Alibaba leaves the past behind and moves forward

![]() 09/01 2024

09/01 2024

![]() 537

537

Alibaba's new story is still unfolding.

Author: Huashang Taolue, Xiong Jianhui

Excellent companies always turn setbacks into treasures, and great companies are all forged through countless trials and tribulations.

[Surpassing Challenges | A New Chapter in Platform Economy]

Within a week, Alibaba announced two major pieces of good news consecutively.

First, on August 30, the State Administration for Market Regulation (SAMR) announced that Alibaba had completed its three-year rectification period.

Moreover, the SAMR's statement on Alibaba included both a full affirmation of the "good results achieved" and a future expectation of "providing solid support for Alibaba to become a world-class enterprise and enhance its international competitiveness in the next step."

This news uplifted both the market and Alibaba investors, and Alibaba's US shares rose accordingly that evening.

This is a positive signal that the storm has passed. It means Alibaba has successfully completed its three-year rectification as scheduled, and the recognition from the regulatory authorities not only signifies that Alibaba has "passed the test" but also that its platform business has proven to be healthy. From now on, Alibaba will be able to move forward more lightly and accelerate its pace under a healthier and more sustainable business strategy.

In response, Alibaba's reaction was positive yet low-key and pragmatic: "This is a new starting point for development. In the future, we will continue to focus on innovation, adhere to compliant operations, increase investment in technology, promote the healthy development of the platform economy, and create more value for society."

In fact, this is not just a "vote of confidence" from the regulators towards Alibaba; to some extent, it is also a new development signal released by the state to the entire society:

In the new era of high-quality development, we must encourage the platform economy to make a significant contribution.

First, Alibaba's completion of rectification has a significant demonstration effect on the entire internet industry.

Alibaba was not the only target in the previous round of platform economy compliance governance, and many other large internet companies were also affected. However, regulation is a means, not an end, and rectification is aimed at better development.

Alibaba has surpassed challenges, left the past behind, and embarked on a new journey, becoming a significant indicator for the development of the internet industry and even the platform economy.

Second, the importance of Alibaba and the platform economy has become increasingly prominent.

As the saying goes, "The deeper the love, the stricter the criticism."

Over the past three years, why did the SAMR personally oversee Alibaba's implementation of rectification? Precisely because Alibaba and its platform attributes are too important for China's economy.

As the largest e-commerce platform in China, the pioneer of Chinese cloud computing, the largest AI open-source technology company in China, and even the most typical representative of Chinese private enterprises and the platform economy, Alibaba's platform carries a vast amount of resources and serves countless small and medium-sized enterprises, micro-enterprises, and technology companies.

From national consumption to overseas expansion by small and medium-sized enterprises, from the development of cutting-edge technologies to enabling Chinese enterprises to independently apply AI, to the millions of jobs created on the platform, platform economy enterprises like Alibaba are vital to the interests of hundreds of millions of people.

Therefore, such enterprises must first stabilize themselves before striving for further development, so as to contribute more significantly to national and social economic development.

Third, this demonstrates the urgency of the country's pursuit of high-quality development in the digital economy.

In 2024, the combined market value of America's seven largest technology companies once exceeded $15 trillion, making them undisputed leaders in global technological innovation. However, the market value gap between Chinese-listed technology companies and American tech giants continues to widen.

Although market value cannot explain everything, it can explain some things, namely, the need to accelerate the development of the platform economy and digital economy from a national strategic perspective.

Platform enterprises are inherently the backbone of developing the digital economy and leading digital technology. Only by stimulating their potential and drive for technological innovation can they secure a place in future technological competition while contributing value to society and the country.

In this sense, having surpassed challenges and embarked on a long journey, platform economy enterprises represented by Alibaba are bound to write a new chapter of accelerated development.

[Starting Lightly | A New Wave of Prosperity in Hong Kong]

The other piece of good news came from the capital market.

On August 28, Alibaba completed the addition of Hong Kong as its primary listing venue, achieving dual primary listings in Hong Kong and New York, with inclusion in the Stock Connect program imminent in September.

Completing the dual primary listing allows Alibaba to be closer to the Chinese market and better rooted in China. Moreover, after Alibaba's inclusion in the Stock Connect program in September, it will attract a significant amount of "southbound funds," bringing tremendous new liquidity.

Some market participants remarked that Alibaba's inclusion in the Stock Connect program had indeed kept mainland investors waiting for a long time!

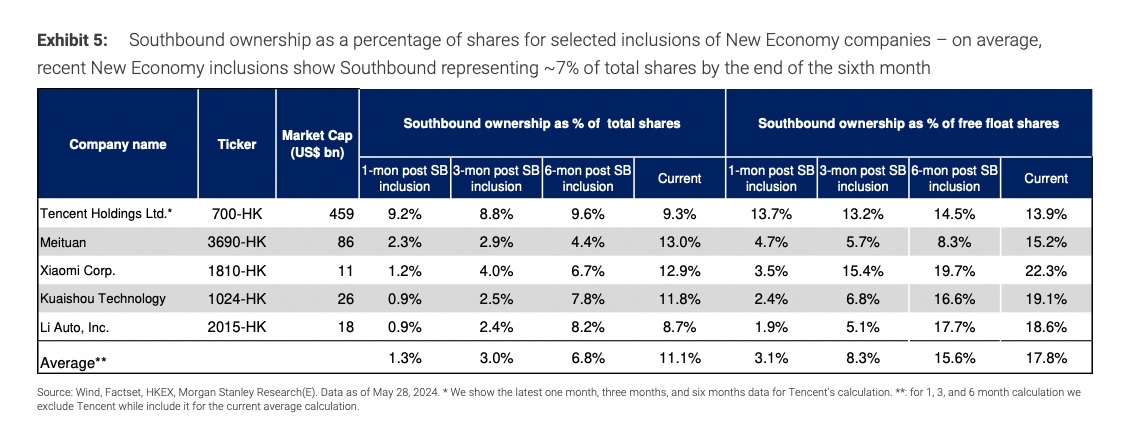

Previously, Morgan Stanley estimated that based on companies like Tencent and Meituan that are already included in the Stock Connect program, if Alibaba were to be included, the long-term shareholding ratio of "southbound funds" could exceed 10%.

Within a week, two major pieces of news hit, prompting many to comment that Alibaba had "seen the dawn" and "ushered in a significant turning point." However, from the perspective of corporate observers, the origin of all positive signs in an excellent company lies in its own changes. The starting point supporting Alibaba's revaluation is its robust fundamentals.

Leaving aside the distant past, let's look back at Alibaba's second-quarter 2024 financial results, which have already shown a positive trend.

According to the financial report, Alibaba achieved revenue of RMB 243.236 billion in the second quarter of 2024, a year-on-year increase of 4%. Adjusted EBITA was RMB 45.035 billion. Although this growth rate may seem modest, it is still noteworthy given the relatively weak macroeconomic environment in the second quarter.

Among them, Alibaba Cloud's growth has resumed: revenue was RMB 26.549 billion, up 6% year-on-year, and adjusted EBITA was RMB 2.34 billion, up 155% year-on-year.

Currently, the most popular AI-related products, which are considered the future, maintained triple-digit growth rates, and public cloud revenue achieved double-digit growth, becoming highlights of the performance.

Alibaba's core business, Taobao and Tmall Group, continued to demonstrate solid profitability, with robust growth in multiple indicators, including high single-digit year-on-year growth in GMV and double-digit year-on-year growth in order volume, indicating that Taobao and Tmall's market share has stabilized. Behind this is the success of a series of transformation strategies implemented by Taobao and Tmall last year, centered on "returning to e-commerce and prioritizing users."

Under the influence of many unfavorable factors at home and abroad, Alibaba's business continued to grow strongly, which is no easy feat, but this may just be the beginning of Alibaba's emergence from the painful transformation.

[Embarking Again | Leading the Industry to "Counter Internal Competition"]

In recent years, amid fierce market competition, some players have resorted to distorted tactics, such as "absolute low prices" and "refunds only," which harm merchants. These platform rules, along with the high growth and profits they generate, have lured many platforms into the vortex of internal competition and harvesting.

Under the condition of absolute low prices and internal competition, many merchants are either forced to operate at a loss or compromise on product quality. While "refunds only" protect some consumers' rights, it also fosters a culture of malicious exploitation, leading to widespread complaints from merchants.

A healthy platform ecosystem benefits consumers, merchants, and the platform itself, rather than sacrificing the interests of one party. This is the most basic business ethic. In other words, if merchants' fundamental interests are not protected, ultimately, consumers' interests will also be compromised.

After this year's 618 shopping festival, Alibaba began to downplay absolute low prices, clarified that GMV was the most critical business metric, optimized the "refunds only" policy, and took the lead in launching the first "counter-internal competition" campaign in the e-commerce industry. Subsequently, Pinduoduo and Douyin also prioritized GMV as their primary goal.

Almost coinciding with this change, the Political Bureau meeting in July set a new tone with "preventing 'internal competition'-style malicious competition."

In fact, looking back, Alibaba's pioneering effort in "countering internal competition" stems from its unwavering commitment to a healthy platform ecosystem. Earlier in Alibaba's narrative, its core actions included adhering to quality-driven low prices, upholding value baselines, enhancing user experience, and optimizing the merchant operating ecosystem.

In summary: users' interests and experiences must be safeguarded and enhanced; merchants' legitimate rights and interests cannot be ignored or trampled upon.

As such, during this year's 618 shopping festival, Taobao and Tmall took the lead in canceling official pre-sales and introduced measures such as full price protection throughout the promotional period. They also comprehensively upgraded 88VIP membership benefits, ensuring user interests and enhancing the experience, which yielded positive results: Taobao's NPS (Net Promoter Score), especially among mid-to-high-end users, steadily improved in 2024, with a higher increase than other mainstream e-commerce platforms.

Enhancing consumer experience is inseparable from merchants' dedication to their businesses. Since the beginning of this year alone, Taobao and Tmall have introduced a series of measures to boost merchants' confidence, including:

Making the "Business Advisor" product completely free; providing shipping insurance subsidies for merchants during the 618 promotion; opening up more than 20 AI tools for free use by merchants; and introducing a new evaluation system, the "Comprehensive Store Experience Score," and eliminating Tmall's annual fees.

Words like "free" and "subsidies" may seem simple, but when multiplied by the millions of merchants on the platform, the cost borne by the platform is immense. As a platform, only by investing heavily in the platform ecosystem to ensure consumer experience and enable merchants to earn money can a positive cycle be achieved.

Over the past three years, despite setbacks, Alibaba has remained true to itself, adhering to the principle of "making it easy to do business everywhere" and investing heavily in consumer experience and the merchant operating environment. This has kept its platform ecosystem healthy and provided Alibaba with sufficient confidence to take the lead in launching the industry's "counter-internal competition" campaign. A healthy platform ecosystem is not only a new starting point for Alibaba but also for it to continue leading the e-commerce industry.

[A New Starting Point | Still a Pioneer Breaking Through]

Completing dual primary listings in Hong Kong marks another new starting point for Alibaba. In addition to the benefits mentioned above from inclusion in the Stock Connect program, there is another clear signal: Alibaba is firmly rooted in China for development.

Standing at this new starting point, Alibaba remains a dynamic, innovative, and responsible "pioneer."

First, Alibaba's e-commerce ecosystem remains vibrant.

In 2023, more than 5 million merchants newly registered and opened stores on Taobao, with 1.3 million of them being post-00s generation. Among the annual active merchants on Taobao and Tmall in fiscal year 2024, 85% were small, medium, and micro-enterprises. Their thriving growth constitutes the vitality of Alibaba's e-commerce platform, which currently offers consumers access to approximately 2 billion products.

Alibaba also continues to support industrial belt factories in connecting with market demand. As Alibaba's oldest business, 1688.com and Alibaba.com remain vibrant. Currently, over 320,000 industrial belt factories have opened stores on the comprehensive domestic wholesale trading platform 1688.com, and over 230,000 global sellers reach over 48 million buyers from more than 190 countries and regions through Alibaba.com.

Second, Alibaba remains dynamic in technological platform innovation.

Many people may not know that Alibaba is currently the only company in China that simultaneously boasts leading AI cloud services and the largest open-source AI model. This model is rare even abroad. Even though Microsoft has a powerful cloud computing platform, its AI model relies on OpenAI. In other words, Alibaba's cloud computing platform can not only serve large model companies for AI training and inference but also help enterprise customers expand their AI application scenarios.

After OpenAI announced the termination of API services to China this year, Alibaba Cloud promptly announced the most cost-effective alternative Chinese large model solution for users, backed by its long-term investment in technology platforms. Statistics show that 80% of technology companies, 60% of listed companies, and 65% of specialized, new, and high-tech enterprises in China are Alibaba Cloud customers; half of the large AI models also "run" on Alibaba Cloud.

Third, Alibaba excels at leveraging platform amplification effects for public welfare.

As a representative of domestic platform enterprises, Alibaba is adept at leveraging its platform advantages to coordinate resources and amplify good intentions. In fiscal year 2024 alone, the "Charity Baby" project on Taobao and Tmall platforms attracted over 1.87 million merchants and over 470 million users, with a net donation amount of approximately RMB 290 million.

Alibaba also launched the "10,000 Disabled Merchants Entrepreneurship and Employment Assistance Program," serving over 4,000 disabled merchants cumulatively by providing free training and business diagnostic services. In fiscal year 2024, a total of 5,786 silent riders were active on the Ele.me platform, with AI providing them with equal employment opportunities.

In the medical field, Alibaba's DAMO PANDA deep learning model enables efficient early screening for pancreatic cancer, achieving a 92.9% accuracy rate in diagnosing lesions among over 20,000 patients, breaking through the worldwide challenge of early pancreatic cancer screening. Its AI intelligent screening tool for Alzheimer's disease has served over 290,000 elderly people.

It is not difficult to understand that "Alibaba's commitment to being rooted in China" is not just a pretty phrase but rather a close connection forged between Alibaba and numerous enterprises, ecosystems, and individuals.

Excellent companies always turn setbacks into treasures, and great companies are forged through countless trials and tribulations. Alibaba, which aims to live for 102 years, is emerging from the growing pains of adulthood, moving forward with a more mature, stable, and powerful stance toward world-class status.