Kill and kill again, will the Chinese stocks ever recover?

![]() 09/03 2024

09/03 2024

![]() 601

601

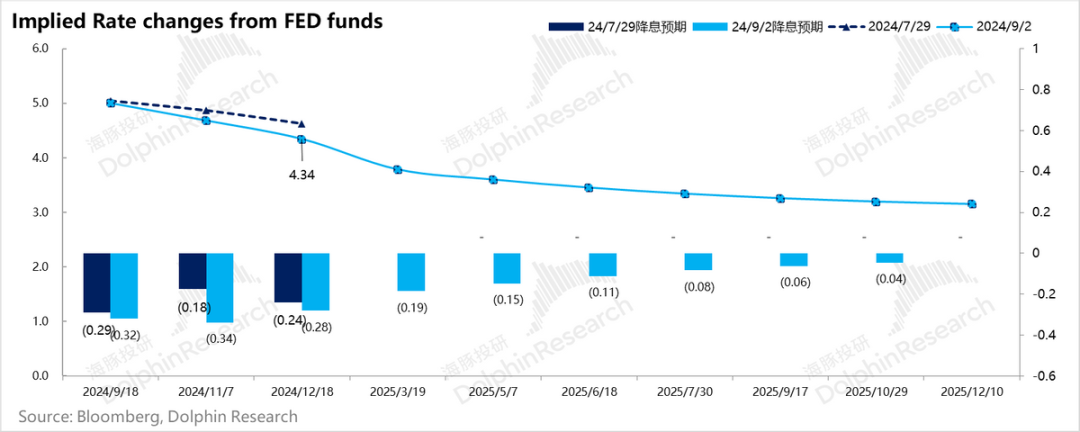

With the official endorsement from Jerome Powell, the Chairman of the Federal Reserve, at the Global Central Bank Meeting, the market has fully priced in the expectation of interest rate cuts. However, the magnitude of each rate cut and the overall scope of rate reductions will still be based on data-driven decisions. These data points have become simpler, primarily focusing on three key indicators: employment, inflation, and consumer spending.

This week, we'll see the most crucial August employment and wage data before the September decision on the intensity of interest rate cuts. Last week, the pivotal data point was July's consumer spending, which remained robust, not supporting aggressive rate cuts.

I. Income Slowdown, Savings Fill the Gap, Consumer Spending Remains Vibrant

Contrary to the weak outlooks expressed by many consumer companies in their Q2 earnings reports, overall US consumer spending in July remained solid. Behind this resilience lies the source of consumers' financial resources:

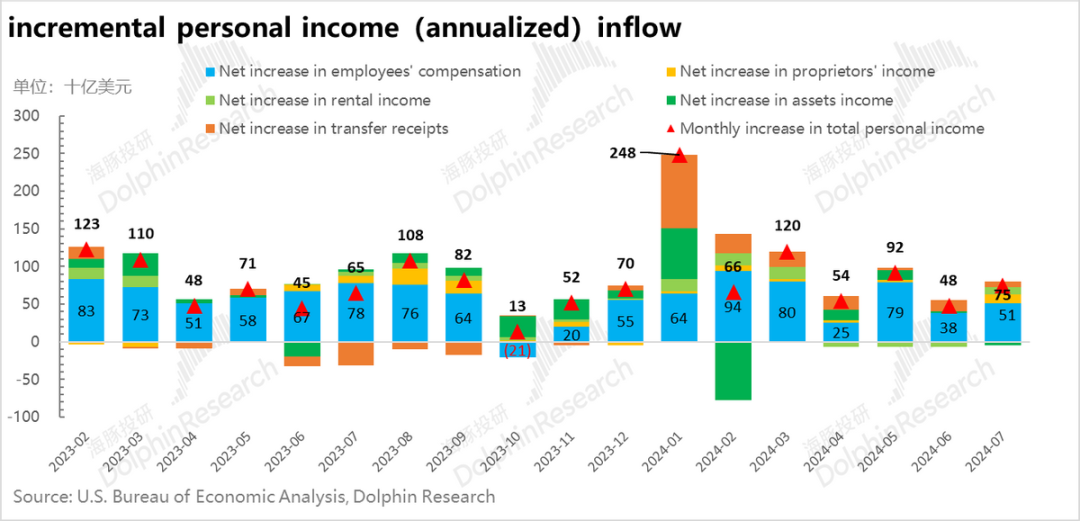

a. In July, the annualized increase in monthly wages for US households was $51 billion, with a month-on-month growth rate of 0.31% when annualized, equivalent to a year-on-year growth rate of nearly 4%. Therefore, whether measured by absolute new additions or year-on-year comparisons, total household income remained stable overall.

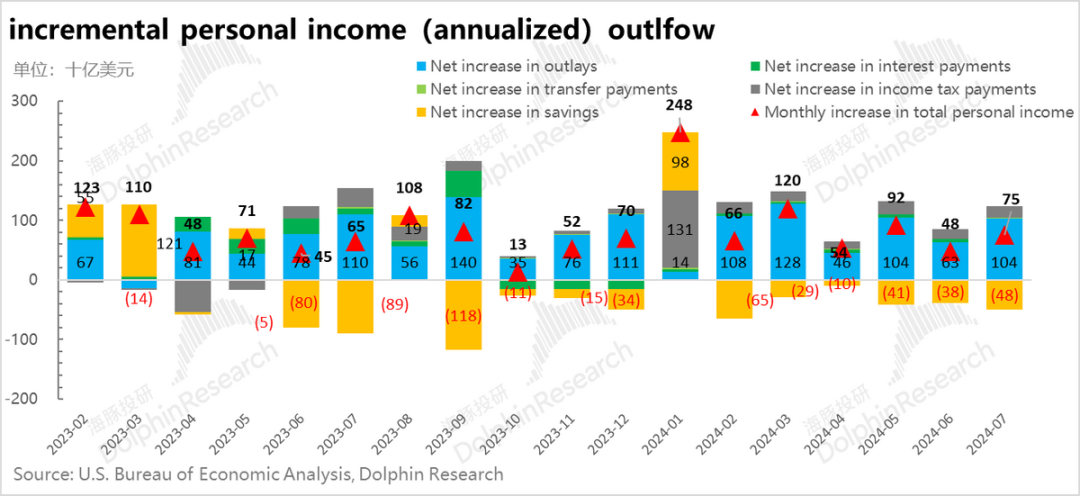

b. On the expenditure side, despite the modest growth in income, consumer spending was robust. Not only did all new income seamlessly convert into spending, but July's spending significantly squeezed out savings, leading to continued higher growth in consumer spending than income. Domestic demand remained robust.

c. Savings Rate Nears Record Low

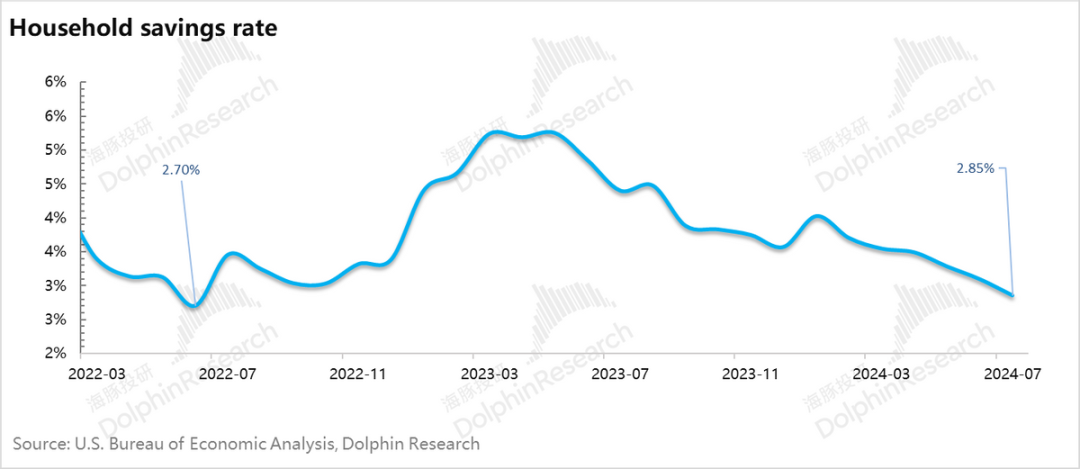

With no significant increase in household income, continuous consumer spending squeezed the savings rate. As a result, the savings rate in July almost hit a new low since the helicopter money policy in 2022, standing at just 2.85%. This means that for every $100 of disposable income earned by US households, only $2.85 was saved (similar to a company's net profit, regardless of whether the savings are deposits or investments).

As the two primary sources of consumer spending, both income growth (driven by robust employment) and savings rate compression (reflecting healthy household balance sheets and confidence) seem to be endless.

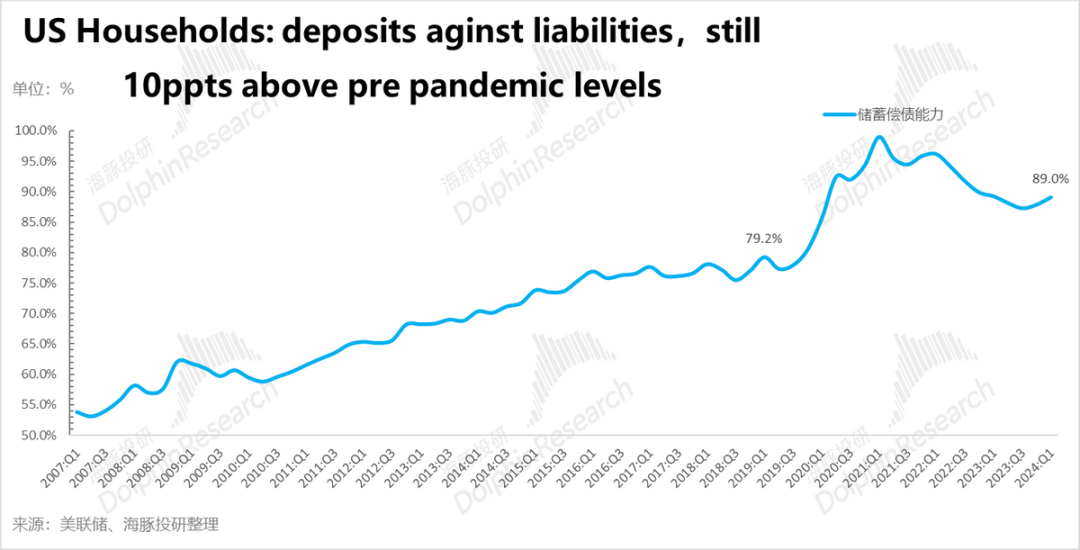

Especially considering that the compression of the savings rate was initially expected to be temporary, yet six months into 2024, consumer spending continues to effectively squeeze savings. This is largely due to the over a decade-long deleveraging of household balance sheets since 2008, coupled with the helicopter money policy during the pandemic, further strengthening household balance sheets.

Currently, the solvency of savings vis-à-vis liabilities in household balance sheets is particularly strong, making savings unnecessary and subject to continuous compression. As a result, both income and savings-fueled consumer spending continue to propel GDP growth at a rapid pace.

Despite the steady decline in prices and the need for interest rate cuts, given the sustained robust domestic demand, Dolphin Your Majesty doubts whether the magnitude will reach the market's expected 100 basis points. With the market fully pricing in interest rate cuts, Dolphin Your Majesty believes the interest rate cut trade is largely played out.

III. Chinese Assets: Will US Interest Rate Cuts Open Up Monetary Policy Space in China?

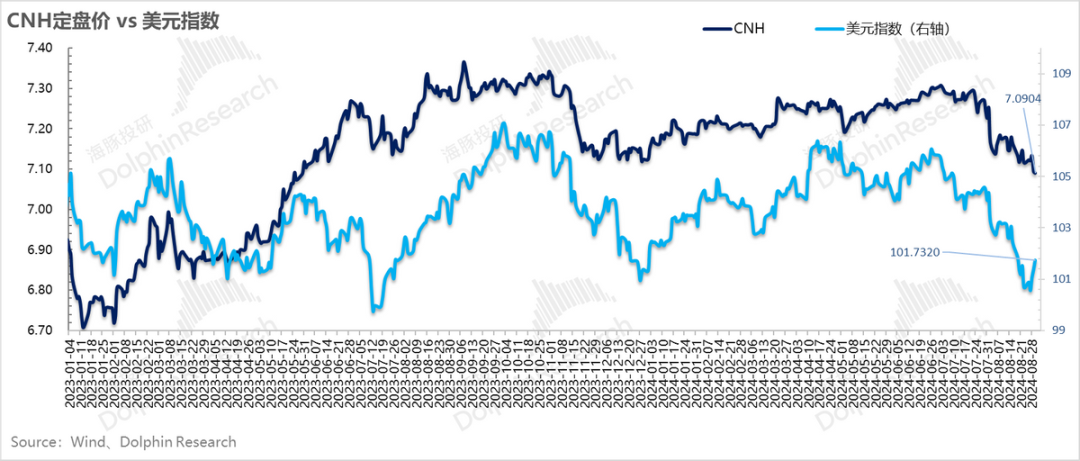

Assuming the Fed cuts interest rates by 75 basis points this year and continues to lower them next year, reaching around 3.5%. Could this improve the Renminbi exchange rate? With the confirmation of US interest rate cuts, the offshore Renminbi has risen to around 7.1.

In this context, could domestic assets potentially open up room for interest rate cuts or debt monetization amid high debt levels? Last week's news about reducing existing mortgage rates and refinancing trials to some extent explored this possibility.

Regarding overseas-denominated Chinese equity assets, after the earnings season, the market has fully recognized the severity of performance challenges. With weak guidance from internet advertising companies, fierce competition among e-commerce firms, conservative outlooks from recruitment firms like Boss, and underperforming consumer goods companies (such as beer brands and dining chains like Jiu Maojiu), the market has shifted focus to cost-cutting and efficiency improvements.

In terms of stock valuations, Dolphin Your Majesty observes that domestically-focused consumer companies, including advertising, e-commerce, entertainment, and consumer goods, are mostly trading at low single-digit to mid-twenties P/E ratios. The question now is how many companies will follow the path of China Duty Free, where PE ratios collapse and earnings decline, leaving investors wondering if there's a true bottom.

This issue is partly macroeconomic, and Dolphin Your Majesty believes that as the US enters an interest rate cut cycle, it could open up policy space in China, at least in the short term, aiding in valuation recovery.

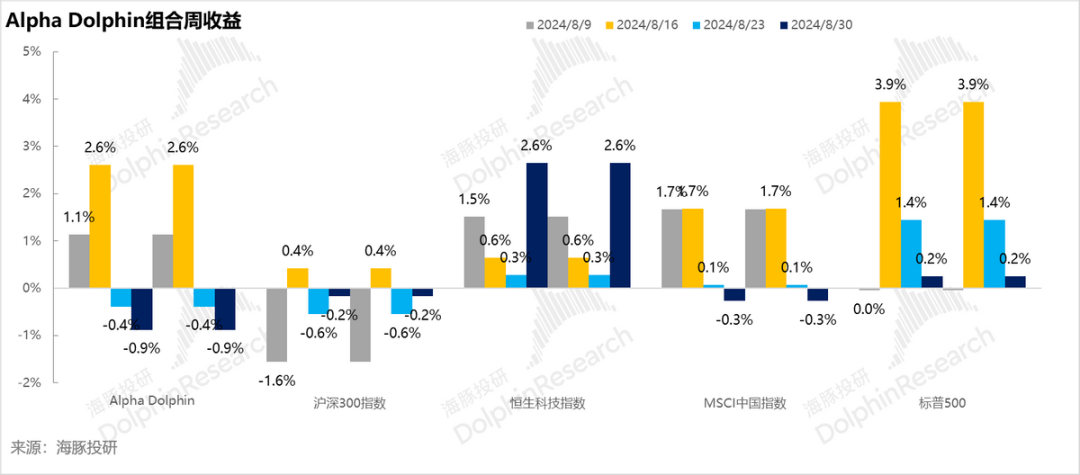

III. Portfolio Rebalancing and Returns

No rebalancing occurred last week, and the portfolio declined by 0.9%, underperforming the MSCI China Index (-0.3%), Hang Seng TECH Index (+2.6%), S&P 500 (+0.2%), and CSI 300 (-0.2%). This was primarily due to Pinduoduo's poor earnings call, dragging down Alibaba and other peers. Meituan, which performed well in Hang Seng TECH last week, was not re-added to the portfolio after Dolphin Your Majesty 's sell-off, as Pinduoduo's decline outweighed its gains.

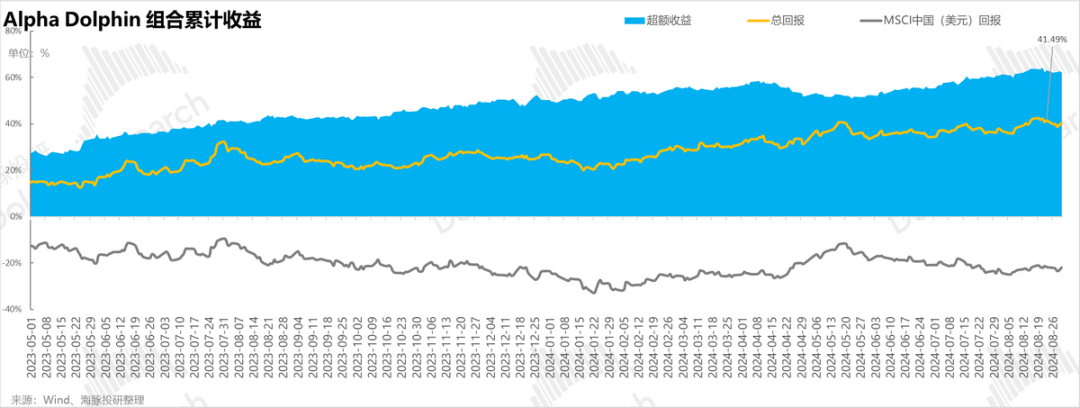

Since the portfolio's inception, it has generated an absolute return of 40% and outperformed the MSCI China Index by 62%. In terms of net asset value, Dolphin Your Majesty 's initial virtual portfolio of $100 million has shrunk to $142 million.

IV. Individual Stock Performance Contributions

Last week, the portfolio significantly underperformed the market due to declines in AI stocks like Micron and Pinduoduo's earnings miss, dragging down Alibaba. Positive performers like Ctrip and Meituan had limited impact due to Dolphin Your Majesty 's prior sell-offs. Dolphin Your Majesty explains the significant moves in the watched stock pool as follows:

V. Portfolio Asset Allocation

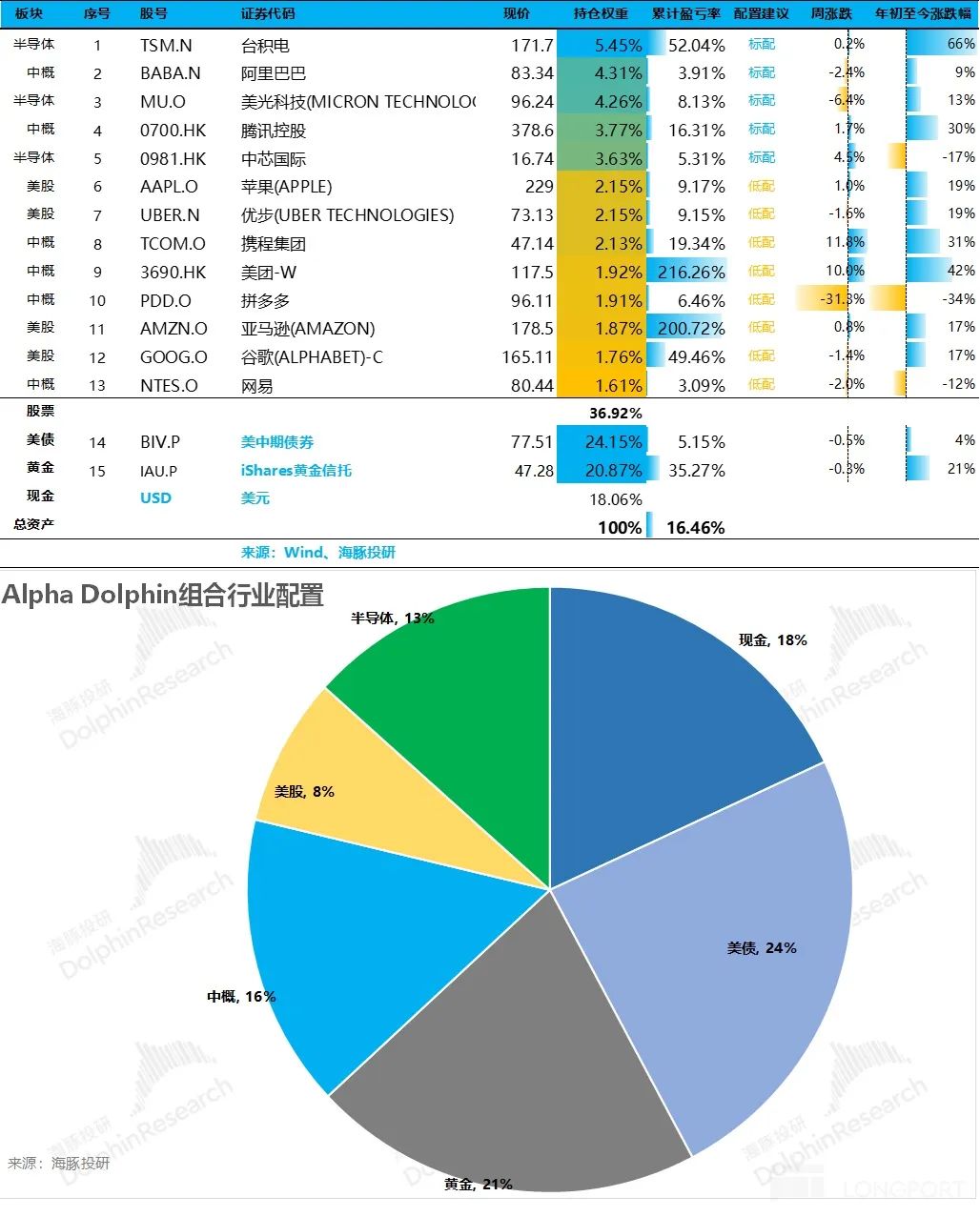

The Alpha Dolphin virtual portfolio holds 13 stocks and equity ETFs, with five at standard weight and eight underweight. The remainder is allocated to gold, US Treasuries, and cash. Cash and cash equivalents remain high and will be gradually invested based on earnings performance post-earnings season. As of last weekend, Alpha Dolphin's asset allocation and equity holdings were as follows:

VI. Key Events This Week:

With the sharp declines in stocks like Pinduoduo, Nongfu Spring, Lixiang ONE, Boss Zhipin, and China Duty Free, the earnings season for Chinese stocks has largely concluded. Among Dolphin Your Majesty 's coverage, only POP MART, Ctrip, and Meituan performed reasonably well in Q2. Companies that fared better either made strides overseas or stabilized their domestic supply chains and focused operations.

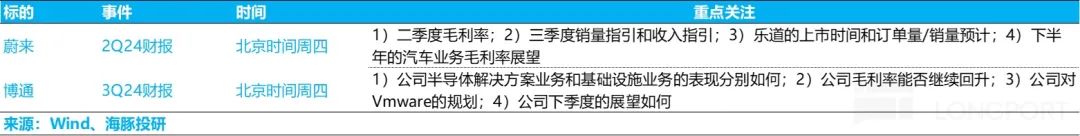

This week, Dolphin Your Majesty 's focus among Chinese and US stocks shifts to NIO and Broadcom. Key highlights include:

- END -

// Reprint Authorization

This article is originally created by Dolphin Investment Research. For reprinting, please obtain authorization.