"The top three in August sales have become the top four, and Xiaomi's bottom card remains unpredictable

![]() 09/04 2024

09/04 2024

![]() 471

471

No one dares to say they are far ahead.

July and August are traditionally slow sales periods, coinciding with summer vacations, making car sales difficult.

However, in August 2024, driven by trade-in promotions, many brands achieved solid growth in sales during the slow season, especially new force brands. Although they may not match the scale of traditional automakers, they have proven themselves with sales figures.

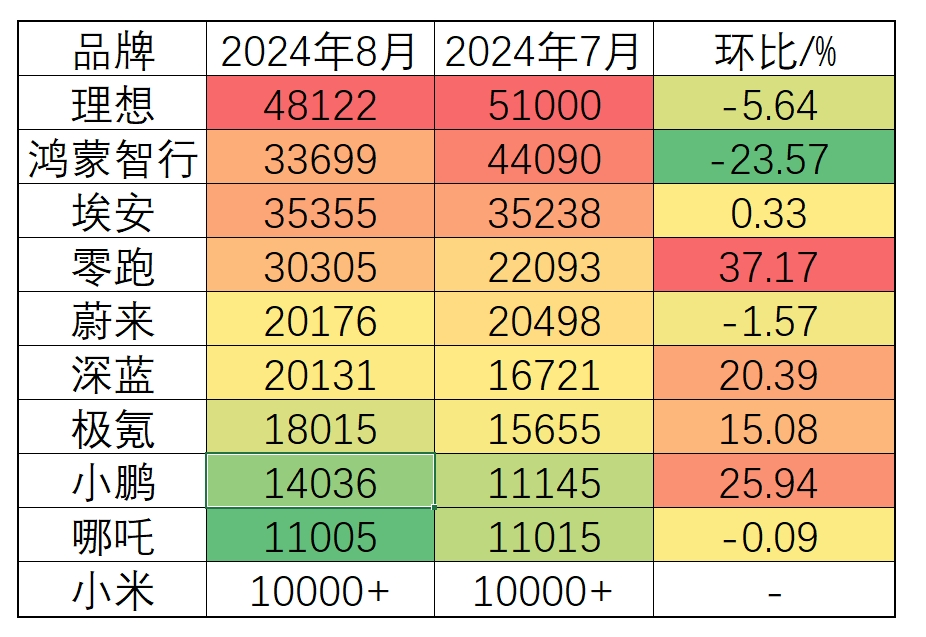

From the overall rankings, the sales rankings of the new forces in August were almost the same as those in July, still showing three distinct tiers. However, unlike July, competition among brands has intensified, with many showing rapid growth and aspiring to become new leaders.

Tight competition at the top

First, let's look at the top group in sales rankings. After Zero Run achieved sales exceeding 30,000 units, the top group finally expanded from three to four brands, intensifying competition. After all, besides Aion, the sales of NIO, Hongmeng Zhixing, and Zero Run are primarily supported by extended-range hybrid models.

In August, Lixiang failed to maintain its monthly sales of 50,000 units, dipping slightly to 48,000 but still ranking first in sales, leaving its "imaginary rival" Wenjie far behind.

As the leader, Lixiang has always been high-profile, never missing the weekly sales rankings on Tuesdays. Although Li Xiang himself has retreated from the spotlight and is no longer active on social platforms like Weibo, controversies surrounding Lixiang have not stopped.

Currently, the monthly sales of Lixiang L6 have reached 25,000 units, accounting for over 50% of total sales, making it the absolute sales leader.

Strong sales have also led to high revenue. According to the unaudited financial report released on August 28, Lixiang reported revenue of 31.7 billion yuan in the second quarter, up 10.6% year-on-year, with a net profit of 1.1 billion yuan, down 52.3% year-on-year.

Although L6 contributed to revenue growth, it also lowered the average selling price, compounded by the impact of price wars, resulting in a year-on-year decline in net profit.

Behind Lixiang's declining net profit lies a decrease in its overall gross margin. Financial reports show that Lixiang's gross margin in the second quarter was only 18.7%, down from 19.3% in the first quarter and 21% in the same period last year, but still relatively high among new forces.

Compared to Lixiang, Hongmeng Zhixing's sales in August were not ideal, experiencing the largest month-on-month decline among new force brands. Sales dropped from 44,090 units in July to 33,699 units in August, a decline of over 20%.

Hongmeng Zhixing has already gathered four brands: Wenjie, Zhijie, Xiangjie, and Zunjie. Except for Zunjie, which has not officially debuted, the other brands have already started sales. Despite growing scale, sales have not increased.

In terms of specific sales, Wenjie delivered 25,000 units of its M9 and M7 models alone, accounting for over 75% of total sales. Among them, M9 was the absolute sales leader, delivering 15,386 units and setting a new domestic precedent—the higher the price, the better the sales.

The most significant model launched by Hongmeng Zhixing in August was the Xiangjie S9, which attracted considerable attention upon its launch. According to official data, the Xiangjie S9 received over 8,000 large orders within 20 days of its launch, impressive for a 400,000-yuan luxury electric sedan.

Comparisons are inevitable, especially in Hongmeng Zhixing's organizational structure. The Xiangjie S9 is often compared to the Wenjie M9. The M9 received over 10,000 large orders within two hours of its launch. Many believe that if the Xiangjie S9 offered an extended-range version, it could sell just as well as the M9.

In contrast, sales of the Zhijie S7 have remained low since its launch, suggesting that pure electric vehicles currently have an inherent disadvantage in sales and struggle to compete with hybrids for market share.

Although the Xiangjie S9 did not receive an overwhelming number of orders like the Wenjie M9, it gained significant media attention, giving rise to the nickname "Xiangjie Slope." We won't delve into the merits of this debate, but the outcome suggests that no true winner emerged.

Regarding Hongmeng Zhixing's future sales scale, it's difficult to make a definitive prediction at this point. However, the increasing number of brands choosing to integrate with Hongmeng Zhixing reflects Huawei's growing influence in the automotive industry, indicating a promising future for Hongmeng Zhixing.

Regarding Aion's sales, they are quite representative. As a brand that sells only pure electric vehicles, Aion stands out on the list. After all, few brands can sell over 30,000 pure electric vehicles per month, aside from Aion.

Compared to other state-owned brands, Aion's sales are also at the upper level. Aion has fully transitioned to its second-generation models, with the first new model, the Aion V, delivering 6,000 units in its first month, marking a solid start.

At a time when almost all brands are focusing on high-end intelligent driving, Aion has further intensified its competition. At the Chengdu Auto Show on August 30, Aion unveiled a LiDAR version of the Aion V with a range of 520km, bringing the price of high-end intelligent driving models down to 169,800 yuan.

It can be said that Aion has unleashed its potential in the face of declining sales, fearlessly facing market competition with a bold determination to succeed.

As the latest brand to break through the 30,000-unit monthly sales barrier, Zero Run can be considered a model of quiet prosperity. Its steady and solid approach has enabled it to achieve sales of 30,000 units, partly due to market recognition of its extended-range models and partly because Zero Run is one of the few brands with the broadest model coverage.

Zero Run's products encompass not only pure electric and extended-range power modes but also a range of SUVs, sedans, and A0-class compact cars. Relying on price advantages, it has achieved steady sales growth, particularly with the C16, considered a viable alternative to the Lixiang L8. Its pricing below 200,000 yuan aligns with contemporary consumption habits, emphasizing practicality.

Moreover, Zero Run's sales of 30,000 units still have room for growth. The C16 delivered 8,000 units in August and is still growing. According to statistics, Zero Run's weekly orders have already exceeded 10,000, indicating that sales will continue to rise in September.

The arrival of a new brand at the top of the new force rankings demonstrates the fierce competition in the new energy vehicle market, where no brand can dominate absolutely, and any brand has the potential to emerge as a dark horse.

Comprehensive rise in the middle tier

Compared to the top-selling brands, those in the middle tier can be said to be fully energized. Double-digit growth rates indicate that competition remains fierce during the slow season, with no brand relaxing their efforts.

NIO's sales in the middle tier remain stable at around 20,000 units, with only minor changes from July's figures. For NIO, this performance represents the best it can currently maintain, given the limited market for pure electric vehicles priced above 300,000 yuan. NIO's monthly sales of 20,000 units are achieved with the support of its battery swapping model.

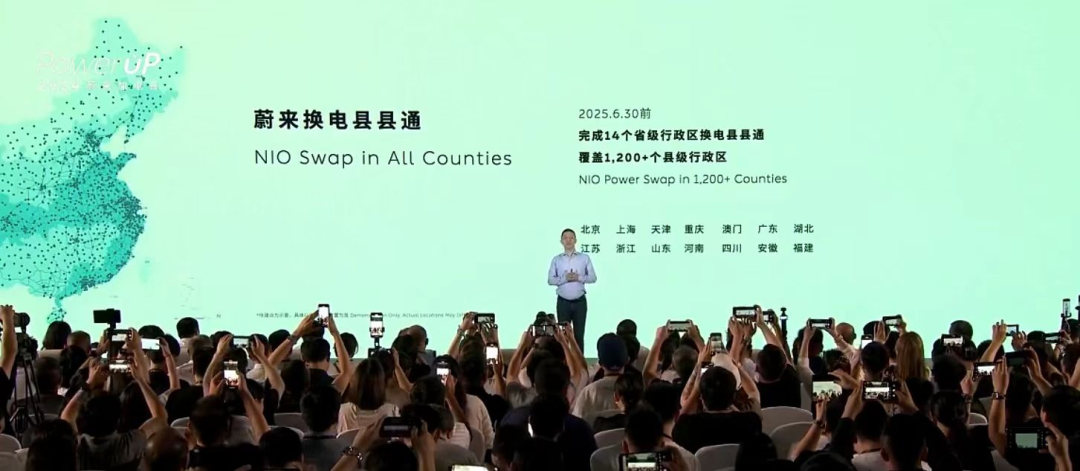

From an industrial scale perspective, NIO resembles more of an energy company than a new energy vehicle enterprise. On August 20, during NIO Power Day, NIO upgraded its energy replenishment network construction goal to cover every county in China.

On the one hand, NIO's competitiveness stems from the scale of its energy replenishment system. Battery swapping is currently considered the most elegant and efficient method of energy replenishment, and it forms NIO's technological moat. On the other hand, NIO's sub-brand Letao is about to be launched, with a lower price point indicating a broader market reach. To maintain product competitiveness and safeguard Letao's sales, expanding the battery swapping network is essential.

NIO's sales growth will likely hinge on the launch of Letao. If this route proves successful, NIO's sales will reach a historical turning point, positioning it closer to the top tier.

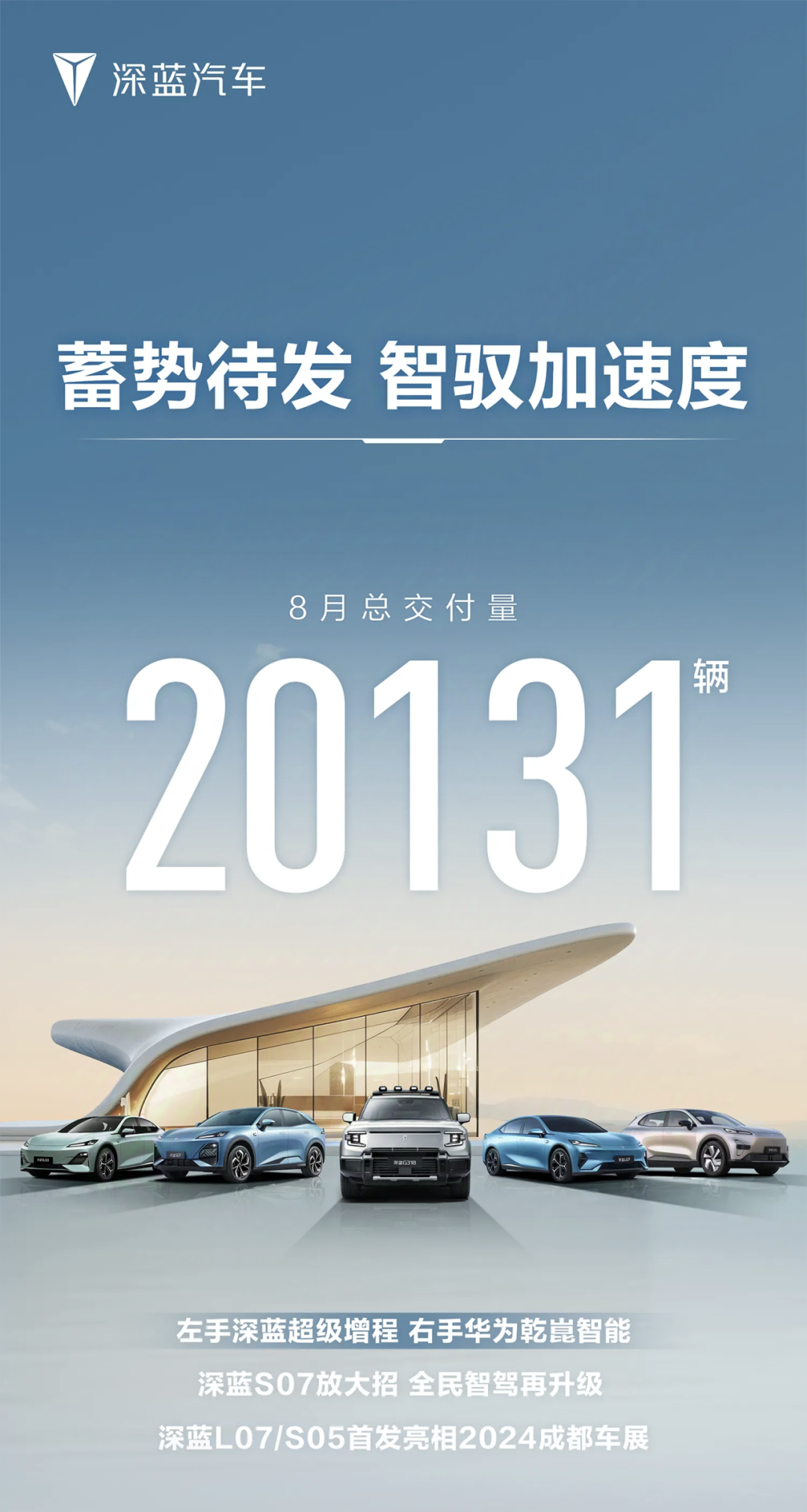

Sales of Deep Blue also grew significantly in August, closely trailing NIO and successfully exceeding 20,000 units.

Starting with the Deep Blue S07, Deep Blue Automobiles has fully embraced Huawei's intelligent driving technology, becoming the first brand to integrate Huawei's Qiankun intelligent driving system into a model priced below 200,000 yuan, further bolstered by extended-range capabilities.

At the Chengdu Auto Show, Deep Blue unveiled two new models, the L07 and S05, both equipped with Huawei's Qiankun intelligent driving system, making them the most cost-effective Huawei intelligent driving models available and even earning them the nickname "Youth Edition of Hongmeng Zhixing."

Moreover, backed by Changan Automobile, Deep Blue enjoys a competitive edge over Hongmeng Zhixing's partner brands, particularly in engine technology. Compared to Wenjie's extended-range system, Deep Blue's Super Extended Range technology is seen as more competitive among consumers.

Most importantly, Deep Blue boasts technological reserves in hydrogen energy, not relying solely on one technological route. Should a technological breakthrough occur, Deep Blue has the potential to transition from a follower to a leader in the new energy vehicle industry.

As for Zeekr, August was a month of controversy. Nevertheless, Zeekr's sales continued to grow steadily, though failing to reach 20,000 units, it still achieved a month-on-month growth of 15%. Apart from existing models, the upcoming 7X model is expected to be Zeekr's most competitive offering, poised to drive significant sales growth.

Behind the controversy surrounding Zeekr's model updates lies a broader industry dilemma: how to maintain product competitiveness and manage product refreshes, particularly price adjustments, which are top priorities for every enterprise.

Currently, only three brands remain in the middle tier. Apart from NIO, both Deep Blue and Zeekr have achieved double-digit sales growth, defying the slow season and demonstrating the intensity of competition in the new energy vehicle market as all brands strive to boost sales.

Mysterious "three"

The last three brands on the sales list are shrouded in mystery. Xiaopeng, Nezha, and Xiaomi—three vastly different new-force automakers—have converged at this position.

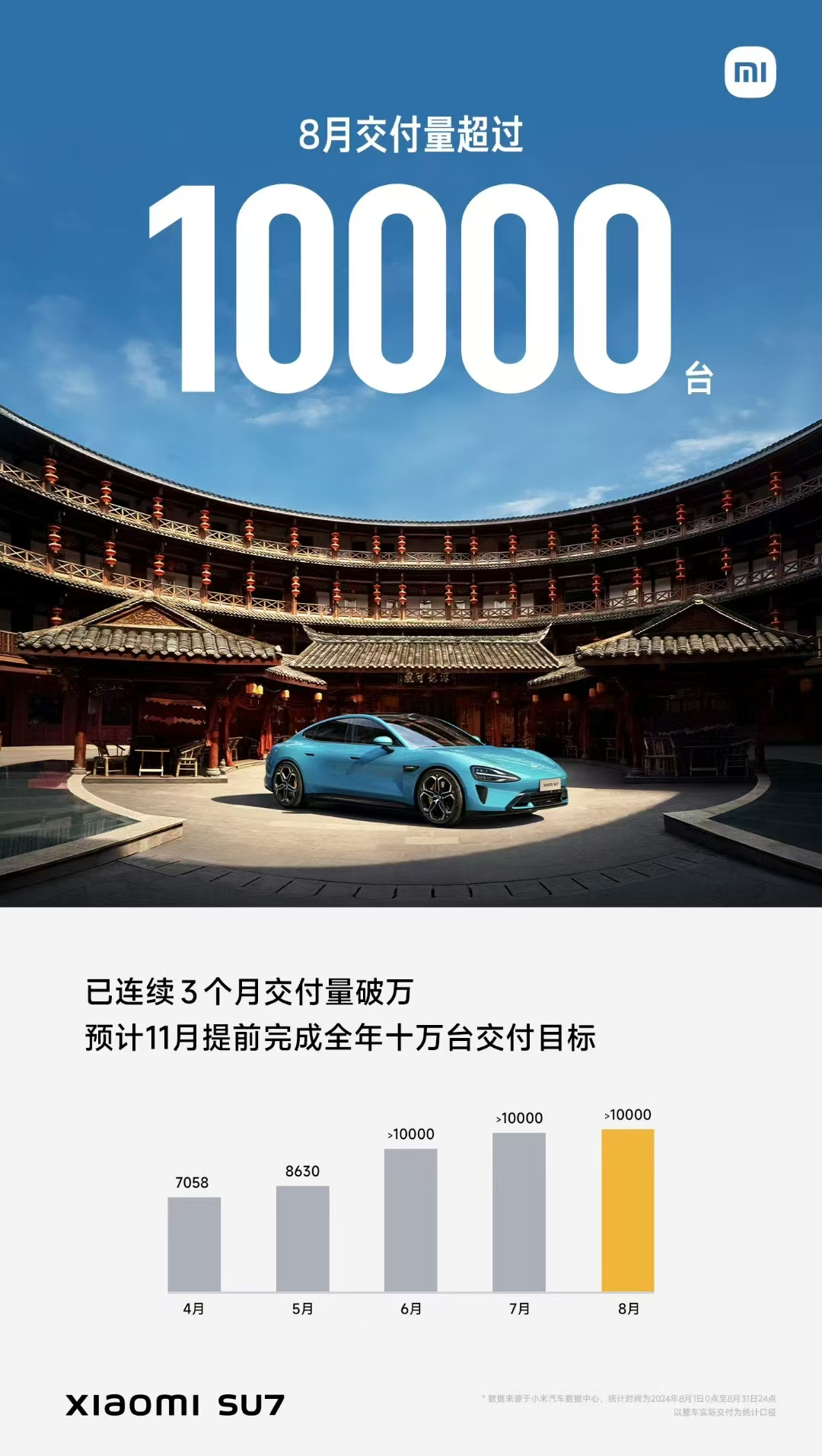

Xiaomi is particularly enigmatic due to its sales figures over the past three months. Monthly sales consistently exceeding 10,000 units make it difficult to discern Xiaomi's true hand.

According to third-party data, Xiaomi sold around 14,000 vehicles in July and continued to grow in August, with conservative estimates exceeding 15,000 units. However, Xiaomi has not officially disclosed these figures, and data from different sources vary in reliability, none of which can be considered official.

Xiaomi continues to advertise on posters that it will complete the delivery of 100,000 vehicles by November and 120,000 vehicles annually. With only three months left until November, Xiaomi needs to achieve monthly sales of at least 20,000 vehicles in September to reach its 100,000-vehicle target by November. It appears that Xiaomi's primary challenge this year is to ramp up production capacity.

Interestingly, with a solid order backlog for the year, Xiaomi has begun to experiment with more eccentric automotive accessories. Its latest offering is a "Are You OK?" valve cap, showcasing Xiaomi's playful side. At 29.9 yuan per piece, some netizens joke that Xiaomi may even be subsidizing its car business through accessory sales.

Xiaopeng's mystery lies in whether the MONA can truly save its sales. In August, Xiaopeng achieved a 25.94% month-on-month growth in sales, delivering 14,000 vehicles. However, this figure pales in comparison to its peers in the NIO-Xpeng-Lixiang trio.

Although Xiaopeng opted for a downward trajectory by lowering the starting price of the MONA M03 to 119,800 yuan, this came at the cost of numerous comfort features, including the digital instrument cluster, which has been replaced by an accessory. This move, inspired by Xiaomi's cost-cutting approach, represents a compromise on Xiaopeng's part to keep costs down. Whether Xiaopeng can achieve the same level of precision as NVIDIA in its cost-cutting efforts remains to be seen by consumers.

Furthermore, this pricing strategy represents a significant test for Xiaopeng's supply chain adjustments over the past year. Currently, large orders for the MONA M03 have surpassed 30,000 units, and delivery will be Xiaopeng's biggest challenge this year. In essence, Xiaopeng's success or failure hinges on this crucial moment.

Perhaps buoyed by strong order numbers, Xiaopeng even found time to host a flying car launch event, seemingly unfazed by its position at the bottom of the rankings. This reflects He Xiaopeng's inner strength and exceptional abilities.

As for Nezha, the brand's operations have been confusing this year, perhaps due to anxiety over a severe decline in sales. It can be seen that Nezha's promotional efforts have been focused on chasing online trends and optimizing marketing efforts.

However, judging from the results, Nezha's efforts do not seem to be proportionate to their rewards, with sales remaining stable at around 10,000 units. What is even more perplexing is that the highly anticipated Nezha S Shooting Brake version, after failing to exceed 10,000 pre-orders, did not release data, prompting CEO Zhang Yong to issue a special Weibo post to explain the situation.

It can be said that Nezha is currently eager for the boost of traffic and wants to rely on the popularity brought by traffic to rescue its currently bleak sales. But is traffic the only factor constraining sales?

Rather than saying that Nezha is eager for traffic, it would be more accurate to say that Nezha is longing for sales to magically appear. Although Nezha is currently relying on overseas markets to boost sales, is the overseas market truly a blue ocean?

Apart from these brands with sales exceeding 10,000 units, other brands are also constantly adjusting their products. Although they are not currently on the list, it is difficult to predict what the future holds.

Car manufacturing has always been a marathon with no finish line. Any lead is only temporary, and no one can guarantee perpetual dominance.

Note: Some images are sourced from the internet. If there is any infringement, please contact us for removal.