Another side of Didi's financial report: squeezing profits from domestic drivers to subsidize overseas operations, becoming increasingly difficult

![]() 09/01 2024

09/01 2024

![]() 552

552

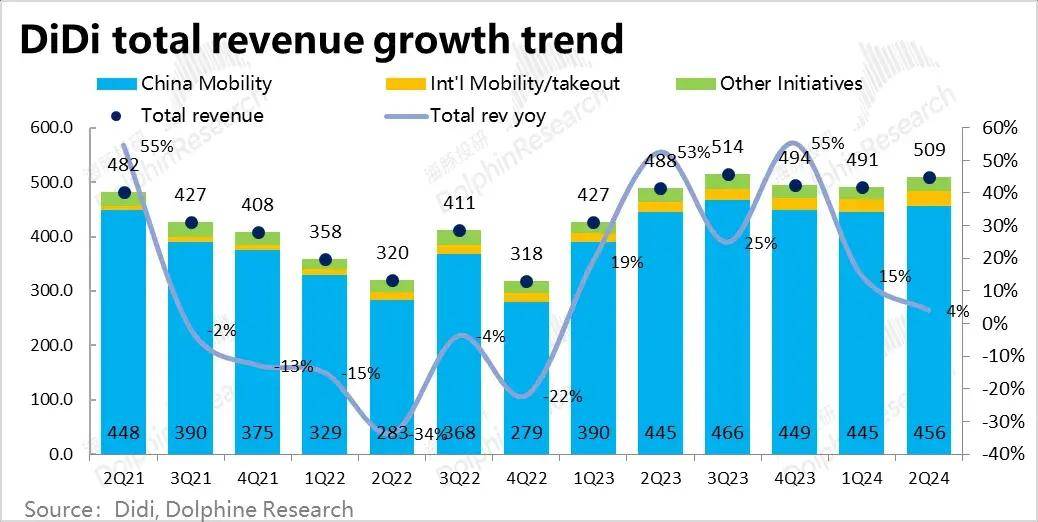

Didi recently released its second-quarter financial report, revealing that it continues to drive order growth and profit increases through marketing activities and cost control in the domestic market, with both domestic and international business volumes reaching new highs.

However, on the other hand, Didi's model of squeezing profits from domestic drivers to subsidize overseas operations may become increasingly challenging.

Behind the new highs in domestic and international business is slowing growth and an unstable market share

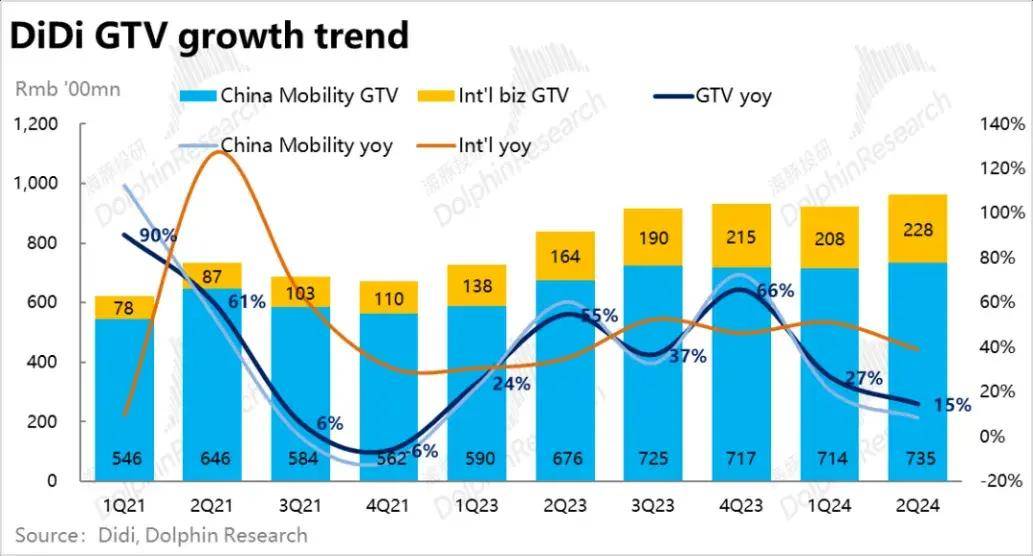

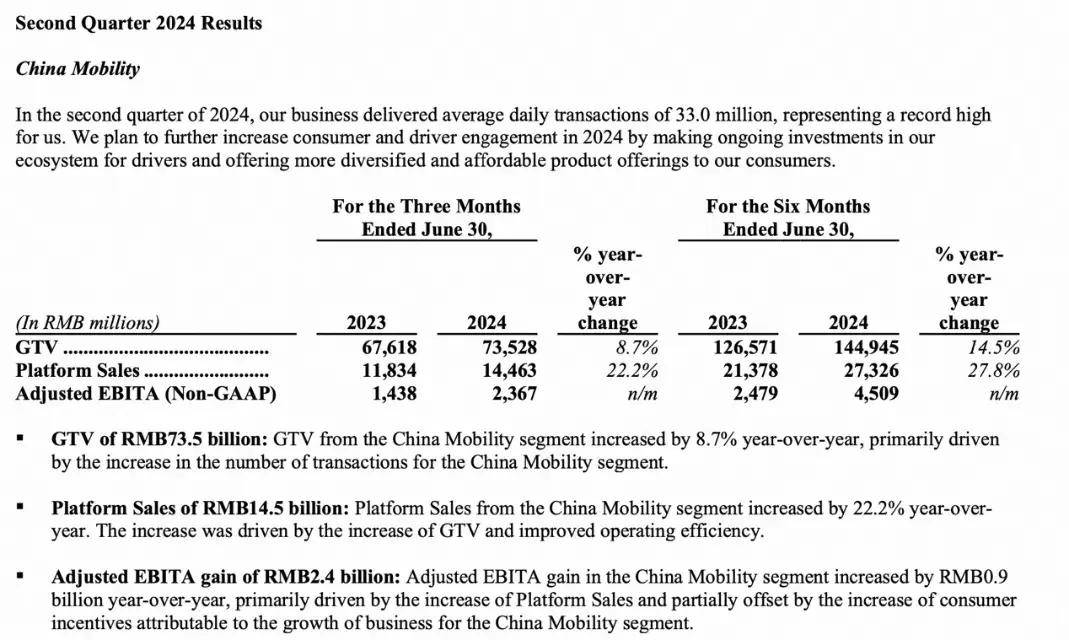

According to Didi's financial report, the company achieved a net profit of 1.7 billion yuan in the second quarter, with a total of 3 billion domestic ride-hailing orders, up 12.3% year-on-year. Daily order volumes for both domestic and international operations reached 33 million and 9.57 million, respectively, continuously setting new records.

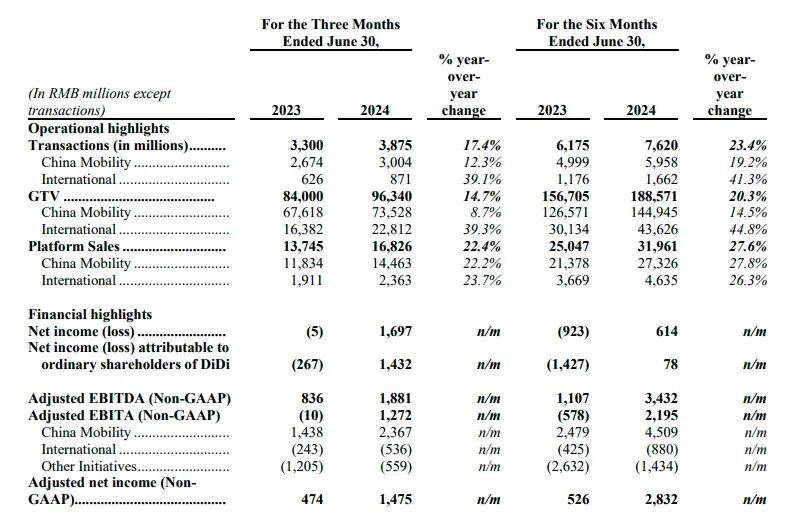

The core platform, which includes both domestic and international operations, processed 3.875 billion orders, up 17.4% year-on-year. Gross transaction value (GTV) on the core platform reached 96.3 billion yuan, an increase of 14.7% year-on-year.

While this financial report appears impressive, there is another hidden side to it.

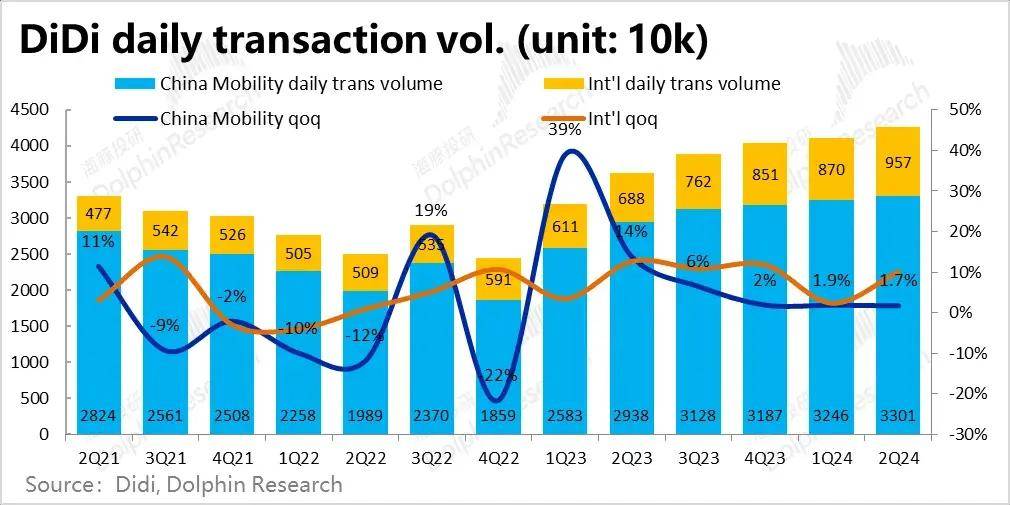

According to Dolphin Investment Research, Didi's domestic GTV in the second quarter reached 73.5 billion yuan, with year-on-year growth slowing significantly to nearly 8.7%. Compared to the previous quarter, domestic GTV increased by 4.4%, representing a stable but slow growth rate considering seasonal variations.

Source: Dolphin Investment Research

Breaking down the data, Didi's disclosed domestic ride-hailing order volume increased by approximately 1.7% quarter-on-quarter, lower than the GTV growth rate. Since the beginning of 2023, the quarter-on-quarter growth rate of orders has continued to slow down.

According to the Ministry of Transport, Didi's domestic online car-hailing orders (excluding Huaxiaozhu, ride-sharing, and aggregation services) increased by 7% quarter-on-quarter, still slightly trailing the overall industry growth rate of 9.1%.

Source: Dolphin Investment Research

The data reveals that behind Didi's new highs in domestic and international business lies slowing order growth and an unstable market share.

The reason behind the slowing growth is that the overall online car-hailing market has become saturated. Since entering the second half of the year, cities such as Suzhou, Shenzhen, Nanning, Qionghai, Qingdao, and Jiaxing have issued warnings about the online car-hailing industry, with many regions experiencing oversaturation or a surplus of capacity.

According to official data from Qingdao in 2024, the city has withdrawn over 16,000 online car-hailing vehicles so far, a significant increase from previous withdrawals.

Increased customer subsidies and reduced driver commissions

The saturation of the online car-hailing market and excess supply have led to weaker consumer demand on the passenger side, with new users gradually reaching a peak.

According to Didi's financial report, its domestic mobility segment generated revenue of 45.6 billion yuan in the quarter, up 2.6% year-on-year, significantly lower than the nearly 9% growth in GTV.

According to Dolphin Investment Research, this is due to higher subsidies to consumers amid weak demand, resulting in a higher proportion of GTV going towards subsidies. Meanwhile, Didi's domestic platform sales (GTV minus driver commissions/incentives and taxes) increased by 23% year-on-year, significantly outpacing GTV and revenue growth, suggesting a noticeable reduction in driver commissions this quarter.

Source: Dolphin Investment Research

Behind this trend is weakening domestic demand for rides, combined with diversions from other platforms and an excess supply of drivers and vehicles in the online car-hailing industry. More subsidies are needed to attract orders, while driver commissions continue to be squeezed.

Didi's continuous reduction of driver commissions over the past few quarters has sparked significant criticism among drivers, with issues such as non-functioning air conditioning and poor service attitudes leading to numerous consumer complaints. However, Didi's commission rate for domestic drivers has continued to rise, reaching a peak of 19.6% in the most recent quarter, indicating a sustained squeeze on driver income.

A tale of two worlds - Overseas driver commissions are only half of domestic levels, subsidizing overseas markets with domestic funds

However, the situation is different for overseas Didi drivers.

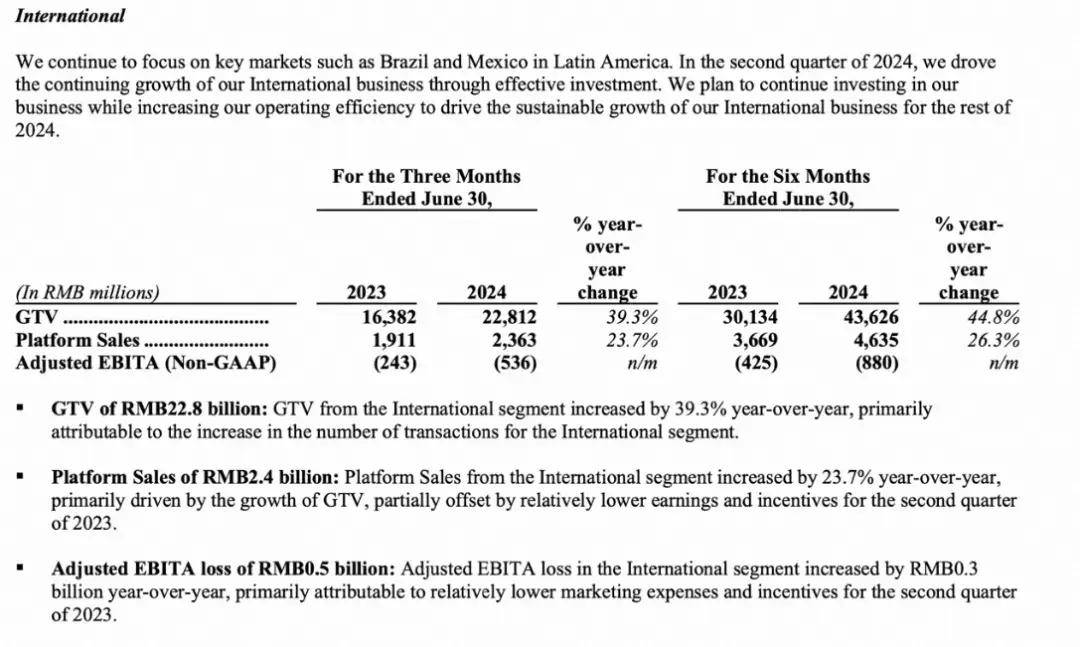

According to Didi's financial report, overseas business growth remains robust, with overseas GTV increasing by 39% year-on-year in the quarter. According to Dolphin Investment Research, Didi's overseas revenue grew by 40.9% year-on-year, but platform revenue growth was only 26%, significantly lower. This reflects a natural increase in commissions to overseas drivers amid strong growth.

Based on financial report data, overseas driver commissions are only 10.3%, roughly half the domestic average.

In other words, Didi is not only earning money from consumers but also from drivers domestically, using these profits to subsidize overseas markets. However, according to Dolphin Investment Research, overseas business losses widened to 540 million yuan this quarter.

The reason is that Didi has clearly felt the bottleneck in the domestic online car-hailing market, where competition is fierce and it is becoming increasingly difficult to squeeze profits from drivers. Compared to Uber's performance, the growth potential of overseas markets is currently higher than that of domestic markets. Didi is using profits squeezed from the domestic market to subsidize overseas operations, aiming to drive its second growth curve.

However, Didi's current situation in overseas markets is similar to its early days in China, requiring significant investments. The overseas market is fragmented, necessitating even more rapid and substantial investments. Moreover, different national conditions in various countries can lead to policy risks.

This also implies that domestic drivers face continued hardships.

Subsidizing overseas with domestic profits: Insufficient R&D support and declining user experience

Didi's practice of squeezing domestic driver profits to subsidize overseas operations has two major drawbacks: inadequate R&D investment and declining driver income, leading to poorer user experience.

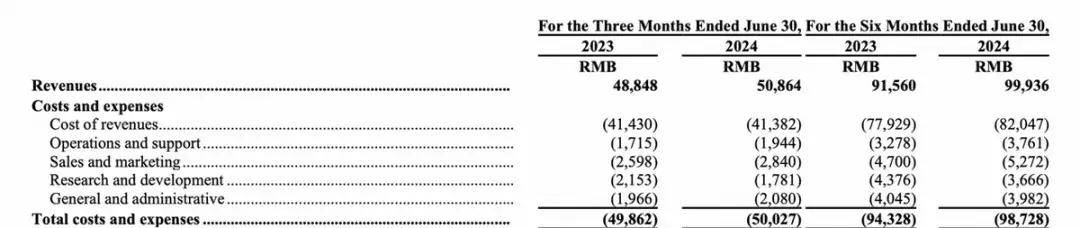

Didi's R&D expenses accounted for only 3.5% of its total revenue in the second quarter. In the first quarter of 2024, R&D expenses were 1.9 billion yuan, down 15.2% year-on-year from 2.2 billion yuan in the same period last year. Additionally, Didi's R&D investment has shown a continuous decline since the first three quarters of 2023.

The continuous reduction in R&D investment has impacted technical support capabilities. Since 2015, Didi has experienced technical failures almost every year. In September 2020, a network failure left users facing a "toughest day to hail a ride."

In February 2021, a system malfunction made some orders unusable. In September 2022, a network failure occurred in the data center, and in November 2023, a system failure led to issues such as location confusion, abnormal order receipt, and login issues.

Essentially, Didi is a technology company. The continuous reduction in R&D investment reflects the severity of competition in the industry but also poses hidden risks, potentially affecting driver and passenger rights and user experience.

Didi lags behind the market, with hidden crises still looming

In summary, behind Didi's financial report lies the fact that its domestic ride-hailing order volume still slightly trails the overall industry, with slowing quarter-on-quarter growth indicating fewer new users and increased competition from rivals.

Moreover, as warnings about ride-hailing market saturation emerge across regions, the average daily order volume per vehicle continues to decline, with news frequently emerging about the difficulties of earning money through ride-hailing. According to Pinghu Media, some novice drivers have expressed regret about entering the market due to a lack of orders.

In August, to encourage drivers to use air conditioning, Didi announced that it would provide a 600 million yuan high-temperature allowance. However, even in such extreme heat, some Didi drivers are reluctant to use air conditioning due to the difficulties in earning a living.

Under these circumstances, it would be logical to use profits to subsidize domestic drivers, enhance user experience, and stabilize the domestic market. However, Didi continues to raise domestic commissions to subsidize overseas operations, potentially making it even harder for Didi drivers to earn a living.

Domestically, competitors such as Ruqi, Dida, and Caocao have submitted IPO prospectuses to the Hong Kong Stock Exchange, while Enjoyway has also announced plans to prepare and launch an IPO in the second half of the year. The entry of competitors like Meituan and Amap has changed the competitive landscape of the industry.

As competition intensifies, Didi's increased commissions may lead drivers to flow to platforms with lower fees. With domestic competition heating up, how long can Didi continue to subsidize its overseas market? And once overseas subsidies cease, will growth be sustainable?

Conclusion:

In summary, behind Didi's seemingly impressive financial report, its current profitability is built on the increasingly challenging living conditions of domestic ride-hailing drivers. As Didi continues to squeeze profits from domestic drivers to heavily subsidize overseas operations, its domestic market share remains unstable, growth is slowing, and competitors are gradually rising. Whether Didi's strategy of compressing domestic driver income and heavily subsidizing overseas markets can create a "second growth curve" for the company as a major mobility player remains to be seen.