the M03 Max version, "Powered by pure vision and end-to-end large models, we aim to provide the most intelligent door-to-door assisted driving experience at an affordable price, enabling users to enjoy high-end intelligent driving without breaking the bank," said He Xiaopeng.

Put simply, consumer interest and expectations for intelligent automotive features, autonomous driving assistance systems, and smart connectivity drive technological innovation among related enterprises, contributing significantly to economic growth and social progress in the automotive industry.