Stunning turnaround! Chinese cars finally defeat Japan

![]() 09/02 2024

09/02 2024

![]() 529

529

Chinese cars completed their masterpiece in 2023, with annual exports reaching 4.91 million vehicles, a year-on-year increase of 57.9%. For the first time, they surpassed Japan to become the world's largest automobile exporter, achieving a three-step leap within two to three years.

The path for Chinese cars to go overseas was once dominated by independent automakers like Chery and Great Wall in developing markets. In 2023, new automakers like NIO and Xpeng boldly entered the European market, followed by BYD's widespread success in the global market.

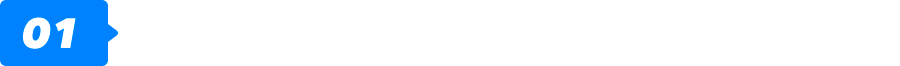

Looking closely at China's automobile exports in 2023, traditional automakers like Chery, SAIC, and Geely remained the main players, with Tesla and BYD providing strong support. However, the new automakers generated more buzz than actual sales.

According to the China Passenger Car Association, China exported 3.83 million passenger cars in 2023, a year-on-year increase of 62%. Among them, 2.79 million were gasoline-powered vehicles, and 1.04 million were new energy vehicles, both showing continuous growth.

Exports from major automakers like Chery, SAIC, Great Wall, and BYD continued to expand, with Chery exporting 923,900 vehicles, SAIC exporting 685,000, Geely exporting 274,100, Great Wall exporting 267,700, and BYD exporting 242,700.

The main markets for gasoline-powered vehicle exports were Russia, Mexico, and Saudi Arabia, while the main markets for new energy vehicle exports were Belgium, Thailand, and the UK.

From being the world's largest automobile seller to the largest exporter, China's automotive industry still faces many challenges on its rise to prominence. The next small goal is comprehensive globalization.

Automotive Overcapacity

Rewriting the Global Automotive Market Rules

Changes in the international landscape, combined with overcapacity caused by advancements in Chinese automotive technology and consumption upgrades, are significantly transforming the global automotive market due to China's status as the largest automotive base.

Against the backdrop of independent automakers rapidly expanding into global markets, Tesla China's model of foreign-invested manufacturing for export could become a new development opportunity for joint ventures. This trend is driven by overcapacity, competitive manufacturing costs, and the need for multinational automakers to readjust their global production layouts.

Of course, China's automakers still lack a say in the three major developed markets of Europe, the US, and Japan, which are also key automotive hubs. Becoming a major player in the global market will present greater challenges than expected, even for ambitious visions outlined by new automakers like NIO and Xpeng.

In developing countries and regions like Russia, the Middle East, and Southeast Asia, where there are no dominant local automotive brands, Chinese cars are capturing market share from foreign brands like Japanese and Korean automakers, showing a trend of replacing them.

With foreign automakers like Toyota, Volkswagen, and Mercedes-Benz gradually exiting the Russian market, China's ready manufacturing capabilities and consumer markets will likely become a focus for Chinese automakers in 2024, helping to rapidly increase their market share overseas.

The Southeast Asian market offers favorable conditions for Chinese automakers to repeat their success in displacing Japanese cars in China. Whether through partnerships like Geely's with Proton or direct factory construction like Changan and Aion, this region will become a new battleground for Chinese automakers against Japanese competitors.

China's gasoline-powered and new energy vehicles will mature and evolve in emerging automotive markets like Russia, the Middle East, and Southeast Asia. This is not a small test for new automakers in European markets but rather a true global moment for Chinese automakers.

Chinese Cars Must Go Overseas

And Have No Choice But To Do So

The potential risks in overseas markets are greater than expected, as evidenced by setbacks faced by Chinese companies in markets like North America, Europe, and India. Calm markets can hide underlying turmoil.

As the largest automaker globally, Toyota learned many lessons in the North American market during its rise. While entry into the North American market may still be far off for Chinese automakers, challenges in other markets are no less significant.

As Chinese automakers make strong inroads into overseas markets, the EU's anti-dumping investigation into Chinese new energy vehicles is just the beginning. Southeast Asia and Russia also face global political and economic uncertainties.

Minimizing risks in the process of expanding overseas, whether voluntarily or out of necessity, is crucial for the global development of Chinese automakers. Even small issues on the global stage can escalate into major accidents.

For Chinese automakers to truly dominate the global market, they will need considerable time and may face painful lessons covering brands, technology, and operations. Examples include Huawei's global blockade and Toyota's unintended acceleration issue in the North American market.

Whether it's avoiding risks in global market development or gaining the initiative in the Chinese market, integrating with local resources globally and opening up joint venture automaker equity ratios in China to ultimately achieve wholly-owned foreign factories is an urgent issue.

Joint venture automakers have been instrumental in China's automotive industry. With the rise of independent brands, it's time for multinational automakers to truly view China as an indispensable global manufacturing base and sales market.

Unbinding Multinational Automakers

Fueling Chinese Automakers' Overseas Expansion

Led by new energy vehicles, Chinese automakers have seized unprecedented opportunities. The phrase 'when multinational automakers flex their muscles' should not be a joke but a call for truly unbinding them.

Automakers like Volkswagen, Toyota, and Honda each have two joint venture partners in China, but Volkswagen is already breaking away from this model. Audi FAW and JAC Volkswagen have achieved foreign control, potentially signaling the future trend for multinational automakers in the Chinese market.

Allowing multinational automakers to choose to retain one joint venture and establish a controlling joint venture or even a wholly-owned new factory is necessary for the future development of China's automotive industry.

The future development of Chinese automakers should not rely solely on multinational automakers' support, even if it's under the guise of market-for-technology exchanges. They must learn to stand on their own to better face and participate in global competition.

The establishment and operation of Tesla's Shanghai Gigafactory is both a sword of Damocles hanging over China's automotive industry and a catalyst for change. It has forced independent automakers to go all in, no longer content to rest on their laurels.

As Chinese new energy vehicles become a catalyst in the global market, perhaps multinational automakers should also take on this role in the Chinese market.

Facing market competition and customer demands with genuine capabilities is a crucible that every industry giant must endure, even if it means many will be swept away by historical tides. Chinese automakers stand at a new crossroads, with new domestic market openings and global market explorations working in tandem. While not necessarily the best choice, it's a worthwhile new start.