ToB Or ToC, large models don't have to 'choose'

![]() 08/30 2024

08/30 2024

![]() 607

607

Source | bohuFN

On the path to commercializing AI large models, the choice between 'ToB or ToC' has always been a dilemma. However, there is a consensus in the AI industry that startups tend to find more opportunities on the consumer side (ToC), while internet giants can gain scale advantages through the business-to-business (ToB) market.

But currently, this consensus may be breaking down. Dark Side of the Moon, often regarded as a 'ToC advocate', recently announced the launch of enterprise-grade APIs, and Kimi's Open Platform will reduce context cache storage costs by 50%, accelerating its push into the ToB market.

Similarly, OpenAI, the pioneer of large models, also recently announced that enterprises would be allowed to customize its flagship AI model GPT-4o using their own data, meaning enterprises can tailor and optimize AI models for enhanced performance.

As the industry moves from the 'Hundred Models War' to the 'Application Battle', large models have reached a critical juncture in commercialization. It's no longer just about product differentiation but also a comprehensive consideration of costs, applications, monetization, and more. Each company is seeking its unique answer, where 'ToB or ToC' might not be a choice but a necessity.

01 Monetization: The Stumbling Block for ToC Large Models

Even before Kimi's push into the ToB market, it had briefly tested a tipping model on the consumer side in May, allowing users to purchase gifts ranging from RMB 5.20 to RMB 399 for priority access during peak hours.

Regarding the tipping feature, Dark Side of the Moon stated it was still in the testing phase and remained open to exploring different commercial models.

From this perspective, Kimi's tipping model seemed more like a probe into users' willingness to pay rather than a profit-driven endeavor. After all, Kimi's user base primarily consists of young individuals transitioned from platforms like Douyin and Bilibili, making it essential for the company to gauge their attitudes.

However, this doesn't mean Kimi plans to rely solely on passion. Large model startups burn through capital at an alarming rate. Firstly, reaching the consumer market necessitates significant marketing expenses.

Since the Spring Festival this year, large model companies have engaged in intense marketing battles, often utilizing CPA (Cost Per Action) models where companies pay for ads upon user registration or app downloads.

Platforms like Bilibili and Douyin, popular among younger audiences, have become the primary targets for advertising. However, the competitive bidding process has inadvertently driven up ad costs. Industry insiders report that while Bilibili's CPA cost was generally below RMB 10 per user at the beginning of 2023, Kimi's current CPA cost on the platform may have reached RMB 30.

According to Sina Tech's estimates, Kimi has invested over RMB 30 million in advertising since February this year. While the campaign significantly increased traffic by over four times, the high marketing costs ultimately burned investors' money.

Secondly, there are training costs. OpenAI initially planned to spend approximately USD 800 million on training costs this year, but as it accelerates the training of its latest flagship models, these costs could double.

Dario, CEO of OpenAI's top competitor Anthropic, also stated that the AI model his company is developing currently incurs training costs of up to USD 1 billion, with projections reaching USD 10 billion or even USD 100 billion by 2027.

Lastly, there are computing costs. These costs escalate as user bases grow. Guosheng Securities estimates that creating a ChatGPT-equivalent large model would require an investment of RMB 1 billion, assuming a single A100 chip costs RMB 100,000.

As costs continue to soar, the 'AI Five Dragons' who have secured recent funding rounds may not be short on cash, but they cannot indefinitely neglect commercial monetization, let alone other large model companies without substantial reserves.

Monetizing the consumer market, however, is no easy feat. For one, most general-purpose large models like Wenxin Yiyan and ChatGPT are free, and cultivating a paid user habit will take time. Homogeneous AI applications are far from being a rigid demand.

Secondly, revenue models in the consumer market are relatively limited for large models. Beyond subscription fees, other monetization strategies face challenges. For instance, relying on advertising could compromise user experience and raise privacy concerns. WPS Office's previous attempt to charge for AI features drew backlash due to its 'nested subscription' model.

Thirdly, consumer recognition of products is heavily brand-driven, explaining why Dark Side of the Moon invests heavily in advertising. In this context, if Alibaba or Tencent heavily promote a particular AI application, other startups may struggle to compete.

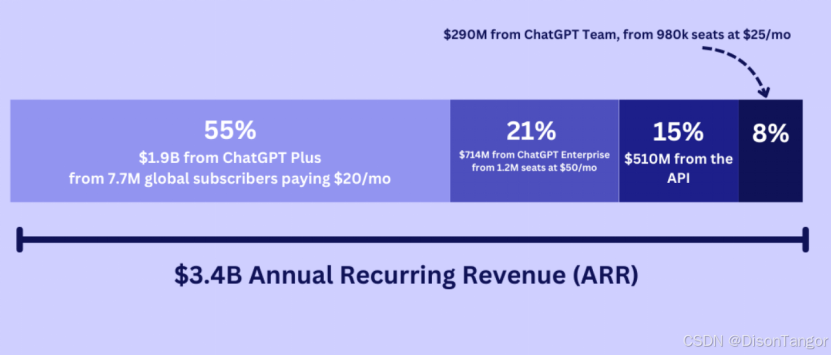

Even for OpenAI, which has generated USD 1.9 billion in revenue from the consumer market, primarily from 7.7 million subscribers paying USD 20 per month for ChatGPT Plus, this still falls short of covering model development and operational costs.

Citing unpublished internal financial data, foreign media reported that OpenAI faces up to USD 5 billion in losses this year. With estimated annual revenues between USD 3.5 billion and USD 4.5 billion, operating costs could reach USD 8.5 billion, including USD 4 billion in inference costs alone.

OpenAI's offer of a free version of ChatGPT to consumers has increased inference costs without generating additional revenue, contributing to its financial strain.

02 Betting on the Future: Is the End of ToC the Beginning of ToB?

In essence, for large models to thrive in the consumer market, they must demonstrate comprehensive capabilities and user-friendly experiences, leveraging low-cost or free access to attract users. This model necessitates continuous investment, prompting top large model players to turn their attention to the ToB market.

Taking Baidu as an example, its Q2 2024 financial report revealed that its intelligent cloud business generated RMB 5.1 billion in revenue, a 14% year-over-year increase, and continued profitability. AI's contribution to revenue climbed from 6.9% in the previous quarter to 9%.

However, Baidu's 2023 annual report shows that while its restructured advertising system based on the Wenxin large model generated hundreds of millions in incremental revenue, online marketing revenue still declined compared to the previous quarters, indicating that large models' consumer market activity and monetization rates fell short of expectations.

Opinions diverge on whether large models should focus on ToB or ToC. Wang Xiaochuan, CEO of Baichuan AI, explicitly stated that the ToC market is ten times larger than the ToB market, and major players will compete in ToB, but Baichuan AI aims for differentiation.

On the other hand, Zhu Xiaohu, a partner at GSR Ventures, believes that the ToB business model is more suitable than ToC for large models in China's current landscape.

Despite varying viewpoints, large model companies appear unfazed by the ToB or ToC dilemma, embracing both and mutually empowering each other.

Zhang Yaqin, Dean of the Institute for AI Industry Research at Tsinghua University, noted that ToB cycles are relatively longer at the application and service level, while ToC products can be rapidly launched, aligning with the development path of mobile internet.

As a result, most large model startups adopt a parallel ToB and ToC strategy. Even Baichuan AI, which professes a focus on the consumer market, has introduced API interface services.

This 'C+B' business model is now mainstream for large model companies. OpenAI, for instance, generates revenue from ChatGPT subscriptions on the consumer side and API calls on the business side through a 'public cloud + API' approach.

Beyond monetization, large model enterprises also leverage AI to enhance their existing businesses. Alibaba's Quark browser recently launched its PC version, upgrading features like AI search and AI writing for ' Full scene AI' functionality, enhancing customer attraction and retention. SenseTime, primarily a ToB player, introduced its AIGC product 'Miaohu Qupai' to the consumer market this year, enabling creative photo generation.

In choosing a commercialization path for large models, betting on both ToC and ToB not only stabilizes income from ToB to offset ToC's uncertainties but also mutually empowers both businesses technically and brand-wise in the long run.

On one hand, large model companies gather user feedback and application insights through consumer products, feeding back into model iterations. Opening APIs alone is insufficient for a closed-loop user feedback system.

On the other hand, as Kai-Fu Lee, CEO of Sinovation Ventures, pointed out, China's ToC market offers short-term opportunities where products can easily gain popularity and reputation, whose traffic and momentum can in turn benefit ToB operations.

Lastly, large model companies focusing on the consumer market actively reduce API costs, hoping developers will create useful AI applications within their ecosystems.

Similar to the early internet industry, where product differentiation was minimal and competition hinged on who could foster a thriving ecosystem first, the same logic applies to AI applications. More creators' participation increases the chances of developing useful AI apps.

Thus, the ongoing debate over ToC vs. ToB holds limited significance as the primary challenge for the large model industry lies not just in financial pressure but in fostering widespread adoption and creating an ecosystem. Neither the ToB nor ToC market alone can easily achieve this goal.

According to the Cyberspace Administration of China, over 190 generative AI service large models have been registered and launched in China as of August. However, Kai-Fu Lee predicts that only around 30 large model companies will survive the fierce competition.

Currently, no clear industry leader has emerged, including among internet giants. Startups must vigorously compete for brand recognition, product excellence, and ecosystem development; otherwise, they risk losing out in the future.

03 ToB: The Battle in the Era of Customization

Evidently, the ToB market is integral to large model companies' commercialization closed loop . However, success in this market is far from guaranteed.

Firstly, the ToB market is plagued by relentless price wars. In May, ByteDance officially launched its Doubao large model, pricing its main model at just RMB 0.0008 per thousand tokens in the enterprise market, a 90% discount compared to industry standards. This has sparked a wave of price cuts among competitors, with token prices plummeting from cents to fractions of a cent.

While most large model companies advocate avoiding price wars, they often find themselves compelled to lower prices to retain market share. Even after Baidu's Robin Li urged entrepreneurs to compete on AI applications rather than prices, ByteDance and Alibaba Cloud's significant price cuts prompted Baidu to announce free access to its two flagship large models.

Industry insiders suggest that few enterprises are willing to pay for software, leading to rapidly shrinking profit margins in the ToB market for large models. Projects valued at tens of millions last year may now fetch only RMB 1 million, with intense competition from numerous open-source large models.

Secondly, ToB and ToG (government) businesses can be tough nuts to crack. Each ToB customization case is unique, necessitating higher costs due to non-standardized services, especially in complex scenarios with late digital transformations, where data security and information silos pose challenges.

Moreover, ToB sales cycles and payment terms are often prolonged, demanding patience and persistence from enterprises. Recently, Liu Qingfeng, Chairman of iFLYTEK, announced that the company would proactively slow down or even abandon some ToG business due to concerns over payment cycles.

Thirdly, collaborations in vertical industries like finance, healthcare, and law require highly specialized talent and significant investments, given their high demand for large model integration.

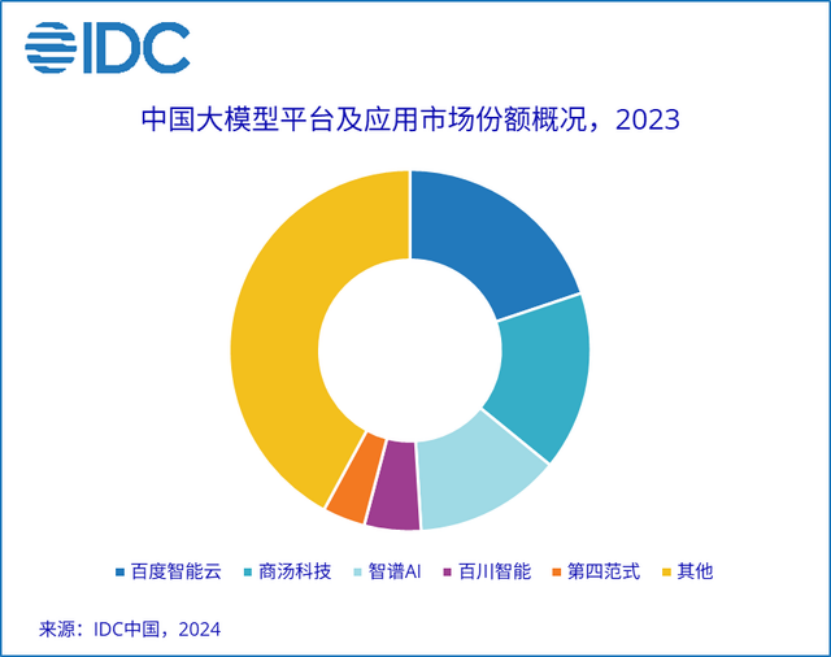

Lastly, even if large model startups overcome these hurdles, enterprises often prefer established cloud vendors for developing foundational models. Data shows that in 2023, Baidu Intelligent Cloud, SenseTime, and Zhipu AI ranked top in the large model market, collectively accounting for half of the market share.

However, this doesn't mean startups can't break through. In 2023, China's generative AI adoption rate reached 15%, with a market size of RMB 14.4 trillion, projected to grow further.

For large models to succeed in the ToB market's second half, they must shift from an enterprise-centric to an industry-wide perspective, integrating into various sectors like office work, production, education, and manufacturing to drive new growth. This is crucial for enterprises to embrace this technology.

Industry insiders emphasize that they're not interested in flashy features but rather cost savings and holistic business solutions based on technological advancements.

As the large model industry evolves, finding a sustainable business model amidst user growth and model capability advancements remains a challenge for all players. However, there's no one-size-fits-all solution. Whether ToB or ToC, the key to a company's future lies in delivering innovative AI applications and services that truly serve customers.

If only 30 large model companies survive, they won't necessarily be the most renowned but undoubtedly the most practical and useful.

* The cover image and illustrations are copyrighted to their respective owners. If copyright holders believe their works should not be publicly accessible or used without compensation, please contact us promptly. We will promptly rectify the situation.