BYD: Struggling with Premiumization, Falling from Grace?

![]() 08/29 2024

08/29 2024

![]() 501

501

BYD (002594.SZ) released its third-quarter results for 2024 after the Hong Kong stock market closed on August 28th, Beijing time. Key points are as follows:

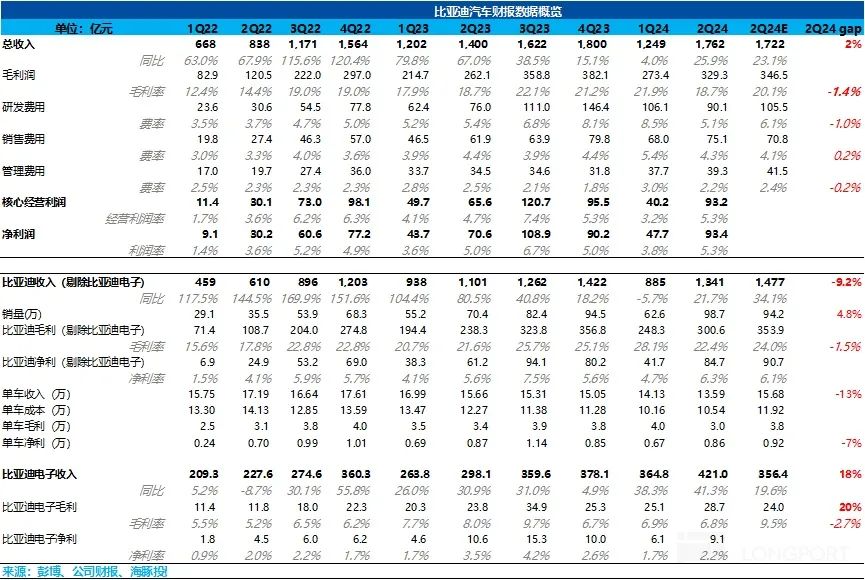

1. The main expectation gap this quarter lies in the average car price: The market had expected the DMI5.0 models to bring about an increase in both volume and price, predicting a continued quarterly rise in average prices. However, in reality, the average price continued to decline by RMB 5,000, resulting in missed market expectations for both automotive business gross margins and revenue.

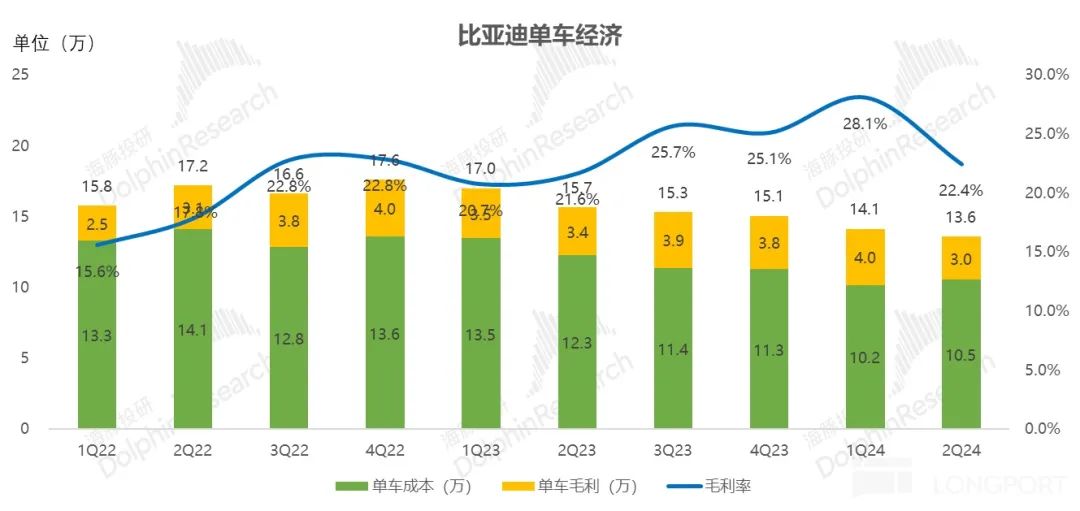

2. Gross margins for automotive operations have declined significantly, and the former gross margin champion appears to be falling from grace: This quarter, the automotive gross margin dropped from 28% in Q1 to just 22.4% in Q3. Excluding the battery business, the actual gross margin for vehicle manufacturing has fallen below 20%, indicating that the former gross margin leader is starting to become mediocre.

3. The rising depreciation per vehicle has hindered the release of gross profits: Despite a 68% increase in sales quarter-on-quarter, releasing economies of scale, and an increase in the proportion of low-priced models, which should have led to lower manufacturing costs, the cost per vehicle has continued to rise. Dolphin believes this may be due to the continued increase in depreciation per vehicle.

The depreciation per vehicle (automotive and battery businesses only) has risen from approximately RMB 13,000 in 2023 to RMB 18,000 in the first half of 2024. This may be due to BYD continuing to accelerate depreciation of fixed assets, which could also hinder the release of gross margins for the remainder of the year.

4. However, due to controlled expenses, net profit per vehicle has risen quarter-on-quarter: Although automotive gross margins declined significantly this quarter, due to controlled expenses, particularly in R&D, combined with the release of economies of scale on the sales side, net profit per vehicle rebounded to RMB 8,600, which is broadly in line with market expectations of RMB 8,500-9,000.

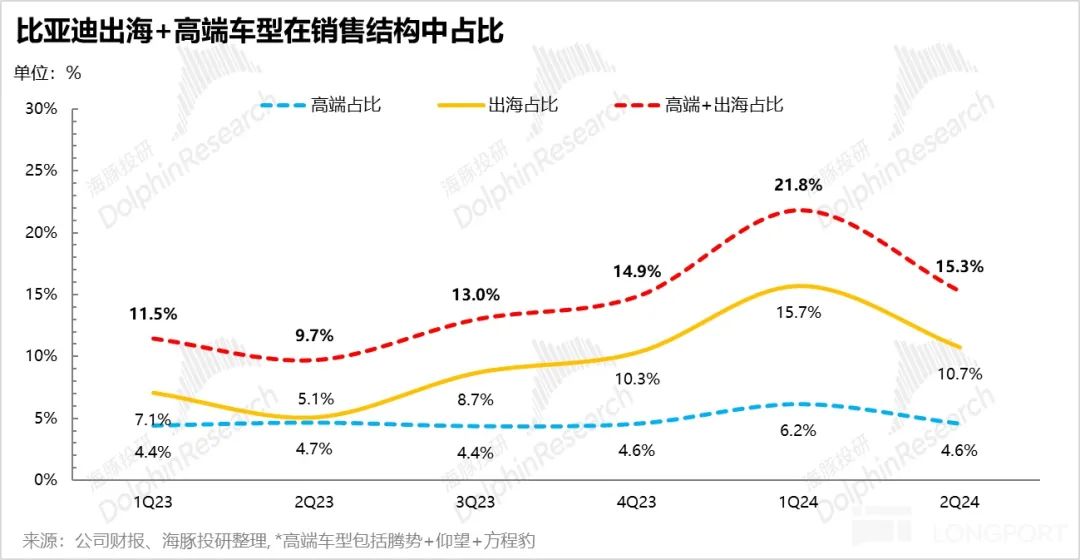

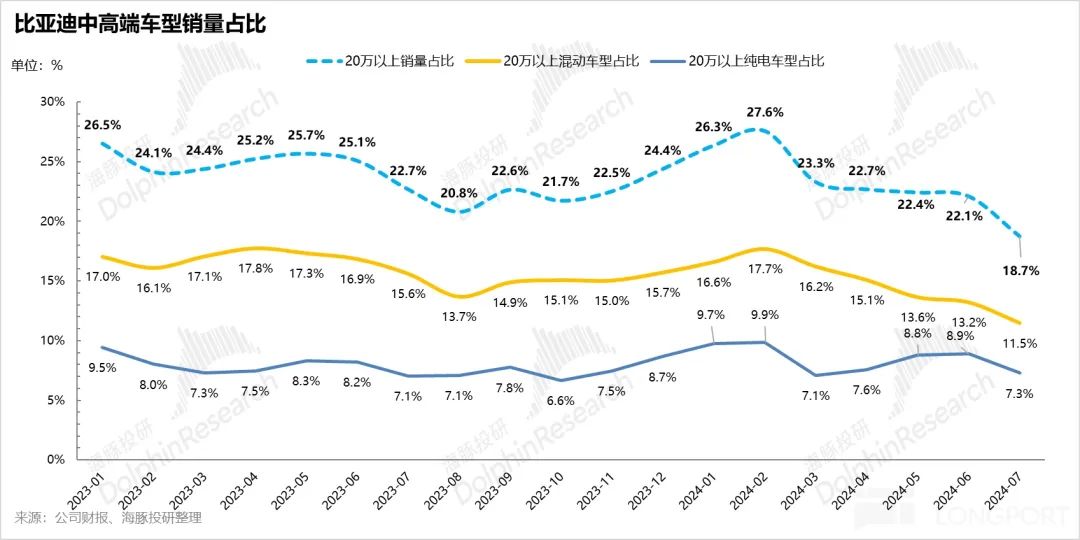

5. Both overseas expansion and premiumization performed weakly this quarter: The weak performance in premiumization is due, in part, to product launch timing, but also to increased competition, with the hybrid mid-to-high-end market share being captured by Wenjie and Huawei. The slowdown in overseas expansion is expected to accelerate in the second half of the year.

Dolphin's Overall View:

Amidst the automotive price war, even BYD, the cost control champion, has seen a significant decline in gross margins this quarter, missing market expectations for both automotive revenue and gross margins. The core reason behind this expectation gap lies in the average car price.

BYD's average car price in Q2 (including a rough estimate for the battery business) was just RMB 136,000, continuing a quarterly decline of RMB 5,000 from Q1. The market had a completely misguided expectation, predicting that the average price would rebound to RMB 157,000 this quarter, likely based on the misconception that the launch of the DMI 5.0 version would lead to both volume and price increases.

However, this decline in average price was entirely within Dolphin's expectations. From Dolphin's analysis of BYD's sales structure, several key changes were observed:

1) The proportion of premium models (Tengshi + Yangwang + Fangchengbao) and overseas sales has declined, with a significant drop in the proportion of overseas sales from 21.8% in Q1 to 15.3% in Q2, primarily due to a 5% decrease in overseas sales to 10.7% of total sales.

2) BYD is gradually losing its mid-to-high-end market share: While BYD has struggled to break into the pure electric premium segment, it has performed well in plug-in hybrid premiumization. However, this quarter, plug-in hybrids in the mid-to-high-end segment have shown significant weakness, leading to a decline in overall mid-to-high-end model sales and market share.

Both mid-range plug-in hybrids (Tang DMI+ Han DMI) and premium models (Tengshi + Yangwang + Fangchengbao) have seen a decline in market share.

The reasons behind this include both product launch timing and increased competition, with the mid-to-high-end hybrid market gradually becoming dominated by Wenjie and Lixiang, capturing BYD's share. Judging from BYD's current actions (price cuts + cooperation with Huawei's intelligent driving), BYD is eager to break this deadlock.

However, premiumization is not something that can be achieved overnight, especially for models priced above RMB 300,000, which have higher requirements for intelligence, brand power, and channel marketing. Dolphin believes that the main drivers for BYD's ASP and gross margin increases in the second half of the year may still come from switching to DMI5.0 models (priced higher than the Glory Edition) within the basic sales volume (mid-to-low-priced models) and an increase in overseas sales proportions.

Fortunately, despite the loss of gross margins this quarter, profit margins have still improved, primarily due to BYD's controlled expenses and the release of operating leverage from increased sales, with net profit per vehicle rebounding to RMB 8,600. Dolphin notes that major banks' expectations are also within the range of RMB 8,500-9,000, which is broadly in line with actual results.

PS: BYD is a company with a complex business structure, encompassing automobiles, mobile phone components and assembly, secondary batteries, and photovoltaics. However, Dolphin's in-depth articles on BYD from last July, "BYD: The Best Battery Maker Among Automakers" and "BYD: Steady Growth After Surging Prices," have helped identify the core of the company. While BYD has many diverse businesses, the automotive business remains the focus. To understand the company better, you can refer back to these two analyses.

Detailed Analysis

I. Both Automotive Gross Margin and Revenue Miss Market Expectations, Primarily Due to a Decline in Average Price

1. Gross margins for automotive operations (including the battery business) declined significantly this quarter!

BYD's automotive gross margin (excluding BYD Electronics) reached 22.4% in Q2, a near 6% quarter-on-quarter decline, falling short of market expectations of 24%. Dolphin's previous analysis in "Can the Price Slayer Still Make Big Profits? How Does BYD Compete with the Best?" estimated that self-produced batteries contribute approximately 3%-4% to gross margins. However, BYD's actual automotive gross margin may have fallen below 20% this quarter.

The primary reason for this expectation gap lies in the significant decline in average prices. The market had a completely misguided directional expectation, believing that the DMI 5.0 models would lead to both volume and price increases. However, Dolphin had anticipated this decline in average prices. Specifically:

1) Average Vehicle Price: The average car price in Q2 was RMB 136,000 (including a rough estimate for the battery business), continuing a quarterly decline of RMB 5,000, primarily due to:

a) A decline in the proportion of premium models (Tengshi + Yangwang + Fangchengbao) and overseas sales: Premium models and overseas sales typically command higher ASPs per vehicle. However, this quarter, the proportion of premium models and overseas sales declined from 21.8% in Q1 to 15.3% in Q2, with a significant drop in overseas sales from 21.8% to 10.7%.

b) BYD is gradually losing its mid-to-high-end market share: While BYD has struggled to break into the pure electric premium segment, it has performed well in plug-in hybrid premiumization. However, this quarter, plug-in hybrids in the mid-to-high-end segment have shown significant weakness, leading to a decline in both sales structure proportions and market share for overall mid-to-high-end models.

Both mid-range plug-in hybrids (Tang DMI+ Han DMI) and premium models (Tengshi + Yangwang + Fangchengbao) have seen a decline in market share.

(Detailed analysis will follow)

c) The launch of Glory Edition models starting in February, with prices further reduced compared to the Champion Edition, fully impacting Q2 results: The launch of BYD's Glory Edition models saw price reductions of RMB 10,000-30,000 compared to the 2023 Champion Edition, lowering the main price range of BYD's plug-in hybrids from RMB 100,000-200,000 to RMB 80,000-150,000.

As a result of these price reductions, the most popular plug-in hybrid models, the Qin Plus DM-i and the Destroyer 05 Glory Edition, priced at just RMB 79,800-125,800, increased their proportion in the model mix by 5.5% in Q2, further dragging down ASP per vehicle.

d) The market had anticipated that the launch of DMI 5.0 models would lead to both volume and price increases, with market expectations for average revenue per vehicle rising to RMB 157,000 quarter-on-quarter. However, only the Qin L DM-i and Sea Lion 06 models were launched under the DMI5.0 lineup this quarter. Due to lower-than-expected pricing (RMB 99,800-139,800) and sales ramp-up, these models only increased their proportion in the model mix by 4.1% in Q2. The full impact of DMI 5.0 models is expected to be felt starting in the second half of the year.

2) Cost per Vehicle: The depreciation per vehicle has instead risen.

The cost per vehicle in Q2 was RMB 105,000, a quarterly increase of RMB 4,000. Despite a 68% increase in sales quarter-on-quarter, releasing economies of scale, and a higher proportion of low-priced models that should have led to lower manufacturing costs, costs per vehicle continued to rise.

Dolphin believes that the primary reason for this increase in costs per vehicle lies in the continued rise in depreciation per vehicle. Depreciation per vehicle (automotive and battery businesses only) has risen from approximately RMB 13,000 in 2023 to RMB 18,000 in the first half of 2024, likely due to BYD continuing to accelerate depreciation of fixed assets.

3) Gross Profit per Vehicle: With average vehicle prices declining by RMB 5,000 quarter-on-quarter and costs per vehicle rising by RMB 4,000, BYD's gross profit per vehicle was just RMB 30,000 in Q2, resulting in an overall automotive gross margin (including the battery business) of 22.4%, down from 28.1% in the previous quarter.

2. BYD is gradually losing its mid-to-high-end market share

While BYD has struggled to break into the pure electric premium segment, it has performed well in plug-in hybrid premiumization. However, this quarter, plug-in hybrids in the mid-to-high-end segment have shown significant weakness, leading to a decline in both sales structure proportions and market share for overall mid-to-high-end models.

Specifically, the proportion of sales for models priced above RMB 200,000 continued to climb in the second half of 2023 but peaked in February and then rapidly declined from 27.6% to just 18.7% in July this year.

The market share of mid-to-high-end models also declined from 8.4% in February 2024 to 6.7% in July 2024, primarily due to the weakness in BYD's mid-to-high-end plug-in hybrids.

1) Plug-in Hybrids: BYD's sales proportions and market share of mid-to-high-end plug-in hybrids have declined significantly

Dolphin's analysis of BYD's market share shows that while BYD's overall plug-in hybrid market share has rebounded, it has been driven by low-priced models. BYD's mid-to-high-end plug-in hybrids priced above RMB 200,000 have seen a rapid decline in both sales structure proportions and market share.

Specifically, both mid-range plug-in hybrids (Tang DMI+ Han DMI) and premium models (Tengshi + Yangwang + Fangchengbao) have seen a decline in market share and sales structure proportions.

(In terms of specific models: BYD's plug-in hybrids priced above RMB 200,000, particularly the Tang DMI+ Han DMI, have been impacted by competition from Huawei and Wenjie's extended-range models this year. In the RMB 200,000-300,000 segment, sales rankings for plug-in hybrids have shifted from being dominated by BYD to being captured by Lixiang L6 and Wenjie M7, with monthly sales of the Tang DMI and Han DMI falling from peaks of 17,000-18,000 units to just around 10,000 units in July.

BYD's premium models (Tengshi + Yangwang + Fangchengbao) are also primarily plug-in hybrids, but sales of the Tengshi D9 DMI have struggled to break 10,000 units this year, while sales of the Yangwang U8 have fallen from a peak of nearly 1,700 units to less than 500 units in July. Sales of the Fangchengbao 5 have also fallen to less than 2,000 units.)

The primary reasons behind this decline include both product launch timing and increased competition. The mid-to-high-end plug-in hybrid market has gradually become dominated by Wenjie and Lixiang, capturing BYD's share. Judging from BYD's current adjustments to its mid-to-high-end plug-in hybrids, it is eager to break this deadlock:

1. Price cuts: BYD has reduced the price of its Fangchengbao 5 by RMB 50,000, directly competing with the Tank 300 Hi4-T. The newly launched Seal 07 based on DMI 5.0 has seen price reductions of 7%-11% compared to the previous model, falling below market expectations.

2. Attempting cooperation with Huawei to address shortcomings in intelligence: BYD's upcoming mid-to-large SUV, the Leopard 8, will cooperate with Huawei on intelligent driving, expected to be equipped with Huawei's Kunpeng Intelligent Driving ADS 3.0, addressing intelligence shortcomings.

2) Pure Electric Vehicles: BYD's mid-to-high-end pure electric market share is relatively stable, but it struggles to produce blockbusters

BYD has struggled to create a popular pure electric vehicle model, with the share/market share of pure electric vehicles priced above 200,000 yuan falling back to around 7.3%/4.8% in July, although the market share is relatively stable compared to plug-in hybrids.

BYD's adjustments to mid-to-high-end pure electric vehicles include:

1. Further upgrades to the 800V platform and intelligent driving capabilities of new vehicles: BYD's August launch of the Dolphin EV, equipped with the newly upgraded E-platform 3.0 Evo (12-in-1 intelligent electric drive), 800V fast charging, and LiDAR for intelligent driving, with the upgraded DPilot 300 chip.

2. The E4.0 pure electric platform is scheduled to be released in the fourth quarter, and specific information about the platform may need to be obtained from performance meetings.

However, Dolphin Insights is cautiously optimistic about BYD's premiumization efforts (Tengshi, AWEX, and Fangchengbao) due to several factors: high pricing of upcoming models in the second half of the year (most above 300,000 yuan, except for Bao 3, which targets a niche market), and the demands of premiumization, including intelligence, brand strength, and channel marketing, which BYD may struggle to meet in the short term.

Furthermore, the premium pure electric vehicle segment has struggled to produce blockbusters (only NIO has stabilized above the 300,000 yuan mark). With a higher proportion of pure electric vehicles among BYD's premium launches in the second half of the year, Dolphin Insights expects ASP growth in the second half to come primarily from the shift to DMI5.0 models (priced higher than the Honor Edition) and increased overseas sales.

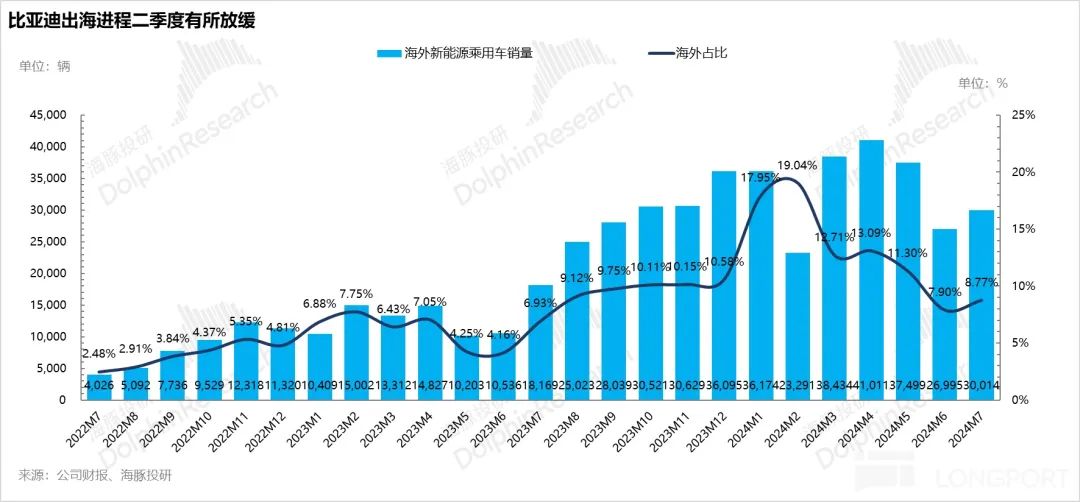

3. The pace of overseas expansion slowed in the second quarter but is expected to accelerate in the second half of the year.

BYD's two main avenues for improving gross margins are premiumization and overseas expansion. While premiumization showed weakness in the current quarter, overseas expansion also slowed.

In the second quarter, BYD sold 105,000 overseas units, a slight increase from 98,000 in the first quarter, but the overseas sales ratio declined significantly from 15.7% to 10.7%. BYD's share of new energy vehicle exports also declined from 21.2% to 19% in the second quarter.

The slowdown in overseas expansion can be partially attributed to seasonal fluctuations and EU tariff policies, but may also be related to BYD's own pacing strategy.

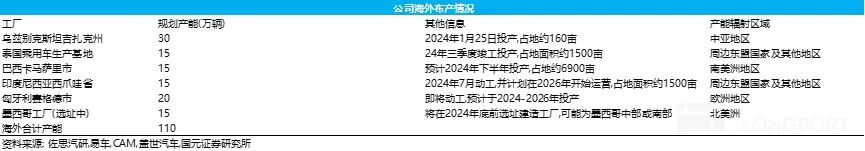

Looking ahead to the second half of 2024, BYD's overseas production capacity is expected to kick in, with a total overseas production capacity of 350,000 vehicles projected for the year.

(Production began in Uzbekistan in June (Song Plus DM-I and Destroyer 05), Thailand in July (Dolphin, Sea Lion, and Yuan Plus), and Brazil in the second half of the year (150,000 capacity).)

With the peak season approaching and new production capacity coming online, BYD expects to accelerate overseas expansion in the second half of the year, achieving its full-year export target of 500,000 vehicles. BYD aims to export 500,000 vehicles this year and 1 million in 2025, contributing to sales targets and gross margin improvements.

Regarding the impact of EU tariffs on BYD, Dolphin Insights believes:

The additional EU tariffs on BYD have been slightly reduced to 17%, better than market expectations of 20%-30%, and the EU currently accounts for only 15% of BYD's overseas sales, making the impact manageable.

Moreover, the tariffs only apply to pure electric and extended-range vehicles, not plug-in hybrids. BYD can temporarily increase its exports of DMI models to Europe, leveraging their cost-effectiveness and range anxiety-free driving to capture market share from local HEVs (26% of the European market, dominated by Japanese brands). Long-term, BYD plans to rely on localized production (Hungary plant scheduled to start production in October 2025).

4. Revenue fell short of expectations due to lower unit prices.

Excluding BYD Electronics, BYD's revenue in the second quarter of 2024 was 134.1 billion yuan, significantly lower than market expectations of 147.7 billion yuan, primarily due to lower unit prices.

However, the quarter also had several bright spots:

5. Stable sales performance, with the launch of Honor Edition and DMI5.0 models driving market share recovery.

BYD sold 990,000 vehicles in the second quarter, up 58% quarter-on-quarter, driven by the launch of the Honor Edition in mid-February and DMI5.0 models in May. BYD's plug-in hybrid sales were mainly concentrated in the 80,000-150,000 yuan price range.

BYD's strategy in this price range involves leveraging its DMI technology to compete on range and fuel economy, and later using economies of scale to maintain market share through lower prices as technological advantages diminish.

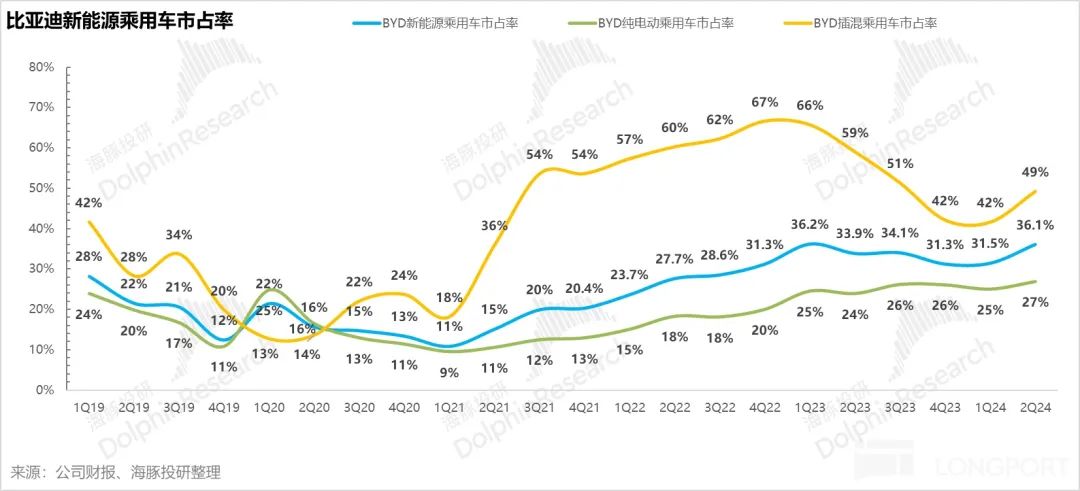

Dolphin Insights expects BYD to use its DM 5.0 technology and lower prices (Honor Edition) to accelerate the phase-out of gasoline-powered vehicles and regain market share lost in 2023. BYD's market share recovered from 31.5% in the first quarter to 36.1% in the second quarter, primarily driven by an increase in plug-in hybrid market share from 42% to 49%.

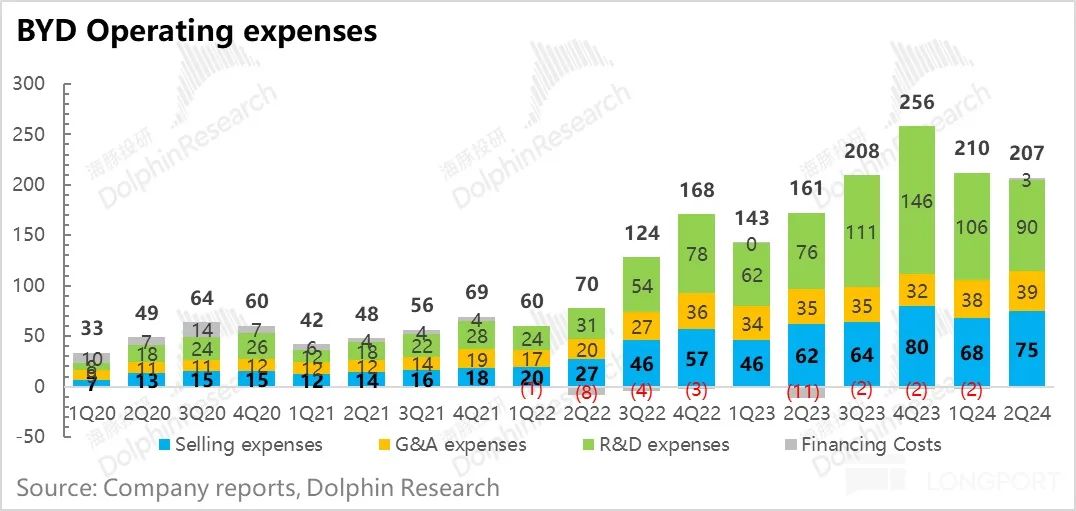

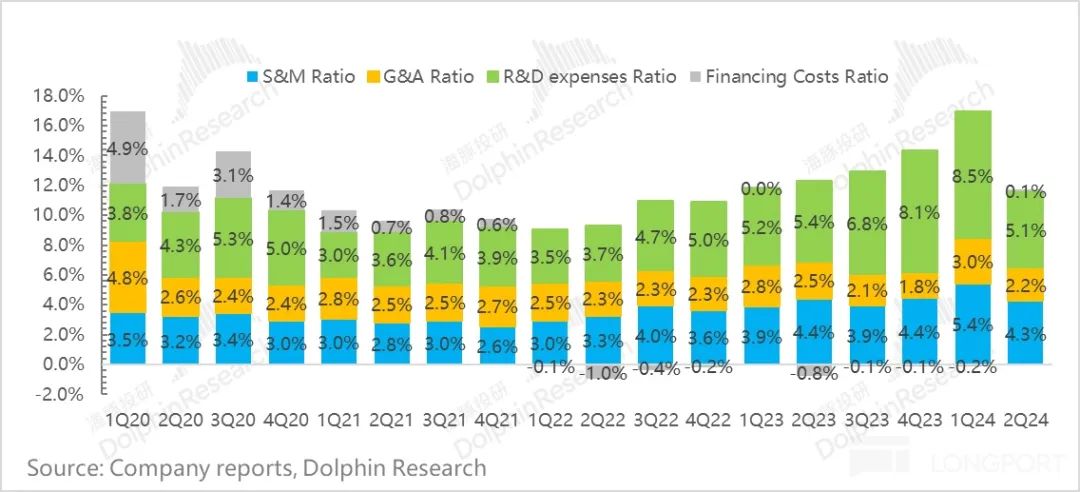

6. Restrained spending on R&D, marketing, and administration, leading to improved profitability.

1) R&D expenses: focused on intelligence and the upcoming E4.0 electric platform. BYD's R&D expenses were 9 billion yuan in the second quarter, significantly lower than market expectations of 10.6 billion yuan, indicating restrained spending. BYD's R&D is focused on intelligence and the E4.0 platform, as evidenced by its efforts to improve intelligence in mid-to-high-end models through collaborations and technology upgrades.

2) Marketing expenses: primarily for the launch of premium brands and Honor Edition/DMI5.0 models. Marketing expenses were 7.5 billion yuan, up 700 million yuan quarter-on-quarter and above market expectations of 7.1 billion yuan. BYD invested in marketing for the launch of Honor Edition and DMI5.0 models, as well as expanding channels for its premium brands (Tengshi, AWEX, and Fangchengbao).

3) Administrative expenses: lower than market expectations at 3.9 billion yuan, up 160 million yuan from the previous quarter but below market expectations of 4.15 billion yuan, indicating reasonable control.

7. Net profit per vehicle improved. The core operating profit margin was 5.3%, up 2.1 percentage points from the previous quarter. Despite a decline in gross margin, restrained spending on R&D, marketing, and administration led to a 5 percentage point decrease in operating expenses as a percentage of revenue. Other income increased by 1.2 billion yuan quarter-on-quarter (likely government subsidies), contributing to a net profit per vehicle (including battery business) of 8,600 yuan, in line with market expectations of 8,500-9,000 yuan.

II. Accelerating growth in the energy business.

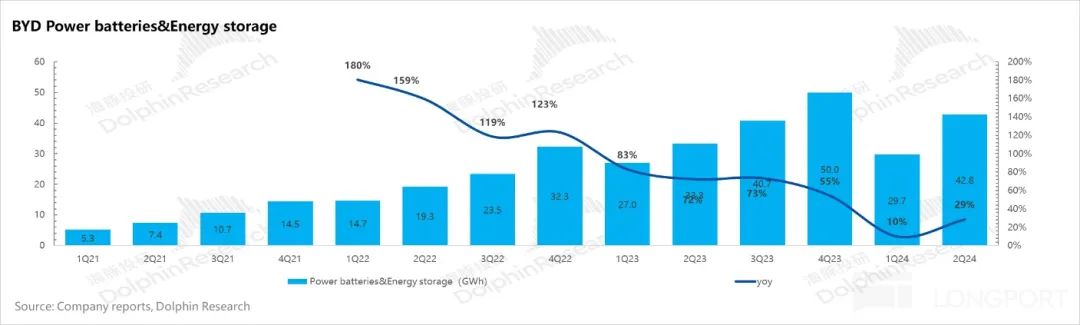

BYD's installed battery and energy storage capacity (including both internal and external supplies) reached 42.8 GWh in the second quarter, up 44% quarter-on-quarter, indicating accelerating growth in the energy business.

The growth was primarily driven by the battery business, with shipments of 32 GWh, up 28% quarter-on-quarter, fueled by improved sales and an increase in domestic market share. However, energy storage shipments declined 3.6 GWh quarter-on-quarter.

III. Strong performance in BYD Electronics' business.

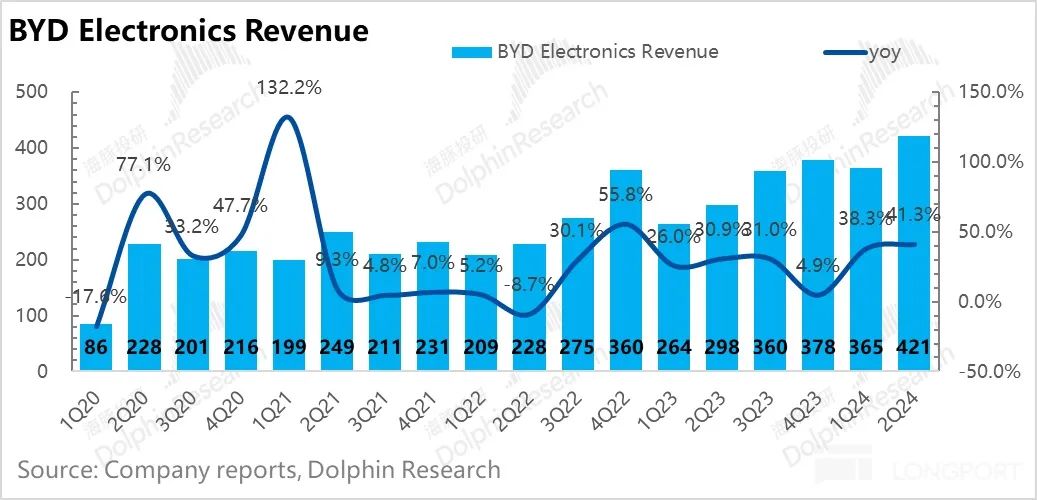

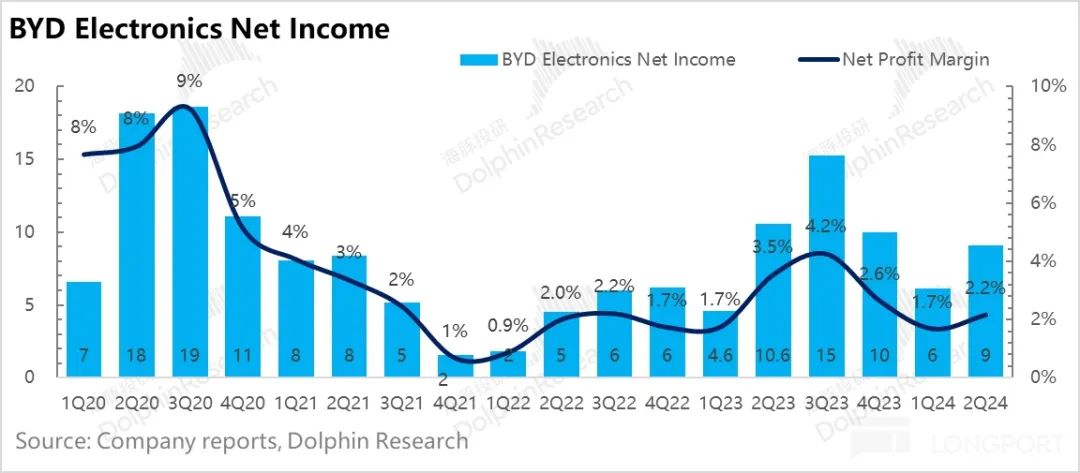

BYD Electronics' mobile phone components and assembly business generated revenue of 42.1 billion yuan in the second quarter, significantly exceeding market expectations of 35.6 billion yuan and contributing to overall revenue exceeding expectations. Gross margin was 6.8%, similar to the previous quarter.

1) Consumer electronics: 1H24 revenue was 63.3 billion yuan, up 54% year-on-year, driven by a 205.8% increase in component revenue to 15.25 billion yuan. According to IDC, global smartphone shipments grew 6.5% year-on-year in 2Q24, and BYD benefited from increased demand and product diversification by major overseas customers.

2) Automotive business: 1H24 revenue was 7.76 billion yuan, up 26.5% year-on-year, driven by growth in BYD's new energy vehicle sales and shipments of intelligent cockpit, ADAS, and thermal management products.