ZTE's less optimistic semi-annual report: target prices cut by multiple institutions, Goldman Sachs predicts further decline in gross margin

![]() 09/02 2024

09/02 2024

![]() 449

449

《 Harbor Business Observation 》 Shi Zifu, Wang Lu

ZTE, a well-known telecommunications service provider (000063.SZ; 00763.HK), recently released its semi-annual report, with both revenue and net profit showing single-digit growth.

Overall, ZTE's semi-annual report had its ups and downs, which also sparked different views on earnings forecasts among institutions.

01

Decline in carrier network business revenue, growth remains top priority

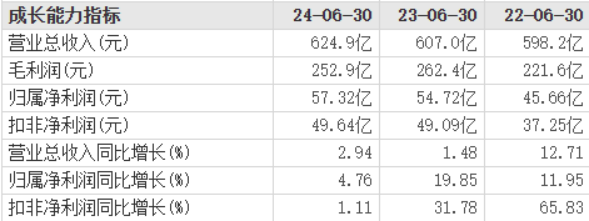

In the first half of 2024, ZTE achieved operating revenue of RMB 62.49 billion, a year-on-year increase of 2.9%; net profit attributable to shareholders of the parent company was RMB 5.73 billion, a year-on-year increase of 4.8%; net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses was RMB 4.96 billion, a year-on-year increase of 1.1%; net operating cash flow was RMB 7.00 billion, a year-on-year increase of 8.9%. Basic earnings per share were RMB 1.20. The company did not distribute profits or convert capital reserves into share capital.

Meanwhile, the company's gross margin was 40.47%, a year-on-year decrease of 2.75 percentage points, primarily due to the combined effects of changes in revenue structure, improved gross margins in carrier networks and consumer businesses, and decreased gross margins in government and enterprise businesses. Specifically, in the first half of 2024, carrier network revenue was RMB 37.296 billion, a year-on-year decrease of 8.61%, primarily affected by the overall domestic investment environment; gross margin was 54.32%, a year-on-year increase of 0.12 percentage points; government and enterprise business revenue was RMB 9.172 billion, a year-on-year increase of 56.09%, primarily driven by revenue growth in servers and storage; gross margin was 21.77%, a year-on-year decrease of 5.74 percentage points, primarily due to changes in revenue structure; consumer business revenue was RMB 16.019 billion, a year-on-year increase of 14.28%, primarily due to revenue growth in home terminals and mobile phone products; gross margin was 18.93%, a year-on-year increase of 1.11 percentage points, primarily due to increased gross margins in home terminals and mobile phone products. These three businesses accounted for 59.7%, 14.7%, and 25.6% of revenue, respectively. In short, carrier network business, which accounts for more than half of revenue, declined, while government and enterprise business and consumer business showed good growth rates.

Regarding the significant double-digit growth in government and enterprise business, ZTE stated that it would focus on key customers in the internet, finance, and power industries, intensify expansion efforts, implement the JDM (Joint Design and Manufacturing) deep cooperation model, cultivate existing business, break through incremental markets, and achieve revenue growth. For data center switches, the company accelerated its layout in the internet and financial industries, with domestic orders growing rapidly year-on-year. For data center accessories, the company partnered with domestic enterprises to expand overseas, continuously increasing its presence in the Indonesian market.

As for the consumer business, the company noted that in mobile phone products, it adhered to a strategy of differentiated innovation and cost leadership, introduced "AI for All," and deployed a full range of AI terminals, including mobile phones, tablets, laptops, and mobile internet devices. For individual users, the company launched multiple AI-innovative products such as the 5G+AI glasses-free 3D tablet nubiaPad3DII, AI all-around imaging flagship nubia Z60 Ultra, affordable AI glasses-free 3D phone ZTE Yuanhang 3D, and AI-enabled dual-satellite dual-system 5G security flagship phone Axon60Ultra to meet industry-specific needs.

In addition, ZTE's R&D expenses in the first half of the year were RMB 12.73 billion, accounting for 20.4% of operating revenue. As of June 30, 2024, the company had approximately 91,500 global patent applications and approximately 46,000 cumulative global granted patents. Specifically, in the chip field, it had approximately 5,400 patent applications and over 2,000 cumulative granted patents; in the AI field, it had approximately 5,000 patent applications and over 2,000 cumulative granted patents.

Regarding ZTE's semi-annual report, Capital Securities noted in its research report on August 21 that the company continued to prioritize cost reduction and efficiency enhancement. In the first half of the year, the management expense ratio was 3.58%, a year-on-year decrease of 0.56 percentage points; the sales expense ratio was 6.70%, a year-on-year decrease of 0.90 percentage points; and the R&D expense ratio was 20.37%, a year-on-year decrease of 0.70 percentage points. The decrease in expense ratios drove the company's net profit margin in the first half of 2024 to 9.14%, a slight year-on-year increase of 0.26 percentage points, indicating a steady improvement in profitability. "We believe that with the company's continued focus on cost reduction and efficiency enhancement, there is still room for improvement in profitability," Capital Securities stated, noting that "growth remains the company's top priority in 2024" and highlighting emerging areas such as 5G-Advanced and AI as new growth engines for the company's performance. The company's chairman mentioned in the annual report that "growth remains the company's top priority in 2024" and that 2024 will be a year of rapid development for 5G-Advanced. As a major contributor and participant in global 5G technology research and standard formulation, the company has been deeply involved in 5G-Advanced standard formulation work and has released products to support multi-scenario technology verification. The company also stated that its 5G-Advanced technology has enhanced general-purpose computing power and intelligence in traditional base stations, enabling efficient identification of networked aircraft and targeted network performance guarantees, thus "escorting" the low-altitude economy.

It is expected that in 2024, while ensuring continuous improvement in the core competitiveness of its first-curve businesses represented by traditional connectivity products such as wireless, wired, and 5G-Advanced, the company will rapidly expand its second-curve businesses represented by AI computing power, achieving rapid growth in both revenue and net profit.

02

Target prices for Hong Kong-listed shares cut by multiple institutions, Goldman Sachs predicts further decline in gross margin

Guoyuan Securities also stated that despite overall pressure on carrier business, the company would fully grasp the growth opportunities in demand for computing hardware brought about by industrial digitization and large-scale deployment of large models through early-stage research and development and abundant government and enterprise customer resources. It is estimated that from 2024 to 2026, the company's net profit attributable to shareholders of the parent company will be RMB 10.436 billion, RMB 11.086 billion, and RMB 11.676 billion, respectively, corresponding to PE valuations of 11.0x, 10.4x, and 9.9x, respectively, with the rating downgraded to "Accumulate".

UOB Kay Hian noted that ZTE's second-quarter results were mixed, with revenue and gross margin falling short of expectations, primarily due to weaker-than-expected performance in carrier network business, which was offset by better-than-expected operating expenses and higher non-core income. Looking ahead, it is expected that local telecom capital expenditures will continue to decline, dragging down revenue growth, but the recovery in mainland corporate spending may partially offset the weak performance in telecom business. The company's earnings forecasts for this year, next year, and 2026 were downgraded by 7.7%, 6.6%, and 6.3%, respectively, with the target price reduced from HKD 21 to HKD 19, maintaining a "Buy" rating.

In its research report, UBS stated that ZTE's second-quarter revenue was RMB 31.9 billion, a 1.1% year-on-year increase but 4% lower than market expectations. Gross profit was RMB 12.4 billion, a 6.3% year-on-year decrease and 11% lower than market expectations. Net profit was RMB 2.99 billion, a 5.7% year-on-year increase but 5% higher than market expectations, primarily due to reduced operating expenses and other income. ZTE's net profit forecasts for 2024 to 2026 were downgraded by 1% to 3%, primarily due to reduced carrier business revenue. The target price was reduced from HKD 19 to HKD 18.5, but the rating was maintained at "Neutral" due to the reasonable P/E ratio.

BOCI stated that although revenue weakness due to reduced telecom capital expenditures was offset in part by increased revenue from government and enterprise IT infrastructure and improved gross margins in the consumer business, ZTE's net profit grew by 4.8% year-on-year in the first half, in line with the bank's expectations. The "Buy" rating for ZTE's Hong Kong-listed shares was reiterated, and the bank downgraded its earnings forecasts for ZTE by 1.9% to 4% for 2024 to 2026, anticipating continued reductions in telecom capital expenditures. The target price was reduced to HKD 20.08.

Goldman Sachs reported that ZTE's second-quarter net profit was RMB 3.0 billion, 38% and 5% higher than the bank's and market expectations, respectively. Revenue increased by 1% year-on-year and 4% quarter-on-quarter, in line with both the bank's and market expectations. Gross margin fell by 3 percentage points quarter-on-quarter to 39%, 2.3 and 3.1 percentage points lower than the bank's and market expectations, respectively. Operating profit was in line with expectations.

Goldman Sachs expects ZTE to achieve modest growth in the third quarter, primarily driven by reduced 5G infrastructure in China and increased demand for computing power fueled by early applications of generative AI technology. Gross margin is expected to decline to 38.9%.

Furthermore, based on the company's second-quarter revenue growth and gross margin decline, Goldman Sachs upgraded its 2024-2026 earnings per share forecasts by 10%, 8%, and 13%, respectively, and its revenue forecasts by 2%, 4%, and 7%, respectively. The bank is optimistic about the prospects for ZTE's server, storage, and liquid cooling businesses, as well as the recovery in demand for smartphones and home appliances after the digestion of supply chain inventory. The bank downgraded its gross margin forecasts for ZTE by 1.3, 0.2, and 0.5 percentage points, respectively, and upgraded its operating profit forecasts by 1%, 8%, and 13%, respectively. The target price for ZTE was downgraded from HKD 23.4 to HKD 22, maintaining a "Neutral" rating.

If we look at ZTE's interim reports over the past three years, the pressure on revenue and net profit growth has been considerable. According to Eastmoney data, from the 2022 interim report to the 2024 interim report, ZTE's revenue growth rates were 12.71%, 1.48%, and 2.94%, respectively; its net profit attributable to shareholders of the parent company grew by 11.95%, 19.85%, and 4.76%, respectively; and its net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses grew by 65.83%, 31.78%, and 1.11%, respectively.

Looking ahead to the second half of the year, ZTE stated that it would adhere to a business strategy of "precision, pragmatism, and steady growth." Amid a complex and ever-changing environment, the company would firmly grasp strategic opportunities in digitization, intelligence, and low-carbon development, pursue steady progress while seeking advancement, actively enhance its existing business landscape, expand into incremental markets, and explore variable opportunities. While maintaining the continuous improvement of the core competitiveness of its first-curve businesses represented by wireless and wired products, the company would accelerate the expansion of its second-curve businesses represented by computing power and mobile phones to achieve long-term development goals. (Produced by Gangwan Finance)